- Home

- »

- Plastics, Polymers & Resins

- »

-

Stretchable Conductive Polymers Market Size Report, 2033GVR Report cover

![Stretchable Conductive Polymers Market Size, Share & Trends Report]()

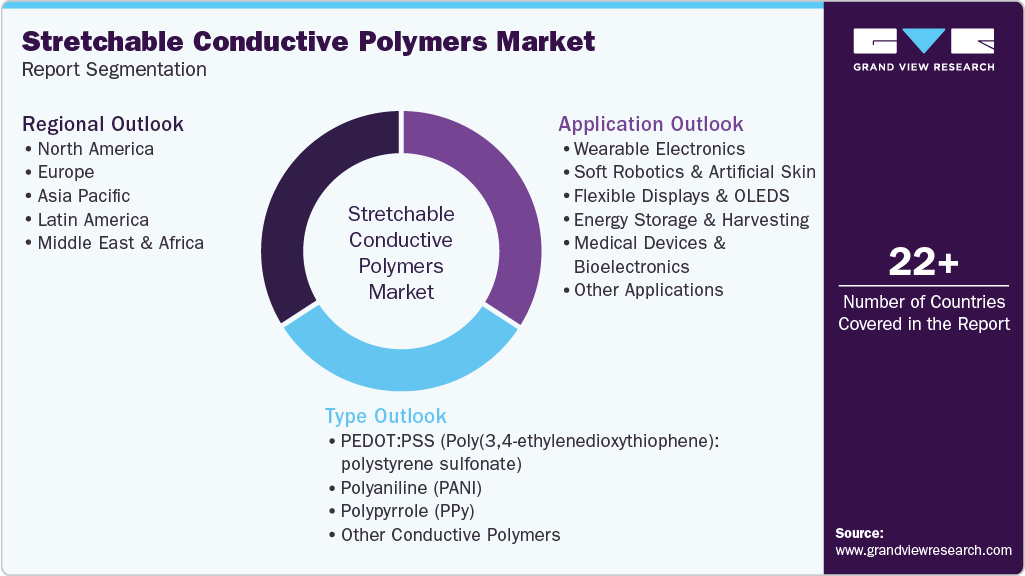

Stretchable Conductive Polymers Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (PEDOT:PSS, PANI, PPy), By Application (Wearable Electronics, Soft Robotics And Artificial Skin), By Region And Segment Forecasts

- Report ID: GVR-4-68040-813-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stretchable Conductive Polymers Market Summary

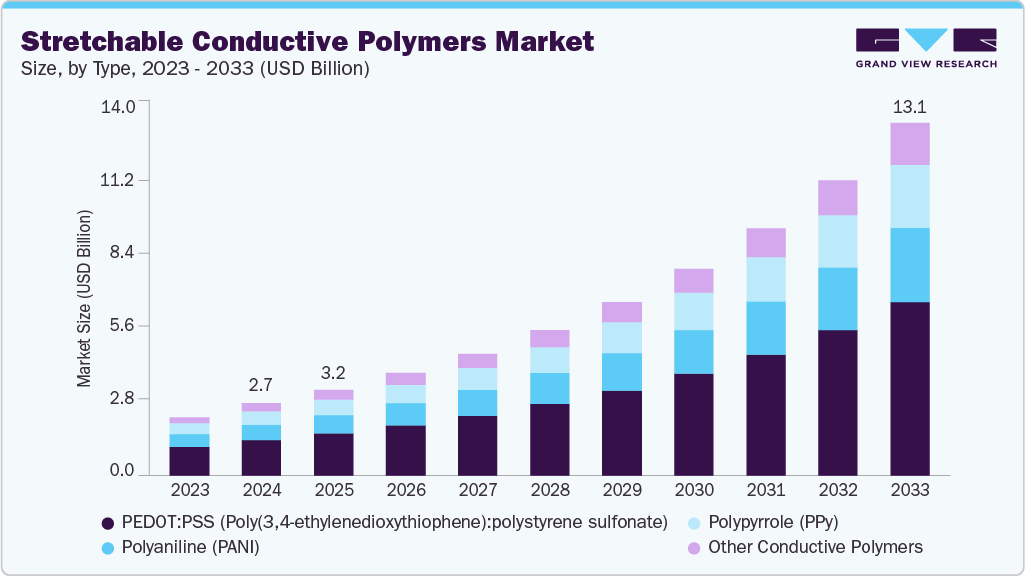

The global stretchable conductive polymers market size was estimated at USD 2.69 billion in 2024 and is projected to reach USD 13.11 billion by 2033, growing at a CAGR of 19.3% from 2025 to 2033. Growing integration of stretchable conductive polymers in flexible displays and smart textiles is driving market growth, as manufacturers seek lightweight, durable materials that maintain conductivity under strain.

Key Market Trends & Insights

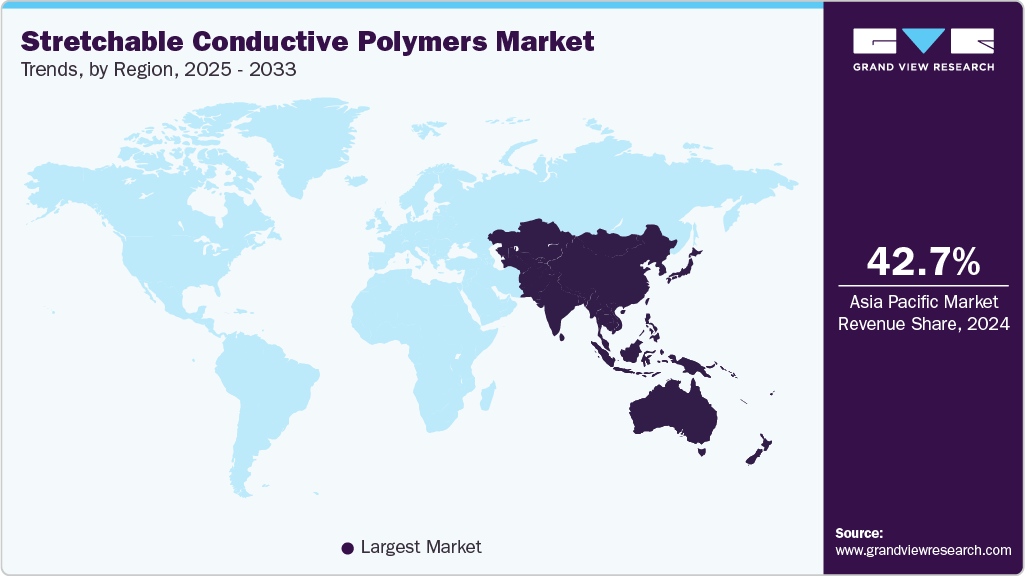

- Asia Pacific dominated the stretchable conductive polymers market with the largest revenue share of 42.69% in 2024.

- The China stretchable conductive polymers industry is propelled by government-backed industrialization of flexible electronics and strong domestic demand for consumer and healthcare wearables.

- By type, the PEDOT:PSS (Poly(3,4-ethylenedioxythiophene): polystyrene sulfonate) segment is expected to grow at a considerable CAGR of 19.3% from 2025 to 2033 in terms of revenue.

- By application, the soft robotics and artificial skin segment is expected to grow at a considerable CAGR of 20.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2.69 Billion

- 2033 Projected Market Size: USD 13.11 Billion

- CAGR (2025-2033): 19.3%

- Asia Pacific: Largest market in 2024

Advancements in printable electronics and scalable manufacturing processes are further boosting adoption by reducing production costs and improving design flexibility. The market is shifting from laboratory demonstrations to scaled, product-ready formulations that integrate directly with wearable electronics, e-skins, and soft robotics. Manufacturers are moving beyond isolated conductive inks to multifunctional composites that combine stretchability, biocompatibility, and signal fidelity. This convergence is shortening product development cycles and increasing collaboration between materials suppliers, device OEMs, and contract manufacturers. The result is faster adoption in clinical wearables and consumer fitness devices.

Drivers, Opportunities & Restraints

The escalating demand for non-invasive, continuous physiological monitoring is driving the adoption of stretchable conductive polymers. These materials enable conformal sensors, skin patches, and textile-embedded electrodes that maintain performance under complex deformation. Regulatory and reimbursement interest in remote patient monitoring further converts clinical pilots into procurement decisions. Molecule-level engineering that improves durability under repeated stretching is unlocking new medical and HMI applications.

There is a clear commercial opportunity to capture a higher margin by supplying engineered polymer blends, coated fabrics, and turnkey sensor modules rather than raw monomers or powders. Firms that pair materials with validated manufacturing protocols and sensor firmware can move up the value chain into recurring revenue models. Licensing proprietary formulations to OEMs and partnering on co-developed medical devices creates defensible revenue streams and accelerates market penetration. Early entrants that standardize performance metrics will shape procurement practices.

Widespread adoption is constrained by manufacturing scale-up challenges and quality variability when translating lab recipes to high-throughput processes. Ensuring consistent conductivity after thousands of stretch cycles remains a technically demanding task. Raw-material costs, dependence on specialized nanofillers, and limited supplier depth add price volatility. These factors raise the total cost of ownership for OEMs and slow procurement cycles until long-term reliability and cost targets are demonstrably met.

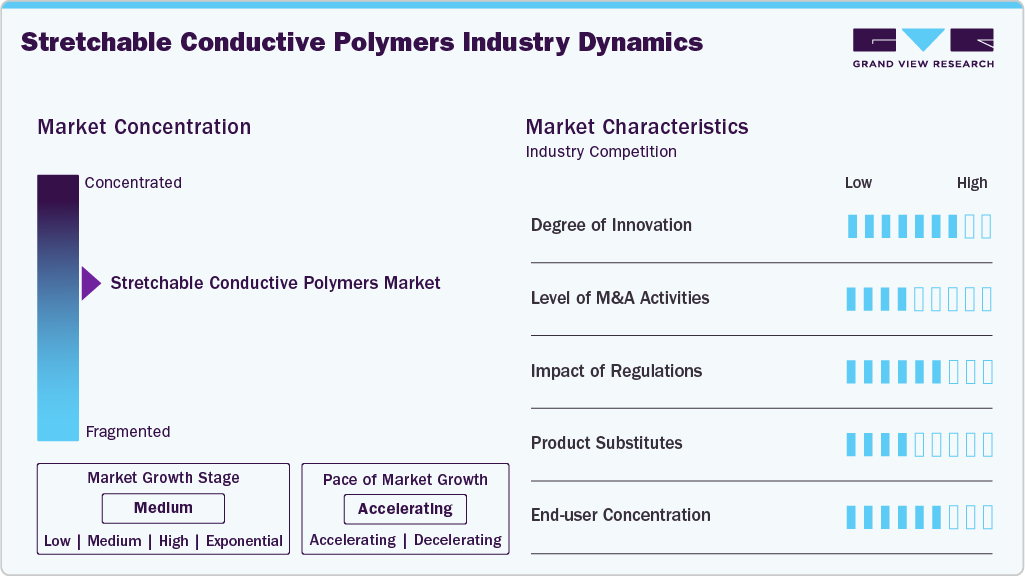

Market Concentration & Characteristics

The growth stage of the stretchable conductive polymers market is exponential, and the pace is accelerating. The market exhibits consolidation, with key players dominating the industry landscape. Major companies, including Heraeus Holding GmbH, Agfa-Gevaert N.V., Merck KGaA, and Solvay S.A., among others, play a significant role in shaping the industry dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving industry demands.

The sector is characterized by a high rate of incremental and platform-level innovation. Materials research is simultaneously improving conductivity, stretch endurance, and biocompatibility, enabling the direct integration of these properties into textiles and skin-mounted devices. Manufacturing innovations, notably roll-to-roll printing and printable PEDOT:PSS formulations, are moving many lab-scale chemistries toward high-volume production. Start-ups and established chemical houses are now pairing materials with process IP and validation data to shorten OEM adoption cycles.

Stretchable conductive polymers face robust substitution from metal-based nanomaterials and carbon allotropes in many use cases. Silver nanowires and nanoparticle inks deliver higher conductivity and mature printability for antennas and interconnects, while graphene and carbon nanotubes offer mechanical resilience and cost-competitive paths for some sensors. Copper-based nanoparticle inks are emerging as a lower-cost alternative, particularly where oxidation can be effectively managed. Buyers choose substitutes based on the trade-off among conductivity, stretch fatigue, cost, and process compatibility.

Type Insights

PEDOT:PSS (Poly(3,4-ethylenedioxythiophene):polystyrene sulfonate) dominated the market across the type segmentation in terms of revenue, accounting for a market share of 49.00% in 2024, and is forecast to grow at a 19.3% CAGR from 2025 to 2033. Market demand for PEDOT:PSS is being driven by its unmatched combination of conductivity, transparency, and processability for printed and flexible electronics. Manufacturers favor it for inkjet and roll-to-roll processes because it enables low-temperature deposition on plastic substrates. Recent commercial activity in flexible displays and organic photovoltaics is raising procurement volumes and supplier investments. This trend creates pricing leverage for formulators that can certify performance and batch-to-batch stability.

The polyaniline (PANI) segment is anticipated to grow at a substantial CAGR of 19.1% over the forecast period. Polyaniline’s commercial appeal stems from its low raw-material cost and ease of synthesis for bulk applications. Industry players use PANI in electrodes, anticorrosion coatings, and scalable sensor films where cost-performance is critical. Ongoing research that improves its mechanical resilience under strain is expanding use cases in flexible devices. As PANI matures, contract manufacturers that can deliver consistent morphology at scale will capture the largest share.

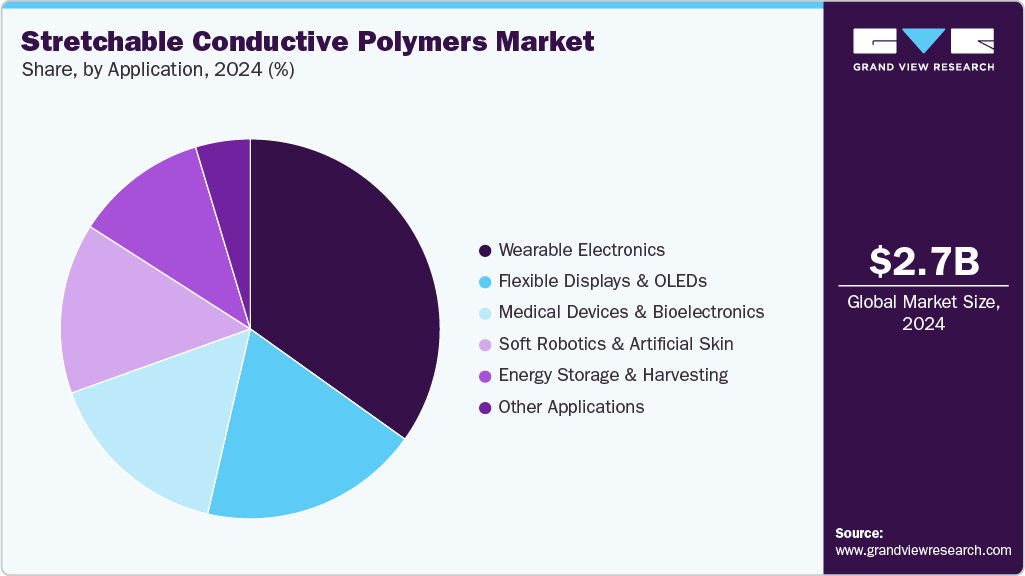

Application Insights

Wearable electronics dominated the stretchable conductive polymers industry across the application segmentation in terms of revenue, accounting for a market share of 34.86% in 2024, and is forecasted to grow at a 19.6% CAGR from 2025 to 2033. The wearable segment is pulling demand for stretchable conductive polymers through clear clinical and consumer use cases. Health monitoring, fitness trackers, and smart garments require materials that combine skin comfort with reliable signal integrity under motion. Procurement is shifting from discrete pilot buys to larger production runs as regulatory and reimbursement frameworks for medical wearables become more established. Suppliers who provide validated integration protocols and textile-compatible formulations will win OEM partnerships.

The soft robotics and artificial skin segment is expected to expand at a substantial CAGR of 20.4% through the forecast period. The development of soft robotics and e-skin is accelerating the demand for polymers that maintain conductivity after repeated deformation. Developers need materials that deliver fine-grain sensing, low hysteresis, and compatibility with pneumatic and elastomeric actuation systems. This creates early-adopter purchases from robotics integrators and medical device firms focused on human-safe interaction.

Regional Insights

The Asia Pacific stretchable conductive polymers industry held the largest share of 42.69% in terms of revenue in 2024, and is expected to grow at the fastest CAGR of 19.6% over the forecast period. Growth here is anchored in scale advantages from large textile clusters and integrated electronics supply chains. Apparel manufacturers and local OEMs embed conductive fibers into smart garments at competitive price points. Rapid commercialization cycles and lower manufacturing costs favour high-volume trials and fast rollouts. This makes Asia Pacific a volume-led market for stretchable conductors.

China Stretchable Conductive Polymers Market Trends

The China stretchable conductive polymers industry is propelled by government-backed industrialization of flexible electronics and strong domestic demand for consumer and healthcare wearables. Large electronics OEMs are vertically integrating materials sourcing and device assembly to shorten time to market. Aggressive local scale-up and AI-enabled product development are accelerating adoption of stretchable conductive formulations. This creates fast-moving supply-side competition and rapid price compression.

North America Stretchable Conductive Polymers Market Trends

The stretchable conductive polymers industry in North America is being driven by strong demand from clinical wearables and military-grade human-machine interfaces that require reliable, skin-conformal conductors. Regional OEMs are pairing materials suppliers with system integrators to accelerate certified product launches. Venture funding and manufacturing acceleration programs are shortening the path from pilot to production. This creates steady procurement from healthcare and defense buyers.

The U.S. stretchable conductive polymers industry leads in commercialization because of deep R&D funding, a large medtech procurement base, and active VC investment in soft-electronics start-ups. Regulatory clarity for remote-monitoring devices and growing telehealth reimbursement are converting pilots into orders. Contract manufacturers in the U.S. are also scaling roll-to-roll processes for printed PEDOT:PSS inks. This combination is raising domestic demand for engineered stretchable polymers.

Europe Stretchable Conductive Polymers Market Trends

The stretchable conductive polymers industry in Europe is shaped by coordinated public funding and clear industrial roadmaps for digital health and robotics. Horizon Europe and national innovation grants are underwriting prototyping and pilot production at regional centers of excellence. Automotive suppliers and medical-device clusters are testing e-textiles and e-skins in controlled production lines. As a result, buyers prioritize suppliers with compliance data and lifecycle testing.

Key Stretchable Conductive Polymers Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Heraeus Holding GmbH, Agfa-Gevaert N.V., Merck KGaA, and Solvay S.A., among others. The market for stretchable conductive polymers is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Stretchable Conductive Polymers Companies:

The following are the leading companies in the stretchable conductive polymers market. These companies collectively hold the largest market share and dictate industry trends.

- Heraeus Holding GmbH

- Agfa‑Gevaert N.V.

- Merck KGaA

- Solvay S.A.

- Ormecon Pvt Ltd

- The Lubrizol Corporation

- Henkel AG & Co. KGaA

- 3M Company

- NTK (Nagase ChemteX Corporation)

- Suzhou Ruihong Electronic Chemical Co., Ltd.

Recent Developments

-

In January 2025, Saralon positioned a new suite of printable stretchable conductive inks for automotive and sensor applications. The company publicized solutions that target harsh-environment sensor integration and in-line printed stretchable circuits for vehicle OEMs and Tier 1 suppliers.

Stretchable Conductive Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.20 billion

Revenue forecast in 2033

USD 13.11 billion

Growth rate

CAGR of 19.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Heraeus Holding GmbH; Agfa-Gevaert N.V.; Merck KGaA; Solvay S.A.; Ormecon Pvt Ltd; The Lubrizol Corporation; Henkel AG & Co. KGaA; 3M Company; NTK (Nagase ChemteX Corporation); Suzhou Ruihong Electronic Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stretchable Conductive Polymers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global stretchable conductive polymers market report on the basis of type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

PEDOT:PSS (Poly(3,4-ethylenedioxythiophene):polystyrene sulfonate)

-

Polyaniline (PANI)

-

Polypyrrole (PPy)

-

Other Conductive Polymers

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Wearable Electronics

-

Soft Robotics And Artificial Skin

-

Flexible Displays And OLEDS

-

Energy Storage And Harvesting

-

Medical Devices And Bioelectronics

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.