- Home

- »

- Next Generation Technologies

- »

-

Satellite Transponder Market Size, Industry Report, 2033GVR Report cover

![Satellite Transponder Market Size, Share & Trends Report]()

Satellite Transponder Market (2025 - 2033) Size, Share & Trends Analysis Report By Frequency Band (C Band, Ka Band), By Service (Leasing, Maintenance And Support), By Satellite Platform), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-628-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite Transponder Market Summary

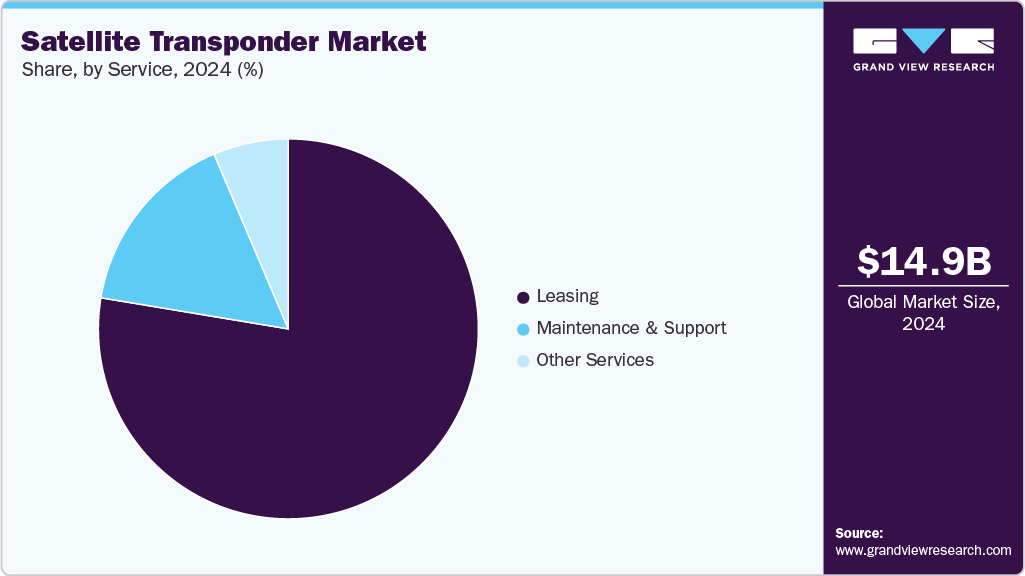

The global satellite transponder market size was estimated at USD 14,911.0 million in 2024 and is expected to reach USD 21,987.2 million in 2033, growing at a CAGR of 4.5% from 2025 to 2033. This growth is primarily driven by increasing demand for high-throughput satellite services, expanding DTH (Direct-to-Home) broadcasting subscriptions, and growing need for secure and reliable satellite communication in defense and aviation.

Key Market Trends & Insights

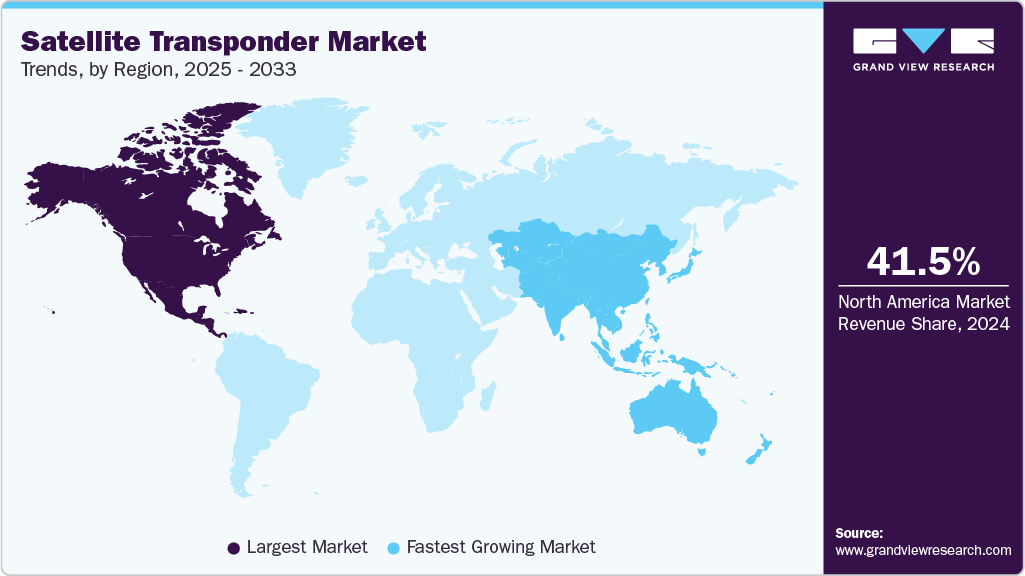

- North America dominated the global satellite transponder market with the largest revenue share of 41.5% in 2024.

- The satellite transponder market in the U.S. led the North America market and held the largest revenue share in 2024.

- By frequency band, C Band led the market and held the largest revenue share of 36.7% in 2024.

- By service, the leasing segment held the dominant position in the market and accounted for the leading revenue share of 77.7% in 2024.

- By satellite platform, geostationary earth orbit satellites (GEO) segment held the largest revenue share of 68.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14,911.0 Million

- 2033 Projected Market Size: USD 21,987.2 Million

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global satellite transponder market is largely driven by the rising demand for high-throughput satellite (HTS) services and the growing penetration of DTH (Direct-to-Home) broadcasting. The increasing need for uninterrupted broadband and telecommunication connectivity in remote and underserved areas has significantly accelerated the deployment of satellite transponders.Additionally, rapid advancements in satellite communication technology, including the adoption of high-capacity Ka-band and Ku-band transponders, are boosting transmission efficiency and expanding service reach. The market is also benefiting from rising investments in defense, surveillance, and navigation systems. Governments and private players enhance infrastructure for space-based communication and IoT integration. Together, these factors contribute to steady market growth globally.

A notable trend in the satellite transponder market is the rising demand for high-speed internet and broadband connectivity in remote and rural areas. The growing global consumption of digital television and direct-to-home (DTH) broadcasting is significantly influencing market dynamics. Smart TV adoption rises, and consumers demand high-definition and ultra-high-definition content, broadcasters increasingly depend on satellite transponders to deliver consistent and high-quality transmissions.

Furthermore, the rapid deployment of low-earth orbit (LEO) satellite constellations is transforming the industry landscape. LEO satellites offer reduced latency and high data throughput, creating new opportunities for cost-effective transponder solutions. Leading companies in the satellite transponder sector are actively investing in research and development to support innovations.

Strategic alliances, partnerships, and satellite sharing agreements are being formed to enhance market presence and optimize network coverage. Companies are also focusing on vertical integration and expanding their offerings to include end-to-end satellite communication services. Additionally, there's a growing emphasis on sustainable and cost-efficient transponder systems to support next-generation satellite networks, which is helping firms stay competitive and meet evolving connectivity demands worldwide.

Frequency Band Insights

The C band segment accounted for the largest revenue share of over 36% in the satellite transponder industry in 2024. The leading position of this segment is driven by its widespread use in broadcasting and telecommunications, making it ideal for stable signal transmission. C Band transponders are extensively utilized for satellite television, radio, and data communications. The increasing demand for reliable and wide-coverage satellite services across emerging markets and rural areas continues to boost the adoption of C Band frequencies. The growing need for uninterrupted connectivity in critical applications such as defense communication and disaster recovery further reinforces the demand for C Band transponders.

The Ka Band segment is projected to have the highest growth rate of 7% during the forecast period. This growth is primarily driven by the increasing demand for high-throughput satellite (HTS) services, which require larger bandwidth and higher frequency capabilities. The Ka Band supports faster data transmission rates, making it ideal for broadband internet, in-flight connectivity, and enterprise communication networks. Additionally, the rising adoption of Ka Band transponders for defense, surveillance, and remote sensing applications is contributing to its rapid expansion. Satellite operators and governments invest in next-generation communication infrastructure, and the Ka Band segment continues to gain traction due to its efficiency and capacity to support global connectivity initiatives.

Satellite Platform Insights

The geostationary earth orbit satellites (GEO)segment accounted for the largest revenue share in 2024. This leading position is primarily driven by the GEO platform’s ability to provide continuous coverage to fixed areas, ideal for television broadcasting and telecommunication services. The segment’s dominance is further supported by the high transponder capacity of GEO satellites. The long operational life of GEO satellites reduces maintenance needs and supports cost efficiency. Demand for high-definition (HD) and ultra-high-definition (UHD) television content surges, and service providers increasingly prefer GEO platforms for their reliable, scalable, and cost-effective delivery capabilities. These advantages continue to drive transponder leasing on GEO satellites, reinforcing their position as the backbone of the satellite transponder industry.

The low earth orbit satellites (LEO) segment is projected to have the highest growth rate during the forecast period. This surge is driven by the increasing deployment of LEO satellite constellations to provide global broadband coverage with low latency and high-speed connectivity. The growing demand for real-time data transmission across sectors such as aviation, maritime, and defense has positioned LEO satellites as a preferred platform. Moreover, their lower launch costs and shorter signal travel times make them highly efficient for modern communication networks. Major companies and governments are investing in LEO-based infrastructure for applications like IoT, remote sensing, and global internet access, the segment is rapidly expanding to meet next-generation connectivity.

Application Insights

The commercial communications segment accounted for the largest revenue share in 2024. The segment’s dominance is primarily driven by the increasing demand for high-speed data transmission and uninterrupted global coverage. Commercial operators are rapidly adopting satellite transponders to enable real-time connectivity and content distribution. The surge in inflight and maritime connectivity, and the expansion of rural broadband initiatives further reinforces the preference for commercial transponder deployment. The scalability and cost-efficiency of commercial satellite platforms make them ideal. Commercial communications remain the primary driver of transponder demand across the satellite platform landscape.

The remote sensing segment is projected to have the highest growth rate during the forecast period. This surge is driven by the increasing remote sensing capabilities to gather real-time data and enhance decision-making processes. The expansion of climate change initiatives, combined with rising investments in geospatial intelligence and defense surveillance. The ability of satellite-based remote sensing to deliver consistent, wide-area coverage at high resolution is making it an essential component in national development and security strategies. The remote sensing platform continues to experience accelerated adoption, positioning it as a key driver of growth within the satellite transponder industry.

Service Insights

The leasing segment accounted for the largest revenue share in 2024. The dominant position of transponder leasing is primarily attributed to its widespread adoption across broadcasting, telecommunications, and broadband service providers. These sectors rely heavily on transponder leasing to ensure flexible bandwidth capacity, reduce capital expenditure, and maintain scalable operations. The increasing demand for direct-to-home (DTH) television and enterprise connectivity in emerging markets is driving the preference for leasing arrangements. Service providers seek to expand coverage rapidly and cost-effectively transponder leasing continues to be a fundamental strategy for market penetration and service reliability.

On the other hand, the maintenance and support segment is expected to experience the fastest growth in the satellite transponder industry during the forecast period. This growth is driven by the increasing complexity of satellite systems, and rising demand for uninterrupted communication services. The growing number of satellite deployments is investing heavily in predictive maintenance and remote monitoring. The surge in government and defense satellite programs, coupled with expanding broadband and broadcasting applications in emerging markets, is boosting the demand for comprehensive maintenance and lifecycle support services. This trend is expected to significantly accelerate the growth of the maintenance and support segment across the global satellite transponder industry.

Regional Insights

The North America satellite transponder market accounted for the largest revenue share of more than 41% in 2024. The dominance of this region is largely due to its advanced space infrastructure and widespread adoption of satellite communication technologies. The growing demand for high-speed internet and broadband services in rural and remote areas is driving the deployment of satellite transponders. Additionally, the region's expanding DTH (Direct-to-Home) broadcasting industry, along with increasing consumption of HD and UHD television content, supports continued demand for the satellite transponder industry.

U.S. Satellite Transponder Market Trends

The U.S. satellite transponder market is dominating the market with the largest market share of over 82% in 2024, driven by rising demand for secure and high-capacity satellite communication. Increasing investments by the Department of Defense (DoD) in satellite-based surveillance, navigation, and encrypted communications are fueling the need for advanced transponder technology. There is a noticeable trend toward low-latency and high-throughput transponder solutions, particularly in support of low Earth orbit (LEO) satellite networks and broadband internet expansion. Additionally, U.S.-based satellite operators and tech firms are incorporating software-defined transponders and AI-powered bandwidth optimization tools that enhance flexibility, reduce costs, and enable real-time network adjustments for diverse applications.

Europe Satellite Transponder Market Trends

The European satellite transponder market is expected to grow at a CAGR of over 3 % in 2024, due to increasing demand for high-quality satellite communication and expanding digital television services. Key industries utilizing satellite transponders in Europe include broadcasting, telecommunications, and aviation. European Union initiatives such as the EU Space Program encourage the deployment of advanced satellite infrastructure to support connectivity. There is also a noticeable shift toward high-throughput transponders and low-latency LEO satellite networks to meet growing data needs and support rural broadband expansion. Companies are investing in innovative transponder technologies and participating in public-private partnerships to enhance service coverage and spectrum efficiency. As a result, the satellite transponder industry in Europe is steadily expanding.

The UK satellite transponder market growth is driven by increasing demand for high-capacity satellite communication in the broadcasting and maritime sectors. The growing need for resilient connectivity in rural and remote regions has prompted investments in satellite broadband services. Government initiatives supporting digital infrastructure are accelerating the deployment of satellite-based communication technologies. There is also a rising focus on national security and defense capabilities, leading to greater reliance on secure, transponder-enabled military satellites. Key players in the UK market include Inmarsat, Airbus Defence and Space, and OneWeb. Owing to these technological advancements and policy-driven investments, the satellite transponder market in the United Kingdom is expected to witness steady growth.

Germany satellite transponder market is driven by rising demand from sectors such as defense and aviation. The country’s strategic focus on secure communication infrastructure, especially in defense and homeland security, is encouraging investments in satellite-based systems. Germany’s push for nationwide broadband connectivity, particularly in rural and underserved areas, is supporting the use of satellite transponders. Aerospace innovation and government-backed satellite programs are further contributing to market growth. Owing to technological advancement and strong institutional demand, the satellite transponder market in Germany remains resilient and continues to expand.

Asia-Pacific Industrial Filtration Market Trends

The Asia Pacific satellite transponder market has the highest CAGR of over 7 %, driven by surging demand for satellite-based communication and expanding broadcasting services. Rapid economic development and increased investment in telecom infrastructure are fueling the adoption of satellite transponders. The region is witnessing a rise in direct-to-home (DTH) broadcasting, mobile backhaul services, and high-speed internet delivery in remote and rural areas. Governments are prioritizing satellite capabilities for national security, disaster management, and maritime surveillance. The deployment of low Earth orbit (LEO) satellite constellations by regional players is accelerating connectivity efforts and creating opportunities. As a result of these drivers, the satellite transponder industry in Asia Pacific is experiencing significant growth.

China satellite transponder market plays a major role in the region's fast-growing market, driven by its ambitious space programs and expanding telecommunications infrastructure. The country is heavily investing in satellite communication technologies to support nationwide internet coverage. The rising demand for DTH broadcasting, growing digital content consumption, and increased adoption of smart TVs are further fueling the need for reliable transponder capacity. The defense sector also remains a significant contributor, with ongoing investments in military-grade satellite communication systems. As China continues to modernize its space and communication networks, the satellite transponder market is expected to expand rapidly.

India’s satellite transponder market is also experiencing rapid growth, propelled by rising demand for digital connectivity and expanding broadcast services. Key sectors such as telecommunications, defense, and media are increasingly leveraging satellite transponders to enhance communication reach. There is also a growing adoption of high-throughput and low-latency satellite solutions to support broadband expansion and smart village initiatives. Increased investments in defense satellite programs and the emergence of private space players are accelerating market growth. Due to these trends, India’s satellite transponder market is growing at a fast pace.

Key Satellite Transponder Company Insights

Some key players operating in the market include Intelsat and SES S.A., among others

-

Intelsat is a global leader in satellite communication, offering a comprehensive portfolio of satellite transponder services that support video distribution, broadband connectivity, and mobility applications. The company operates a large fleet of geostationary satellites with extensive C-band and Ku-band transponders, enabling it to serve broadcasters, telecom operators, government agencies, and maritime clients worldwide. Intelsat continues to modernize its network with high-throughput satellites (HTS) and software-defined payloads, enhancing its capacity to meet growing data demand across multiple sectors.

-

SES S.A., based in Luxembourg, provides satellite transponder capacity through its dual fleet of geostationary (GEO) and medium Earth orbit (MEO) satellites. The company is a pioneer in high-performance satellite connectivity for video broadcasting, enterprise networks, and government communications. SES offers flexible transponder leasing solutions across multiple frequency bands (C, Ku, and Ka) and has been expanding its capabilities through the O3b mPOWER constellation to deliver low-latency, high-throughput services globally.

Thaicom Public Company Limited and Inmarsat Global Limited are some emerging market participants in the satellite transponder market.

-

Thaicom Public Company Limited operates a fleet of satellites offering transponder services across Southeast Asia, South Asia, and parts of Oceania. The company provides satellite capacity for video broadcasting, internet services, and corporate networks. Thaicom has been focusing on enhancing its competitiveness through technological upgrades, including the development of software-defined satellites to support future digital broadcasting and data applications with higher flexibility and efficiency.

-

Inmarsat Global Limited specializes in mobile satellite services, including transponder-based communication for aviation, maritime, and defense sectors. While traditionally focused on L-band services, the company has expanded its offerings to include Ka-band HTS for high-speed broadband connectivity. Following its acquisition by Viasat, Inmarsat is positioned to integrate geostationary and LEO assets, enhancing its transponder and managed service capabilities for mission-critical applications.

Key Satellite Transponder Companies:

The following are the leading companies in the satellite transponder market. These companies collectively hold the largest market share and dictate industry trends.

- Intelsat

- SES S.A.

- EUTELSAT COMMUNICATIONS SA

- Arabsat

- Telesat

- EchoStar Corporation

- Thaicom Public Company Limited.

- ASIA SATELLITE TELECOMMUNICATIONS CO. LTD.

- Inmarsat Global Limited

- Viasat, Inc.

Recent Developments

-

In 2025, Eutelsat Communications signed a multi-year extension agreement with Panasonic Avionics to provide high-throughput Ku-band transponder capacity on the EUTELSAT 10B satellite. This initiative aims to enhance inflight connectivity services for commercial airlines operating across the North Atlantic, Europe, the Middle East, Africa, and the Indian Ocean region. By delivering robust, high-speed broadband capabilities via satellite transponders, Eutelsat strengthens its presence in the aviation connectivity segment and supports the growing demand for seamless passenger communication and entertainment services during air travel.

-

In 2025, Arabsat signed a strategic term sheet with Telesat to support the integration of Lightspeed Low Earth Orbit (LEO) services into its multi-orbit satellite network. This initiative aims to enhance Arabsat’s connectivity capabilities by combining high-bandwidth LEO capacity with its existing geostationary (GEO) transponder infrastructure. The collaboration is designed to better serve enterprise, telecom, and mobility customers across the Middle East and Africa, positioning Arabsat as a next-generation satellite service provider that offers low-latency and high-throughput connectivity solutions. The agreement is expected to be finalized by December 2025.

-

In 2025, Eutelsat Communications, in collaboration with MediaTek and Airbus, achieved the world’s first 5G Non-Terrestrial Network (NTN) connection using LEO satellite transponders via the OneWeb constellation. This groundbreaking demonstration validated the capability of satellite transponders to integrate with 5G core networks, delivering connectivity in remote and underserved regions. The initiative highlights the growing potential of hybrid terrestrial-satellite networks to support seamless, high-speed communications and positions Eutelsat at the forefront of next-generation mobile connectivity solutions.

Satellite Transponder Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15,481.4 million

Revenue forecast in 2033

USD 21,987.2 million

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Frequency band, service, satellite platform, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Intelsat; SES S.A.; EUTELSAT COMMUNICATIONS SA; Arabsat; Telesat; EchoStar Corporation; Thaicom Public Company Limited; ASIA SATELLITE TELECOMMUNICATIONS CO. LTD.; Inmarsat Global Limited; Viasat, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Satellite Transponder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global satellite transponder market report based on frequency band, service, satellite platform, application, and region:

-

Frequency Band Outlook (Revenue, USD Million, 2021 - 2033)

-

C Band

-

Ku Band

-

Ka Band

-

K Band

-

Others

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Leasing

-

Maintenance and Support

-

Other Services

-

-

Satellite Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Geostationary Earth Orbit Satellites (GEO)

-

Medium Earth Orbit Satellites (MEO)

-

Low Earth Orbit Satellites (LEO)

-

High Elliptical Orbit Satellites (HEO)

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Communications

-

Government Communications

-

Navigation

-

Remote Sensing

-

R&D

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global satellite transponder market size was estimated at USD 14,911.0 million in 2024 and is expected to reach USD 15,481.4 million in 2025.

b. The global satellite transponder market is expected to grow at a compound annual growth rate of 4.5 % from 2025 to 2033 to reach USD 21,987.2 million by 2033.

b. North America accounted for the largest market share of more than 41% in 2024. The dominance of this region is largely due to its advanced space infrastructure and widespread adoption of satellite communication technologies. The growing demand for high-speed internet and broadband services in rural and remote areas is driving the deployment of satellite transponders. Additionally, the region's expanding DTH (Direct-to-Home) broadcasting industry, along with increasing consumption of HD and UHD television content, supports continued demand for the satellite transponder industry.

b. The key players in the satellite transponder market include Intelsat, SES S.A., EUTELSAT COMMUNICATIONS SA, Arabsat, Telesat, EchoStar Corporation, Thaicom Public Company Limited., ASIA SATELLITE TELECOMMUNICATIONS CO. LTD., Inmarsat Global Limited, Viasat, Inc.

b. Key factors driving market growth in the satellite transponder market include the rising demand for high-throughput satellite (HTS) services, increasing deployment of direct-to-home (DTH) broadcasting, growing investments in global broadband connectivity initiatives, rapid expansion of mobility services in aviation and maritime sectors, and technological advancements enabling more efficient and flexible bandwidth usage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.