Spatial Transcriptomics Market Size, Share & Trends Analysis Report By Products (Instruments, Consumables, Software), By Technology (Sequencing-Based Methods), By Workflow, By Sample Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-293-3

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Spatial Transcriptomics Market Size & Trends

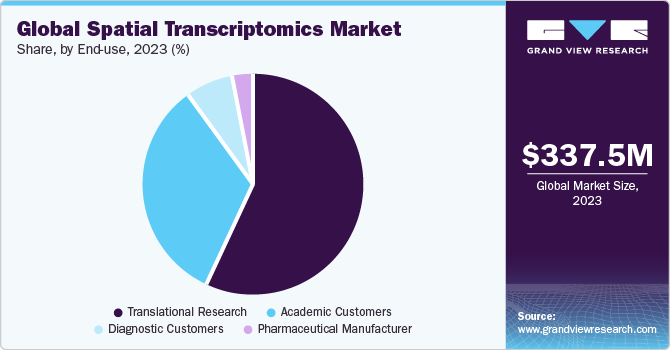

The global spatial transcriptomics market size was estimated at USD 337.5 million in 2023 and is projected to grow at a CAGR of 15.23% from 2024 to 2030. The growth of the market can be attributed to the rising prevalence of genetic diseases, increasing investments in research and development for spatial OMICS research, and the growing advancements in sequencing technologies. Moreover, one of the major drivers of this market is the potential for spatial organization of genomes to be used as disease markers such as cancer. Chromosomes and genes undergo a distinct spatial arrangement in diseased conditions, which varies in different diseases. Thus, genome positioning is considered a novel biomarker for early cancer diagnosis.

An exponential rise in the number of COVID-19 cases globally boosts the demand for spatial transcriptomics tools. A diagnostic kit based on CRISPR technology was developed by Sherlock Biosciences, which works by programming CRISPR machinery for the detection of COVID-19 genetic material in the mouth, throat swab, nose, or in specimens from the lungs. In case the genetic material of the virus is present, the CRISPR enzyme produces a fluorescent glow. The test can deliver results in about an hour, as reported by the company. Such factors indicate the positive impact of the COVID-19 pandemic on this market. Thus, increasing awareness and interest in medical research has further boosted the market growth. In addition, significant government investments were made toward the research and development of COVID-19 vaccines and treatments, thereby propelling the growth of the market.

Furthermore, rising demand for robust cancer diagnostic solutions, increasing investments in genomic & transcriptomics studies, and technological advancements in genetic tools have created significant opportunities for market entities to expand their businesses. Hence, investment in this market can be a crucial growth strategy for entities to boost their position in the disease diagnostics & genomics sector. Emerging and startup genomic companies are making efforts to address the increasing demand for advanced techniques to study spatial patterns by the addition of novel products to their product portfolios.

Moreover, in cancer treatment, spatial transcriptomics technology helps evaluate the position of T and cells-whether the cells have infiltrated inside a tumor or are surrounding the tumor. This acts as an important prognostic indicator. Understanding the spatial pattern of the biological analytes in tissues accelerates the determination of the underlying causes and treatment approaches for chronic conditions. Visium Spatial Gene Expression platform is based on a technology acquired from Spatial Transcriptomics, a subsidiary of 10x Genomics. The platform helps in designing libraries of molecules that can be sequenced using a standard sequencing system. The emergence of spatial transcriptomics data provides a chance to decode the complex dynamics of cellular conditions and interactions among cells in cancer. Thereby, propelling the market growth of spatial transcriptomics over the forecast period.

Market Concentration & Characteristics

The spatial transcriptomics industry has seen significant innovation in recent years, with the introduction of advanced technologies that have improved the efficiency and accuracy of data analysis. The advancement in bioinformatics and computational biology has been instrumental in the growth of the spatial transcriptomics sector. Enhanced algorithms and software tools for analyzing and visualizing data have simplified the interpretation of complex datasets produced by spatial transcriptomics. This has led to broader applications and more intricate analyses.

In this industry, partnerships and collaboration activities are moderately prevalent, reflecting a medium level of engagement within the industry. Spatial transcriptomics are used across various industries such as pharmaceuticals, biotechnology, and research institutions. In November 2023, 10x Genomics and OWKIN collaborated to add 10x Genomics single-cell technologies and spatial omics for the MOSAIC project. Thus, boosting the demand for spatial transcriptomics in tumor analysis for therapeutic discovery.

The regulatory impact on spatial transcriptomics industry moderate. This is attributed to the lack of standardized protocols and methodologies for spatial OMICS experiments can lead to variability in results, affecting the reproducibility of studies. Hence, compliance with regulatory standards represents one of the challenges that may limit market growth to a certain extent.

The industry has seen significant growth in recent years, driven by the increasing demand for spatial transcriptomics due to the increasing research & development activities in the genomics area. For instance, in October 2023, Ultivue, Inc. introduced a portfolio of customizable biomarker panels, OmniVUE, for multiplex immunofluorescence analysis of the tumor immune microenvironment.

The industry is experiencing a high level of regional expansion, indicating rapid growth and increasing market presence across different geographic regions. This expansion is driven by several factors, including the growing research activities in genomic research and increasing epigenetic services worldwide. For instance, in May 2023, 10x Genomics opened a new HOK-designed building in Pleasanton, U.S., adding 150,000 square feet to transform cell and gene research.

Product Insights

The consumables segment dominated the market with a share of 52.73% in 2023. The consumables segment includes products required to run the instruments across various stages of genome mapping, from sample preparation to result derivation. This segment held the largest share in terms of sales owing to high product penetration, increasing use of reagents & kits, wide product availability, and frequent purchase of consumables to run the instruments.

For instance, in February 2023, Curio Bioscience launched Curio Seeker, the world's first high-resolution whole-transcriptome spatial mapping kit. Leveraging the Slide-seq technique offers an easy-to-use, unbiased, and high-resolution solution for spatial transcriptomics, enhancing insights in biological research. Thus, anticipated to fuel the growth of the segment over the forecast period

The software segment is expected to register the highest CAGR over the forecast period. This includes products used for visualization, interpretation, and management of data generated after spatial studies of DNA & RNA molecules. The increasing volume of ongoing genomic research studies has led to the need for robust software solutions for data management and their interpretation. This is anticipated to drive the segment in the coming years.

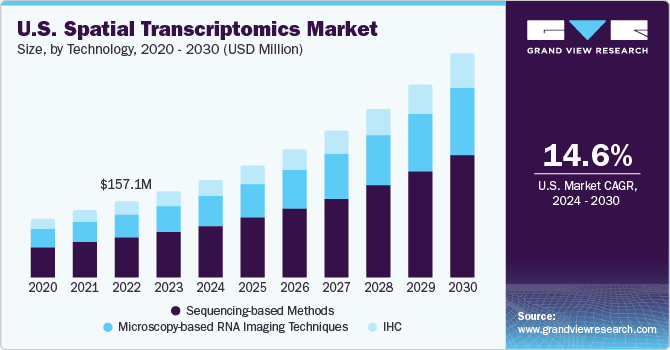

Technology Insights

The sequencing-based methods segment dominated the market with a share of 53.61% in 2023 and is anticipated to grow at the highest CAGR over the forecast period. This is attributed to the growing technological advancements and rising demand in research & clinical diagnostics. Moreover, sequencing-based methods provide high-resolution and accurate spatial mapping of gene expression within tissues. This precision allows for detailed insights into cellular functions and interactions that are critical for advanced research and clinical applications.

For instance, in March 2024, a study was conducted by Nature in March 2024, which described a new method called FISHnCHIPs for analyzing gene expression in tissues. FISHnCHIPs is a significant improvement over existing spatial transcriptomics technologies because it is less expensive and requires less work. These factors are expected to impel the growth of the segment from 2024 to 2030

The microscopy-based RNA imaging techniques segment is expected to register a significant CAGR over the forecast period. This is attributed to the high adoption of fluorescence microscopy for determining protein subcellular location and advancements in microscopy technology. Several advancements in this technique, have improved its sensitivity, imaging resolution, and throughput for gaining more insightful single‐cell level information with exceptional spatial resolution. Thus, projected to propel the growth of the segment over the forecast period.

Workflow Insights

The instrumental analysis segment dominated the market with a share of 47.02% in 2023 and is anticipated to grow at the highest CAGR over the forecast period. The growth in the segment can be primarily attributed to substantial advancements in instruments such as microscopy and mass spectrometry. Mass spectrometry is one of the most promising tools for quantifying nucleic acid & proteins. companies are launching new and advanced mass spectrometers for various applications such as metabolomics, proteomics, genomics, & biopharmaceutical characterization, further propelling segment growth.

The sample preparation segment is expected to register a significant CAGR over the forecast period. Sample preparation is crucial for obtaining high-quality sequencing products for performing transcriptomics studies. Companies launching new products for streamlining and automating the sample preparation procedure are expected to boost segment growth. For instance, in June 2022, 10x Genomics, a major player operating in the market, launched Visium CytAssist, a compact, benchtop spatial instrument to streamline sample processing by enabling the transfer of analytes from tissue sections premounted on standard glass slides to Visium slides. Thus, projected to propel the growth of the segment over the forecast period.

Sample Type Insights

The FFPE segment dominated the market with larger share in 2023. FFPE is a standard sample type widely used to preserve human tissue for clinical diagnosis. Hence, it holds a major market share in the spatial transcriptomics market. This technique is considered the best in researching tissue morphology for clinical histopathology & diagnostic purposes. Moreover, new techniques are devised for gene expression profiling in FFPE that further drive segment growth.

Furthermore, market players are implementing different strategies to gain market share and contribute to further market growth. For instance, in June 2023, Bionano Genomics introduced new kits for its Ionic Purification System, enhancing nucleic acid extraction from challenging samples, such as FFPE & tumors. The technology, based on isotachophoresis, aims to improve quality and yield.

The fresh frozen segment is expected to register the higher CAGR of 16.82% over the forecast period. The growth of this segment can be attributed to its high application in proteomic studies based on tandem Mass Spectrometry (MS). The advantage of fresh frozen tissues (mostly in the case of breast & liver cancer) is that they have existing standardized protocols for protein digestion and peptide extraction, which can be adapted for such samples.

Moreover, according to a study published in January 2023 by MDPI, researchers have developed a 3D-printed device for preparing fresh-frozen needle biopsies. This device enables multimodal spatial OMICS analysis alongside routine FFPE histopathology from the same core. Thereby, propelling the growth of the segment over the forecast period.

End-use Insights

The translational research segment dominated the market with a share of 56.63% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Increasing the usage of spatial transcriptomics to translate real-time tissue responses to an external agent increases the technology’s adoption in translational research. The use of spatial translational in translational research is projected to potentially benefit researchers by providing a clear analysis of the physiology & state of a disease, the evolution of new diagnostic tools, and the development of new drugs & therapeutics.

In July 2023, IDIBAPS launched three new multidisciplinary research initiatives aimed at fostering collaboration across its various groups. These include the Translational Cancer Research Program, the Synaptic Autoimmunity in Neurology, Psychiatry, and Cognitive Neuroscience Program, and the Lymphoid Neoplasms Program. Such initiatives are propelling the growth of the segment over the forecast period.

The academic customers segment is expected to register a significant CAGR over the forecast period. The academic institute especially focuses on cancer, metabolic (diabetes), neurologic (Alzheimer's, insomnia, schizophrenia), and autoimmune & inflammatory diseases. Hence, increasing the demand for spatial transcriptomics analyses. Over the past few years, universities have commercialized their research to fund further research and as a potential source of income. Correspondingly, funding bodies are also interested in promoting the commercialization of research.

Regional Insights

North America accounted for the largest market share of 57.73% in 2023 for the spatial transcriptomics market. The increasing prevalence of cancer, growing demand for personalized medicine, well-developed healthcare facilities, and availability of novel diagnostic techniques are among the factors contributing to the large market share held by North America. Growing morbidity and mortality rates due to cancer and other metabolic, autoimmune, & inflammatory disorders have led to an increase in the need for developing novel therapies, thereby driving the market in this region. In addition, companies operating in the region are launching new initiatives and programs for discovering & increasing translational applications, which is further contributing to market growth

U.S. Spatial Transcriptomics Market Trends

The spatial transcriptomics market in the U.S. is expected to grow over the forecast period due to a growing demand for comprehensive biological insights, fueled by advancements in omics technologies.

Europe Spatial Transcriptomics Market Trends

Europe spatial transcriptomics market was identified as a lucrative region in this industry. This can be attributed to the advancements in the fields of genomics, sequencing, and biochemical technologies. The presence of genome sequencing firms such as 24 Genetics and Dante Labs has ensured easy accessibility of genome sequencing services in the region.

The spatial transcriptomics market in the UK held a significant share in 2023. The UK-based biotech firms are outperforming their European counterparts in securing early-stage funding. In March 2023, the UK government announced plans to allocate USD 295.35 million (GBP 277 million) to support manufacturing projects in medical diagnostics & human medicines of four life sciences companies in the UK.

France spatial transcriptomics market is expected to grow remarkably over the forecast period. Key players around the world are expanding their presence in France. For instance, The Institut Curie Mass Spectrometry and Proteomics Facility (LSMP) is also involved in providing researchers with technical services that enable them to analyze proteins by mass spectrometry.

The spatial transcriptomics market in Germany is anticipated to grow significantly over the forecast period. Germany is witnessing substantial growth in the multi-omics field, characterized by active participation from renowned academic institutions, biotechnology & pharmaceutical companies, and government funding for research projects.

Asia Pacific Spatial Transcriptomics Market Trends

The Asia Pacific spatial transcriptomics market held highest CAGR of 16.92% over the forecast period. This upsurge is attributed to the increase in the incidence of cancer, diabetes, Alzheimer’s disease, rheumatoid arthritis, and other neurodegenerative, autoimmune, and metabolic disorders. Moreover, the large population and untapped markets of emerging economies have increased the focus of leading global firms in Asia Pacific. In addition, the region offers relatively inexpensive manufacturing & operating units for conducting R&D.

The spatial transcriptomics market in China is expected to grow over the forecast period. This is attributed to an increase in translational research in the country. The field of translational research has received considerable attention from regional and central governments in China. Therefore, the funding for translational research has increased over the past few years

Japan spatial transcriptomics market is witnessing rapid growth due to the growth of biotechnology research in the country and provides funds to conduct research in the fields of medicine and life sciences. Thus, encourages researchers to actively explore transcriptomics space by engaging in research activities to determine the spatial arrangement of cells in a tissue.

MEA Spatial Transcriptomics Market Trends

The spatial transcriptomics market in MEA is expected to grow exponentially over the forecast period. Cancer is a major public health concern in MEA. High mortality associated with the unavailability of resources, such as diagnostics, underdeveloped healthcare infrastructure, and lack of affordable treatment options make MEA a preferred region for investments by large manufacturers. However, a limited number of institutes having advanced sequencing facilities is hampering market growth in the region.

Saudi Arabia spatial transcriptomics market is expected to grow over the forecast period. This is attributed to various initiatives undertaken by the government to expand the biotechnology sector in the country.

The spatial transcriptomics market in Kuwait is anticipated to grow over the forecast period, owing to the substantial developments in its healthcare infrastructure, the country is addressing the rising incidence of infectious diseases, chronic ailments, and lifestyle-related health issues.

Key Spatial Transcriptomics Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Spatial Transcriptomics Companies:

The following are the leading companies in the spatial transcriptomics market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- NanoString Technologies, Inc.

- 10x Genomics.

- Cantata Bio

- Bruker

- EVOSEP

- Shimadzu Corporation

- Waters

- Horizon Discovery Group plc

- Bio-Techne

Recent Development

-

In April 2024, Vizgen broadened its portfolio in single-cell spatial transcriptomics by launching the MERSCOPE Ultra Platform and introducing MERFISH 2.0 Chemistry at the AACR 2024 event.

-

In April 2024, Bruker announced the acquisition of NanoString Technologies which is a U.S.-based provider of spatial transcriptomics solutions. This acquisition is anticipated to strengthen Bruker’s product portfolio, thus expanding its business.

-

In March 2024, 10x Genomics, Inc. officially announced the commercial launch of its Visium HD Spatial Gene Expression assay. This advanced product allows scientists to analyze the entire transcriptome in FFPE tissue sections with the precision of single-cell resolution.

-

In February 2024, DNAnexus the provider of Precision Health Data Cloud announced their collaboration with Curio Bioscience to simplify and streamline data analysis for spatial transcriptomics projects at a larger-scale. The integration of Curio Seeker and Precision Health Data Cloud offers researchers a secure and scalable platform to manage and distribute high-resolution, spatially defined gene expression data.

Spatial Transcriptomics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 385.5 million |

|

Revenue forecast in 2030 |

USD 902.2 million |

|

Growth rate |

CAGR of 15.23% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, workflow, sample type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Illumina, Inc.; NanoString Technologies, Inc.; 10x Genomics.; Cantata Bio; Bruker; EVOSEP; Shimadzu Corporation; Waters; Horizon Discovery Group plc; Bio-Techne |

|

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Spatial Transcriptomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global spatial transcriptomics market based on product, technology, workflow, sample type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

By Mode

-

Automated

-

Semi-automated

-

Manual

-

-

By Type

-

Sequencing Platforms

-

IHC

-

Microscopy

-

Flow Cytometry

-

Mass Spectrometry

-

Others

-

-

-

Consumables

-

Software

-

Bioinformatics Tools

-

Imaging Tools

-

Storage And Management Databases

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing-based Methods

-

Laser Capture Microdissection (LCM)

-

Transcriptome In-Vivo Analysis (TIVA)

-

In Situ Sequencing

-

Microtomy Sequencing

-

-

IHC

-

Microscopy-based RNA Imaging Techniques

-

Single Molecule RNA Fluorescence In-Situ Hybridization (smFISH)

-

Padlock Probes/ Rolling Circle Amplification

-

Branched DNA Probes

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation

-

Instrumental Analysis

-

Data Analysis

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

FFPE

-

Fresh Frozen

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Translational Research

-

Academic Customers

-

Diagnostic Customers

-

Pharmaceutical Manufacturer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global spatial transcriptomics market size was estimated at USD 337.5 million in 2023 and is expected to reach USD 385.5 million in 2024.

b. The global spatial transcriptomics market is expected to grow at a compound annual growth rate of 15.23% from 2024 to 2030 to reach USD 902.2 million by 2030.

b. Consumables segment dominated the spatial transcriptomics market with a share of 52.73% in 2023. This is attributed to the high product penetration and high usage of kits & reagents.

b. Major market players operating in the global spatial transcriptomics market include Illumina, Inc., NanoString Technologies, Inc., 10x Genomics., Cantata Bio, Bruker, EVOSEP, Shimadzu Corporation, Waters, Horizon Discovery Group plc, and Bio-Techne among others.

b. The rising potential of spatial omics analysis as a cancer tool increased the demand for spatial transcriptomics, continuous advancements in spatial transcriptomics technologies, and the expanding field of drug discovery and development are anticipated to increase the demand for spatial transcriptomics over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."