- Home

- »

- Biotechnology

- »

-

Precision Genomic Testing Market Size, Industry Report 2030GVR Report cover

![Precision Genomic Testing Market Size, Share & Trends Report]()

Precision Genomic Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Consumables, Equipment, Services), By Application (Oncology, Cardiovascular Diseases), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-352-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Genomic Testing Market Summary

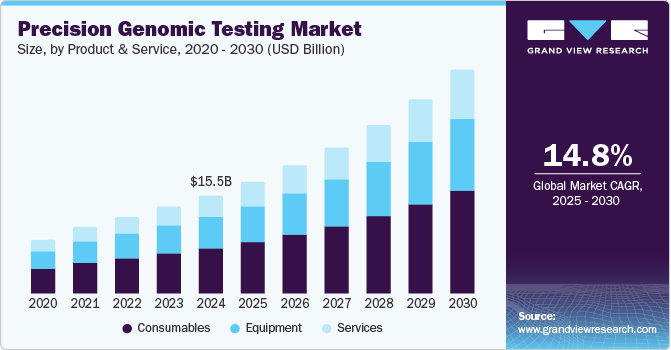

The global precision genomic testing market size was estimated at USD 15,491.7 million in 2024 and is projected to reach USD 35,201.1 million by 2030, growing at a CAGR of 14.8% from 2025 to 2030. This market encompasses a range of diagnostic tools and techniques used to analyze genetic information, leading to more accurate diagnoses, targeted therapies, and improved patient outcomes.

Key Market Trends & Insights

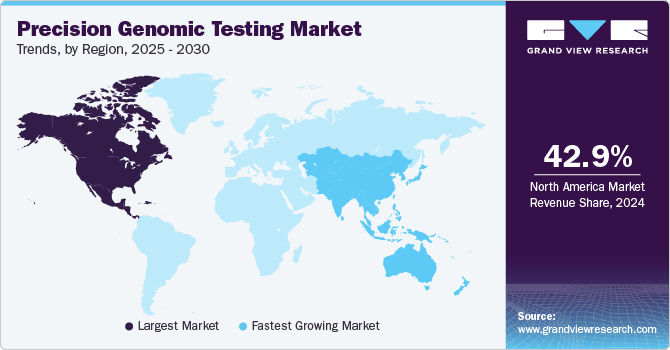

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, consumables accounted for a revenue of USD 8,100.6 million in 2024.

- Services is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 15,491.7 million

- 2030 Projected Market Size: USD 35,201.1 million

- CAGR (2025-2030): 14.8%

- North America: Largest market in 2024

The demand for precision genomic testing is driven by the need for early disease detection, effective treatment planning, and better management of chronic conditions.

Precision genomic testing, driven by CRISPR-Cas9 genome editing technology, is gaining momentum with continuous innovations and increasing investment in research and development. As a result, the market is poised for robust expansion in the coming years. For instance, in March 2024, The Advanced Genomics Collaboration (TAGC) awarded funding to four Innovation Projects led by the University of Melbourne in partnership with entities across the Melbourne Biomedical Precinct. These projects will also benefit from access to cutting-edge DNA sequencing technology at TAGC’s world-class genomics hub, made possible through a collaboration between the University and global biotech firm Illumina, with backing from Invest Victoria.

The rising prevalence of genetic disorders and chronic diseases is driving the demand for precision genomic testing. An estimated 10,000 single-gene diseases result from mutations in a single gene, affecting approximately 10 out of every 1,000 people, according to the World Health Organization. This translates to nearly 70-80 million individuals worldwide living with such conditions. Disorders like cystic fibrosis, Huntington's disease, and various cancers significantly impact on patient health and quality of life. Early and accurate diagnosis is essential for effective treatment and management. Precision genomic testing enables the identification of disease-causing genetic mutations, allowing for timely interventions and personalized treatment plans. As the incidence of these conditions continues to rise, the need for reliable and comprehensive genomic testing solutions will drive market growth.

Additionally, collaborations among academic institutions, research organizations, healthcare providers, and biotechnology companies are accelerating market expansion. These partnerships foster innovation by facilitating knowledge exchange, resource sharing, and technological advancements. Strategic alliances with pharmaceutical firms further integrate precision genomic testing into drug development and personalized medicine. As the collaborative ecosystem grows, the precision genomic testing industry is expected to see sustained growth.

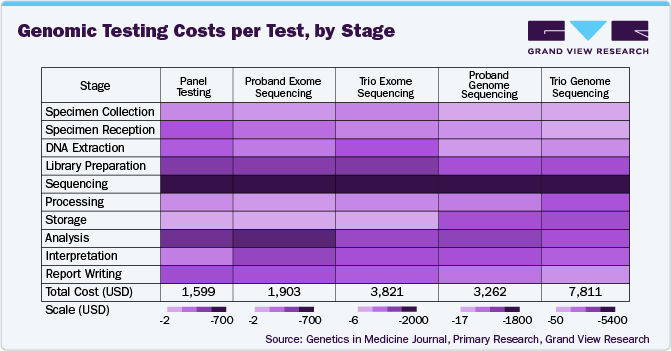

Genomic Testing Cost Analysis

Genomic testing costs vary significantly across different test types and processing stages. The table below presents the per-unit cost of genomic testing for each stage across various test types:

Sequencing is the most expensive stage, especially for trio genome sequencing (~USD 5,400), followed by proband genome sequencing (~USD 1,800). Trio testing, which involves sequencing for a patient and both parents, generally incurs higher costs across all stages due to increased data volume and complexity. Furthermore, library preparation and DNA extraction also contribute substantially to total costs, particularly in trio sequencing. Notably, analysis costs remain similar across tests, except for proband and trio genome sequencing, which are slightly higher. Storage costs escalate dramatically in genome sequencing, with trio genome sequencing requiring ~USD 680, indicating increased data storage demands.

Panel testing is the most cost-effective (~USD 1,600), while trio genome sequencing is the most expensive (~USD 7,800), driven by sequencing, storage, and processing costs. These insights highlight the scalability challenges of whole genome sequencing and the efficiency of panel-based approaches for targeted diagnostics.

AI Applications in Genomic Testing

The integration of artificial intelligence (AI)-based technologies in genomic testing is revolutionizing the way genetic data is analyzed, interpreted, and applied in clinical and research settings. With the exponential growth of sequencing data, AI-driven tools streamline variant calling, annotation, and classification, significantly reducing the time required to identify pathogenic mutations. Machine learning algorithms are enhancing accuracy by recognizing complex patterns in genomic data that may be overlooked by traditional bioinformatics methods. AI is also improving the ability to correlate genetic variants with disease phenotypes, enabling more precise diagnostics and risk assessments. For instance, DeepSEA and ExPecto are AI-driven deep learning models designed for mutation detection. DeepSEA predicts how genetic sequence changes affect chromatin by analyzing transcription factor binding, DNase I sensitivity, and histone modifications across various cell types. This enables it to assess chromatin alterations caused by sequence variants and prioritize regulatory mutations with potential functional impact.

In oncology, AI-powered models assist in predicting cancer progression and identifying personalized treatment options by analyzing tumor genomic profiles. AI also plays a crucial role in pharmacogenomics, helping clinicians determine the most effective drug regimens based on a patient’s genetic makeup. Additionally, AI-driven automation enhances laboratory workflows by optimizing sequencing processes, minimizing errors, and increasing efficiency in genomic testing pipelines.

Beyond diagnostics, AI is advancing predictive genomics by identifying individuals at higher risk for hereditary diseases, facilitating early interventions and preventive strategies. In reproductive health, AI improves non-invasive prenatal testing (NIPT) by refining fetal genetic analysis from maternal blood samples. AI’s role extends to rare disease research, where it accelerates the discovery of novel genetic mutations and their associations with previously undiagnosed conditions.

Market Concentration & Characteristics

The precision genomic testing industry is characterized by a high degree of innovation, driven by advancements in next-generation sequencing (NGS), CRISPR gene editing, and AI-driven bioinformatics. These cutting-edge technologies enable more accurate and rapid genetic analysis, facilitating personalized medicine. Continuous R&D efforts and collaborations between biotech firms, research institutions, and healthcare providers are pushing the boundaries of genomic testing, enhancing diagnostic capabilities and treatment outcomes for various genetic disorders.

The precision genomic testing industry is experiencing a moderate level of mergers and acquisitions (M&A) activity. For instance, in August 2021, ProPhase Labs, Inc., a medical science company, announced the acquisition of Nebula Genomics, a personal genomics firm. Companies are actively pursuing strategic acquisitions to expand their technological capabilities, enhance their test portfolios, and increase market share. Notable acquisitions, such as Myriad Genetics acquiring assets from Intermountain Precision Genomics, exemplify this trend. M&A activities are driven by the need to innovate rapidly and meet the growing demand for personalized medicine and advanced diagnostic solutions.

Regulations play a crucial role in shaping the precision genomic testing industry by ensuring the safety, accuracy, and ethical use of genetic information. Regulatory frameworks, such as FDA approvals in the U.S. and CE marking in Europe, validate the quality and reliability of genomic tests. Compliance with these regulations is essential for market entry and acceptance, influencing investment decisions and innovation strategies among companies in the precision genomic testing sector.

Product/service expansion in the precision genomic testing industry involves the development and launch of new tests and technologies to meet evolving healthcare needs. Companies are expanding their product portfolios to include comprehensive panels for disease screening, pharmacogenomics tests for personalized medicine, and direct-to-consumer genetic testing kits. For instance, in April 2022, pharmaceutical companies united to establish the Precision Cancer Consortium, aimed at enhancing worldwide accessibility to comprehensive genomic testing for all cancer patients. This expansion aims to enhance diagnostic capabilities, improve treatment outcomes, and broaden market reach, catering to increasing demand for precise genetic information in clinical and research settings.

Regional expansion in the precision genomic testing industry is experiencing moderate to high growth as companies seek to broaden their geographical footprint. By increasing their presence globally, companies aim to enhance market penetration, deliver personalized genetic testing solutions to diverse populations, and capitalize on emerging opportunities in healthcare systems focused on precision medicine and genomic diagnostics.

Product & Services Insights

The consumables segment dominated the market with a share of 45.82% in 2024. New product launches and advancements in technology drive this. Market players are introducing innovative consumables such as reagents, kits, and assay components tailored for genomic sequencing and analysis. These advancements include improved sample preparation methods and high throughput sequencing technologies, enhancing the efficiency and accuracy of genomic testing. For instance, in May 2024, QIAGEN introduced a new library preparation kit designed to enhance multiomics studies and propel precision medicine forward. This innovative kit simplifies the preparation of DNA and RNA libraries for next-generation sequencing (NGS), including whole genome sequencing (WGS) and whole transcriptome sequencing. It also facilitates downstream target enrichment through hybrid-capture from a single sample, streamlining the process of genomic analysis for researchers and healthcare providers alike. As competition intensifies among key players like Illumina, Thermo Fisher Scientific, and Qiagen, the consumables segment continues to expand to meet the rising demand for precise genetic analysis tools.

The services segment in the market is expected to grow at the highest CAGR of 15.27% from 2025 to 2030 due to the growing demand for specialized testing and analysis services. Companies offering genetic counseling, interpretation of genomic data, and clinical trial support are expanding their service offerings. These services cater to healthcare providers, pharmaceutical companies, and research institutions seeking expert guidance in implementing genomic testing strategies.

Application Insights

The oncology segment dominated the market and accounted for a 31.50% share in 2024, driven by innovations in cancer genomics. Advances such as liquid biopsy techniques, comprehensive genomic profiling, and targeted therapy development are enhancing early detection, diagnosis, and personalized treatment of cancers. For instance, in November 2023, Illumina Inc. unveiled the latest generation of its distributed liquid biopsy. The new TruSight Oncology is a research assay designed for noninvasive comprehensive genomic profiling of circulating tumor DNA from blood. It serves as an alternative when tissue testing is unavailable or as a complement to tissue-based testing. Companies are investing in research to identify novel biomarkers and develop precise genomic tests, enabling tailored treatment plans for cancer patients. This focus on innovation and personalized oncology care is propelling the growth of the market within the oncology segment.

The neurological disorders segment is anticipated to grow at the highest CAGR of 15.57% from 2025 to 2030, driven by advancements in genomic technologies and increased investment. For instance, in May 2023, NIH launched a USD 140 million initiative to explore genetic variation in normal human cells and tissues. Technologies like next-generation sequencing (NGS) and CRISPR are enabling more precise identification of genetic mutations associated with neurological conditions such as Alzheimer's, Parkinson's, and epilepsy. Significant investment in research and development is further propelling the development of specialized genomic tests. These advancements are enhancing early diagnosis, personalized treatment options, and overall patient care, contributing to the robust growth of this market segment.

Technology Insights

The next-generation sequencing segment held the largest market share of 32.67% in 2024, driven by continuous innovation and strategic partnerships. Advances in NGS technologies are enhancing sequencing speed, accuracy, and cost-effectiveness, enabling comprehensive genomic profiling. Collaborations between biotech firms, research institutions, and healthcare providers are accelerating the development and adoption of NGS-based tests. For instance, in January 2023, QIAGEN and Helix entered partnership to advance next-generation sequencing companion diagnostics for hereditary disorders. This collaboration will leverage the Helix Laboratory Platform alongside QIAGEN’s biopharma relationships and NGS capabilities. These partnerships facilitate the translation of cutting-edge research into clinical applications, driving market expansion and improving personalized medicine approaches for various diseases.

The microarray technology segment is expected to grow at the fastest CAGR of 15.47% over the forecast period, due to advancements in technology. Enhanced microarray platforms now offer higher resolution and greater accuracy, enabling comprehensive analysis of genetic variations and gene expression. These technological improvements facilitate the identification of disease-associated genes and biomarkers, driving the adoption of microarray-based tests in research and clinical settings. The continuous evolution of microarray technology is expanding its applications in personalized medicine, contributing to the robust growth of this market segment.

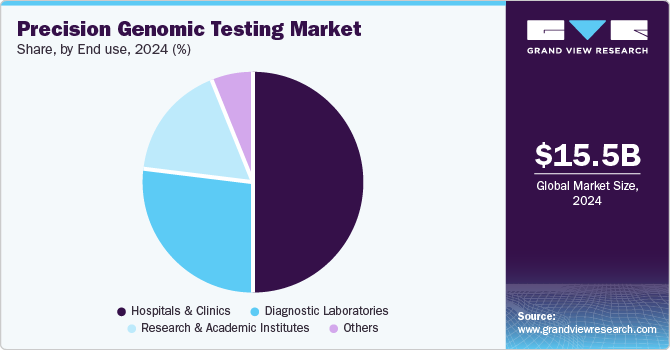

End Use Insights

The hospitals and clinics companies dominated the market with the largest revenue share of 50.03% in 2024, driven by increased funding and the rising prevalence of genetic disorders. Financial support from government initiatives and private investments is enhancing the infrastructure and capabilities of healthcare facilities. As the incidence of genetic disorders continues to rise, hospitals and clinics are increasingly adopting precision genomic testing to provide accurate diagnoses and personalized treatment plans. This trend is propelling the expansion and development of genomic testing services within clinical settings.

The diagnostic laboratories segment is anticipated to grow at the highest CAGR over the forecast period, fueled by advancements in technology, ongoing research, and increased demand for clinical testing of genetic disorders. Diagnostic labs are integrating sophisticated genomic technologies like next-generation sequencing (NGS) and advanced bioinformatics to enhance diagnostic accuracy and efficiency. This sector's growth is driven by the need for precise genetic analysis in disease diagnosis and treatment planning, addressing the growing incidence of genetic disorders and supporting personalized medicine approaches in healthcare settings.

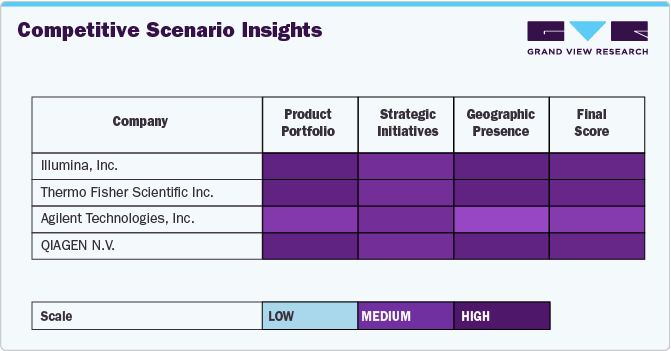

Competitive Scenario Insights

The market consists of companies with varying levels of geographic reach and product/service portfolio diversity. The figure below illustrates the competitive scenario for the key players based on these parameters.

Danaher, Merck KGaA, QIAGEN, and Illumina, Inc. lead the space with a comprehensive portfolio spanning sequencing, diagnostics, and reagents, coupled with a strong global presence, making them dominant players. PacBio, while global, remains more specialized in long-read sequencing, positioning it as a niche leader.

Oxford Nanopore and 10x Genomics offer innovative technologies but are still scaling their global footprint, competing in the high-growth mid-market segment. Meanwhile, Revvity, Maravai LifeSciences, and GenScript focus on niche applications like reagents, sample prep, and custom genomic solutions, serving targeted markets with regional influence.

This trend highlights market consolidation at the top, with smaller players differentiating through specialization. The mid-market innovators (Oxford Nanopore, 10x Genomics) could challenge established leaders as they expand globally, while niche players may see M&A activity as larger firms seek to integrate specialized capabilities.

Regional Insights

North America precision genomic testing market dominated and accounted for a 42.92% share in 2024, by robust participation from key players like Illumina, Thermo Fisher Scientific, and QIAGEN. Innovation in next-generation sequencing (NGS) technologies and bioinformatics is driving market growth, enabling enhanced genomic analysis and personalized medicine applications. For instance, in June 2022, Labcorp, a global life sciences company, recognizes the expanding significance of precision medicine and is dedicated to expanding access to targeted and personalized treatments for a broader population. These advancements support the region's leadership in genomic research and clinical applications, fostering collaborations between academic institutions, healthcare providers, and biotechnology firms. North America remains at the forefront of advancing precision genomic testing capabilities, catering to increasing demands for accurate and tailored healthcare solutions.

U.S. Precision Genomic Testing Market Trends

The precision genomic testing market in U.S. is anticipated to grow over the forecast period with increased partnerships between industry leaders and research institutions. For instance, in May 2023, Pfizer and Thermo Fisher Scientific Inc. announced a collaboration agreement aimed at expanding local availability of next-generation sequencing (NGS)-based testing for patients with lung and breast cancer. These collaborations foster innovation and accelerate the development of advanced genomic technologies, enhancing diagnostic capabilities and personalized treatment options for patients.

Europe Precision Genomic Testing Market Trends

The Europe precision genomic testing market is anticipated to grow over the forecast period, driven by robust investments in research and development. Increased funding supports advancements in genomic technologies, fostering innovation in diagnostics and personalized medicine across the continent.

The UK precision genomic testing market is expected to grow over the forecast period due to technological innovations. In June 2024, in the UK, robotic technology is employed to aid genomic testing for cancer patients through a collaboration between The Royal Marsden NHS Foundation Trust and Automata Technologies, an automation company specializing in life sciences lab automation. These advancements include next-generation sequencing (NGS) and CRISPR gene editing technologies, enhancing the accuracy and efficiency of genetic analysis for personalized medicine applications.

The Germany precision genomic testing market is expected to grow over the forecast period with cutting-edge technological improvements in genomic sequencing. These advancements, including next-generation sequencing (NGS) technologies, are enhancing the precision and scope of genetic analysis, driving innovation in personalized medicine and healthcare solutions. For instance, in April 2023, CENTOGENE introduced CentoGenome, a new whole genome sequencing solution designed for diagnosing rare and neurodegenerative diseases. This innovative tool enables healthcare professionals to access more extensive diagnostic information, potentially expediting access to treatment options for patients.

Asia Pacific Precision Genomic Testing Market Trends

The Asia Pacific precision genomic testing marketis expected to experience rapid growth, with a projected CAGR of 20.28% from 2025 to 2030, with significant investments in research and development. These efforts are driving technological innovations in genomic sequencing and diagnostics, enhancing the region's capabilities in personalized medicine and healthcare solutions.

The China precision genomic testing market is anticipated to grow over the forecast period. driven by global expansion efforts and strategic partnerships with international companies. For instance, in December 2023, Illumina and HaploX, a China-based high-tech firm specializing in liquid biopsy and genetic big data, jointly unveiled the inaugural NextSeq genetic sequencing system. This milestone signifies a significant advancement in their strategic partnership. These collaborations enhance access to advanced genomic technologies and expertise, supporting China's aim to strengthen its position in personalized medicine and healthcare innovation on a global scale.

The Japan precision genomic testing market is expected to witness a rapid growth over the forecast period with advancements in technology, particularly through AI interventions. These developments are enhancing the accuracy and efficiency of genomic testing and analysis, positioning Japan at the forefront of personalized medicine and healthcare innovation. For instance, in July 2024, SoftBank Group formed a joint venture named "SB TEMPUS" with Tempus to advance healthcare in Japan by leveraging medical data and AI. The venture aims to offer precision medicine services, including genetic testing and AI-driven treatment recommendations.

Middle East & Africa Precision Genomic Testing Market Trends

The precision genomic testing market in the Middle East and Africais poised to grow amid a rise in genetic disorders. Increased investment in research and development is driving advancements in genomic technologies, improving diagnostic accuracy and personalized treatment options across the region. These efforts are crucial in addressing the growing healthcare needs and enhancing genomic healthcare capabilities in Middle Eastern and African countries.

The precision genomic testing market in Saudi Arabia is expected to grow over the forecast period due to government funding and healthcare investments. These initiatives aim to enhance diagnostic capabilities, promote personalized medicine, and address healthcare challenges through advanced genomic technologies and research.

Key Precision Genomic Testing Company Insights

Key players operating in the precision genomic testing industry are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Precision Genomic Testing Companies:

The following are the leading companies in the precision genomic testing market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- Merck KGaA

- Revvity, Inc.

- Maravai LifeSciences

- GenScript

- QIAGEN

- PacBio

- Oxford Nanopore Technologies plc.

- Illumina, Inc.

- 10x Genomics, Inc.

Recent Developments

-

In July 2024, Phenomix Sciences and Hello Alpha partnered to offer personalized obesity genetic testing, catering specifically to women. Hello Alpha, a virtual primary care platform, aims to empower women by providing accessible, affordable, and confidential online healthcare services.

-

In January 2024, Myriad Genetics, Inc. acquired assets from IPG laboratory business, including the St. George, Utah laboratory. By integrating the Precise Tumor and Precise Liquid tests into their operations, Myriad aims to unlock new opportunities for innovation and growth.

-

In February 2024, Exact Sciences Corp., a provider of cancer screening and diagnostic tests, launched the Riskguard cancer test in the U.S. The Riskguard test offers individualized patient reports that detail gene-specific and familial risks for 10 common cancers.

Precision Genomic Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.66 billion

Revenue forecast in 2030

USD 35.20 billion

Growth rate

CAGR of 14.80% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & Service, application, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Danaher, Merck KGaA, Revvity, Inc., Maravai LifeSciences, GenScript, QIAGEN, PacBio, Oxford Nanopore Technologies plc., Illumina, Inc., 10x Genomics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Genomic Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precision genomic testing market report based on product & service, application, technology, end use, and region:

-

Product & Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumables

-

Kits

-

Reagents

-

-

Equipment

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Neurological Disorders

-

Reproductive Health

-

Rare Diseases

-

Others

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Next-Generation Sequencing

-

Polymerase Chain Reaction

-

Microarray Technology

-

Sanger Sequencing

-

CRISPR/Cas Systems

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global precision genomic testing market size was estimated at USD 15.49 billion in 2024 and is expected to reach USD 17.66 billion in 2025

b. The global precision genomic testing market is expected to grow at a compound annual growth rate of 14.80% from 2025 to 2030 to reach USD 35.20 billion by 2030.

b. North America dominated the market and accounted for a 42.92% share in 2024, by robust participation from key players like Illumina, Thermo Fisher Scientific, and QIAGEN. Innovation in next-generation sequencing (NGS) technologies and bioinformatics is driving market growth, enabling enhanced genomic analysis and personalized medicine applications.

b. Some key players operating in the precision genomic testing market include Danaher, Merck KGaA, Revvity, Inc., Maravai LifeSciences, GenScript, QIAGEN, PacBio, Oxford Nanopore Technologies plc., Illumina, Inc., 10x Genomics, Inc.

b. The demand for precision genomic testing is driven by early disease detection, effective treatment planning, and better management of chronic conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.