- Home

- »

- Animal Health

- »

-

Poultry Medicine Market Size & Share, Industry Report, 2033GVR Report cover

![Poultry Medicine Market Size, Share & Trends Report]()

Poultry Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Species (Chicken, Turkey, Ducks), By Product (Biologics, Pharmaceuticals), By Disease, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-639-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Poultry Medicine Market Summary

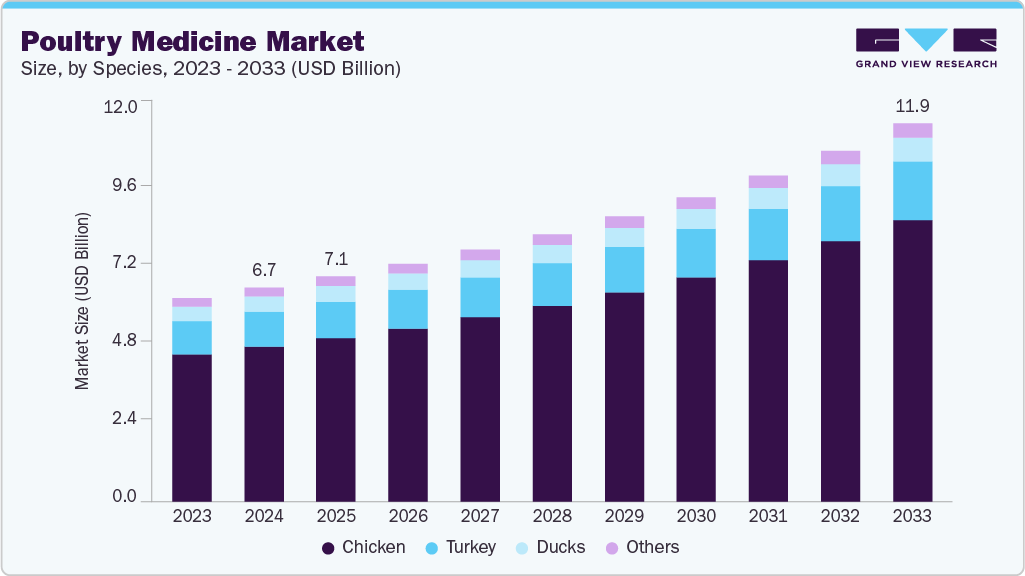

The global poultry medicine market size was estimated at USD 6.72 billion in 2024 and is projected to reach USD 11.90 billion by 2033, growing at a CAGR of 6.70% from 2025 to 2033. The market is advancing, driven by the growing prevalence of poultry diseases, rising demand for poultry products, and expansion of commercial poultry farming.

Key Market Trends & Insights

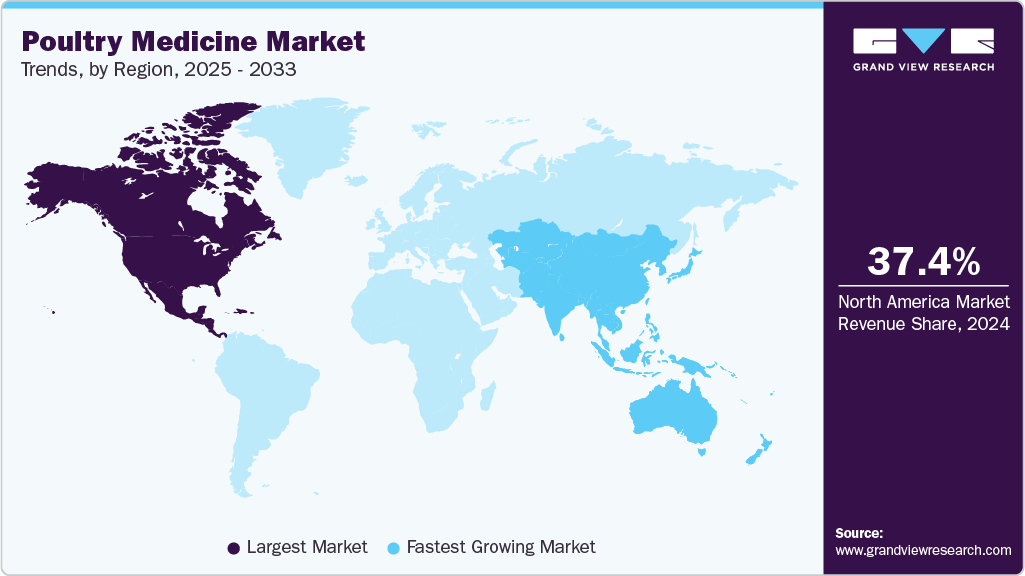

- The North American poultry medicine industry dominated the market with the largest revenue share of 37.42% in 2024.

- The poultry medicine industry in the U.S. is driven by avian influenza outbreaks and regulatory shifts away from antibiotics.

- Based on species, the chicken segment represented the largest revenue share of 72.50% in 2024.

- Based on product, the pharmaceuticals represented the largest segment in the market in terms of revenue share of 67.55% in 2024.

- Based on disease, the Newcastle disease was the largest disease segment with a share of 22.49% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.72 Billion

- 2033 Projected Market Size: USD 11.90 Billion

- CAGR (2025-2033): 6.70%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

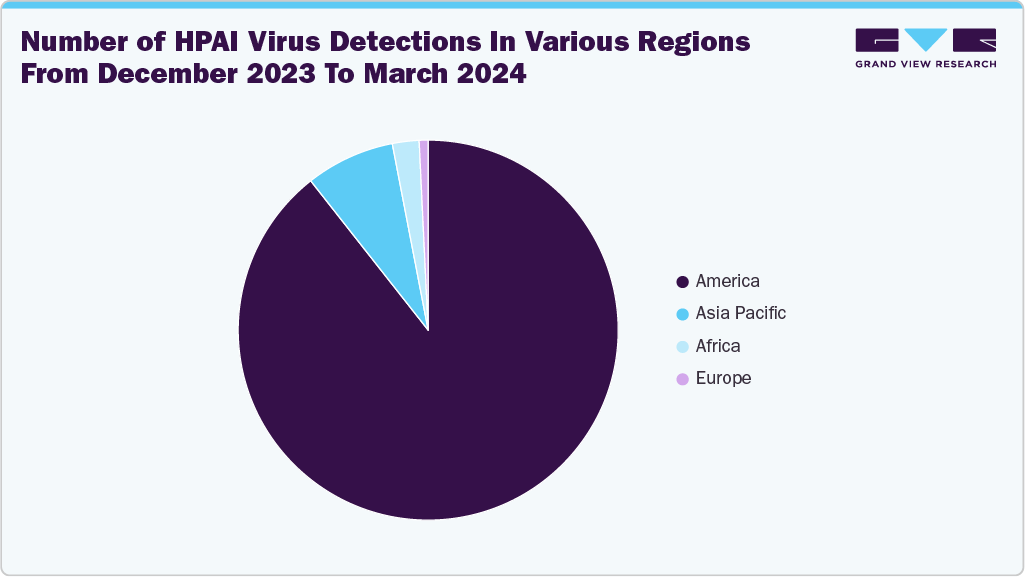

The frequent occurrence of poultry diseases like avian influenza, Newcastle disease, and infectious bronchitis has significantly increased the demand for effective pharmaceuticals. According to the Food and Agriculture Organization of U.S., as of April 2025, a total of 297 outbreaks or events of Highly Pathogenic Avian Influenza (HPAI) in poultry animals have been reported across five geographic regions.

Outbreaks of infectious diseases significantly impact poultry mortality and productivity. These recurrent health threats drive a strong demand for vaccines, antimicrobials, and antiparasitic treatments to protect flocks and reduce losses. Governments and producers are investing in better biosecurity and routine health management practices, creating consistent demand for poultry medicines. With the rise in intensive poultry farming and high bird densities, the risk of disease transmission grows, making regular medicinal interventions critical. This need for consistent health protection fuels steady growth in the market across all production scales.The World Organization for Animal Health (WOAH), an international body that sets global standards for animal health and monitors disease outbreaks to improve animal welfare and public health, conducted surveillance activities for Highly Pathogenic Avian Influenza (HPAI) in both poultry and non-poultry bird populations in the period of 2020-2023. The chart below illustrates the reporting of avian disease across various regions:

The growing prevalence of diseases can cause substantial economic losses due to decreased productivity, high mortality rates, and trade restrictions. As a result, poultry farmers and producers are increasingly reliant on vaccines, antibiotics, and antiparasitics to prevent and control outbreaks. The growing emphasis on biosecurity measures and disease management protocols has further propelled the use of pharmaceutical products to ensure flock health, safeguard food supply chains, and maintain regulatory compliance in both domestic and international markets.

Another significant factor is the increasing global consumption of poultry meat and eggs, which is driving the poultry pharmaceuticals industry. As consumers shift toward leaner protein sources, poultry has become a preferred option due to its affordability, taste, and perceived health benefits. This surge in demand necessitates large-scale poultry farming, which in turn drives the need for medicines to maintain flock health, prevent disease outbreaks, and ensure high productivity. Countries experiencing economic growth and urbanization are particularly fuelling this trend, boosting investments in veterinary drugs, vaccines, and feed additives specific to poultry health.

The shift from traditional backyard poultry farming to large-scale, industrialized operations has increased the need for systematic health management, fuelling demand for medicines. Commercial poultry farms operate under high-density conditions that elevate the risk of disease transmission, making preventive care and routine medication essential. These operations often rely on integrated health management strategies that include vaccinations, growth promoters, and disease control agents, ensuring flock health and productivity. The growth of vertically integrated poultry producers, especially in emerging economies, further stimulates demand for consistent and regulated pharmaceutical solutions.

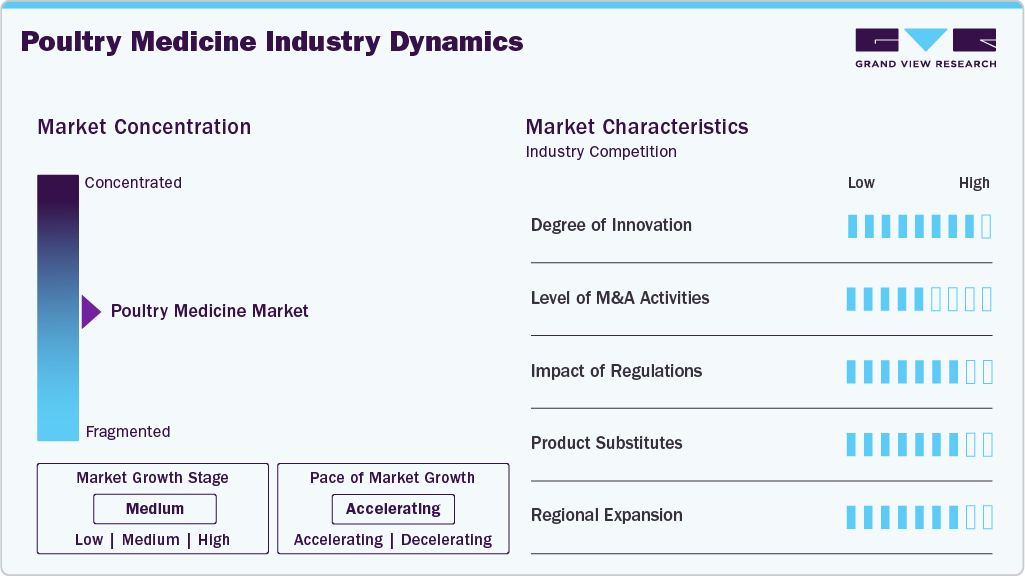

Market Concentration & Characteristics

The poultry medicine industry exhibits a moderate growth in the market, with an accelerating pace. The market is dominated by global players such as Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, and Ceva. These companies leverage strong R&D, broad portfolios, and global distribution networks to maintain competitiveness.

The market is marked by moderate to high innovation, particularly in vaccine development. For instance, in February 2025, Boehringer Ingelheim introduced VAXXITEK HVT+IBD+H5, a trivalent poultry vaccine that provides single-shot protection against Marek’s disease, Infectious Bursal Disease, and H5 avian influenza, enhancing efficiency and flock immunity. Advancements include recombinant, vector-based, and thermostable vaccines, as well as point-of-care diagnostics and precision health monitoring. Innovation is driven by rising disease outbreaks, antibiotic restrictions, and growing demand for effective, sustainable solutions in both developed and emerging poultry-producing regions.

Mergers and acquisitions play a significant role in shaping the market. In December 2022, Russia’s Cherkizovo Group acquired the poultry, crop, and feed production operations of Russian Grain Ufa, strengthening its integrated agribusiness portfolio and expanding its presence in key agricultural regions. Companies like Zoetis, Elanco, and Ceva have actively acquired smaller firms and technology platforms to enhance product portfolios, enter new regions, and expand diagnostic capabilities. These activities support competitive advantage, speed up innovation pipelines, and improve access to underserved markets globally.

Regulatory frameworks greatly influence the market. Increasing restrictions on antibiotic use, driven by antimicrobial resistance concerns, are pushing the market toward vaccines and alternative therapies. Strict approval processes for new biologics and veterinary drugs, especially in the EU and U.S., can delay market entry, though they also ensure higher product quality, safety, and traceability.

Substitutes such as phytogenic feed additives, probiotics, and improved farm management practices are gaining traction, especially where antibiotic usage is restricted. These alternatives, while not always as potent as traditional medicines, are perceived as safer and more sustainable. The growing consumer preference for antibiotic-free meat also fuels demand for non-pharmaceutical health solutions in poultry farming.

Regional expansion is a key strategy for major poultry medicine manufacturers. Emerging markets in Asia-Pacific, Latin America, and Africa present high growth potential due to rising poultry consumption and disease prevalence. Companies are investing in local production units, partnerships, and government collaborations to enhance access, reduce costs, and tailor products to region-specific disease profiles and farming practices.

Species Insights

The chicken segment represented the largest revenue share of 72.50% in 2024 and is also amongst the fastest growing segment, driven by their dominant role in both meat and egg production. The sheer volume of broiler chickens raised annually, along with increasing demand for poultry protein, necessitates widespread use of vaccines, antibiotics, probiotics, and nutritional supplements. As the industry moves toward intensive farming practices to meet consumption needs, disease prevention and productivity enhancement in chickens have become top priorities.

In addition, layers require continuous health management to ensure consistent egg production, further boosting medicine usage. Growing concerns around avian diseases such as Newcastle disease, infectious bronchitis, and coccidiosis have led to a sharp rise in preventive and therapeutic interventions specifically targeted at chickens. Furthermore, advancements in vaccine technology and the push for antimicrobial stewardship are fueling demand for innovative, species-specific solutions. These factors collectively position chickens as the most influential segment in shaping trends and growth in the poultry medicine industry.

Product Insights

The pharmaceuticals represented the largest segment in the market in terms of revenue share of 67.55% in 2024, due to their critical role in disease prevention, treatment, and overall flock health management. This segment includes antibiotics, antivirals, anticoccidials, and antiparasitics, which are widely used to combat infectious diseases and support productivity in commercial poultry farming. As poultry producers face increasing pressure to maintain biosecurity and reduce mortality rates, the demand for effective pharmaceutical solutions continues to rise. Moreover, the emergence of drug-resistant pathogens and regulatory shifts toward controlled antibiotic use are prompting the development of targeted and next-generation pharmaceuticals, further solidifying this segment’s dominance in the market.

Biologics are anticipated to be the fastest-growing segment in the market over the forecast period. This growth is driven by their effectiveness and alignment with sustainable farming standards. This category includes vaccines (live attenuated, recombinant, mRNA), immunostimulants, and probiotics that enhance immune function without antibiotics. Growing concerns over antimicrobial resistance and regulations on antibiotic use have accelerated the shift toward biologics to maintain flock health. In addition, innovations such as recombinant vector vaccines and next-generation mRNA-based immunizations offer improved safety, specificity, and ease of deployment.

Disease Insights

The Newcastle disease was the largest disease segment with a share of 22.49% in 2024, owing to its highly contagious nature and substantial economic impacts. This avian paramyxovirus causes severe respiratory and nervous system disease in poultry, frequently resulting in high mortality rates up to 90% in virulent outbreaks, leading to major productivity losses for farmers. As a result, vaccination remains the cornerstone of preventive efforts, with live attenuated vaccines dominating due to their strong immunity and cost-effectiveness. The scale of poultry farming, combined with global trade requirements and regulatory biosecurity measures, makes routine ND vaccination essential, propelling this segment's continued prominence and growth in the poultry pharmaceuticals realm.

Infectious Bronchitis (IB) is recognized as the fastest-growing segment over the forecast period. This viral respiratory disease significantly impacts both broilers and layers by reducing growth rates, causing poor egg quality, and triggering high mortality up to 80% in young chicks. The virus’ high mutation rate necessitates frequent vaccine updates, prompting manufacturers to continually innovate and produce strain-specific or multivalent formulations. As poultry production scales and intensifies, effective IB prevention becomes essential. Emerging vaccine technologies such as freeze-dried, spray, and vector-based vaccines are rapidly adopted, further fueling this segment’s expansion.

Route Of Administration Insights

The injectable segment dominated the market as the most widely used therapeutic route with a revenue share of 49.32% in 2024. Their precision dosing and robust immune activation are essential for serious diseases like Newcastle Disease, infectious bursal disease, and Avian Influenza. The recent innovations, such as advanced adjuvants and needle-free delivery, have enhanced safety, efficacy, and ease of administration, reinforcing injectables' leading position in poultry health management and vaccine deployment.

The others segment, which includes ocular and intranasal routes of administration, is anticipated to grow fastest over the forecast period. These non-invasive delivery methods offer significant advantages such as ease of administration, reduced stress for birds, and improved compliance. Ocular and intranasal vaccines and treatments allow rapid absorption and localized immune response, enhancing disease prevention and control. In addition, these routes minimize the need for injections, lowering labor costs and the risk of injury. The growing awareness of animal welfare and advancements in formulation technology are driving the adoption of ocular and intranasal products, making this segment a key growth area in poultry healthcare.

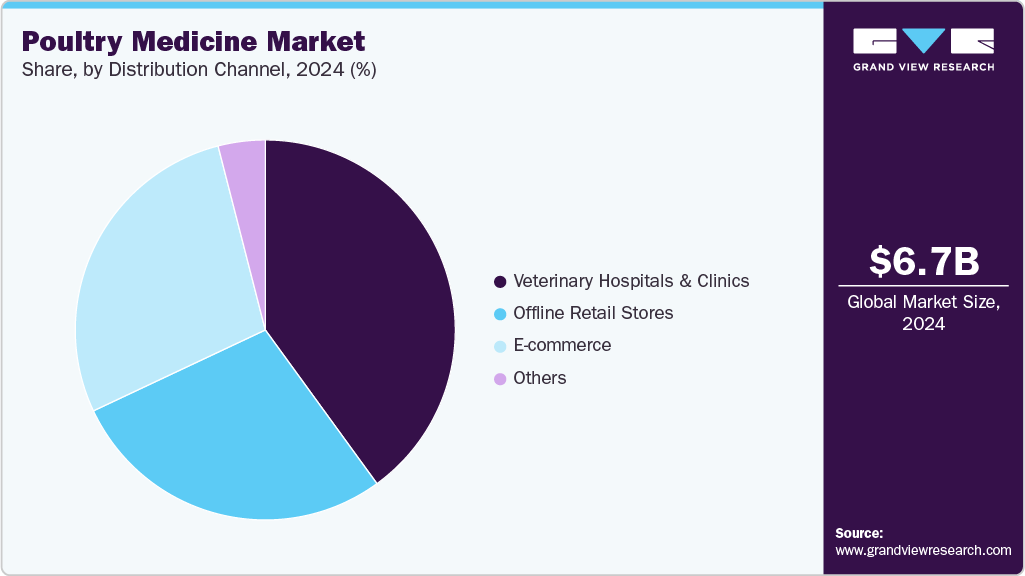

Distribution Channel Insights

The veterinary hospitals & clinics segment dominated the market with a share of 40.37% in 2024, due to its comprehensive diagnostic and therapeutic offerings. These facilities provide essential services including vaccinations, disease screening (via ELISA, PCR), and treatment for conditions like avian influenza, Newcastle disease, and coccidiosis under one roof. They also manage biosecurity protocols and herd health programs, supporting both emergency response and routine healthcare. They are equipped with advanced laboratory instruments, and these centres are critical access points for farmers seeking reliable, high-quality care. Their established infrastructure and expert personnel make them the most influential and expansive distribution channel in the market.

E-commerce has emerged as the fastest-growing segment in the market, driven by increasing digital adoption among poultry farmers and veterinary professionals. Online platforms offer convenient access to a wide range of products, including vaccines, antibiotics, feed additives, and diagnostic tools, often at competitive prices. The ability to compare brands, read reviews, and receive doorstep delivery enhances user experience and supports quick procurement in remote areas. Moreover, tech-savvy younger farmers and integrators are increasingly relying on e-commerce for inventory planning and disease management.

Regional Insights

The North American poultry medicine industry dominated the market with the largest revenue share of 37.42% in 2024, fueled by rising poultry consumption and zoonotic disease risks (like avian influenza). Major companies, including Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, Ceva, Virbac, and Phibro, dominate through diversified portfolios of vaccines, antimicrobials, and diagnostics.

U.S. Poultry Medicine Market Trends

The poultry medicine industry in the U.S. is driven by avian influenza outbreaks and regulatory shifts away from antibiotics. According to the CDC's 2022 report, a staggering 174.8 million birds were affected by highly pathogenic avian influenza (HPAI) A(H5) viruses, with 1,708 outbreaks reported across the U.S., highlighting the virus’ widespread impact on the poultry industry.

Europe Poultry Medicine Market Trends

The European poultry medicine industry is facing tightening regulations on antibiotic use and increasing emphasis on flock biosecurity. Some of the companies, such as Boehringer Ingelheim, Ceva, Zoetis, MSD, Elanco, and Virbac, dominate through comprehensive vaccine portfolios and diagnostics. The EU’s procurement of over 40 million bird flu vaccine doses, notably from CSL Seqirus, in June 2024, provides a strategic shift toward preventive measures.

The UK poultry medicine industry's growth is driven by rising demand for poultry products and increasing focus on animal health. For example, in November 2023, Antech introduced its first full-scale veterinary diagnostics service in the UK, featuring a cutting-edge reference laboratory to support advanced animal health testing and diagnostics.

Asia Pacific Poultry Medicine Market Trends

The Asia Pacific poultry medicine industry is experiencing robust growth and is the fastest growing over the forecast period, driven by stronger zoonotic awareness and extensive government vaccination initiatives. Poultry-related facilities in Asia Pacific are rapidly expanding due to rising meat demand, disease control needs, and increased investment in advanced veterinary and feed additive infrastructure. For instance, in April 2025, Clariant opened a new feed additive production line at its Cileungsi facility in West Java, Indonesia.

The India poultry medicine industry benefits from robust livestock growth, increasing poultry consumption, and elevated disease risk awareness. Government initiatives such as the National Animal Disease Control Programme boost demand for vaccines and diagnostics. The domestic and multinational players, including Hester Biosciences, Indian Immunologicals, Zoetis, Ceva, Virbac, Boehringer Ingelheim, and Elanco, compete with diverse portfolios covering vaccines, therapeutics, feed additives, and rapid diagnostics. For instance, in June 2025, Boehringer Ingelheim introduced a three-in-one poultry vaccine in India, providing early, reliable, and long-lasting immunity with a single hatchery-administered dose, addressing key challenges faced by poultry farmers.

Latin America Poultry Medicine Market Trends

The Latin America poultry medicine industry growth is propelled by frequent avian influenza and rising demand for food safety. Rapid advancements in ELISA, PCR diagnostics, recombinant vaccines, and point-of-care testing are enhancing disease control efficiency and biosecurity standards, In January 2025, Poultry farming will be a central theme of the Latin American Poultry Summit at the 2025 IPPE that shared insights on the key factors influencing the effective marketing of poultry farming in Latin America.

The Brazil poultry medicine industry growth is propelled by the country's role as the world’s top chicken exporter and second-largest producer, driving demand for vaccines, antimicrobials, and diagnostics. Governmental concerns over recent bird flu outbreaks have sparked debate around vaccination strategies and regional containment to maintain trade flow. In June 2025, Brazil declared itself free of bird flu and is now focusing on resuming its poultry export operations.

Middle East & Africa Poultry Medicine Market Trends

The Middle East & Africa (MEA) poultry medicine industry growth is driven by rising poultry consumption, frequent avian influenza and Newcastle disease outbreaks. Technological upgrades include onsite molecular diagnostics, data-driven surveillance, and region-specific vaccine development to enhance disease control and production efficiency. In June 2025, with the support of the Food and Agriculture Organization of the United Nations (FAO), Zimbabwe has made significant progress in reducing antimicrobial use in poultry farming, promoting more sustainable and responsible poultry health practices.

The South African poultry medicine industry's growth is driven by large-scale poultry production, ongoing avian influenza threats, and government-led vaccination and biosecurity initiatives. Some of the players, including Merck, Zoetis, Boehringer Ingelheim, Ceva, Virbac, and domestic innovator Afrigen, compete using recombinant/live vaccines, inactivated formulations, and POC diagnostics.

Key Poultry Medicine Company Insights

Leading players such as Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, Ceva Santé Animale, and Virbac hold substantial portions of the market due to their diversified product portfolios, global distribution networks, and strong regulatory compliance. These companies continue to strengthen their positions through innovation in recombinant and vector-based vaccines, expansion into emerging markets, and strategic mergers and acquisitions. However, challenges such as regulatory complexities, high R&D costs, and growing restrictions on antibiotic use are reshaping the competitive landscape. Emerging players and regional firms are also gaining traction by offering affordable, targeted solutions suited for local disease profiles and resource-limited environments.

Key Poultry Medicine Companies:

The following are the leading companies in the poultry medicine market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- Zoetis Services LLC

- Vaxxinova International BV

- Merck & Co., Inc.

- Calier

- Elanco

- Hester Biosciences Limited

- Ceva Santé Animale

- Phibro Animal Health Corporation

- Virbac

- Venkys India

- Calier

- Hipra

- Vetanco

- Kemin Industries, Inc

- Indovax

- Avimex

Recent Developments

-

In June 2025, Boehringer Ingelheim announced the launch of a next-generation, single-dose poultry vaccine in India that protects against Bursal disease, Newcastle disease, and Marek’s disease.

-

In November 2024, Ceva Animal Health launches Ceva Genesys, an innovative system for automatic, precise separation of male and female broilers at hatch, enhancing flock uniformity and overall production efficiency.

-

In April 2024, Zoetis sold its medicated feed additive portfolio, select water-soluble products, and related assets to Phibro Animal Health, streamlining its focus on core veterinary innovations.

Poultry Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.07 billion

Revenue forecast in 2033

USD 11.90 billion

Growth rate

CAGR of 6.70% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Species, product, disease, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; Zoetis Services LLC;Vaxxinova International BV; Merck & Co., Inc.; Calier; Elanco; Hester Biosciences Limited; Ceva Santé Animale; Phibro Animal Health Corporation; Virbac; Venkys India; Hipra; Vetanco; Kemin Industries, Inc; Indovax; Avimex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Poultry Medicine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global poultry medicine market report based on species, product, disease, route of administration, distribution channel, and region.

-

Species Outlook (Revenue, USD Million, 2021 - 2033)

-

Chicken

-

Broiler

-

Layer

-

-

Turkey

-

Ducks

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicated Feed Additives

-

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Newcastle Disease

-

Infectious Bronchitis

-

Infectious Bursal Disease

-

Coccidiosis

-

Salmonella

-

Marek's Disease

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Oral

-

Injectable

-

Topical

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Veterinary Hospitals & Clinics

-

E-commerce

-

Offline Retail Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021- 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the poultry medicine market include Boehringer Ingelheim International GmbH, Zoetis Services LLC, Vaxxinova International BV, Merck & Co., Inc., Calier, Elanco, Hester Biosciences Limited, Ceva Santé Animale, Phibro Animal Health Corporation, Virbac, Venkys India, Calier, Hipra, Vetanco, Kemin Industries, Inc, Indovax, Avimex.

b. Key factors that are driving the market growth include the growing prevalence of poultry diseases, rising demand for poultry products and expansion of commercial poultry farming. The frequent occurrence of poultry diseases like avian influenza, Newcastle disease, and infectious bronchitis has significantly increased the demand for effective pharmaceuticals

b. The global poultry medicine market size was estimated at USD 6.72 billion in 2024 and is expected to reach USD 7.07 billion in 2025

b. The global poultry medicine market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2033 to reach USD 11.90 billion by 2033.

b. North America dominated the poultry medicine market with a share of 37.42% in 2024. This is attributable to rising poultry consumption and zoonotic disease risks (like avian influenza). Major companies including Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, Ceva, Virbac, and Phibro dominate through diversified portfolios of vaccines, antimicrobials, and diagnostics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.