- Home

- »

- Next Generation Technologies

- »

-

Sales Intelligence Market Size, Share & Growth Report, 2030GVR Report cover

![Sales Intelligence Market Size, Share & Trends Report]()

Sales Intelligence Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering (Software, Service), By Application (Data Management, Lead Management), By Deployment Mode (Cloud, On-Premises), By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-946-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sales Intelligence Market Summary

The global sales intelligence market size was valued at USD 2.95 billion in 2022 and is projected to reach USD 6.68 billion by 2030, growing at a CAGR of 10.8% from 2023 to 2030. Artificial intelligence (AI) has demonstrated a potential impact on the sales industry over the past decade. For instance, AI-enabled solutions like chatbots have improved customer interactions and related services in the B2C (Business-to-Consumer) domain.

Key Market Trends & Insights

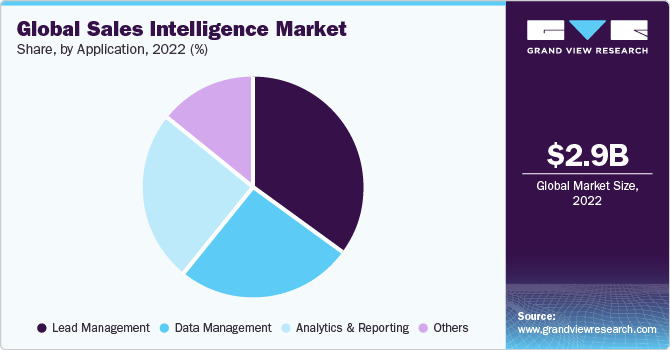

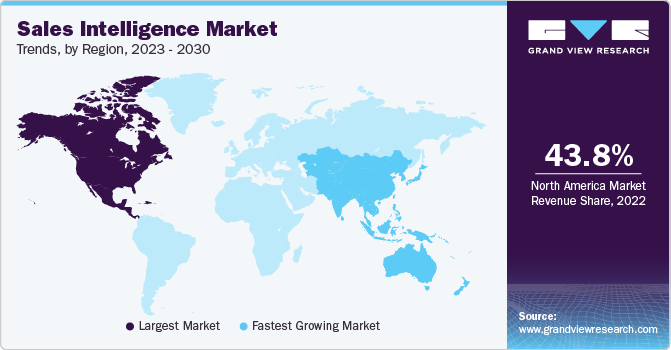

- North America dominated the sales intelligence market and accounted for the largest revenue share of 43.8% in 2022.

- Asia Pacific is expected to expand at the fastest CAGR of 14.0% during the forecast period.

- Based on application, the lead management segment accounted for the largest revenue share of 35.0% in 2022.

- Based on offering, the software offerings segment accounted for the largest revenue share of 87.5% in 2022.

- Based on deployment mode, the cloud segment accounted for the largest revenue share of 61.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.95 billion

- 2030 Projected Market Size: USD 6.68 billion

- CAGR (2023-2030): 10.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Also, fintech organizations offer the end-use industries a wide range of AI-supported advisor services to make automated investment decisions. Sales intelligence provides marketers with precise information about buyers and improves the process of content mapping and creation. The accessibility to real-time, enriched company data helps salespeople boost their lead generation process and transactions. Exponentially increasing data volumes, strict regulations, and low interest rates are encouraging organizations to reconsider their traditional business strategies.

Also, recent technological advancements have paved the way for artificial intelligence in sales and marketing operations. Connection of knowledge, domain-enriched Machine Learning (ML), and Natural Language Processing (NLP) are adopted by several companies to offer improved sales intelligence software and services. For instance, in September 2019, China Asset Management, a China-based fund management company, collaborated with Microsoft’s researchers to develop an AI model. This AI model analyzes the vast amount of real-time data of financial transactions, to provide insights about clients’ budgets and financial status. This partnership was done under Microsoft’s Innovation Partnership program, which allows the sharing of AI expertise with companies across various industries. This program is anticipated to help these industries derive digital transformation in their portfolio.

Artificial intelligence is integrated with sales and marketing for data extraction about a company’s several operations. These operations include extracting insights about organizational reporting structure, decision-making, customer experience and interfaces, year-over-year growth, strategic initiatives, and investment processes. An essential application of sales intelligence is lead generation. Many companies have dedicated teams to generate new business prospects. Sales intelligence provides the marketing team with an organization chart that includes a visual map of a company’s reporting structure of the entire department of peers and their hierarchy in the organization.

Researchers have made tremendous strides in developing the ultimate human-machine interaction systems in recent years. AI is used to capture audio, text, and imagery data from various vendor/internal databases and public sources by implementing computer vision, NLP, and machine learning programs. For instance, computer vision and NLP are used for data extraction from issuer filings for valuation models and transcription of analyst conference calls. More extensive programs will further process the information gathered from various sources to generate insights into the decision-making process. It often requires advanced AI techniques, such as machine learning and deep learning.

Businesses across various end-use verticals are realizing the importance of improving customer targeting to extract the best potential for future revenue. As a result, they are increasingly relying on advanced solutions for enhancing their customer targeting processes. Such solutions assist in the identification of new sales opportunities at non-customer companies as well as existing client accounts. Further, the marketing and sales executives implement such solutions for seamless workflows along with carrying out more efficient operations.

In the current scenario, the sales executives are looking to procure a holistic solution for aligning their data, salesforce, and processes. Demand for content optimization has witnessed a considerable surge in recent times since the sales team across numerous end-use verticals is demanding clean, automated, and comprehensive data collection. The technologies, such as Robotic Process Automation (RPA), are being used to auto-capture the activities, which the sales teams carry out on their work tools. artificial intelligence and machine learning are also increasingly being implemented to deliver transparency in the workflow, without the hassle of lengthy reviews and any mismanagement.

The sales intelligence solutions make a huge difference in procuring high-quality leads. The latest technologies and data enrichment tools help automate the collection process of relevant lead information & data storage, and use the same to craft personalized and targeted content to nurture the leads. The marketers can save a considerable amount of time, which initially was spent in manual segmenting and scoring of lead lists, substantiating the delivery of only high-quality leads to the sales team.

Significant surges in data volumes, stringent regulations, as well as low-interest rates are persuading organizations to re-evaluate their conventional business strategies. As a result, professionals heavily rely on sales intelligence software due to its ability to curate prospect lists based on a specific contact search. Moreover, it is easy for them to regularly update target customer information with minimal need for attention.

Application Insights

The lead management segment accounted for the largest revenue share of 35.0% in 2022 and it is expected to expand at the fastest CAGR during the forecast period. This high share is attributed to the increasing adoption of AI platforms for lead generation and business expansion. For instance, LinkedIn Sales Navigator, a cloud-based sales intelligence platform offered by LinkedIn Corporation, is used by several large enterprises and SMEs for lead management. This platform enables advanced lead search and recommendations based on saved leads. It also offers real-time insights on respective leads and accounts.

The data management segment is expected to witness the second-highest CAGR of 11.2% over the forecast period. Robust data management solutions are necessary because of the exponential rise in the number and complexity of data that enterprises generate. Companies now collect enormous data about their customers and sales owing to the progress in digital technology and online interactions, and this data needs to be organized, integrated, and analyzed. An AI-powered platform called Traq.ai tracks your conversations and CRM activity to generate sales intelligence. It recognizes sales objections and shows risks & opportunities during calls. Additionally, it transcripts the calls, highlighting significant ideas. Over time, it also identifies prospecting tendencies and suggests necessary corrections.

Besides, the analytics and reporting segment is anticipated to witness substantial growth over the forecast period. This growth is attributed to the fast-growing acceptance of sales analytics to improve decision-making processes and gain visibility into sales activities. Increasing penetration of real-time leaderboards to build competitive intelligence is one of the significant factors encouraging the adoption of sales intelligence platforms for analytics and reporting applications. For instance, Elastic Inc., an on-demand business development services provider, offers analytics and reporting solutions for inbound, outbound, and remote sales.

Regional Insights

North America dominated the sales intelligence market and accounted for the largest revenue share of 43.8% in 2022. This high share is attributed to the presence of an enormous number of sales intelligence vendors. Several companies, including tech giants and start-ups, are developing sales intelligence platforms for different verticals. For instance, LinkedIn Corporation (U.S.) is one of the most preferred and trusted lead management applications. It offers the Sales Navigator platform to enable targeting the right companies and clients, along with personalized engagement.

Data is fueling in the retail segment which is adding a new dimension towards understating and anticipating customer needs. The deployment of sales intelligence in the retail sector across various regions helps the sales team gather a greater amount of information from beacons, wearables, PoS terminals, CRMs, and various other databases. The sales intelligence platform is helping retailers cement their position in the domain of sales and trade intelligence. It also helps enable transformation into an intelligent and agile retail enterprise.

Asia Pacific is expected to expand at the fastest CAGR of 14.0% during the forecast period. This growth can be attributed to the significantly increasing investments in sales intelligence by FinTech companies. Besides, a growing number of AI start-ups in the region are boosting the adoption of sales intelligence solutions and services to enable process automation and increase sales productivity.

The solution providers across various regions offer cloud-based sales intelligence tools that help sales professionals access real-time customer information, sales opportunity pipeline, dashboards, embedded reports, track wins, losses, activities, and revenue trends. For instance, Salesforce.com offers its cloud-based offerings for large enterprises and SMEs to monitor leads & progress, store data, forecast opportunities, and gain insights through analytics. Additionally, the sales intelligence tools are embedded with AI that delivers a personalized shopping experience and drives increased engagement, conversion, revenue, and customer loyalty.

Offering Insights

The software offerings segment accounted for the largest revenue share of 87.5% in 2022. This high share is attributed to the integration capabilities of sales intelligence software to be deployed within existing systems, such as marketing platforms and Customer Relationship Management (CRM). It is often preferred to enable the availability of multiple deployment options and quality data enrichment. Besides, the penetration of lead-generation software tools among organizations bolster the adoption of such solutions in the market.

Several companies offer sales intelligence software for different applications, such as lead management, data management, risk management, and data analytics. For instance, DueDil Ltd, a U.K.-based database research services provider, offers an AI platform, called DueDil for BFSI, FinTech, and B2B tech industry verticals. This platform is primarily used for lead management, risk management, and business expansion capabilities.

The service offerings segment is expected to expand at the fastest CAGR of 13.2% over the forecast period. Cloud-based sales intelligence services can be used by businesses of all sizes, and they are constantly being updated with new data and insights. This makes them a valuable tool for businesses that are looking to stay ahead of the competition. In addition, the service offerings segment is expected to witness substantial growth because of the increasing adoption of AI. AI-powered sales intelligence services can automate tasks, such as lead generation and qualification. This frees up sales professionals to focus on more strategic activities, such as closing deals.

Deployment Mode Insights

The cloud segment accounted for the largest revenue share of 61.3% in 2022 and is expected to expand at the fastest CAGR during the forecast period. This high share is attributed to the fact that cloud solutions eliminate the firewall restrictions that can hamper the users’ access to an on-premise solution. Cloud-based Software as a Service (SaaS) solution eliminates maintenance and overhead costs. Also, cloud object storage services provide virtually unlimited storage capacity that limits the scalability and storage volume restrictions of locally-placed hardware.

The on-premise segment is expected to witness a significant CAGR over the forecast period. This growth is attributed to the security and privacy provided by the on-premises solutions in sales intelligence. Also, on-premise solutions use edge analytics that reduces the bandwidth requirement. Integrating these solutions with on-premise deployment brings higher speed and more reliability in the results.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share of 75.0% in 2022. This high share is attributed to the rising rates of data decay and increasing competition among key players in several industry verticals. Also, higher technological proficiency in large enterprises than in SMEs encourages the adoption of sales intelligence tools to reduce sales cycles and increase sales productivity. These tools provide large enterprises with data enrichment capabilities to maintain their position among competitors.

The SMEs segment is expected to witness the fastest CAGR of 12.3% over the forecast period. This growth is attributed to the fast-gained acceptance of digital solutions in every industry. Multiple sales & marketing solutions are being adopted by SMEs to boost their sales. For instance, Infogroup.com, a U.S.-based marketing company, offers analytics & reporting and data management solutions for large enterprises and SMEs.

Vertical Insights

The IT & telecom segment accounted for the largest revenue share of 23.7% in 2022 owing to the increasing availability of data and the development of new technologies. As the overall IT & Telecom sector is growing owing to increasing investments and expansion of telecom infrastructure, the demand for sales intelligence solutions is expected to rise in the near future. For instance, COSO IT has been at the forefront of the revolution in the telecom sector, providing consulting solutions that have helped a number of clients achieve new heights in efficiency, customer engagement, customer service delivery, and business intelligence. The company's easy-to-integrate consulting services are highly preferred in the telecom sector, and they have delivered exceptional results in core aspects of the industry such as data integration, advanced analytics, business intelligence, predictive analysis, and machine learning-driven automation.

Sales intelligence vendors are now able to collect and analyze large amounts of data, which gives businesses a better understanding of their target customers and the market. Additionally, new technologies, such as artificial intelligence and machine learning, are being used to automate tasks and improve the accuracy of sales intelligence. Big Data can help telecom companies increase profitability in a number of ways. By optimizing network usage and services, telecom companies can reduce costs and improve customer satisfaction. Big Data can also be used to enhance the customer experience by providing personalized recommendations and services. Additionally, it can be used to improve security by identifying and preventing fraud.

The retail & e-commerce segment is expected to witness the fastest CAGR of 12.9% over the forecast period. This makes it more important than ever for businesses in this industry to have access to accurate and up-to-date information about their target customers, the market, and their competitors. Sales intelligence can provide businesses with this information, which can help them to make better decisions about marketing and sales strategies. In addition, the retail and e-commerce industry is data-rich. Businesses in this industry collect a lot of data about their customers, such as purchase history, browsing behavior, and demographic information. Sales intelligence can help businesses to optimize this data and use it to improve their marketing and sales strategies.

Besides, the BFSI segment is anticipated to witness substantial growth over the forecast period, which is attributed to the rapid adoption of sales intelligence systems in the financial services and banking sectors. There are several AI applications in financial services, including lead management, risk management, fraud detection, relationship manager augmentation, and algorithmic trading, among other use cases. For instance, LeadGenius, an American marketing automation company, offers sales intelligence solutions for banking, finance, and the FinTech industry. The company's solution caters to data management, lead management, and analytics, and reporting requirements in the BFSI industry.

Other verticals in the industry include IT and telecom, retail and e-commerce, healthcare, media & entertainment, and others. Lead management is one of the most used applications in every vertical. For instance, Zoho Corporation Pvt. Ltd., an India-based IT management company, offers a customer experience platform called Zoho CRM Plus. This platform includes a comprehensive set of lead management features for all sizes of businesses in all verticals. Also, law, manufacturing, automotive, and HR/ payroll are other verticals where sales intelligence is being used for data management and enrichment applications.

Key Companies & Market Share Insights

Vendors in the market are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, partnerships, and collaborations with other key players in the industry. For instance, in May 2021, IBM announced plans to acquire Waeg, a Salesforce Consulting Partner in Europe. With this acquisition, IBM planned to meet client demand for business transformation and customer engagement efforts, expand its portfolio of Salesforce consulting services, and move forward with its hybrid cloud and AI aspirations.

Key Sales Intelligence Companies:

- Clearbit

- DEMANDBASE, INC.

- Dun & Bradstreet

- DueDil Ltd

- EverString Technology

- FullContact

- GRYPHON NETWORKS

- Infogroup.com

- Insideview

- LeadGenius

- LinkedIn Corporation

- List Partners LLC

- Oracle

- Relationship Capital Partners Inc. and RelPro, Inc.

- RingLead, Inc.

- UpLead

- Yesware, Inc.

- Zoho Corporation Pvt. Ltd.

- Zoom Information, Inc.

Recent Developments

- In June 2023, Vidyard Rooms announced the launch of its new Digital Sales Rooms (DSR). The company aims to transform how sellers and buyers engage in the digital-first era.

-

In May 2023, Gong.io Inc. introduced Gong Insights, a new product that automatically transfers insights obtained from the Gong revenue intelligence platform to a company's current business intelligence (BI) platform. The solution is created in collaboration with the U.S.-based data cloud company, Snowflake.

-

In March 2023, 6sense announced the launch of revenue AI for sales. By making it simpler to locate prospects and accounts in-market for products, prioritize a seller's day with high-impact activities, and identify deeper data about buyers and marketing tools, this new platform was developed to improve sellers' daily lives.

-

In March 2023, DemandScience US, a top B2B demand generation company, announced the general release of Klarity, its next-generation self-service sales intelligence tool for creating, sharing, and saving contact lists. 'One-click prospecting' is now a reality for sales professionals because of Klarity's Chrome extension, user-friendly UI, and email accuracy.

-

In February 2023, FlashInfo introduced a new "Job Posting" filter. It enables sales teams to recognize key indicators that point to a prospective buying opportunity, enabling them to target clients and close deals more successfully. By offering access to real time information about job postings and company growth, the "Job Posting" filter is intended to aid sales teams in staying one step ahead of the competition.

Sales Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.26 billion

Revenue forecast in 2030

USD 6.68 billion

Growth rate

CAGR of 10.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, application, deployment mode, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Dun & Bradstreet; LinkedIn Corporation; Zoom Information, Inc.; Oracle; DEMANDBASE, INC.; Clearbit; Insideview; LeadGenius; Infogroup.com; UpLead; Relationship Capital Partners Inc. and RelPro, Inc.; DueDil Ltd; EverString Technology; RingLead, Inc.; GRYPHON NETWORKS; List Partners LLC; FullContact; Yesware, Inc.; Zoho Corporation Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sales Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global sales intelligence market report based on offering, application, deployment mode, organization size, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Analytics and Reporting

-

Data Management

-

Lead Management

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-Premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & E-Commerce

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global sales intelligence market size was estimated at USD 2.95 billion in 2022 and is expected to reach USD 3.26 billion in 2023.

b. The global sales intelligence market is expected to grow at a compound annual growth rate of 10.8% from 2023 to 2030 to reach USD 6.68 billion by 2030.

b. North America dominated the sales intelligence market with a share of 43.8% in 2022. This is attributable to the companies and governments taking significant initiatives for the adoption of AI and machine learning in the region.

b. Some key players operating in the sales intelligence market include dnb.co.in.; LinkedIn Corporation; Oracle; DEMANDBASE, INC.; Clearbit; LeadGenius; Infogroup.com; UpLead; Relationship Capital Partners Inc. and RelPro, Inc.; and RingLead, Inc.

b. Key factors that are driving the market growth include increasing use of company technographic; growing demand for data enrichment software; the rising need for improvement of sales conversions; and the presence of sales intelligence vendors in a large number.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.