- Home

- »

- Alcohol & Tobacco

- »

-

Modern Oral Nicotine Products Market Size Report, 2030GVR Report cover

![Modern Oral Nicotine Products Market Size, Share & Trends Report]()

Modern Oral Nicotine Products Market Size, Share & Trends Analysis Report By Product (Nicotine Pouches, Nicotine Gums, Nicotine Patches), By Flavor (Original/Unflavored, Flavored), By Strength, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-434-7

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

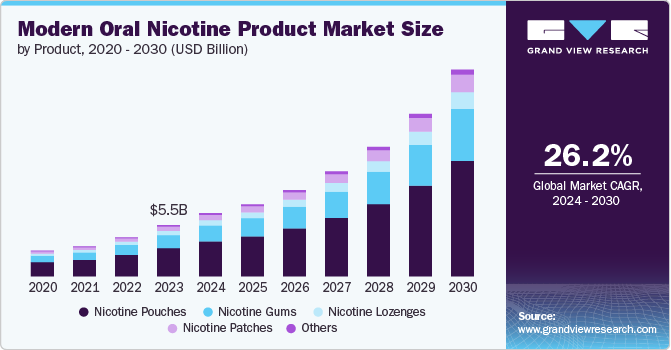

The global modern oral nicotine products market size was estimated at USD 5.5 billion in 2023 and is expected to grow at a CAGR of 26.2% from 2024 to 2030. The market is experiencing rapid growth, driven by increasing consumer demand for alternatives to traditional tobacco products. Modern oral nicotine products are smokeless, tobacco-free, and typically come in forms such as nicotine pouches, lozenges, gum, and tablets. These products are designed to deliver nicotine without the harmful byproducts associated with smoking or chewing tobacco.

As public awareness of the health risks associated with smoking continues to grow, more consumers are turning to oral nicotine products as a safer alternative. These products are often marketed as harm-reduction tools, helping people reduce or quit smoking.

Regulatory bodies across various regions are imposing stricter regulations on traditional tobacco products, which is pushing consumers and manufacturers towards nicotine alternatives. Some regions have also seen favorable regulations for modern oral nicotine products and other modern products, further boosting market growth.

The market is seeing significant innovation in product offerings, with a wide range of flavors and nicotine strengths to cater to diverse consumer preferences. Additionally, the discreet and convenient nature of these products makes them attractive to users who want to consume nicotine without the social stigma of smoking.

There is a growing preference for tobacco-free nicotine products among consumers who want to avoid the harmful effects of tobacco while still enjoying nicotine. This shift is particularly pronounced among younger demographics.

Companies are increasingly focusing on targeted marketing strategies to attract health-conscious consumers and those looking to quit smoking. This includes branding that emphasizes the clean and modern aspects of these products, appealing to a broader audience.

The modern oral nicotine products market is set for sustained growth, driven by innovations in product designs, campaigns and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Product Insights

The nicotine pouches segment accounted for a global revenue share of 55.58% in 2023. Nicotine pouches are increasingly popular among people trying to quit smoking. The rising demand for non-combustible tobacco products and alternative nicotine products that aid smoking cessation is expected to drive market growth over the forecast period. The surge in the consumption of nicotine products has led to a significant shift in the market dynamics, driving the demand for nicotine pouches.

Several factors contribute to this trend. Firstly, the evolving perception of nicotine consumption, particularly among younger demographics, has driven the demand for alternative, convenient, and discreet delivery methods. Nicotine pouches offer a smoke-free, odorless, and socially acceptable way to satisfy nicotine cravings, appealing to individuals seeking a less conspicuous form of consumption. According to a study published in 2023 by the National Library of Medicine, between December 2021 and May 2022, 16% of adolescents and young adults in the U.S. reported having tried nicotine pouches.

Nicotine gums segment is expected to grow at a CAGR of 26.3% from 2024 to 2030. There is a growing awareness of the health risks associated with smoking, leading more people to seek ways to quit. Nicotine gum is a popular choice for smoking cessation because it provides a controlled dose of nicotine to help manage withdrawal symptoms and reduce the urge to smoke. It allows users to gradually reduce their nicotine intake by controlling the dosage. This step-down approach appeals to individuals who want to quit smoking at their own pace, which can make the cessation process less overwhelming and more manageable.

Flavor Insights

Flavored segment accounted for a global revenue share of 90.81% in 2023. Modern oral nicotine products come in many varieties, from those with lower nicotine levels to those with higher levels. They also come in different flavors, including mint, coffee, lemon, and berry. Manufacturers are concentrating on the current trend of flavored oral nicotine products. For instance, in April 2022, a globally recognized brand, Juice Head, launched the latest addition to its line of premium, fruit-flavored products: Juice Head Pouches, featured in 6mg and 12mg tobacco-free nicotine strengths and are available in five flavors including blueberry lemon mint, watermelon strawberry mint, mango strawberry mint, peach pineapple mint, and raspberry lemonade mint.

Original/Unflavored segment is expected to grow at a CAGR of 25.8% from 2024 to 2030. Increased demand for reduced-risk alternatives that are both tobacco-free and smoke-free with a taste of tobacco is propelling the sales of unflavored/original products. Unflavored pouches resonate with minimalist lifestyles, offering simplicity and authenticity. A high preference for pure nicotine among U.S. consumers is driving sales of unflavored nicotine products in North America.

Unflavored nicotine products offer flexibility, allowing users to tailor their experience by mixing them with other flavors or additives according to their preferences. Some consumers find flavored pouches overwhelming and opt for unflavored options to avoid sensory overload. In April 2023, the Swedish market saw the debut of String Free, a brand offering modern oral nicotine pouches. This introduction provides consumers with a new product option for a convenient and discreet nicotine experience. String Free's entry into the market underscores the continuous expansion and innovation within the oral nicotine pouch category.

Strength Insights

The strong oral nicotine segment accounted for 43.07% of the global revenue share in 2023. Higher levels of nicotine dependency often prompt individuals to opt for stronger doses, as they provide a more effective means of satisfying cravings and staving off withdrawal symptoms. Particularly for those endeavoring to quit smoking, the stronger nicotine content closely mirrors the intake experienced with cigarettes, facilitating the transition to modern oral nicotine products. Some users prefer the intensified sensation offered by these higher nicotine levels. Beyond personal preference, stronger pouches offer efficiency by delivering nicotine more promptly and effectively, appealing to individuals seeking a rapid onset of effects.

The normal oral nicotine segment is expected to grow at a CAGR of 26.5% from 2024 to 2030. Moderate tobacco users and those with a lower tolerance to the effects of nicotine prefer oral nicotine products with a regular strength type. However, the availability of various flavors and strength levels that allow customers to choose products tailored to their individual needs will drive the industry's growth. For instance, Swedish Match AB brand ZYN offers a tobacco-flavored nicotine pouch that contains no tobacco in a normal strength range of 3mg. Such factors are likely to bode well for segment growth.

Distribution Channel Insights

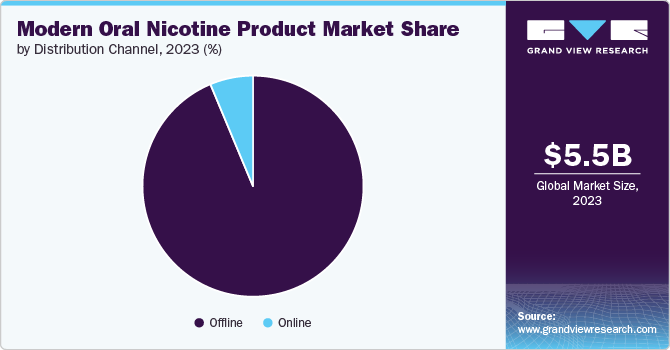

The sales of modern oral nicotine products through offline channel accounted for a revenue share of 93.70% in 2023. The increasing availability of oral nicotine products in various flavors through offline stores such as pharmacies, drug stores, supermarkets/hypermarkets, and convenience stores is likely to drive the segment. Key players/brands in the market majorly opt for offline distribution channels to make products easily available and accessible at nearby stores. For instance, Walmart U.S. offers nicotine products like nicotine pouches in various strengths and flavors of brands-2ONE, NicoDerm CQ, Nicorette, Habitrol, Grinds, Baccoff, Jake’s Mint Chew, Ground Coffee, Smokey Mountain, TeaZa Energy, PrimeScreen, and Herbion.

The sales of modern oral nicotine products through online channels is expected to grow at a CAGR of 28.1% from 2024 to 2030. Increasing third-party retailer platforms and the availability of products directly from brands’ websites are some of the key factors determining segment growth. New entrants in the industry prefer online channels for product distribution. Competitive pricing and potential discounts further incentivize online purchases, potentially making them more economical than buying from traditional outlets. Accessibility is another factor, particularly for those residing in remote areas or lacking nearby stores stocking oral nicotine products. Furthermore, product information, including detailed descriptions, reviews, and ratings, helps buyers make informed decisions.

Regional Insights

The modern oral nicotine products market in North America captured a revenue share of over 80.20% in 2023. The North America market for modern oral nicotine products is experiencing significant growth, driven by increasing consumer demand for alternatives to traditional smoking and smokeless tobacco products. The market is anticipated to grow at a significant CAGR during the forecast period due to increasing investments in the development of alternative products for tobacco, coupled with shifting consumer preference toward tobacco-free substitutes such as nicotine patches, gums, and lozenges. The rising consumption of nicotine products by adult smokers in the U.S. and Canada is a key factor driving the demand for modern oral nicotine products in the region.

U.S. Modern Oral Nicotine Products Market Trends

The modern oral nicotine products market in the U.S. is projected to grow at a significant CAGR from 2024 to 2030, owing to the presence of large-scale companies including Altria Group, Inc., Reynolds American Inc., and Imperial Brands Plc, and their extensive strategic initiatives like product launches and innovation. The national Cigarette & Tobacco Manufacturing industry is most heavily concentrated in North Carolina, Virginia, and Florida. The use of these products has been increasing as U.S. consumers want to reduce tar consumption while smoking. Furthermore, the introduction of various flavors to mask the harsh taste of tobacco is fueling the demand for these innovative products among young consumers.

Europe Modern Oral Nicotine Products Market Trends

The modern oral nicotine products market in Europe is expected to grow at a CAGR of 26.4% from 2024 to 2030. The surge in popularity of modern oral nicotine products can be attributed to several factors, including shifting attitudes toward smoking, increased health consciousness, and evolving lifestyles. Consumers value its discreetness, lack of secondhand smoke, and lower risk compared to traditional smoking. Moreover, strict smoking regulations in many European countries have spurred individuals to seek smoke-free alternatives, fueling the demand for such products.

Asia Pacific Modern Oral Nicotine Products Market Trends

The modern oral nicotine products market in Asia Pacific is expected to witness a CAGR of 32.4% from 2024 to 2030. Rapid urbanization, per capita income, and attractive marketing strategies adopted by global players are set to propel market growth in Asia Pacific. Key manufacturers present in the region continued to expand their geographic and store footprint for their oral smokeless product portfolios, often accompanied by promotional discount activities. For instance, SHIRO, a Japan-based brand, offers nicotine pouches in seven flavors, including Tingling Mint, Sour Red Berry, Fresh Mint, Cooling Mint, and more.

Key Modern Oral Nicotine Products Company Insights

The modern oral nicotine products market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace dog treats.

Key Modern Oral Nicotine Products Companies:

The following are the leading companies in the modern oral nicotine products market. These companies collectively hold the largest market share and dictate industry trends.

- British American Tobacco PLCO

- Altria Group, Inc.

- Swedish Match AB

- Nicopods ehf.

- Triumph Tobacco Alternatives LLC

- Japan Tobacco International

- Swisher

- Skruf Snus AB

- Tobacco Concept Factory

- GN Tobacco Sweden AB

Recent Developments

-

In April 2024, Scandinavian Tobacco Group UK announced its entry into the innovative nicotine product market by introducing XQS pouches. This new line-up includes four flavors in different intensity levels: Tropical, Blueberry Mint, Cool Ice, and Arctic Freeze.

-

In April 2024, Imperial Tobacco Canada initiated a campaign aimed at educating the public, positioning itself as a reliable authority on facts surrounding ZONNIC nicotine pouches, the company's latest product designed to help people quit smoking. This initiative seeks to correct misconceptions and furnish precise, scientifically backed details about nicotine replacement treatments and the effectiveness of ZONNIC in cutting down smoking rates in Canada.

Modern Oral Nicotine Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.52 billion

Revenue forecast in 2030

USD 26.42 billion

Growth rate

CAGR of 26.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, strength, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Scandinavia; China; Japan; India; Australia & New Zealand; Indonesia; Brazil; South Africa

Key companies profiled

British American Tobacco PLCO; Altria Group, Inc.; Swedish Match AB; Nicopods ehf.; Triumph Tobacco Alternatives LLC; Japan Tobacco International; Swisher; Skruf Snus AB; Tobacco Concept Factory; GN Tobacco Sweden AB

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Modern Oral Nicotine Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global modern oral nicotine products market report based on product, flavor, strength, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nicotine Pouches

-

Nicotine Gums

-

Nicotine Lozenges

-

Nicotine Patches

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light

-

Normal

-

Strong

-

Extra Strong

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

Scandinavia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global modern oral nicotine products market size was estimated at USD 5.5 billion in 2023 and is expected to reach USD 6.52 billion in 2024.

b. The global modern oral nicotine products market is expected to grow at a compounded growth rate of 26.2% from 2024 to 2030 to reach USD 26.42 billion by 2030.

b. The nicotine pouches segment dominated the modern oral nicotine products market with a share of 55.58% in 2023. The rising demand for non-combustible tobacco products and alternative nicotine products that aid smoking cessation is expected to drive market growth over the forecast period. The surge in the consumption of nicotine products has led to a significant shift in the market dynamics, driving the demand for nicotine pouches.

b. Some key players operating in the modern oral nicotine products market include British American Tobacco PLCO; Altria Group, Inc.; Swedish Match AB; Nicopods ehf.; Triumph Tobacco Alternatives LLC; and Japan Tobacco International

b. Key factors that are driving the market growth include the demand for alternatives to traditional tobacco products. Moreover, regulatory bodies across various regions are imposing stricter regulations on traditional tobacco products, which is pushing consumers and manufacturers towards nicotine alternatives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."