- Home

- »

- Semiconductors

- »

-

Passive And Interconnecting Electronic Components Market Report, 2030GVR Report cover

![Passive And Interconnecting Electronic Components Market Size, Share & Trends Report]()

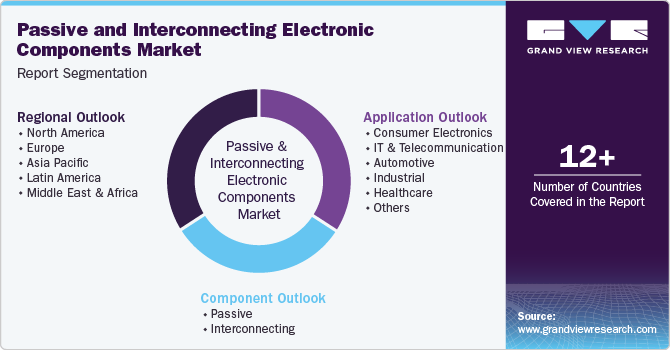

Passive And Interconnecting Electronic Components Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Passive, Interconnecting), By Application (Consumer Electronics, IT & Telecommunication), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68038-555-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

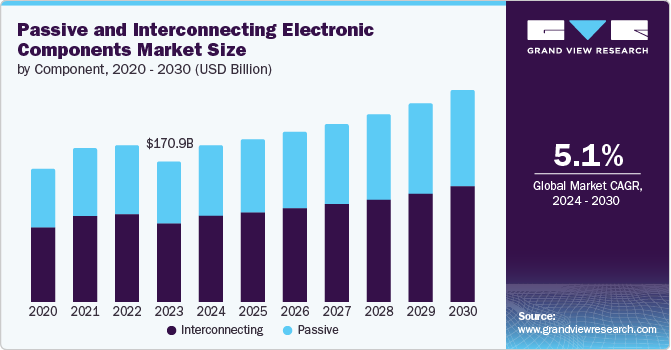

The global passive and interconnecting electronic components market size was estimated at USD 170.94 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. Passive and interconnecting electronic components are integral parts of electronic devices such as smartphones, computers, gaming consoles, and home appliances. Thus, the significantly growing adoption of smartphones and laptops in developing countries such as India and China is estimated to drive market growth over the forecast period.

The 5G network infrastructure is being rapidly deployed in major countries, including China, the U.S., South Korea, the UK, and Japan. According to the GSM Association, global 5G coverage has expanded from 4% in 2019 to 32.5% in 2022. The rollout of 5G services, combined with the increasing need for high-speed internet connectivity among consumers, has driven demand for 5G devices worldwide. The considerable rise in demand for 5G devices across various sectors, such as automotive, industrial, and consumer electronics, is expected to boost the market’s growth.

The rising adoption of Internet of Things (IoT) devices is driving rapid transformation in the industrial sector. Industrial IoT devices enhance productivity and operational efficiency in manufacturing facilities by simplifying operations and reducing system downtime. Additionally, with the advent of the fourth industrial revolution (Industry 4.0), many manufacturing facilities are integrating connected devices to streamline processes through remote monitoring. Consequently, the rising deployment of IoT devices in industrial applications, such as automation and motion control, is anticipated to boost the growth of the market.

The growing percentage of the geriatric population and the occurrence of diseases such as diabetes and high blood pressure have resulted in a rise in demand for electronic medical devices to measure blood pressure, sugar levels, and so on, is increasing. The medical device manufacturers are introducing affordable and reliable medical equipment in the market. Various passive and interconnecting electronic components are used in all kinds of medical care devices to achieve higher reliability and affordability. Devices such as blood glucose meters and blood pressure monitors incorporate a significant number of passive components. Thus, there is substantial demand for passive and interconnecting electronic components from the medical industry.

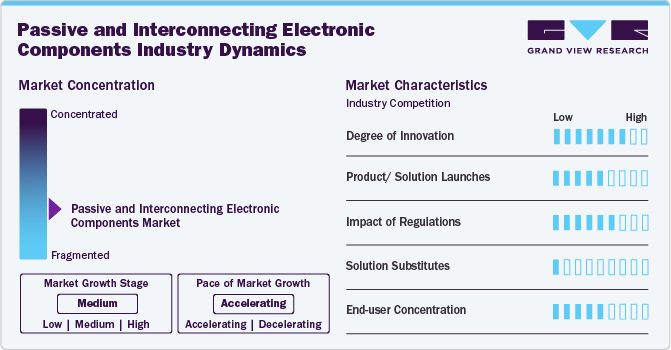

Industry Dynamics

The passive and interconnecting electronic components market growth stage is medium, and the pace of growth is accelerating. The market is fragmented, with the presence of numerous passive and interconnecting electronic component manufacturers. The target market is characterized by a high degree of innovation, with market players introducing smaller passive electronic components. This has led to advancements in materials and manufacturing techniques to ensure the development of smaller components without compromising performance.

The target market is also characterized by many product launches by the leading companies. For instance, in January 2024, TDK Corporation introduced the KLZ2012-A series multilayer inductors designed specifically for automotive audio bus (A2B) applications. These inductors boast a wide operating range and high durability and can withstand temperatures up to 150°C, as well as mechanical stresses and thermal shocks.

Passive and interconnecting electronic component manufacturers must ensure compliance with regulations such as Restricted Hazardous Substances (RoHS) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). Moreover, they must follow various industry standards, such as the Automotive Electronics Council (AEC)'s AEC-Q200 standards for passive components in the automotive industry.

Passive and interconnecting electronic components are essential products for building an electronic circuit. They enable the control and manipulation of electrical signals, facilitating functions such as filtering and signal conditioning. Hence, there are no direct substitutes for them, and the threat of substitutes is low.

The end-user concentration in the market is diverse, with demand coming from various industries, including consumer electronics, industrial, automotive, and IT and telecommunications. The aerospace and defense industry requires reliable passive and interconnecting electronic components for various applications, such as avionics and radar systems.

Component Insights

In 2023, the interconnecting segment held the largest revenue share of 55.0%. The interconnecting segment’s growth is attributed to the need for reliable and secure method of connecting different electronic components in an electronic circuit. Connectors enable manufacturers to effortlessly assemble, repair, or upgrade various components within an electronic system. Such versatility is essential in today's dynamic technological environment, where adaptability minimizes expenses and shortens the time required to introduce new products. Their significance is paramount in guaranteeing the seamless and effective functioning of electronic devices.

The passive segment is expected to register the fastest CAGR over the forecast period. The segment’s growth can be attributed to the growing advancements and introduction of smaller passive electronic components that integrate with compact electronic devices. For instance, in February 2024, Murata Manufacturing Co., Ltd. announced the launch of the Monolithic Ceramic Chip Capacitor (MLCC) series, GJM022. Measuring 0.4 mm × 0.2 mm LW, the GJM022 series aids electronic engineers in surpassing packaging constraints without compromising performance. Additionally, its high-temperature assurance grants designers more flexibility in the placement, ensuring dependable long-term functionality, even near heat-emitting components like power semiconductors.

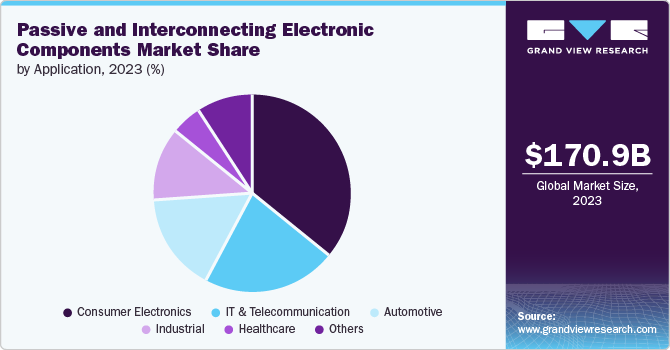

Application Insights

The consumer electronics segment dominated the target market with a share of 35.0% in 2023. The segment’s growth can be attributed to the growing demand for consumer electronic devices, such as smartphones and home appliances. According to the GSM Association’s 2023 report, over half of the global population owned a smartphone. With the growing adoption of smartphones, the demand for passive and interconnecting electronic components is expected to grow. Moreover, the introduction of smart devices is contributing to the segment’s growth.

The automotive segment is expected to register the fastest CAGR over the forecast period. The expansion is growing due to factors such as growing vehicle electrification, rising adoption of Advanced Driver-Assistance Systems (ADAS) technologies, and integration of connected car technologies in automobiles. According to TDK Corporation’s March 2023 annual report, the number of MLCCs in an Electric Vehicle (EV) is set to be from 5,000 to 10,000 or more, growing from 3,000 to 5,000 in a gasoline car. Hence, with the growing adoption of EVs, the demand for passive and interconnecting electronic components is expected to grow.

Regional Insights

The market in North America is projected to grow at a CAGR of 4.7% from 2024 to 2030. The market’s growth in the region is driven by the rising adoption of advanced technologies and increasing industrial automation. Regional governments and businesses invest in technologies such as Artificial Intelligence (AI) and IoT, which drives the need for a wide range of passive and interconnecting electronic components.

U.S. Passive And Interconnecting Electronic Components Market Trends

The market in the U.S. is projected to grow at a CAGR of 4.3% from 2024 to 2030. Amid the rising popularity of connected vehicles in the U.S., major telecom companies like Verizon and AT&T are making substantial investments in rolling out 5G network infrastructure. This advanced 5G mobile network is expected to offer seamless connectivity to vehicles across the nation through widespread infrastructure. The anticipated deployment of 5G network infrastructure in the upcoming years is expected to drive the adoption of new installations of telecom equipment and networking devices, consequently fueling the market’s growth.

Europe Passive And Interconnecting Electronic Components Market Trends

The market in Europe was valued at USD 32.10 billion in 2023. The market’s growth in the region is driven by the growing adoption of renewable energy, the expanding automotive sector, and the growing adoption of Industrial IoT. According to the European Commission, the share of renewable energy in total energy consumption in the European Union (EU) has grown to 23% in 2022 from 12.5% in 2010. This drives the growth of the market.

Germany passive and interconnecting electronic components market is expected to grow at a CAGR of 6.0% from 2024 to 2030. The target market's growth in Germany can be attributed to the strong automotive industry in the country. According to the German Association of the Automotive Industry, over 4.1 million passenger cars were manufactured in the automotive manufacturing plants in Germany in 2023, growing by 18% from 2022. Target market components are used in various automotive applications, such as safety systems and engine control systems. Hence, with the growth of the automotive sector in the country, the target market is expected to witness growth.

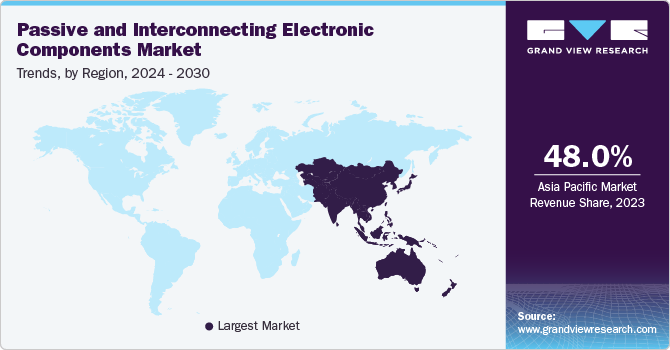

Asia Pacific Passive And Interconnecting Electronic Components Market Trends

Asia Pacific dominated the market and accounted for 48.0% of the revenue share in 2023. The presence of major electronic product manufacturers and exporters in the region significantly drives growth. Key consumer electronics manufacturers like South Korea-based SAMSUNG, Japan-based Panasonic Holdings Corporation, and India-based Godrej.com are expected to positively impact regional growth.

China passive and interconnecting electronic components market is projected to grow at a CAGR of 5.0% from 2024 to 2030. The market’s growth is driven by a strong electronics manufacturing base and advancements in 5G technology in the country. China is a global center for electronics manufacturing, hosting numerous companies that produce a diverse array of components. This well-established manufacturing base drives the growth of the target market in the country.

Key Passive And Interconnecting Electronic Components Company Insights

Some of the key companies operating in the market include Murata Manufacturing Co., Ltd., TE Connectivity, TDK Corporation, and YAGEO Group, among others.

-

Murata Manufacturing Co., Ltd. is a Japan-based manufacturer of electronic components, modules, and devices. The company operates in three business segments, namely, Components, Devices/modules, and Others. It offers passive electronic components, such as capacitors and inductors.

-

YAGEO Group is a Taiwan-based company manufacturing passive electronic components. It serves numerous industries, including automotive, aerospace & defense, and industrial, among others. YAGEO Group has a robust global presence, with 53 manufacturing sites, 35 sales offices, and 20 R&D centers spread across 32 countries worldwide.

Fenghua (HK) Electronics Ltd. and SAMTEC are some of the emerging companies in the target market.

-

Fenghua (HK) Electronics Ltd. is a prominent manufacturer specializing in passive electronic components. The company offers a broad range of passive electronic components, including MLCC, disk ceramic capacitors, tantalum capacitors, and chip inductors.

-

Samtec is a U.S.-based manufacturer of electronic interconnect solutions, providing a wide range of products in various industries worldwide. The company specializes in high-speed, high-performance interconnects designed to meet the demanding requirements of modern electronic systems. It has a global presence with sales offices and distributors located worldwide.

Key Passive And Interconnecting Electronic Components Companies:

The following are the leading companies in the passive and interconnecting electronic market. These companies collectively hold the largest market share and dictate industry trends.

- KYOCERA AVX Components Corporation

- Vishay Intertechnology, Inc.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- TAIYO YUDEN CO., LTD.

- TE Connectivity

- SAMSUNG ELECTRO-MECHANICS

- Hosiden Corporation

- YAGEO Group

- NICHICON CORPORATION

- Fenghua (HK) Electronics Ltd.

- ROHM CO., LTD.

- Amphenol Corporation

- Molex

- Samtec

Recent Developments

-

In March 2024, KEMET, a division of the YAGEO Group, unveiled the initial release of T581 capacitors, which adhere to the Military Performance Specification Sheets MIL-PRF-32700/2. These capacitors, rated at 35V, cater to the demanding needs of military applications by delivering MIL-PRF-certified components and leveraging the exceptional volumetric efficiency of polymer tantalum technology, especially beneficial in high-efficiency fast-switching DC/DC converters.

-

In February 2024, Samtec unveiled the extension of its Edge Rate connectors with the introduction of the ERM6 & ERF6 Series. These connectors boast a denser mated set, narrower width, and a low-profile height of 5 mm, catering to industries like embedded vision, industrial, instrumentation, and robotics with support for 56 Gbps PAM4 high-speed applications.

-

In January 2024, Murata Manufacturing Co., Ltd. unveiled the DFE2MCPH_JL series, a collection of automotive-grade power inductors designed for automotive powertrain/safety equipment, available in 0.33µH and 0.47µH variants. Leveraging Murata Manufacturing Co., Ltd.'s advancements in material and manufacturing technology, these metal alloy inductors deliver exceptional quality and performance, rendering them ideal for rigorous automotive applications like ADAS and In-Vehicle Infotainment (IVI) Systems, which are experiencing rapid growth.

Passive And Interconnecting Electronic Components Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 191.14 billion

Revenue forecast in 2030

USD 258.01 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

KYOCERA AVX Components Corporation; Vishay Intertechnology, Inc.; Murata Manufacturing Co., Ltd.; TDK Corporation; TAIYO YUDEN CO. LTD.; TE Connectivity; SAMSUNG ELECTRO-MECHANICS; Hosiden Corporation; YAGEO Group; NICHICON CORPORATION; Fenghua (HK) Electronics Ltd.; ROHM CO., LTD.; Amphenol Corporation; Molex; Samtec

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Passive And Interconnecting Electronic Components Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global passive and interconnecting electronic components market report based on component, application, and region:

-

Component Outlook (Revenue, USD Million; 2017 - 2030)

-

Passive

-

Resistors

-

Capacitors

-

Inductors

-

Transformers

-

Others

-

-

Interconnecting

-

PCB

-

Connectors/Sockets

-

Switches

-

Relays

-

Others

-

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Consumer Electronics

-

Mobile Phones

-

Personal Computers

-

Home Appliances

-

Audio and Video Systems

-

Storage Devices

-

Others

-

-

IT & Telecommunication

-

Telecom Equipment

-

Networking Devices

-

-

Automotive

-

Driver Assistance Systems

-

Engine Control Systems

-

Safety Systems

-

Infotainment Systems

-

Others

-

-

Industrial

-

Industrial Automation and Motion Control

-

Industrial Power Electronics

-

Others

-

-

Healthcare

-

Diagnostic Imaging Systems

-

Patient Monitoring Systems

-

Surgical Instruments and Robots

-

Consumer Medical Devices

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global passive and interconnecting electronic components market size was estimated at USD 170.94 billion in 2023 and is expected to reach USD 191.14 billion in 2024.

b. The global passive and interconnecting electronic components market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 258.01 billion by 2030.

b. Asia Pacific dominated the passive and interconnecting electronic components market with a share of over 48.0% in 2023. This is attributable to the presence of numerous consumer electronics device manufacturers in the region.

b. Some key players operating in the passive and interconnecting electronic components market include KYOCERA AVX Components Corporation, Vishay Intertechnology, Inc., Murata Manufacturing Co., Ltd., TDK Corporation, TAIYO YUDEN CO., LTD., TE Connectivity, SAMSUNG ELECTRO-MECHANICS, Hosiden Corporation, YAGEO Group, NICHICON CORPORATION, Fenghua (HK) Electronics Ltd., ROHM CO., LTD., Amphenol Corporation, Molex, and Samtec.

b. Key factors driving market growth include the growing demand for consumer electronics devices such as smartphones, the growing rollout of 5G services, and the increasing electrification of automobiles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.