- Home

- »

- Clinical Diagnostics

- »

-

Rapid Pathogen Detection Diagnostics Market Report, 2033GVR Report cover

![Rapid Pathogen Detection Diagnostics Market Size, Share & Trends Report]()

Rapid Pathogen Detection Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Rapid Test Kits, Consumables & Reagents), By Technology (Immunoassays, NAAT), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-815-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rapid Pathogen Detection Diagnostics Market Summary

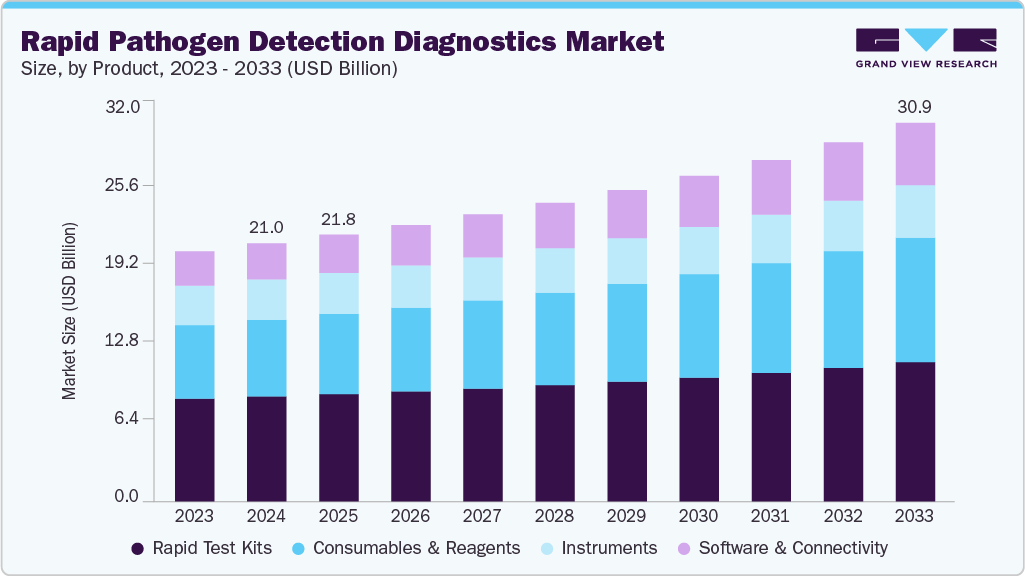

The global rapid pathogen detection diagnostics market size was estimated at USD 21.05 billion in 2024 and is projected to reach USD 30.90 billion by 2033, growing at a CAGR of 4.48% from 2025 to 2033. The growth is driven by growing demand for point-of-care testing, rising awareness and screening programs, as well as increasing product launches and approvals.

Key Market Trends & Insights

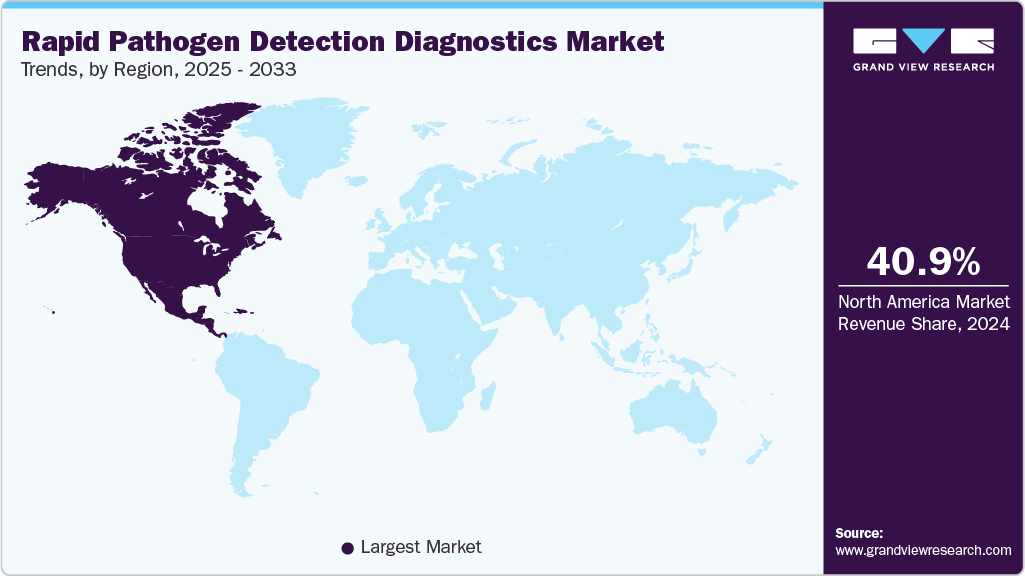

- North America rapid pathogen detection diagnostics market dominated the global market and accounted for the largest revenue share of 40.95% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024

- Based on product, the rapid test kits segment dominated the global market with a 40.67% market share in 2024.

- Based on technology, the nucleic acid amplification tests (NAAT) segment held the largest revenue share of 38.56% in 2024.

- On the basis of application, the clinical diagnostics segment held the largest revenue share of 71.23% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 21.05 Billion

- 2033 Projected Market Size: USD 30.90 Billion

- CAGR (2025-2033): 4.48%

- North America: Largest Market in 2024

The increasing emphasis on early detection and timely intervention in infectious diseases has led healthcare systems to prioritize rapid diagnostic solutions that offer speed, accuracy, and portability. These technologies are becoming essential tools in clinical decision-making, outbreak management, and infection control across hospitals, clinics, and community healthcare settings. For instance, in July 2025, Becton, Dickinson, and Company received U.S. FDA 510(k) clearance for the BD Veritor System for SARS-CoV-2, a digital test designed to detect COVID-19 antigens in symptomatic people in approximately 15 minutes at doctors' offices, urgent care centers, retail clinics, and other convenient points of care.

Moreover, the increasing number of government programs, public health initiatives, and funding efforts aimed at controlling and preventing bacterial diseases are boosting the growth of the rapid pathogen detection diagnostics market. National and international agencies are investing in early detection technologies and point-of-care diagnostic tools to strengthen outbreak preparedness. For instance, in 2024, the WHO announced that, as part of a landmark global health initiative, more than 1.2 million cholera rapid diagnostic test kits were deployed across 14 countries, marking the largest coordinated effort of its kind. This rollout marked the first official implementation of its diagnostic support framework, real-time surveillance, significantly enhancing early detection, and the strategic execution of cholera vaccination campaigns. Thus, the global procurement and distribution program was the result of such collaborative effort among Gavi, WHO, UNICEF, FIND, and other partners committed to strengthening global health security.

Furthermore, the decreasing prices of molecular rapid diagnostic tests for infectious diseases, particularly tuberculosis, are presenting lucrative opportunities for the market. Affordable and accessible diagnostics enable wider adoption in hospitals, clinics, and resource-limited settings, improving early detection and treatment outcomes. For instance, in September 2023, Danaher’s (U.S.) subsidiary, Cepheid, announced a reduction in the price of its primary GeneXpert tuberculosis (TB) diagnostic test, lowering it from USD 9.98 to USD 7.97 in response to pressure from TB advocacy groups. The reduction in diagnostic costs is also facilitating the growth of point-of-care testing in decentralized and rural healthcare settings where laboratory infrastructure remains limited. Affordable diagnostics, coupled with continuous technological advancements like automated sample processing and faster turnaround times, are enabling healthcare providers to provide accurate and timely results, which will ultimately strengthen efforts to monitor and control disease. As a result, the downward trend in molecular test prices is helping to lower the morbidity and mortality of infectious diseases worldwide, in addition to increasing market penetration.

In addition, the demand for point-of-care testing in the market is growing rapidly due to the need for faster, more accessible, and decentralized diagnostic solutions. POC tests enable healthcare providers to deliver immediate results at the patient’s bedside or in remote locations, reducing the time between diagnosis and treatment. Furthermore, the rising prevalence of respiratory diseases such as acute respiratory infections (ARIs) and influenza, is further driving adoption. In January 2025, the WHO reported an advisory, it was reported that ARI and influenza‑like illness (ILI) rates in many Northern Hemisphere countries are currently above seasonal baseline levels, driven by viruses such as Influenza, Respiratory syncytial virus (RSV) and Human metapneumovirus (hMPV). Furthermore, technological advancements in portable molecular and immunoassay-based platforms are making POC testing more reliable and cost-effective, fueling its demand across hospitals, clinics, and community healthcare settings globally.

Market Concentration & Characteristics

The demand for multiplexed, quicker, and more accurate diagnostic solutions is driving significant innovation in the global market for rapid pathogen detection diagnostics. Traditional diagnostics is being revolutionized by emerging technologies like lab-on-a-chip platforms, biosensors, CRISPR-based assays, and microfluidics. Furthermore, integration with artificial intelligence (AI), machine learning, and cloud-based data management enhances real-time disease tracking and outbreak response. Globally, ongoing R&D is making portable point-of-care devices possible while enhancing accessibility, dependability, and quick detection capabilities in community and healthcare settings.

Mergers and acquisitions are highly active in this market as companies seek to strengthen technological expertise, expand product portfolios, and enhance global reach. Strategic acquisitions allow firms to acquire innovative diagnostic platforms, enter emerging markets, and consolidate their position in an increasingly competitive industry. For instance, in January 2023, Biosynex SA of France and Chembio Diagnostics, Inc. finalized a merger agreement in which Biosynex, via a subsidiary, acquired Chembio at USD 0.45 per share. This represented a 27% premium over Chembio’s closing stock price on January 30, 2023, in an all-cash transaction valued at USD 17.2 million. This high level of M&A activity reflects the growing market potential and urgency to provide advanced, rapid, and accurate pathogen detection solutions across hospitals, laboratories, and point-of-care environments.

The industry is moderately impacted by regulations. Regulatory agencies are increasingly implementing quicker review processes for point-of-care and emergency-use diagnostics, even though adherence to strict standards for clinical validation, safety, and quality is crucial. To ensure safe, effective, and dependable diagnostics while preserving speed-to-market for new technologies globally, businesses must strike a balance between innovation and compliance with regulatory requirements, such as cybersecurity, data integrity, and post-market surveillance.

Companies are constantly introducing new automated platforms, multiplex panels, portable devices, and assays. Detecting a broad range of bacterial, fungal, and viral pathogens in clinical, environmental, and point-of-care settings is made possible by expanding product portfolios. Adoption in labs, hospitals, and field applications is improved by ongoing innovation in sensitivity, specificity, and speed. In addition, businesses are concentrating on affordable, easily navigable solutions that promote accessibility and better healthcare outcomes worldwide, which propels expansion and market share.

Regional expansion is a key driver of growth for the market. Companies are entering emerging markets in Africa, Asia-Pacific, and Latin America, where infectious disease prevalence is high, and access to rapid diagnostics is limited. Investments in local distribution networks, government collaborations, and affordable point-of-care solutions support adoption in resource-limited settings. Furthermore, developed regions are experiencing growth due to rising demand for rapid testing in hospitals, clinics, and public health programs. This strategic regional diversification enhances market reach and revenue potential.

Product Insights

On the basis of Product, the rapid test kits segment held the largest share of 40.67% in 2024, driven by increasing product launches, growing consumer awareness, and the rising demand for convenient at-home testing solutions. Furthermore, continuous advancements in rapid diagnostics have made testing faster, more accurate, and widely available. For instance, in September 2024, Mankind Pharma Ltd. (India) launched RAPID NEWS self-test kits, designed to detect dengue, urinary tract infections, addressing important health challenges in India. This launch offers a significant advance in home-based diagnostics, providing individuals with quick, secure, and reliable testing possibilities while also reflecting the broader market trend toward accessible and patient-centered healthcare technologies.

Moreover, the software & connectivity segment is the fastest-growing during the forecast period as digital technologies, data analytics, and cloud-based platforms become more integrated into diagnostic systems. The rising emphasis on real-time data sharing, remote patient monitoring, and integrated healthcare ecosystems is propelling adoption. Advanced software solutions provide smooth data interpretation, automated reporting, and increased diagnostic accuracy, which improves clinical decision-making. Furthermore, growing demand for AI-driven analytics and Internet of Medical Things (IoMT) connectivity is propelling this industry forward, allowing for faster, smarter, and more efficient tests.

Technology Insights

Based on technology, the nucleic acid amplification tests segment represented the largest market share of 38.56% in 2024, owing to the high sensitivity and specificity of NAAT-based assays, the growing prevalence of infectious diseases worldwide, and increasing demand for rapid and accurate molecular diagnostics. For instance, in February 2025, bioMérieux launched GENE‑UP TYPER, an innovative, had specifically targeted Listeria monocytogenes and included ready-to-use reagents and consumables, allowing laboratories to quickly identify contamination sources and prevent future outbreaks.

The others segment is expected to be the fastest-growing segment during the forecast period rapid pathogen detection diagnostics market, due to the rising adoption of CRISPR-based systems for precise, rapid, and cost-effective pathogen detection. CRISPR diagnostics provide great sensitivity and specificity, allowing infections and antibiotic resistance genes to be identified in minutes without the use of complex laboratory equipment. The increasing number of research collaborations, clinical validations, and product launches is fueling market growth. In addition, CRISPR-based tools are gaining popularity for point-of-care and decentralized testing, particularly in low-resource environments.

Application Insights

Based on application, the clinical diagnostics segment accounted for the largest market share of 71.23% in 2024, driven by the approval for the IVDR certification which ensures rapid diagnostic devices meet rigorous European standards for safety, clinical performance, and post-market surveillance. For instance, in October 2025, Gradientech announced that its QuickMIC diagnostic test for ultra-rapid antibiotic susceptibility testing of sepsis samples received official certification under the European Union’s In Vitro Diagnostic Medical Device Regulation (IVDR). The IVDR establishes stricter requirements for clinical performance, safety, and post-market surveillance, replacing the previous European directive for in vitro diagnostics.

Furthermore, the public-health surveillance & outbreak response segment is the fastest-growing segment during the forecast period in the rapid pathogen detection diagnostics market, driven by increasing investments in disease monitoring infrastructure and the rising need for early detection and management of infectious outbreaks. The growing adoption of rapid, point-of-care diagnostic technologies, combined with government initiatives and global health programs, further fueled growth. Real-time data collection and analysis enabled faster decision-making, improved epidemic response, and enhanced preparedness in hospitals, community health centers, and field-deployed testing sites worldwide.

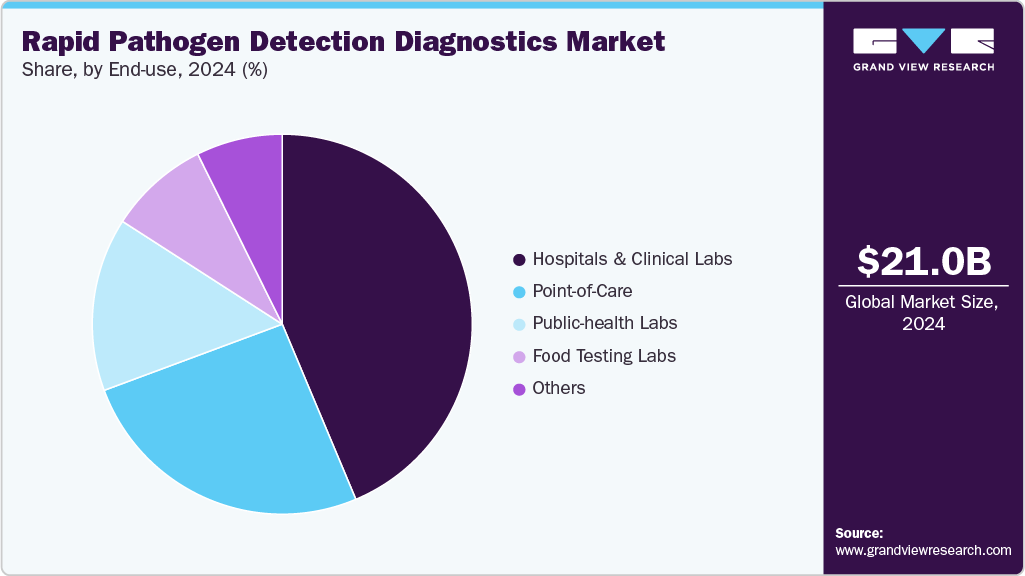

End-use Insights

Hospitals and clinical laboratories dominated the market in 2024, accounting for a 43.67% revenue share, driven by the increasing demand for accurate, fast, and high-throughput diagnostic solutions to manage infectious diseases. The growing prevalence of hospital-acquired infections, rising patient admissions, and the need for early detection to guide timely treatment have further boosted adoption. According to the Medscape study in June 2024, U.S. hospitals found that HAIs associated with antimicrobial-resistant organisms increased by 32% during the COVID-19 pandemic and remained 13% higher than pre-pandemic levels. In addition, advancements in molecular diagnostic technologies and automation have enhanced testing efficiency, reinforcing hospitals and laboratories as key end users in this market.

The public-health labs segment is expected to witness the fastest growth during the forecast period, driven by increasing investments in disease surveillance, outbreak preparedness, and antimicrobial resistance (AMR) monitoring. Following the COVID-19 pandemic, many governments have expanded their diagnostic infrastructure to enable faster, decentralized detection of emerging pathogens, boosting the adoption of advanced molecular and biosensor-based platforms. Public-health labs play a critical role in early detection and containment of infectious diseases through nationwide testing programs and environmental monitoring initiatives. The integration of rapid nucleic acid amplification tests (NAATs), next-generation sequencing (NGS), and automated data-sharing systems has enhanced real-time pathogen tracking and response.

Regional Insights

The North America rapid pathogen detection diagnostics market held the largest share in 2024, driven by the strong presence of major diagnostic manufacturers, advanced healthcare infrastructure, and supportive regulatory frameworks by agencies such as the U.S. FDA. A significant factor boosting market growth was the surge in availability and adoption of at-home over the counter COVID-19 diagnostic tests, which allowed individuals to self-test quickly and safely without visiting a laboratory. These rapid diagnostics, providing results within minutes, improved disease surveillance and public health response, particularly during outbreaks. Key FDA-authorized tests include:

Key FDA-Authorized At-Home OTC COVID-19 Diagnostic Tests Driving the North American Rapid Pathogen Detection Market

S. No

Manufacturer

Test Name

Test Type / Method

Time to Result

Key Features

1 Abbott Diagnostics Scarborough, Inc.

BinaxNOW COVID-19 Antigen Self Test

Antigen, Nasal Swab

15 minutes

FDA-authorized OTC test; no prescription needed; suitable for symptomatic & asymptomatic users

2 ACON Laboratories, Inc.

Flowflex COVID-19 Antigen Home Test

Antigen, Nasal Swab

15 minutes

Easy self-use test; smartphone optional; shelf life up to 24 months

3 Access Bio, Inc.

CareStart COVID-19 Antigen Home Test

Antigen, Nasal Swab

10 minutes

OTC self-test; alternate branding as On/Go COVID-19 Self-Test

4 Aptitude Medical Systems, Inc.

Metrix COVID/Flu Test

Molecular (NAAT), Nasal/Saliva

20 minutes

Detects COVID-19 and Flu A/B; requires Metrix Reader device

5 Advin Biotech, Inc.

Advin COVID-19 Antigen Test @Home

Antigen, Nasal Swab

15-30 minutes

Extended shelf life; suitable for self-testing by individuals aged 14+ years

Source: U.S. Food Drug and Administration

U.S. Rapid Pathogen Detection Diagnostics Market Trends

The U.S. rapid pathogen detection diagnostics market is expanding steadily, driven by the increasing prevalence of infectious diseases, growing demand for rapid and accurate diagnostic tools, advancements in molecular and immunoassay technologies, and the adoption of at-home and point-of-care testing solutions. The high incidence of respiratory pathogens has further fueled the need for faster detection methods. For instance, during the 2024-25 influenza season, clinical laboratories reporting to the CDC tested 3,978,954 respiratory specimens for influenza viruses using clinical diagnostic tests. Among these, 489,579 (12.3%) tested positive, including 434,985 (88.8%) for influenza A and 54,594 (11.2%) for influenza B viruses. Peak activity was observed at the week ending February 2025, representing the highest weekly percentage of positive influenza tests in the past nine seasons, underscoring the critical role of rapid pathogen detection diagnostics in timely outbreak management.

Europe Rapid Pathogen Detection Diagnostics Market Trends

The rapid pathogen detection diagnostics market in Europe is expected to grow steadily over the forecast period, driven by rising infectious disease prevalence, increased demand for rapid and accurate diagnostic solutions, and increased use of point-of-care testing. Furthermore, supportive government initiatives, investments in healthcare infrastructure, and stringent regulatory frameworks such as the In Vitro Diagnostic Regulation (IVDR) are encouraging innovation and product development, accelerating market expansion across hospitals, clinical laboratories, and decentralized testing settings across the region.

The UK rapid pathogen detection diagnostics market is expanding rapidly, driven by rising demand for quick and accurate diagnostic solutions and growing usage of genomic technologies for public health surveillance. For instance, in January 2025, the UK Health Security Agency (UKHSA) started the world's first metagenomics Surveillance Collaboration and Analysis Programme (mSCAPE), with an objective of increasing health security through quick pathogen detection. The programme, developed in collaboration with NHS and academic partners including the University of Birmingham, University of Edinburgh, and the NHS Clinical Respiratory Metagenomics Network, pilots the use of metagenomic data for pathogen analysis, reinforcing the UK’s capacity for early disease detection and public health preparedness.

The rapid pathogen detection diagnostics market in Germany is mainly fueled by a strong emphasis on early detection and management of infectious diseases, increasing investments in advanced healthcare infrastructure, and growing adoption of point-of-care and molecular diagnostic technologies. In addition, supportive government initiatives, high healthcare expenditure, and robust R&D activities in the country drive innovation in rapid diagnostic solutions. Further, rising awareness among clinicians and patients about the benefits of timely pathogen detection further accelerates market growth, positioning Germany as a leading market in Europe for rapid diagnostic technologies.

Asia Pacific Rapid Pathogen Detection Diagnostics Market Trends

The rapid pathogen detection diagnostics market in Asia Pacific is experiencing significant growth, owing to rising infectious disease prevalence, increased government initiatives to strengthen healthcare infrastructure, and growing adoption of advanced molecular and point-of-care diagnostic technologies. The Mahidol-Oxford Tropical Medicine Research Unit (MORU), Chiang Mai University, Vidyasirimedhi Institute of Science and Technology (VISTEC), and the Wellcome Sanger Institute developed a novel quick test for melioidosis in April 2024 that can diagnose patients in hours rather than days. The test uses a CRISPR-Cas12a system (CRISPR-BP34) to detect Burkholderia pseudomallei with 93% sensitivity, allowing patients to obtain life-saving medications faster. Moreover, published in Lancet Microbe, this rapid, easy-to-use diagnostic highlights the potential to save lives across Asia and the tropics, reinforcing the region’s focus on faster and more accurate pathogen detection.

The Japan rapid pathogen detection diagnostics market is driven by the rising prevalence of infectious diseases, increasing demand for rapid and accurate diagnostic solutions, ongoing technological advancements in molecular and immunoassay platforms, and greater adoption of point‑of‑care testing in hospitals, clinics, and community health centers. Timely pathogen detection has become particularly crucial in response to public‑health emergencies. For instance, Japan is experiencing a record pertussis outbreak in 2025 which is increasing the demand for the rapid diagnostic tests. In August 2025, Japan Institute for Health Security (JIHS), a total of 72,448 pertussis cases were reported across all 47 prefectures, with Tokyo (5,846), Niigata (3,496), and Saitama (3,857) reporting the highest counts. The outbreak emphasizes the importance of rapid diagnostic testing, especially for at-risk populations such as pregnant women and infants, in order to provide timely treatment and avoid further transmission.

The rapid pathogen detection diagnostics market in China is expanding rapidly, owing to the rising prevalence of infectious diseases, increased demand for rapid and accurate diagnostic solutions, increased adoption of point-of-care testing platforms, and strengthened government-led disease surveillance efforts. For instance, in May 2025, research reported that COVID-19 testing demand had increased in Hong Kong and China due to rising case numbers. Authorities predict that this wave will match last year's summer peak. This heightened testing requirement emphasizes significant market opportunities for diagnostic kit producers and service providers in the region.

Latin America Rapid Pathogen Detection Diagnostics Market Trends

The rapid pathogen detection diagnostics market in Latin America is steadily expanding, owing to increased investments in healthcare infrastructure, rising adoption of molecular and point-of-care diagnostic technologies, and growing government initiatives to improve infectious disease management. For instance, in June 2025, Colombia's National Institute of Health (INS) issued technical guidelines for using quick diagnostic tests to detect antibodies against Trypanosoma cruzi, the parasite that causes Chagas disease. These suggestions, released on May 21, aim to assist healthcare providers in diagnosing patients early, thereby speeding access to life-saving medicines. This effort, created with technical assistance from the non-profit Drugs for Neglected Diseases initiative (DNDi), emphasizes the region's focus on increasing quick pathogen identification to enhance public health outcomes.

The Brazil rapid pathogen detection diagnostics market is growing steadily, owing to increased investments in public health innovation, rising infectious disease prevalence, and government-led measures to expand diagnostic capability. In recent years, Brazil has achieved significant strides in eliminating sexually transmitted illnesses, particularly syphilis. For instance, in 2022, the Laboratory for Technological Innovation in Health (LAIS/UFRN) collaborated with Johns Hopkins University and the University of Coimbra to develop a new quick syphilis diagnostic test. This innovation, part of the ongoing "Syphilis No" Project, improves early detection and affordability for use in Brazil's primary healthcare network.

Further advancing these efforts, the Brazilian Federal District's Western Region established an evidence-based management strategy in December 2024 under the program "Eliminating congenital syphilis," which successfully reduced congenital syphilis cases by 37% in two years. These combined measures represent Brazil's expanding emphasis on rapid pathogen detection technology, which is being backed by government action, academia research, and public health collaborations, all of which are projected to fuel market growth during the forecast period.

Middle East & Africa Rapid Pathogen Detection Diagnostics Market Trends

The rapid pathogen detection diagnostics market in the Middle East and Africa is experiencing comparatively slower growth due to challenges such as limited healthcare infrastructure in rural areas, inadequate laboratory facilities, low awareness of rapid diagnostic technologies, and regulatory hurdles that slow product approvals. However, the market is being driven by increased government initiatives to control infectious diseases, rising prevalence of pathogens such as influenza, COVID-19, and antibiotic-resistant bacteria, growing investments in modern diagnostic laboratories, and the adoption of portable point-of-care testing solutions that allow for faster disease detection and better patient outcomes.

Saudi Arabia rapid pathogen detection diagnostics market is driven by rising infectious disease prevalence, demand for fast and accurate diagnostics, adoption of advanced molecular and point-of-care technologies, and private sector investment in diagnostic infrastructure. Leading worldwide companies including Roche Diagnostics, Abbott Laboratories, Bio-Rad Laboratories, and Thermo Fisher Scientific are expanding their presence in Saudi Arabia through local alliances, improved distribution networks, and innovative product introductions.

The UAE rapid pathogen detection diagnostics market is expanding rapidly, owing to breakthroughs in biotechnology, greater government support for healthcare innovation, and a growing demand for speedy, reliable illness testing. In 2025, scientists at New York University Abu Dhabi (NYUAD) reached an important milestone by developing the Radially Compartmentalized Paper Chip (RCP-Chip), a paper-based diagnostic tool that diagnoses infectious diseases in under 10 minutes and does not require laboratory equipment. Furthermore, this innovation, reported in June 2025, shows the UAE's leadership in medical technology and its emphasis on portable, inexpensive, and high-precision diagnostics, particularly for use in distant or low-resource settings. Such advancements, together with government health programs and increased investment in research, are moving the country's quick testing and diagnostics business into a new era of accessible, efficient, and scalable disease detection.

Key Rapid Pathogen Detection Diagnostics Companies Insights

Key players operating in the rapid pathogen detection diagnostics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Rapid Pathogen Detection Diagnostics Companies:

The following are the leading companies in the rapid pathogen detection diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Danaher Corporation

- BD

- QIAGEN

- Siemens Healthineers AG

- PerkinElmer

- Illumina, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Eurofins Scientific

- Charles River Laboratories

- DiaSorin S.p.A.

Recent Developments

-

In July 2025, Neogen Corporation launched the molecular detection Assay, Listeria Right Now, a rapid, enrichment-free solution for detecting Listeria species in environmental samples. Further, without requiring advanced laboratory infrastructure, the system allowed for quicker sanitation decisions by producing results in about two hours. It streamlined workflow and enhanced testing consistency by combining an inventive reagent system with an easy-to-use surface swab device.

-

In May 2025, Eurofins Viracor (U.S.) launched quantitative real-time PCR testing for rapid and accurate detection of life-threatening dimorphic fungi. These advanced molecular tests are intended to provide clinicians with timely and reliable diagnostic information, allowing for rapid and targeted treatment of potentially fatal fungal infections.

-

In February 2025, the Institut Pasteur and AlterDiag announced the signing of a strategic partnership focused on the R&D of next-generation rapid diagnostic technologies. Through this long-term partnership, both organizations carried out R&D projects to create new rapid diagnostic tests based on single-domain antibodies using lateral flow immunochromatography, aiming to reinforce efforts in combating infectious diseases.

-

In December 2024, Thermo Fisher Scientific, Inc. (U.S.) received FDA 510(k) approval for the TaqPath COVID-19 Diagnostic PCR Kit, which allows clinical and public health laboratories to use a validated in vitro diagnostic workflow for SARS-CoV-2 detection. The kit's multi-gene target design (ORF1ab, N, S) ensures reliable SARS-CoV-2 detection, proven performance based on over one billion EUA tests, 510(k) clearance, and PCR results in only three hours, allowing for timely and accurate clinical decisions.

Rapid Pathogen Detection Diagnostics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 21.77 billion

Revenue forecast in 2033

USD 30.90 billion

Growth rate

CAGR of 4.48% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; BIOMÉRIEUX; Danaher Corporation; BD; QIAGEN; Siemens Healthineers AG; PerkinElmer; Illumina, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Eurofins Scientific; Charles River Laboratories; DiaSorin S.p.A.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rapid Pathogen Detection Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rapid pathogen detection diagnostics market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Rapid Test Kits

-

Consumables & Reagents

-

Software & Connectivity

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Immunoassays

-

Nucleic Acid Amplification Tests (NAAT)

-

Next-Generation Sequencing & Rapid Genotyping

-

Biosensors, Microfluidics & Lab-on-Chip

-

Others (CRISPR)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical Diagnostics

-

Respiratory Infections

-

Sexually Transmitted Infections (STIs)

-

Bloodborne & Hepatic Infections

-

Gastrointestinal Pathogens

-

Tropical & Vector-Borne Diseases

-

Others

-

-

Public-health Surveillance & Outbreak Response

-

Food Safety & Environmental Monitoring

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinical Labs

-

Point-of-Care

-

Public-health Labs

-

Food Testing Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.