- Home

- »

- Digital Media

- »

-

Subscription Video On Demand Market, Industry Report 2030GVR Report cover

![Subscription Video On Demand Market Size, Share & Trends Report]()

Subscription Video On Demand Market (2025 - 2030) Size, Share & Trends Analysis Report By Content Type (Movies, TV Shows, Documentaries), By Device Type (Tablets, Laptops, Smart TVs), By Revenue Model, By End-use (Individual, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-581-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

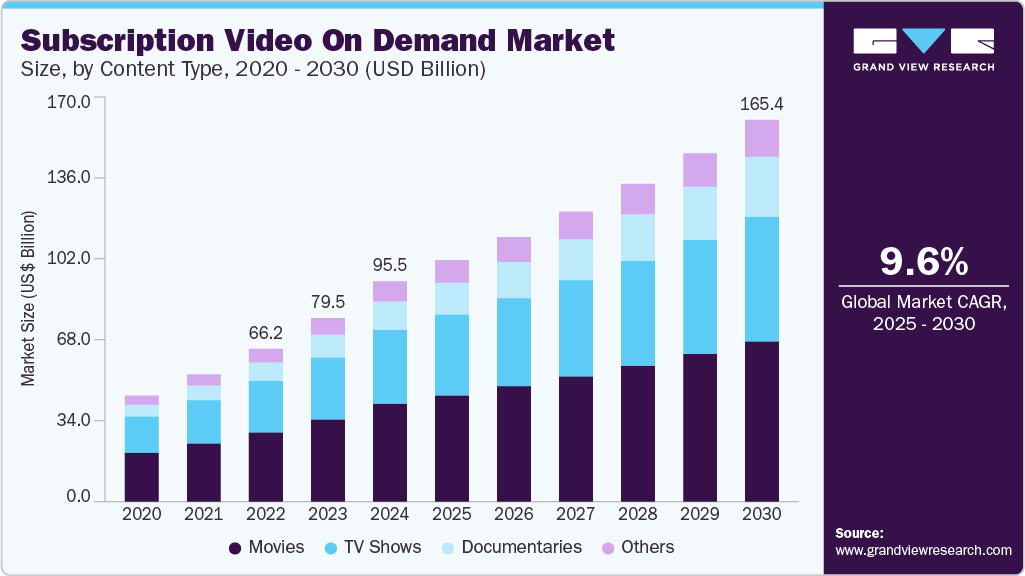

The global subscription video on demand market size was estimated at USD 95.50 billion in 2024 and is expected to grow at a CAGR of 9.6% from 2025 to 2030. The growing influence of social media is driving significant changes in the subscription video-on-demand (SVOD) industry.

Key Highlights:

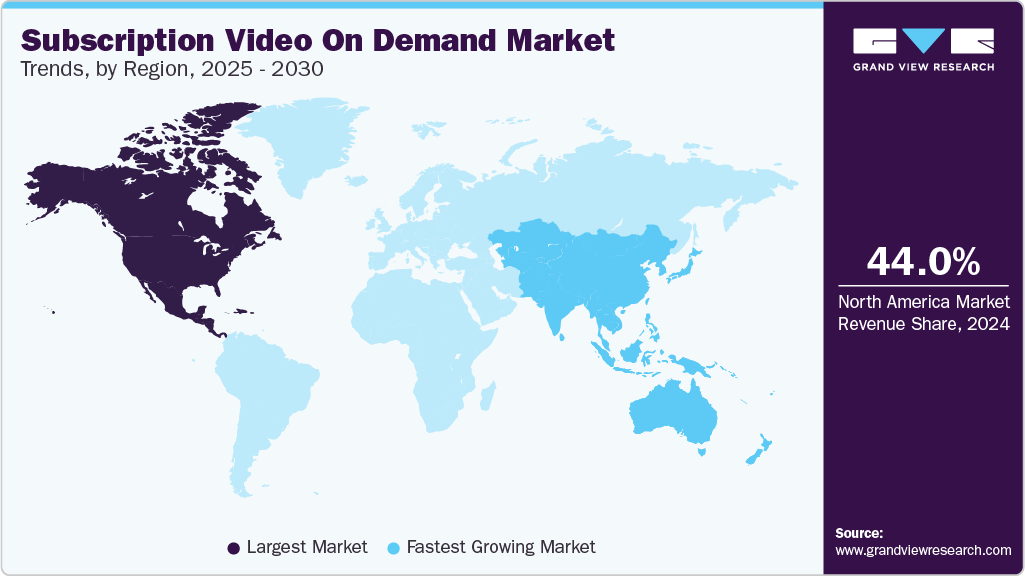

- The North America subscription video on demand market accounted for a significant share of over 44% in 2024

- The U.S. subscription video on demand industry dominated with a share of over 67% in 2024, driven by increasing demand for viewing flexibility.

- By content type, the movies segment dominated the SVOD market with a share of over 44% in 2024.

- By device type, the smartphones segment is expected to witness the fastest CAGR from 2025 to 2030.

- By revenue model, the subscription-based segment accounted for the largest market share in 2024.

Streaming platforms are leveraging social media to spotlight trending content, share exclusive behind-the-scenes insights, and engage directly with audiences in real time. This real-time interaction is crucial for staying relevant, sparking conversations, and building deeper connections with viewers. By increasing content visibility and creating buzz via social media platforms, SVOD providers are enhancing user engagement and loyalty, establishing social media as a crucial growth driver for the market.

The integration of subscription video on demand services with smart TVs, streaming devices, and voice assistants is becoming increasingly seamless, significantly enhancing the user experience. This frictionless connectivity allows consumers to access content effortlessly across multiple platforms, aligning with the growing expectation for consistent performance and usability. Consequently, the subscription video on demand industry is expanding its reach by catering to a broader, tech-savvy audience. This trend is a key enabler of the market growth, as convenience and accessibility drive higher engagement and subscriber acquisition.

The rising global appetite for animated content is emerging as a key growth catalyst within the subscription video on demand industry, appealing to both younger audiences and adults. SVOD platforms are strategically investing in premium animated series and films that address diverse age groups, including family-friendly titles and more sophisticated animated offerings. As animation gains recognition as a genre with wide-ranging appeal, it is strengthening viewer engagement and retention. This dynamic is accelerating the expansion of the SVOD market by tapping into a versatile content segment with cross-generational relevance.

In emerging regions such as Asia-Pacific and Latin America, increasing demand for on-demand content is serving as a major growth driver for the market. Improved internet infrastructure, the affordability of mobile devices, and greater access to digital payment solutions are transforming content consumption patterns in these markets. In response, SVOD platforms are rolling out localized content strategies and flexible pricing models tailored to regional preferences. This evolution is fueling rapid growth in the subscription video on demand market, positioning these developing economies as critical engines of global industry expansion.

The demand for exclusive, high-quality programming continues to be a major force propelling the subscription video on demand industry forward. Leading providers are prioritizing investment in original content and region-specific productions to differentiate their platforms and foster stronger viewer loyalty. These efforts enhance brand positioning and cater to evolving consumer expectations for culturally relevant and engaging entertainment. Consequently, the creation of original and localized content remains a central growth driver in the SVOD market, helping platforms retain competitive advantage in a crowded digital media landscape.

Content Type Insights

The movies segment dominated the SVOD market with a share of over 44% in 2024. The integration of advanced technologies such as AI, virtual reality (VR), and high-definition formats is revolutionizing movie production within the SVOD segment. These technologies enable filmmakers to create more immersive and visually stunning content, enhancing the overall viewing experience for subscribers. In addition, AI-driven content recommendations and data analytics allow platforms to optimize the movie selection process, ensuring viewers have access to highly personalized movie suggestions. As technology continues to evolve, it is expected to play a more significant role in both the production and distribution of movies within the subscription video-on-demand market.

The documentaries segment is expected to witness the fastest CAGR of over 13% from 2025 to 2030. The increasing demand for high-quality documentary content is driving SVOD platforms to forge more partnerships with documentary filmmakers and production companies. These collaborations enable streaming services to offer exclusive, top-tier documentaries that give them a competitive advantage in the market. By co-producing content with renowned filmmakers, platforms can tap into niche audiences while ensuring the documentaries meet the highest standards. As a result, these partnerships are becoming a key strategic driver for the growth of the documentary segment.

Device Type Insights

The laptops segment accounted for a significant market share in 2024, driven by the increasing demand for enhanced computing power, the high-performance laptop segment is experiencing significant growth. Consumers are increasingly seeking laptops with faster processors, more RAM, and better graphics capabilities to support work, entertainment, and gaming. This trend is particularly fueled by the rise of remote work and the need for powerful devices that can handle multitasking, video conferencing, and resource-intensive applications. Consequently, laptop manufacturers are prioritizing innovation to meet the evolving performance needs of their customers.

The smartphones segment is expected to witness the fastest CAGR from 2025 to 2030. The growing demand for high-quality mobile photography is pushing smartphone manufacturers to prioritize advanced camera technologies. With consumers using their smartphones for a variety of photography and video purposes, from social media content creation to professional-grade photography, there is a significant focus on improving camera resolution, lens capabilities, and AI-driven photography features. Driven by this trend, smartphones are integrating multi-camera setups, enhanced sensors, and cutting-edge software to deliver superior photo and video quality, making camera performance a key selling point in the competitive smartphone market.

Revenue Model Insights

The subscription-based segment accounted for the largest market share in 2024. The growing demand for sustainability is influencing the adoption of subscription-based services, with consumers seeking eco-friendly and socially responsible options. Subscription services are increasingly incorporating sustainable practices such as eco-friendly packaging, carbon-neutral shipping, and offering products that are ethically sourced. This trend is particularly prominent in industries like fashion, beauty, and food, where brands are aligning their business models with sustainability goals. As environmental concerns grow, businesses that integrate sustainability into their subscription offerings can attract eco-conscious consumers and build long-term brand loyalty.

The advertisement-based segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the increasing use of smartphones for media consumption, and the advertisement-based segment is shifting towards mobile-first ad models. As mobile devices become the primary means for accessing content, advertisers are adapting their strategies to reach users on their smartphones through mobile-optimized ads. This includes in-app ads, video ads, and interactive formats designed specifically for smaller screens. The mobile-first approach allows advertisers to capitalize on the growing number of mobile users, expanding the reach and effectiveness of their campaigns within the advertisement-based segment.

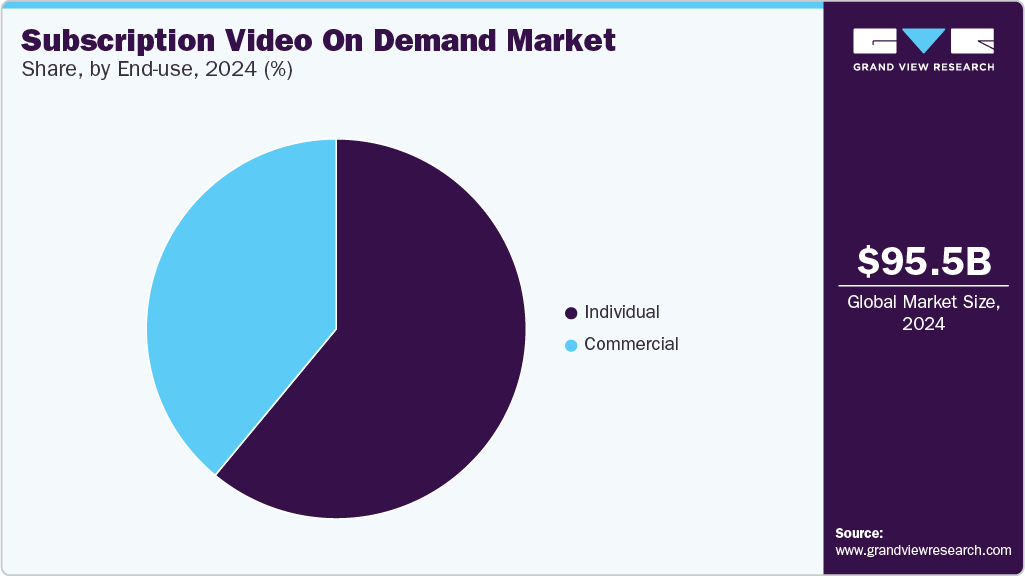

End-use Insights

The individual segment accounted for the largest market share in 2024, driven by the rising consumer demand for hyper-personalized digital experiences, businesses are increasingly leveraging AI and behavioral analytics to offer tailored recommendations, dynamic content, and customized user interfaces. This growing expectation is compelling platforms to focus on first-party data utilization and enhance user segmentation strategies to maintain a competitive edge. Personalization has evolved into a key growth enabler for organizations aiming to engage users on an individual level.

The commercial segment is expected to witness the fastest CAGR from 2025 to 2030, primarily driven by the need for diversified revenue streams. Many subscription video on demand (SVOD) platforms are adopting hybrid monetization models that combine subscription fees with ad-supported content. This approach allows platforms to cater to both premium subscribers who prefer an ad-free experience and price-sensitive users who are willing to tolerate ads in exchange for lower subscription costs. By offering tiered pricing plans and varying content access, these hybrid models help platforms maximize revenue potential across different customer segments. This trend is contributing to the market’s expansion, particularly in emerging economies where cost-conscious consumers dominate.

Regional Insights

The North America subscription video on demand market accounted for a significant share of over 44% in 2024, driven by the rapid growth of smart home technologies. SVOD platforms in North America are strategically integrating their services with IoT devices like Amazon Alexa and Google Assistant. This integration enhances user experience by providing seamless voice control for content navigation, thereby improving accessibility and engagement. By tapping into the growing smart device ecosystem, platforms are increasing consumer touchpoints and solidifying their presence in connected households.

U.S. Subscription Video On Demand Market Trends

The U.S. subscription video on demand industry dominated with a share of over 67% in 2024, driven by increasing demand for viewing flexibility. U.S.-based platforms are enhancing their services to support seamless access across multiple devices, including smartphones, smart TVs, and gaming consoles. This approach caters to consumer expectations for on-the-go streaming and uninterrupted viewing experiences. By adopting a multi-platform strategy, providers are boosting customer satisfaction and broadening their subscriber base.

Europe Subscription Video On Demand Market Trends

Europe subscription video on demand industry is expected to grow at a CAGR of over 7% from 2025 to 2030, driven by the increasing demand for localized content, prompting platforms to prioritize region-specific programming that addresses the diverse cultural preferences of their audiences. To enhance viewer engagement, platforms are investing in subtitling, dubbing, and local production to ensure that content resonates with regional viewers. This emphasis on cultural relevance and personalized experiences is strengthening platform-user relationships and driving growth in the European market.

The UK subscription video on demand market is expected to grow at a significant rate in the coming years, owing to the adoption of hybrid monetization models, which combine both subscription-based and ad-supported content. This flexible pricing strategy enables platforms to cater to a wider demographic, appealing to both premium users and cost-sensitive consumers. By diversifying their revenue models, platforms are extending their market reach and enhancing subscriber acquisition.

The subscription video on demand market in Germany is driven by the rising demand for eco-conscious solutions, driven by considerable investments in high-quality, exclusive original programming designed to attract local audiences. Platforms are focusing on producing German-language series and films to meet the increasing demand for locally relevant content. The emphasis on exclusive, localized content is helping platforms differentiate themselves in a competitive marketplace while fostering long-term subscriber retention.

Asia Pacific Subscription Video On Demand Market Trends

The Asia Pacific subscription video on demand industry is expected to grow at the highest CAGR of over 14% from 2025 to 2030, driven by mobile-first consumer behavior, with a growing number of viewers accessing video content through smartphones and tablets. In response, platforms are optimizing their services for mobile devices, ensuring a seamless streaming experience for consumers on the go. This mobile-centric shift is expanding the reach of SVOD services, particularly among younger, tech-savvy audiences, and broadening market penetration.

The Japan subscription video on demand market is gaining traction, driven by the rising demand for niche content, particularly anime, which continues to captivate a global audience. In response, platforms are offering exclusive anime series and films tailored to both domestic and international viewers. This focus on specialized content is not only driving subscriber growth within Japan but also expanding the global reach of Japanese entertainment.

The subscription video on demand market in China is rapidly expanding, primarily influenced by government policies that prioritize the promotion of domestic content while limiting foreign programming. Platforms are increasingly focusing on producing Chinese-language content that aligns with local cultural values and societal norms. This regulatory support is fueling the growth of domestic SVOD services, enhancing their appeal to local subscribers and driving robust market expansion.

Key Subscription Video On Demand Company Insights

Some of the key players operating in the market are Netflix and Amazon Prime Video.

-

Netflix is one of the prominent players in the SVOD market, consistently setting industry benchmarks for content investment and subscriber growth. The company continues to expand its library with high-performing originals across multiple genres and languages, bolstering its global presence. Strategic localization, strong data analytics, and seamless user experience have been central to maintaining its dominance. Netflix specializes in high-quality original programming and international content scalability.

-

Amazon Prime Video leverages its integration with Amazon’s broader ecosystem to increase customer retention and enhance value for Prime members. Its aggressive investment in regional productions and live sports broadcasting has expanded its global market share. The platform benefits from cross-service bundling and a growing slate of exclusive releases, reinforcing customer engagement. Amazon Prime Video specializes in bundled content delivery and globally diversified entertainment offerings.

Apple TV+ and Discovery+ are some of the emerging participants in the subscription video on demand market.

-

Apple TV+ has established itself as a premium content provider, focusing on quality over quantity through high-budget, critically acclaimed originals. Its content strategy prioritizes A-list talent and award-winning storytelling, supported by seamless integration with Apple’s ecosystem. Although its content library remains smaller, Apple TV+ benefits from bundling with Apple One services, improving retention rates. Apple TV+ specializes in exclusive, high-production-value scripted content.

-

Discovery+ is gaining traction by targeting niche audiences with non-scripted, lifestyle, and factual content that includes home, cooking, nature, and true crime genres. It benefits from an expansive content library and efficient production capabilities, making it cost-effective to scale. Telecom partnerships and regional bundling strategies further support the platform’s growth. Discovery+ specializes in unscripted and documentary-style programming, appealing to viewers seeking educational and lifestyle content.

Key Subscription Video On Demand Companies:

The following are the leading companies in the subscription video on demand market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Prime Video

- Apple TV+

- DAZN

- Discovery+

- Disney+

- HBO Max

- Hulu

- Netflix

- Paramount+

- Peacock

- Sony Crackle

- YouTube Premium

Recent Developments

-

In May 2025, Roku acquired Frndly TV, a U.S.-based streaming service provider recognized for its cost-effective, family-oriented programming. The acquisition aligns with Roku’s strategic objective to broaden its content offerings and strengthen its appeal among price-sensitive consumer segments. This move is expected to bolster Roku’s presence in the ad-supported streaming market and enhance the platform’s content diversity for its expanding user base.

-

In February 2025, Stingray Advertising partnered with Vistar Media to introduce in-store video advertising across 576 METRO grocery stores in Quebec and Ontario, including Metro, Super C, and Food Basics. This collaboration leverages Vistar’s advanced platform to deliver dynamic, data-driven video content at retail entrances and METRO pharmacy banners, enabling brands to engage shoppers at key moments in their purchase journey. The partnership marks Stingray's expansion into video advertising, enhancing their retail media network with cutting-edge targeting capabilities, real-time analytics, and seamless operations.

-

In February 2025, STARZPLAY partnered with Seekr to enhance its AI-driven streaming experience in the GCC region. This collaboration introduces a sentiment-based search feature, allowing users to discover content aligned with their current mood by entering mood-related keywords. Additionally, STARZPLAY plans to offer Seekr’s AI solutions to businesses, enabling them to leverage advanced tools like intelligent chatbots, deep learning search, and anti-piracy measures to drive growth and improve customer engagement.

Subscription Video On Demand Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 104.66 billion

Revenue forecast in 2030

USD 165.45 billion

Growth rate

CAGR of 9.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Segments covered

Content type, device type, revenue model, end-use, region

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Amazon Prime Video; Apple TV+; DAZN; Discovery+; Disney+; HBO Max; Hulu; Netflix; Paramount+; Peacock; Sony Crackle; YouTube Premium

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Subscription Video On Demand Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the subscription video on demand market report based on content type, device type, revenue model, end-use, and region:

-

Content Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Movies

-

TV Shows

-

Documentaries

-

Others

-

-

Device Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartphones

-

Tablets

-

Laptops

-

Smart TVs

-

Others

-

-

Revenue Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Subscription-based

-

Advertisement-Based

-

Hybrid

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Individual

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global subscription video on demand market size was estimated at USD 95.50 billion in 2024 and is expected to reach USD 104.66 billion in 2025.

b. The global subscription video on demand market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 165.45 billion by 2030.

b. North America dominated the subscription video on demand market with a share of over 44.0% in 2024, driven by high internet penetration, widespread adoption of smart devices, and strong consumer demand for personalized, on-demand content.

b. Some key players operating in the subscription video on demand market include Amazon Prime Video, Apple TV+, DAZN, Discovery+, Disney+, HBO Max, Hulu, Netflix, Paramount+, Peacock, Sony Crackle, and YouTube Premium.

b. Key factors that are driving the market growth include rapid expansion of mobile streaming services, growing adoption of smart TVs and connected home devices, rising disposable incomes, and shifting consumer behavior toward cord-cutting.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.