- Home

- »

- Network Security

- »

-

Railway Cybersecurity Market Size, Industry Report, 2030GVR Report cover

![Railway Cybersecurity Market Size, Share & Trends Report]()

Railway Cybersecurity Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Security Type, By Type (Infrastructure, On-board), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-589-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Railway Cybersecurity Market Summary

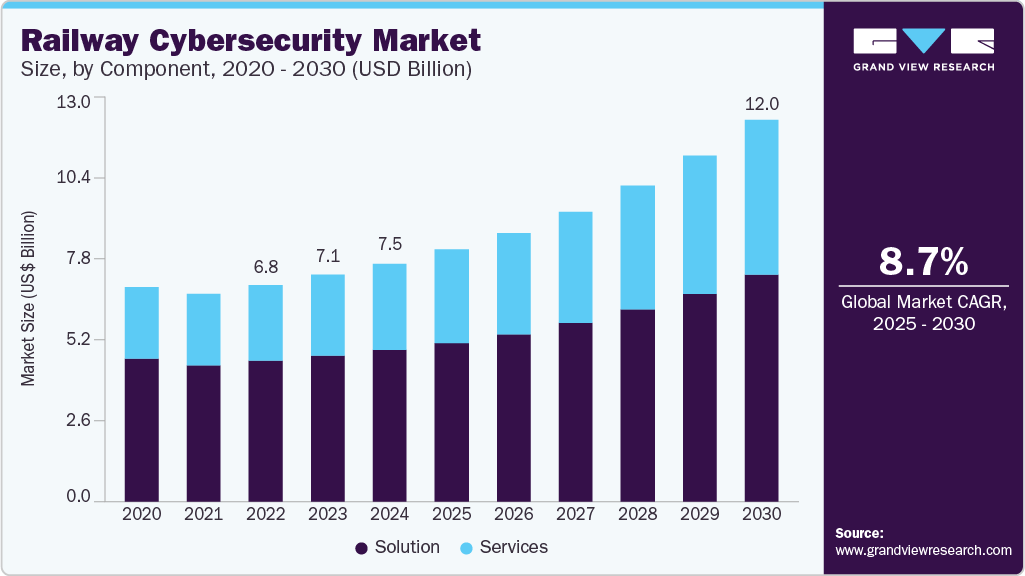

The global railway cybersecurity market size was estimated at USD 7.50 billion in 2024 and is estimated to reach USD 12.04 billion in 2030, growing at a CAGR of 8.7% from 2025 to 2030. The digital transformation of railway systems is driving the railway cybersecurity industry’s growth.

Key Market Trends & Insights

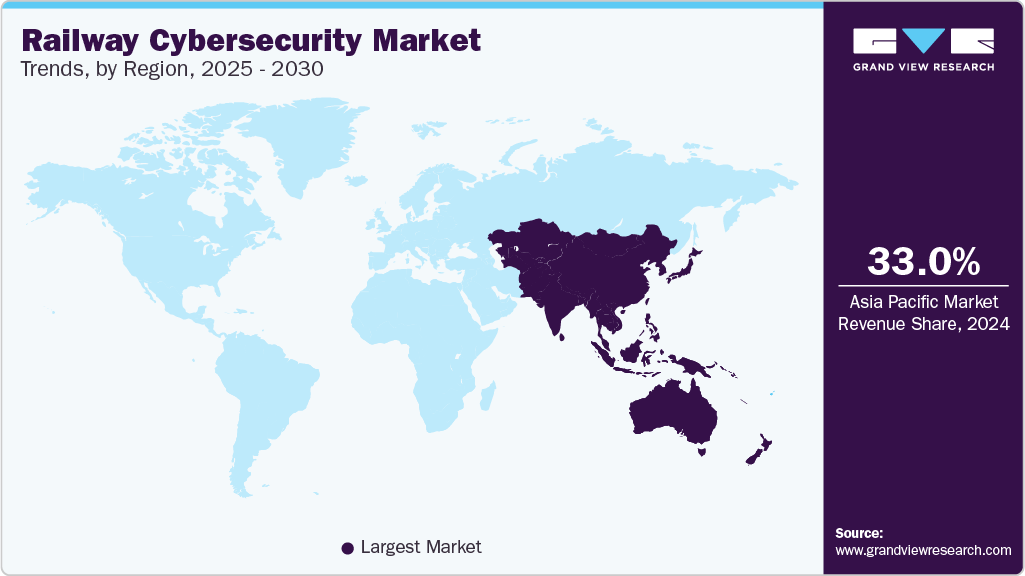

- Asia Pacific held the major share of the railway cybersecurity industry with 33.0% in terms of revenue in 2024.

- The railway cybersecurity industry in India is projected to grow during the forecast period.

- In terms of component, the solution segment accounted for the largest market share of over 63.0% in 2024.

- In terms of security type, the network security segment dominated the market and accounted for a revenue share of over 32.0% in 2024.

- In terms of type, the infrastructure segment dominated the industry and accounted for a revenue share of over 62.0% in 2024

Market Size & Forecast

- 2024 Market Size: USD 7.50 Billion

- 2030 Projected Market Size: USD 12.04 Billion

- CAGR (2025-2030): 8.7%

- Asia Pacific: Largest market in 2024

Modern rail networks rely heavily on information and communication technologies for operations such as traffic control, asset monitoring, scheduling, and passenger information systems. As these systems shift from isolated networks to interconnected digital platforms, they become potential targets for cyber threats. The integration of real-time data and remote operations enhances efficiency but also opens doors to cyber vulnerabilities. As a result, railway companies are investing in cybersecurity solutions that offer intrusion detection, data encryption, access control, and real-time monitoring to secure their digital ecosystems.The increasing frequency and sophistication of cyberattacks targeting critical infrastructure are another major growth driver for the market. Railways, as part of a nation's critical infrastructure, are attractive targets for cybercriminals, hacktivists, and even state-sponsored actors aiming to disrupt public services or cause economic damage. High-profile cyberattacks on transport systems, such as ransomware attacks and malware infiltrations, have highlighted the vulnerabilities in operational technology (OT) environments within the transportation sector. The need to protect signaling systems, ticketing networks, onboard communications, and freight management platforms from unauthorized access is compelling rail operators to adopt comprehensive cybersecurity strategies.

The expansion of smart rail infrastructure and high-speed rail projects is further contributing to the growth of the railway cybersecurity industry. Countries across Asia, Europe, and the Middle East are investing heavily in smart rail and metro systems, equipped with AI-driven analytics, real-time control centers, and autonomous operations. While these technologies improve passenger experience and operational efficiency, they also create new points of vulnerability that cyber threats can exploit. This has led to an increased demand for endpoint security, network segmentation, and threat intelligence solutions within rail systems.

The rise in urban mobility solutions and interconnected transit systems also drives the need for enhanced cybersecurity. As railways integrate with other transportation modes, such as buses, metros, ride-sharing, and digital ticketing platforms, through Mobility-as-a-Service (MaaS) models, the attack surface expands. The seamless connectivity between different systems makes it critical to ensure the confidentiality, integrity, and availability of data across platforms. Cybersecurity solutions that offer identity management, secure API communications, and multi-layered threat protection are thus becoming indispensable for multi-modal transit operators.

Furthermore, growing public awareness and concerns over passenger safety further reinforce the demand for railway cybersecurity. Cyberattacks on rail systems not only pose risks to financial and operational assets but also endanger human lives. A compromised signaling system or train control platform can have catastrophic consequences. As a result, public and stakeholder pressure is mounting on governments and operators to demonstrate proactive cybersecurity planning and preparedness. This, in turn, is prompting rail operators to invest in workforce training, cybersecurity audits, and robust incident response frameworks.

Component Insights

The solution segment accounted for the largest market share of over 63.0% in 2024. The increasing deployment of smart technologies across rail infrastructure is a key driver of the segment growth. From automated signaling to IoT-enabled asset monitoring, today's railways depend on seamless communication between digital components. However, this level of interconnectivity introduces complex vulnerabilities. Railway cybersecurity solutions are being deployed to secure endpoints, manage access controls, and detect anomalous behavior in real time. Solutions like Security Information and Event Management (SIEM) and advanced threat analytics enable operators to identify and mitigate threats before they escalate, ensuring operational reliability and safety.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The growing threat of targeted and sophisticated cyberattacks has spurred demand for advanced managed security services (MSS). Railway companies are increasingly turning to third-party providers to monitor networks 24/7, detect anomalies, respond to incidents, and ensure business continuity. Managed detection and response (MDR), threat intelligence, and incident response services are especially critical in environments where downtime or a security breach can directly impact passenger safety and national infrastructure. These service offerings enable rail operators to proactively defend against evolving cyber threats without overextending internal IT resources.

Security Type Insights

The network security segment dominated the railway cybersecurity market and accounted for a revenue share of over 32.0% in 2024. The rising threat of cyberattacks targeting operational technology (OT) in rail infrastructure is driving network security growth in the market. OT systems that control train movements, track switching, and signaling operations are increasingly integrated with IT systems for efficiency and automation. However, this convergence makes OT networks more vulnerable to cyber threats. Network security tools are being deployed to create secure zones, monitor communication patterns, and prevent unauthorized commands that could disrupt rail services or endanger safety.

The data protection segment is expected to register the fastest CAGR from 2025 to 2030. The expansion of cloud adoption and remote access in rail operations further necessitates robust data protection. As railway systems shift from on-premise platforms to cloud-based environments for functions such as asset tracking, workforce coordination, and AI-powered decision-making, the risk of data exposure grows. Data protection solutions that secure cloud workloads, implement role-based access control, and ensure secure API interactions are becoming critical to safeguarding information exchanged across hybrid environments. In this context, data encryption and tokenization are widely used to mitigate risks associated with cloud data storage and remote access.

Type Insights

The infrastructure segment dominated the railway cybersecurity industry and accounted for a revenue share of over 62.0% in 2024. National security concerns and critical infrastructure protection mandates drive the growth of this segment. Railways are considered vital to the economy and public safety, and cyberattacks on rail infrastructure can have far-reaching consequences, including economic disruption and loss of life. Governments are therefore implementing strict cybersecurity standards for railway infrastructure and requiring risk assessments, security-by-design principles, and continuous monitoring of critical assets. These regulatory frameworks are pushing railway organizations to invest in specialized cybersecurity tools that protect the backbone of their operational infrastructure.

The on-board segment is expected to register the fastest CAGR from 2025 to 2030. The rising demand for connected passenger services, such as internet access, digital ticketing, real-time journey updates, and entertainment systems, is driving market growth. While these features enhance the travel experience, they also introduce new cybersecurity challenges. Public-facing networks can serve as potential entry points for attackers attempting to move laterally to critical systems. To mitigate such threats, railway operators are investing in network segmentation, access control, and endpoint protection on board, ensuring that passenger services remain isolated from core operational systems.

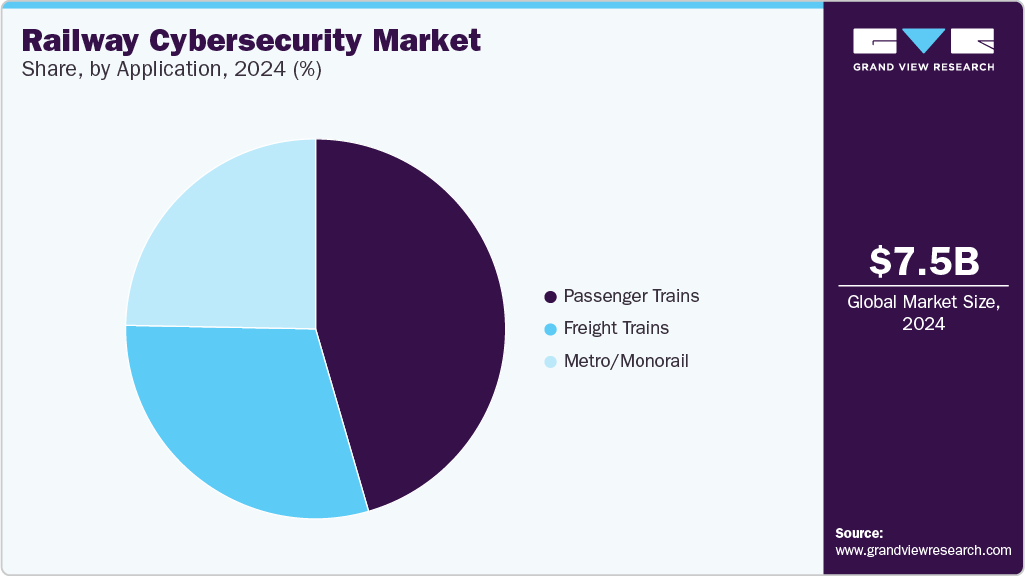

Application Insights

The passenger trains segment accounted for the largest market share of over 45.0% in 2024. The increased provision of passenger services, such as onboard internet access, real-time travel updates, and contactless payments, has also fueled the need for cybersecurity. These services often rely on public or shared networks, which malicious actors can exploit to gain unauthorized access or launch attacks. Moreover, they require the processing and storage of sensitive passenger information, including payment details and personal identification, which must be protected to ensure privacy and compliance with data protection laws. This has led to a rising demand for encryption, authentication, and endpoint protection technologies tailored to the unique environment of passenger rail systems.

The metro/monorail segment is anticipated to register the fastest CAGR of 9.4% during the forecast period. The high level of automation and integration with urban infrastructure is driving the segment's growth. Modern metro and monorail systems often operate using Automatic Train Operation (ATO), Automatic Train Protection (ATP), and Automatic Train Control (ATC) systems. These systems depend on seamless, real-time data exchange between trains, control centers, and wayside infrastructure. A cyberattack on any of these components could lead to service disruptions, delays, or even accidents. As a result, cybersecurity solutions are being implemented to ensure data integrity, authenticate communication, and detect anomalies in control systems.

Regional Insights

Asia Pacific held the major share of the railway cybersecurity industry with 33.0% in terms of revenue in 2024. The massive expansion of urban rail and high-speed rail projects across Asia Pacific is driving the railway cybersecurity market growth. With the rise in urbanization, cities are rapidly scaling up metro, monorail, and commuter train systems that rely on interconnected control and communication systems. These digitally controlled environments are vulnerable to cyberattacks that can disrupt service continuity or compromise passenger safety. As a result, governments and rail operators are increasingly integrating cybersecurity measures into the design and deployment of new infrastructure projects.

India Railway Cybersecurity Market Trends

The railway cybersecurity industry in India is projected to grow during the forecast period. The emergence of digital passenger services is also contributing significantly to the market’s growth. Features such as online ticket booking, mobile ticketing apps, station Wi-Fi, and digital payment systems are widely used by millions of daily commuters. These services process vast amounts of personal and financial data, making them attractive targets for cybercriminals. To maintain user trust and comply with India’s data protection norms, rail operators are increasingly implementing strong data encryption, user authentication protocols, and secure cloud-based infrastructures.

Europe Railway Cybersecurity Market Trends

The railway cybersecurity industry in Europe is expected to grow at a CAGR of 9.0% from 2025 to 2030. European investment in high-speed rail and green mobility is bolstering railway cybersecurity adoption. As the European Union promotes rail as a sustainable alternative to air and road travel under its Green Deal and climate targets, there is significant funding being directed toward expanding and upgrading rail systems. These large-scale infrastructure projects involve heavy use of digital control systems and smart technologies, which in turn require strong cybersecurity measures as an embedded component of planning and deployment.

The railway cybersecurity industry in the UK is grow during the forecast period. The digitalization of the railway signaling system, notably through the rollout of the European Train Control System (ETCS) and the broader Digital Railway Programme, is another key factor. These initiatives are designed to increase capacity, reduce delays, and enable more efficient use of the existing network. However, the move from analogue to digital systems introduces new cybersecurity challenges. Real-time data exchange between trains, trackside equipment, and control centers must be safeguarded from interference, prompting strong demand for secure network infrastructure, encryption technologies, and endpoint protection.

North America Railway Cybersecurity Market Trends

The railway cybersecurity industry in North America is expected to grow at a CAGR of 8.6% from 2025 to 2030. The modernization of freight rail and passenger transit systems is fueling the market growth. Initiatives such as the implementation of Positive Train Control (PTC) systems in the U.S., which rely on wireless data communication to prevent accidents, have introduced new cybersecurity considerations. As railways adopt more advanced systems for automation, predictive maintenance, and real-time analytics, the need for robust cybersecurity frameworks that protect both legacy and next-generation infrastructure becomes increasingly urgent.

The U.S. railway cybersecurity industry is projected to grow during the forecast period. The digitization of passenger services is also influencing the market growth. Many U.S. cities are upgrading their commuter rail and metro systems with features like contactless ticketing, mobile apps, Wi-Fi connectivity, and real-time service updates. These customer-facing services handle sensitive user data and depend on secure digital infrastructure. To prevent potential exploitation of these systems, rail authorities are implementing data protection measures, user authentication protocols, and secure mobile platforms to protect both passengers and back-end systems.

Key Railway Cybersecurity Company Insights

Some of the key companies operating in the market include Thales Group and Siemens Mobility.

-

Thales Group, a French multinational corporation, operates in over 68 countries. The company specializes in designing and manufacturing a wide array of systems and equipment for various sectors, including aerospace, military, and cybersecurity. Thales has been instrumental in providing advanced signaling and automation solutions. The company developed SelTrac, a communications-based train control system widely adopted in urban transit networks. SelTrac enhances operational efficiency and safety by enabling real-time train monitoring and control. Thales' expertise in rail signaling was further solidified through the acquisition of Alcatel's Rail Signalling Solutions division in 2006, expanding its capabilities in transportation-based automation solutions.

-

Siemens Mobility GmbH, a subsidiary of Siemens AG, is a global company specializing in rail transportation solutions. Siemens Mobility has prioritized cybersecurity to protect critical infrastructure from evolving cyber threats. The company adopts a holistic approach, integrating cybersecurity measures across the entire lifecycle of its products and services. This includes the implementation of secure development processes, adherence to international standards, and the deployment of advanced security technologies.

Wabtec Corporation and Cylus are some of the emerging participants in the railway cybersecurity market.

-

Wabtec Corporation is a global provider of equipment, systems, digital solutions, and value-added services for the freight and transit rail industries. Wabtec's diverse portfolio includes rail braking systems, locomotives, propulsion and control systems, and digital intelligence solutions, catering to both freight and passenger transit needs.

Furthermore, Wabtec has expanded its cybersecurity capabilities through strategic acquisitions. In June 2022, the company acquired the ARINC rail solutions business segment from Collins Aerospace, a move that enhanced its cybersecurity offerings for the rail sector. This acquisition enabled Wabtec to integrate advanced cybersecurity services into its portfolio, providing comprehensive solutions to address the growing digital threats facing modern rail systems.

-

Cylus is a cybersecurity company specializing in the protection of railway systems. Cylus's flagship product, CylusOne, is a rail-specific cybersecurity solution designed to safeguard signaling and control networks, both trackside and onboard trains. In February 2024, the company announced that CylusOne became the world's first rail cybersecurity solution to receive the IEC 62443-4-2 certification for Security Level 3. This certification, awarded by Bureau Veritas, underscores the robustness of CylusOne in meeting the stringent cybersecurity requirements for industrial automation and control systems.

Key Railway Cybersecurity Companies:

The following are the leading companies in the railway cybersecurity market. These companies collectively hold the largest market share and dictate industry trends.

- Thales Group

- Siemens Mobility GmbH

- Alstom

- Hitachi Rail

- Nokia Networks

- Huawei Technologies

- Cylus

- Cisco Systems

- IBM Corporation

- Raytheon Technologies

- Fortinet

- ABB

- Toshiba Infrastructure Systems & Solutions

- Wabtec Corporation

- Atos SE

Recent Developments

-

In January 2025, Siemens Mobility has secured four major contracts from HS2 Ltd to support the development and operation of the 225-kilometer high-speed rail line between London and the West Midlands. As part of the Rail Systems Alliance, Siemens will deliver an Engineering Management System for real-time equipment monitoring, partner with Costain Ltd on high-voltage power supply systems, and implement Operational Telecommunications and Security Systems across the HS2 route. The contracts, valued at around USD 755.5 million including long-term maintenance and optional extensions, are set to begin in 2025.

-

In September 2024, Kore.ai signed a partnership agreement with Microsoft. This collaboration combines Kore.ai’s advanced agent platform and tailored business solutions with Microsoft’s scalable infrastructure and AI capabilities, enabling global enterprises to adopt AI rapidly, securely, and at scale. The partnership underscores a shared commitment to delivering flexible, interoperable, and human-centric AI that boosts productivity and redefines the way work is accomplished across organizations.

-

In August 2024, The Government of Kenya partnered with Huawei Technologies to provide training for state officers on Cloud Computing Security. This initiative is part of a broader, long-term collaboration focused on enhancing the skills of government personnel to strengthen their understanding and application of international cybersecurity standards. The training supports Kenya’s National Cybersecurity Strategy, which seeks to reduce cyber threats to critical infrastructure and safeguard sensitive data.

-

In August 2024, Cylus collaborated with RailTel to deploy CylusOne, its specialized cybersecurity solution for the rail industry. This collaboration aims to enhance the cybersecurity of India's railway infrastructure, focusing on signaling systems, both trackside and onboard, as well as SCADA systems. Through this alliance, RailTel and Cylus reaffirm their commitment to strengthening the cybersecurity framework of Indian railways, ensuring the safety, reliability, and resilience of critical railway technologies against evolving cyber threats.

Railway Cybersecurity Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.94 billion

Revenue forecast in 2030

USD 12.04 billion

Growth rate

CAGR of 8.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, security type, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Thales Group; Siemens Mobility; Alstom; Hitachi Rail; Nokia Networks; Huawei Technologies; Cylus; Cisco Systems; IBM Corporation; Raytheon Technologies; Fortinet; ABB; Toshiba Infrastructure Systems & Solutions; Wabtec Corporation; Atos SE

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Railway Cybersecurity Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the railway cybersecurity market report based on component, security type, type, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Risk and Compliance Management

-

Threat Intelligence and Response

-

Identity and Access Management

-

Data Loss Prevention

-

Others

-

-

Services

-

Consulting

-

Support

-

Integration

-

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Security

-

Network Security

-

Data Protection

-

Endpoint Security

-

System Administration

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure

-

On-board

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passenger Trains

-

Freight Trains

-

Metro/Monorail

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global railway cybersecurity market size was estimated at USD 7.50 billion in 2024 and is expected to reach USD 7.94 billion in 2025.

b. The global railway cybersecurity market is expected to grow at a compound annual growth rate of 8.7% from 2025 to 2030 to reach USD 12.04 billion by 2030.

b. The solution segment accounted for the largest market share of over 63.0% in 2024 in the railway cybersecurity market. The increasing deployment of smart technologies across rail infrastructure is a key driver of growth in the solution segment.

b. Some key players operating in the market include Thales Group, Siemens Mobility, Alstom, Hitachi Rail, Nokia Networks, Huawei Technologies, Cylus, Cisco Systems, IBM Corporation, Raytheon Technologies, Fortinet, ABB, Toshiba Infrastructure Systems & Solutions, Wabtec Corporation, Atos SE

b. Factors such the adoption of the digital transformation of railway systems, The increasing frequency and sophistication of cyberattacks targeting critical infrastructure, and The expansion of smart rail infrastructure and high-speed rail projects are anticipated to accelerate the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.