- Home

- »

- Nutraceuticals & Functional Foods

- »

-

North America Protein Ingredients Market Size Report, 2033GVR Report cover

![North America Protein Ingredients Market Size, Share & Trends Report]()

North America Protein Ingredients Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Plant Protein, Animal/Dairy Protein), By Application (Food & Beverages, Infant Formulations), By Country, Segment Forecasts

- Report ID: GVR-4-68040-215-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Protein Ingredients Market Summary

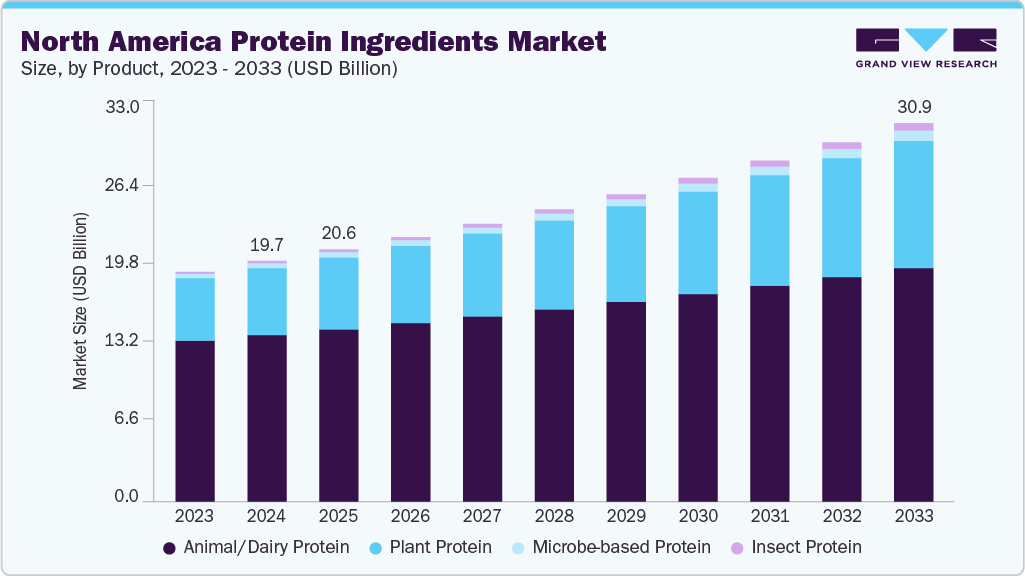

The North America protein ingredients market size was estimated at USD 19.66 billion in 2024, and is projected to reach USD 30.96 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033, driven by growing consumer demand for health and wellness products and the rising popularity of plant-based and functional foods. Additionally, advancements in food processing technology and increased use in sports nutrition sports nutrition further fuel market growth.

Key Market Trends & Insights

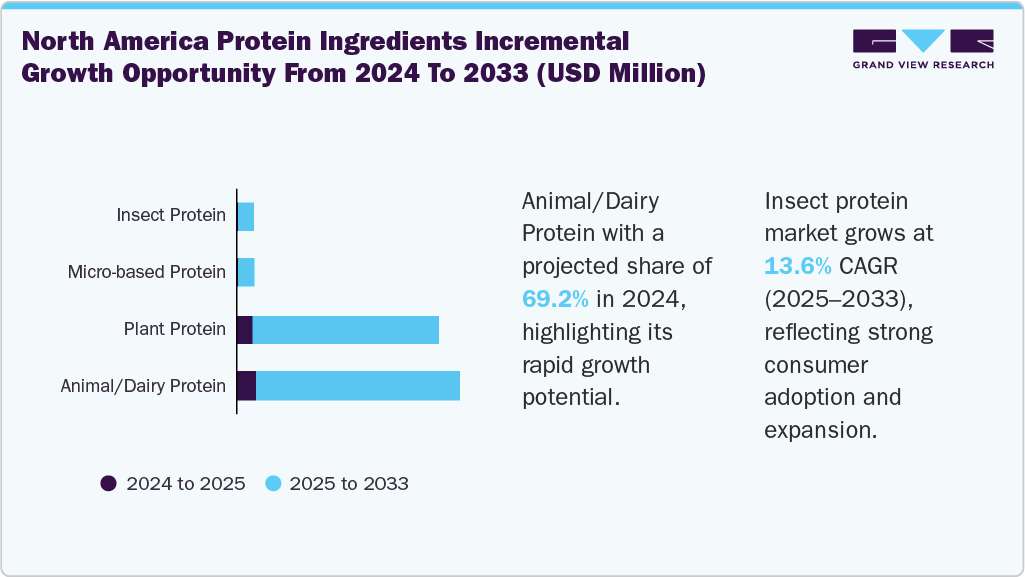

- The animal/ dairy protein market in the North America protein ingredients market accounted for a revenue share of 69.2% in 2024.

- The insect protein segment in the North America protein ingredients market is expected to witness a CAGR of 13.6% from 2025 to 2033.

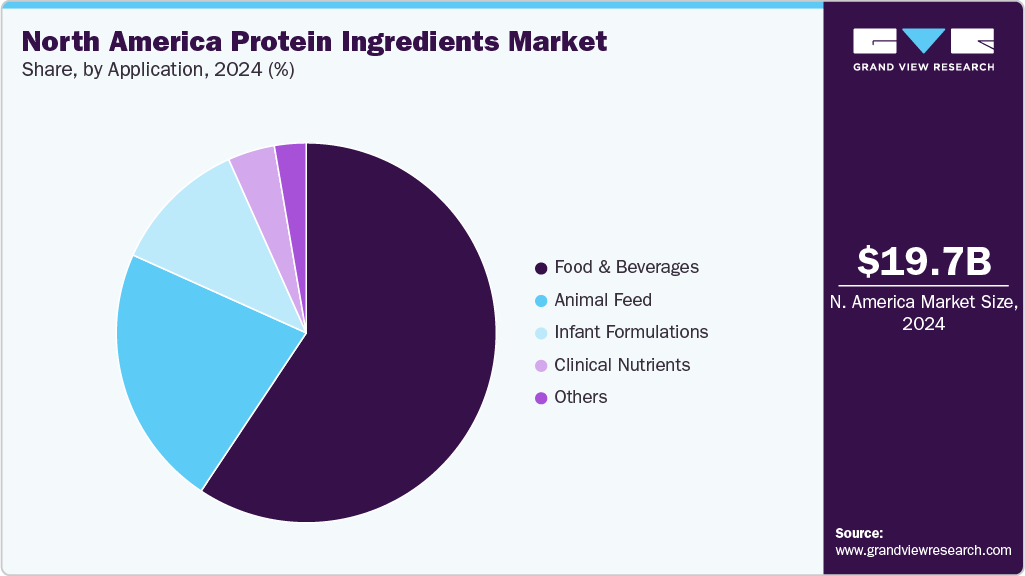

- By application, the food & beverages segment accounted for a revenue share of 59.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.66 Billion

- 2033 Projected Market Size: USD 30.96 Billion

- CAGR (2025-2033): 5.2%

The North America protein ingredient industry’s growth is driven by increasing health consciousness and demand for high-protein diets across diverse consumer groups. The growing popularity of plant-based and functional foods, especially among fitness enthusiasts and aging populations, is boosting market growth. Additionally, innovations in food processing and formulation are expanding protein applications in snacks, beverages, and meal replacements. Sustainability and clean-label trends are also influencing consumer preferences and product development in the region.

The North America protein ingredient market’s growth is propelled by rising demand from the sports nutrition and functional food sectors, driven by active lifestyles and fitness trends. Technological advancements in protein extraction and formulation are enhancing product quality and expanding applications across food and beverage categories. Collaborations between food tech companies and established brands are fostering innovation and boosting consumer interest. Moreover, digital marketing and influencer-led health campaigns are shaping consumer awareness and driving preference for high-protein, clean-label products. Companies such as ADM and Cargill offer a wide range of protein ingredients, including soy, pea, and wheat proteins, and are collaborating to widen their horizon. For instance, in August 2022, ADM partnered with Benson Hill to scale the latter's proprietary Ultra-High Protein (UHP) soybeans for the North American food ingredients market. This collaboration aims to meet the growing demand for plant-based proteins by leveraging Benson Hill's genomics-driven CropOS platform and ADM's extensive processing capabilities.

Product Insights

Animal/Dairy Protein in the North America protein ingredients market accounted for the largest revenue share of 69.2% in 2024. The North America animal and dairy protein ingredient market is driven by increasing consumer demand for high-quality, functional proteins like whey and casein in sports nutrition and health products. Advances in processing technologies have improved protein functionality and clean-label appeal. Growing interest in muscle recovery, weight management, and gut health further fuels market growth. Additionally, sustainability and ethical sourcing are becoming key factors influencing product development. For instance, according to the data published in May 2025, HealthFocus U.S. Trend Study, a study conducted in 2024, approximately 39% of consumers stated that incorporating protein into their diet has become essential, with many choosing products such as yogurts to obtain dairy protein.

The demand for insect protein is expected to grow at a CAGR of 13.6% from 2025 to 2033. Insect protein is gaining traction due to its high sustainability and low environmental footprint compared to traditional animal proteins. Its rich nutritional profile, including essential amino acids and healthy fats, makes it appealing to health-conscious consumers. Growing demand for alternative and eco-friendly proteins is pushing their adoption in both food and pet nutrition. Additionally, its versatility across products such as snacks, powders, and feed enhances its commercial potential. Recognizing the rising demand, companies are introducing new products and are collaborating with local companies. For instance, in October 2023, Tyson Foods, Inc. partnered with Protix, a leading producer of insect-based ingredients, to advance sustainable protein production. As part of the collaboration, Tyson acquired a minority stake in Protix to support its global growth and jointly develop an insect ingredient production facility in the U.S.

Application Insights

Protein ingredients for food & beverage applications accounted for the largest revenue share of 59.4% in 2024. Food and beverage applications are a major driver for the North America protein ingredients industry, fueled by rising consumer demand for high-protein, functional, and clean-label products. Protein fortification in snacks, dairy alternatives, beverages, and bakery items is growing rapidly, especially among health-conscious and fitness-oriented consumers. The popularity of plant-based and low-carb diets is further accelerating innovation in protein-enriched formulations. Additionally, advancements in taste, texture, and solubility of protein ingredients are expanding their use in mainstream food products.

Protein ingredients for animal feed applications are projected to grow at a CAGR of 5.0% from 2025 to 2033. The North American animal feed segment of the protein ingredients market is propelled by rising demand for high-quality proteins like soybean meal, fishmeal, and insect-derived proteins to support expanding livestock, poultry, and aquaculture industries. Enhanced feed efficiencies, achieved through precision nutrition and enzyme-enriched formulations, are improving livestock growth rates and reducing waste. Sustainability concerns and regulatory pressures are encouraging the adoption of eco-friendly alternatives, such as insect meal, algae, and single-cell proteins, which offer a lower environmental impact. For instance, according to the UN Food and Agriculture Organization (FAO) data, crickets need about six times less feed than cattle, four times less than sheep, and half as much as pigs and chickens to produce the same amount of protein.

Country Insights

The North America protein ingredients market is driven by rising consumer awareness of health, wellness, and fitness, leading to increased demand for functional foods and dietary supplements. Growing preference for clean-label and plant-based products is pushing innovation across the food, beverage, and personal care sectors. Regulatory support for sustainable sourcing and protein fortification is also shaping the market. Technological advancements in protein extraction and formulation further enhance application diversity.

U.S. Protein Ingredients Market Trends

The protein ingredients industry in the U.S. is projected to grow at a CAGR of 5.1% from 2025 to 2033. In the U.S., the protein ingredients market is expanding due to a strong focus on sports nutrition, weight management, and the needs of an aging population. High disposable income and evolving dietary preferences have fueled demand for high-protein snacks, beverages, and meal replacements. The booming plant-based sector and investment in food tech startups are accelerating market growth. Additionally, consumer demand for transparency and traceability is influencing ingredient sourcing.

The Mexico protein ingredients market is projected to grow at the fastest CAGR of 5.8% from 2025 to 2033. Mexico’s protein ingredients market is growing steadily, driven by increasing urbanization, a rising middle class, and growing interest in nutrition and wellness. Government initiatives to combat malnutrition and obesity are encouraging protein enrichment in staple foods. Local food manufacturers are incorporating protein ingredients into traditional products to appeal to evolving tastes.

Key North America Protein Ingredients Company Insights

The North America protein ingredients market is dynamic and competitive, with key players continually innovating to strengthen their market positions. Companies are investing in advanced processing technologies, clean-label product development, and diversified protein sources, including plant, animal, and alternative proteins, to meet evolving consumer preferences. Strategic partnerships, acquisitions, and regional expansion efforts are helping brands enhance distribution networks and reach new demographic segments.

Key North America Protein Ingredients Companies:

- Burcon

- The Scoular Company

- International Flavors & Fragrances Inc

- Nutri-Pea

- Ingredion

- Axiom Foods, Inc

- Aspire Food Group

- EnviroFlight

- Beta Hatch

- Entomo Farms

Recent Developments

-

In March 2025, The Canadian Meat Council (CMC) introduced the Protein PACT sustainability framework to the Canadian meat processing sector. This initiative, developed by the U.S.-based Meat Institute, aims to enhance sustainability practices across the industry, aligning with global standards and addressing critical issues.

-

In July 2024, Ingredion launched new pea protein under its brand VITESSENCE Pea 100 HD, optimized for cold-pressed bars, and expanded its line of protein fortification solutions. The newly launched pea protein is rich with 84% protein content on a dry basis and functions similarly to whey or soy protein.

North America Protein Ingredients Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 20.61 billion

Revenue Forecast in 2033

USD 30.96 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Burcon; The Scoular Company; International Flavors & Fragrances Inc.; Nutri-Pea; Ingredion; Axiom Foods, Inc.; Aspire Food Group; EnviroFlight; Beta Hatch; Entomo Farms

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America protein ingredients market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Plant Protein

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

-

Ancient Grains

-

Hemp

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Others

-

-

Nuts & Seeds

-

Canola

-

Almond

-

Flaxseeds

-

Others

-

-

-

Animal/Dairy Protein

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymenoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages (Non-Dairy Alternatives)

-

Breakfast Cereals

-

Dairy Alternatives

-

Beverages

-

Cheese

-

Snacks

-

Others

-

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Poultry

-

Beef

-

Pork

-

Others

-

-

Snacks (Non-Dairy Alternatives)

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrients

-

Animal Feed

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America Protein Ingredients market size was estimated at USD 19.66 billion in 2024 and is expected to reach USD 20.61 billion in 2025.

b. The North America Protein Ingredients market is expected to grow at a compound annual growth rate (CAGR) of 5.2 % from 2025 to 2033 to reach USD 30.96 billion by 2033.

b. Animal/dairy protein ingredients accounted for a revenue share of 69.2% in 2024, driven by rising consumer demand for high-protein diets and functional foods.

b. Some key players operating in the North America Protein Ingredients market include Burcon, The Scoular Company, International Flavors & Fragrances Inc., Nutri-Pea, Ingredion, and Axiom Foods, Inc.

b. Key factors driving growth in the North America protein ingredients market include increasing consumer focus on health, fitness, and muscle maintenance, rising demand for high-protein and functional food products, and a growing preference for clean-label, plant-based, and sustainable protein sources. Additionally, innovations in protein extraction technologies, expanding applications in sports nutrition and dietary supplements, and wider availability across retail and e-commerce channels are accelerating market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.