- Home

- »

- Biotechnology

- »

-

Research Antibodies Market Size And Share Report, 2030GVR Report cover

![Research Antibodies Market Size, Share & Trend Report]()

Research Antibodies Market Size, Share & Trend Analysis Report By Product (Primary Antibodies), By Type (Monoclonal Antibodies), By Technology, By Source, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-124-5

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Research Antibodies Market Size & Trends

The global research antibodies market size was valued at USD 1.59 billion in 2023 and is expected to grow at compound annual growth rate (CAGR) of 4.76% from 2024 to 2030. B cells are responsible for producing antibodies, which are essential components of the human immune system. These molecules are ideal probes for studying cells since they can attach themselves to particular molecules and can be employed to separate or identify important chemicals found in cells. These attributes of antibodies are anticipated to drive their adoption in various research applications in the near future. The outbreak of COVID-19 has created lucrative opportunities in the research antibodies market. Several leading pharmaceutical companies are investing heavily in R&D to create brand-new vaccinations, treatments, and testing tools for this pandemic.

The need for research antibodies has greatly increased as a result of these intense R&D operations for the development of novel vaccination and therapy techniques. Additionally, a number of public and commercial entities are making significant efforts to fund the development of COVID-19 vaccines and therapeutics. For instance, in April 2020, Emergent BioSolutions, a biopharmaceutical company, received USD 14.5 million from the federal government to work on an antibody therapy study for COVID-19.

In addition, antibodies are currently one of the most crucial tools for research projects exploring the functions of various proteins in cells. The prevalence of neurodegenerative conditions including Huntington's disease, Multiple Sclerosis, and Parkinson's disease is fueling research prospects aimed at better understanding of such diseases. Furthermore, the increase in geriatric population and a dearth of remedies for chronic diseases have also contributed to a sharp increase in demand for research antibodies to create customized medicines, cutting-edge pharmaceuticals, and novel & effective treatments.

One of the key reasons fueling the growth of the market for research antibodies is the increase in demand for high-quality antibodies for reproducible research. The market is also witnessing growth due to the expanding landscape of proteomics and genomics research as well as increased research and development efforts in the life sciences domain. Furthermore, the market is also influenced by the rise of industry-academia partnerships as well as the expanding stem cell research and neurobiology research fields to provide for the unmet medical needs across the globe.

In addition, an increase in funding for research initiatives from for-profit and nonprofit groups, as well as rising focus on biomarker development and outsourcing interests is driving the market growth. Moreover, the growing demand for protein therapies and personalized medicine are opening new market opportunities and present lucrative growth prospects for the research antibodies market players over the forecast period. For instance, in 2021, Thermo Fisher acquired PPD, extending its value proposition for pharmaceutical and biotechnology clients with the addition of PPD's top clinical research services. Such endeavors by biotechnology corporations are anticipated to boost the market growth.

Market Concentration & Characteristics

The market growth stage is low, and pace of the market growth is accelerating. The market is witnessing increasing investments in the development of novel research-use only (RUO) antibodies. Furthermore, with the rise in demand for innovative research-use only products for application areas such as flow cytometry, cell signaling, epigenetics, etc., research antibodies are expected to witness significant growth in near future.

Key innovations in the market are driving advancements in specificity, sensitivity, and multiplexing capabilities of research antibodies. Novel technologies are enhancing antibody performance and enable researchers to explore complex biological processes which is likely to contribute towards market growth.

Several key players are undertaking mergers and acquisitions in this industry to maintain their market presence. For instance, in December 2023, Danaher acquired Abcam for USD 5.7 billion to strengthen its product portfolio and increase customer reach. Such strategies are anticipated to drive the growth of research antibodies market over the forecast period.

Regulations in this market include guidelines for enhancing data reproducibility and trust in experimental outcomes. However, navigating complex regulatory landscapes can pose challenges for companies, impacting product development timelines and costs in research and development activities.

The market has moderate to high levels of product and regional expansion. Increasing availability of product offerings, such as primary and secondary antibodies, across various geographies is enhancing experimental flexibility and accuracy. This expansion is anticipated to propel scientific discoveries by providing researchers with a more comprehensive range of tools for varied applications.

Product Insights

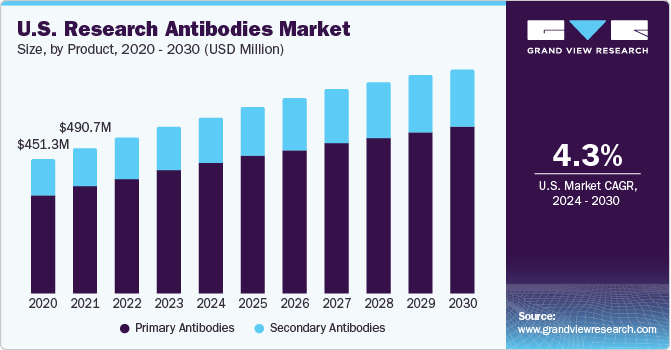

The primary antibodies segment captured the highest revenue share of 74.46% in 2023, and is also projected to grow at the fastest rate throughout the forecast period. This can be attributed to increasing availability of primary antibodies using rabbit, mouse, goat, and other species as host, and the wide range of utility offered by such antibodies for applications in the R&D space. Also, owing to the usage of primary antibodies for frequently performed laboratory procedures, such as staining and imaging, the segment is predicted to grow at an exponential rate.

The secondary antibodies segment is expected to grow at a significant CAGR from 2024 to 2030 as these are more convenient and cost-effective to develop. Demand for secondary research antibodies is also anticipated to increase due to the availability of ready-to-use conjugated antibodies that can improve product development activities by assisting in the identification, grouping, and purification of targeted antigens. For instance, Thermo Fisher Scientific, Inc. provides fluorescent dye-conjugated secondary antibodies that make it easier to identify proteins in a variety of applications, including immunohistochemistry, western blotting, and fluorescent cell imaging, among others.

Type Insights

Monoclonal antibodies segment accounted for the dominant share of the market in 2023, due to a sharp increase in the number of cancer research projects that demand high specificity antibodies. As monoclonal antibodies can efficiently adhere to or block antigens on cancer cells, these are employed in the identification and development of new medicines for various cancer types. This factor is expected to expand the growth prospects for the segment in the near future.

Polyclonal antibodies are projected to grow at lucrative CAGR over the forecast period as these antibody structures are essential for the research aspects focusing on purification of antigens and examination of histopathological tissue. Furthermore, polyclonal antibodies provide benefits like stability, practical storage methods, strong affinity, and excellent compatibility for ELISA and western blotting technologies, thereby propelling the market growth.

Technology Insights

Western blotting segment accounted for the largest market share in 2023, due to the widespread availability and adoption of the technique. In addition, due to the increased accuracy that the western blotting technique offers, it is typically chosen over alternative technologies for applications involving the detection of important protein entities. These attributes are expected to positively affect the segment growth.

Immunohistochemistry segment is projected to grow at the fastest CAGR from 2024 to 2030. The segment is anticipated to expand steadily due to its significant applications in detection of enzymes, antigens, tumor suppressor genes, and tumor cell growth for cell-based research. Additionally, rising R&D spending and a high level of scientific awareness regarding the technique have led to increasing growth prospects for immunohistochemistry. Furthermore, benefits provided by the technique, such as high sensitivity & simplicity of use, are some of the factors anticipated to drive the market growth.

Source Insights

The rabbit source segment held the largest market share in 2023. Rabbits are extensively used for antibody production, owing to several advantages such as higher affinity antibodies provided by rabbits as compared to those obtained from other animal hosts. Furthermore, higher specificity provided by these antibodies makes them ideal for detection of small molecules, hormones, toxins and other biologically important substances.

Mouse source segment is anticipated to witness the fastest CAGR from 2024 to 2030. Mice have been predominantly used in production of antibodies due their high reproduction rate and smaller size. Furthermore, the main factor influencing their widespread use is the structural similarity between mouse and human antibodies, which can significantly drive their adoption for R&D applications.

Application Insights

Oncology segment accounted for the largest market share in 2023, owing to rise in prevalence of cancer in key geographies. According to the American Cancer Society, in 2021, over 1.9 million new cancer cases were estimated to be recorded in the U.S. Additionally, over 608,570 cancer deaths were also recorded in the same year in the U.S. As a result, more research antibodies will likely be used for designing and evaluation of new diagnostic and therapeutic approaches for mitigation of cancer.

Stem cells segment is expected to witness the fastest CAGR from 2024 to 2030 owing to increase in number of stem cell research activities globally. The growth is also attributable to increase in adoption of stem cells for the treatment of a wide range of chronic ailments such as diabetes, cancer, Alzheimer’s, Parkinson’s, rheumatoid arthritis, and kidney and lung diseases. Furthermore, antibodies are also used for stem cell research areas that include disease modeling, developmental biology, drug screening, reprogramming techniques development, and cell therapy that can positively affect the market growth.

End-use Insights

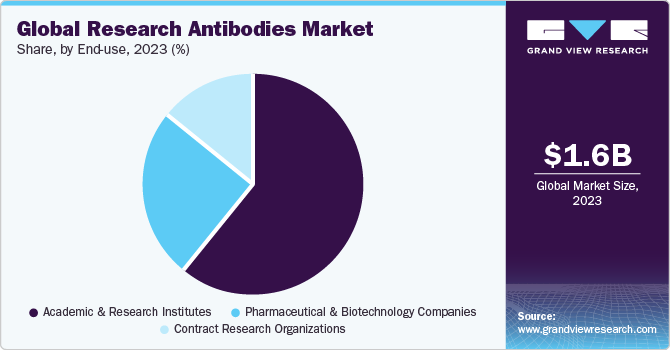

The academic & research institutions segment captured the highest revenue share in 2023 and is projected to grow at the fastest growth rate throughout the forecast period. This can be attributed to the increase in scientific initiatives by such centers for development of novel therapies and tests for chronic diseases. For instance, in January 2021, researchers at The University of Texas Medical Branch at Galveston (UTMB Health) and The University of Texas Health Science Center at Houston (UTHealth) discovered two novel antibodies CoV2-06 and CoV2-14 for a potential novel antibody therapy for COVID-19 infection. Such initiatives can positively affect the segment growth in the near future.

Pharmaceutical and biotechnology companies end-use segment is expected to grow at a significant CAGR over the forecast period due to the increase in R&D activities in life sciences domain. Furthermore, the increasing importance of antibodies for development of novel biologic products and rising demand for quality control applications for various techniques, such as PCR and electrophoresis, are likely to boost the segment growth.

Regional Insights

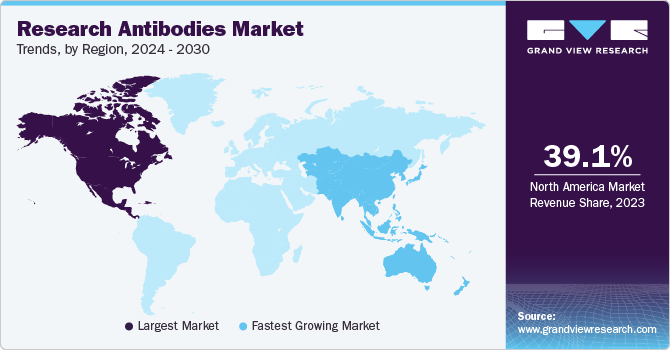

North America dominated the market in 2023 by capturing the largest revenue share of 39.15%. Growing emphasis on biomedical, stem cells, as well as cancer research, is a major contributor to its large market share. Presence of key players such as Thermo Fisher Scientific, Inc. and PerkinElmer, Inc. among others and increasing number of biotechnology & biopharmaceutical firms in the region that focus on life sciences innovation are expected to drive the market growth.

The market in the Asia Pacific region is expected to grow at the fastest CAGR from 2024 to 2030 due to an increase in collaborative activities among academic institutions. For instance, scientists from Tsinghua University, China Medical University, and the Vaccine Research Center at the NIH are currently conducting a research study on the identification and characterization of HIV-1 strains as well as their robust and widespread resistance to a variety of neutralizing antibodies. The National Natural Science Foundation Award, China's Ministry of Science and Technology, and Gates Foundation Grand Challenges China all supported this project. As a result, such government-funded scientific activities in the region are anticipated to drive the market growth.

Key Companies & Market Share Insights

Key players in this market are undertaking various strategic initiatives such as mergers, acquisitions, and collaborations to strengthen their market position and enhance their offerings across various geographical region. Strategic activities related to new product launch are also prominent in this market.

Key Research Antibodies Companies:

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson ImmunoResearch Inc.

Recent Developments

-

In July 2023, Bio-Techne Corporation announced the completion of acquisition of Lunaphore. The intent of this business decision was to augment the companies’ spatial biology leadership in the fields of translational and clinical research.

-

In June 2023, Cell Signaling Technology (CST) announced its partnership with Lunaphore. This initiative was aimed at enabling the deployment of CST antibodies on the COMET platform by Lunaphore for strengthening fully-automated spatial biology.

-

In April 2023, Abcam teamed up with Lunaphore to co-commercialize primary antibodies from Abcam. These antibodies were precisely validated for use on the COMET platform by Lunaphore.

-

In February 2023, Cell Signaling Technology entered into a partnership with Bio-Techne. This deal was aimed at the inclusion of Bio-Techne’s Simple Western validation to CST antibodies.

-

In March 2022, Sysmex America, Inc., expanded its reagents portfolio for single-color antibodies, cell stains and buffering solutions and introduced several new products in this domain.

Research Antibodies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.68 billion

Revenue forecast in 2030

USD 2.21 billion

Growth rate

CAGR of 4.76% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, source, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abcam Plc; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; PerkinElmer, Inc.; Becton; Dickinson and Company; Bio-Techne Corporation; Proteintech Group, Inc.; Jackson ImmunoResearch Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Research Antibodies Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global research antibodies on the basis of product, type, technology, source, application, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary Antibodies

-

Secondary Antibodies

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Immunohistochemistry

-

Immunofluorescence

-

Western Blotting

-

Flow Cytometry

-

Immunoprecipitation

-

ELISA

-

Others

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mouse

-

Rabbit

-

Goat

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infectious Diseases

-

Immunology

-

Oncology

-

Stem Cells

-

Neurobiology

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academic & Research Institutes

-

Contract Research Organizations

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Primary antibodies dominated the research antibodies market with a share of 74.5% in 2022. This is attributable to high adoption due to benefits such as easy availability, greater specificity, and suitability to various research needs.

b. Some key players operating in the research antibodies market include PerkinElmer, Inc.; F.Hoffmann La Roche Ltd.; Thermo Fisher Scientific; Merck Millipore; Bio-Rad Laboratories; Abcam PLC; BD; Lonza Group; Cell Signalling Technology, Inc.; and Agilent Technologies.

b. Key factors that are driving the research antibodies market growth include a rise in the number of R&D activities by various biopharmaceutical and pharmaceutical companies and increasing incidence of neurodegenerative diseases such as Huntington’s disease, Multiple Sclerosis, and Parkinson’s disease.

b. The global research antibodies market size was estimated at USD 1.5 billion in 2022 and is expected to reach USD 1.59 billion in 2023.

b. The global research antibodies market is expected to grow at a compound annual growth rate of 4.76% from 2023 to 2030 to reach USD 2.21 billion by 2030.

Table of Contents

Chapter 1. Research Antibodies Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product Segment

1.1.2. Type Segment

1.1.3. Technology Segment

1.1.4. Source Segment

1.1.5. Application Segment

1.1.6. End-use Segment

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources

1.3.4. Primary Research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List Of Secondary Sources

1.8. List Of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Research Antibodies Market: Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Research Antibodies Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing Investment In R&D

3.2.1.2. Growing Stem Cells and Neurobiology Research

3.2.1.3. Increase In Research Academies and Industry Collaborations

3.2.1.4. Rise In the Availability of Technologically Advanced Products

3.2.1.5. Rise In Proteomics and Genomics Research

3.2.2. Market Restraint and Challenges Analysis

3.2.2.1. Uncertain Government Regulations

3.2.2.2. Quality Concerns Associated with Research Antibodies and Time- & Cost-Intensive Process Of Antibody Development

3.2.3. Market Opportunities Analysis

3.2.3.1. Growing Demand for Personalized Medicine and Rising Focus on Biomarker Discovery

3.2.3.2. Increasing Opportunities In Various Emerging Markets

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

3.4. Pricing Analysis

Chapter 4. Product Business Analysis

4.1. Research Antibodies Market: Product Movement Analysis

4.2. Primary Antibodies

4.2.1. Primary Antibodies Market, 2018 - 2030 (USD Billion)

4.3. Secondary Antibodies

4.3.1. Secondary Antibodies Market, 2018 - 2030 (USD Billion)

Chapter 5. Type Business Analysis

5.1. Research Antibodies Market: Type Movement Analysis

5.2. Monoclonal Antibodies

5.2.1. Monoclonal Antibodies Market, 2018 - 2030 (USD Billion)

5.3. Polyclonal Antibodies

5.3.1. Polyclonal Antibodies Market, 2018 - 2030 (USD Billion)

Chapter 6. Technology Business Analysis

6.1. Research Antibodies Market: Technology Movement Analysis

6.2. Immunohistochemistry

6.2.1. Immunohistochemistry Market, 2018 - 2030 (USD Billion)

6.3. Immunofluorescence

6.3.1. Immunofluorescence Market, 2018 - 2030 (USD Billion)

6.4. Western Blotting

6.4.1. Western Blotting Market, 2018 - 2030 (USD Billion)

6.5. Flow Cytometry

6.5.1. Flow Cytometry Market, 2018 - 2030 (USD Billion)

6.6. Immunoprecipitation

6.6.1. Immunoprecipitation Market, 2018 - 2030 (USD Billion)

6.7. ELISA

6.7.1. ELISA Market, 2018 - 2030 (USD Billion)

6.8. Others

6.8.1. Other Technologies Market, 2018 - 2030 (USD Billion)

Chapter 7. Source Business Analysis

7.1. Research Antibodies Market: Source Movement Analysis

7.2. Mouse

7.2.1. Mouse Market, 2018 - 2030 (USD Billion)

7.3. Rabbit

7.3.1. Rabbit Market, 2018 - 2030 (USD Billion)

7.4. Goat

7.4.1. Goat Market, 2018 - 2030 (USD Billion)

7.5. Others

7.5.1. Other Sources Market, 2018 - 2030 (USD Billion)

Chapter 8. Application Business Analysis

8.1. Research Antibodies Market: Application Movement Analysis

8.2. Infectious Diseases

8.2.1. Infectious Diseases Market, 2018 - 2030 (USD Billion)

8.3. Immunology

8.3.1. Immunology Market, 2018 - 2030 (USD Billion)

8.4. Oncology

8.4.1. Oncology Market, 2018 - 2030 (USD Billion)

8.5. Stem Cells

8.5.1. Stem Cells Market, 2018 - 2030 (USD Billion)

8.6. Neurobiology

8.6.1. Neurobiology Market, 2018 - 2030 (USD Billion)

8.7. Others

8.7.1. Other Applications Market, 2018 - 2030 (USD Billion)

Chapter 9. End-Use Business Analysis

9.1. Research Antibodies Market: End-use Movement Analysis

9.2. Academic & Research Institutes

9.2.1. Academic & Research Institutes Market, 2018 - 2030 (USD Billion)

9.3. Contract Research Organizations

9.3.1. Contract Research Organizations Market, 2018 - 2030 (USD Billion)

9.4. Pharmaceutical & Biotechnology Companies

9.4.1. Pharmaceutical & Biotechnology Companies Market, 2018 - 2030 (USD Billion)

Chapter 10. Regional Business Analysis

10.1. Research Antibodies Market Share By Region, 2023 & 2030

10.2. North America

10.2.1. SWOT Analysis

10.2.2. North America Research Antibodies Market, 2018 - 2030 (USD Billion)

10.2.3. U.S.

10.2.3.1. Key Country Dynamics

10.2.3.2. Target Disease Prevalence

10.2.3.3. Competitive Scenario

10.2.3.4. U.S. Research Antibodies Market, 2018 - 2030 (USD Billion)

10.2.4. Canada

10.2.4.1. Key Country Dynamics

10.2.4.2. Target Disease Prevalence

10.2.4.3. Competitive Scenario

10.2.4.4. Canada Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3. Europe

10.3.1. SWOT Analysis

10.3.2. Europe Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.3. UK

10.3.3.1. Key Country Dynamics

10.3.3.2. Target Disease Prevalence

10.3.3.3. Competitive Scenario

10.3.3.4. UK Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.4. Germany

10.3.4.1. Key Country Dynamics

10.3.4.2. Target Disease Prevalence

10.3.4.3. Competitive Scenario

10.3.4.4. Germany Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.5. France

10.3.5.1. Key Country Dynamics

10.3.5.2. Target Disease Prevalence

10.3.5.3. Competitive Scenario

10.3.5.4. France Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.6. Italy

10.3.6.1. Key Country Dynamics

10.3.6.2. Target Disease Prevalence

10.3.6.3. Competitive Scenario

10.3.6.4. Italy Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.7. Spain

10.3.7.1. Key Country Dynamics

10.3.7.2. Target Disease Prevalence

10.3.7.3. Competitive Scenario

10.3.7.4. Spain Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.8. Denmark

10.3.8.1. Key Country Dynamics

10.3.8.2. Target Disease Prevalence

10.3.8.3. Competitive Scenario

10.3.8.4. Denmark Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.9. Sweden

10.3.9.1. Key Country Dynamics

10.3.9.2. Target Disease Prevalence

10.3.9.3. Competitive Scenario

10.3.9.4. Sweden Research Antibodies Market, 2018 - 2030 (USD Billion)

10.3.10. Norway

10.3.10.1. Key Country Dynamics

10.3.10.2. Target Disease Prevalence

10.3.10.3. Competitive Scenario

10.3.10.4. Norway Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4. Asia Pacific

10.4.1. SWOT Analysis

10.4.2. Asia Pacific Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.3. Japan

10.4.3.1. Key Country Dynamics

10.4.3.2. Target Disease Prevalence

10.4.3.3. Competitive Scenario

10.4.3.4. Japan Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.4. China

10.4.4.1. Key Country Dynamics

10.4.4.2. Target Disease Prevalence

10.4.4.3. Competitive Scenario

10.4.4.4. China Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.5. India

10.4.5.1. Key Country Dynamics

10.4.5.2. Target Disease Prevalence

10.4.5.3. Competitive Scenario

10.4.5.4. India Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.6. Australia

10.4.6.1. Key Country Dynamics

10.4.6.2. Target Disease Prevalence

10.4.6.3. Competitive Scenario

10.4.6.4. Australia Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.7. Thailand

10.4.7.1. Key Country Dynamics

10.4.7.2. Target Disease Prevalence

10.4.7.3. Competitive Scenario

10.4.7.4. Thailand Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.8. South Korea

10.4.8.1. Key Country Dynamics

10.4.8.2. Target Disease Prevalence

10.4.8.3. Competitive Scenario

10.4.8.4. South Korea Research Antibodies Market, 2018 - 2030 (USD Billion)

10.4.9. Singapore

10.4.9.1. Key Country Dynamics

10.4.9.2. Target Disease Prevalence

10.4.9.3. Competitive Scenario

10.4.9.4. Singapore Research Antibodies Market, 2018 - 2030 (USD Billion)

10.5. Latin America

10.5.1. SWOT Analysis

10.5.2. Latin America Research Antibodies Market, 2018 - 2030 (USD Billion)

10.5.3. Brazil

10.5.3.1. Key Country Dynamics

10.5.3.2. Target Disease Prevalence

10.5.3.3. Competitive Scenario

10.5.3.4. Brazil Research Antibodies Market, 2018 - 2030 (USD Billion)

10.5.4. Mexico

10.5.4.1. Key Country Dynamics

10.5.4.2. Target Disease Prevalence

10.5.4.3. Competitive Scenario

10.5.4.4. Mexico Research Antibodies Market, 2018 - 2030 (USD Billion)

10.5.5. Argentina

10.5.5.1. Key Country Dynamics

10.5.5.2. Target Disease Prevalence

10.5.5.3. Competitive Scenario

10.5.5.4. Argentina Research Antibodies Market, 2018 - 2030 (USD Billion)

10.6. MEA

10.6.1. SWOT Analysis

10.6.2. MEA Research Antibodies Market, 2018 - 2030 (USD Billion)

10.6.3. South Africa

10.6.3.1. Key Country Dynamics

10.6.3.2. Target Disease Prevalence

10.6.3.3. Competitive Scenario

10.6.3.4. South Africa Research Antibodies Market, 2018 - 2030 (USD Billion)

10.6.4. Saudi Arabia

10.6.4.1. Key Country Dynamics

10.6.4.2. Target Disease Prevalence

10.6.4.3. Competitive Scenario

10.6.4.4. Saudi Arabia Research Antibodies Market, 2018 - 2030 (USD Billion)

10.6.5. UAE

10.6.5.1. Key Country Dynamics

10.6.5.2. Target Disease Prevalence

10.6.5.3. Competitive Scenario

10.6.5.4. UAE Research Antibodies Market, 2018 - 2030 (USD Billion)

10.6.6. Kuwait

10.6.6.1. Key Country Dynamics

10.6.6.2. Target Disease Prevalence

10.6.6.3. Competitive Scenario

10.6.6.4. Kuwait Research Antibodies Market, 2018 - 2030 (USD Billion)

Chapter 11. Competitive Landscape

11.1. Company Categorization

11.2. Strategy Mapping

11.3. Company Market Share Analysis, 2023

11.4. Company Profiles/Listing

11.4.1. Abcam Plc

11.4.1.1. Overview

11.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.1.3. Product Benchmarking

11.4.1.4. Strategic Initiatives

11.4.2. Merck KGaA

11.4.2.1. Overview

11.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.2.3. Product Benchmarking

11.4.2.4. Strategic Initiatives

11.4.3. Thermo Fisher Scientific, Inc.

11.4.3.1. Overview

11.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.3.3. Product Benchmarking

11.4.3.4. Strategic Initiatives

11.4.4. Cell Signaling Technology, Inc.

11.4.4.1. Overview

11.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.4.3. Product Benchmarking

11.4.4.4. Strategic Initiatives

11.4.5. Santa Cruz Biotechnology Inc.

11.4.5.1. Overview

11.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.5.3. Product Benchmarking

11.4.5.4. Strategic Initiatives

11.4.6. PerkinElmer, Inc.

11.4.6.1. Overview

11.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.6.3. Product Benchmarking

11.4.6.4. Strategic Initiatives

11.4.7. Becton, Dickinson and Company

11.4.7.1. Overview

11.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.7.3. Product Benchmarking

11.4.7.4. Strategic Initiatives

11.4.8. Bio-Techne Corporation

11.4.8.1. Overview

11.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.8.3. Product Benchmarking

11.4.8.4. Strategic Initiatives

11.4.9. Proteintech Group, Inc.

11.4.9.1. Overview

11.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.9.3. Product Benchmarking

11.4.9.4. Strategic Initiatives

11.4.10. Jackson ImmunoResearch Inc

11.4.10.1. Overview

11.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

11.4.10.3. Product Benchmarking

11.4.10.4. Strategic Initiative

List of Tables

Table 1 List of abbreviations

Table 2 Global research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 3 Global research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 4 Global research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 5 Global research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 6 Global research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 7 Global research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 8 Global research antibodies market, by region, 2018 - 2030 (USD Billion)

Table 9 North America research antibodies market, by country, 2018 - 2030 (USD Billion)

Table 10 North America research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 11 North America research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 12 North America research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 13 North America research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 14 North America research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 15 North America research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 16 U.S. research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 17 U.S. research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 18 U.S. research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 19 U.S. research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 20 U.S. research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 21 U.S. research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 22 Canada research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 23 Canada research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 24 Canada research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 25 Canada research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 26 Canada research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 27 Canada research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 28 Europe research antibodies market, by country, 2018 - 2030 (USD Billion)

Table 29 Europe research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 30 Europe research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 31 Europe research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 32 Europe research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 33 Europe research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 34 Europe research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 35 UK research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 36 UK research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 37 UK research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 38 UK research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 39 UK research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 40 UK research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 41 Germany research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 42 Germany research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 43 Germany research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 44 Germany research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 45 Germany research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 46 Germany research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 47 France research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 48 France research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 49 France research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 50 France research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 51 France research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 52 France research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 53 Italy research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 54 Italy research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 55 Italy research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 56 Italy research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 57 Italy research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 58 Italy research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 59 Spain research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 60 Spain research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 61 Spain research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 62 Spain research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 63 Spain research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 64 Spain research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 65 Denmark research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 66 Denmark research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 67 Denmark research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 68 Denmark research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 69 Denmark research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 70 Denmark research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 71 Sweden research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 72 Sweden research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 73 Sweden research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 74 Sweden research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 75 Sweden research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 76 Sweden research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 77 Norway research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 78 Norway research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 79 Norway research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 80 Norway research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 81 Norway research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 82 Norway research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 83 Asia Pacific research antibodies market, by country, 2018 - 2030 (USD Billion)

Table 84 Asia Pacific research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 85 Asia Pacific research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 86 Asia Pacific research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 87 Asia Pacific research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 88 Asia Pacific research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 89 Asia Pacific research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 90 Japan research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 91 Japan research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 92 Japan research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 93 Japan research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 94 Japan research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 95 Japan research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 96 China research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 97 China research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 98 China research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 99 China research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 100 China research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 101 China research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 102 India research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 103 India research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 104 India research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 105 India research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 106 India research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 107 India research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 108 South Korea research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 109 South Korea research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 110 South Korea research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 111 South Korea research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 112 South Korea research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 113 South Korea research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 114 Thailand research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 115 Thailand research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 116 Thailand research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 117 Thailand research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 118 Thailand research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 119 Thailand research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 120 Australia research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 121 Australia research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 122 Australia research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 123 Australia research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 124 Australia research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 125 Australia research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 126 Singapore research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 127 Singapore research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 128 Singapore research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 129 Singapore research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 130 Singapore research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 131 Singapore research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 132 Latin America research antibodies market, by country, 2018 - 2030 (USD Billion)

Table 133 Latin America research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 134 Latin America research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 135 Latin America research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 136 Latin America research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 137 Latin America research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 138 Latin America research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 139 Brazil research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 140 Brazil research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 141 Brazil research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 142 Brazil research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 143 Brazil research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 144 Brazil research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 145 Mexico research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 146 Mexico research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 147 Mexico research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 148 Mexico research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 149 Mexico research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 150 Mexico research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 151 Argentina research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 152 Argentina research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 153 Argentina research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 154 Argentina research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 155 Argentina research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 156 Argentina research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 157 MEA research antibodies market, by country, 2018 - 2030 (USD Billion)

Table 158 MEA research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 159 MEA research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 160 MEA research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 161 MEA research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 162 MEA research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 163 MEA research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 164 South Africa research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 165 South Africa research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 166 South Africa research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 167 South Africa research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 168 South Africa research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 169 South Africa research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 170 Saudi Arabia research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 171 Saudi Arabia research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 172 Saudi Arabia research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 173 Saudi Arabia research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 174 Saudi Arabia research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 175 Saudi Arabia research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 176 UAE research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 177 UAE research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 178 UAE research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 179 UAE research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 180 UAE research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 181 UAE research antibodies market, by end-use, 2018 - 2030 (USD Billion)

Table 182 Kuwait research antibodies market, by product, 2018 - 2030 (USD Billion)

Table 183 Kuwait research antibodies market, by type, 2018 - 2030 (USD Billion)

Table 184 Kuwait research antibodies market, by technology, 2018 - 2030 (USD Billion)

Table 185 Kuwait research antibodies market, by source, 2018 - 2030 (USD Billion)

Table 186 Kuwait research antibodies market, by application, 2018 - 2030 (USD Billion)

Table 187 Kuwait research antibodies market, by end-use, 2018 - 2030 (USD Billion)

List of Figures

Figure 1 Market research process

Figure 2 Information procurement

Figure 3 Primary research pattern

Figure 4 Market research approaches

Figure 5 Value chain-based sizing & forecasting

Figure 6 Market formulation & validation

Figure 7 Research antibodies market segmentation

Figure 8 Market snapshot, 2023

Figure 9 Market trends & outlook

Figure 10 Market driver relevance analysis (current & future impact)

Figure 11 Market restraint relevance analysis (current & future impact)

Figure 12 PESTEL analysis

Figure 13 Porter’s five forces analysis

Figure 14 Global research antibodies market: Product movement analysis

Figure 15 Global research antibodies market, for primary antibodies, 2018 - 2030 (USD Billion)

Figure 16 Global research antibodies market, for secondary antibodies, 2018 - 2030 (USD Billion)

Figure 17 Global research antibodies market: Type movement analysis

Figure 18 Global research antibodies market, for monoclonal antibodies, 2018 - 2030 (USD Billion)

Figure 19 Global research antibodies market, for polyclonal antibodies, 2018 - 2030 (USD Billion)

Figure 20 Global research antibodies market: Technology movement analysis

Figure 21 Global research antibodies market, for immunohistochemistry, 2018 - 2030 (USD Billion)

Figure 22 Global research antibodies market, for immunofluorescence, 2018 - 2030 (USD Billion)

Figure 23 Global research antibodies market, for western blotting, 2018 - 2030 (USD Billion)

Figure 24 Global research antibodies market, for flow cytometry, 2018 - 2030 (USD Billion)

Figure 25 Global research antibodies market: immunoprecipitation, movement analysis

Figure 26 Global research antibodies market, for ELISA, 2018 - 2030 (USD Billion)

Figure 27 Global research antibodies market, for other technologies, 2018 - 2030 (USD Billion)

Figure 28 Global research antibodies market: Source movement analysis

Figure 29 Global research antibodies market, for mouse, 2018 - 2030 (USD Billion)

Figure 30 Global research antibodies market, for rabbit, 2018 - 2030 (USD Billion)

Figure 31 Global research antibodies market, for goat, 2018 - 2030 (USD Billion)

Figure 32 Global research antibodies market, for other sources, 2018 - 2030 (USD Billion)

Figure 33 Global research antibodies market: Application movement analysis

Figure 34 Global research antibodies market, for infectious diseases, 2018 - 2030 (USD Billion)

Figure 35 Global research antibodies market, for immunology, 2018 - 2030 (USD Billion)

Figure 36 Global research antibodies market, for oncology, 2018 - 2030 (USD Billion)

Figure 37 Global research antibodies market, for stem cells, 2018 - 2030 (USD Billion)

Figure 38 Global research antibodies market, for neurobiology, 2018 - 2030 (USD Billion)

Figure 39 Global research antibodies market, for other applications, 2018 - 2030 (USD Billion)

Figure 40 Global research antibodies market: End-use movement analysis

Figure 41 Global research antibodies market, for academic & research institutes, 2018 - 2030 (USD Billion)

Figure 42 Global research antibodies market, for contract research organizations, 2018 - 2030 (USD Billion)

Figure 43 Global research antibodies market, for pharmaceutical & biotechnology companies, 2018 - 2030 (USD Billion)

Figure 44 Regional marketplace: key takeaways

Figure 45 Regional outlook, 2023 & 2030

Figure 46 Global research antibodies market: region movement analysis

Figure 47 North America research antibodies market, 2018 - 2030 (USD Billion)

Figure 48 U.S. research antibodies market, 2018 - 2030 (USD Billion)

Figure 49 Canada research antibodies market, 2018 - 2030 (USD Billion)

Figure 50 Europe research antibodies market, 2018 - 2030 (USD Billion)

Figure 51 Germany research antibodies market, 2018 - 2030 (USD Billion)

Figure 52 UK research antibodies market, 2018 - 2030 (USD Billion)

Figure 53 France research antibodies market, 2018 - 2030 (USD Billion)

Figure 54 Italy research antibodies market, 2018 - 2030 (USD Billion)

Figure 55 Spain research antibodies market, 2018 - 2030 (USD Billion)

Figure 56 Denmark research antibodies market, 2018 - 2030 (USD Billion)

Figure 57 Sweden research antibodies market, 2018 - 2030 (USD Billion)

Figure 58 Norway research antibodies market, 2018 - 2030 (USD Billion)

Figure 59 Asia Pacific research antibodies market, 2018 - 2030 (USD Billion)

Figure 60 Japan research antibodies market, 2018 - 2030 (USD Billion)

Figure 61 China research antibodies market, 2018 - 2030 (USD Billion)

Figure 62 India research antibodies market, 2018 - 2030 (USD Billion)

Figure 63 Australia research antibodies market, 2018 - 2030 (USD Billion)

Figure 64 Thailand research antibodies market, 2018 - 2030 (USD Billion)

Figure 65 South Korea research antibodies market, 2018 - 2030 (USD Billion)

Figure 66 Singapore research antibodies market, 2018 - 2030 (USD Billion)

Figure 67 Latin America research antibodies market, 2018 - 2030 (USD Billion)

Figure 68 Brazil research antibodies market, 2018 - 2030 (USD Billion)

Figure 69 Mexico research antibodies market, 2018 - 2030 (USD Billion)

Figure 70 Argentina research antibodies market, 2018 - 2030 (USD Billion)

Figure 71 MEA research antibodies market, 2018 - 2030 (USD Billion)

Figure 72 South Africa research antibodies market, 2018 - 2030 (USD Billion)

Figure 73 Saudi Arabia research antibodies market, 2018 - 2030 (USD Billion)

Figure 74 UAE research antibodies market, 2018 - 2030 (USD Billion)

Figure 75 Kuwait research antibodies market, 2018 - 2030 (USD Billion)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Research Antibodies Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Primary Antibodies

- Secondary Antibodies

- Research Antibodies Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Research Antibodies Technology Outlook (Revenue, USD Billion, 2018 - 2030)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Research Antibodies Source Outlook (Revenue, USD Billion, 2018 - 2030)

- Mouse

- Rabbit

- Goat

- Others

- Research Antibodies Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Research Antibodies End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Research Antibodies Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Research Antibodies Market by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- North America Research Antibodies Market by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- North America Research Antibodies Market by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- North America Research Antibodies Market by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- North America Research Antibodies Market by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- North America Research Antibodies Market by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- U.S.

- U.S. Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- U.S. Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- U.S. Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- U.S. Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- U.S. Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- U.S. Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- U.S. Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Canada

- Canada Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Canada Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Canada Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Canada Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Canada Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Canada Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Canada Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- North America Research Antibodies Market by Product, 2018 - 2030 (USD Billion)

- Europe

- Europe Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Europe Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Europe Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Europe Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Europe Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Europe Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- UK

- UK Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- UK Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- UK Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- UK Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- UK Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- UK Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- UK Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Germany

- Germany Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Germany Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Germany Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Germany Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Germany Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Germany Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Germany Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Italy

- Italy Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Italy Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Italy Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Italy Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Italy Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Italy Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Italy Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- France

- France Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- France Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- France Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- France Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- France Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- France Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- France Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Spain

- Spain Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Spain Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Spain Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Spain Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Spain Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Spain Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Spain Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Denmark

- Denmark Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Denmark Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Denmark Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Denmark Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Denmark Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Denmark Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Denmark Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Sweden

- Sweden Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Sweden Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Sweden Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Sweden Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Sweden Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Sweden Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Sweden Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Norway

- Norway Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Norway Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Norway Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Norway Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Norway Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Norway Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Norway Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Europe Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Asia Pacific

- Asia Pacific Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Asia Pacific Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Asia Pacific Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Asia Pacific Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Asia Pacific Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Asia Pacific Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Japan

- Japan Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Japan Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Japan Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Japan Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Japan Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Japan Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Japan Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- China

- China Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- China Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- China Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- China Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- China Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- China Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- China Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- India

- India Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- India Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- India Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- India Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- India Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- India Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- India Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Australia

- Australia Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Australia Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Australia Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Australia Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Australia Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Australia Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Australia Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Thailand

- Thailand Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- Thailand Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- Thailand Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- Thailand Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- Thailand Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others

- Thailand Research Antibodies Market, by End-use, 2018 - 2030 (USD Billion)

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Thailand Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- South Korea

- South Korea Research Antibodies Market, by Product, 2018 - 2030 (USD Billion)

- Primary Antibodies

- Secondary Antibodies

- South Korea Research Antibodies Market, by Type, 2018 - 2030 (USD Billion)

- Monoclonal Antibodies

- Polyclonal Antibodies

- South Korea Research Antibodies Market, by Technology, 2018 - 2030 (USD Billion)

- Immunohistochemistry

- Immunofluorescence

- Western Blotting

- Flow Cytometry

- Immunoprecipitation

- ELISA

- Others

- South Korea Research Antibodies Market, by Source, 2018 - 2030 (USD Billion)

- Mouse

- Rabbit

- Goat

- Others

- South Korea Research Antibodies Market, by Application, 2018 - 2030 (USD Billion)

- Infectious Diseases

- Immunology

- Oncology

- Stem Cells

- Neurobiology

- Others