- Home

- »

- Plastics, Polymers & Resins

- »

-

Polypyrrole Bioelectronics Market Size, Industry Report 2033GVR Report cover

![Polypyrrole Bioelectronics Market Size, Share & Trends Report]()

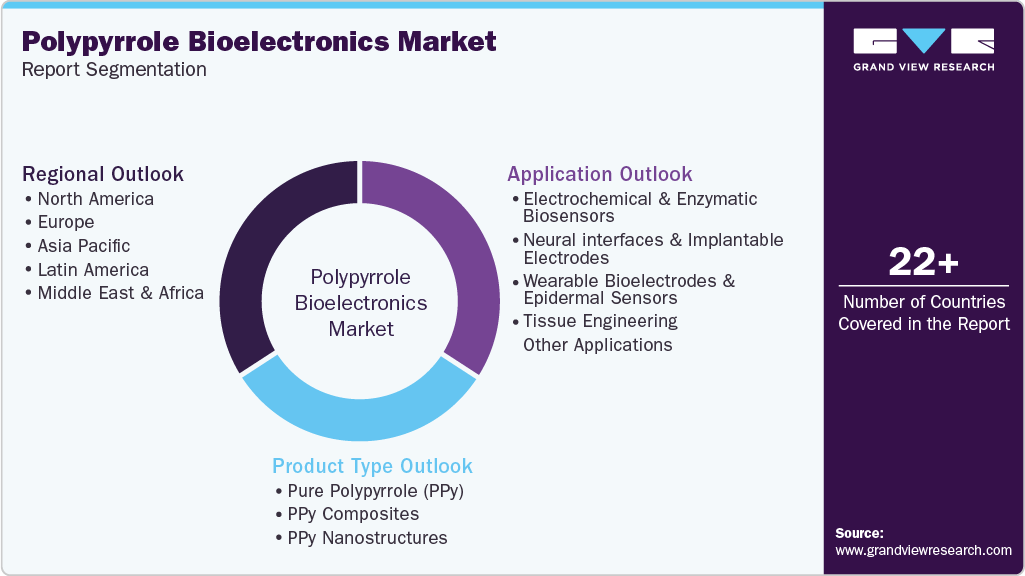

Polypyrrole Bioelectronics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Pure Polypyrrole (PPy), PPy Composites, PPy Nanostructures), By Application (Electrochemical & Enzymatic Biosensors, Neural interfaces & Implantable Electrodes, Wearable Bioelectrodes & Epidermal Sensors, Tissue Engineering), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-799-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polypyrrole Bioelectronics Market Summary

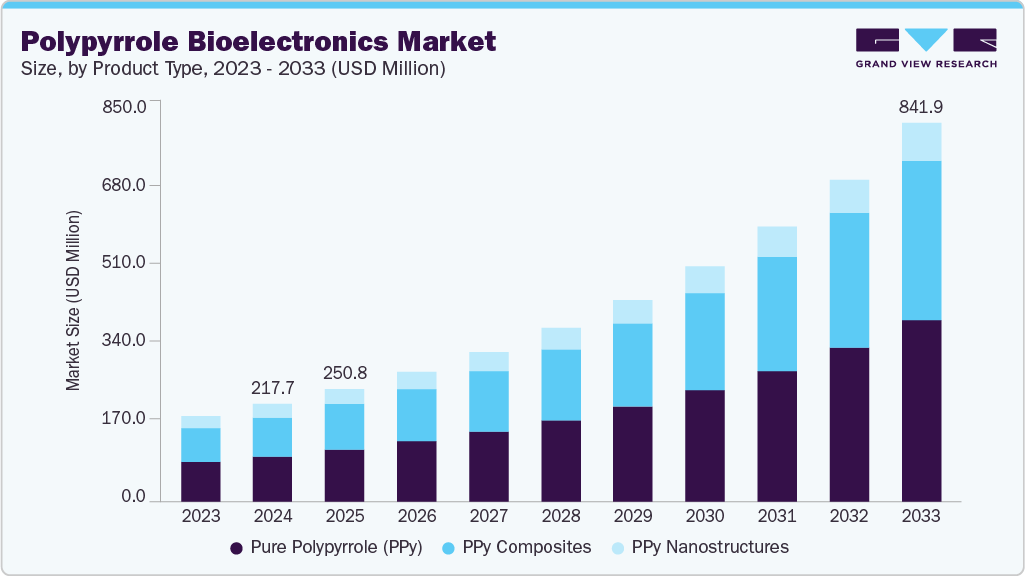

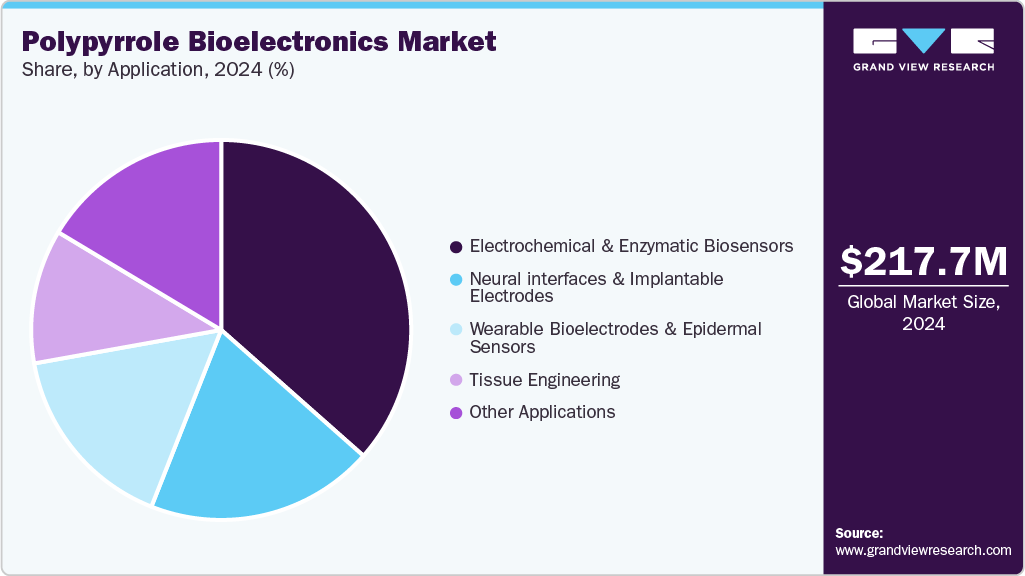

The global polypyrrole bioelectronics market size was estimated at USD 217.7 million in 2024 and is projected to reach USD 841.96 million by 2033, growing at a CAGR of 16.4% from 2025 to 2033. Polypyrrole (PPy), a conductive polymer known for its high electrical conductivity, biocompatibility, and environmental stability, is increasingly utilized in neural interfaces, biosensors, actuators, and tissue engineering scaffolds.

Key Market Trends & Insights

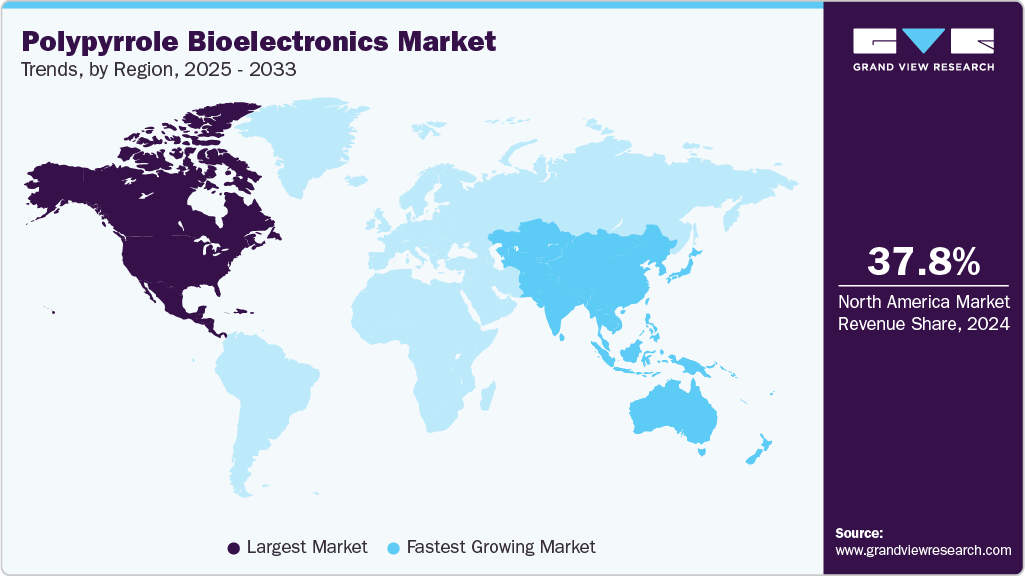

- North America dominated the polypyrrole bioelectronics market with the largest revenue share of 37.82% in 2024.

- The polypyrrole bioelectronics market in Canada is expected to grow at a substantial CAGR of 16.5% from 2025 to 2033.

- By product type, the PPy Composites segment is expected to grow at a considerable CAGR of 17.1% from 2025 to 2033 in terms of revenue.

- By application, the wearable bioelectrodes & epidermal sensors segment is expected to grow at a considerable CAGR of 17.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 217.74 Million

- 2033 Projected Market Size: USD 841.96 Million

- CAGR (2025-2033): 16.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The polypyrrole bioelectronics market represents a rapidly evolving intersection of materials science, electronics, and biomedicine. The ability of polypyrrole to translate electrical signals into biochemical responses makes it a key enabler in next-generation medical devices and implantable electronics designed for precision diagnostics and therapeutics. The market’s growth is underpinned by the convergence of flexible electronics, bio-integrated systems, and nanotechnology.

Moreover, the shift toward bioresorbable and adaptive electronics in healthcare and wearable applications is strengthening PPy’s role as a preferred conductive polymer. Partnerships among universities, medtech firms, and polymer innovators are accelerating translation from laboratory-scale prototypes to commercial bioelectronic products. The market also benefits from the miniaturization trend in medical devices and the global push for real-time, non-invasive monitoring systems. With rapid development in PPy composites and nanostructures that offer enhanced signal sensitivity and flexibility, the market is transitioning from niche R&D to scalable industrial adoption.

Drivers, Opportunities & Restraints

A major driver for the PPy bioelectronics market is the rising demand for advanced neural and biosensing technologies. As healthcare systems focus on precision medicine, chronic disease management, and neuroprosthetic rehabilitation, conductive polymers like polypyrrole enable seamless electrical interfacing with biological tissues. PPy’s electrochemical responsiveness allows for efficient signal transduction in neural electrodes and biosensors, offering an edge over metallic alternatives due to lower impedance, flexibility, and biocompatibility. This advantage is especially relevant for brain-machine interfaces, cardiac sensors, and glucose monitors, where stable long-term performance is essential.

The emerging opportunity lies in biocompatible energy storage and self-powered bioelectronic systems. With the rise of closed-loop medical systems, there is a growing need for flexible supercapacitors and biofuel cells that can power implantable sensors and stimulators. Polypyrrole’s high redox activity and reversible charge-discharge behavior make it ideal for miniaturized energy devices that can be integrated within bioelectronic architectures. Collaborations between materials companies and healthcare device manufacturers are expanding R&D into hybrid PPy-graphene or PPy-cellulose nanocomposites that offer both conductivity and biodegradability.

One major restraint is the limited long-term stability and biocompatibility of polypyrrole in physiological environments. Although PPy demonstrates high initial conductivity, its performance can degrade over time due to oxidative and hydrolytic reactions in the body. This limits its usability for chronic implants or devices that require sustained electrochemical activity. In addition, the synthesis process often involves dopants or surfactants that may raise biotoxicity concerns, thereby increasing the burden of regulatory testing and compliance.

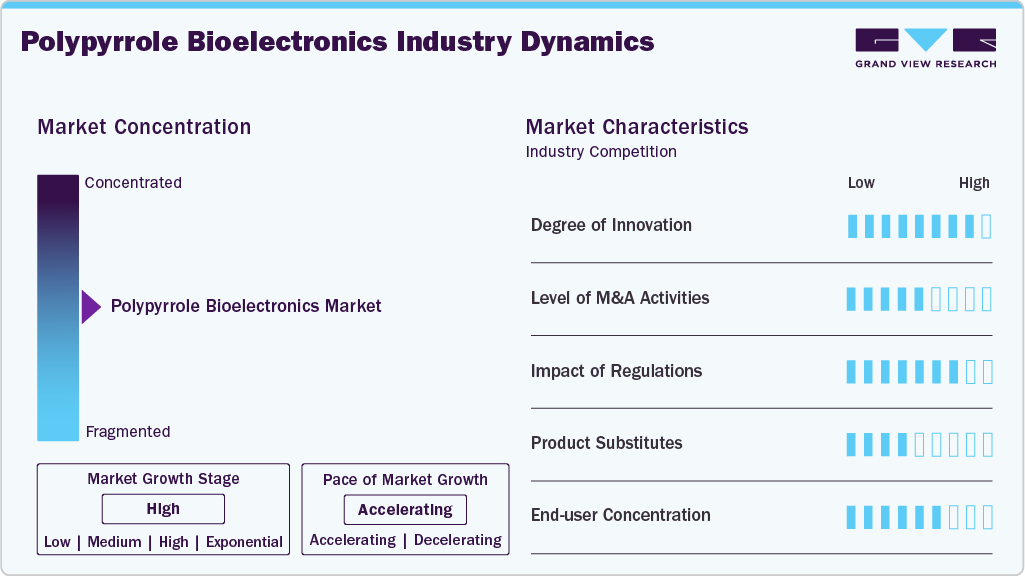

Market Concentration & Characteristics

The market growth stage of the polypyrrole bioelectronics market is high, and the pace is accelerating. The degree of innovation in the market is high, characterized by breakthroughs in nanostructuring, doping chemistry, and hybridization with biomaterials such as hydrogels, graphene, and collagen. Innovations are directed toward improving flexibility, signal sensitivity, and biodegradability while reducing cytotoxicity. Emerging research focuses on 3D-printable PPy composites and self-healing bioelectronic coatings, reflecting a shift from experimental materials to clinically viable technologies.

M&A activity remains moderate, primarily focused on strategic collaborations, licensing agreements, and acquisitions by medical device or specialty polymer firms. Companies seek to strengthen IP portfolios and integrate PPy-based technologies into neurostimulation, biosensing, and flexible electronics platforms. Startups specializing in conductive biomaterials are increasingly being targeted by medtech and advanced materials corporations aiming to expand their bioelectronics capabilities.

Regulations exert a significant impact as PPy-based bioelectronics must meet stringent safety, biocompatibility, and performance standards. Frameworks such as the U.S. FDA’s Class II and III medical device regulations, ISO 10993 for biocompatibility, and EU MDR guidelines shape product development cycles. Delays in clinical validation and device approval processes can slow commercialization, though harmonization of standards for conductive biomaterials is gradually improving.

PPy faces competition from other conductive polymers and nanomaterials like PEDOT: PSS, polyaniline, and carbon nanotube composites. These materials often offer higher stability, transparency, or mechanical flexibility depending on the application. However, PPy remains favored in scenarios requiring high charge storage and facile surface modification, ensuring its continued relevance in niche biomedical electronics.

End-user concentration is moderate, with demand distributed among medical device manufacturers, academic research institutions, and biotech firms. Neural interface and biosensor developers account for a large portion of usage, while emerging players in wearable health and regenerative medicine are expanding the customer base. As clinical adoption increases, concentration is expected to shift toward regulated medical and implantable device producers.

Product Type Insights

Pure Polypyrrole (PPy) dominated the market across the product segmentation in terms of revenue, accounting for a market share of 46.57% in 2024. Pure polypyrrole represents the foundational form of the polymer used in bioelectronics, known for its intrinsic conductivity, ease of synthesis, and compatibility with biological systems. It is widely employed in fundamental research and low-cost biosensor applications where electrical responsiveness and chemical stability are prioritized over mechanical flexibility.

PPy composites segment is anticipated to grow at a fastest CAGR of 17.1% through the forecast period. PPy composites combine polypyrrole with conductive fillers, polymers, or biopolymers to achieve tailored electrical, mechanical, and biocompatible properties. Integration with materials such as graphene, carbon nanotubes, chitosan, or polylactic acid improves flexibility, adhesion, and electrochemical sensitivity, making composites highly attractive for neural electrodes, soft sensors, and flexible circuits. In addition, these materials bridge the gap between performance and durability, enabling scalable fabrication and multifunctionality, key factors driving their dominance in next generation bioelectronic platforms.

Nanostructured PPy, including nanowires, nanotubes, and nanoparticles, plays a transformative role in miniaturized bioelectronic systems. Their high surface area-to-volume ratio enhances charge transfer efficiency and biomolecule immobilization, leading to superior sensitivity in biosensing and signal transduction. Moreover, nanostructured PPy enables conformal coating on complex 3D microelectrodes and scaffolds, which is critical for advanced neural and tissue engineering applications. This segment is witnessing strong research traction as nanofabrication and in situ polymerization methods mature toward scalable production.

Application Insights

Electrochemical & enzymatic biosensors dominated the market across the application segmentation in terms of revenue, accounting for a market share of 36.53% in 2024. In biosensors, PPy serves as a versatile transducer matrix for immobilizing enzymes and biomolecules, enabling selective and sensitive detection of analytes such as glucose, lactate, and neurotransmitters. The growing demand for point-of-care and wearable diagnostic devices continues to drive innovation in PPy-based biosensing platforms, particularly in hybrid architectures integrating nanomaterials and microfluidic systems.

Polypyrrole’s ability to conduct both ionic and electronic signals makes it a key material for neural electrodes and brain-machine interfaces. Its soft, tissue-compatible nature reduces inflammatory responses compared to metallic electrodes, allowing long-term neural stimulation and recording. PPy coatings on microelectrode arrays improve charge injection capacity and signal fidelity, essential for treating neurological disorders and enabling neuroprosthetic control.

Wearable bioelectrodes & epidermal sensors segment is expected to expand at the fastest CAGR of 17.2% over the forecast period. PPy-based wearable electrodes and epidermal sensors capitalize on the polymer’s flexibility, conductivity, and skin-conforming properties. They enable continuous health monitoring for parameters such as ECG, EMG, and hydration levels, integrating seamlessly into textiles, patches, and smartbands. PPy composites, especially those combined with elastomers or hydrogels, provide comfort, reusability, and robust signal acquisition, aligning with the rapid expansion of personalized and non-invasive healthcare electronics.

In tissue engineering, PPy scaffolds enable electrically stimulated cell growth and differentiation, supporting regeneration of neural, muscle, and cardiac tissues. Its electroactive nature allows the delivery of bioelectrical cues that mimic physiological signaling, enhancing cellular adhesion and proliferation. Blending PPy with biodegradable polymers yields conductive scaffolds that gradually resorb after promoting tissue repair. This emerging application area holds immense promise for regenerative medicine, particularly in bioelectrically responsive tissue constructs.

Regional Insights

North America polypyrrole bioelectronics market held the largest share of 37.82% in terms of revenue of the Polypyrrole bioelectronics market in 2024, supported by robust academic research, high adoption of implantable and neural technologies, and significant venture funding in bioelectronic medicine. The region hosts strong collaborations between polymer scientists, neuroengineering firms, and device manufacturers. With increasing FDA approvals of bioelectronic devices and strong focus on personalized healthcare, North America continues to shape technological standards and commercialization pathways for PPy-based systems.

U.S. Polypyrrole Bioelectronics Market Trends

The U.S. accounted for the majority of North American demand, driven by its dominant R&D ecosystem, with major universities and biotech firms developing PPy-coated electrodes, biosensors, and bioactuators. The NIH and DARPA have funded extensive projects exploring conductive polymers for neural modulation and regenerative interfaces. A mature medtech supply chain and growing private investment in wearable and implantable technologies are fostering commercialization, making the U.S. a benchmark market for clinical-grade PPy applications.

Europe Polypyrrole Bioelectronics Market Trends

Europe exhibits steady growth in PPy bioelectronics, supported by stringent biocompatibility regulations and active R&D in medical polymers and neural engineering. EU-funded projects under Horizon Europe and the Graphene Flagship are catalyzing PPy composite innovation for biosensors and neural prosthetics. Countries such as Germany, France, and the UK lead in academic patents and prototype development, while regional manufacturers focus on sustainable, regulatory-compliant production processes for medical-grade conductive polymers.

Germany serves as Europe’s research and manufacturing powerhouse for conductive polymer bioelectronics. Its well-established medical device industry and strong academic-industry collaborations enable continuous innovation in PPy-based neural electrodes, smart implants, and biosensors. The country’s adherence to high regulatory and quality standards under the EU MDR framework fosters commercial confidence in PPy applications, particularly within clinical diagnostics and regenerative medicine domains.

Asia Pacific Polypyrrole Bioelectronics Market Trends

Asia Pacific is emerging as the fastest-growing region in the polypyrrole bioelectronics market with CAGR of 17.5% over the forecast period, supported by strong biomedical research, expanding healthcare infrastructure, and active nanomaterials innovation in countries such as China, Japan, and South Korea. The region’s emphasis on wearable healthcare technology, neural engineering, and low-cost biosensors is propelling demand for PPy-based materials.

China holds the dominant share within Asia Pacific, driven by high investment in biopolymer nanotechnology, bioelectronic sensors, and implantable device R&D. Numerous academic institutions and startups are developing PPy composites and nanostructures for biosensing and neural applications, supported by the government’s “Made in China 2025” initiative emphasizing advanced materials and healthcare technology.

Latin America Polypyrrole Bioelectronics Market Trends

Latin America is an emerging participant in the PPy bioelectronics market, with growing academic research activity in Brazil, Argentina, and Mexico focused on conductive polymers for biosensing and tissue engineering. Market penetration remains limited due to high costs and weak manufacturing infrastructure, but healthcare modernization and rising interest in local medical device innovation are creating gradual opportunities. Regional pilot projects supported by universities are introducing PPy-based sensors for point-of-care diagnostics.

Middle East & Africa Polypyrrole Bioelectronics Market Trends

The Middle East & Africa region is in the early adoption phase of PPy bioelectronics, driven by healthcare digitization programs and medical innovation initiatives in countries like the UAE, Israel, and South Africa. While local manufacturing is minimal, collaborations with European and U.S. research institutions are helping build technical capacity. Demand for advanced biosensing and neural monitoring technologies is slowly increasing in specialized healthcare segments.

Saudi Arabia’s bioelectronics sector is expanding under its Vision 2030 strategy, which emphasizes biomedical innovation, digital healthcare, and materials science R&D. Investments through KAUST and other national research institutions are exploring conductive polymers such as PPy for biosensors and implantable systems. With government-backed funding for healthcare technology startups and growing partnerships with global medtech firms, Saudi Arabia is emerging as a focal point for next-generation bioelectronic research in the Gulf region.

Key Polypyrrole Bioelectronics Company Insights

The PPy bioelectronics market is competitively shaped by two overlapping ecosystems: specialty polymer suppliers and device/OEM integrators. On the materials side, established chemical distributors and specialty electronics-chemicals supply research and production-grade PPy; they compete on grade consistency, purity, and the ability to supply medical/ISO-grade batches. On the device side, neural-interface, wearable and diagnostic OEMs compete on device design, clinical validation and integration capability, frequently partnering with materials houses or contract R&D groups to qualify PPy coatings and composites for specific electrodes or biosensor form-factors.

Barriers to competition are mixed. Market entry is relatively easy for exploratory R&D but commercial, regulated device supply is high-barrier: medical-grade manufacturing, long-term in-vivo stability data, and regulatory approvals favor either well-funded startups or established MedTech firms that can absorb long qualification cycles.

Key Polypyrrole Bioelectronics Companies:

The following are the leading companies in the polypyrrole bioelectronics market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Heraeus Group

- ORGACON

- Blackrock Neurotech

- Medtronic

Recent Developments

-

In September 2023, Acta Biomaterialia published a study reporting that electrodes coated with Polypyrrole/heparin (PPy/Hep) and immobilized with the cytokine IL-4 demonstrated long-term in-vivo signal recording and reduced inflammation in implant settings. While not a company press release, this shows significant progress in PPy-based implantable bioelectrode technology, signaling commercial potential.

Polypyrrole Bioelectronics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 250.26 million

Revenue forecast in 2033

USD 841.96 million

Growth rate

CAGR of 16.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report segmentation

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Merck KGaA; Heraeus Group; ORGACON; Blackrock Neurotech; Medtronic

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polypyrrole Bioelectronics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polypyrrole bioelectronics market report on the basis of product type, application, and region:

-

Product Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Pure Polypyrrole (PPy)

-

PPy Composites

-

PPy Nanostructures

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Electrochemical & Enzymatic Biosensors

-

Neural interfaces & Implantable Electrodes

-

Wearable Bioelectrodes & Epidermal Sensors

-

Tissue Engineering

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.