- Home

- »

- Biotechnology

- »

-

Molecular Biology Enzymes, Reagents & Kits Market ReportGVR Report cover

![Molecular Biology Enzymes, Reagents And Kits Market Size, Share & Trends Report]()

Molecular Biology Enzymes, Reagents And Kits Market Size, Share & Trends Analysis Report By Product (Kits & Reagents, Enzymes), By Application (Cloning, Sequencing, PCR, Epigenetics), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-913-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global molecular biology enzymes, reagents, and kits market size was valued at USD 20.94 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.65% from 2023 to 2030. The consistently developing technologies in the field of molecular biology have resulted in a significant impact on the life science research that is being directed for the betterment of health and medical conditions. These research activities involving advanced molecular biology technologies are driving the usage of consumables, thus paving the path for designing innovative methods with a wide range of applications. The adoption rate of molecular biology enzymes, reagents, and kits is also increasing due to the growing use of bioinformatics and computational tools for genome analysis and drug discoveries.

The COVID-19 pandemic positively impacted industry growth. Management of the pandemic resulted in the launch of multiple new kits and products by key players. For example, in January 2020, Bio-Rad Laboratories launched its new SEQuoia Complete Stranded RNA Library Prep Kit designed for the first step of library preparation during RNA sequencing. This new kit from the company even possessed high compatibility with a wide variety of samples, such as possibly degraded RNA samples during transit. Moreover, the launch of new molecular diagnostic instruments by these market players furthered the usage of these consumables during analysis. Additionally, scientists strived for developing the biological database of the SARS-CoV2 virus and employed computational methods coupled with sequencing techniques, which consequently led to an increase in the usage of molecular biology enzymes, reagents, and kits.

The ever-growing applications of sequencing techniques and the building of huge data sets have revolutionized the study of genomics and molecular biology with excellent accuracy and precision. The advent of NGS enabled cost-effective and time-efficient methods of DNA sequencing. In addition to NGS, third-generation sequencing technology is creating a resurgence in genome sequencing and addressing longstanding problems in de-novo genome assembly, haplotype phasing, and analysis of structural variation. In response to the rising demand for sequencing technologies globally, companies are continuously developing and launching their sequencing reagents and kits. For instance, in March 2022, Jumpcode Genomics launched the CRISPRclean Single Cell RNA Boost kit. The technology removes uninformative sequences and improves single-cell experiments by offering better insights from genomic data. Such initiatives strongly demonstrate the molecular biology consumables market growth.

The genetic information obtained from sequencing techniques contains large data sets and confidential personal information. These genomic databases need to be ethically stored and handled. This information is commonly stored by using cloud technologies and can be accessed by researchers across the world. The lack of high-end technology to store genetic information, particularly in emerging countries, is likely to restrain the adoption rate of sequencing technologies. This further reduces the uptake of molecular biology enzymes, kits, and reagents. However, local government funding and initiatives for developing biobanks and genome programs may reduce this ethical burden.

Advances in synthetic biology and the rising demand for analytical tools have increased the research toward the understanding of genomes, proteomes, and transcriptomes. These multi-omics-based research activities are the emerging concepts of identifying molecular medicines and they assist researchers in understanding the genetic basis of disease along with its progression at a cellular level. This rise of omics-based R&D programs increases the demand for molecular biotechnology tools such as enzymes and other proteins. For instance, restriction endonucleases have sequence-specific DNA cleavage activity and other enzymatic events that ligate and amplify the nucleic acids, which has driven several types of research in molecular biology. Furthermore, the use of these molecular biology consumables during various stages of discovery, development, or everyday research activities boosts the market demand.

Product Insights

Kits and reagents held the largest share of over 67.50% in 2022. This can be attributed to the vast availability of these products in the market space, novel developments, and continuous product launches from key players, which was further fueled by the rising number of SARS-CoV-2 variants. For instance, PerkinElmer announced the launch of NEXTFLEX Variant-Seq SARS-CoV-2 Kit v2 in December 2021 for disease surveillance and enhancement of sequencing throughput and reliability for variant identification. The company further launched this kit, which is compatible with the Illumina platform, which further increases its utilization rate.

With the continuous growth of cloning technology as a routine laboratory practice along with increasing scope in molecular biology, enzymes are anticipated to witness the fastest growth in the forecast period. This has allowed the manufacturers and suppliers to provide multiple enzymes for nucleic acid manipulation. The presence of different sources of enzymes such as ligases, polymerases, nucleases, methylases, phosphatases, and topoisomerases for cloning applications has resulted in the advancement of cloning techniques. Moreover, efforts are taken by companies for developing novel and advanced enzymes. For example, in November 2021, Novozymes and Novo Nordisk collaborated to develop specialty enzymes for applications in biopharmaceutical production processes and are expected to launch new products within the next few years. Hence, all this will influence the lucrative growth of enzymes in the market.

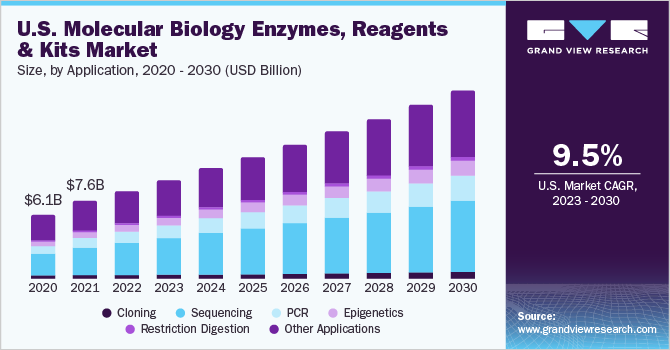

Application Insights

Sequencing segment dominated the market and held a revenue share of over 35.82% in 2022. This growth can be attributed to the increasing implementation of sequencing-based medical treatments and the application of sequencing in oncology. The use of NGS for analysis of genomics, tumor diagnostics, and biomarker discovery fuels the segment growth and drives the use of molecular biology consumables under this segment. Major companies are undertaking different business strategies to drive the segment. For instance, in January 2022, Pacific Biosciences collaborated with Berry Genomics for extending the use of its long-read sequencing technology to the clinical market in China. Such initiatives are anticipated to drive the segment in the near future.

The PCR segment is expected to grow at a steady growth rate in the coming years. An exponential increase in COVID-19 cases resulted in the increased production of real-time-PCR (RT-PCR) based detection kits as PCR tests became the golden standard for the detection of COVID-19. The accuracy and reliable results of genetic material detection increased its adoption across the globe. In addition, the advent of new technologies including ddPCR (droplet digital PCR) offers enhanced detection platforms. These advances and increasing applications of PCR are anticipated to continue driving revenue in this segment.

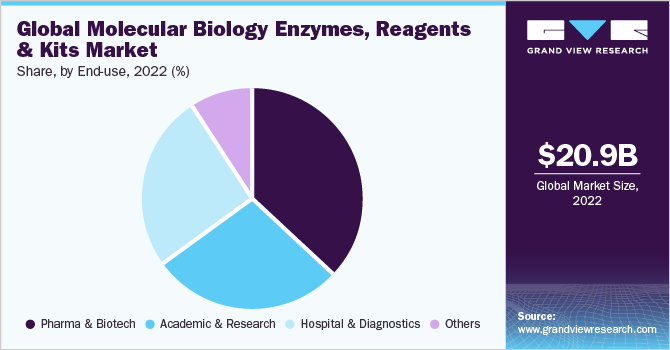

End-use Insights

The pharma and biotech segment held the largest share of around 37.44% in 2022. This is owing to a wide acceptance of molecular biology products such as PCR, sequencing, genotyping, and DNA/RNA extraction enzymes that make the workflow easier. The ease and efficiency of these products during the research for drug candidates, personalized medicine, or diagnostics of the pharma and biotech companies boost advancements of offerings and consequently increase their sales. Such huge implementation of molecular technologies by companies during R&D stages and clinical trials will drive the market in the forthcoming years.

The academic and research segment held a prominent share in 2022. The surge in demand for new diagnostics tools and treatment options for COVID-19 infection surged the demand for kits and reagents in research centers. Furthermore, the wide application of PCR and NGS fuels the progress in various research projects directed toward the development of health such as cancer, pathogenesis, and mutation. Government funding schemes towards these institutes are also contributing to the growth of the market due to the increased adoption of molecular biology consumables. For instance, in April 2021, the NIH awarded a grant worth USD 10.8 million to the University of Arkansas for the establishment of the Arkansas Integrative Metabolic Research Center, which would function as a Center of Biomedical Research Excellence.

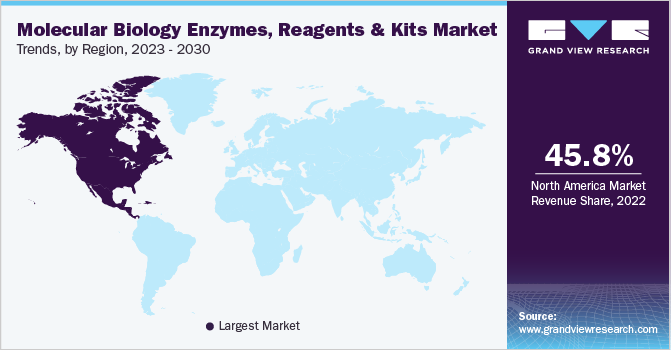

Regional Insights

North America accounted for the largest revenue share of 45.78% in 2022. The commonality of cancer within the population and the prevalence of chronic diseases across different age groups are increasing research activities for prevention and treatment solutions. This consequently drives the demand for molecular products. The presence of well-established players, renowned research institutes, aggregated government, and private funding, developed healthcare settings, and ease of adoption of new technologies are considered to be the major factors fueling revenue generation in this region.

Asia Pacific is expected to register a productive growth rate in the forecast period. The poor healthcare services, high population, high demand for targeted therapies, and rapid economic growth have created lucrative growth opportunities for molecular biology manufacturers. Additionally, the increased spending power in these nations has encouraged western companies to launch new products and gain market share in these regions, consequently driving revenue in the market.

Key Companies and Market Share Insights

The accelerating interest of the scientific community, companies, and government bodies in the range of applications offered by molecular biology tools has expanded the market for enzymes, kits, and reagents. Companies are aggressively expanding their technologies and portfolios to make molecular products commercially available. Furthermore, collaborations related to enhancements in product offerings from key players are contributing to market progress. For instance, in May 2023, QIAGEN announced its expansion of enzyme product portfolio to support the industrial and researcher’s customers globally with the flexibility to tailor their workflows and assays. This makes the company one-stop shop for all the research needs. QIAGEN offers specialized enzymes for an extensive range of applications, comprising amplification using PCR and DNA cloning, labeling, RNA analysis, sequencing, repairing and nicking. Some of the key players in the global molecular biology enzymes, reagents, and kits market include:

-

Thermo Fisher Scientific, Inc.

-

Illumina, Inc.

-

Agilent Technologies, Inc.

-

QIAGEN

-

Promega Corporation

-

New England Biolabs

-

Merck KGaA

-

F. Hoffmann-La Roche Ltd.

-

Bio-Rad Laboratories, Inc.

-

Takara Bio, Inc.

-

LGC Limited

-

Bausch Health Companies Inc.

Molecular Biology Enzymes, Reagents And Kits Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.45 billion

Revenue forecast in 2030

USD 44.67 billion

Growth rate

CAGR of 9.65% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; QIAGEN, Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; New England Biolabs; Merck KGaA; Promega Corporation; Takara Bio, Inc.; LGC Limited; Bausch Health Companies Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molecular Biology Enzymes, Reagents And Kits Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global molecular biology enzymes, reagents, and kits market report on the basis of product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

Enzymes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloning

-

Sequencing

-

PCR

-

Epigenetics

-

Restriction Digestion

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & Biotech

-

Academic & Research

-

Hospital & Diagnostics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global molecular biology enzymes, reagents, and kits market size was estimated at USD 20.94 billion in 2022 and is expected to reach USD 23.45 billion in 2023

b. The global molecular biology enzymes, reagents, and kits market is expected to grow at a compound annual growth rate of 9.65% from 2023 to 2030 to reach USD 44.67 billion by 2030.

b. Kits & Reagents dominated the molecular biology enzymes, reagents, and kits market with a share of 67.50% in 2022. This is attributed to the increasing demand for reagents during the COVID-19 pandemic.

b. Some of the key market players include Thermo Fisher Scientific, Inc., Illumina, Inc., Agilent Technologies, Inc., QIAGEN, Promega Corporation, New England Biolabs, Merck KGaA, F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories, Inc., Takara Bio, Inc., and LGC Limited.

b. Key factors that are driving the molecular biology enzymes, reagents, and kits market are advancements in the field of molecular biology, rising incidence of infectious diseases, and advent of the COVID-19 pandemic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."