- Home

- »

- Plastics, Polymers & Resins

- »

-

Poly (Butylene Adipate-Co-Terephthalate) Market Report 2030GVR Report cover

![Poly (Butylene Adipate-Co-Terephthalate) Market Size, Share & Trends Report]()

Poly (Butylene Adipate-Co-Terephthalate) Market Size, Share & Trends Analysis Report By Grade (Extrusion, Thermoforming), By Application (Composite Bags, Bin Bags, Mulch Films, Cling Films), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-395-1

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

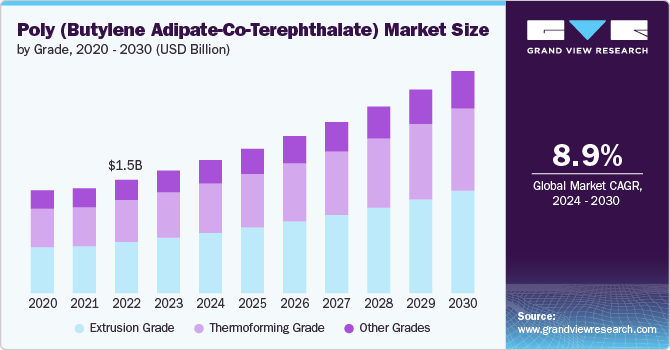

The global poly (butylene adipate-co-terephthalate) market size was estimated at USD 1.60 billion in 2023 and expected to expand at a CAGR of 8.91% from 2024 to 2030. polybutylene adipate-co-terephthalate (PBAT) is a type of biopolymer that offers excellent biodegradability, flexibility, and processability, making it an ideal grade for various end uses, particularly in packaging and agriculture. The increasing awareness about environmental sustainability and stringent government regulations regarding the use of conventional plastics have further propelled the market growth. In addition, advancements in polymer technology and increasing R&D activities are expected to enhance the performance characteristics of PBAT, fostering its adoption in diverse industries.

The growing consumer preference for eco-friendly applications has led to a surge in the adoption of PBAT-based applications. Major companies are investing in the development of innovative PBAT formulations to meet the specific requirements of different end uses. The market is also benefitting from the collaboration between raw grade suppliers and industries to ensure a consistent supply of high-quality PBAT. However, the market faces challenges such as high application costs and the availability of alternative biodegradable polymers, which may hinder its growth to some extent.

Drivers, Opportunities & Restraints

The primary drivers of the PBAT market include the increasing demand for biodegradable and compostable grades, driven by environmental concerns and government regulations. The packaging industry, in particular, is a major driver, with consumers and businesses seeking sustainable alternatives to conventional plastics. The agriculture sector is also adopting PBAT for end uses such as mulch films, which help reduce plastic waste in farming. Moreover, the advancements in PBAT application technologies and the development of cost-effective manufacturing processes are expected to further boost market growth.

There is significant opportunity in the PBAT market for companies to develop innovative and high-performance PBAT formulations. The increasing focus on sustainability and the circular economy presents a lucrative opportunity for market players to expand their application portfolios and cater to the rising demand for eco-friendly grades. In addition, the growing adoption of PBAT in emerging markets, particularly in Asia Pacific, offers substantial growth potential. Companies can also explore strategic partnerships and collaborations to enhance their market presence and leverage the expertise of other industry players.

One of the major restraints in the PBAT market is the high application cost associated with biopolymers, which makes them less competitive compared to conventional plastics. The limited availability of raw grades and the complex manufacturing processes further add to the cost. In addition, the presence of alternative biodegradable polymers such as polylactic acid (PLA) poses a challenge to the market growth. The lack of awareness and infrastructure for the proper disposal and composting of PBAT applications can also hinder market expansion.

Grade Insights & Trends

Based on grade, extrusion grade held the market with the largest revenue share of 45.39% in 2023. The extrusion grade PBAT is widely used in the manufacturing of films and sheets due to its excellent processability and mechanical properties. Thermoforming grade PBAT is preferred for end use requiring high flexibility and durability, such as packaging trays and containers. Other grades of PBAT find end use in various niche markets, offering specialized properties for specific end-use requirements.

Thermoforming grade PBAT is also witnessing significant growth, supported by the rising demand for sustainable packaging materials in the food and beverage industry. Other grades of PBAT are gaining traction in specialized end uses, providing manufacturers with the flexibility to develop customized solutions.

Application Insights & Trends

Based on application, composite bags held the market with the largest revenue share of 43.85% in 2023. Composite bags made from PBAT are gaining popularity due to their biodegradability and strength, making them suitable for various packaging applications. Bin bags and mulch films are other significant applications of PBAT, driven by the need for sustainable waste management solutions and agricultural practices. Cling films made from PBAT offer excellent transparency and flexibility, making them ideal for food packaging. Stabilizers enhance the performance of PBAT, improving its thermal and mechanical properties.

The composite bags segment is expected to witness robust growth, supported by the increasing demand for sustainable packaging solutions in various industries. Bin bags and mulch films are also anticipated to register significant growth, driven by the need for environmentally friendly waste management and agricultural practices. Cling films and stabilizers are gaining traction, supported by the rising awareness about food safety and quality. The diverse applications of PBAT are creating ample opportunities for market players to innovate and cater to the evolving needs of end-users.

End-Use Insights & Trends

Based on end-use, packaging held the market with the largest revenue share of 48.88% in 2023. The packaging industry is the largest consumer of PBAT, driven by the demand for biodegradable and compostable packaging materials. The agriculture sector is also a major end-user, utilizing PBAT for applications such as mulch films and plant pots. In the bio-medical sector, PBAT is used in medical devices and drug delivery systems due to its biocompatibility and biodegradability. Other industries include consumer goods, automotive, and textiles.

The packaging segment is expected to dominate the market, supported by the increasing demand for sustainable packaging solutions from consumers and businesses. The agriculture sector is also anticipated to witness significant growth, driven by the need for eco-friendly agricultural practices. The bio-medical sector offers promising opportunities for PBAT, supported by the advancements in medical technologies and the growing focus on sustainability. Other industries are also adopting PBAT, driven by the need for sustainable materials in various applications.

Regional Insights & Trends

The PBAT market in North America is experiencing robust growth due to increasing consumer awareness and regulatory support for sustainable materials. The region's packaging industry is a major driver, with a significant shift towards biodegradable alternatives. In addition, the agricultural sector is adopting PBAT for applications such as mulch films, further boosting demand. Leading companies are investing in expanding their PBAT production capacities to cater to the rising demand for eco-friendly products.

U.S. Poly (Butylene Adipate-Co-Terephthalate) Market Trends

The U.S. holds a prominent position in the North American PBAT market, driven by stringent environmental regulations and a strong push towards sustainability from both consumers and corporations. The packaging and agriculture industries are key sectors utilizing PBAT, with growing demand for biodegradable packaging solutions and sustainable agricultural practices. Innovations in PBAT formulations and increased funding for R&D activities are further propelling market growth in the U.S.

Asia Pacific Poly (Butylene Adipate-Co-Terephthalate) Market Trends

Asia Pacific dominated global poly (butylene adipate-co-terephthalate) market and accounted for largest revenue share of over 41.09% in 2023. The region's large consumer base and rapid industrialization are driving the demand for PBAT. Moreover, government initiatives to reduce plastic waste and promote eco-friendly alternatives are expected to further accelerate market growth in APAC. The Asia-Pacific region is witnessing the fastest growth in the PBAT market, fueled by increasing environmental awareness and regulatory measures promoting biodegradable materials. China and India are key markets, with substantial investments in sustainable packaging solutions and agricultural applications.

Europe Poly (Butylene Adipate-Co-Terephthalate) Market Trends

Europe is a significant market for PBAT, driven by stringent environmental policies and a strong emphasis on sustainability. Countries such as Germany, France, and the UK are leading the adoption of PBAT, particularly in the packaging and agricultural sectors. The European Union's regulations on single-use plastics and the increasing demand for compostable materials are major factors contributing to the market growth. In addition, collaborations between PBAT manufacturers and industries are fostering innovation and market expansion.

Key Poly (Butylene Adipate-Co-Terephthalate) Market Company Insights

The PBAT market is highly competitive, with several key players actively engaged in the development and commercialization of PBAT products. Major companies such as BASF SE, Novamont S.p.A., Eastman Chemical Company, and JinHui Zhaolong High Technology Co., Ltd. dominate the market, supported by their strong R&D capabilities and extensive product portfolios. These companies are focusing on strategic collaborations, mergers and acquisitions, and the development of innovative PBAT formulations to strengthen their market position. In addition, the entry of new players and the increasing investments in sustainable materials are expected to further intensify the competition in the PBAT market.

Key Poly (Butylene Adipate-Co-Terephthalate) Companies:

The following are the leading companies in the poly (butylene adipate-co-terephthalate) market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Novamont S.p.A

- Willeap

- Kingfa

- Hangzhou Peijin Chemical Co. Ltd

- Zhejiang Biodegradable Advanced Material Co. Ltd

- Anhui Jumei Biotechnology

- Go Yen Chemical Industrial Co. Ltd

- Jinhui Zhaolong Advanced Technology Co. Ltd

- Mitsui Plastics, Inc

- Chang Chun Group

Recent Developments

-

In June 2024, BASF SE, a chemical company, announced the expansion of its biopolymers portfolio by introducing a biomass-balanced ecoflex PBAT variant called ecoflex F Blend C1200 BMB. This new product aims to use renewable feedstock derived from residual and waste biomass instead of petroleum-based raw materials in the production process, reducing fossil resource usage and lowering the product's carbon footprint by 60% compared to the standard ecoflex F Blend C1200.

-

In May 2024, SK Leaveo officially began construction on the biodegradable material plant in Hai Phong City, Vietnam. This facility is expected to have an annual production capacity of 70,000 tons of PBAT and is expected to be operational by the third quarter of 2025.

-

In November 2023, Jiangsu Shenghong Petrochemical Co., Ltd announced the selection of Clariant, a specialty chemical company, to provide its SynDane 3142 LA catalyst for a new maleic anhydride (MA) production plant in Lianyungang, China. The plant, which will have an annual capacity of 200,000 tons, will produce MA as an intermediate for PBAT, a biodegradable plastic.

Poly (Butylene Adipate-Co-Terephthalate) Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.74 billion

Revenue forecast in 2030

USD 2.91 billion

Growth rate

CAGR of 8.91% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Grade, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Novamont S.p.A; Willeap; Kingfa; Hangzhou Peijin Chemical Co. Ltd; Zhejiang Biodegradable Advanced Material Co. Ltd; Anhui Jumei Biotechnology; Go Yen Chemical Industrial Co. Ltd; Jinhui Zhaolong Advanced Technology Co. Ltd; Mitsui Plastics, Inc; Chang Chun Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Poly (Butylene Adipate-Co-Terephthalate) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented poly (butylene adipate-co-terephthalate) market report on the basis of grade, application, end-use, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion Grade

-

Thermoforming Grade

-

Other Grades

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Composite Bags

-

Bin Bags

-

Mulch Films

-

Cling Films

-

Stabilizers

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Agriculture

-

Bio-medical

-

Other Industries

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Poly (Butylene Adipate-Co-Terephthalate) market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global Poly (Butylene Adipate-Co-Terephthalate) market is expected to grow at a compound annual growth rate of 8.91% from 2024 to 2030 to reach USD 2.91 billion by 2030.

b. Asia Pacific emerged as the largest regional segment and accounted for 41.09% of the market in 2023. The region's large consumer base and rapid industrialization are driving the demand for PBAT. Moreover, government initiatives to reduce plastic waste and promote eco-friendly alternatives are expected to further accelerate market growth in APAC.

b. Some key players operating in this industry include BASF SE, Novamont S.p.A, Willeap, Kingfa, Hangzhou Peijin Chemical Co. Ltd, Zhejiang Biodegradable Advanced Material Co. Ltd, Anhui Jumei Biotechnology, Go Yen Chemical Industrial Co. Ltd, among others.

b. The increasing awareness about environmental sustainability and stringent government regulations regarding the use of conventional plastics have further propelled the market growth. Additionally, advancements in polymer technology and increasing R&D activities are expected to enhance the performance characteristics of PBAT, fostering its adoption in diverse industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."