- Home

- »

- Catalysts & Enzymes

- »

-

Polyethylene Terephthalate Catalyst Market Size Report, 2033GVR Report cover

![Polyethylene Terephthalate Catalyst Market Size, Share & Trends Report]()

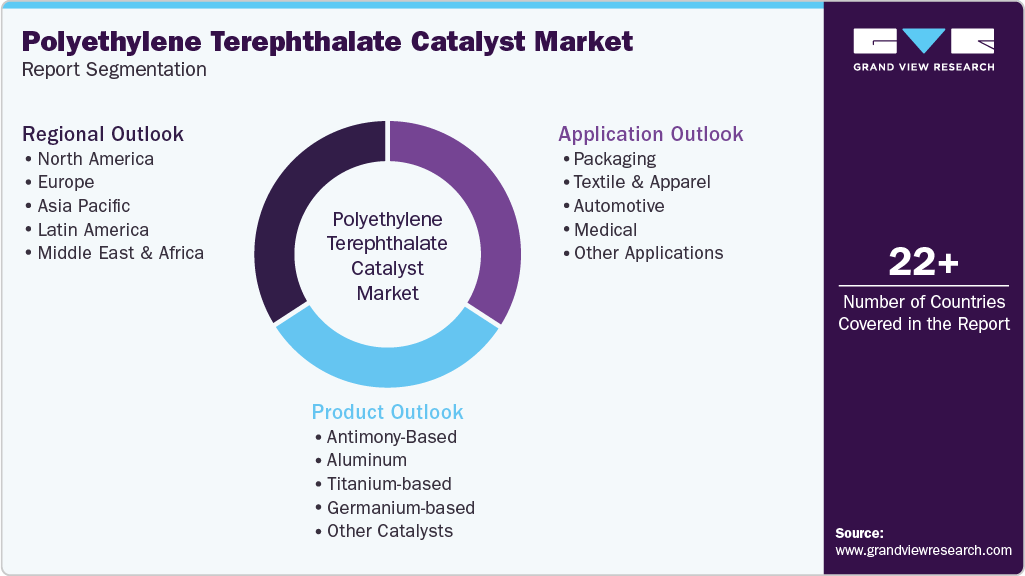

Polyethylene Terephthalate Catalyst Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Antimony-Based, Aluminum-based, Titanium-based, Germanium-based), By Application (Packaging, Textile & Apparel), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-710-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyethylene Terephthalate Catalyst Market Summary

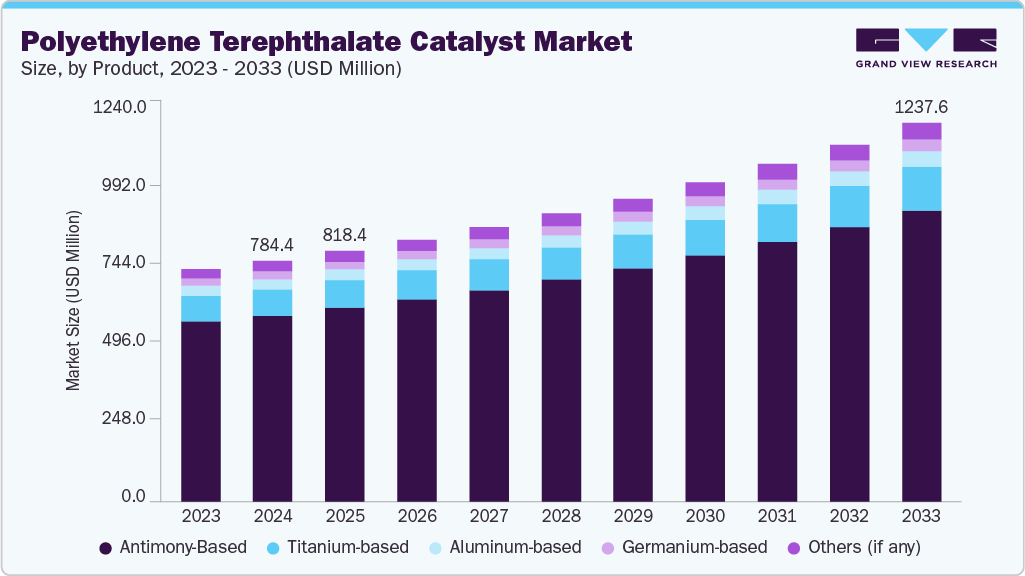

The global polyethylene terephthalate catalyst market size was estimated at USD 784.4 million in 2024 and is projected to reach USD 1237. 6 million by 2033, growing at a CAGR of 5.3% from 2025 to 2033, driven by the sustained growth in polyethylene terephthalate (PET) bottle and packaging production, particularly for water and soft beverages, owing to PET’s lightweight, safe, cost-effective, and recyclable nature. As global consumption of plastic bottles rises, increasing environmental concerns over single-use plastics have accelerated the adoption of more sustainable PET production processes.

Key Market Trends & Insights

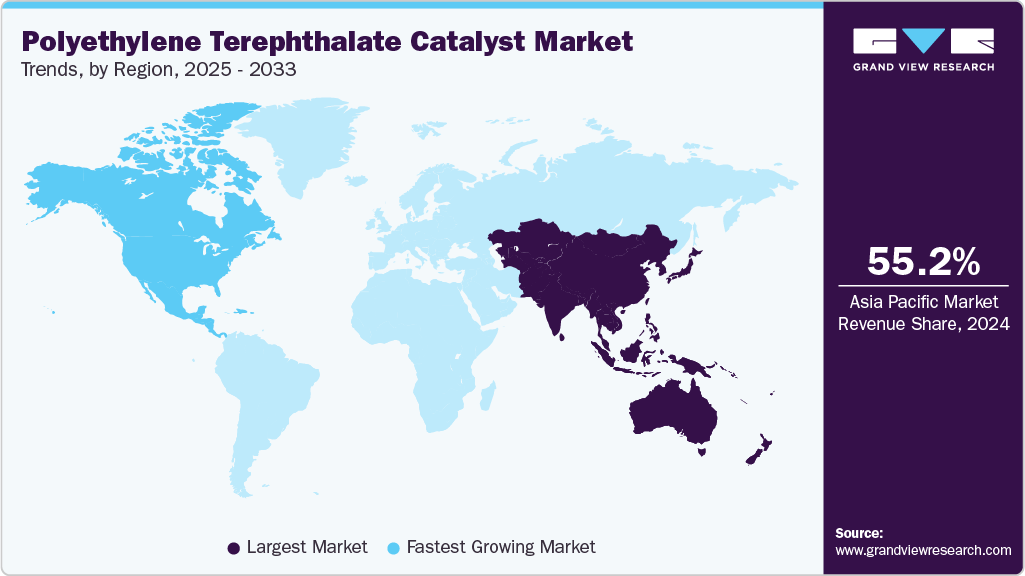

- Asia Pacific dominated the polyethylene terephthalate catalyst market with the largest revenue share of 55.2% in 2024.

- China held over 49.9% revenue share of the Asia Pacific polyethylene terephthalate (PET) catalyst market.

- By product, antimony-based dominated the market with a revenue share of 77.5% in 2024.

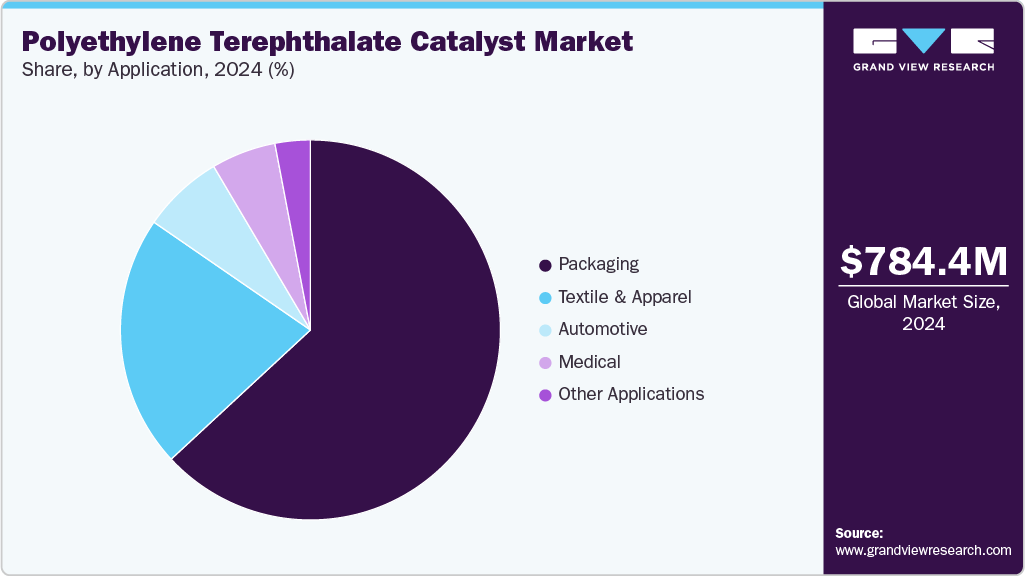

- By application, packaging dominated the polyethylene terephthalate catalyst market with a revenue share of 63.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 784.4 Million

- 2033 Projected Market Size: USD 1,237.6 Million

- CAGR (2025-2033): 5.3%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

PET catalysts play a critical role in improving polymer quality, production efficiency, and recyclability, enabling manufacturers to meet both regulatory standards and consumer expectations. A key market driver is the shift toward recycled PET (R-PET) and bio-based PET, supported by technological advancements in catalyst formulations that enhance polymer performance while reducing environmental impact. Consumer demand for transparency, product safety, and recognizability in packaging, especially in food contact applications, further boosts the need for high-quality PET resins, which rely on efficient and specialized catalysts.Additionally, PET’s superior barrier and mechanical properties, coupled with ongoing innovation in recycling technologies (such as converting PET bottles into textile fibers), reinforce its position in the packaging sector. Strategic investments in catalyst technology to improve recyclability, reduce energy consumption, and lower greenhouse gas emissions are increasingly important. Growing consumer and stakeholder awareness, along with global educational campaigns promoting effective recycling, are expected to sustain long-term demand for PET catalysts in both virgin and recycled PET production.

In the automotive sector, polyethylene terephthalate (PET) derived from PET catalyst technology is extensively used in seat cover applications due to its exceptional performance and cost-effectiveness. Modern automobile seats are typically manufactured in a three-layer structure: the top layer being the seat cover, a middle foam layer, and a bottom scrim backing, all bonded together with adhesive layers. PET is the dominant fiber used in woven, warp-knitted, or circular-knitted seat cover fabrics, with its adoption reaching nearly 95% since the late 1990s. This popularity is attributed to PET’s high tensile strength and modulus, excellent resistance to abrasion, UV radiation, and heat, superior anti-aging properties, shape retention, dimensional stability, and low production cost.

While PET is often used in its pure form, it may also be blended with wool for enhanced properties. Additional advantages include high tear resistance, easy maintenance, and wrinkle resistance, although its low moisture absorption (~0.4%) can reduce thermal comfort in hot climates.

In the polyethylene terephthalate (PET) catalyst market, aluminum-based catalysts are emerging as a promising alternative to traditional antimony- and titanium-based options, driven by their lower cost, lightweight nature, and minimal environmental and health impact. Sharing the same active sites as trivalent metals, these catalysts garnered significant research interest for their role in PET polycondensation. The shift toward aluminum-based catalysts is supported by growing environmental regulations and the industry's push to replace antimony due to toxicity concerns.

However, restraint in the polyethylene terephthalate (PET) catalyst market is the stringent environmental and health regulations imposed on antimony-based catalysts. Antimony trioxide, one of the most used catalysts in PET production, comes under increasing regulatory scrutiny due to concerns over its potential toxicity and environmental persistence.

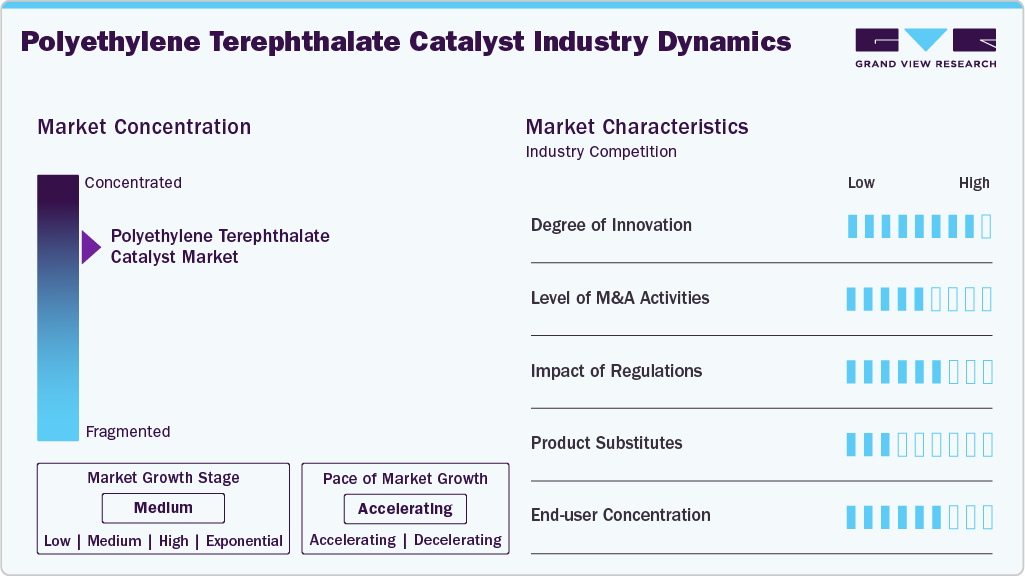

Market Concentration & Characteristics

The polyethylene terephthalate (PET) catalyst market is moderately consolidated, with dominance by a select group of large, vertically integrated chemical manufacturers. These leading players capitalize on economies of scale, in-house production of raw materials like purified terephthalic acid (PTA) and monoethylene glycol (MEG), and extensive global distribution networks to maintain strong market positions. Their integration across the PET value chain, from raw material processing to catalyst formulation, ensures cost efficiency, consistent catalyst performance, and reliable supply to critical end-use sectors including packaging, textiles, automotive, and electronics. This strategic positioning enables them to meet the growing demand for high-quality PET production while supporting innovations in sustainability, recyclability, and process efficiency.

At the same time, emerging players in the Asia-Pacific and Middle East regions are expanding their presence in the PET catalyst market by leveraging abundant local raw materials such as purified terephthalic acid (PTA) and monoethylene glycol (MEG), lower production costs, and growing domestic PET resin demand. These regional manufacturers, often supported by strategic investments in integrated PET production facilities within petrochemical hubs, focus on supplying cost-competitive catalyst solutions for high-volume applications, including PET bottle-grade resin, polyester fibers, and films. This evolving competitive landscape, marked by consolidation among established multinational catalyst suppliers and regional expansion driven by cost and resource advantages, continues to shape the market’s structure.

However, the PET catalyst market faces notable challenges, with one major restraint being increasing environmental and regulatory pressures surrounding the use of certain catalyst chemistries, particularly those containing antimony. Concerns over catalyst residue in food-contact PET products, potential toxicity, and environmental impact prompted stricter regulations and the promotion of alternative catalyst systems, such as titanium-based or organic catalysts, particularly in North America and Europe.

Product Insights

Antimony-based polyethylene terephthalate (PET) catalyst dominated the market and accounted for the largest revenue share of 77.5% in 2024, driven by the need for consistent polymer quality, rapid reaction rates, and process flexibility across a wide range of manufacturing conditions. Sb catalysts enable the production of PET with controlled crystallinity and orientation, factors that directly influence mechanical performance, transparency, and barrier properties.

Furthermore, Sb catalysts remain the industry standard for large-scale PET production due to their well-established processing technology, compatibility with existing manufacturing infrastructure, and proven performance in both amorphous and semi-crystalline PET products. Additionally, due to its high catalytic efficiency, cost-effectiveness, and ability to produce PET with excellent optical clarity, mechanical strength, and thermal stability. These properties are essential for applications such as beverage bottles, food containers, and high-performance packaging, where durability, safety, and aesthetic quality are critical.

The titanium-based segment is expected to grow fastest with a CAGR of 5.8% from 2025 to 2033, due to emerging as a next-generation alternative to traditional antimony systems in PET production, driven by the growing demand for improved product performance, sustainability, and compliance with increasingly stringent health and environmental regulations. Unlike antimony catalysts, titanium catalysts are non-toxic, environmentally benign, and capable of producing PET with enhanced clarity, reduced acetaldehyde (AA) content, and better thermal stability-critical factors for applications in food and beverage packaging, hot-fill bottles, and high-clarity containers.

Technological advancements in titanium catalyst formulations, such as titanium-phosphate systems and SO₄²⁻/ZnO-TiO₂ composites, demonstrated superior catalytic activity and higher bis(2-hydroxyethyl) terephthalate (BHET) recovery in PET chemical recycling compared to conventional zinc acetate. For example, titanium-phosphate catalysts achieved 97.5% BHET recovery in glycolysis, outperforming zinc acetate’s 62.8%, while SO₄²⁻/ZnO-TiO₂ catalysts delivered 100% PET conversion at 180 °C within 3 hours.

For instance, commercial adoption is accelerating, with companies like Wellman, Inc. introducing patented titanium-based PET resins such as PermaClearTi and ThermaClearTi for the carbonated soft drink and hot-fill packaging markets. These products, launched in the mid-2000s and produced at Wellman’s large-scale facilities in South Carolina and Mississippi, offer benefits including reduced injection cycle times (up to 10%), higher filling temperatures, light-weighting potential, and improved visual properties over antimony-based systems.

Application Insights

Packaging segments of polyethylene terephthalate (PET) catalyst market dominated with a revenue share of 63.1% in 2024. The increasing demand for efficient, durable, and sustainable packaging solutions is a major driver of the polyethylene terephthalate (PET) catalyst market, particularly in packaging applications. PET offers a unique combination of material properties-including high durability, chemical resistance, and excellent clarity-that make it highly suitable for a wide range of packaging formats.

In the food and beverage industry, PET is widely used for packaging products such as water, carbonated drinks, condiments, and salad dressings due to its strong barrier properties against moisture and carbon dioxide, which help preserve freshness and extend shelf life. Its chemical inertness also ensures that the original taste and quality of consumables remain intact. Additionally, PET is used in the production of caps and closures, which are valued for their lightweight, moldability, and recyclability, all of which contribute to safer and more efficient packaging. In personal care and pharmaceutical sectors, PET’s strength and resistance to chemical degradation make it ideal for packaging shampoos, lotions, supplements, and other sensitive products.

Textile & apparel-based polyethylene terephthalate (PET) catalyst application is expected to grow at the fastest CAGR from 2025 to 2033, driven by polyester's dominance as the most widely used synthetic fiber. With increasing demand for sustainable fashion, PET catalysts play a crucial role in enabling recycled PET (rPET) fiber production, supporting circular economy initiatives. The market benefits from PET's cost-effectiveness, durability, and moisture-wicking properties, making it ideal for sportswear and fast fashion. However, challenges like fiber blending complexities and high-energy recycling processes hinder full-scale adoption. Innovations in chemical recycling and bio-based PET catalysts present significant growth opportunities, aligning with global sustainability goals in the textile industry.

Regional Insights

The polyethylene terephthalate (PET) catalyst market in the asia pacific dominated with a 55.2% share in 2024, owing to the PET catalyst market in food packaging is driven by the rising demand for lightweight, durable, and cost-effective solutions that ensure food safety and extended shelf life. PET's excellent tensile strength, clarity, and barrier properties make it ideal for food-grade containers, especially in applications like frozen storage and ready-to-cook meals. Advancements in catalyst technologies enabled the production of high-performance, recyclable PET materials, replacing traditional packaging like PVC and glass. Urbanization, growing disposable incomes, and on-the-go lifestyles are further boosting demand. For instance, on May 24, 2024, Toyobo's eco-friendly TOYOBO GS Catalyst received APR certification for recyclability, reflecting the region’s shift toward sustainable food packaging.

The polyethylene terephthalate (PET) Catalyst market in China held a substantial revenue share of the APAC market in 2024, driven by its expanding food packaging industry, where PET's intrinsic properties eliminate the need for additional stabilizers, plasticizers, or antioxidants. The demand for lightweight, chemically inert, and thermally stable packaging is rising, especially with the surge in packaged foods, beverages, and ready-to-eat meals.

PET’s ability to form bottles, trays, films, and foils with excellent gas and moisture barrier properties, along with high clarity and impact resistance, makes it ideal for preserving food quality and extending shelf life. Moreover, advances in catalyst technologies enabled production of high molecular weight, food-grade PET with minimal extractables or migration, ensuring consumer safety an increasingly critical factor in China’s regulated food sector. Enhanced catalyst systems also support applications such as oxygen barrier bottles and microwaveable trays, further aligning with the region’s need for high-performance, recyclable, and multifunctional packaging solutions.

Europe Polyethylene Terephthalate (PET) Catalyst Market Trends

The polyethylene terephthalate (PET) catalyst market in Europe held 20.6% of the global revenue share in 2024. This can be credited to Europe’s push toward a circular economy, backed by policies like the Circular Economy Action Plan (CEAP) and mandates for recycled content, encouraging the transformation of PET waste into high-value electrochemical materials. PET is increasingly upcycled into energy‑oriented products such as supercapacitors, batteries, fuel cells, CO₂ reduction devices, and sensors.

Advancements in electrocatalytic technologies are key to enabling this shift. For example, novel processes using molybdic polyoxometalate catalysts can convert waste PET into terephthalic acid and hydrogen fuel under mild conditions, demonstrating energy efficiency and environmental benefits. Such innovations demand specialized PET catalysts across Europe to support electrocatalytic upcycling, aligning with sustainability goals while enabling new, performance-driven applications of PET-derived materials.

In June 2025, Catalytic Technologies Ltd (CTL) launched CTL Ti955 UP, a new titanium-based catalyst designed for polyester production, including polyethylene terephthalate (PET). This catalyst offers cost savings and easier handling, is non-hazardous, and fully complies with UK and EU REACH regulations. CTL Ti955 UP already been commercially adopted in Europe and Asia and is based on CTL’s proprietary “UP” high-purity titanium technology. It directly replaces antimony-based catalysts or existing titanium catalysts like titanium butoxide, enhancing both environmental and performance profiles in PET manufacturing. This development supports the PET catalyst market’s shift toward safer, more sustainable alternatives.

North America Polyethylene Terephthalate (PET) Catalyst Market Trends

The North America polyethylene terephthalate (pet) catalyst market secured 17.3% of the revenue share in 2024, owing to the demand in the packaging industry, where their application is in bottled water and soft beverages. PET bottles become the dominant packaging format in this sector due to their excellent properties, including light weight, impact resistance, high transparency, and superior barrier performance against gas and moisture. These characteristics make PET an ideal alternative to glass, especially for larger containers, offering both cost-efficiency and consumer convenience.

In addition, modern manufacturing processes significantly reduced the levels of acetaldehyde (AA) and antimony (Sb), residues commonly formed during PET production, ensuring regulatory compliance and product safety. Advanced PET catalysts are instrumental in minimizing these residues while enhancing polymer quality and production efficiency. The increasing preference for larger volume PET bottles (up to 5L) in the beverage industry, owing to their better CO₂ retention and cost benefits, further fuels the need for high-performance catalysts.

Middle East & Africa Polyethylene Terephthalate (PET) Catalyst Market Trends

The Middle East & African polyethylene terephthalate (PET) catalyst market is experiencing strong growth, primarily largely driven by the expanding use of PET bottles in beverage packaging, particularly in response to rising consumer demand for convenient, lightweight, and durable packaging formats. PET's superior properties, such as high transparency, excellent gas and moisture barrier characteristics, impact resistance, UV stability, and shatterproof performance compared to glass-make it the preferred material for packaging water, carbonated soft drinks, tea, coffee, and energy drinks. In a region characterized by high temperatures and a growing urban population, bottled beverages are a key necessity, fueling continuous PET consumption.

As a recyclable material, PET also supports national and regional sustainability goals, offering performance advantages over alternatives like glass bottles, aluminum cans, paperboard, and other plastics. The increasing shift toward localized PET production boosted demand for efficient and high-performance PET catalysts that can enable faster polymerization, improve clarity, and support recycling processes.According to data from Euromonitor International, PET bottles dominate the global beverage packaging market, accounting for 67% of total volume across water and soft drinks. This global trend is mirrored in the Middle East & Africa, where single-serve PET bottles are gaining traction due to convenience, portability, and cost-effectiveness.

Latin America Polyethylene Terephthalate (PET) Catalyst Market Trends

The Latin American polyethylene terephthalate (pet) catalyst market is witnessing steady growth, largely driven by rising emphasis on sustainable and circular textile production. With mounting environmental concerns over the disposal of synthetic textile waste, especially non-biodegradable materials like PET fibers, there is increasing interest in chemical recycling methods such as glycolysis, which relies on catalysts to depolymerize waste PET into reusable monomers like bis(2-hydroxyethyl) terephthalate (BHET). These monomers can be repurposed into value-added products like fatty amide-based textile softeners, contributing to waste reduction and product innovation. The need for eco-friendly and cost-effective catalysts has become critical, especially as traditional heavy metal-based catalysts like zinc acetate pose environmental hazards.

In response, companies such as Catalytic Technologies Ltd are innovating alternative PET catalysts that are less toxic and offer comparable performance. In Latin America, where the textile industry is a major economic sector, especially in countries like Brazil, Colombia, and Mexico, the adoption of PET catalyst-based recycling solutions aligns with regulatory trends and consumer preference for greener textile processes. For instance, in August 2023, Indorama Ventures, a global leader in PET recycling, tripled the capacity of its PET recycling facility in Juiz de Fora, Brazil. This expansion enhances the production of post-consumer recycled PET (rPET) and integrates advanced technologies such as new washing machines that reduce water use by 70%. Supported by a Blue Loan from the International Finance Corporation (IFC), this move aligns with broader sustainability goals to tackle plastic waste across emerging markets, including Brazil.

Key Polyethylene Terephthalate Catalysts Company Insights

Some key players operating in the polyethylene terephthalate (pet) catalyst market include Indorama Ventures and Teijin.

-

Teijin, headquartered in Tokyo, Japan, is a globally integrated technology-driven company and a dominant, mature player in the Polyethylene Terephthalate (PET) catalyst market. With a strong foundation in high-performance polymers, Teijin has decades of experience in PET production, particularly in engineering and specialty-grade PET resins used across textiles, packaging, electronics, and automotive sectors. Teijin’s deep technical expertise encompasses polymer chemistry and catalyst optimization, enabling the development and deployment of advanced PET polymerization catalyst systems including antimony-based and alternative metal catalysts that enhance molecular weight control, polymer clarity, thermal stability, and recyclability. Teijin’s PET catalysts produce resins with high processing efficiency, mechanical strength, and superior end-use performance, particularly in bottle-grade PET and high-heat applications. With manufacturing and R&D centers across Japan, the U.S., and Europe, Teijin continues investing in next-generation PET catalyst technologies, including those aligned with bio-based feedstocks and low-energy polymerization routes.

Catalytic Technologies Ltd and SAKAI CHEMICAL INDUSTRY CO. LTD. are an emerging market participants in the Polyethylene Terephthalate (PET) catalyst market.

-

Catalytic Technologies Ltd (CTL), headquartered in the UK, is an emerging and innovative player in the global Polyethylene Terephthalate (PET) catalyst market. It is recognized for its specialized focus on next-generation catalyst technologies. Unlike traditional bulk chemical companies, CTL is a technology-driven firm dedicated to transforming PET polymerization processes by developing high-performance, environmentally friendly catalyst systems, particularly antimony-free alternatives such as titanium- and germanium-based catalysts. CTL’s PET catalyst solutions address industry challenges related to toxicity, recyclability, color stability, and thermal degradation, making them ideal for bottle-grade, food-contact, and high-clarity PET applications. Its proprietary catalysts offer advantages such as faster reaction rates, lower heavy metal contamination, and improved processing flexibility, aligning well with global trends toward sustainable manufacturing and circular economy practices. Through strategic partnerships with PET resin producers, global packaging companies, and research institutions, CTL is steadily expanding its international footprint, particularly in Europe, North America, and Asia.

Key Polyethylene Terephthalate Catalyst Companies:

The following are the leading companies in the polyethylene terephthalate (PET) catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- TOYOBO

- Teijin

- Catalytic Technologies Ltd

- Iwatani Corporation

- Evonik Industries AG

- Wellman Introduces

- Indorama Ventures

- SAKAI CHEMICAL INDUSTRY CO.,LTD.

- Amerex Hubei Decon Polyester Co., Ltd.

- NAN YA PLASTICS CORPORATION

Recent Developments

-

In June 2025, Toyobo Co., Ltd. signed a joint R&D agreement with U.S.-based DMC Biotechnologies to develop and commercialize sustainable chemical compounds, specifically as raw materials for general-purpose plastics, via advanced biomanufacturing techniques using synthetic biology and precision fermentation. This initiative aims to enhance production efficiency while reducing reliance on fossil-based inputs and greenhouse gas emissions.

-

In May 2024, Toyobo Co., Ltd. announced that its newly developed PET shrink label film, ReCrysta, received recognition under the APR Design for Recyclability from the Association of Plastic Recyclers (APR). This designation confirms that ReCrysta meets or exceeds the strictest guidelines under APR’s Critical Guidance Recognition pathway, based on third-party testing. ReCrysta is manufactured using over 50% recycled PET resin and is designed using the same monomers found in PET bottles, unlike traditional PET shrink films that use different monomers and require separate sorting during recycling. This chemical compatibility enables PET bottles and shrink labels made from ReCrysta to be recycled together, thereby improving the efficiency and quality of recycled PET resin flakes.

Polyethylene Terephthalate Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 818.4 million

Revenue forecast in 2033

USD 1,237.6 million

Growth rate

CAGR of 5.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; India; China; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

TOYOBO; Teijin; Catalytic Technologies Ltd; Iwatani Corporation; Evonik Industries AG; Wellman Introduces; Indorama Ventures; SAKAI CHEMICAL INDUSTRY CO. LTD; Amerex Hubei Decon Polyester Co., Ltd.; NAN YA PLASTICS CORPORATION

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyethylene Terephthalate Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global polyethylene terephthalate catalyst market report based on product, application, and region

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Antimony-Based

-

Aluminum

-

Titanium-based

-

Germanium-based

-

Other Catalysts

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Packaging

-

Textile & Apparel

-

Automotive

-

Medical

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyethylene terephthalate catalyst market size was estimated at USD 784.4 million in 2024 and is expected to reach USD 818.4 million in 2025.

b. The global polyethylene terephthalate catalyst market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach USD 1,237.6 million by 2033.

b. The packaging-based segment led the market and accounted for the largest revenue share of 63.1 % in 2024, due to increasing demand for efficient, durable, and sustainable packaging solutions.

b. Some of the key players operating in the PET catalyst market include TOYOBO, Teijin, Catalytic Technologies Ltd, Iwatani Corporation, Evonik Industries AG, Wellman Introduces, Indorama Ventures, SAKAI CHEMICAL INDUSTRY CO.,LTD., Amerex Hubei Decon Polyester Co., Ltd. and NAN YA PLASTICS CORPORATION.

b. The growth in polyethylene terephthalate catalyst markets is increasingly attributed to the sustained growth in PET bottle and packaging production, particularly for water and soft beverages, owing to PET’s lightweight, safe, cost-effective, and recyclable nature.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.