- Home

- »

- Medical Devices

- »

-

Powered Surgical Instruments Market Size Report, 2030GVR Report cover

![Powered Surgical Instruments Market Size, Share & Trends Report]()

Powered Surgical Instruments Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hand Pieces, Power Source & Control, Accessories), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-583-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Powered Surgical Instrument Market Trends

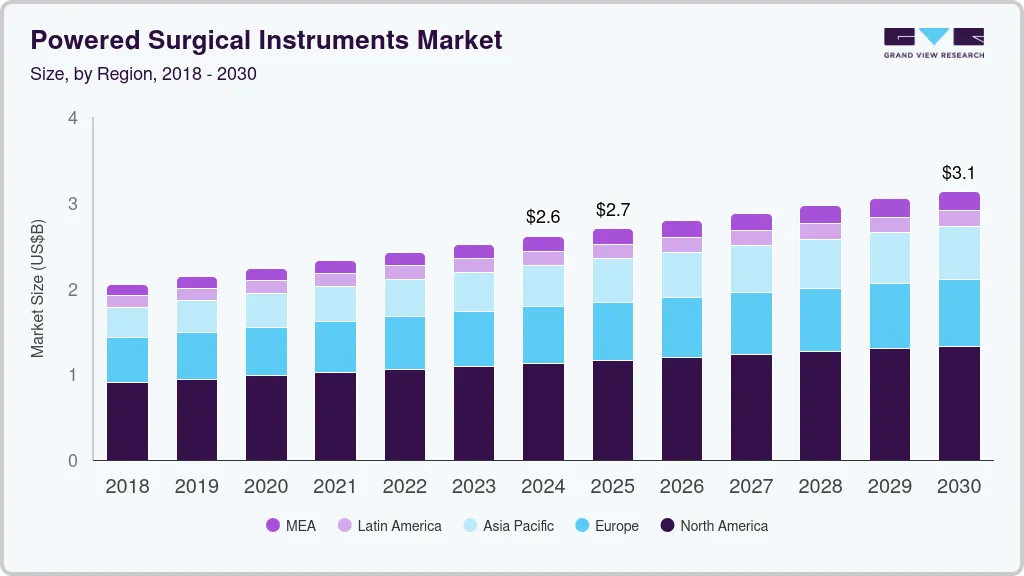

The global powered surgical instruments market size was valued at USD 2.60 billion in 2024 and is projected to reach USD 3.13 million by 2030, growing at a CAGR of 3% from 2025 to 2030. The increasing volume of surgeries globally drives market growth. As populations age and healthcare access improves, surgical procedures, including minimally invasive surgeries, continue to grow. Powered surgical instruments, known for their precision and efficiency, are essential in these procedures, facilitating quicker and more accurate operations. This efficiency benefits surgeons and enhances patient outcomes by reducing recovery times and the risk of complications.

Technological advancements are another major contributor to the rising demand for powered surgical instruments. Innovations in battery life, ergonomics, and device versatility have made these instruments more reliable and user-friendly. Furthermore, the integration of robotics and computer-assisted systems in surgical tools has expanded their capabilities, allowing for greater precision and control, which is particularly beneficial in complex procedures. The growing focus on improving surgical outcomes and patient safety also plays a crucial role in the increased adoption of powered surgical instruments. Hospitals and surgical centers are investing in advanced tools that offer greater accuracy and consistency, reducing the likelihood of human error. Additionally, these instruments are designed to be easily sterilized and maintained, ensuring high hygiene standards and minimizing the risk of infections.

Lastly, the rise in chronic diseases and the subsequent increase in surgeries to address these conditions contribute to the demand. Conditions such as cardiovascular diseases, cancer, and orthopedic issues often require surgical interventions where powered instruments are indispensable. As the prevalence of these conditions grows, so does the need for efficient and effective surgical solutions, further propelling the demand for powered surgical instruments on a global scale.

Product Insights

The hand pieces segment held the largest market revenue share of 44.9% in 2023. The increase in minimally invasive surgical procedures requiring precise and efficient instruments has boosted the need for advanced hand pieces. These devices offer surgeons better control and accuracy, which is essential for delicate surgeries. Additionally, technological advancements have led to the development of more ergonomic and user-friendly hand pieces, enhancing surgeon comfort and reducing fatigue during lengthy procedures. The growing prevalence of chronic diseases necessitating surgical intervention also contributes to the demand, as does the expanding aging population, which often requires more frequent surgeries.

The power source & control segment is projected to grow with the fastest CAGR of 3.8% over the forecast period. The ongoing advancement of technology in medical equipment has resulted in the creation of advanced powered surgical tools. Advancements, including better battery longevity, upgraded power management systems, and sophisticated control mechanisms, have increased the effectiveness and dependability of these devices. Healthcare facilities are placing more importance on patient safety and enhancing surgical outcomes. Advanced control features on powered surgical instruments reduce human error by ensuring consistent performance and precision during procedures.

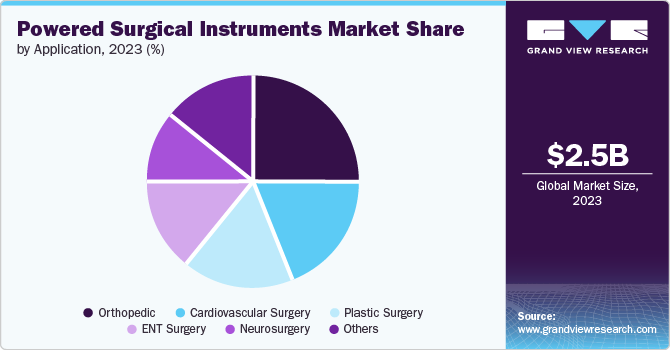

Application Insights

The orthopedic surgery segment held the largest market revenue share in 2023. The increasing prevalence of musculoskeletal disorders and injuries drives the market growth. The growing number of sports-related injuries and accidents also contributes to the need for orthopedic surgeries. Additionally, advancements in minimally invasive surgical techniques, which often utilize powered surgical instruments, make these procedures more convenient due to their shorter recovery times and reduced risk of complications. Moreover, rising awareness and the availability of health insurance coverage are enabling more patients to opt for surgical interventions to improve their quality of life, further boosting the demand in this segment.

The ENT surgery segment is projected to witness a significant CAGR over the forecast period. The rising prevalence of ENT-related disorders, such as chronic sinusitis, hearing loss, and sleep apnea, drives the segment growth. An aging population also contributes to the demand, as older individuals are more susceptible to conditions requiring ENT surgeries. Furthermore, increased healthcare access and awareness about available treatments encourage more patients to opt for surgical solutions.

Regional Insights

North America held the largest market revenue share of 43.9% in 2023. The region has a growing aging population, which leads to a higher incidence of age-related health conditions requiring surgical intervention. Additionally, there is an increased prevalence of chronic diseases such as cardiovascular disorders and orthopedic issues, necessitating more surgical procedures. Technological advances have also played a crucial role, as newer powered surgical instruments offer enhanced precision, efficiency, and safety, which are highly valued in modern surgical practices.

U.S. Powered Surgical Instruments Market Trends

The U.S. dominated the regional market in 2023. The region's aging population and the rising prevalence of chronic conditions like cardiovascular diseases, obesity, and diabetes drive the market growth. The U.S. sees many surgeries related to these conditions, necessitating advanced surgical tools for more efficient and effective procedures. Additionally, the presence of a well-established healthcare infrastructure and a high adoption rate of advanced medical technologies further boosts the demand.

Europe Powered Surgical Instruments Market Trends

Europe market was witnessed as lucrative in this industry. The aging population, particularly in countries like Germany and Italy, is leading to a higher incidence of age-related conditions that require surgical intervention. Moreover, the region's strong emphasis on minimally invasive surgeries, especially in countries like the UK and France, is boosting the need for specialized powered instruments that enable these procedures.

The UK market is projected to grow rapidly in the coming years. The increasing number of orthopedic surgical procedures due to the rising prevalence of arthritis and several other bone disorders is driving the nation’s market growth. The increasing influence of invasive procedures, including laparoscopy and endoscopy, is driving market demand. Healthcare providers are giving major priority to patient safety, resulting in significant investment in technologically advanced surgical tools to decrease risks associated to surgeries.

Asia Pacific Powered Surgical Instruments Market Trends

Asia Pacific is anticipated to witness a significant CAGR in the coming years. The region is experiencing significant growth in its healthcare infrastructure, driven by increased government investment and the expansion of private healthcare facilities. This expansion is accompanied by a growing population, including an aging demographic that requires more surgical interventions. Moreover, the region's economic growth has improved access to healthcare services and technologies, making advanced surgical instruments more accessible.

India market is projected to grow rapidly over the forecast period. The Indian healthcare sector is experiencing rapid growth, driven by an expanding middle class, increasing health awareness, and rising incidences of chronic diseases that require surgical interventions. The government's initiatives to improve healthcare infrastructure, such as the Ayushman Bharat scheme, have also expanded access to surgical care, boosting the need for advanced medical equipment. Additionally, there is a growing trend toward minimally invasive surgeries, which require sophisticated powered instruments.

Middle East And Africa Powered Surgical Instruments Market Trends

The Middle East and Africa market is projected to grow at the fastest CAGR over the forecast period. The MEA region is experiencing a rise in chronic diseases such as diabetes and obesity, leading to more surgical interventions. In Africa, initiatives like the African Health Strategy promote improved healthcare access, boosting the need for modern medical equipment, including powered surgical instruments. The growing medical tourism industry in countries like Turkey and the UAE also contributes to this demand, as they aim to offer state-of-the-art surgical care to international patients.

Key Powered Surgical Instruments Company Insights

Some of the key companies in the powered surgical instruments market include Smith+Nephew; MicroAire; Korea SMEs and Startups Agency; CONMED Corporation; De Soutter Medical; and others.

-

Smith+Nephew provides powered surgical instrument solutions for orthopedics, sports medicine, ENT, and advanced wound management. Their powered surgical instruments include the CORI Surgical System, a handheld robotics system for knee arthroplasty, and VISIONAIR Patient-Matched Technology, which provides patient-specific surgical instruments and implants for precise knee replacements.

-

MicroAire provides powered surgical equipments for orthopaedics and aesthetic surgery. These include orthopaedic power instruments such as drills, saws, and reamers for precision in surgeries, endoscopic soft-tissue release instruments for minimally invasive procedures, and devices for aesthetic plastic surgery such as liposuction and facial contouring.

Key Powered Surgical Instruments Companies:

The following are the leading companies in the powered surgical instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Korea SMEs and Startups Agency

- CONMED Corporation

- Medtronic

- Stryker

- Zimmer Biomet

- B. Braun Medical Inc.

- adeor medical AG.

- Smith+Nephew

- MicroAire

- De Soutter Medical

Recent Developments

-

In June 2024, Zimmer Biomet announced a collaboration with THINK Surgical to offer the TMINI, a miniature handheld robotic system for total knee arthroplasty. The TMINI complements Zimmer Biomet's existing ROSA Robotics portfolio, providing surgeons with a wireless, ergonomic option for knee replacements. This partnership aims to expand the use of robotic assistance in orthopedic surgeries, particularly in walk-in surgery centers.

Powered Surgical Instruments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.69 billion

Revenue forecast in 2030

USD 3.13 billion

Growth rate

CAGR of 3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy Spain, Denmark, Sweden, Norway, China, India, Japan, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Korea SMEs and Startups Agency; CONMED Corporation; Medtronic; Stryker; Zimmer Biomet; B. Braun Medical Inc.; adeor medical AG.; Smith+Nephew; MicroAire; De Soutter Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powered Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global powered surgical instruments market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Handpiece

-

Drill System

-

Saw System

-

Staplers

-

Shaver's

-

Others

-

-

Power Source & Control

-

Battery Power Instruments

-

Electric Instruments

-

Pneumatic Instruments

-

-

Accessories

- Surgical Accessories

- Electrical Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic

-

Neurosurgery

-

ENT Surgery

-

Cardiovascular Surgery

-

Plastic Surgery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.