- Home

- »

- Advanced Interior Materials

- »

-

Polyester Hot Melt Adhesives Market, Industry Report, 2033GVR Report cover

![Polyester Hot Melt Adhesives Market Size, Share & Trends Report]()

Polyester Hot Melt Adhesives Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Packaging, Textiles & Fabrics, Automotive, Electrical & Electronics, Polymer Films & Foils), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: 978-1-68038-605-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyester Hot Melt Adhesives Market Summary

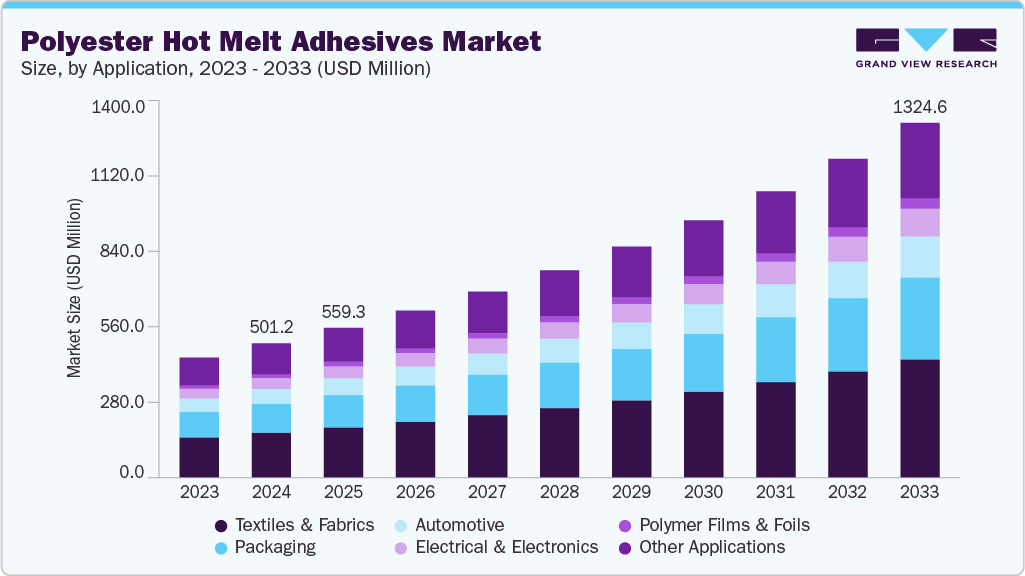

The global polyester hot melt adhesives market size was estimated at USD 501.2 million in 2024 and is projected to reach USD 1324.6 million by 2033, growing at a CAGR of 11.4% from 2025 to 2033, due to the rising demand from the packaging industry is expected to be a key driver of market growth. The packaging segment is anticipated to be the fastest-growing application area throughout the forecast period.

Key Market Trends & Insights

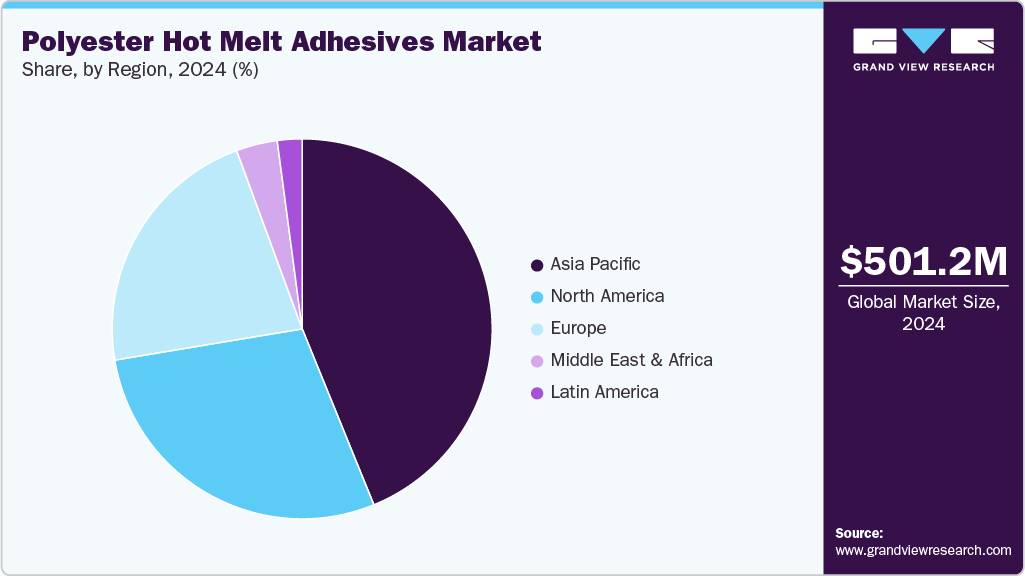

- Asia Pacific dominated the polyester hot melt adhesives market with the largest revenue share of 43.8% in 2024.

- The global polyester hot melt adhesives market is projected to grow at a CAGR of 11.4% from 2025 to 2033.

- By application, textiles & fabrics dominated the polyester hot melt adhesives market with a revenue share of 33.7% in 2024.

- By application, packaging based polyester hot melt adhesives market is expected to witness the fastest growth of 12.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 501.2 Million

- 2033 Projected Market Size: USD 1,324.6 Million

- CAGR (2025-2033): 11.4%

- Asia Pacific: Largest market in 2024

The increasing need for flexible packaging in the food and beverage industry, along with the surge in e-commerce and food delivery services, is expected to boost the demand for polyester hot melt adhesives. Additionally, innovations in packaging materials and technologies are further propelling the use of corrugated packaging, particularly in the food and beverage sector. Paper-based packaging and packaged food and beverage products categories, such as dairy, frozen meats and seafood, vegetables, baked goods, ready-to-eat meals, and baking mixes, significantly contribute to the rising need for effective packaging solutions. Polyester hot melt adhesives are gaining popularity in this space due to their strong bonding capabilities, low odor, lightweight nature, and ability to perform across a broad temperature range, making them highly suitable for food packaging.

As consumers, the expanding middle- and upper-middle-class populations in emerging markets such as India and Brazil, coupled with evolving retail landscapes, further propel the need for sustainable and efficient packaging. Additionally, the growth of e-commerce is creating indirect demand for high-performance polyester hot melt adhesives, solidifying their role in modern food and beverage packaging solutions.

Pharmaceutical packaging represents a key growth opportunity for the market and is expected to expand considerably over the next eight years. Developments in biotechnology and the increasing demand for biologic drugs are likely to drive the need for specialized packaging solutions such as pre-fillable syringes and parenteral vials. These trends are anticipated to positively influence the long-term growth of the polyester hot melt adhesives market.

Rising automotive production, particularly in emerging economies across Asia Pacific, the Middle East, and Latin America. Polyester hot melts offer reliable bonding solutions as the industry shifts toward more advanced and decorative interiors, including car seats with integrated electronics and door panels with multi-material components. They are also critical for sound insulation systems and securely attaching heavy-duty rubber mats and fabric linings. The ongoing demand for customized interiors, enhanced comfort, and functional features in vehicles is expected to create significant growth opportunities for polyester hot melt adhesives in the automotive sector.

Driven by rising populations and a growing middle class, these regions are witnessing a surge in vehicle manufacturing. For instance, in April 2024, Henkel announced expansion of its hot melt adhesive production capabilities in Asia, citing strong demand from automotive OEMs for sustainable and high-performance adhesives, including polyester-based variants. This highlights a clear growth trajectory and investment momentum within the automotive adhesive segment, making polyester hot melt adhesives a key focus for manufacturers aiming to meet evolving industry requirements.

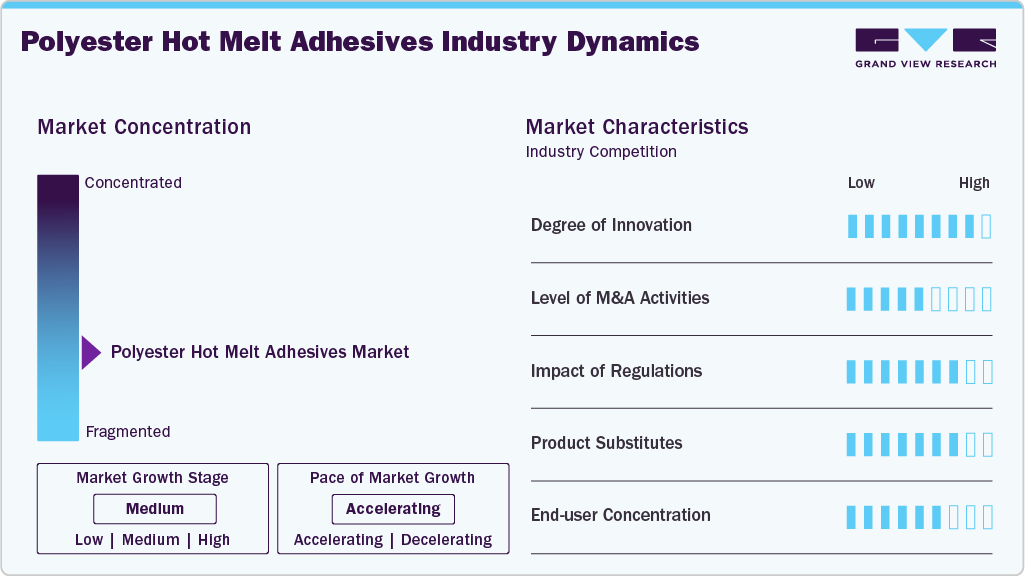

Market Concentration & Characteristics

The polyester hot melt adhesives market exhibits a moderately fragmented structure, dominated by a few large multinational chemical companies that are vertically integrated across the value chain. These key players benefit from economies of scale, in-house feedstock processing (such as natural oils or fatty acids), and extensive global supply chains, enabling them to ensure product consistency, cost competitiveness, and supply reliability across high-demand sectors like packaging, automotive, textiles, and consumer goods.

Concurrently, regional and emerging players in Asia-Pacific, Latin America, and the Middle East are steadily gaining market share by capitalizing on low-cost local resources, favorable regulatory environments, and rising domestic demand. Many of these companies are investing in polyester resin and adhesive production infrastructure to serve cost-sensitive, high-volume applications. This dual dynamic, global consolidation by established producers and regional expansion by cost-competitive manufacturers, continues to shape the evolving landscape of the polyester hot melt adhesives market.

However, the rising adoption of ethylene vinyl acetate hot melt adhesives across industries such as packaging, footwear, and solar panels poses a key restraint to the polyester hot melt adhesives market. EVA’s flexibility, ease of processing, cost-effectiveness, and strong presence in high-growth sectors like film laminates and textile bonding continue to divert demand away from polyester-based alternatives.

Application Insights

Textiles & fabrics segment by application dominated the polyester hot melt adhesives market with a revenue share of 33.7% in 2024, driven by the need for strong, durable bonding solutions, particularly for water-repellent textiles that are pre-treated with hydrophobic polymers. Industries such as footwear require adhesives that offer both breathability and water resistance, pushing innovation in adhesive technologies. The rapid growth of the textile industry in emerging economies like China and India is further boosting product adoption.

Advanced manufacturing processes in sectors such as automotive, aerospace, architecture, and healthcare have also opened new avenues for polyester-based adhesives in textile applications. These adhesives have shown significant benefits, especially in cotton, wool, and blended fabrics, by improving anti-pilling properties and enhancing fabric elasticity. For instance, in Jan 2019, Killto, a Finland-based company, launched a biodegradable hot melt adhesive specifically designed for the textile sector, posing a challenge, particularly in the apparel sub-sector. However, polyester-based adhesives remain dominant in high-performance and technical textile applications, where their superior mechanical and thermal properties are essential.

Packaging-based polyester hot melt adhesives are expected to grow fastest with a CAGR of 12.4% from 2025 to 2033, due to their wide use in widely used in packaging applications such as labeling carbonated beverage plastic bottles, glass bottles, and metal cans. Their low viscosity allows application at lower temperatures, minimizing label deformation and improving production efficiency. Moreover, these adhesives offer high cohesion and excellent heat resistance, which helps maintain label alignment and cleanliness, especially under conditions of container expansion. The growing focus on flexible packaging is expected to drive long-term demand in Europe.

Multinational food brands are increasing their investment in Eastern Europe to benefit from growing packaged food demand and cost-efficient production environments. Continued demand from the healthcare and consumer goods sectors helped cushion the impact. The shift toward sustainable and recyclable flexible packaging in Europe is poised to strengthen market growth. For instance, in September 2020, the partnership between Amcor and Nestle resulted in a recyclable retort flexible packaging solution launched in the Netherlands. Innovations like these are anticipated to drive the adoption of polyester hot melt adhesives in sustainable packaging solutions.

Regional Insights

China held over 45.0% revenue share of the Asia Pacific polyester hot melt adhesives market. The polyester hot melt adhesives market in Asia Pacific dominated with a 43.8% share in 2024, driven by the expanding base of adhesive manufacturers, rapid industrialization, and increasing adoption of polyester hot melts in the packaging and textile sectors. The region's robust food & beverage industry, rising disposable incomes, and urbanization are fueling demand for processed food and flexible packaging solutions, key application areas for polyester-based adhesives. For instance, in January 2024, H.B. Fuller expanded its manufacturing facility in Gujarat, India, to increase production capacity for hot melt adhesives targeted at hygiene, packaging, and assembly applications. This expansion reflects growing regional demand, especially in consumer goods and food packaging, where polyester hot melts are gaining prominence for their performance and sustainability.

The polyester hot melt adhesives market in China held a substantial revenue share of the APAC market in 2024, driven by the country’s leadership in the global production of electronic components and devices. The rapid adoption of emerging technologies such as 5G, AI, and IoT is spurring demand for advanced adhesives with high thermal and electrical performance for use in component assembly, insulation, and flexible circuits. Additionally, China’s thriving automotive electronics sector, bolstered by local manufacturers like Chery and BAIC, as well as major international players like Toyota, Honda, and Ford, continues to support demand for polyester hot melts used in laminates and wire harnessing applications.

Europe Polyester Hot Melt Adhesives Market Trends

The polyester hot melt adhesives market in Europe held 22.0% of the global revenue share in 2024. This is driven by the region's strong R&D investments and a concentration of leading automotive manufacturers such as Volkswagen, BMW, Renault, and Audi. The rising demand for cost-effective bonding solutions in vehicle assembly and aftermarket applications propels product adoption. For instance, Bostik (Arkema) expanded its adhesives R&D capabilities in Europe at Bostik Smart Technology Center in Venette, France, which serves as Arkema's European hub for innovation in adhesives, including polyester hot melt technologies. Hosting 125 researchers, the center focuses on developing advanced polymer solutions for industrial, construction, and consumer markets. Its emphasis on sustainable, high-performance hot-melt adhesives underscores Europe's strategic role in driving innovation and growth in the polyester hot-melt adhesives market.

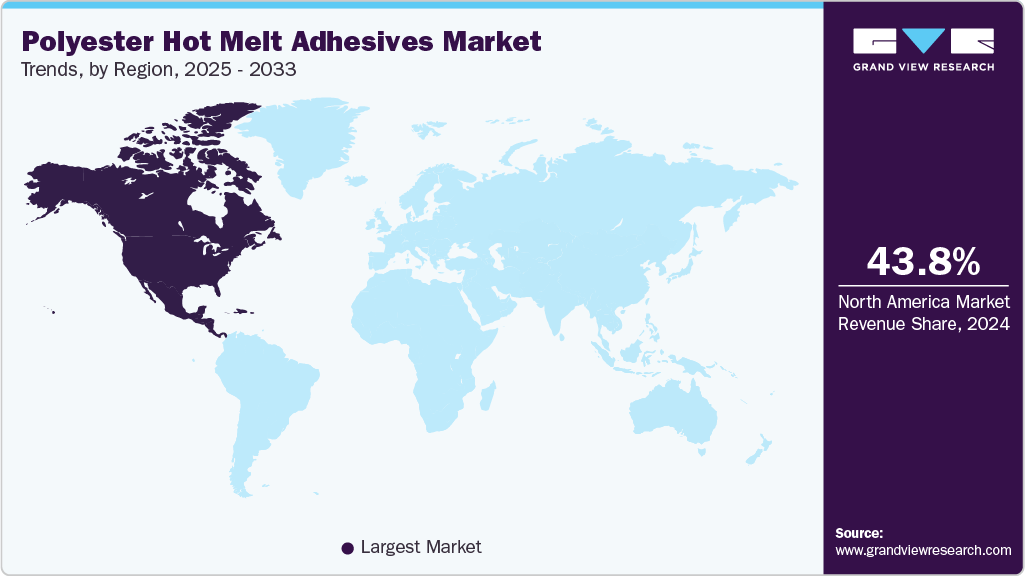

North America Polyester Hot Melt Adhesives Market Trends

The North America polyester hot melt adhesives market secured 28.5% of the revenue share in 2024, for its use in laminate packaging applications, particularly films and foils used for food and beverage packaging. Steady demand from this sector remains a primary growth driver for the regional market. Additionally, the expanding footprint of discount retailers in the U.S. and the emergence of grocery retail hubs in Mexico are expected to stimulate the demand for packaged products, thereby bolstering the need for high-performance adhesives like polyester-based hot melts.

A recent development highlighting this trend includes investment by packaging companies in North America to meet growing demand for food-safe and efficient laminate adhesives. For instance, in April 2024, Henkel, Kraton, and Dow collaboratively introduced lower-emission formulations, TECHNOMELT SUPRA 100 LE and 106M LE, for end-of-line packaging in North America, reducing the carbon footprint by 25%. These biobased polyester hot melt adhesives use Kraton’s SYLVALITE 2200 and Dow’s AFFINITY GA, maintaining food safety and performance. This move aligns with the growing demand for sustainable, efficient packaging solutions in the region.

U.S. Polyester Hot Melt Adhesives Market Trends

The U.S. polyester hot melt adhesives market is driven by wide use for bonding in non-apparel textile products such as home furnishings, carpets, upholstery, and technical textiles, where high strength, flexibility, and temperature resistance are critical. Their thermoplastic nature and rapid curing capabilities make them highly suitable for automated and high-speed production lines in modern textile manufacturing. Additionally, the demand for sustainable and recyclable materials across consumer goods is pushing textile manufacturers to adopt environmentally friendly adhesives, where polyester-based hot melt adhesives offer an edge due to their compatibility with synthetic fibers and reduced VOC emissions.

Middle East & Africa Polyester Hot Melt Adhesives Market Trends

The Middle East & Africa polyester hot melt adhesives market is experiencing strong growth, primarily driven by the growing automotive and textile industries, especially in Dubai. The region has emerged as a major importer of textiles from Europe and Asia and a key re-export hub within the Gulf. Technological advancements in textile manufacturing and the presence of multinational companies are enhancing regional competitiveness. The integration of polyester hot melt adhesive technologies into the production of high-end knitted and non-woven fabrics is enabling durable and efficient solutions for the apparel, household goods, and footwear sectors.

For instance, in May 2025, H.B. Fuller inaugurated a state-of-the-art facility in Cairo, Egypt, equipped with advanced PSA and non-PSA hot melt adhesive production capabilities. This facility is designed to serve the growing needs of the packaging, hygiene, and assembly sectors, with scalable infrastructure for future technological integration. Its strategic location near major Mediterranean and Red Sea ports enables efficient distribution across the Middle East and Africa, enhancing supply chain reliability and reducing lead times.

Latin America Polyester Hot Melt Adhesives Market Trends

The Latin America polyester hot melt adhesives market is witnessing steady growth, driven by the expanding packaging, automotive, and electrical & electronics industries, particularly in Brazil. The rise in foreign investments in food processing and flexible packaging sectors continues to boost demand for polyester hot melt adhesives, especially for laminating and sealing applications.

However, economic and political instability in countries such as Brazil and Argentina may pose challenges, although stimulus measures and recovery in industrial activity are likely to support medium-term growth. For instance, Avery Dennison expanded its hot melt adhesives production and distribution capabilities in Brazil to meet the rising demand from the flexible packaging and consumer goods sectors. The investment includes advancements in sustainable adhesive technologies aligned with the region’s increasing focus on recyclable and food-safe packaging materials.

Key Polyester Hot Melt Adhesives Company Insights

Some key players operating in the polyester hot melt adhesives market include Henkel Corporation and H.B. Fuller Company

-

Henkel Corporation, headquartered in Düsseldorf, Germany, is a dominant and mature player in the Polyester Hot Melt Adhesives market, renowned for its Technomelt product line. With a strong global presence and decades of expertise in adhesive technologies, Henkel delivers high-performance polyester hot melt solutions for packaging, automotive, electronics, textiles, and hygiene applications. These adhesives offer superior bonding strength, thermal stability, and processing efficiency, tailored to meet demanding industrial standards. Henkel emphasizes sustainability and innovation, developing low-VOC, bio-based, and energy-efficient adhesive systems supported by advanced R&D centers across Europe, North America, and Asia.

Avery Dennison Corporation and TEX YEAR INDUSTRIES INC. are emerging market participants in the polyester hot melt adhesives market.

-

TEX YEAR INDUSTRIES INC., headquartered in Taiwan, is an emerging and agile player in the global polyester hot melt adhesives market, steadily expanding its footprint across Asia-Pacific, Europe, and the Americas. Known for its innovation in hot melt technologies, TEX YEAR offers a diverse portfolio of polyester-based adhesives used in packaging, hygiene products, textiles, electronics, and labeling. The company emphasizes eco-friendly, high-performance formulations tailored to meet modern industrial and consumer demands. Backed by robust R&D and regional technical support, TEX YEAR focuses on customization, energy efficiency, and sustainability. Its strategic growth initiatives and strong customer partnerships position it as a rising force in the evolving polyester hot melt adhesives landscape.

Key Polyester Hot Melt Adhesives Companies:

The following are the leading companies in the polyester hot melt adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Arkema (Bostik)

- Dow

- H.B. Fuller Company

- Henkel Corporation

- Avery Dennison Corporation

- Sika India

- Evonik

- TEX YEAR INDUSTRIES INC.

- Jowat SE

- Paramelt

- Palmetto Adhesives.

Recent Developments

-

In October 2024, Palmetto Adhesives announced the acquisition of the assets of AccuBond Corporation, a Pennsylvania-based adhesive manufacturer. This move strengthens Palmetto’s manufacturing footprint in the Northeastern U.S. and expands its product portfolio, particularly in hot melt adhesives, including polyester-based formulations. The acquisition supports Palmetto’s ongoing growth in the polyester hot melt adhesives market, enhancing its production capacity, regional reach, and ability to deliver customized adhesive solutions to a broader customer base across North America.

-

In September 2024, Bostik, a segment of the Arkema Group, launched Kizen LIME, a new range of sustainable polyester-based hot melt packaging adhesives designed for end-of-line applications in the Fast-Moving Consumer Goods (FMCG) sector. Made with at least 80% renewable ingredients and supported by Dow’s AFFINITY RE and Nordson’s energy-efficient ProBlue™ Flex Melters, Kizen LIME significantly reduces carbon footprint while delivering high adhesion, energy savings, and compatibility with recyclable paper/cardboard packaging. This innovation marks a key step in decarbonizing packaging adhesives and reinforces Bostik’s leadership in eco-friendly polyester hot melt adhesive technologies.

Global Polyester Hot Melt Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 559.3 million

Revenue forecast in 2033

USD 1,324.6 million

Growth rate

CAGR of 11.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; China; Japan; India; South Korea; Brazil; Saudi Arabia; South Africa

Key companies profiled

3M; Arkema (Bostik); Dow; H.B. Fuller Company; Henkel Corporation; Avery Dennison Corporation; Sika India; Evonik; TEX YEAR INDUSTRIES INC.; Jowat SE; Paramelt; Palmetto Adhesives.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyester Hot Melt Adhesives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global polyester hot melt adhesives market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Packaging

-

Textiles & fabrics

-

Automotive

-

Electrical & electronics

-

Polymer films & foils

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global polyester hot melt adhesives market size was estimated at USD 501.2 million in 2024 and is expected to reach USD 559.3 million in 2025.

b. The global polyester hot melt adhesives market is expected to grow at a compound annual growth rate of 11.4% from 2025 to 2033 to reach USD 1,324.6 million by 2033.

b. The Polyester Hot Melt Adhesives market in Asia Pacific dominated with a 43.8% share in 2024, driven by the expanding base of adhesive manufacturers, rapid industrialization, and increasing adoption of polyester hot melts in packaging and textile sectors

b. Some of the key players operating in the polyester hot melt adhesives market include 3M, Arkema (Bostik), Dow, H.B. Fuller Company, Henkel Corporation, Avery Dennison Corporation, Sika India, Evonik, TEX YEAR INDUSTRIES INC., Jowat SE, Paramelt, and Palmetto Adhesives.

b. The key factors that are driving the polyester hot melt adhesives market include growing packaging, and textile & fabric industries and increasing usage of products for lamination applications in the automotive sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.