- Home

- »

- Plastics, Polymers & Resins

- »

-

Polypropylene Compounds Market Size & Share Report 2030GVR Report cover

![Polypropylene Compounds Market Size, Share & Trends Report]()

Polypropylene Compounds Market Size, Share & Trends Analysis Report By Product (Mineral Filled, Compounded TPO, Compounded TPV, Glass Fiber Reinforced, Talc Filled), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-734-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Polypropylene Compounds Market Trends

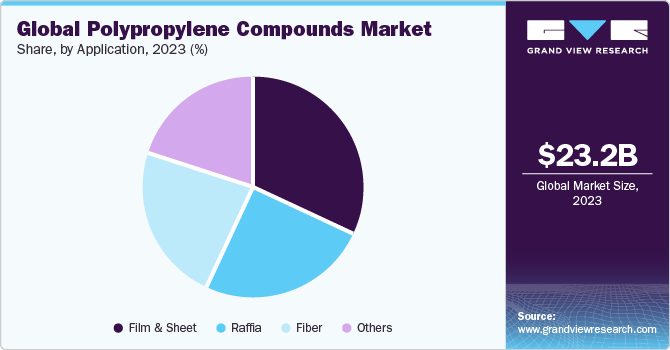

The global polypropylene compounds market size was estimated at USD 23.20 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030. The market growth is driven by the rising demand for lightweight and high performing plastics in automotive industry. The automotive industry displayed the highest penetration as of 2023 and is expected to witness significant growth during the forecast period.

Polypropylene (PP) compounds are low cost with exceptional mechanical properties and flexibility. It is used in a variety of parts which includes instrumental panels, bumper facias and door trims. The U.S. is one of the world’s largest automotive markets with the presence of several large vehicles and auto parts manufacturers. The demand for polypropylene in the region is driven by its utilization in automotive manufacturing to achieve better fuel efficiency. PP compounds are lightweight, durable, cost-effective and recyclable which makes them the ideal alternative for the heavy metal parts used in trims, spoilers, and panels, among others, and in turn improving fuel efficiency and mitigating emissions.

Moreover, the substantial investment in research & development (R&D) by various automotive manufacturers has resulted in greater weight reduction in vehicles without compromising on safety. Polypropylene compounds are an integral part of such vehicles further propelling their demand in the region. The use of PP compounds in electrical appliances owing to their superior insulation properties, creating lucrative opportunities for the market in the region.

Market Concentration & Characteristics

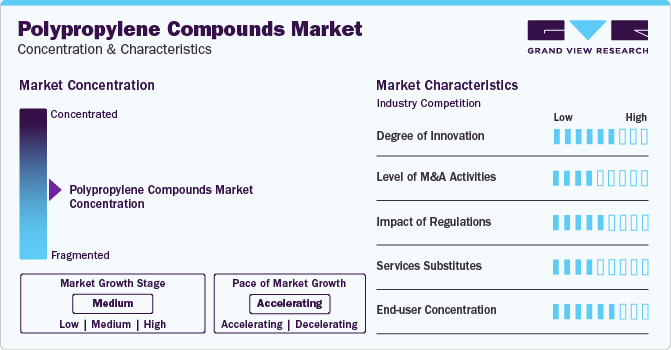

Market growth stage is medium and the growth pace is accelerating. The polypropylene compounds market is characterized by a high degree of innovation owing to the rapid technological advancements.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new production technologies and talent, need to consolidate in a rapidly growing market.

The market is also subject to increasing regulatory scrutiny. This is due to numerous regulations, guidelines, and restrictions such as Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), and U.S. Environmental Protection Agency (EPA). Agencies such as REACH in Europe have established directives to govern the monomers used for polypropylene production as well as the additives added to the final product. Propane gas is toxic and harmful for human exposure. Additives may have adverse effects on humans within proximity of polypropylene usage.

There is a limited number of direct product substitutes for polypropylene compounds. However, few environment-friendly substitute are available for compounded plastics. These alternatives, such as paper & paperboard used in packaging applications, are safer for the environment and are, thus, gaining popularity. The performance of substitutes used are not as much effective as compounded plastics, which have exclusive properties and outperform commercially available plastics. This reduces the impact of substitute products such as paper, metal, or glass.

End-user concentration is a significant factor in the polypropylene compounds market. There are a large number of end-users driving demand for polypropylene compounds. Increasing sales of passenger cars and EVs and the rising construction activities are expected to propel product demand.

Product Insights

The mineral filled PP compounds segment dominated the market with a revenue share of over 29% in 2023. These compounds are most widely used in home appliances and automotive interiors such as consoles, panels, and knee bolsters. Compounded TPVs have also witnessed substantial growth in under-the-hood automotive applications owing to their improved oil and temperature resistance. Minerals are incorporated in the polypropylene compounds to produce higher heat distortion and rigidity. The most widely used minerals in polypropylene compounds include talc, glass beads, mica, silica, and calcium. The improved thermal stability and mechanical stiffness enable their extensive use in several end-use such as automotive, electrical & electronics.

The glass fiber reinforced segment is expected to grow at a CAGR of 8.0% from 2024 to 2030. Glass fiber reinforced compounds exhibit superior properties including rigidity & strength, excellent chemical resistance, good mechanical properties, improved dimensional stability, and resistance to warpage. Polypropylene with 30% chemically coupled glass reinforcement has a 180% improvement in tensile strength. Glass-reinforced polypropylene offers higher tensile strength, enhanced heat resistance and significantly improved stiffness. They are commonly used in structural components that require the aforementioned properties and are predominantly a part of the furniture, appliances, and automotive applications.

End-use Insights

The automotive segment held the dominant revenue share of over 54.0% in 2023. This segment is expected to witness rapid growth, owing to the increasing incorporation of plastics in automotive components and simultaneous rise in passenger car & heavy-duty vehicle production, particularly in Asia and Central & South America. Polypropylene compounds have become a popular alternative for engineering plastics and metals in automotive applications. They are used in the interior, exterior, and under-the-hood applications in the automotive segment such as instrument panels, trims, and bumper facias. The use of PP compounds can provide significant weight reduction and cost savings to the manufacturers owing to their low cost, exceptional mechanical properties, and good flexibility.

The building & construction segment is expected to grow at a CAGR of 7.5% over the forecast period. The construction industry is on the rise as the numerous architects are realizing the benefits of polypropylene in glazing, sheeting, curve forming, and other applications that require high aesthetic appeal with durability and sustainability. Polypropylene compounds are used in several building applications such as sheets, siding, barrier, piping, and wiring. The use of polypropylene-based compounds has increased over the past few years owing to several benefits such as energy efficiency, weather resistance, and green roofing options.

Application Insights

The film and sheet segment held the largest revenue share of over 32.0% in 2023. The rising application of polypropylene compounds in packaging materials, binders, boxes, and portfolios due to its better chemical resistance, high-temperature stability, and exceptional contact clarity is expected to propel the segment’s growth.

Fiber emerged as the second largest application segment and captured a revenue share of around 23% in 2023. Rising demand from the automotive sector for automotive flooring, pull straps, seat cover construction, and seam reinforcement is expected to boost product demand in the coming years.

Regional Insights

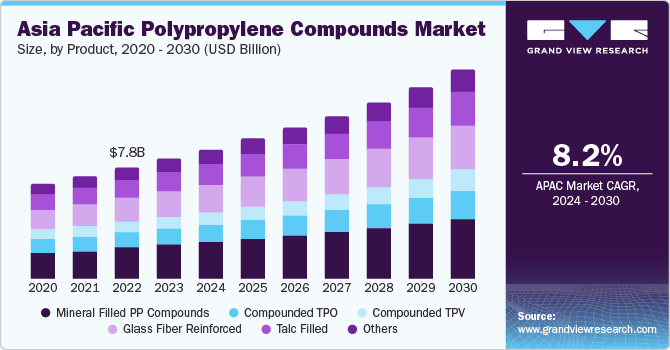

Asia Pacific dominated the global PP compounds market with revenue share of over 36.0% in 2023. Asian countries such as Vietnam, Indonesia, Thailand, India, China, and Japan are expected to emerge as the primary growth markets for PP compounds in Asia Pacific. The growing manufacturing sector is expected to propel the demand for PP compounds in the automotive industry. Japan, South Korea, China, Taiwan, and other Southeastern countries are the manufacturing hubs for household appliances with intense competition due to the presence of global manufacturers such as LG Electronics, Samsung, and Panasonic Corporation.

North America is expected to grow at a CAGR of 7.9% over the forecast period. North America is a highly competitive market with a significant demand for polypropylene compounds across various end-use sectors such as automotive and electrical & electronics. The regional market is characterized by the presence of several established suppliers and high domestic demand, particularly in the automotive end-use.

Key Polypropylene Compounds Company Insights

Some of the key players operating in the market include Mitsui Chemicals, Inc. and Exxon Mobil Corporation

-

Mitsui Chemicals, Inc. is a chemical manufacturer and provider engages in businesses including mobility, healthcare, food & packaging, basic materials, and others. It provides services to automotive, home appliances/IT devices, packaging/printing materials, healthcare, construction/industrial materials, agriculture, chemical products, and other industries. The company’s product portfolio includes polypropylene, polyurethane, hexene, olefin copolymer, acetone, acrylamide, acrylonitrile, reducing additives, adhesive polyolefin, modified polyolefin, ammonia, polyamide, thermoplastic polyamide, and others.

-

Exxon Mobil Corporation is a U.S. based company engages in the production of energy and chemicals. Chemical division of the company includes plastics, rubber, plasticizers, acids, additives, solvents & fluids, and others. The division caters to end-use industries including automotive, construction, lubricants, medical & healthcare, oil & gas, consumer goods, utility, and packaging. Plastics include polyethylene, polypropylene, and polymer modifiers of grades such as high-density polyethylene, low-density polyethylene, linear low-density polyethylene, plastomers, advanced polypropylene, and performance polyolefin.

LyondellBasell Industries Holdings B.V. and Trinseo S.A. are the emerging market participants

-

LyondellBasell Industries Holdings B.V. is engages in the manufacturing of chemicals, fuels, refining products, and plastic polymers. It operates its business through operating segments, namely olefins and polyolefins (Americas); olefins and polyolefins (Europe, Asia, and International); intermediates and derivatives; refining; technology; and advanced polymer solutions. The company’s polymer segment includes plastic resins such as polyethylene, polypropylene, and polypropylene compounds.

-

Trinseo S.A. is engaged in manufacturing synthetic rubber and a latex binder. It operates through two business segments including performance materials and basic plastics & feedstock. The company serves various application industries including automotive, personal care, edge bands, footwear, building & construction, consumer electronics, consumer goods, home appliances, medical, packaging, and sheet & profile extrusion.The basic plastics & feedstock segment of the company manufactures products include acrylonitrile butadiene styrene (ABS), acrylonitrile butadiene styrene long glass fiber (ABS LGF), bioplastics, polycarbonate (PC), polycarbonate acrylonitrile butadiene styrene (PC/ABS), polycarbonate polyethylene terephthalate (PC/PET), polypropylene (PP), polystyrene (PS), recycled content containing resins, reinforced elastomers, styrene acrylonitrile resin, thermoplastic elastomers (TPE), and thermoplastic polyurethane (TPU). The performance materials segment of the company is engaging in manufacturing performance plastics, latex, and synthetic rubber.

Key Polypropylene Compounds Companies:

The following are the leading companies in the polypropylene compounds market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these polypropylene compounds companies are analyzed to map the supply network.

- Mitsui Chemical, Inc.

- IRPC Public Company Limited

- Exxon Mobil Corporation

- Avient Corporation

- Japan Polypropylene Corporation

- SABIC

- Trinseo S.A.

- Sumitomo Chemical Co., Ltd.

- Washington Penn

- Borealis AG

- LyondellBasell Industries Holdings B.V.

- DAEHACOM Co., Ltd.

- GS Caltex Corporation

Recent Developments

-

In August 2022, SABIC, a Saudi Arabia-based chemical manufacturing company, announced the launch of high-performance automotive polypropylene compounds, namely SABIC PP Compound G3440X and G3430X. These new glass fiber-reinforced compounds offer enhanced performance and processing for demanding automotive exterior, interior, and under-hood applications.

-

In February 2021, Sumitomo Chemical Co., Ltd. announced the establishment of Sumika Polymer Compounds Poland Sp.z.o.o. (SPCP), a new production facility in Poland to enhance the polypropylene (PP) compound business.

Polypropylene Compounds Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.9 billion

Revenue forecast in 2030

USD 39.2 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Netherlands; Norway; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Mitsui Chemical, Inc.; IRPC Public Company Limited; Exxon Mobil Corporation; Avient Corporation; Japan Polypropylene Corporation; SABIC; Trinseo S.A.; Sumitomo Chemical Co., Ltd.; Washington Penn; Borealis AG; LyondellBasell Industries Holdings B.V.; DAEHACOM Co., Ltd.; GS Caltex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polypropylene Compounds Market Report Segmentation

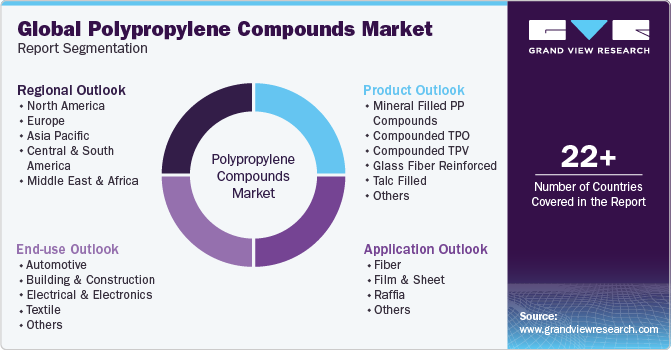

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polypropylene compounds market report based on product, application, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral filled PP compounds

-

Compounded TPO

-

Compounded TPV

-

Glass fiber reinforced

-

Talc filled

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fiber

-

Film & sheet

-

Raffia

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & construction

-

Electrical & electronics

-

Textile

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America (MEA)

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polypropylene compounds market size was estimated at USD 23.20 billion in 2023 and is expected to reach USD 24.9 billion in 2024 owing to the increasing exponential demand from the automotive industry.

b. The global polypropylene compounds market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 39.2 billion by 2030.

b. The automotive segment dominated the PP compounds market with a share of 54% in 2023. The growing popularity of polypropylene compounds as an alternative for engineering plastics and metal in automotive applications is projected to increase the product demand over the forecast period.

b. Some key players operating in the polypropylene compounds market include Mitsui Chemical, Inc.; IRPC Public Company Limited; Exxon Mobil Corporation; Avient Corporation; Japan Polypropylene Corporation; SABIC; Trinseo S.A.; Sumitomo Chemical Co., Ltd.; Washington Penn; Borealis AG; LyondellBasell Industries Holdings B.V.; DAEHACOM Co., Ltd.; and GS Caltex Corporation

b. Key factors that are driving the PP compounds market growth include increasing utilization of lightweight components in automotive and electrical & electronics end-use industries.

b. The mineral-filled PP compound product segment led the global market in 2023 and accounted for the largest revenue share of 29%. Minerals are incorporated in the PP compounds to produce higher heat distortion and rigidity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."