- Home

- »

- Biotechnology

- »

-

Phosphoramidite Market Size & Share, Industry Report, 2033GVR Report cover

![Phosphoramidite Market Size, Share & Trends Report]()

Phosphoramidite Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (DNA Phosphoramidites, RNA Phosphoramidites), By Application (Drug Discovery & Development, Diagnostics Development), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-310-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Phosphoramidite Market Summary

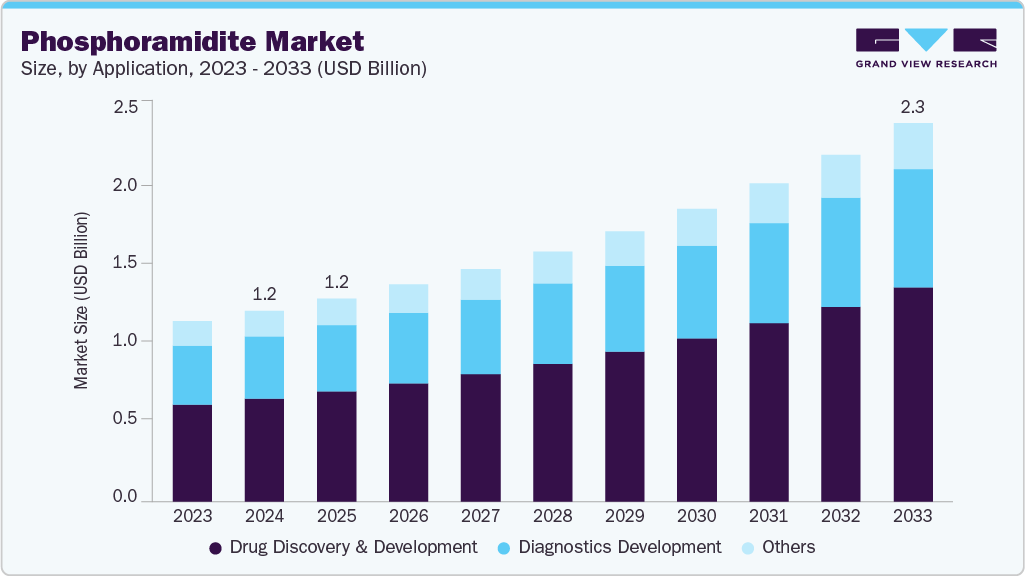

The global phosphoramidite market size was estimated at USD 1.15 billion in 2024 and is projected to reach USD 2.27 billion by 2033, growing at a CAGR of 8.06% from 2025 to 2033. The market growth can be attributed to the increasing demand for phosphoramidite in the production of oligonucleotides, the rising prevalence of genetic disorders and infectious diseases has led to a surge in research and development activities in the biotechnology and pharmaceutical industries, which further fuels the demand for phosphoramidite.

Key Market Trends & Insights

- North America dominated the phosphoramidite industry with the largest revenue market share of 39.30% in 2024.

- The phosphoramidite industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- Based on type, the DNA phosphoramidites segment led the market with the largest revenue share of 36.06% in 2024.

- Based on application, the drug discovery & development segment led the market with the largest revenue share of 54.14% in 2024.

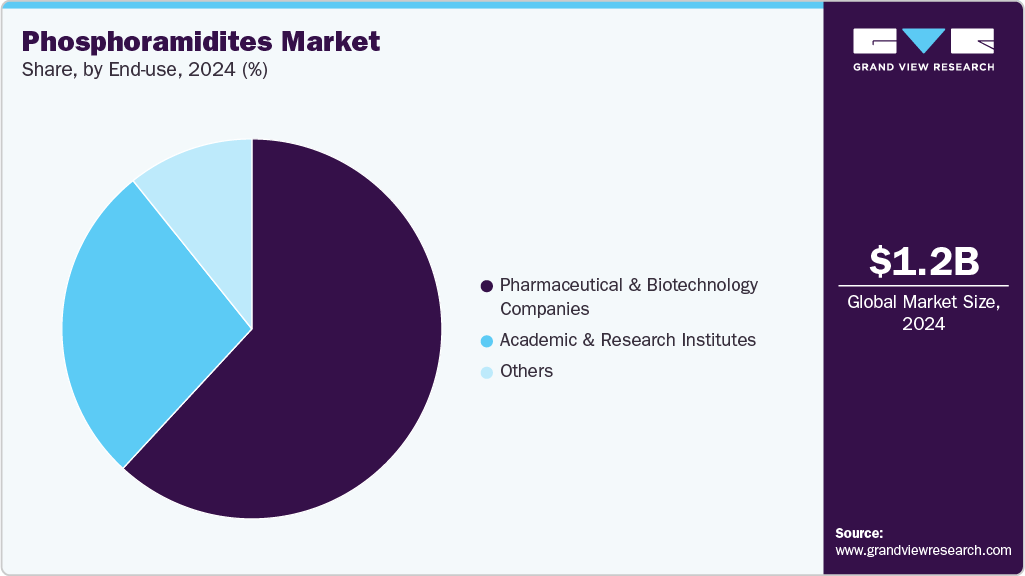

- Based on end use, the pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 61.88% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.15 Billion

- 2033 Projected Market Size: USD 2.27 Billion

- CAGR (2025-2033): 8.06%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the growing geriatric population and increasing healthcare expenditure are also expected to drive the market growth in the coming years.

Rising Demand for Oligonucleotide Therapeutics

The increasing adoption of oligonucleotide-based therapeutics is a major growth driver for the phosphoramidite industry. Pharmaceutical and biotechnology companies are investing heavily in the development of antisense oligonucleotides (ASOs), small interfering RNAs (siRNA), and messenger RNA (mRNA) therapies to address a wide range of genetic, infectious, and rare diseases. These therapies rely on precisely synthesized oligonucleotides, with phosphoramidites serving as the essential chemical intermediates for constructing nucleotide chains. The success of mRNA vaccines during the COVID-19 pandemic has further validated the therapeutic potential of synthetic RNA, accelerating research and regulatory acceptance of oligo-based modalities.

ASOs and siRNAs are gaining prominence as next-generation therapeutics due to their ability to selectively silence or modulate gene expression. Multiple ASO-based drugs have already received regulatory approvals, and a robust pipeline is in development targeting neurological disorders, cancers, and metabolic conditions. As the therapeutic landscape shifts towards nucleic acid-based solutions, the demand for high-purity, modified, and scalable phosphoramidites is growing exponentially. Drug developers require consistent and high-quality oligonucleotides that meet stringent regulatory standards for safety and efficacy, thereby increasing reliance on trusted suppliers with proven synthesis capabilities.

In addition, mRNA therapeutics are being explored beyond vaccines, including applications in oncology, cardiovascular diseases, and protein replacement therapies. These advancements demand more complex and specialized phosphoramidites for coding sequences, modified caps, and regulatory elements. This trend is prompting strategic partnerships between oligo manufacturers and pharmaceutical innovators to ensure secure supply chains, technological integration, and quality assurance. With the global pipeline for nucleic acid drugs expanding and clinical trials accelerating, the phosphoramidite industry is well-positioned for long-term growth as a foundational enabler of oligonucleotide therapeutics.

Expansion of Genomic Research & Synthetic Biology

The phosphoramidite industry is witnessing strong momentum driven by the rapid expansion of genomic research and synthetic biology. As global research institutions and biotech companies increase their focus on decoding and manipulating genetic material, there is a growing need for high-quality DNA and RNA synthesis reagents. Phosphoramidites, being fundamental to oligonucleotide production, are essential for applications ranging from gene sequencing and editing to synthetic circuit design and gene expression studies. Governments and private investors are allocating significant funding towards advanced genomic initiatives, such as the Human Genome Project-style programs, genome-wide association studies (GWAS), and large-scale synthetic biology platforms.

In addition, synthetic biology is emerging as a transformative field with applications spanning healthcare, agriculture, and environmental science. The ability to engineer biological systems using custom-designed oligonucleotides has led to breakthroughs in areas like gene therapy, biosensor development, and bio-based manufacturing. This shift toward engineered biology is amplifying demand for modified and specialty phosphoramidites that enable precise control over nucleotide composition and function. As a result, suppliers are scaling their capabilities to meet the growing complexity and volume required by research labs and industrial-scale synthetic biology programs. This trend is expected to accelerate market growth over the next decade, positioning phosphoramidites as a critical component of innovation in life sciences.

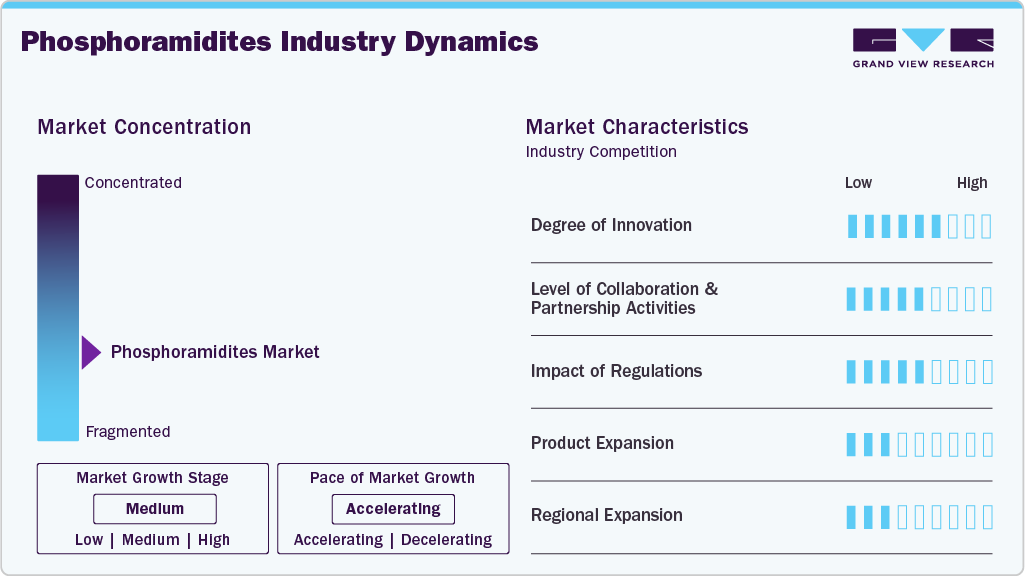

Market Concentration & Characteristics

The degree of innovation in the phosphoramidite industry is significant, with new technologies and processes constantly being developed to improve efficiency and effectiveness. This has resulted in the production of high-quality products that meet the diverse needs of consumers. Advances in research and development have led to the discovery of new applications for Phosphoramidite, making it a valuable product for a wide range of industries.

Collaboration and partnership activities can have a significant impact on the growth of the phosphoramidite industry. Partnerships help companies to reduce costs and increase efficiency. In February 2023, Fluor Corp., based in Irving, Texas, was chosen by Agilent Technologies, Inc. to enhance its oligonucleotide therapeutics manufacturing facility in Frederick, Colorado, situated just north of Denver. Under this collaboration, Fluor will support the project's engineering and procurement. The total value of the project is estimated at USD 725 million. This project is expected to expand Agilent's manufacturing capacity, which lead to an increased demand for phosphoramidites.

Regulations set standards for the quality, purity, and safety of phosphoramidite compounds. Compliance with these standards is essential for manufacturers to ensure that their products meet regulatory requirements. This necessitates investments in quality control measures, adherence to good manufacturing practices, and stringent testing protocols to verify compliance. Regulatory approval processes and compliance requirements can serve as entry barriers for new entrants in the phosphoramidite industry.

The phosphoramidite industry is experiencing growth due to the increasing demand for phosphoramidite-based products in various applications such as DNA synthesis, pharmaceuticals, and agrochemicals. To cater to this demand, manufacturers are expanding their product portfolios by introducing novel phosphoramidite-based products with enhanced features and functionalities. This includes the development of new phosphoramidite reagents, nucleosides, and phosphoramidite linkers that can be used in a variety of applications.

The phosphoramidite industry has witnessed significant regional expansion in recent years. The increasing demand for phosphoramidite from various end use industries has led to the growth of the market across different regions. For instance, in May 2023, GenScript expanded its life sciences facility in Zhenjiang, Jiangsu, China, to offer a rapid, high-purity oligonucleotide and peptide synthesis service tailored for research & development as well as preclinical applications. This expansion is expected to fuel the industry growth of phosphoramidite.

Type Insights

The DNA phosphoramidites segment led the market with the largest revenue share of 36.06% in 2024. This type of phosphoramidite is commonly used in the production of DNA oligonucleotides, which are short DNA sequences that can be used for a variety of applications, such as gene synthesis, PCR, and DNA sequencing. The increasing demand for DNA oligonucleotides in various fields such as research, diagnostics, and therapeutics has been a major factor driving the growth of the DNA phosphoramidite segment in the phosphoramidite industry. In addition, companies in this segment are expanding their presence in the market through different initiatives such as expansion, collaboration, and partnership, which further fuel the market expansion. For instance, in October 2023, Integrated DNA Technologies inaugurated a new therapeutic oligonucleotide manufacturing facility in Iowa, U.S., with an area of 41,000 square feet. This new facility provides customer support through enhanced research and manufacturing capabilities and specialized expertise.

The RNA phosphoramidites segment is anticipated to grow at the fastest CAGR of 9.54% during the forecast period. RNA phosphoramidites encompass a range of phosphoramidites utilized to modify RNA oligonucleotides, tailoring their properties for specific applications. The rising need for modified RNA oligonucleotides in areas like RNA therapeutics, functional genomics, and RNA-based diagnostics is poised to propel the expansion of this segment. Furthermore, advancements in RNA synthesis technologies have facilitated the production of modified RNA oligonucleotides with enhanced efficiency and precision, further boosting the growth of this segment.

Application Insights

The drug discovery & development segment led the market with the largest revenue share of 54.14% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2033. The demand for phosphoramidites in this segment is driven by the increasing focus on developing new drugs and therapies for various diseases. In drug discovery, researchers target specific genes or genetic sequences implicated in diseases. Phosphoramidites enable the synthesis of oligonucleotides tailored to these specific targets, allowing for the development of targeted therapies with potentially higher efficacy and fewer side effects compared to traditional small-molecule drugs. In addition, the increasing prevalence of chronic diseases and the need for effective treatments further drive the demand for phosphoramidites in the drug discovery and development segment.

The diagnostics development segment is expected to register at a significant CAGR over the forecast period. Phosphoramidites play a crucial role in enabling the synthesis of custom oligonucleotides for various diagnostic applications. The growing prevalence of infectious diseases and genetic disorders worldwide is driving the demand for accurate and sensitive diagnostic tests and supporting the market growth of phosphoramidites. Phosphoramidites enable the synthesis of oligonucleotide probes and primers used in the development of diagnostic assays for detecting pathogens, identifying genetic mutations, and characterizing disease biomarkers. In addition, advancements in diagnostic technologies, such as digital PCR, droplet digital PCR, and loop-mediated isothermal amplification, require custom-designed oligonucleotides synthesized using phosphoramidites. These technologies offer enhanced sensitivity, specificity, and multiplexing capabilities for various diagnostic applications. These factors are expected to support segment growth in the forecast years.

End Use Insights

The pharmaceutical & biotechnology companies segment led the market with the largest revenue share of 61.88% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing demand for innovative drugs and therapies, and the rising prevalence of chronic diseases such as cancer and diabetes. In addition, many pharmaceutical and biotech companies are actively engaged in developing nucleic acid-based therapeutics, such as antisense oligonucleotides, siRNA, and mRNA-based drugs. Phosphoramidites are essential reagents in the synthesis of these therapeutic nucleic acids. This factor is expected to support segment growth in the forecast years.

The academic and research institutes segment is expected to register at a significant CAGR over the forecast period. Academic and research institutes are hubs of scientific research in fields such as molecular biology, genetics, and drug discovery. As research in these areas continues to expand, the demand for phosphoramidites as key reagents in nucleic acid synthesis and related experiments is expected to grow. Academic institutions also serve as training grounds for future scientists and researchers. As curricula evolve to incorporate the latest techniques and technologies, there is an increased emphasis on hands-on experience with nucleic acid synthesis and molecular biology techniques, further driving the demand for phosphoramidites. In addition, many academic and research institutes collaborate with pharmaceutical, biotechnology, and other industries. For instance, in March 2023, CPI, AstraZeneca, Novartis, and The University of Manchester collaborated to enable the large-scale manufacture of oligonucleotides. In the collaboration, the university's role is in research and development. They contribute their knowledge in areas in biocatalysis, which is a technique for oligonucleotide synthesis and is expected to support the phosphoramidite industry.

Regional Insights

North America dominated the phosphoramidite market with the largest revenue share of 39.30% in 2024, owing to the increasing demand for oligonucleotides in research and development activities related to genetics and molecular biology. The U.S. is the largest market for phosphoramidites in North America due to the presence of major pharmaceutical and biotechnology companies, research institutions, and academic centers. Rising investments in drug discovery and development and technological advancements in the field of DNA sequencing and synthesis are driving the market in the region.

U.S. Phosphoramidite Market Trends

The phosphoramidite market in the U.S. accounted for the largest market revenue share in North America in 2024, due to the presence of a large number of market players in the U.S., undergoing various strategic initiatives such as collaborations and new product launches. For instance, in June 2022, Amerigo Scientific introduced extra-large drying traps designed for research purposes. These DNA moisture traps are used for creating moisture-free environments during oligonucleotide synthesis. They remove moisture from phosphoramidite solutions in acetonitrile, tetrazole solutions in acetonitrile, and dry acetonitrile.

Europe Phosphoramidite Market Trends

The phosphoramidite market in Europe was identified as a lucrative region in this industry. Europe has a robust healthcare sector with a growing demand for pharmaceuticals and biotechnology products. European countries invest significantly in research and development across various sectors, including life sciences. Phosphoramidites are critical reagents for academic and industrial research institutions engaged in genomics, proteomics, and molecular biology studies. Europe has a well-established regulatory framework governing the development and commercialization of pharmaceuticals and biotechnology products. The regulatory bodies ensure product quality, safety, and efficacy standards, assuring manufacturers and End Users in the phosphoramidites market. These factors are expected to support the phosphoramidites market in the region.

The UK phosphoramidite market accounted for the largest market revenue share in Europe in 2024. The UK government's investment in research and development is one of the major factors driving the growth of the phosphoramidites market in the country. With increasing focus on developing innovative technologies and products, the demand for high-quality phosphoramidites has been on the rise. The government's support in the form of funding for research and development activities, tax incentives, and favorable policies has encouraged companies to invest in this sector. For instance, in November 2023, The UK government announced investments of USD 652.9 million for life sciences funding, changes to R&D tax credits, and a clinical trials accelerator scheme. This growing investment is anticipated to boost the demand for phosphoramidite over the forecast period.

The phosphoramidite market in France is expected to grow at a remarkable CAGR over the forecast period. The French government provides support for life sciences research and innovation through funding programs, tax incentives, and infrastructure development. This support encourages investment in biotechnology, genomics, and personalized medicine, driving the demand for phosphoramidites in these sectors.

The Germany phosphoramidite marketis anticipated to grow at a significant CAGR over the forecast period. Germany is one of the global leaders in scientific research, with renowned institutions and multiple biotechnology companies actively developing oligonucleotide-based diagnostics, research tools, and novel therapeutics. This advancement is predicted to facilitate phosphoramidite industry growth by creating demand for high-quality oligonucleotide synthesis services.

Asia Pacific PhosphoramiditesMarket Trends

The phosphoramidite market in Asia Pacific is projected to grow at the fastest CAGR of 9.78% over the forecast period. Countries in the Asia Pacific region, such as China, India, Japan, South Korea, and Singapore, are experiencing rapid industrialization and economic growth. This growth fuels demand across various industries, including pharmaceuticals and biotechnologies, all of which require phosphoramidites. Governments and private companies in the Asia Pacific are investing significantly in healthcare infrastructure, pharmaceutical research, and life sciences. This investment boosts the demand for phosphoramidites, which are essential in drug discovery. The Asia Pacific region is home to a rapidly growing population, coupled with rising urbanization. This drives the demand for healthcare services, leading to increased pharmaceutical production and research activities and boosting the phosphoramidite market.

The China phosphoramidite market is expected to grow at a substantial CAGR over the forecast period. The Chinese government is actively promoting the development of the domestic pharmaceutical industry, including oligonucleotide therapies. These government initiatives translate into funding for research and development, which can benefit the phosphoramidite industry. Furthermore, China's aging population is a factor as it creates a greater demand for treatments for chronic diseases, a category where oligonucleotide therapies are used. This increased need for treatments is expected to fuel the phosphoramidite industry.

The phosphoramidite market in Japan is anticipated to witness at a significant CAGR over the forecast period. Japan is investing significantly in biotechnology research and development. Phosphoramidites find application in the synthesis of oligonucleotides, which are essential tools in biotechnology for research, diagnostics, and therapeutics. Thus, advancements in biotechnology drive the demand for phosphoramidites.

MEA Phosphoramidites Market Trends

The phosphoramidite market in the MEA is expected to grow at a exponential CAGR over the forecast period. MEA region is witnessing an increase in investments in the healthcare sector, mainly in the development of healthcare infrastructure and capabilities. This trend is expected to fuel the demand for phosphoramidites in the region, as these reagents are essential for the synthesis of custom oligonucleotides used in diagnostics and therapeutics. However, the MEA region is a relatively small market for phosphoramidites compared to other regions, and the market growth is limited by factors such as stringent regulatory standards and quality requirements for pharmaceutical and biotechnology products.

The Saudi Arabia phosphoramidite market is expected to grow at a substantial CAGR over the forecast period. Saudi Arabia has been investing significantly in developing its biotechnology and healthcare sectors. With a growing focus on research and innovation in life sciences, there is increasing demand for phosphoramidites, which are essential in nucleic acid synthesis for applications such as drug discovery, diagnostics, and personalized medicine.

The phosphoramidite market in Kuwait is anticipated to grow at a significant CAGR over the forecast period. The growth of the biotechnology and healthcare sectors in Kuwait fuels the demand for phosphoramidites. As the country focuses on advancing its healthcare infrastructure and capabilities, there is a greater need for nucleic acid-based diagnostics and therapeutics, which rely on phosphoramidites for synthesis.

Key Phosphoramidite Company Insights

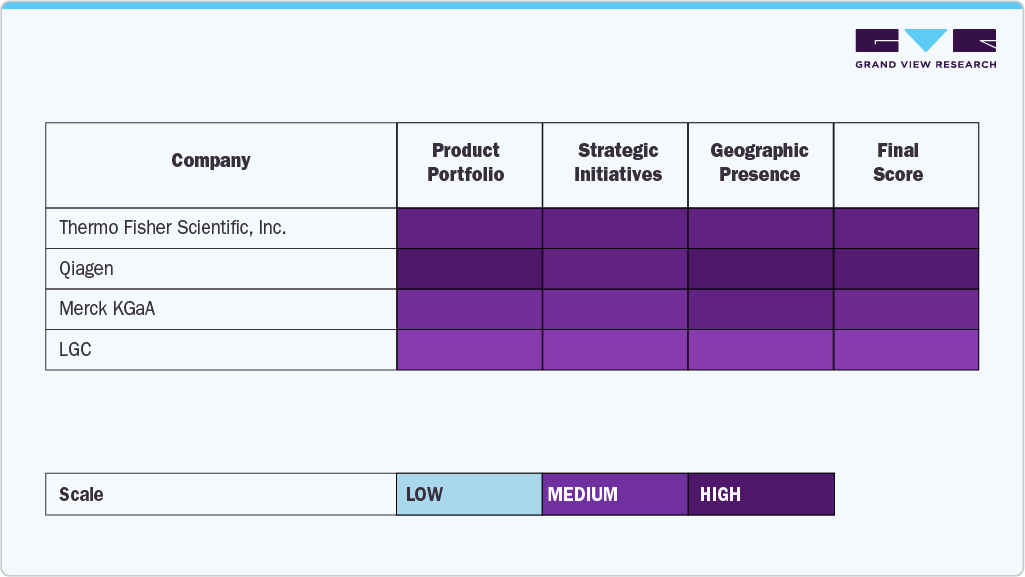

The phosphoramidite industry is characterized by the presence of several prominent global and regional players competing on product quality, supply reliability, and innovation in oligonucleotide synthesis. Thermo Fisher Scientific Inc. and Merck KGaA dominate the landscape with robust manufacturing capabilities, global distribution networks, and comprehensive product portfolios. These companies continue to invest in advanced synthesis technologies and strategic collaborations to reinforce their positions. BOC Sciences, known for its wide selection of custom phosphoramidites, has strengthened its global footprint by offering rapid turnaround and scalable solutions, catering to both research and industrial demand.

Glen Research and LGC Biosearch Technologies are recognized for their specialization in modified and specialty phosphoramidites, making them key suppliers for academic and biotech firms focused on advanced applications. Biosynth, through recent acquisitions and expansions, has widened its phosphoramidite portfolio, integrating with diagnostic and therapeutic markets. QIAGEN, though primarily known for its nucleic acid technologies, plays a critical role in custom synthesis and specialty reagents, enhancing its share in the growing genomics sector. Companies like BIONEER CORPORATION and PolyOrg, Inc., focus on cost-effective manufacturing and regional supply efficiencies, giving them a competitive edge in niche and emerging markets.

Lumiprobe Corporation has gained traction in recent years due to its strong positioning in fluorescent phosphoramidites and quality control standards that meet international benchmarks. Collectively, these companies are capitalizing on increasing demand for oligonucleotide-based therapeutics, personalized medicine, and gene editing tools. While the market remains moderately consolidated at the top, smaller players with specialized offerings continue to find strategic growth opportunities, particularly in custom and modified phosphoramidite segments. Strategic alliances, technological integration, and expansion into untapped regions are expected to shape the competitive landscape over the next decade.

Key Phosphoramidite Companies:

The following are the leading companies in the phosphoramidite market. These companies collectively hold the largest market share and dictate industry trends.

- BOC Sciences

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Glen Research

- LGC Biosearch Technologies

- Biosynth

- BIONEER CORPORATION

- QIAGEN

- PolyOrg, Inc

- Lumiprobe Corporation

Recent Development

-

In March 2023, Oligo Factory, a manufacturer specializing in custom oligonucleotides, inaugurated a new manufacturing facility of 13,000 square feet, incorporating office spaces, bench areas, and laboratories, located in Holliston, U.S. This investment is expected to propel the phosphoramidites market.

-

In May 2023, Twist Bioscience and CeGaT GmbH launched the Twist Alliance CeGaT RNA Fusion Panel. This collaborative effort aims to provide a specialized tool for oncology research, facilitating the detection of RNA fusions and enabling transcript variant analysis. RNA fusions, a result of chromosomal arrangements often seen in cancers, can now be efficiently studied using this newly introduced panel.

-

In April 2022, Ansa Biotech raised funding of USD 68 million to launch a customizable DNA synthesis service and strengthen its market position. Such initiatives are expected to boost the demand for phosphoramidite used for DNA synthesis.

Phosphoramidites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.22 billion

Revenue forecast in 2033

USD 2.27 billion

Growth rate

CAGR of 8.06% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia;, UAE; Kuwait

Key companies profiled

BOC Sciences; Thermo Fisher Scientific Inc.; Merck KGaA; Glen Research; LGC Biosearch Technologies; Biosynth; BIONEER CORPORATION; QIAGEN ; PolyOrg, Inc; Lumiprobe Corporation

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phosphoramidite Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global phosphoramidite market based on type, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

DNA Phosphoramidites

-

RNA Phosphoramidites

-

Labeled Phosphoramidites

-

Modifier Phosphoramidites

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Development

-

Diagnostics Development

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global phosphoramidite market size was estimated at USD 1.15 billion in 2024 and is expected to reach USD 1.22 billion in 2025.

b. The global phosphoramidite market is expected to grow at a compound annual growth rate of 8.06% from 2025 to 2033 to reach USD 2.27 billion by 2033.

b. North America dominated the phosphoramidite market with a share of 39.30% in 2024. This is attributable to the well-developed research and development infrastructure and the rising adoption of synthetic DNA for the development of therapeutics.

b. Some key players operating in the phosphoramidite market include BOC Sciences; Thermo Fisher Scientific Inc.; Merck KGaA; Glen Research; LGC Biosearch Technologies; Biosynth; BIONEER CORPORATION; QIAGEN ; PolyOrg, Inc; Lumiprobe Corporation

b. Key factors that are driving the market growth include the increasing demand for phosphoramidite in the production of oligonucleotides and the rising prevalence of genetic disorders and infectious diseases which has led to a surge in research and development activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.