- Home

- »

- Catalysts & Enzymes

- »

-

Specialty Enzymes Market Size, Share, Industry Report 2030GVR Report cover

![Specialty Enzymes Market Size, Share & Trends Report]()

Specialty Enzymes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Carbohydrase, Proteases, Lipases), By Application (Pharmaceutical, Research & Biotechnology), By Source (Plants, Animals, Microorganisms), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-112-8

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Specialty Enzymes Market Summary

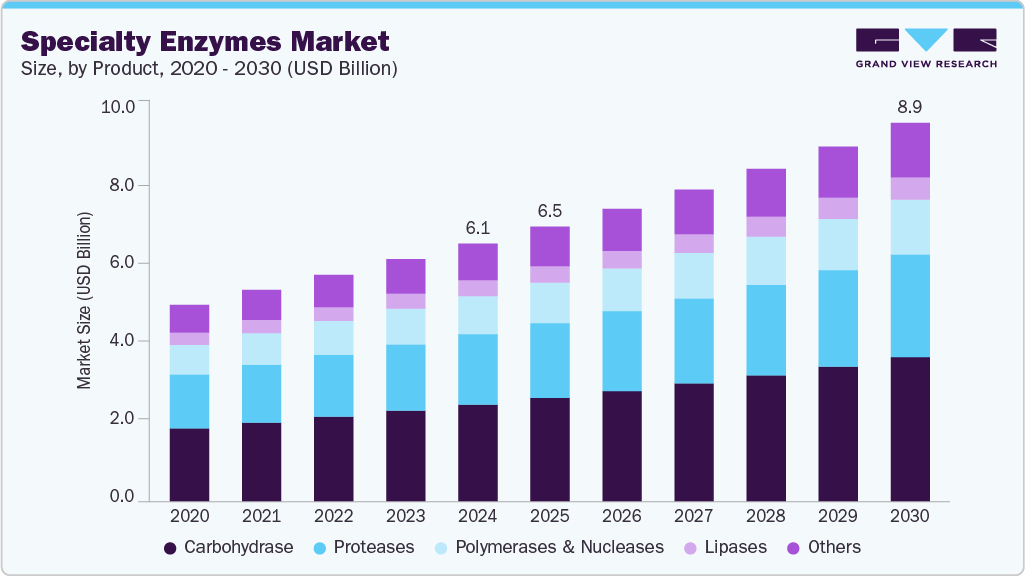

The global specialty enzymes market size was valued at USD 6.05 billion in 2024 and is projected to reach USD 8.89 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The growth of the product market is attributed to the growing prevalence of chronic diseases such as cancer and rheumatoid arthritis.

Key Market Trends & Insights

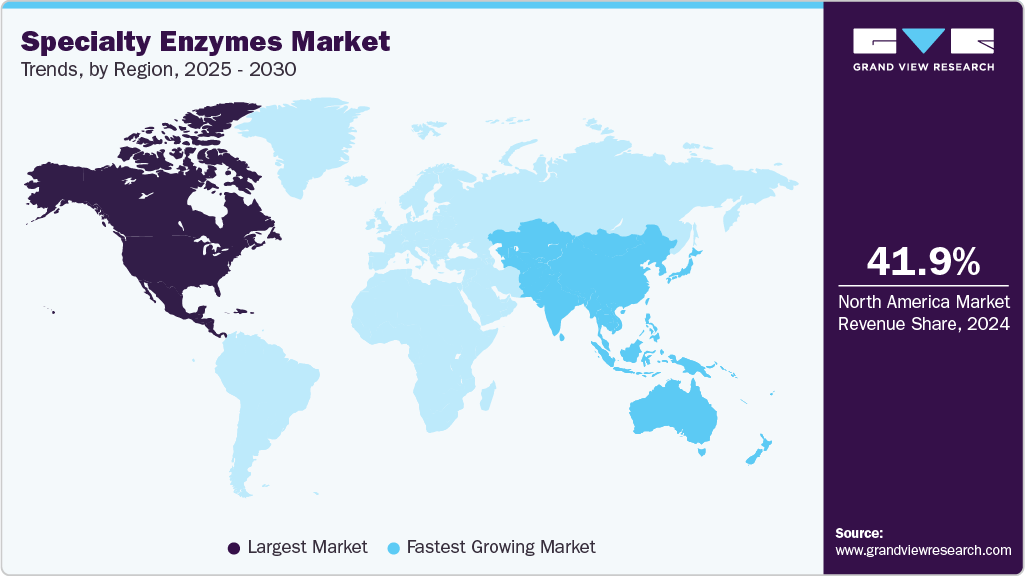

- North America specialty enzymes market dominated the global market with the largest revenue share of 41.9% in 2024.

- The U.S. specialty enzymes market held the largest share in 2024, owing to increased demand for specialty enzymes in pharmaceuticals and diagnostics.

- By product, the carbohydrase segment dominated the market with the largest revenue share of 37.6% in 2024.

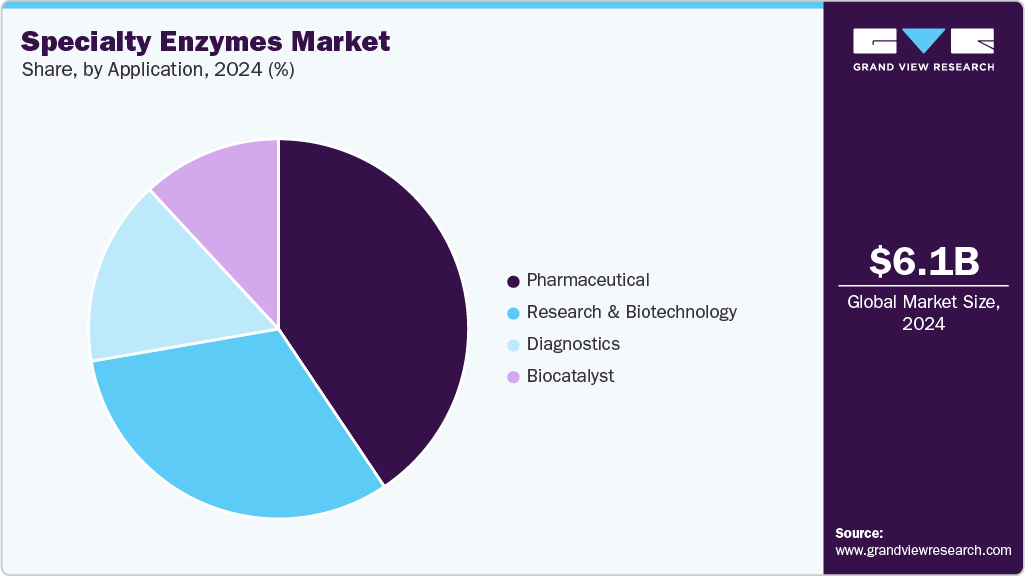

- By application, the pharmaceutical segment held the largest revenue share in 2024.

- By source, the microorganisms segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Revenue: USD 6.05 Billion

- 2030 Projected Market Size: USD 8.89 Billion

- CAGR (2025-2030):6.6%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Furthermore, the expansion of food industries drives the demand for specialty enzymes. The enzymes such as lipases, amylases, proteases, rennet, pectinases, invertases, cellulases, and glucose oxidase play a vital role in the food processing industry. However, the complexities in biosimilar development may hinder the market's growth. Utilizing specialty enzymes provides swift and effective solutions to various challenges, contributing to market expansion. These enzymes are widely used in diagnostic methods, including DNA modification and sequencing. The anticipated decline in the costs of DNA modification and sequencing is expected to drive enzyme demand in research, biotechnology, and medical applications. Moreover, the aging population in affluent countries is likely to increase the need for specialty enzymes in healthcare.

The development of innovative diagnostic methods, increasing adoption of enzymes in healthcare, and ongoing technological advancements are key drivers of global market growth. However, a major challenge is the limited consumer awareness of the benefits of specialty enzymes.

Legal and ethical concerns and low consumer awareness, particularly in emerging economies, also threaten market growth. Nevertheless, the rising rate of industrialization and adoption of advanced technologies in the pharmaceutical sector across emerging markets are expected to create future opportunities for market participants.

Increasing demand in pharmaceuticals and biotechnology fuels the specialty enzymes industry, driven by the need for efficient drug development, diagnostics, and therapeutic solutions. Breakthroughs in biotechnology and enzyme engineering improve enzyme performance, specificity, and stability, enabling customized applications across various industries. These advancements reduce production costs and enhance process efficiency, making specialty enzymes more attractive to manufacturers.

The combination of growing industry needs and technological innovation is projected to accelerate market growth, expanding the use of specialty enzymes in healthcare, research, and industrial processes worldwide. In February 2024, New England Biolabs (NEB) introduced the NEBNext Enzymatic 5hmC-seq Kit (E5hmC-seq), a new enzyme-based method for detecting 5-hydroxymethylcytosine (5hmC) sites.

Product Insights

The carbohydrase segment dominated the market with the largest revenue share of 37.6% in 2024, fueled by rising consumer demand for dietary supplements and digestive health products that rely heavily on carbohydrase enzymes. In addition, extensive research and development efforts focused on improving enzyme yield, specificity, and stability through advanced fermentation techniques have further boosted the segment’s growth. The versatile applications of carbohydrases in biotechnology and food processing continue to reinforce their leading position within the specialty enzymes market.

Polymerase and nuclease products are also anticipated to witness lucrative growth due to their significant use in molecular biology applications, such as recombinant DNA and polymerase chain reactions. Gene therapy holds promise for treating many diseases, such as cancer, cystic fibrosis, heart disease, diabetes, hemophilia, and AIDS. Thus, an upsurge in cancer prevalence propels this segment's growth.

Lipases, phospholipases, and cellulases are prominent enzymes in the biofuel sector. For instance, enzymes such as phospholipase and lipase play a vital role in biodiesel production. Numerous biodiesel manufacturers have commercialized their biodiesel production by adding enzymatic processes. From a processing standpoint, lipase converts free fatty acids (FFAs) to fatty acid methyl esters (FAME), while phospholipase converts diacylglycerol, which acts as a substrate for lipase. Such factors are responsible for increasing yield and reducing chemical waste.

The proteases segment is anticipated to grow at a significant CAGR of 6.5% over the forecast period. Advances in enzyme engineering have improved their efficiency and stability, making them suitable for specialized uses. Growing consumer preference for sustainable and eco-friendly products increases the demand for proteases. Expansion in biopharmaceutical research and personalized medicine also supports broader use of proteases.

Application Insights

The pharmaceutical segment held the largest revenue share in 2024, propelled by rising population, growing consumer demand, and increasing disease awareness. This growth is attributed to the growing population, high consumer demand, and rising disease awareness. Cysteine proteinases, streptokinase, asparaginase, deoxyribonuclease, glucocerebrosidase, urokinase, pegademase, and hyaluronidase are the prominently used enzymes in the pharmaceutical sector. The critical applications of specialty enzymes in the pharmaceutical industry include diagnosing diseases, promoting wound healing, and killing disease-causing microorganisms. Further, increasing research & development has made it possible for specialty enzymes to be used in drug formulation and delivery.

The research & biotechnology sector is responsible for developing new medicines and diagnostic solutions. Ascending demand for medicinal drugs, extensive research activities, and substantial funding initiatives are expected to drive this sector, which, in turn, is likely to fuel the demand for enzymes in the coming years.

The R&D centers of several companies focus on the evaluation, validation, development, and upscaling of technologies and innovative enzyme formulation for commercial processing and human welfare. Furthermore, they are used to diagnose bone diseases, autoimmune & inflammatory diseases, cancer, diabetes, liver diseases, myocardial infarction, kidney disorder, pancreatitis, and skin disorders. Moreover, rising government spending in developed countries for medical and diagnostic purposes is anticipated to create growth opportunities for the market over the forecast period.

The biocatalyst segment is projected to be the fastest-growing segment in the specialty enzymes industry from 2025 to 2030, owing to its essential role in accelerating metabolic reactions across various sectors. Its applications in waste degradation, fermentation, and stain removal highlight its environmental and economic benefits. Biocatalysts provide sustainable solutions that meet industry demands for greener processes by increasing energy efficiency, minimizing solvent consumption, and boosting productivity.

Source Insights

The microorganisms segment accounted for the largest market share in 2024 due to the widespread use of amylases in the biotechnology and pharmaceutical industries. Microbial enzymes offer high efficiency, stability, and cost-effectiveness, making them ideal for diverse applications across the chemical, fermentation, agriculture, pharmaceutical, and food production sectors. Microorganisms' ability to produce a wide variety of enzymes supports continuous innovation and scalability. Growing industrial demand for sustainable and efficient enzyme solutions further strengthens the dominance of the microorganism-derived specialty enzymes segment in the market.

Microbial enzymes are vital for medical treatments as they are inexpensive, consistent, and simple to isolate. The main advantage of microbial enzyme production is that it quickly yields high yields on low-cost media. These factors are expected to boost the segment's growth potential over the forecast period. Some commercial enzymes such as amylase, invertase, papain, bromelain (bromelin) ficin, and malt diastase are derived from plant sources. These enzymes have played an essential part in food production, including syrups, bakery products, alcoholic beverages, dairy products, etc.

The animal segment is projected to grow at the fastest CAGR over the forecast period, propelled by the increasing prevalence of digestive disorders and the rising demand for health supplements. These enzymes, naturally found in animals consumed by humans, offer safe and effective solutions for digestive health. Growing awareness about the benefits of animal-derived enzymes in improving nutrient absorption and overall wellness supports market expansion. Innovations in extraction and formulation methods further enhance their appeal, positioning the animal segment as one of the fastest-growing areas within the specialty enzymes industry.

Regional Insights

North America specialty enzymes market dominated the global market with the largest revenue share of 41.9% in 2024, driven by the increasing number of specialty enzyme product approvals and launches for disease treatment. Enhanced regulatory support and advancements in biotechnology have accelerated the development of enzyme-based therapies, making them more accessible for drug formulation, diagnostics, and personalized medicine. Key enzymes like proteases and polymerases are gaining prominence in these applications. The U.S.'s well-developed pharmaceutical infrastructure and considerable R&D investments continue to drive market growth, making North America a major contributor to specialty enzyme innovation and adoption.

U.S. Specialty Enzymes Market Trends

The U.S. specialty enzymes market held the largest share in 2024, owing to increased demand for specialty enzymes in pharmaceuticals and diagnostics. Enzymes are essential for drug development, improving the precision of diagnostic tests, and supporting advancements in healthcare. In addition, growing consumer preference for natural and clean-label ingredients encourages food and personal care manufacturers to incorporate specialty enzymes into their products.

Europe Specialty Enzymes Market Trends

Europe specialty enzymes market is anticipated to experience significant expansion during the forecast period. Europe is one of the major producers of pharmaceutical, medicinal, and cosmetic products. The presence of leading pharmaceutical and cosmetics companies in the region is expected to propel demand for specialty enzymes. Moreover, the rapidly expanding pharmaceutical sector, driven by significant biotech companies, is expected to increase demand for specialty enzymes in pharmaceutical, biocatalyst, and research & biotechnology applications over the forecast period.

Asia Pacific Specialty Enzymes Market Trends

Asia Pacific specialty enzymes market is set to witness the fastest CAGR of 7.5% from 2025 to 2030, attributed to the increased incidence of cardiovascular diseases, high prevalence of various cancers, and a rise in product launches in the region. The increase in foreign investments in the region’s pharmaceutical sector is expected to provide further opportunities for specialty enzyme consumption. Furthermore, growing consumption of processed food products, coupled with consumer preference for high-quality items and natural raw materials, is driving market growth.

China Specialty Enzymes Market Trends

China's specialty enzymesmarket accounted for the largest share in the regional market in 2024, fueled bythe rising utilization of specialty enzymes in baking applications. Bakers increasingly rely on enzymes to improve dough quality, enhance shelf life, and optimize texture, meeting consumer demand for better baked goods.

Key Specialty Enzymes Company Insights

Some of the key companies in the specialty enzymes industry include Advanced Enzyme Technologies, Codexis, Inc., F. Hoffmann-La Roche Ltd. BASF, and Sanofi.

-

BASF is a global chemical company offering a diverse range of products and services across various industries. Their portfolio includes chemicals, materials, industrial solutions, surface technologies, nutrition & care, and agricultural solutions.

-

Sanofi specialized in the research, development, and manufacturing of prescription medicines, vaccines, and consumer health products. Its portfolio spans therapeutic areas such as immunology, oncology, neurology, diabetes, and rare diseases.

Key Specialty Enzymes Companies:

The following are the leading companies in the specialty enzymes market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Enzyme Technologies

- Affymetrix Inc. (Thermo Fisher Scientific Inc.)

- Amano Enzyme Inc.

- BBI Solutions

- BASF

- Codexis, Inc.

- Nagase & Co., Ltd.

- Life Technologies (Thermo Fisher Scientific Inc.)

- F. Hoffmann-La Roche Ltd

- Sanofi

Recent Developments

-

In October 2024, Novo Nordisk Pharmatech introduced TrypsiNNex, a new recombinant enzyme added to their portfolio. This launch is a strategic move to strengthen their position and drive growth in the specialty enzymes market for pharmaceutical manufacturing.

-

In May 2024,Biocatalysts Ltd launched two novel protease enzymes tailored for efficient hydrolysis of extracted collagen, to produce neutral-tasting and low molecular weight collagen peptides.

Specialty Enzymes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.45 billion

Revenue forecast in 2030

USD 8.89 billion

Growth Rate

CAGR of 6.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, source, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; Japan; India; South Korea; Indonesia; Australia; Brazil; Argentina; Saudi Arabia; and Türkiye.

Key companies profiled

Advanced Enzyme Technologies; Affymetrix Inc. (Thermo Fisher Scientific Inc.); Amano Enzyme Inc.; BBI Solutions; BASF; Codexis, Inc.; Nagase & Co., Ltd.; Life Technologies (Thermo Fisher Scientific Inc.); F. Hoffmann-La Roche Ltd; and Sanofi.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

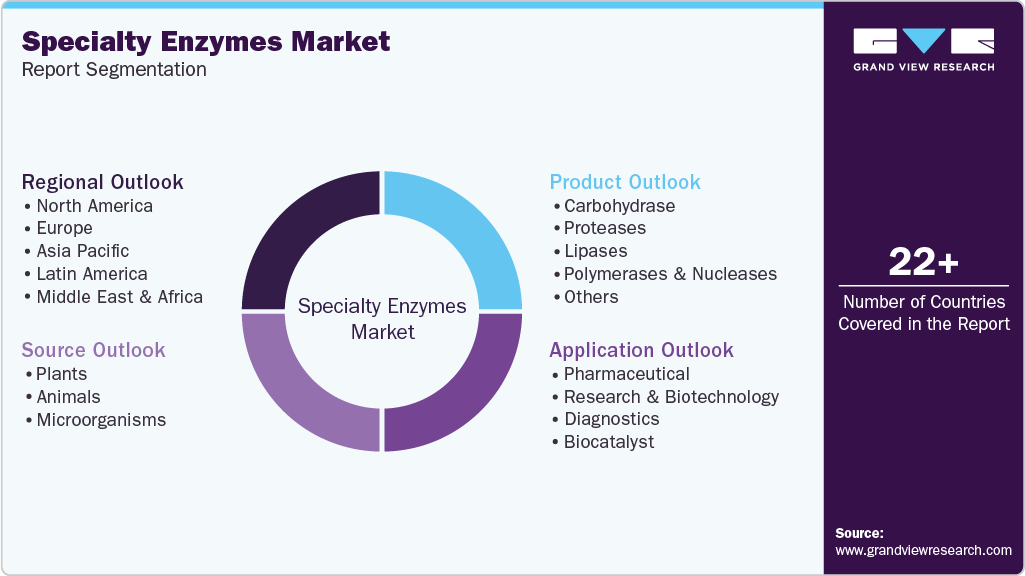

Global Specialty Enzymes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global specialty enzymes market report based on product, application, source, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Carbohydrase

-

Proteases

-

Lipases

-

Polymerases & Nucleases

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical

-

Research & Biotechnology

-

Diagnostics

-

Biocatalyst

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plants

-

Animals

-

Microorganisms

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Türkiye

-

-

Frequently Asked Questions About This Report

b. The global specialty enzymes market size was estimated at USD 6.05 billion in 2024 and is expected to reach USD 6.45 billion in 2025.

b. The global specialty enzymes market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 8.89 billion by 2030.

b. North America dominated the market with a revenue share of 41.9% in 2024. This is attributed to the growing number of specialty enzyme product approvals and product launches for treating diseases.

b. Some key players operating in the specialty enzymes market include Advanced Enzyme Technology Ltd., Amano Enzyme Inc., Bbi Enzymes Ltd., BASF SE, Codexis Inc., Nagase & Co. Ltd., Life Technologies, Roche Holding Ag., Sanofi S.A.

b. Key factors that are driving the market growth include the growth of the product market is attributed to the growing prevalence of chronic diseases such as cancer and rheumatoid arthritis

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.