- Home

- »

- Plastics, Polymers & Resins

- »

-

Caps And Closures Market Size And Share Report, 2030GVR Report cover

![Caps And Closures Market Size, Share & Trends Report]()

Caps And Closures Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal), By Product (Dispensing Caps, Screw Closures, Crown Closures, Aerosol Closures), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-460-4

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caps And Closures Market Summary

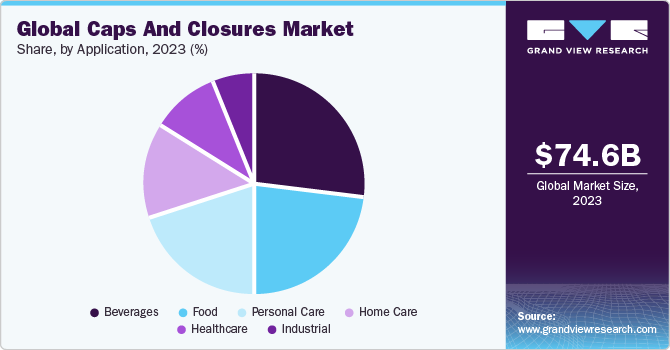

The global caps and closures market size was estimated at USD 74.64 billion in 2023 and is projected to reach USD 103.87 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. Growing demand for various food products and alcoholic andnon-alcoholic beverages is anticipated to trigger market growth.

Key Market Trends & Insights

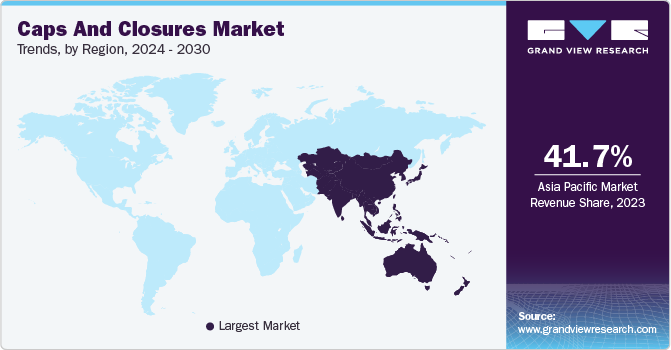

- Asia Pacific dominated the global caps and closures market with the largest revenue share of over 41.7% in 2023.

- Based on application, the beverages segment held the largest revenue share of over 27.0% in 2023.

- Based on material, the plastic segment led the market with the largest revenue share of over 54.0% in 2023.

- Based on product, the screw closures segment led the market with the largest revenue share of over 32.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 74.64 Billion

- 2030 Projected Market Size: USD 103.87 Billion

- CAGR (2024-2030): 4.9%

- Asia Pacific: Largest market in 2023

Caps and closures act as a barrier and prevent packaged contents from getting exposed to ambient air and dust particles and allow easy dispensing. Caps and closures have applications in several other end-use industries, such as healthcare, personal care, home care, and automotive. Rising awareness about the benefits of healthy eating is likely to boost the demand for dietary supplements, which in turn is expected to further drive demand for packaging products.Council for Responsible Nutrition (CRN), a leading trade association representing dietary supplement and functional food manufacturers and ingredient suppliers in the U.S. conducted a consumer survey in 2023 on dietary supplements, wherein multivitamins were consumed by 70% of participants, followed by specialty supplements such as omega-3s, melatonin, probiotics, and fiber used by 52 % of participants. In addition, the sports nutrition supplements segment witnessed a 5% increase in consumption compared to previous years. All these factors are anticipated to drive the demand for market growth.

Increasing demand for caps and closures is closely associated with the rise of urbanization in the U.S. Consumers in urban areas prefer packaging solutions that are convenient and suitable for on-the-go consumption of food and beverages. Caps and closures play a vital role in providing this convenience by ensuring easy opening and closing of products, as well as preventing spills. In addition, they create an airtight seal that keeps the products fresh for a longer period by preventing the entry of bacteria. These address the growing concerns about safety and hygiene associated with food and beverage products, as they help prevent spoilage. Hence, expanding food and beverage industries with growing urbanization is expected to boost the demand for caps and closures over the forecast period.

Application Insights

Based on application, the market is categorized into beverages, food, personal care, home care, healthcare, and industrial segments. Beverages segment held the largest revenue share of over 27.0% in 2023. Growing consumption of non-alcoholic beverages is anticipated to support segment growth. The emergence of functional beverages including energy and sports drinks, probiotic beverages, meal replacers, and fruit & vegetable-based beverages that can be packaged in glass & plastic bottles is further likely to spur the segment growth.

Rising consumption of packaged food products, Ready-To-Eat (RTE) meals, and on-the-go snacks is anticipated to drive segment growth over the forecast period. Moreover, in the healthcare segment, caps and closures are used for sealing bottles and cans of drugs, supplements, saline bottles, and vaccine vials among others. Growing demand for senior-friendly as well as child-resistant closures that minimize incidences of accidental ingestion of over-the-counter (OTC) medications by infants and children is expected to augment demand for caps and closures in this segment over the forecast period.

Regional Insights

Asia Pacific dominated the market with the largest revenue share of over 41.7% in 2023. The presence of highly populous countries, such as China and India, coupled with the growing food & beverage industry is expected to drive the regional market. Furthermore, increasing demand for cosmetics and home care products from countries, such as Japan and South Korea, is expected to boost caps and closures consumption.

In North America, increased consumption of alcoholic and non-alcoholic beverages in countries, such as the U.S. and Canada are triggering demand for caps and closures in the beverage industry. The introduction of new types of beverages in the region is expected to further accelerate demand for its packaging products. For instance, in February 2022, Starbucks Coffee Company collaborated with PepsiCo to launch an energy drink known as Baya. The energy drink is available in three flavors, namely pineapple passionfruit, raspberry lime, and mango guava. This positive outlook for the beverage industry is anticipated to stimulate market growth during the forecast period.

Market Dynamics

The use of caps and closures is widespread in the beverage packaging industry, as they play a crucial role in preserving the freshness, taste, and texture of beverages. In recent years, there has been a growing trend towards utilizing packaging options such as cartons and pouches to enhance the shelf life of beverages. Furthermore, the global presence of some key beverage companies such as PepsiCo, Anheuser-Busch Companies LLC, and Coca‑Cola Company fuels the demand for caps in the beverage industry, boosting market growth.

The alcoholic beverage industry was negatively impacted in the wake of COVID-19 pandemic due to the closure of resorts, hotels, and bars in 2020. However, countrywide lockdown restrictions globally increased at-home consumption of beverages, such as beer. As per the National Beer Wholesalers Association, a U.S.-based trade association, the share of beer cans increased to 67% in 2020 from 60% in 2019 among all packaging types for beer. This is attributed to the fact that cans are more likely to be used for at-home consumption due to their convenient packaging size, giving a boost to metal can closure demand.

Companies are increasingly prioritizing the use of recycled materials in the manufacturing of caps. They are exploring the utilization of Post-Consumer Recycled (PCR) aluminum, steel, and plastic, which can undergo further processing and can be utilized as raw material. For instance, in October 2023, Berry Global Inc. introduced lightweight tube closure solutions that are manufactured using virgin plastics including polyethylene (PE) and polypropylene (PP) and can be additionally manufactured using post-consumer recycled plastics (rPE and rPP) from Berry Global Inc.’s internal closed-loop recycling facility.

Material Insights

Based on material, the market is categorized into plastic, metal, and other segments. Plastic segment held the largest revenue share of over 54.0% in 2023. Plastic material poses environmental concerns due to lower degradability as well as occurrence of CO2 emissions during its production. The trend of recycling is therefore emerging in manufacturing of caps and closures with numerous companies making use of recycled content as raw material to minimize dependence on virgin plastic. For instance, MENSHEN and Borealis AG launched ten packaging closures in September 2020, which are manufactured using 50% PCR polypropylene. These are intended to be used for laundry and home care products.

Metal is sustainable and durable as compared to plastic material and therefore has gained traction in the market. Metal closures are widely used for covering beverage glass bottles, metal cans of food products, as well as bottles of pharmaceuticals.

The others segment contains materials, such as glass, cork, and rubber, which are gaining popularity as these offer robust sealing solutions as well as provide aesthetic appeal to packaging. Therefore, glass and corks or stoppers are used for wine bottles and for perfumery glass bottles that can retain perfume fragrance for a longer time.

Product Insights

Based on product, the market is divided into screw closures, dispensing caps, aerosol closures, crown closures, and other segments. Screw closures segment held the largest revenue share of over 32.0% in 2023. Screw closures can be easily screwed on and off containers, allowing for repeated opening and closing without compromising the integrity of the product. This makes them suitable for a wide range of applications, from food and beverages to pharmaceuticals and personal care products.

Dispensing caps of various types including pumps, triggers, and flip flops among others, are used in multiple end-use industries, such as food, cosmetics, pharmaceutical, and automotive. Availability of various types of dispensing caps according to the product being packaged, convenience in usage, and controlled flow of packaged products are anticipated to boost the growth of this segment.

Moreover, crown closures are primarily made up of metal and have crown-like structures. Crown closures are predominantly used for glass bottles of beer, energy drinks, and soft drinks. Thus, rising consumption of beverages is expected to lead to increasing demand for packaging closures.

Key Companies & Market Share Insights

The market is characterized by the presence of multinational as well as regional players and several public-listed companies globally, making the market space highly competitive. Key players mainly cater to the demand from food, beverages, pharmaceutical, and beauty products industries.

Major players operating in the caps and closures industry are undertaking different strategies such as product launches, mergers, joint ventures, acquisitions, and geographical expansion. For instance, in February 2023, Berry Global Inc. introduced a comprehensive packaging solution specifically designed for pharmaceutical and herbal markets, targeting syrup and liquid medicines. This solution includes child-resistant and tamper-evident PET bottles and closures. The product range consists of seven different sizes, ranging from 20ml to one liter, all featuring a 28mm neck. Notably, certain bottles and closures within this range have undergone rigorous testing and certification processes, meeting child-resistant standards set by the EU's ISO8317 and US' 16CFR1700.20 regulations.

Key Caps And Closures Companies:

- Crown

- Amcor plc

- Closure Systems International

- Ball Corporation

- Silgan Holdings Inc.

- Guala Closures S.p.A

- AptarGroup, Inc.

- BERICAP

- Nippon Closures Co., Ltd.

- Sonoco Products Company

- Webpac Ltd

- JELINEK CORK GROUP

- UAB Elmoris

- CL Smith

- PELLICONI & C. SPA

- O. BERK

- UNITED CAPS

Caps And Closures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 78.0 billion

Revenue forecast in 2030

USD 103.87 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Volume in million units, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

Crown; Amcor plc; Closure Systems International; Ball Corporation; Silgan Holdings Inc.; Berry Global Inc.; Guala Closures S.p.A; AptarGroup, Inc.; BERICAP; Nippon Closures Co., Ltd.; Sonoco Products Company; Webpac Ltd; JELINEK CORK GROUP; UAB Elmoris; CL Smith; PELLICONI & C. SPA; O.BERK; UNITED CAPS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caps And Closures Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caps and closures market report based on material, product, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Others

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Dispensing Caps

-

Screw Closures

-

Crown Closures

-

Aerosol Closures

-

Others

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Food

-

Healthcare

-

Personal Care

-

Home Care

-

Industrial

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global caps and closures market was estimated at around USD 74.64 billion in the year 2023 and is expected to reach around USD 78.00 billion in 2024.

b. The global caps and closures are expected to grow at a CAGR of 4.9% from 2024 to 2030 to reach around USD 103.87 billion by 2030.

b. Beverage emerged as a dominating application with a value share of around 27.1% in the year 2023 owing to the increasing demand for bottled water, alcoholic beverages, and non-alcoholic beverages such as juices, energy drinks, and probiotic beverages which is expected to fuel the demand for caps and closures.

b. The key market player in the caps and closures market includes Crown, Amcor plc, Closure Systems International, Ball Corporation, Silgan Holdings Inc., Berry Global Inc., Guala Closures S.p.A, AptarGroup, Inc., BERICAP, Nippon Closures Co., Ltd., Sonoco Products Company, Webpac Ltd, JELINEK CORK GROUP, UAB Elmoris, CL Smith, PELLICONI & C. SPA, O.BERK, UNITED CAPS.

b. Rising consumption of bottled water coupled with alcoholic beverages from the growing population across the globe is expected to drive the caps and closures market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.