- Home

- »

- Next Generation Technologies

- »

-

Software Defined Vehicles Market, Industry Report, 2033GVR Report cover

![Software Defined Vehicles Market Size, Share & Trends Report]()

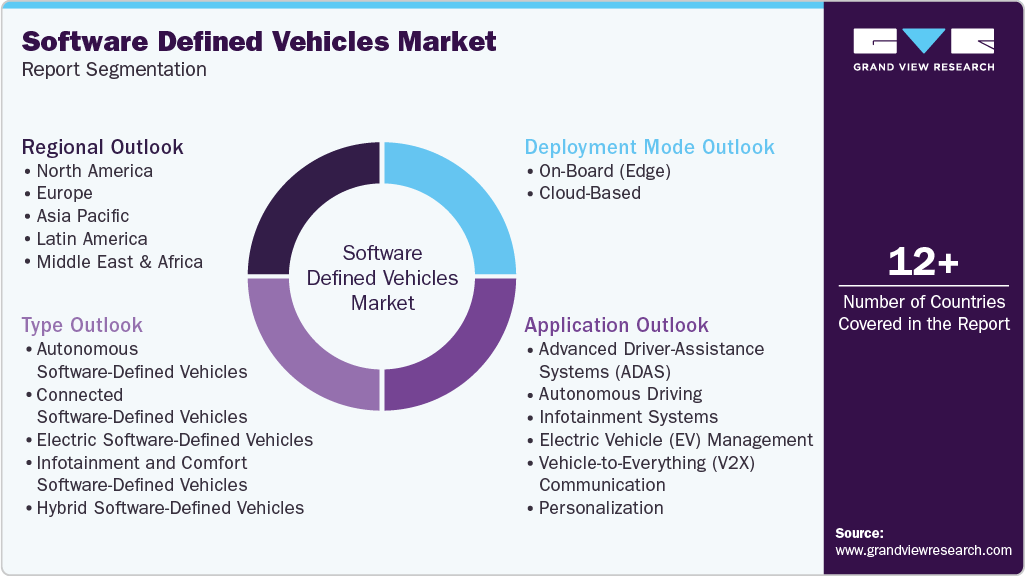

Software Defined Vehicles Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment Mode (On-Board (Edge), Cloud-Based), By Type (Autonomous Software-Defined Vehicles, Hybrid Software-Defined Vehicles), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-678-9

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Software Defined Vehicles Market Summary

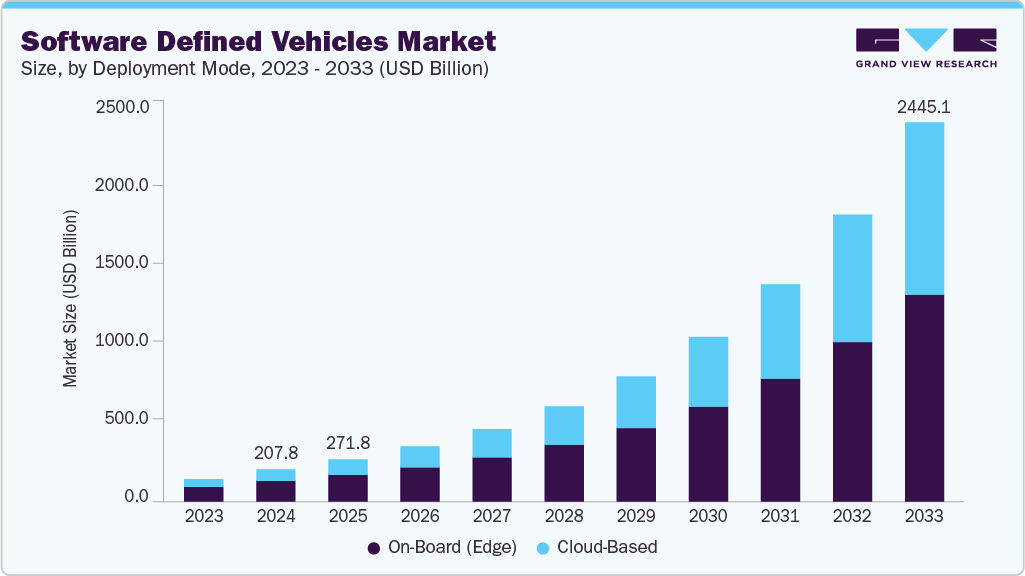

The global software defined vehicles market size was estimated at USD 207.76 billion in 2024 and is projected to reach USD 2,445.10 billion by 2033, growing at a CAGR of 31.6% from 2025 to 2033. Automakers are transitioning from traditional distributed electronic control units to domain- and zonal-based architectures.

Key Market Trends & Insights

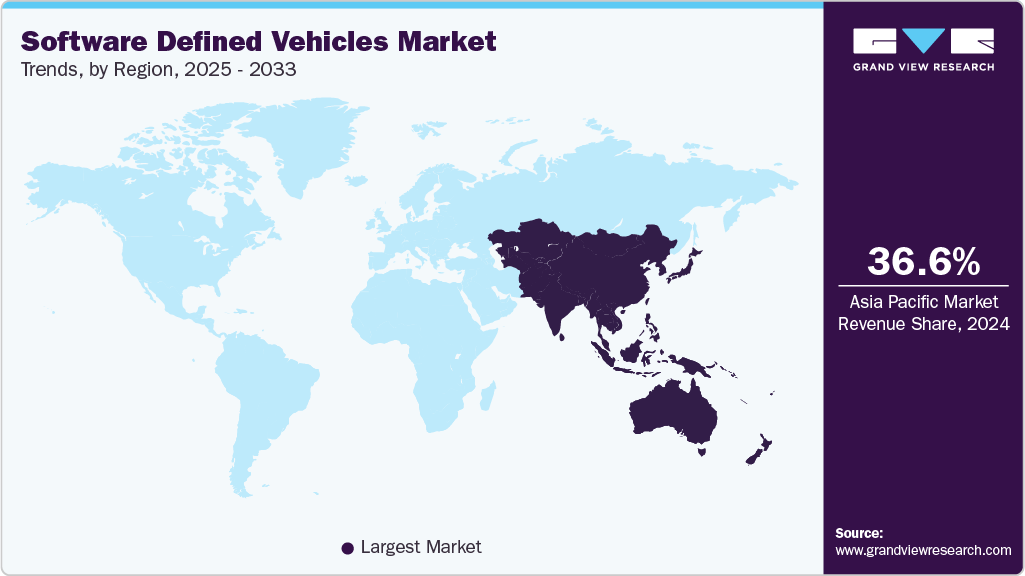

- Asia Pacific Software Defined Vehicles dominated the global market with the largest revenue share of 36.6% in 2024.

- The Software Defined Vehicles market in the U.S. led the North America and held the largest revenue share in 2024.

- By deployment mode, the on-board (Edge) led the market and held the largest revenue share of 64.3% in 2024.

- By type, the connected software-defined vehicles segment held the dominant position in the market and accounted for the largest revenue share of 27.4% in 2024.

- By application, the autonomous driving segment is expected to grow at the fastest CAGR of 36.6% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 207.76 Billion

- 2033 Projected Market Size: USD 2,445.10 Billion

- CAGR (2025-2033): 31.6%

- Asia Pacific: Largest and Fastest market in 2024

This change allows for faster and more efficient real-time data processing within the vehicle. It also simplifies the implementation of over-the-air software updates and centralized control. These advancements are contributing to the steady growth of the software-defined vehicles market. Virtualization enables developers to simulate vehicle systems without physical prototypes, accelerating software design and testing. This reduces development time and cost, allowing automakers to launch feature-rich vehicles more quickly. Early validation of safety-critical functions improves reliability and lowers warranty risks for suppliers.

Continuous updates extend vehicle lifecycles and increase product value. Companies are adopting virtualization to streamline development and drive software-defined vehicle adoption. For instance, in January 2025, Intel Corporation, a U.S.-based Semiconductor manufacturing corporation, partnered with Amazon Web Services, Inc. to launch a virtual development environment for software-defined vehicles. This partnership enables seamless automotive software and hardware integration throughout the development cycle.

Software-defined vehicles are incorporating real-time AI analytics to improve overall driving experiences. These systems enable personalized driver support through continuous monitoring of vehicle and environmental data. Predictive maintenance powered by AI helps identify issues before failure, reducing downtime and costs. Remote diagnostics allow quicker service responses and streamlined vehicle upkeep. This trend shows the shift toward intelligent, connected, and proactive automotive systems. Companies are deploying AI-based solutions to enable smart remote assistance and real-time vehicle support. For instance, in January 2025, Valeo, an automotive technology company in France, and Amazon Web Services (AWS) partnered to advance software-defined vehicles with cloud-based tools that accelerate ECU development and autonomous mobility testing. Their solutions also enhance the driving experience through real-time AI-driven services.

The expansion of V2X and connected vehicle ecosystems is accelerating the adoption of Software-Defined Vehicles (SDVs) by enabling seamless communication between vehicles, infrastructure, and external networks. This connectivity requires advanced software platforms that can handle real-time data processing and decision-making. SDVs are uniquely positioned to support these requirements through centralized computing and flexible software-defined architectures. The integration of 5G and edge computing ensures low-latency communication, which is essential for safety-critical V2X applications. As vehicles exchange data with their surroundings, the need for adaptive, updateable software becomes more critical. Over-the-air (OTA) updates allow SDVs to continuously evolve and respond to changes in traffic systems and regulations.

Deployment Mode Insights

The On-Board (Edge) segment dominated the software defined vehicles market in 2024, accounting for a 64.3% share, due to their ability to process data locally with minimal latency. This is critical for real-time decision-making in applications such as autonomous driving, ADAS, and V2X communication. Edge computing reduces dependency on external networks, ensuring higher reliability in safety-critical operations. Automakers prefer on-board architectures for enhanced control over system performance and cybersecurity. These systems also directly support advanced sensor fusion and environmental mapping within the vehicle. Edge-based platforms remain essential for enabling immediate responses in dynamic driving conditions.

Cloud-Based solutions are growing rapidly in the SDV market as demand rises for scalable, updateable, and data-driven vehicle systems. They enable centralized fleet management, predictive maintenance, and continuous feature deployment through OTA updates. Cloud infrastructure supports large-scale AI training, software development, and integration of third-party services. The rise of connected and electric vehicles is driving cloud adoption for real-time traffic insights, route optimization, and infotainment. Cloud platforms also facilitate cross-vehicle data sharing, creating a foundation for vehicle-as-a-platform models.

Type Insights

Connected software defined vehicles dominated the market in 2024, due to their focus on real-time communication, infotainment, and vehicle-to-everything (V2X) capabilities. These vehicles rely on continuous data exchange with cloud services, infrastructure, and other vehicles to improve the driving experience and safety. High demand for in-vehicle connectivity, telematics, and navigation services has strengthened their adoption. Automakers are integrating connected platforms to deliver OTA updates, remote diagnostics, and personalized user interfaces. Regulatory support for intelligent transportation systems has also fueled the dominance of connected SDVs. Their widespread presence forms the backbone for evolving mobility ecosystems.

Autonomous Software-Defined Vehicles are witnessing rapid growth as the automotive industry moves toward higher levels of autonomy. These vehicles require advanced perception, decision-making, and control software to operate with minimal or no human intervention. Progress in AI, sensor fusion, and compute platforms is accelerating their development and commercialization. Autonomous SDVs heavily depend on on-board edge computing to manage latency-sensitive tasks. Pilot programs and real-world deployments are increasing, especially in logistics and ride-hailing. While still in the early stages compared to connected SDVs, their market share is expanding steadily with ongoing R&D investments.

Application Insights

Advanced Driver-Assistance Systems (ADAS) dominated the software-defined vehicles market in 2024, driven by their proven impact on vehicle safety and driving comfort. Functions such as emergency braking, lane-keeping assist, and adaptive cruise control are now commonly available in newer models. Regulatory support and lower implementation costs have supported their inclusion across both premium and mid-range vehicles. ADAS depends on software to interpret sensor data, make decisions, and execute actions in real time, fitting well within the SDV framework. Automakers are adopting centralized computing platforms to streamline ADAS operations and improve system efficiency. Their broad deployment represents a key step toward semi-automated driving while maintaining driver control.

Autonomous driving applications are growing rapidly as the industry advances toward full automation. These systems require high-performance software stacks capable of handling complex driving scenarios without human intervention. Growth is driven by advancements in AI, LiDAR, radar, and edge computing, which enable real-time perception and control. Testing programs and limited deployments in robo-taxi and delivery fleets are validating autonomous capabilities. As safety frameworks and regulatory acceptance evolve, autonomous driving solutions are gaining investment and commercial interest. While still emerging, their increasing integration into software-defined platforms signals long-term growth in this application area.

Regional Insights

Asia Pacific software defined vehicles market dominated the market and accounted for a 36.6% share in 2024. Asia-Pacific is the largest region due to a strong automotive manufacturing infrastructure. Countries such as China, Japan, and South Korea are aggressively investing in EVs and intelligent mobility. High demand for connected features and advanced safety systems is driving SDV adoption. Government initiatives promoting smart transportation and 5G deployment are supporting growth. Regional tech firms are also collaborating with automakers to develop scalable SDV platforms.

U.S. Software Defined Vehicles Market Trends

The U.S. software-defined vehicles market is expanding rapidly due to strong demand for connected and autonomous vehicle technologies. Major automakers and tech firms are investing in centralized computing platforms and OTA capabilities. Regulatory support for vehicle safety and emissions compliance is accelerating SDV adoption. The presence of advanced infrastructure and innovation ecosystems further supports market growth.

Europe Software Defined Vehicles Market Trends

Europe’s software-defined vehicles market is growing steadily, driven by strict regulations on vehicle safety and emissions. Automakers are adopting SDV platforms to meet Euro 7 standards and integrate advanced ADAS features. Investments in 5G infrastructure and V2X technologies are supporting connected vehicle deployment. Collaboration between OEMs and software providers is accelerating development of modular and scalable vehicle platforms.

North America Software Defined Vehicles Market Trends

North America’s software-defined vehicles market is expanding, supported by early adoption of connected and autonomous vehicle technologies. Automakers are focusing on software integration to enhance safety, infotainment, and OTA functionality. Regulatory initiatives and pilot programs for self-driving vehicles are encouraging SDV deployment. Collaboration between OEMs, tech firms, and chipmakers is driving innovation across the region.

Key Software Defined Vehicles Company Insights

Some of the key companies in the software defined vehicles industry include Aptiv PLC, General Motors Company, Hyundai Motor Company, NVIDIA Corporation, Qualcomm Technologies, Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amazon Web Services, Inc. (AWS) is supporting the software-defined vehicles market by offering robust cloud infrastructure for data storage, analytics, and over-the-air update management. It enables OEMs to simulate, test, and deploy vehicle software using services such as AWS IoT FleetWise and AWS SimSpace Weaver. Through edge services such as AWS Wavelength and Greengrass, it addresses low-latency processing needs in connected vehicles. These capabilities assist manufacturers accelerate innovation, manage large-scale vehicle data, and deliver dynamic in-vehicle services.

-

NVIDIA Corporation is advancing software-defined vehicles with its DRIVE platform, which integrates high-performance computer hardware and AI-powered software stacks. The company offers end-to-end solutions including DRIVE OS, DRIVE AV, and DRIVE Sim to support autonomous functionality and real-time decision-making. Its systems-on-chip (SoCs), such as Orin and Xavier, are used in zonal and centralized SDV architectures to process vast sensor data efficiently.

Key Software Defined Vehicles Companies:

The following are the leading companies in the software defined vehicles market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Aptiv PLC

- General Motors Company

- Hyundai Motor Company

- Mercedes-Benz Group AG

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Tesla, Inc.

- Toyota Motor Corporation

Recent Developments

-

In March 2025, Magna International Inc., a mobility technology company in Canada, and NVIDIA Corporation partnered to integrate the NVIDIA DRIVE AGX platform, built on the DRIVE Thor SoC, into Magna’s next-generation automotive technology solutions. This partnership aims to enable scalable, AI-powered systems for software-defined vehicles, enhancing ADAS, autonomous driving, and interior cabin intelligence features.

-

In February 2025, Hyundai Motor Group launched its new software brand Pleos and a development platform featuring software development kits (SDKs) and application programming interfaces (APIs) for software-defined vehicles. The platform supports next-generation infotainment, third-party app development, and SDV integration across Hyundai, Kia, and Genesis vehicles.

-

In February 2025, QORIX GmbH, a software company in Germany, collaborated with Qualcomm Technologies to develop software-defined vehicle (SDV) solutions by integrating QORIX’s middleware into Qualcomm’s Snapdragon Digital Chassis, including the Ride and Cockpit platforms. This collaboration aims to simplify system integration for OEMs and Tier 1 suppliers, enabling high-performance, scalable, and adaptable SDV development.

Software Defined Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 271.77 billion

Revenue forecast in 2033

USD 2,445.10 billion

Growth rate

CAGR of 31.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Deployment mode, type, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Amazon Web Services, Inc.; Aptiv PLC; General Motors Company; Hyundai Motor Company; Mercedes-Benz Group AG; NVIDIA Corporation; Qualcomm Technologies, Inc.; Robert Bosch GmbH; Tesla, Inc.; Toyota Motor Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Software Defined Vehicles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global software defined vehicles market in terms of deployment mode, type, application, and region:

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Board (Edge)

-

Cloud-Based

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Autonomous Software-Defined Vehicles

-

Connected Software-Defined Vehicles

-

Electric Software-Defined Vehicles

-

Infotainment and Comfort Software-Defined Vehicles

-

Hybrid Software-Defined Vehicles

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Advanced Driver-Assistance Systems (ADAS)

-

Autonomous Driving

-

Infotainment Systems

-

Electric Vehicle (EV) Management

-

Vehicle-to-Everything (V2X) Communication

-

Personalization

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global software defined vehicles market size was estimated at USD 207.76 billion in 2024 and is expected to reach USD 271.77 billion in 2025.

b. The global software defined vehicles market is expected to grow at a compound annual growth rate of 31.6% from 2025 to 2033 to reach USD 2,445.10 billion by 2033.

b. Asia Pacific dominated the software defined vehicles market with a share of 36.6% in 2024. This is attributable to rapid vehicle electrification, strong government support for smart mobility, and increasing investment in automotive software development.

b. Some key players operating in the software defined vehicles market include Amazon Web Services, Inc., Aptiv PLC, General Motors Company, Hyundai Motor Company, Mercedes-Benz Group AG, NVIDIA Corporation, Qualcomm Technologies, Inc., Robert Bosch GmbH, Tesla, Inc., Toyota Motor Corporation.

b. Key factors that are driving the market growth include increasing demand for connected vehicles, rising adoption of advanced driver-assistance systems, growing focus on software-centric vehicle architectures, and rapid advancements in automotive electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.