- Home

- »

- Next Generation Technologies

- »

-

Small Drone Market Size, Share And Trends Report, 2030GVR Report cover

![Small Drone Market Size, Share & Trends Report]()

Small Drone Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Fixed-Wing, Rotary, Hybrid), By Application, By Mode Of Operation, By Maximum Take-Off Weight, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-475-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Drone Market Summary

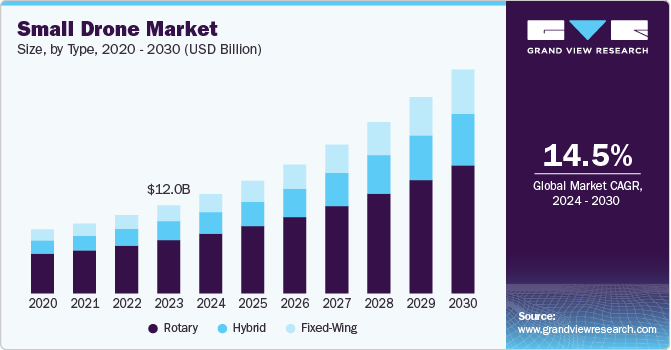

The global small drone market size was estimated at USD 12.03 billion in 2023 and is projected to reach USD 30.57 billion by 2030, growing at a CAGR of 14.5% from 2024 to 2030. The market is witnessing significant growth due to increasing demand across various industries such as construction, real estate, and media for aerial photography, surveying, monitoring, infrastructure inspections, etc.

Key Market Trends & Insights

- North America dominated the small drone market with the largest revenue share of 40.0% in 2023.

- The small drone market in the U.S. is expected to record at a considerable CAGR of 13% during the forecast period.

- Based on type, the rotary segment led the market with the largest revenue share of 60.6% in 2023.

- Based on application, the military segment led the market with the largest revenue share of 43.93% in 2023.

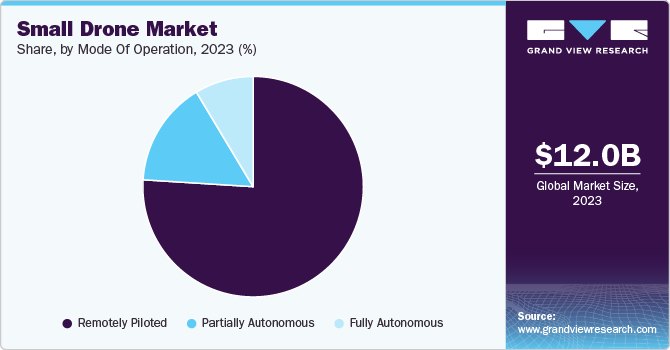

- Based on mode of operation, the remotely piloted segment led the market with the largest revenue share of 76.01% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.03 Billion

- 2030 Projected Market Size: USD 30.57 Billion

- CAGR (2024-2030): 14.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, technological advancements are also contributing to the market growth. Improvements in battery technology, propulsion systems, camera capabilities, and autonomous flight capabilities are making drones more efficient, versatile, and user-friendly. The development of advanced sensors, such as thermal cameras and LiDAR, is expanding the applications of small drones.The market growth is being further driven by the favorable regulatory environment across various countries, with the establishment of guidelines for commercial drone operations. Furthermore, drones are being increasingly adopted by law enforcement agencies for various tasks, including crime scene investigation, surveillance, search and rescue operations, and crowd control. The ability of drones to provide aerial perspectives, gather evidence, and monitor large areas efficiently has made them invaluable tools for law enforcement.

The development of specialized drones with features such as thermal imaging, night vision, and long-endurance capabilities has further expanded their applications within the law enforcement sector. As law enforcement agencies continue to recognize the benefits of drone technology, the demand for small drones is expected to grow further. For instance, in September 2023, the U.S. government launched the Drone as First Responder (DFR) Program, which involves launching a camera-equipped drone from a regular base (like the police station roof) in response to 911 calls and other law enforcement calls for service. This initiative is aimed at reaching the incident first place, providing the responding officers with a view of the scene before their arrival. Such initiatives are expected to propel the market growth over the upcoming years.

The increased adoption of small drones across various commercial applications is opening new growth avenues for the market. Industries such as construction, infrastructure inspection, media & entertainment, and public safety are increasingly adopting drones for various applications. In construction, drones are employed for site surveying, progress monitoring, and safety inspections. For infrastructure inspection, drones can assess bridges, power lines, and other critical assets. In media & entertainment, drones are used for aerial photography, videography, and filmmaking. In public safety, drones assist in search and rescue operations, law enforcement, and disaster response. The growing adoption of drones across such diverse industries is expected to enhance the overall outlook of global market in the coming years.

Type Insights

Based on type, the rotary segment led the market with the largest revenue share of 60.6% in 2023, due to its superior maneuverability, vertical takeoff and landing (VTOL) capabilities, and suitability for a wide range of applications. Rotary-wing drones are finding important usage in operations requiring precision and stable hoverings, such as aerial photography, surveillance, and infrastructure inspection. Moreover, advancements in battery technology and improved flight control systems have further enhanced their performance, impelling their adoption in many commercial and industrial applications. These factors collectively contribute to the segment growth.

The fixed-wing segment is expected to record at the fastest CAGR of nearly 16% from 2024 to 2030, owing to the superior endurance, range, and efficiency offered by these drones. Fixed-wing drones are particularly well-suited for applications requiring long-duration flights, such as agriculture, environmental monitoring, and large-area surveying. Their ability to cover greater distances on a single battery charge makes them ideal for industries focused on mapping, surveillance, and inspection tasks. The segment growth is being further driven by the development of more efficient and affordable fixed-wing drone platforms, coupled with advancements in propulsion systems and autopilot technology, which makes them attractive to a wider range of users.

Application Insights

Based on application, the military segment led the market with the largest revenue share of 43.93% in 2023 on account of rising demand for drones for advanced surveillance, reconnaissance, and tactical operations. Small drones offer military forces agility, cost-effectiveness, and the ability to access hard-to-reach or dangerous areas without risking human life. These drones are equipped with advanced sensors and imaging technology, allowing real-time data collection and enhanced situational awareness on the battlefield. Their compact size, ease of deployment, and low cost compared to larger military aircraft make them ideal for various missions, including intelligence gathering, target acquisition, and even defense. Growing investments in drone technologies by defense departments globally further accelerate the expansion of the segment.

The consumer segment is anticipated to grow at the fastest CAGR from 2024 to 2030, owing to the increasing popularity of drones for recreational activities, photography, and videography. As drone technology has become more advanced, affordable, and user-friendly, it has attracted a wide range of consumers, from hobbyists to professional content creators. The integration of high-quality cameras, longer battery life, and enhanced stabilization features has made drones a popular tool for personal content creation, particularly for social media platforms. Moreover, regulations in many regions now allow for the operation of small, lightweight drones with minimal restrictions, further driving demand in this segment.

Mode Of Operation Insights

Based on mode of operation, the remotely piloted segment led the market with the largest revenue share of 76.01% in 2023, owing to the versatility and wide range of applications of these small drones in both commercial and recreational fields. Remotely piloted small drones allow operators to control them in real-time from a distance, making them suitable for applications including infrastructure inspection, aerial photography, and public safety. Advancements in communication technology, GPS, and automation have made these drones more reliable, increasing their adoption. In addition, the establishment of clearer guidelines by regulatory bodies for remotely piloted drones is expected to drive product demand, favoring segmental growth.

The fully autonomous segment is expected to record at the fastest CAGR from 2024 to 2030 due to rising demand for these drones driven by advancements in AI, machine learning, and sensor technologies that allow them to operate without human intervention. This autonomy enhances safety, efficiency, and reliability, making these drones attractive for various applications, including commercial mapping, surveillance, and inspection tasks. Moreover, fully autonomous drones can navigate complex environments, make real-time decisions, and optimize routes, which enhances productivity and reduces operational costs. Such advantages associated with fully autonomous drones are stimulating their demand and creating ample growth opportunities in this segment.

Maximum Take-Off Weight Insights

Based on maximum take-off weight, the 250g to 2kg segment led the market with the largest revenue share of 39.23% in 2023, owing to the rising demand for small drones within this maximum take-off weight range due to their versatility, ease of use, and wide range of applications. Drones in this weight class are ideal for both recreational and commercial purposes, such as aerial photography, mapping, and inspection, making them popular among consumers as well as professionals alike. Their lightweight design ensures they are portable and often subject to fewer regulatory restrictions compared to larger drones. In addition, the increasing availability of advanced features such as high-resolution cameras, obstacle avoidance systems, and longer flight times of these drones has made them more attractive to consumers and businesses, further accelerating growth in this segment.

The <250g segment is expected to record at the fastest CAGR from 2024 to 2030. The increasing affordability and portability of micro-drones have made them accessible to a wider range of consumers, including hobbyists, researchers, and commercial users. Moreover, advancements in technology, such as improved battery life, camera capabilities, and autonomous flight features, have enhanced the capabilities and versatility of micro-drones. These factors, combined with the growing demand for compact and easy-to-operate drones for various applications, are expected to drive segmental growth over the coming years.

Regional Insights

North America dominated the small drone market with the largest revenue share of 40.0% in 2023. The favorable regulatory environment in North America, with the Federal Aviation Administration (FAA) establishing guidelines for commercial drone operations, is contributing to market growth. The small drone market is witnessing significant growth in North America due to several factors. In addition, the presence of various prominent drone manufacturers in the region who are inclined to deliver advanced drones with cutting-edge capabilities is also fueling the market growth. The increasing adoption of drones for commercial applications and recreational use is expected to expand the market further in the coming years.

U.S. Small Drone Market Trends

The small drone market in the U.S. is expected to record at a considerable CAGR of 13% during the forecast period. The increasing affordability and accessibility of small drones have made them popular among consumers for recreational and personal use. Moreover, the growing number of commercial applications for small drones and the development of advanced features such as autonomous flight capabilities, high-resolution cameras, and long-range transmission have enhanced the versatility and appeal of small drones, creating lucrative opportunities for the market.

Asia Pacific Small Drone Market Trends

The small drone market in Asia Pacific is expected to grow at the fastest CAGR of 16% from 2024 to 2030. The growth is attributed to the increasing adoption of small drones for commercial applications such as infrastructure inspection, mapping & surveying, photography, filming, surveillance & monitoring, etc. Moreover, a favorable regulatory environment in various regional countries, coupled with the growing awareness of the benefits of drone technology, has encouraged investment in drones among businesses and entrepreneurs. In addition, the availability of affordable and high-quality small drones offered by regional manufacturers is further fueling the market growth.

Europe Small Drone Market Trends

The small drone market in Europe accounted for a notable revenue share of 23% in 2023. The increasing adoption of drones for commercial applications, such as aerial photography, agriculture, and infrastructure inspection, is driving market expansion. Moreover, favorable regulatory environments in various European countries, which have established clear guidelines for drone operations, have contributed to market expansion. Furthermore, advancements in drone technology, including improved battery life, payload capacity, and autonomous capabilities, have made drones more versatile and appealing to a wider range of users, thereby positively influencing the overall regional market.

Key Small Drone Company Insights

Some of the key players operating in the market are SZ DJI Technologies Co. Ltd., Northrop Grumman Corporation, AeroVironment, Inc., Parrot Drone SAS, and Teledyne Technologies Incorporated, among others.

-

Northrop Grumman delivers a broad range of products, services, and solutions to the U.S. and global customers, mainly to the U.S. Department of Defense (DoD) and intelligence community. The company’s major segments include aeronautics systems, defense systems, mission systems, and space systems

-

SZ DJI Technologies Co. Ltd. manufactures and supplies a range of commercial drones along with accessories and payloads. The company’s product portfolio includes drone series, such as the Phantom, Inspire, Ronin, and Spreading Winds. The company also provides attachments, such as aerial gimbals, flight controllers, flame wheels, and propulsion systems

-

Parrot Drone SAS is involved in the professional microdrone business with a focus on a variety of advanced, lightweight drones, combining multi-capabilities and performance. The company has three main vertical markets, namely defense and security; 3D mapping, surveying, and inspection; and agriculture

Key Small Drone Companies:

The following are the leading companies in the small drone market. These companies collectively hold the largest market share and dictate industry trends.

- SZ DJI Technology Co., Ltd.

- Parrot Drone SAS

- Teledyne Technologies Incorporated

- Northrop Grumman Corporation

- AeroVironment Inc.

- Draganfly Innovations Inc.

- Guangzhou EHang Intelligent Technology Co. Ltd

- 3DR, Inc.

- BAE Systems plc

- Autel Robotics Co., Ltd.

- Yuneec - ATL Drone

- Skydio, Inc.

- DELAIR SAS

Recent Developments

-

In September 2024, Draganfly Innovations Inc. launched the APEX Drone that has been specifically designed to support military and law enforcement surveillance missions while catering to the increasing global demand for a compact, transportable version of Commander 3XL. This new drone complies with the high standards of government and military applications, making it suitable for defense and law enforcement operations

-

In September 2024, SZ DJI Technology Co., Ltd. launches DJI Neo, the company's lightest and most compact drone, weighing just 135g. It can be fully operated without a remote control, features AI subject tracking, QuickShots, lands and launched on the palm, and offers 4K ultra-stabilized video with a flight time of up to 18 minutes. Its full-coverage propeller guards give users the safest experience while recording their day-to-day adventures

-

In June 2024, Teledyne Technologies Incorporated acquired Adimec Holding B.V. and its subsidiaries. The latter is engaged in the development of customized high-performance industrial and scientific cameras for applications wherein image quality is of utmost importance

-

In March 2024, Autel Robotics Co., Ltd. secured the C2 certification for the EVO II V3 series of drones, which marks a major milestone for the company in complying with the European Drone Regulation 2019/945 (R945). The certification involves a firmware update for the EVO II V3 series to ensure compliance with the latest regulatory standards

Small Drone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.57 billion

Revenue forecast in 2030

USD 30.57 billion

Growth rate

CAGR of 14.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, mode of operation, maximum take-off weight, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

SZ DJI Technology Co., Ltd.; Parrot Drone SAS; Teledyne Technologies Incorporated; Northrop Grumman Corporation; AeroVironment Inc.; Draganfly Innovations Inc.; Guangzhou EHang Intelligent Technology Co. Ltd; 3DR, Inc.; BAE Systems plc; Autel Robotics Co., Ltd.; Yuneec - ATL Drone; Skydio, Inc.; DELAIR SAS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Drone Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global small drone market report based on type, application, mode of operation, maximum take-off weight, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-Wing

-

Rotary

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Commercial

-

Military

-

Government & Law Enforcement

-

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Piloted

-

Partially Autonomous

-

Fully Autonomous

-

-

Maximum Take-Off Weight (MTOW) Outlook (Revenue, USD Million, 2018 - 2030)

-

<250g

-

250g to 2kg

-

2kg to 25kg

-

25kg to 150kg

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global small drone Market size was estimated at USD 12.03 billion in 2023 and is expected to reach USD 13.57 billion in 2024.

b. The global small drone Market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 30.57 billion by 2030

b. The rotary segment captured the largest revenue share of over 60% in 2023 within the small drone market due to its superior maneuverability, vertical takeoff and landing (VTOL) capabilities, and suitability for a wide range of applications. Rotary-wing drones are finding important usage in operations requiring precision and stable hovering, such as aerial photography, surveillance, and infrastructure inspection. Moreover, advancements in battery technology and improved flight control systems have further enhanced their performance, impelling their adoption in many commercial and industrial applications. These factors collectively contribute to the segment growth.

b. Some of the key players operating in the small drone include SZ DJI Technology Co., Ltd.; Parrot Drone SAS; Teledyne Technologies Incorporated; Northrop Grumman Corporation; AeroVironment Inc.; Draganfly Innovations Inc.; Guangzhou EHang Intelligent Technology Co. Ltd; 3DR, Inc.; BAE Systems plc; Autel Robotics Co., Ltd.; Yuneec - ATL Drone; Skydio, Inc.; and DELAIR SAS

b. The market is witnessing significant growth due to increasing demand across various industries such as construction, real estate, and media for aerial photography, surveying, monitoring, infrastructure inspections, etc. In addition, technological advancements are also contributing to the growth of the small drone market. Improvements in battery technology, propulsion systems, camera capabilities, and autonomous flight capabilities are making drones more efficient, versatile, and user-friendly. The development of advanced sensors, such as thermal cameras and LiDAR, is expanding the applications of small drones.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.