- Home

- »

- Homecare & Decor

- »

-

Pest Control Products Market Size, Industry Report, 2033GVR Report cover

![Pest Control Products Market Size, Share & Trends Report]()

Pest Control Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sprays/Aerosols, Baits/Gels, Repellents), By Pest Type (Flying Insects, Crawling Insects, Rodents), By Control Mechanism, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-731-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pest Control Products Market Summary

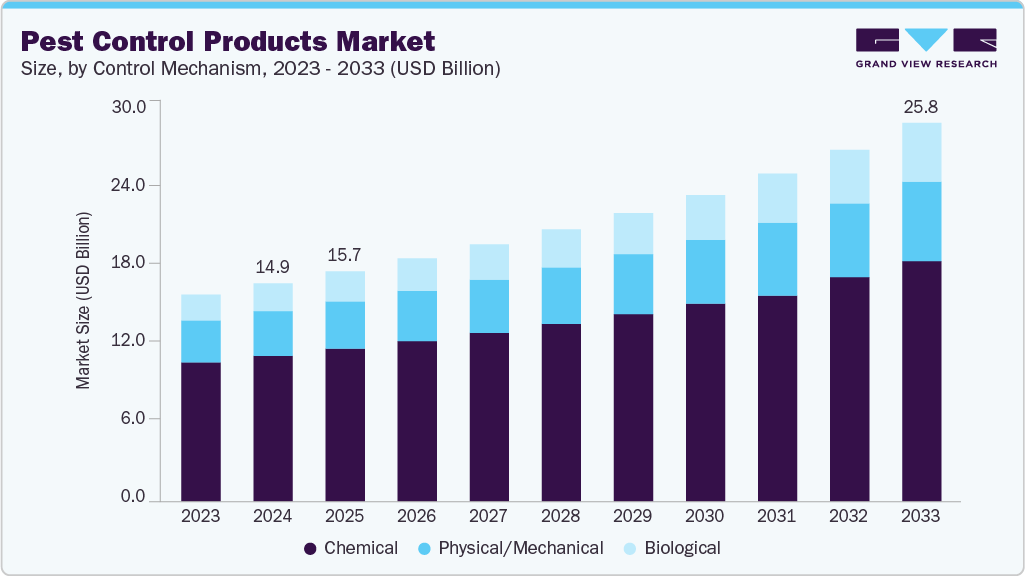

The global pest control products market size was estimated at USD 14.87 billion in 2024 and is projected to reach USD 25.83 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033. This growth is driven by rising public health awareness and increasing incidences of vector-borne diseases. Outbreaks of mosquitoes carrying dengue, chikungunya, and Zika, alongside rodents and cockroaches in urban and suburban regions, have prompted both households and commercial operators to adopt more proactive pest management strategies.

Key Market Trends & Insights

- North America pest control products market held the largest share of 40.2% of the global market in 2024.

- By product, the sprays/aerosols segment held the highest market share of 36.8% in 2024.

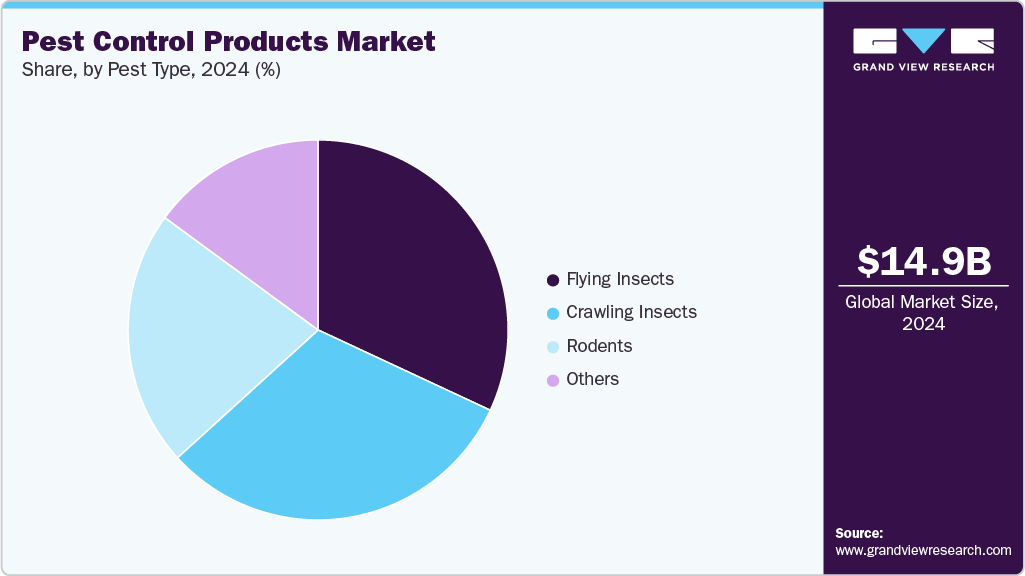

- By pest type, crawling insects segment held the highest market share in 2024.

- Based on end use, B2B segment held the largest market share in 2024.

- By control mechanism, the chemical products segment accounted for the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.87 Billion

- 2033 Projected Market Size: USD 25.83 Billion

- CAGR (2025-2033): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hotels, restaurants, hospitals, and residential complexes increasingly prioritize solutions that combine fast efficacy, safety, and long-term prevention, including integrated pest management (IPM) programs and eco-conscious formulations. Lifestyle and housing trends are also boosting market demand. Expanding suburban and urban outdoor spaces, the growth of single-family homes, and increased pet ownership drive the use of sprays, aerosols, baits, and lawn- and garden-specific products. Consumers seek solutions that are convenient, easy to apply, and compatible with everyday household routines, while commercial operators focus on reliability, regulatory compliance, and traceable service documentation.

Homeowners and facility managers increasingly prefer plant-based, low-residue sprays, biodegradable baits, and electronic traps that reduce environmental impact without compromising effectiveness. Smart devices, mobile apps, and IoT-enabled monitoring systems are gaining traction, allowing real-time reporting and predictive pest control for both urban and rural properties.

On the innovation front, companies are accelerating launches to meet evolving consumer and institutional needs. In July 2025, Liphatech unveiled the BugScents Sentry Pro, a pheromone-based monitoring device for bed bugs targeted at pest control professionals. The system uses a specialized attractant to draw and capture bed bugs, providing accurate early detection within 24-96 hours. Designed for hotels, apartments, and commercial facilities, it helps operators quickly identify infestations and implement timely interventions, improving efficiency and reducing the risk of widespread outbreaks.

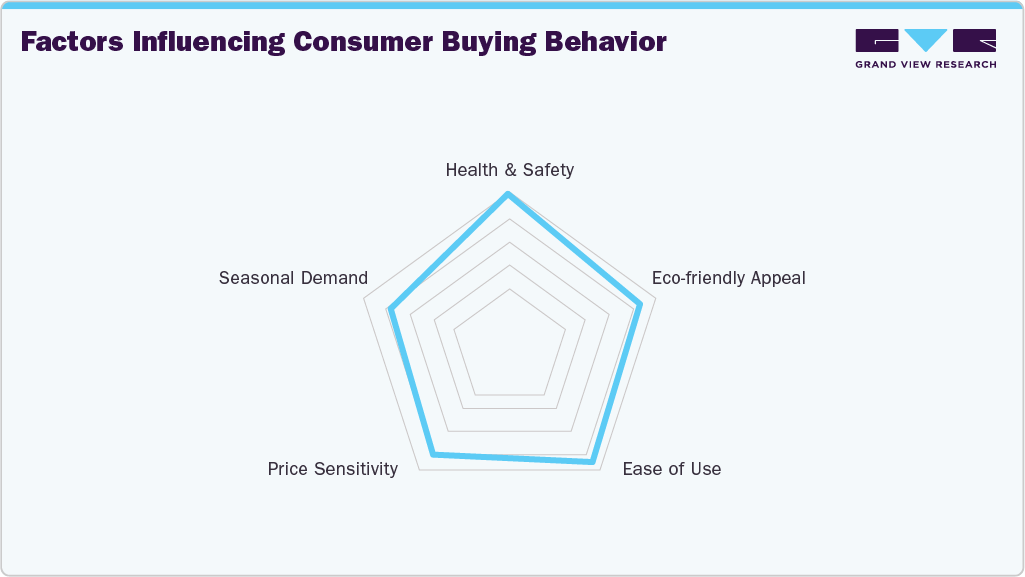

Buyers’ Behavioral Analysis

Consumers increasingly prioritize products that ensure their well-being. Items that are non-toxic, hygienic, and safe for use at home, especially around children and pets, tend to gain higher trust and loyalty. Brands emphasizing safety certifications and transparent ingredient information often influence purchasing decisions positively, as consumers are willing to pay a premium for safety assurance.

Similarly, environmental consciousness is becoming a major driver in buying behavior. Products that are sustainable, biodegradable, or made from recycled materials attract consumers who are concerned about their ecological footprint. Eco-friendly labeling and packaging differentiate products in a competitive market and align with the values of a growing segment of environmentally conscious shoppers.

Control Mechanism Insights

Control mechanisms through chemicals accounted for a revenue share of 66.7% in 2024. Both households and commercial operators rely on chemical insecticides, rodenticides, and fumigants to quickly eliminate pests such as cockroaches, mosquitoes, ants, and rodents. Their broad availability, ease of application, and cost efficiency make them a preferred choice for immediate results, while innovations in low-residue and eco-safer formulations address regulatory and consumer concerns about safety and environmental impact.

Biological control mechanisms are expected to grow at a CAGR of 8.7% from 2025 to 2033 within the global pest control products industry. These approaches use beneficial organisms, such as predatory insects, nematodes, or microbial agents, to target pests without harmful chemical residues. Adoption is being fueled by stricter regulations on synthetic pesticides, rising consumer preference for eco-friendly products, and the need for long-term, sustainable control in homes, commercial properties, and agricultural settings. Advances in formulation, delivery systems, and monitoring technologies enhance their reliability and effectiveness, making biological control an increasingly attractive option in global pest management strategies.

Product Insights

Sprays/aerosols accounted for a revenue market share of 36.8% in 2024. These products allow both households and commercial operators to quickly target common pests such as mosquitoes, ants, cockroaches, and flies, offering immediate knockdown and easy application without specialized equipment. Their compact packaging and ready-to-use formulations make them ideal for urban apartments, offices, restaurants, and outdoor recreational spaces where space and time efficiency are priorities. In addition, global distribution networks and strong retail availability, coupled with ongoing innovation in low-odor and environmentally safer variants, have reinforced sprays and aerosols as a preferred first-line pest control solution worldwide.

Microbials/biopesticides are expected to grow at a CAGR of 9.5% from 2025 to 2033 within the global pest control products industry. These solutions use naturally occurring organisms or plant-based compounds to manage pests, minimizing risks to humans, pets, and beneficial insects. Increased consumer preference for sustainable products, stricter chemical regulations, and a growing focus on environmentally responsible practices drive adoption across homes, commercial spaces, and agricultural operations. Innovations in formulation and application methods further improve their effectiveness and convenience, making them an attractive alternative to traditional chemical pesticides worldwide.

End Use Insights

B2B end use of pest control products accounted for a revenue share of 78.7% in 2024, due to the large-scale, ongoing requirements of commercial, industrial, and institutional facilities. Hotels, restaurants, hospitals, food processing plants, and property management companies rely on professional pest control solutions to maintain hygiene standards, comply with regulatory mandates, and protect brand reputation. These buyers favor integrated pest management programs, low-residue chemical treatments, and monitoring systems that ensure consistent efficacy, traceability, and safety.

B2C end use for pest control products is expected to grow at a CAGR of 8.8% from 2025 to 2033. Rising awareness of vector-borne diseases and the expansion of suburban and urban living spaces have driven demand for convenient, easy-to-use solutions such as sprays, aerosols, electronic traps, and eco-friendly repellents. Households seek products that deliver effective pest elimination while being safe for children, pets, and the environment. Furthermore, growing online retail penetration, accessible DIY options, and smart pest management devices are making it easier for individual consumers to adopt advanced pest control practices.

Pest Type Insights

Crawling insects accounted for a revenue market share of 34.6% in 2024, due to their widespread prevalence in residential and commercial environments. These pests pose significant health and hygiene risks, contaminating food, spreading pathogens, and triggering allergic reactions, which drives consistent demand for effective control solutions. Products such as gel baits, sprays, traps, and integrated monitoring systems are widely used because they offer targeted elimination and long-term prevention.

Flying Insects are expected to grow at a CAGR of 6.8% from 2025 to 2033. These pests are vectors for diseases such as dengue, Zika, and West Nile virus, prompting households, municipalities, and businesses to invest in effective control measures. The increasing popularity of outdoor living areas, gardens, and recreational spaces has further elevated the need for sprays, traps, and larvicides that can provide fast, reliable protection. Advancements in eco-friendly formulations, long-lasting residual products, and smart monitoring devices also enhance efficacy and convenience, supporting the growing adoption of solutions targeting flying insects across global markets.

Regional Insights

The North America pest control products market held 40.2% of the global revenue in 2024. Rising concerns over household hygiene, urban pest infestations, and public health risks have driven the adoption of residential and commercial pest management solutions. Growth in suburban housing, outdoor recreational spaces, and pet ownership has further supported demand for sprays, baits, and electronic pest control devices. Moreover, the strong presence of leading manufacturers, extensive retail and e-commerce availability, and well-established professional service networks have solidified North America’s significant contribution to the global market.

U.S. Pest Control Products Market Trends

The pest control products market in the U.S. held 30.9% of the global revenue in 2024. Growing awareness of home hygiene and food safety, particularly in residential kitchens, restaurants, and food processing facilities, has heightened demand for reliable pest management solutions. Increased frequency of extreme weather events, such as hurricanes and floods, has also expanded habitats for mosquitoes, rodents, and other pests, driving year-round consumption of sprays, baits, and electronic control devices. The presence of leading manufacturers, strong e-commerce penetration, and professional service networks has also helped the U.S. maintain a significant market share.

Europe Pest Control Products Market Trends

The pest control products market in Europe accounted for a revenue share of around 23.5% in the year 2024. Strong demand is driven by the need to manage seasonal pest outbreaks in urban and suburban areas, such as mosquitoes and flies. Widespread adoption of eco-friendly and low-toxicity solutions by households and commercial facilities is boosting sales, while the growth of multi-family housing and outdoor leisure spaces supports higher usage of sprays, baits, and traps. Efficient distribution networks and professional pest management services across the region help maintain Europe’s significant global market share.

Asia Pacific Pest Control Products Market Trends

The pest control products market in Asia Pacific is projected to grow at a CAGR of 10.3% from 2025 to 2033, driven by rapid urbanization, rising population density, and increasing concerns over public health and hygiene. Countries such as China, India, and Indonesia are experiencing higher incidences of vector-borne diseases and household pest infestations, prompting greater adoption of chemical, biological, and eco-friendly pest control solutions. Government programs promoting sanitation, stricter food safety regulations, and awareness campaigns support market expansion. In addition, the growing availability of affordable sprays, baits, electronic traps, and smart pest management devices is increasing accessibility for residential and commercial users, fueling sustained growth across the Asia Pacific region.

Key Pest Control Products Company Insights

A mix of well-established chemical manufacturers, emerging biopesticide firms, and technology-focused solution providers drives the global pest control products industry. Companies worldwide are responding to tightening environmental and safety regulations and increasing consumer demand for non-toxic, eco-conscious products by developing plant-based formulations, smart monitoring systems, and easy-to-use application tools. Innovations such as biodegradable baits, electronic traps, and IoT-enabled pest control devices demonstrate the industry’s focus on both effectiveness and sustainability. This adaptive approach enables global players to expand their reach, capture diverse customer segments, and remain competitive in a market increasingly influenced by health, safety, and environmental concerns.

-

BASF SE is a leading global player in the market, offering a wide range of chemical and biological solutions for agriculture, commercial, and residential applications. Its portfolio includes insecticides, rodenticides, and biopesticides designed for efficacy and environmental safety. BASF invests heavily in research and development to produce low-residue, eco-friendly formulations and digital monitoring tools, allowing operators worldwide to implement integrated pest management (IPM) strategies. With a strong international distribution network and technical support services, BASF is a preferred partner for large-scale agricultural operations, food processing facilities, and commercial establishments.

-

Bayer CropScience Ltd. is a major global manufacturer of pest control products, providing chemical and biological solutions for crop protection, public health, and residential use. Its offerings include insecticides, fungicides, herbicides, and biocontrol products designed to meet multiple regions' strict regulatory and environmental standards. Bayer emphasizes innovation through advanced formulations, digital pest monitoring systems, and sustainable product lines, catering to both professional operators and household consumers. The company’s integrated approach, combining efficacy, compliance, and technical guidance, positions it as a key player in the global pest control market, enabling widespread adoption of modern and responsible pest management practices.

Key Pest Control Products Companies:

The following are the leading companies in the pest control products market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Bayer AG

- FMC Corporation

- Control Solutions, Inc.

- Rentokil Initial plc

- Ecolab Inc.

- Syngenta Group

- Woodstream Corporation

- Bell Laboratories, Inc.

- Corteva Agriscience

Recent Developments

-

In April 2025, U.S.-based Envu expanded its professional pest management portfolio with the launch of Barricor Essential Mosquito Control, a plant-based insecticide safe for pollinators, and Suspend Contact & Residual Aerosol, which combines pyrethrin and deltamethrin for fast, long-lasting control of pests such as cockroaches, ants, ticks, and spiders. Both products focus on safety, ease of use, and sustained effectiveness, and are available through Envu’s U.S. distribution network.

-

In April 2025, the Senske Family of Companies strengthened its footprint in Canada by acquiring Ontario-based Huron Pest Control. After the acquisition, Huron began operating under Mosquito Buzz, Senske’s Canadian brand focused on mosquito and tick management, expanding service capabilities and market presence.

-

In March 2023, Zevo, Procter & Gamble’s pest control brand, introduced On-Body Mosquito + Tick Repellents offering up to eight hours of protection. Made with IR3535, the odorless, non-greasy formula is available in aerosol, pump spray, and lotion formats, providing a comfortable alternative to traditional repellents. The products are now sold across major U.S. retailers such as Walmart, Target, Home Depot, Lowe’s, Kroger, and Meijer.

Pest Control Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.69 billion

Revenue forecast in 2033

USD 25.83 billion

Growth rate (revenue)

CAGR of 6.4% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, pest type, control mechanism, end use, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Thailand; Philippines; Vietnam; South Korea; Indonesia; UAE; Saudi Arabia; South Africa; Egypt; Kenya; Nigeria; Morocco; Brazil

Key companies profiled

BASF SE; Bayer AG; FMC Corporation; Control Solutions, Inc.; Rentokil Initial plc; Ecolab Inc.; Syngenta Group; Woodstream Corporation; Bell Laboratories, Inc.; Corteva Agriscience

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pest Control Products Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pest control products market report based on product, pest type, control mechanism, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Sprays/Aerosols

-

Baits/Gels

-

Repellents

-

Predators/Parasites

-

Microbials/Biopesticides

-

Barriers/Exclusion

-

Mechanical Traps

-

Electronic Devices

-

-

Pest Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Flying Insects

-

Crawling Insects

-

Rodents

-

Others

-

-

Control Mechanism Outlook (Revenue, USD Billion, 2021 - 2033)

-

Chemical

-

Physical/Mechanical

-

Biological

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

B2B

-

Supermarkets and Hypermarkets

-

Pharmacies & Drugstores

-

Home Improvement & Hardware Stores

-

E-commerce/Online

-

Others

-

-

B2C

-

Direct Sales

-

Distributors & Wholesalers

-

Agricultural Supply Stores & Co-operatives

-

Commercial & Institutional E-procurement Platforms

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

Thailand

-

Vietnam

-

Philippines

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

Egypt

-

Saudi Arabia

-

Kenya

-

Nigeria

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global pest control products market was estimated at USD 14.87 billion in 2024 and is expected to reach USD 15.69 billion in 2025.

b. The global pest control products market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2033 to reach USD 25.83 billion by 2033.

b. Sprays/aerosols accounted for a revenue share of 36.8% of the global pest control products market in 2024. These products allow both households and commercial operators to quickly target common pests such as mosquitoes, ants, cockroaches, and flies, offering immediate knockdown and easy application without specialized equipment.

b. Some of the key players in the pest control products market is BASF SE; Bayer AG; FMC Corporation; Control Solutions, Inc.; Rentokil Initial plc; Ecolab Inc.; Syngenta Group; Woodstream Corporation; Bell Laboratories, Inc.; Corteva Agriscience.

b. The global pest control products market is witnessing accelerated growth, driven by rising public health awareness and increasing incidences of vector-borne diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.