- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Antioxidants Market Size, Share, Industry Report 2030GVR Report cover

![Plastic Antioxidants Market Size, Share & Trends Report]()

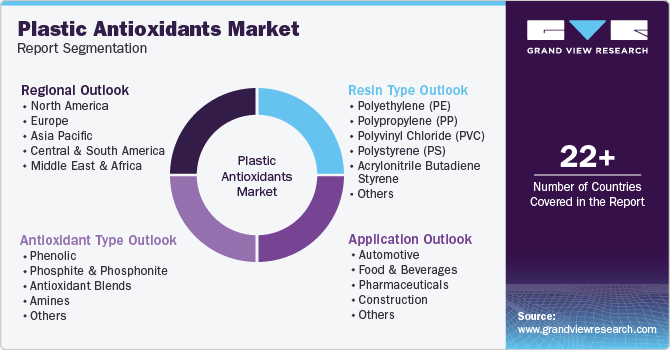

Plastic Antioxidants Market (2025 - 2030) Size, Share & Trends Analysis Report By Antioxidants Type (Phenolic, Phosphite & Phosphonite), By Resin Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-319-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Antioxidants Market Summary

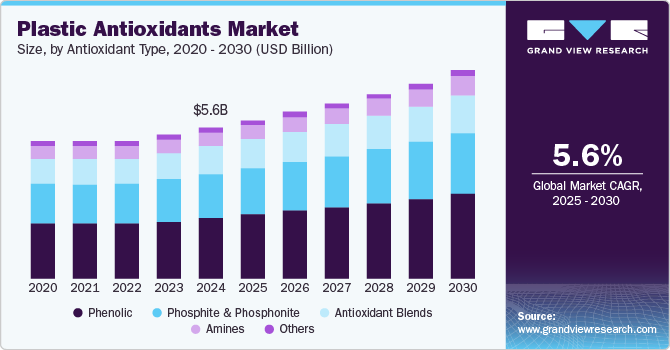

The global plastic antioxidants market size was estimated at USD 5.62 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2030. The increased usage of plastics in industries such as food & beverage, automotive, construction, packaging, and electronics drives up the demand for plastic antioxidants.

Key Market Trends & Insights

- Asia Pacific region led the market and accounted for over 35.0% of global revenue in 2024.

- By antioxidant type, the Phenolic segment held the largest share of over 40.0% in 2024.

- By resin type, the polyethylene segment held the largest share of over 34.0% in 2024.

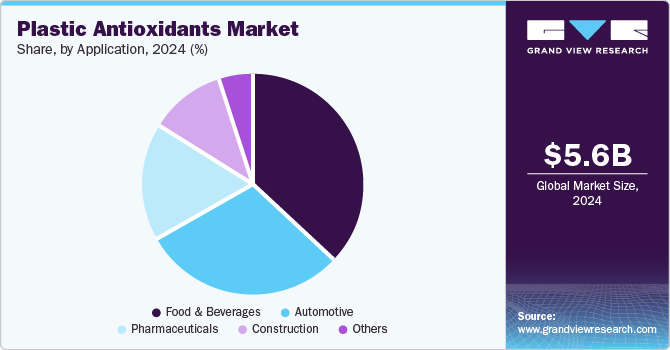

- By resin application, the food & beverage industry dominated the market and accounted for the largest revenue share of over 37.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.62 Billion

- 2030 Projected Market Size: USD 7.74 Billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

Antioxidants are widely used to enhance the performance of plastic products as it prevents degradation.

In recent years, there has been significant demand for plastic antioxidants in packaging applications as they offer durability and shelf life of the product. Several resins used in food packaging include polyethylene terephthalate (PET), polyethylene (PE), and polystyrene (PS). These polymers guard against chemical, biological, and physical damage and help preserve aroma, flavor, and/or antioxidants. The increasing consumption of packaged and ready-to-eat meals has created the need for long-lasting and dependable packaging solutions. This is expected to boost market demand in the coming years.

Furthermore, the rising usage of plastic resins in end-user industries such as electrical and electronics, automotive, and oil and gas is expected to boost the demand for plastic antioxidants. Plastic antioxidants are widely used in several automotive applications as they offer lightweight and durability to the plastic components.

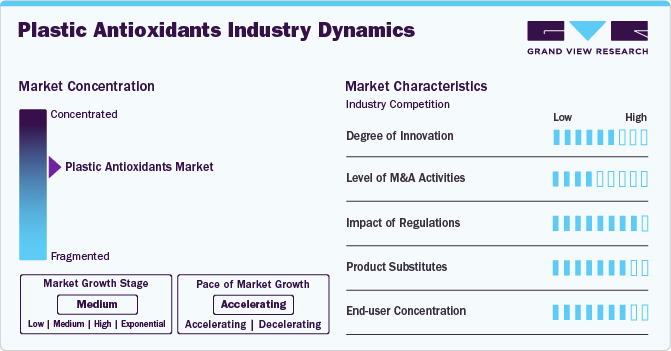

Market Concentration & Characteristics

Market is slightly concentrated with key players operating in industry such as BASF SE, Lanxess AG, Syensqo, Clariant AG., SONGWON. SI Group, Astra Polymers, Eastman Chemical Company, Dover Chemical Corporation. Players operating in the market are launching new products to meet the rising demand for plastic products such as PET, PBT, among others.

The growing focus on sustainability and the use of eco-friendly materials in manufacturing processes is expected to boost market growth. Antioxidants that enhance the recyclability of plastics and extend their lifecycle are in high demand as part of these initiatives. However, increased availability and improved extraction methods of natural antioxidants, such as tocopherols, polyphenols, flavonoids, and others is likely to hamper market growth.

Antioxidant Type Insights

The Phenolic segment held the largest share of over 40.0% in 2024. Phenolic antioxidants are widely used to preserve materials, particularly polymers and plastics, against oxidative destruction, thus enhancing their lifespan and performance. Phenolic resins are commonly used in several construction applications such as laminates, adhesives, insulating materials, and coatings. The market is being driven by an increased demand for long-lasting, fire-resistant, and high-performance construction materials.

Moreover, several factors influence the demand for phosphite and phosphonite in various industries, causing the market to increase. Phosphites and phosphonites are generally utilized as stabilizers and antioxidants in polymers and plastics, preventing thermal and oxidative deterioration. The growth of the packaging industry, particularly in food, drinks, and pharmaceuticals, is expected to propel the demand for high-performance plastic materials, including phosphite and phosphonite.

Resin Type Insights

The polyethylene segment held the largest share of over 34.0% in 2024. Polyethylene is an extensively used polymer as it offers excellent stability to improve performance and lifetime. The surge in flexible packaging solutions for food, beverages, and pharmaceuticals has boosted the demand for PE. The widespread use of PE demands the use of antioxidants to maintain material stability and durability.

The demand for polypropylene has experienced a substantial surge, particularly within automotive applications, marking potential growth in recent times. Polypropylene is commonly utilized in automobile interior and exterior components. Antioxidants are required to sustain the performance and appearance of these components in adverse environmental conditions.

Application Insights

The food & beverage industry dominated the market and accounted for the largest revenue share of over 37.0% in 2024. Plastic antioxidants play a vital role in maintaining the safety and integrity of food and beverage packaging materials. The increased consumer preference for sustainable and ecologically friendly packaging materials fuels the demand for antioxidants that improve the recyclability and sustainability of plastics in food and beverage packaging.

Automotive industry is anticipated to grow at a significant pace due to increasing demand for plastic antioxidants in automotive applications. Antioxidants are crucial for sustaining the performance, durability, and aesthetic appeal of plastic components used in vehicles. Furthermore, transitioning to electric vehicles (EVs) increases the requirement for lightweight materials to maximize battery range. Antioxidants contribute to the long-term longevity and reliability of EV plastic components. These factors are likely to contribute to the rising consumption of plastic antioxidants in automobiles.

Regional Insights

North America is one of the key regional markets and held a revenue share of over 26.0% in 2024. The increased awareness and regulations imposed by the government are expected to drive the inhibitors market throughout the forecast period. The expanding need for protective coatings in the aerospace and electronics industries has spurred countries such as the United States, Canada, and Mexico to achieve astonishing market growth.

U.S. Plastic Antioxidants Market Trends

The U.S. engineering plastic market is expected to grow at a CAGR of 5.9% from 2025 to 2030. The demand for advanced plastic antioxidants in the country is majorly generated by the expanding automotive and food & beverage industry coupled with rising construction activities.

Europe Plastic Antioxidants Market Trends

The European market is expected to grow at a moderate pace of 5.4% during the forecast period. The European market is shaped by stringent environmental regulations enforced by entities such as the European Chemicals Agency (ECHA) and the European Commission, along with other federal-level agencies, further influencing industry dynamics.

Germany was the leading manufacturer of Plastic Antioxidants in Europe and captured around 38.0% of the revenue market share in 2024. The country is self-sufficient in terms of high performance plastic production, with an adequate number of plants and production capacities to fulfill the local demand.

Asia Pacific Plastic Antioxidants Market Trends

Asia Pacific region led the market and accounted for over 35.0% of global revenue in 2024. The region's fast industrialization has resulted in the expansion of several manufacturing sectors, including automotive, construction, packaging, and consumer products, increasing demand for plastics and additives such as antioxidants. Moreover, increased urbanization in countries such as China, India, and Southeast Asia drives up demand for plastic products in infrastructure development, housing, transportation, and consumer items, increasing the need for antioxidants.

Automotive and transportation segment captured the largest revenue share of over 35.0% in 2024. Continuing infrastructural investments are expected to sustain economic growth in China and the automotive, construction, and food & beverage sectors are expected to benefit from reforms include regulatory changes, policy adjustments, or structural enhancements.

Central & South America Plastic Antioxidants Market Trends

Brazil accounts for the highest passenger car production is expected to continue to witness growth at a steady pace of 5.4% from 2025 to 2030 owing to rising GDP and high demand for Brazilian & other exports. Passenger cars make up a substantial portion of the total automobile sales in the Central & South American region. The rise in automotive production is expected to propel the demand for antioxidants in industry.

Middle East & Africa Plastic Antioxidants Market Trends

GCC countries have ongoing infrastructure projects, including rails, roads, and bridges, which require the use of plastic antioxidants. This is expected to further boost the demand for the product in the region.

Key Plastic Antioxidants Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

For instance, in September 2023, BASF launched the industry's first biomass balance plastic additives with initial offerings including Irganox 1010 BMBcert and Irganox 1076 FD BMBcert antioxidants, both certified by TÜV Nord according to the International Sustainability and Carbon Certification (ISCC PLUS). These additives are produced using a mass balance approach where fossil-based raw materials are replaced by ISCC-certified renewable biomass feedstocks, significantly reducing the product’s cradle-to-gate carbon footprint by up to 60% compared to conventional grades. This innovation supports BASF’s commitment to advancing sustainable plastics by reducing fossil resource use and greenhouse gas emissions while enabling customers to meet their sustainability targets with drop-in solutions.

Key Plastic Antioxidants Companies:

The following are the leading companies in the plastic antioxidants market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Lanxess AG

- Syensqo

- Clariant AG.

- SONGWON. SI Group

- Astra Polymers

- Dover Chemical Corporation

- Tosaf Compounds Ltd.

- 3V Sigma USA

- Avient Corporation

- Eastman Chemical Company

Plastic Antioxidants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.90 billion

Revenue forecast in 2030

USD 7.74 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base Year

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Antioxidant type, resin type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

BASF SE; Lanxess AG; Syensqo; Clariant AG.; SONGWON. SI Group; Astra Polymers; Dover Chemical Corporation; Tosaf Compounds Ltd.; 3V Sigma USA; Avient Corporation; Eastman Chemical Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Antioxidants Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic antioxidants market report based on antioxidant type, resin type, application, and region:

-

Antioxidant Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Phenolic

-

Phosphite & Phosphonite

-

Antioxidant Blends

-

Amines

-

Others

-

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Acrylonitrile Butadiene Styrene

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Food & Beverages

-

Pharmaceuticals

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastic antioxidants market size was estimated at USD 5.62 billion in 2024 and is expected to reach USD 5.90 billion in 2025.

b. The global plastic antioxidants market is expected to grow at a compound annual rate of 5.6% from 2025 to 2030, reaching USD 7.74 billion by 2030.

b. The phenolic type segment led the global plastic antioxidants market, accounting for more than 40.0% of the global revenue in 2024.

b. Some of the major companies in the global plastic antioxidants market include BASF, Lanxess AG, Syensqo, Clariant AG., SONGWON. SI Group, Astra Polymers, Dover, Tosaf Compounds Ltd., 3V Sigma USA, Avient Corporation, and Eastman Chemical Company.

b. The plastic antioxidants market is driven by rising demand for durable, high-performance plastics across automotive, packaging, and construction industries. Additionally, growing environmental stress and heat-resistance requirements in polymer processing are boosting antioxidant usage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.