- Home

- »

- Clinical Diagnostics

- »

-

Mycoplasma Testing Market Size, Industry Report, 2033GVR Report cover

![Mycoplasma Testing Market Size, Share & Trends Report]()

Mycoplasma Testing Market (2025 - 2033) Size, Share & Trends Analysis By Product (Instruments, Services), By Technology (PCR, ELISA, Direct Assay, Enzymatic Methods), By Application (Cell Line Testing, Virus Testing), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-897-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2033

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mycoplasma Testing Market Summary

The global mycoplasma testing market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 2.81 billion in 2033, growing at a CAGR of 11.94% from 2025 to 2033. The rising investments in research and development (R&D) across the life sciences sector are a significant market driver.

Key Market Trends & Insights

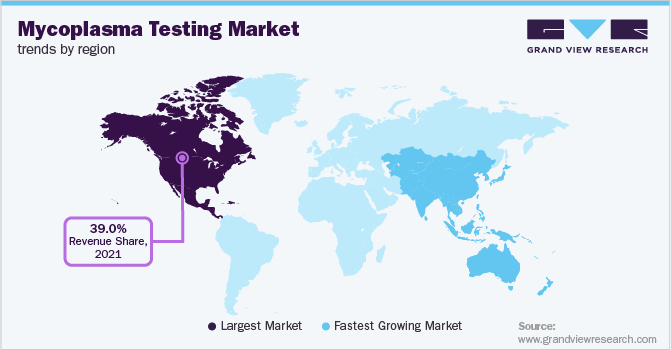

- North America mycoplasma testing market dominated the global market and accounted for the largest revenue share of 40.52% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- Based on product, the kits and reagents segment dominated the global market and accounted for the largest revenue share of 55.72% in 2024.

- Based on technology, the PCR segment held the largest revenue share of 47.14% in 2024.

- Based on application, the cell line testing segment held the largest revenue share of 40.99% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2033 Projected Market Size: USD 2.81 Billion

- CAGR (2025-2033): 11.94%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

Pharmaceutical companies are actively channeling substantial resources into biopharmaceutical and biosimilar development, which requires stringent contamination control. For instance, Bristol-Myers Squibb has invested heavily in the production of investigational medicines to support its expanding portfolio of clinical trials.The biopharmaceutical and related markets have not been significantly impacted by the COVID-19 pandemic when compared to other industries. According to a study published in May 2022, there is a correlation between mycoplasma testing numbers and COVID-19-related Non-Pharmaceutical Interventions (NPIs). This study analyzed the incidence of M. pneumonia after the implementation of COVID-19 NPIs. This survey showed that there has been a decrease in M. pneumoniae detection during the pandemic, and a reduction was observed globally between March 2020 and March 2021. The reduction is majorly due to restricted transmission of M. pneumonia, resulting in a significant reduction in M. pneumoniae infections across the globe.

As biopharmaceutical and vaccine production scales up, manufacturers require reliable mycoplasma testing solutions to ensure the purity, safety, and regulatory compliance of their products. Consequently, the need for advanced testing kits has intensified. Moreover, as more biologics advance through clinical development, maintaining uncontaminated cell cultures becomes critical, thereby increasing the demand for rigorous mycoplasma testing. Ongoing innovations in detection technologies are also expected to yield faster, more sensitive, and cost-effective testing methods that align with the growing requirements of the pharmaceutical industry.

The rising global emphasis on public health preparedness and the expanding demand for vaccines are expected to drive strong market growth. Supporting this trend, leading pharmaceutical companies continue to invest heavily in biomanufacturing infrastructure. For example, in October 2025, Merck & Co., Inc. announced the start of construction on a USD 3 billion, 400,000-square-foot pharmaceutical manufacturing facility at its Elkton, Virginia site. This major investment underscores the industry’s commitment to expanding vaccine and biologics production capacity to meet global demand.

Increasing R&D investments by key companies and rising research costs are likely to encourage firms to adopt highly efficient tools. For instance, in April 2024, Merck announced an investment exceeding USD 338 million to construct a new Life Science Center in Darmstadt, Germany. Expected to become operational by 2025, the facility will strengthen Merck’s R&D capabilities in life sciences, pharmaceuticals, and biotechnology, with a focus on digitalization, automation, and sustainability. The project aims to foster global scientific collaboration, create around 500 new jobs, and accelerate innovation across the biopharmaceutical value chain. Furthermore, in July 2023, Merck invested approximately USD 25.85 million (EUR 23 million) in Kansas, U.S., to expand the production of cell culture media-a key input in biologics manufacturing that directly supports contamination-free cell growth and testing reliability.

Rising government initiatives to support biotechnology and pharmaceutical companies is driving the market. The FDA proposed to exclude a test for detecting mycoplasma within in vitro living cell cultures, as it can help identify only a single test method. Such changes in biologics regulations are expected to improve sensitivity and specificity in mycoplasma detection tests, evolving new technologies in the industry. This change is expected to create huge opportunities for major market players. According to Saudi Arabia’s Vision 2030, its government is promoting the growth of the pharmaceutical industry, as only 30% of its medication requirements are produced locally. Empire State Development funded USD 300,000 to Bionique to help upgrade lab equipment in its Testing Laboratories. The company’s project, worth USD 1.5 million, includes the development of advanced technology for mycoplasma testing in labs.

Market Concentration & Characteristics

The mycoplasma testing industry is experiencing swift technological advancements with rapid adoption of molecular-based detection techniques such as CRISPR-based assays, NGS, and digital PCR replacing slow-based traditional culture methods. There is a growing demand for rapid Mycoplasma tests that can provide results within minutes or hours. This is important for clinical settings where quick diagnosis is critical. Platforms are becoming smaller and more portable. This makes them more convenient and easier to use in a variety of settings. These platforms are increasingly being integrated with laboratory information systems. This allows for the automated transfer of test results to the patient's medical record. POC mycoplasma tests are being developed that can be used in non-laboratory settings, such as doctors' offices and clinics.

Regulatory agencies around the world have implemented guidelines and regulations to ensure the safety and efficacy of biopharmaceutical products. These regulations mandate that biopharmaceutical products be tested for mycoplasma contamination. Regulatory agencies are working together to harmonize standards for these tests. It is easier for companies to comply with regulations in different countries. There is a strong regulatory push towards Rapid Microbial Methods (RMMs), promoting faster product release and data integrity. Compliance documentation and validation protocols are becoming key competitive differentiators.

Raw materials used in cell culture, such as media and reagents, play a crucial role in supporting the growth of cells for mycoplasma testing. Quality control of these materials is essential to prevent contamination. Antibodies and other detection reagents are used in various immunoassays for mycoplasma detection. Producing high-quality antibodies and detection reagents is integral to the accuracy and sensitivity of these tests. In addition, data analysis software is increasingly important in mycoplasma testing. These factors are expected to support market growth.

The level of regional expansion in the mycoplasma testing industry appears to be moderate. Companies in Europe are extending their operations in Germany, Austria, Switzerland, and the Nordic biotechnology clusters. International players such as Lonza and Eurofins are focusing on expanding their testing services in China and India. Multiple diagnostic kit manufacturers are entering the Asia Pacific countries via distribution partnerships.

Product Insights

The kits and reagents segment captured the highest revenue share of 55.72% in 2024. Collectively, this segment drives the market by supplying the consumables that create recurring revenue from installed instrument bases and stand-alone molecular workflows in both R&D and regulated QC environments. The emphasis on maintaining high-quality standards throughout production reinforces the necessity for effective mycoplasma testing kits and reagents. In April 2024, Merck KGaA made a significant investment of USD 326.4 million in its Life Science Business’ Research and Development (R&D) facilities. This substantial investment is expected to have significant implications for the market.

Services is expected to grow at the fastest CAGR over the forecast period. Services, including contract testing (CROs), method validation services, auditing, on-site testing support, and training, play a pivotal role in the market. The trend toward outsourcing testing services plays a significant role; many companies prefer to engage third-party service providers with advanced technologies and expertise in mycoplasma detection, thus allowing them to focus on their core operations while ensuring high-quality standards. For instance, Bionique Testing Laboratories focuses on providing specialized testing services for biological products and raw materials, specifically targeting mycoplasma contamination.

Technology Insights

The PCR segment dominated the market with a revenue share of 47.14% in 2024 and exhibits the fastest growth rate during the projected period, attributed to its unparalleled sensitivity and rapid detection capabilities. Advancements in PCR technology have led to the development of more sophisticated testing kits that enhance user experience and accuracy. In July 2025, Microzone introduced the MycoDetect qPCR Detection Kit for sensitive detection of cell culture contamination. In July 2025, MP Biomedicals highlighted their Myco-Visible PCR Kit, a rapid and sensitive solution for routine screening in research and manufacturing settings, providing results within 3 hours.

ELISA technology held the second largest market share during the forecast period, as it facilitates easy detection with the use of labeled probes or antibodies for mycoplasma detection. In some instances, PCR and ELISA tests are combined to form PCR-ELISA, a photometric enzyme-based immunoassay that facilitates the detection of PCR-amplified mycoplasma DNA in samples. Ongoing advancements in ELISA technologies, such as the development of more sensitive and specific antibodies, are expected to enhance the effectiveness of this market segment further.

Application Insights

The cell line testing segment accounted for the largest share of 40.99% in 2024, as well as the fastest growth rate throughout the forecast period, owing to the increase in research projects being done in the field of cell culture. There is a significant demand for cell line testing in the detection of mycoplasma, which is driving growth in this segment and prompting increased R&D initiatives as well as investment. For example, the Canadian Institutes of Health Research (CIHR), the federal agency responsible for health research funding in Canada, has allocated approximately USD 981 million to support numerous health researchers across the country. Lonza is further expanding its MycoAlert product line with new rapid detection technologies, and its intent to acquire Redberry to expand bioscience testing offerings was announced in October 2025.

End of production cells testing held the second-largest market share in 2024. The increasing demand for end of production cell testing in the market is driven by the heightened awareness of contamination risks associated with biopharmaceutical production. Moreover, the increasing number of clinical trials in regions such as the Asia Pacific is driving the demand for reliable mycoplasma testing in end-of-production cells.

End-use Insights

The pharmaceutical and biotechnology companies segment received the highest revenue shares of 35.15% in 2024, as well as the fastest CAGR throughout the forecast period. These firms have made significant investments in R&D efforts, which have fostered advancements in the field of drug development research. These businesses carry out quality tests on raw materials to manage biological safety. Furthermore, the prevalence of disorders like rheumatoid arthritis and psoriasis is rising, contributing to market growth.

Due to the expanding research services offered by these firms, contract research organizations (CROs) are predicted to grow profitably over the projected period. CROs deliver services such as biologic assay development, commercialization, biopharmaceutical development, and pharmacovigilance. They require the use of tests, such as mycoplasma testing, which are needed to maintain the sterility of cultures used in preclinical research and biopharmaceutical development. These facilities ensure the quality of the outsourced testing services. An increase in the number of CROs is expected to contribute to the growth of this segment.

Regional Insights

North America mycoplasma testing market dominated the global market and accounted for a revenue share of 40.52% in 2024. Regulatory agencies like the FDA have stringent guidelines for mycoplasma testing, further driving its necessity. Advances in detection methods, such as PCR and ELISA, have improved the accuracy and speed of testing, making it more accessible and essential. With the growing emphasis on precision medicine and biologics, the demand for reliable mycoplasma testing is expected to continue its upward trend, ensuring the production of safe and effective biomedical products. In September 2024, bioMérieux, a global leader in in vitro diagnostics, announced the availability of method validation services for its BIOFIRE Mycoplasma testing system in partnership with Bionique Testing Laboratories, a U.S.-based GMP-compliant service provider.

U.S. Mycoplasma Testing Market Trends

The mycoplasma testing market in the U.S. testing is expected to witness lucrative growth as it is the biggest market for biotechnology & biopharmaceuticals and a leader in biopharmaceutical R&D. The upward trajectory of biologics, cell & gene therapies, vaccine production, and upstream cell-culture systems is driving demand for contamination-control assays such as mycoplasma detection thus creating a favorable commercial environment for kits & reagents, instruments, and services. For instance, in February 2024, Thermo Fisher Scientific announced that its PPD clinical-research business (in the U.S.) expanded its GMP laboratory service offerings at Middleton, Wisconsin, to include biosafety testing such as mycoplasma testing.

Europe Mycoplasma Testing Market Trends

The mycoplasma testing market in Europe is significantly growing due to multiple factors integral to the region's robust biopharmaceutical and biotechnology sectors. Strategies undertaken by various key & emerging players, such as new product launches and distribution agreements, are likely to drive the regional growth positively. In August 2025, Fuse Diagnostics (Fuse) announced a strategic distribution partnership with CliniSciences, covering major European countries, including France, Germany, Spain, and Italy, for the commercialisation of its rapid test, Flip Mycoplasma. The product claims to deliver laboratory-PCR quality results in just 12 minutes, in a simple single-use format, enabling ultra-rapid detection of mycoplasma contamination in cell cultures.

The UK mycoplasma testing market is experiencing high growth owing to increasing investments in developing innovative cell culture solutions and emerging regional players with advanced solutions. Clinical trials and translational studies focusing on cell-based therapies, including stem cell-based treatments, are actively conducted in the country. With continuous innovation and research being done within the country, there has been a continuous demand for products & services.

The mycoplasma testing market in Germany is boosted by an established biopharmaceutical industry, increasing R&D activities by biopharmaceutical companies, and a high prevalence of chronic diseases, such as cancer & diabetes. Extensive R&D activities by regional players and research institutions for developing novel vaccines & therapeutics are anticipated to create significant demand for products & services.

Asia Pacific Mycoplasma Testing Market Trends

The mycoplasma testing market in the Asia Pacific is estimated to grow at the fastest CAGR over the forecasted period. Regulatory policies imposed by healthcare organizations favoring improvements in biosafety quality are likely to create growth opportunities in the future. The National Biotechnology Development Strategy-led by the government to establish itself as a leading manufacturing entity-is anticipated to have a positive effect in promoting the use of mycoplasma tests, owing to the maintenance of higher product safety standards and better infrastructure. In addition, these changes are anticipated to impart long-term benefits to human health and ensure sustainable industrial growth of the biologics and pharmaceutical industry. The presence of biological safety guidelines, specific to the research segments, such as recombinant DNA research and cell culture, indicates further growth potential.

Japan mycoplasma testing market is both mature and evolving, driven by a strong domestic biotechnology and pharmaceutical manufacturing base and increasing adoption of advanced molecular and rapid detection methods. In recent years, Otsuka Pharmaceutical Co., Ltd. announced the launch of its Quick Navi-Mycoplasma Diagnostic Kit in Japan, a high-sensitivity antigen detection kit marketed for rapid mycoplasma antigen screening in cell culture applications. This launch underscored how Japanese suppliers were beginning to respond to contamination-risk awareness in upstream cell culture and biologics manufacturing workflows.

The mycoplasma testing market in China is saturated, despite the low cost of production drives global investments in the country for manufacturing. China is a pioneer in stem cell research, which is projected to drive the demand for mycoplasma testing. The presence of global players, such as Thermo Fisher Scientific, Inc. & Merck KGaA, and local suppliers aids in meeting the diverse needs of R&D in the biopharmaceutical industry in the country.

Latin America Mycoplasma Testing Market Trends

The mycoplasma testing market in Latin America presents significant opportunities as the adoption of biosimilars and biologics is growing, requiring reliable mycoplasma testing to ensure product safety and efficacy. In addition, regional regulatory bodies are implementing stricter guidelines, further driving the need for advanced testing technologies. Brazil is anticipated to be one of the most lucrative markets for mycoplasma testing products in Latin America. This dominance can be attributed to the presence of an established pharmaceutical industry compared to other Latin American countries.

Middle East Mycoplasma Testing Market Trends

The mycoplasma testing market in the MEA is experiencing future growth due to the expanding biopharmaceutical and biotechnology industries of the region. Government initiatives to promote healthcare innovation and attract international biotech companies are also key factors boosting the growth. These initiatives often include implementing rigorous regulatory standards aligned with global practices, which emphasize the importance of mycoplasma testing.

Key Mycoplasma Testing Company Insights

Key players in this market are implementing various strategies, including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations, to expand their market presence. Key players in the market include major companies such as Charles River Laboratories, Merck KGaA, Lonza Group, and Thermo Fisher Scientific. These companies offer a range of mycoplasma detection kits and services, leveraging advanced technologies such as Polymerase Chain Reaction (PCR), Enzyme-Linked Immunosorbent Assay (ELISA), and Next-Generation Sequencing (NGS).

Key Mycoplasma Testing Companies:

The following are the leading companies in the mycoplasma testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- Merck & Co., Inc.

- Lonza Group AG

- Charles River Laboratories International, Inc.

- PromoCell GmbH

- Asahi Kasei Medical Co., Ltd.

- Sartorius AG

- InvivoGen

- Eurofins Scientific

- (ATCC) American Type Culture Collection

Recent Developments

-

In February 2025, Thermo Fisher allocated new funding to expand R&D in rapid microbial detection, including next-gen mycoplasma assays using digital PCR.

-

In April 2025, Lonza launched a new operating model (three CDMO platforms) to streamline execution and support services, including QC/facility scale-up.

-

In September 2024, bioMérieux announced the availability of method-validation services for its BIOFIRE Mycoplasma test via Bionique, enabling faster implementation of the system for mycoplasma detection in biologics manufacturing.

-

In January 2024, Thermo Fisher Scientific, Inc.,launched an enhanced qPCR-based assay for complex cell and gene therapy matrices, validated for over 200 mycoplasma species.

-

In April 2023, Agathos Biologics announced its offering of analytical testing services to life science researchers. Agathos exclusively utilizes QIAcuity instrumentation and assays developed by QIAGEN. Furthermore, Agathos has formed a collaboration with QIAGEN to conduct testing and validation for mycoplasma and recombinant adeno-associated viral vector (rAAV) assays.

-

In February 2023, Thermo Fisher Scientific, Inc. launched the TrueMark STI Select Panel. It is used to detect the four most common sexually transmitted infectious pathogens with one panel. The panel uses polymerase chain reaction to detect Chlamydia trachomatis and Mycoplasma genitalium.

Mycoplasma Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.14 billion

Revenue forecast in 2033

USD 2.81 billion

Growth rate

CAGR of 11.94% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2033

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck & Co., Inc.; Lonza Group AG; Charles River Laboratories International, Inc.; PromoCell GmbH; Asahi Kasei Medical Co., Ltd.; Sartorius AG; InvivoGen; Eurofins Scientific, (ATCC) American Type Culture Collection

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mycoplasma Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mycoplasma testing market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Kits & Reagents

-

PCR Assays

-

Nucleic Acid Detection Kits

-

Stains

-

Elimination Kits

-

Standards & Controls

-

Others

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR

-

ELISA

-

Direct Assay

-

Indirect Assay

-

Microbial Culture Techniques

-

Enzymatic Methods

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Line Testing

-

Virus Testing

-

End of Production Cells Testing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research Institutes

-

Cell Banks

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global mycoplasma testing market size was estimated at USD 1.03 billion in 2024 and is expected to reach USD 1.14 billion in 2025.

b. The global mycoplasma testing market is expected to grow at a compound annual growth rate of 11.94% from 2025 to 2033 to reach USD 2.81 billion by 2033.

b. North America dominated the mycoplasma testing market with a share of 40.52% in 2024. This is attributable to rising healthcare spending and investments by the U.S. government to promote research-based activities in biopharmaceutical industries.

b. Some key players operating in the mycoplasma testing market include Bionique Testing Laboratories, Inc.; Lonza Group Ltd.; Merck KGaA; PromoCell GmbH; ATCC (American Type Culture Collection); Biological Industries Israel Beit Haemek Ltd.; Charles River Laboratories International, Inc.; Thermo Fisher Scientific; and InvivoGen.

b. Key factors that are driving the mycoplasma testing market growth include increasing investments in R&D activities, the rising introduction of novel technologies by key players, and a rise in cell culture contamination.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.