- Home

- »

- Catalysts & Enzymes

- »

-

Phase-transfer Catalyst Market Size, Industry Report, 2030GVR Report cover

![Phase-transfer Catalyst Market Size, Share & Trends Report]()

Phase-transfer Catalyst Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Ammonium Salts, Potassium Salts), By End-use (Pharmaceuticals, Agriculture, Chemical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-147-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Phase-transfer Catalyst Market Summary

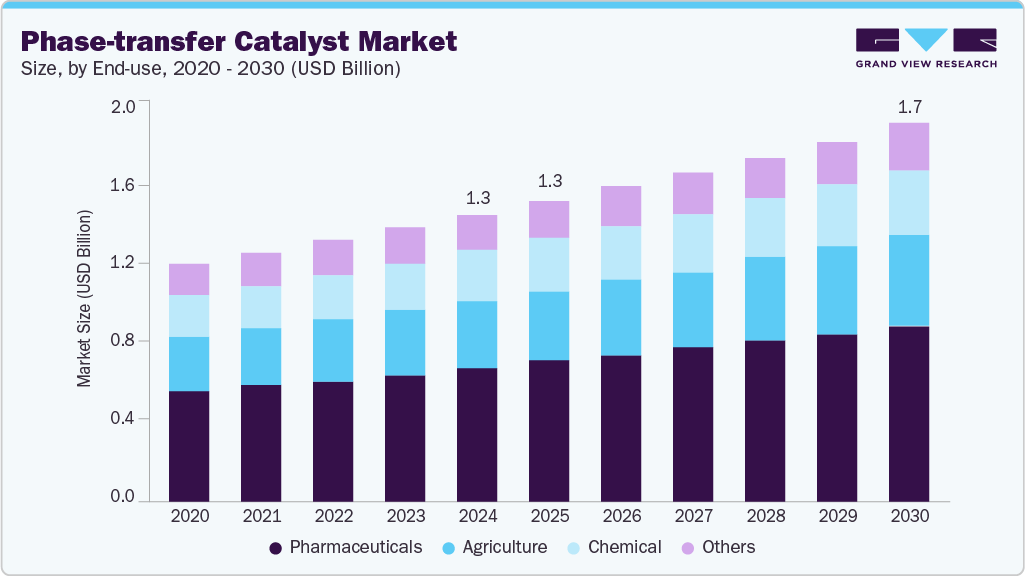

The global phase-transfer catalyst market size was valued at USD 1.25 billion in 2024 and is projected to reach USD 1.68 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. Growth is driven by the widespread use of Phase-transfer Catalysts (PTCs) in organic synthesis across the chemical, pharmaceutical, polymer, agrochemical, food, and cosmetics industries.

Key Market Trends & Insights

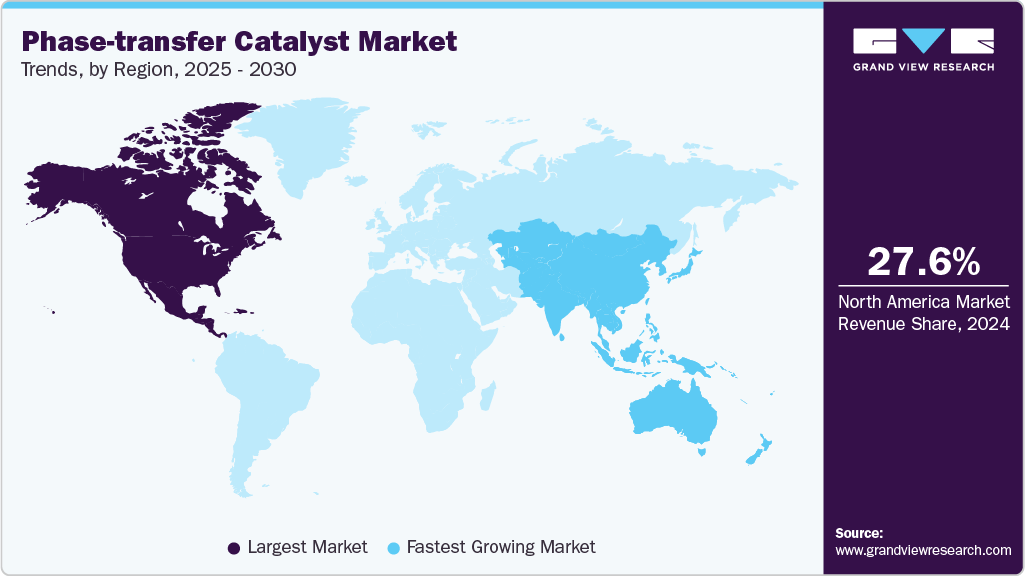

- North America phase-transfer catalysts market dominated the global market with 27.6% share in 2024.

- The U.S. phase-transfer catalyst market held a significant position within the North American region.

- By type, the ammonium salts segment accounted for the largest revenue share of 48.5% in 2024.

- By end use, the pharmaceuticals segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.25 Billion

- 2030 Projected Market Size: USD 1.68 Billion

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

PTCs enhance reaction speed under milder conditions, improve process flexibility and reliability, and allow safer, cost-effective bases such as sodium hydroxide instead of expensive, hazardous organic bases. The pharmaceutical industry is a major end user of phase transfer catalysts, which are widely used to synthesize pharmaceutical ingredients and intermediates. They are employed across various essential chemical reactions, including alkylation, nucleophilic substitution, esterification and amidation, Hofmann elimination, asymmetric synthesis, and microwave-assisted reactions. The catalysts commonly used in these processes are crown ethers, quaternary ammonium salts, sulfonium salts, and phosphine oxides, selected based on compatibility with specific solvents and reactants used in pharmaceutical synthesis.

The growing reliance on PTCs in pharmaceutical manufacturing contributes to increased product innovation and improved process efficiency. By enabling reactions between immiscible phases such as aqueous and organic solutions, PTCs reduce the need for harmful solvents and support cleaner synthesis pathways. This enhances the conversion efficiency of active compounds and reduces chemical waste generation. In addition, maintaining better control over reaction conditions helps achieve higher selectivity and yield, which drives steady adoption of PTCs within the pharmaceutical segment.

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of growth is accelerating. The phase-transfer catalyst market is moderately fragmented, with established global players and regional manufacturers actively shaping its competitive landscape. Leading companies such as Tokyo Chemical Industry Co., Ltd. (TCI), SACHEM Inc., Nippon Chemical Industrial Co., Ltd., and Tatva Chintan Pharma Chem Limited drive market development through research-led innovation, sustainable manufacturing, and strategic capacity expansions. For instance, Tatva Chintan’s 2023 launch of a new facility in Gujarat, India, enhanced its capacity to meet the rowing demand for specialty chemicals, including PTCs.

The phase-transfer catalyst industry is experiencing robust growth, driven by rising demand from the pharmaceutical, agrochemical, specialty chemical, and polymer industries. PTCs facilitate chemical reactions between immiscible phases (such as aqueous and organic layers), enabling more energy-efficient, selective, and scalable processes under milder conditions. This enhances production cost-efficiency and reduces environmental impact, supporting the shift toward greener and more sustainable chemical manufacturing. Mergers and Acquisitions (M&A) activity remains moderate, with occasional strategic moves focused on enhancing production capabilities, expanding geographic reach, or vertically integrating operations to optimize supply chains and capture niche markets.

Government regulations and environmental mandates significantly influence the PTC market by promoting the adoption of safer and more sustainable chemical processes. In the U.S., the Environmental Protection Agency (EPA) enforces regulations under the Toxic Substances Control Act (TSCA) and the Clean Air Act, which limit the use of hazardous chemicals and Volatile Organic Compounds (VOCs) in industrial operations. These mandates encourage industries to seek greener alternatives, such as PTCs, which facilitate cleaner, more efficient reactions under milder conditions and reduce reliance on harmful solvents.

Type Insights

The ammonium salts segment accounted for the largest revenue share of 48.5% in 2024. This growth is driven by their extensive use in alkylation and nucleophilic substitution reactions across the chemical and polymer industries. Tetra-n-butylammonium Bromide (TBAB), a widely used quaternary ammonium salt, is a PTC in various industrial processes. It plays a key role in the Williamson ether synthesis, a reaction essential for producing ethers, surfactants, and pharmaceutical intermediates. The rising demand for TBAB is closely linked to the expanding pharmaceutical and agrochemical sectors, which require efficient and scalable synthesis methods. It is also impelled by supportive government initiatives. In September 2024, the U.S. Department of Health and Human Services allocated USD 14 million to the API Innovation Center to boost domestic pharmaceutical manufacturing. This initiative is expected to drive further demand for ammonium salts. These salts also facilitate anion transfer in chemical processes and monomer transfer in polymer synthesis, underscoring their importance in enabling cleaner, safer, and more efficient production systems within the phase-transfer catalyst industry.

The potassium salts segment is expected to grow notably during the forecast period. Potassium salt-based PTCs are commonly used in halogenation and esterification reactions because they form stable, water-soluble complexes. These salts are vital in producing herbicides, insecticides, and pest control formulations in the agrochemical sector. Their effectiveness in enabling selective and environmentally safer reactions continues to drive demand across chemical and agricultural applications.

End Use Insights

The pharmaceuticals segment dominated the market in 2024. The pharmaceutical industry utilizes PTCs in synthesis, drug formulation, research and development, and other laboratory applications. Stringent regulations in Europe and North America regarding harmful compounds have driven higher adoption of PTCs, as they reduce reliance on organic solvents and toxic reactants, aligning with stricter environmental and safety standards. The phase-transfer catalyst industry continues to benefit from this regulatory shift, particularly in pharmaceutical manufacturing, where cleaner, more efficient processes are prioritized.

The agriculture segment is expected to grow at a significant rate over the forecast period. This growth is driven by the role of PTCs in enhancing the efficiency and control of chemical reactions used in agrochemical synthesis. PTCs enable reactions under mild conditions with simplified work-up processes, making them suitable for large-scale industrial applications. One notable use is in synthesizing specialty agrochemicals, including extracting and separating compounds such as crown ethers from aqueous solutions.

Regional Insights

North America phase-transfer catalysts market dominated the global market with 27.6% share in 2024. This leadership is attributable to the presence of large end-user industries in the region, such as pharmaceuticals and agriculture, and supportive government regulations.

U.S. Phase-transfer Catalyst Market Trends

The U.S. phase-transfer catalyst market held a significant position within the North American region, driven by increasing demand from key sectors such as pharmaceuticals, chemicals, and agrochemicals. PTCs are highly valued for enhancing reaction efficiency, enabling cost-effective production, and supporting greener chemical processes. Continuous investments and regulatory initiatives that support sustainable and efficient chemical manufacturing further enhance the strong market position. In 2024, increased R&D investments in green and specialty chemicals in the U.S. chemical industry have facilitated greater adoption of PTCs. This has simplified complex synthesis processes and reduced the use of hazardous solvents. Moreover, innovations in catalyst formulations and an emphasis on sustainable manufacturing contribute to market growth. The Environmental Protection Agency’s (EPA) Green Chemistry Challenge Awards highlight technologies that minimize hazardous chemicals, water usage, and emissions—benefits that are closely associated with PTCs. These advancements propel the U.S. market forward by encouraging the adoption of advanced PTC technologies.

Europe Phase-transfer Catalyst Market Trends

Europe phase-transfer catalyst market accounted for a significant share of the overall market in 2024.PTCs are widely used in processes such as the production of resins, plastics, and other petrochemical products, contributing to higher product yields and reduced waste. In addition, Europe is a major producer of specialty chemicals for industries such as coatings, adhesives, and cosmetics. The phase-transfer catalyst industry benefits from the region’s emphasis on sustainability and process efficiency, as PTCs help improve product quality while minimizing the use of hazardous reagents. This aligns with stringent environmental regulations and growing demand for greener chemical processing solutions across the continent.

Asia Pacific Phase-transfer Catalyst Market Trends

Asia Pacific phase-transfer catalysts market is expected to grow at the fastest CAGR, driven by rapid industrial growth and an expanding chemical manufacturing sector. Rising demand from pharmaceuticals, agrochemicals, and specialty chemicals fuels this expansion. PTCs are used to enhance reaction efficiency, lower production costs, and support greener, more sustainable chemical processes. This growth is supported by government initiatives and increasing investments to strengthen domestic production capacities. In India, the government introduced the Production-linked Incentive (PLI) scheme to boost the manufacturing of pharmaceuticals. This initiative is expected to strengthen the industry's competitiveness and drive greater adoption of PTCs. With ongoing investments in advanced manufacturing and R&D, the use of PTCs is steadily increasing in the region. Moreover, tightening environmental regulations and a stronger focus on eco-friendly technologies accelerate PTC adoption, as these catalysts help reduce hazardous waste and energy consumption. These factors make Asia Pacific a key contributor to the global growth of the phase-transfer catalyst industry.

China phase-transfer catalyst market held a major share of the Asia Pacific market, driven by its large-scale chemical manufacturing base and rapidly evolving industrial ecosystem. With growing demand across pharmaceuticals, agrochemicals, and specialty chemicals, the country is experiencing a steady rise in the adoption PTCs to enhance process efficiency and reduce production costs. Government-led initiatives such as “Made in China 2025” further support this trend by promoting industrial upgrades and driving the adoption of environmentally sustainable technologies. As regulatory standards tighten and the focus on cleaner production intensifies, chemical manufacturers are increasingly turning to PTCs for their ability to minimize hazardous waste and energy usage. Combined with robust investments in R&D and capacity expansion, these factors reinforce China's role as a key contributor to regional and global growth.

Key Phase-transfer Catalyst Company Insights

Key players in the phase-transfer catalyst industry include SACHEM Inc.; Tokyo Chemical Industry Co., Ltd. (TCI); Nippon Chemical Industrial Co., Ltd.; Tatva Chintan Pharma Chem Limited; and Pat Impex; Otto Chemie Pvt. Ltd.

-

Tokyo Chemical Industry Co., Ltd. (TCI) provides a broad range of phase transfer catalysts widely used in chemical synthesis for pharmaceuticals, agrochemicals, and fine chemicals. TCI emphasizes research-driven product development and quality, supplying catalysts that improve reaction efficiency and selectivity.

-

Tatva Chintan Pharma Chem Limited offers a variety of quaternary ammonium and phosphonium phase-transfer catalysts primarily serving pharmaceutical and specialty chemical industries. The company is recognized for its sustainable manufacturing practices and global export footprint.

Key Phase-transfer Catalyst Companies:

The following are the leading companies in the phase-transfer catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- SACHEM, INC.

- Tokyo Chemical Industry Co., Ltd.

- Nippon Chemical Industrial Co., Ltd.

- Pat Impex

- Tatva Chintan Pharma Chem Limited

- Central Drug House

- Volant-Chem Corp.

- Pacific Organics Pvt Ltd

- Otto Chemie Pvt. Ltd.

Recent Developments

-

In March 2025, NAGASE & CO., LTD. approved the resolution to acquire the Asian business of SACHEM Inc., which specializes in high-purity chemicals for semiconductors. This strategic move included five SACHEM subsidiaries, including SACHEM Wuxi Co., Ltd.. This move strengthened NAGASE’s position in the chemicals market and enhanced collaborative innovation in high-purity chemical solutions.

Phase-transfer Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2030

USD 1.68 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

SACHEM, INC.; Tokyo Chemical Industry Co., Ltd.; Nippon Chemical Industrial Co., Ltd.; Pat Impex; Tatva Chintan Pharma Chem Limited; Central Drug House; Volant-Chem Corp.; Pacific Organics Pvt Ltd; Otto Chemie Pvt. Ltd..

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phase-transfer Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Phase-transfer Catalyst Market report based on type, end use, and region:

-

Type Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

Ammonium Salts

-

Potassium Salts

-

Others

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Agriculture

-

Chemical

-

Others

-

-

Regional Outlook (Volume, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global phase-transfer catalyst Market size was estimated at USD 1.14 billion in 2022 and is expected to reach USD 1.19 billion in 2023.

b. The global phase-transfer catalyst market is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 1.68 billion by 2030.

b. North America dominated the global phase-transfer catalyst market with a share of 27.62% in 2022. This is attributed to the large end-user industries in the region such as pharmaceuticals and agriculture.

b. Some key players operating in the global phase transfer catalysts market include Sachem Inc., PAT IMPEX and Informa Markets Japan Co Ltd., among others

b. The pharmaceutical industry is a key end-user of phase transfer catalysts in facilitating reactions for the synthesis of pharma ingredients and intermediates. PTCs are used in several types of reactions in the pharma industry such as alkylation, nucleophilic substitution, esterification and amidations, Hofmann elimination, asymmetric synthesis, and microwave-assisted reactions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.