- Home

- »

- Medical Devices

- »

-

North America Breast Reconstruction Market Report, 2030GVR Report cover

![North America Breast Reconstruction Market Size, Share & Trends Report]()

North America Breast Reconstruction Market Size, Share & Trends Analysis Report By Product (Implant, Tissue Expander, Acellular Dermal Matrix), By Shape (Round Shape, Anatomical Shape), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-656-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The North America breast reconstruction market size was valued at USD 218.1 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The rising number of breast cancer patients and an increased number of breast reconstruction surgeries are the major factors driving the market. Moreover, the availability of reimbursement policies concerning breast reconstruction is further boosting the market. The incidence rate of breast cancer has increased considerably in the past two decades. For instance, as per Cancer.net, since the mid-2000s, invasive breast cancer in women has increased approximately half a percent yearly. Additionally, it was estimated that 287,850 women in the U.S. would be diagnosed with invasive breast cancer in 2022.

The COVID-19 pandemic had a negative impact on the North American market for breast reconstruction, owing to the termination & delay of elective treatments, including breast reconstruction. However, as the cases of COVID-19 reduced and vaccination started globally, elective breast reconstruction surgery is expected to gain traction resulting in growth in the regional market. Moreover, many companies adopted strategies such as awareness campaigns, partnerships, and product approvals to cope with the demand and have a larger patient reach.

Besides, some companies opted for clinical trials during the post-pandemic period, which was expected to boost the market growth. For instance, in March 2021, Surgical Innovation Associates announced the launch of a clinical trial under an Investigational Device Exemption from the U.S. FDA, which accessed the durability & effectiveness of their product ‘DuraSorb’. Similarly, in October 2021, Sientra, Inc. and Mission Plasticos launched a nationwide program, ‘Reshaping Lives: Full Circle’, to provide reconstructive breast surgery for impoverished women. Thus, with such strategies initiated by key players, the regional market is projected to witness significant growth in the post-pandemic period.

As per the Canadian Cancer Society, breast cancer is the most common cancer among Canadian women. According to Fondation cancer du sein du Québec, 28,600 Canadian women are diagnosed with breast cancer yearly. Moreover, 19.0% of the country’s women are expected to die from breast cancer. To minimize the risk of breast cancer, many women opt for mastectomy & lumpectomy procedures; as a result, the demand for breast reconstruction products is anticipated to increase throughout the forecast period.

The growing adoption of breast reconstruction procedures is another factor driving the market. For instance, according to the American Society of Plastic Surgeons, the overall number of breast reconstruction procedures was calculated to be 137,808 in 2020, which was a 75.0% increase in the number of breast reconstruction surgeries conducted in 2000. Thus, the growing demand for breast reconstruction procedures is poised to boost the North American market during the forecast period.

Furthermore, Medicare usually does not cover most cosmetic surgeries. However, it covers breast reconstruction only if the person has had a mastectomy due to breast cancer. According to Mentor Medical Systems B.V., the Medicare national average payment may vary from USD 147 to USD 10,623, depending upon the procedure. Moreover, the national average payment also varies depending on where the surgery occurs.

For instance, breast reconstruction by a physician is reimbursed at an average payment of USD 1,193. In contrast, the same is reimbursed at USD 14,929 and USD 5,635 at outpatient and ambulatory surgical centers respectively. Therefore, the availability of suitable reimbursement policies promotes breast reconstruction in women who had a mastectomy, which is expected to help the development of the regional breast reconstruction market during the forecast period.

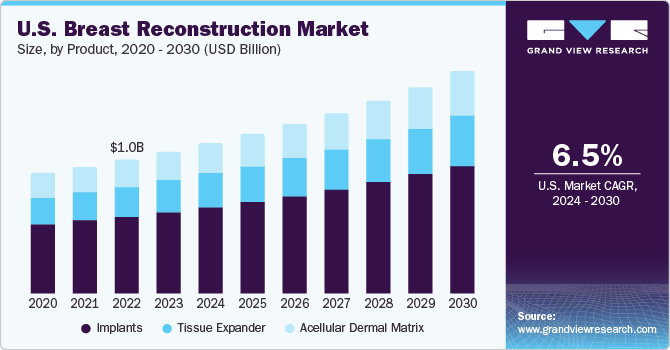

Product Insights

Based on product, the implants segment dominated the market with the largest revenue share of 63.5% in 2022, owing to the availability of various breast implants such as silicone & saline. Moreover, the FDA has approved the use of such breast implants in women aged 22 and above. Additionally, the FDA has overturned the ban on silicone implants while approving silicone gel implants manufactured by two major companies, Mentor Worldwide LLC & AbbVie Inc.

As per data collected by NCBI, around 8.08 women per 1000 in the U.S. reported having some type of breast implant. Furthermore, breast implants provide advantages such as shorter hospital stays, less complex surgeries, and quick recovery times. Thus, due to the above-mentioned factors, women tend to opt for breast implants, thereby boosting the market.

The tissue expander segment is expected to progress at the fastest CAGR of 6.9% during the forecast period. A tissue expander is extensively used in breast reconstruction surgeries. For instance, the two-stage expander to implant breast reconstruction accounts for more than 67.0% of all breast reconstruction surgeries in the U.S. As per a study published by NCBI in 2019, the 2-stage tissue expander has been the most common & considerably evolved technique since the 1980s. Additionally, the presence of some major players such as Allergan PLC, Johnson & Johnson Services Inc., and AirXpanders, Inc. is further expected to boost segment growth.

Shape Insights

Based on shape, the round shape segment dominated the market with the largest revenue share of 55.3% in 2022, owing to the various advantages that a round implant provides. A round breast implant provides women with a fuller look & appearance. Moreover, these are symmetrical in appearance from all angles and are more affordable than teardrop-shaped implants.

On the other hand, the anatomical shape segment is expected to witness the fastest CAGR of 6.9% during the forecast period, owing to its various advantages. For instance, anatomical-shaped implants mimic the curves of the natural breast for subtle enhancement. Moreover, they provide a textured surface for better grip, which helps keep the implant in place. Furthermore, the rough surface helps minimize hardened scar tissue capsules all over the implant. Additionally, they provide better results, as their texture makes them ideal for breast augmentation in females with little breast tissue. Thus, the segment is expected to have lucrative growth over the forecast period.

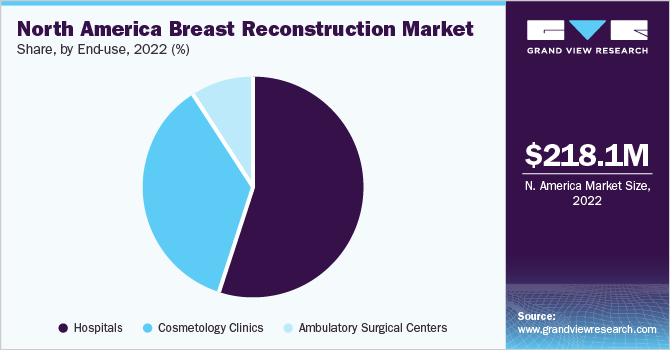

End-use Insights

Based on end-use, the hospital segment dominated the market with a revenue share of 55.3% in 2022, owing to the increasing number of hospitals in the North American region. For instance, according to a study published by the American Hospital Association in 2022, the number of hospitals in the U.S. was estimated to be 6,093 in 2020. Similarly, as per The Canadian Encyclopedia, there are 706 public & 193 private hospitals in Canada. Therefore, the rise in the number of hospitals provides patients with several options for breast reconstruction surgeries, thereby propelling the market growth.

On the other hand, the cosmetology clinics segment is expected to expand at the fastest CAGR of 7.0% over the forecast period from 2023 to 2030, owing to the rise in the number of cosmetologists in this region. For instance, according to Zippia, as of 2021, there were more than 196,744 licensed cosmetologists in the U.S. Increase in the number of cosmetologists is expected to augment the number of cosmetology clinics in this region, thereby boosting segment growth.

Regional Insights

The U.S. dominated the market with the largest revenue share of 74.4% in 2022, owing to the high number of breast cancer patients in the U.S. For instance, according to Breastcancer.org, 1 in every 8 women in the U.S. will develop invasive breast cancer in their lifetime. Additionally, 30.0% of the newly diagnosed cancer in American women is estimated to be breast cancer. Thus, rising breast cancer cases are expected to increase the demand for mastectomy procedures, which can potentially boost the North American breast reconstruction market.

There has been a rise in breast reconstructive procedures conducted in the U.S. For instance, as per NCBI, breast reconstruction surgery in the U.S. increased by 29.0% from 2000 to 2018. Similarly, there have been increasing cases of breast reconstruction post-mastectomy. For instance, according to a study by the National Library of Medicine, 40.0% of women in the U.S. have breast reconstruction surgery post-mastectomy. Thus, due to the factors mentioned above, the U.S. is expected to dominate the North American breast reconstruction market.

Canada is expected to expand at the fastest CAGR of 7.0% over the forecast period, owing to the robust healthcare system in Canada and rising cases of breast cancer. For instance, as per estimates from the Canadian Cancer Society, in 2021, approximately 27,700 women will be diagnosed with breast cancer, representing around 25.0% of all new cancer cases in women. Furthermore, approximately 76 women are diagnosed with breast cancer daily in Canada. Thus, mastectomy procedures in the country are expected to increase, further advancing the regional breast construction market.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements, and companies are constantly working towards improving their products with a major focus on research and development. Factors such as investments in R&D, compliance with regulatory policies, and technological advancements constantly drive the introduction of novel techniques. The degree of competition and competitive rivalry among the key players is expected to intensify during this period.

Moreover, many market players opt for tested strategies, such as product approvals, partnerships, and mergers, to have an edge over their competitors. For instance, in January 2021, Mentor Worldwide LLC announced the approval of MENTOR MemoryGel BOOST breast implant by the U.S. Food and Drug Administration (FDA) for breast augmentation in women of at least 22 years of age. The implant has been commercially available to surgeons in the United States since early 2022.

In another instance, in July 2021, BD announced the acquisition of Tepha, Inc. The acquisition will enable BD to use Tepha’s patented resorbable polymer to expand its mesh portfolio’s innovation potential for soft tissue repair, reconstruction & regeneration segments. Similarly, in December 2020, Establishment Labs received a CE mark for its next-generation Motive Ergonomicx2 silicone breast implant platform. The company also received a CE mark for the Motiva Ergonomix2 Diamond breast implant, intended to be used with the Motiva MIA system. Some of the prominent industry players operating in the North America breast reconstruction market include:

-

Mentor Worldwide LLC

-

AbbVie Inc.

-

Integra LifeSciences

-

Sientra, Inc.

-

Stryker

-

Establishment Labs

-

RTI Surgical

-

MTF Biologics

-

Surgical Innovation Associates

-

TELA Bio, Inc.

North America Breast Reconstruction Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 231.3 million

Revenue forecast 2030

USD 366.2 million

Growth Rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, shape, end-use, region

Country scope

U.S.; Canada

Key companies profiled

Mentor Worldwide LLC; AbbVie Inc.; Integra LifeSciences; Sientra, Inc.; Stryker; Establishment Labs; RTI Surgical; MTF Biologics; Surgical Innovation Associates; TELA Bio, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Breast Reconstruction Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America breast reconstruction market report based on product, shape, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Silicone Breast Implants

-

Saline Breast Implants

-

-

Tissue Expander

-

Saline Expander

-

Air Tissue Expander

-

-

Acellular Dermal Matrix

-

-

Shape Outlook (Revenue, USD Million, 2018 - 2030)

-

Round Shape

-

Anatomical Shape

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Cosmetology Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North American breast reconstruction market size was estimated at USD 218.1 million in 2022 and is expected to reach USD 231.30 million in 2023.

b. The North American breast reconstruction market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 366.2 million by 2030.

b. U.S. dominated the North American breast reconstruction market with a share of 74.4% in 2022. This is attributable to an increase in the number of mastectomies due to the rising incidence and prevalence of breast cancer, and well-established healthcare infrastructure.

b. Some key players operating in the North America breast reconstruction market include Mentor Medical Systems B.V. (Johnson & Johnson), Abbvie (Allergan Inc.), Integra LifeSciences Corporation, Sientra, Inc., Ideal Implant Incorporated, Stryker Corporation, Establishment Labs Holdings, Inc. (Motiva USA LLC), RTI Surgical, MTF Biologics, SIA (Surgical Innovation Associates), Tela Bio, Inc.

b. Key factors that are driving the North America breast reconstruction market growth include an increase in the number of breast reconstruction procedures, rising incidence of breast cancer, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."