- Home

- »

- Plastics, Polymers & Resins

- »

-

Synthetic Resin Market Size & Share, Industry Report, 2033GVR Report cover

![Synthetic Resin Market Size, Share & Trends Report]()

Synthetic Resin Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Solid, Liquid, Emulsion, Dispersion), By Product Type (Thermosetting Resin, Thermoplastic Resin), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-613-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Synthetic Resin Market Summary

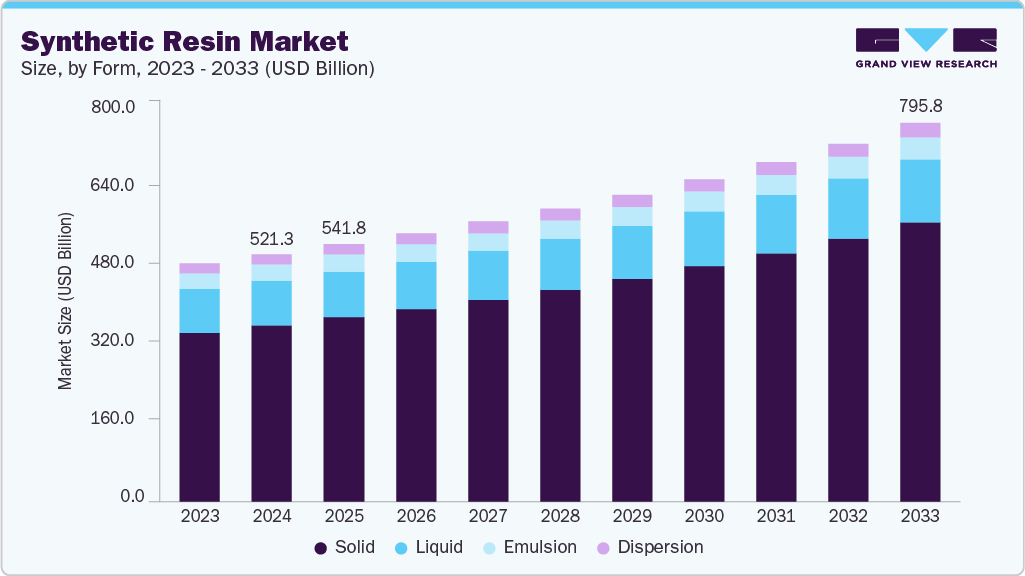

The global synthetic resin market size was estimated at USD 521.33 billion in 2024 and is projected to reach USD 795.83 billion by 2033, growing at a CAGR of 4.92% from 2025 to 2033. Growing demand for high-performance resins in the electronics industry is driving market growth, as manufacturers seek materials with superior thermal and electrical properties for consumer devices.

Key Market Trends & Insights

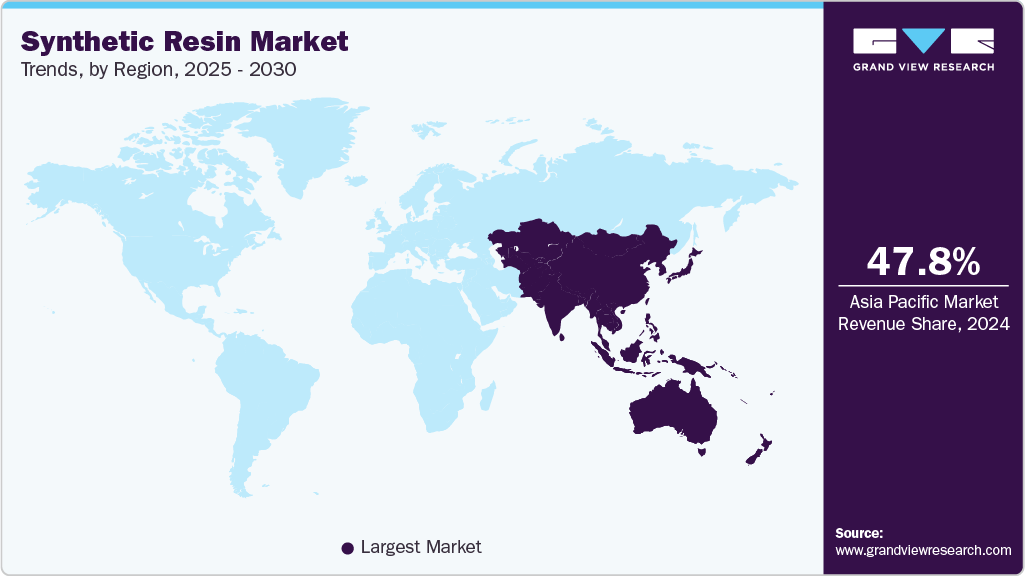

- Asia Pacific dominated the synthetic resin market with the largest revenue share of 47.78% in 2024.

- The China synthetic resin market is expected to grow during the forecast period.

- By form, Solid segment dominated and accounted for a market share of 71.28% in 2024.

- By product type, thermosetting resins segment accounted for a market share of 77.00% in 2024.

- By application, packaging segment led the market and accounted for a market share of 42.60% in 2024

Market Size & Forecast

- 2024 Market Size: USD 521.33 Billion

- 2033 Projected Market Size: USD 795.83 Billion

- CAGR (2025-2033): 4.92%

- Asia Pacific: Largest market in 2024

In 2025, the synthetic resin market is witnessing a pronounced shift toward sustainability-driven formulations, as stakeholders increasingly prioritize life-cycle assessments and circular economy principles. Manufacturers are investing in advanced recycling technologies, enabling post-consumer resin streams to re-enter production cycles without significant quality degradation.

Concurrently, digitalization in supply chain management is enhancing demand forecasting and inventory optimization, reducing waste, and improving responsiveness to market shifts. This trend reflects a strategic pivot from traditional, linear production models toward more agile, environmentally conscious operations.

Drivers, Opportunities & Restraints

Rising demand from the packaging and automotive sectors is propelling synthetic resin consumption, with global packaging manufacturers seeking lightweight, durable materials to meet consumer expectations for convenience and product protection. Automakers, under pressure to reduce vehicle weight and improve fuel efficiency, are integrating high-performance resins into structural components.

Moreover, robust growth in emerging markets, especially within Asia Pacific’s expanding middle class, is fueling increased consumption of consumer goods, which in turn sustains resin demand. Enhanced manufacturing capabilities and competitive pricing further bolster this driver, making synthetic resins a cornerstone of modern industrial production.

The emerging bio-based resin segment represents a significant growth avenue, as regulatory incentives and consumer awareness drive exploration of renewable feedstocks such as plant-derived polymers. Investment in R&D to develop cost-competitive, high-performance bio-resins can open new market niches in medical devices, electronics, and premium packaging applications. Geographic expansion into underpenetrated regions, particularly Eastern Europe and Southeast Asia, offers additional upside, where infrastructure development and urbanization are accelerating construction and consumer goods demand. Strategic partnerships with agricultural producers can also secure feedstock supply chains, creating vertically integrated models that differentiate market positioning.

Volatility in crude oil and petrochemical feedstock prices continues to undermine margin predictability for synthetic resin producers. Raw material costs can fluctuate abruptly due to geopolitical tensions or supply disruptions. Stringent environmental regulations, particularly in North America and Europe, are increasing compliance costs, as manufacturers must invest in emission-reduction technologies and adhere to tighter disposal standards.

Market Concentration & Characteristics

The market growth stage of the synthetic resin industry is medium, and the pace is accelerating. The market exhibits market fragmentation, with key players dominating the industry landscape. Major companies like BASF SE, SABIC, Covestro AG, Mitsubishi Chemical Group Corporation, LG Chem, Sumitomo Chemical Co., Ltd., Arkema S.A., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

As sustainability concerns intensify, bio-based polymers such as polylactic acid (PLA) and starch-derived blends are emerging as viable alternatives to conventional synthetic resins, particularly in packaging applications where end-of-life recovery is critical. Moreover, natural fibers reinforced with biodegradable matrices are gaining traction in automotive interiors and consumer goods, offering comparable mechanical properties while reducing reliance on petrochemical feedstocks.

In certain high-barrier applications, metal and glass are even reclaiming market share from resin-based packaging due to superior recyclability and consumer preference for inert materials. These trends reflect a broader industry pivot toward materials that balance performance with lower carbon footprints and enhanced circularity.

Stringent environmental regulations, especially under frameworks such as the European Union’s REACH and forthcoming U.S. PFAS restrictions, are forcing resin producers to reformulate products and phase out legacy additives that pose health or ecological risks. In North America, updates to the Toxic Substances Control Act (TSCA) are driving increased testing and compliance costs, particularly for specialty resins used in electronics and automotive components.

Form Insights

Solid form dominated the synthetic resin market across the form segmentation in terms of revenue, accounting for a market share of 71.28% in 2024. Manufacturers are responding to increasing regulatory and consumer pressures for sustainability by developing bio-based solid resins derived from lignocellulosic feedstocks. These formulations provide comparable mechanical strength to petroleum-derived counterparts while reducing carbon footprints by up to 30% during production.

The liquid form segment is anticipated to grow at a significant CAGR of 4.08% through the forecast period, due to its adaptability in high-speed coatings, adhesives, and composites, especially within electronics and automotive verticals. UV- and LED-curable liquid formulations allow rapid crosslinking at low temperatures, significantly shortening production cycles and minimizing volatile organic compound (VOC) emissions. This trend is particularly evident in Asia-Pacific, where rapid industrialization is driving demand for fast-curing coatings that meet stringent environmental regulations.

Product Type Insights

Thermosetting resins dominated the synthetic resin industry across the application segmentation in terms of revenue, accounting for a market share of 77.00% in 2024. Thermosetting resins are witnessing robust growth as industries seek materials capable of withstanding extreme temperatures and chemical exposures. Epoxy and polyurethane resins, renowned for their superior thermal stability and adhesion characteristics, are increasingly used in aerospace, wind energy, and electronics applications.

The thermoplastic resins segment is anticipated to augment over the forecast period with a CAGR of 2.94%, benefitting from their inherent recyclability and alignment with circular economy initiatives, especially in the automotive and packaging sectors.

Materials such as polyethylene and polypropylene are being reengineered to accommodate higher post-consumer recycled (PCR) content, supported by legislative mandates that require significantly increasing PCR in packaging. In the automotive space, lightweight thermoplastics like polycarbonate blends are critical to reducing vehicle weight and meeting stringent fuel-efficiency targets.

Application Insights

Packaging led the synthetic resin market across the application segmentation in terms of revenue, accounting for a market share of 42.60% in 2024, driven by e-commerce growth and escalating demand for sustainable packaging solutions. Flexible films and rigid containers made from resins like PET and biaxially oriented polypropylene (BOPP) offer excellent barrier properties, extending shelf life and reducing food waste. In North America, the rising adoption of mono-material packaging to meet recycling targets has increased demand for high-purity resin grades.

The printing inks segment is expected to expand at a substantial CAGR of 5.67% through the forecast period. Resin-based printing inks are experiencing growth as digitalization and personalization trends drive demand for high-quality, durable print applications. Advanced resins formulated for UV-LED curing enable faster drying times, improved adhesion, and enhanced gloss qualities essential for premium packaging and specialty paper products.

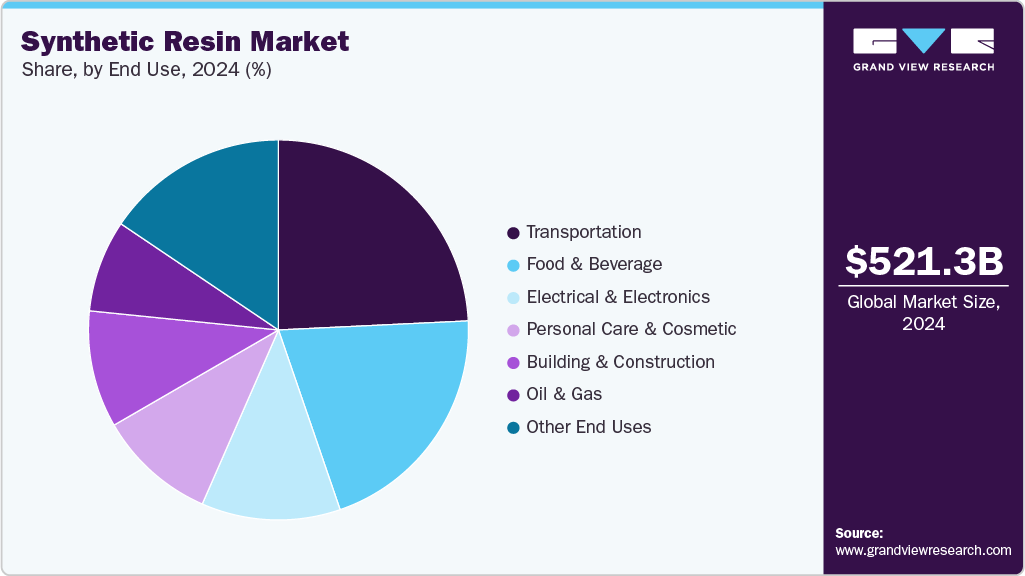

End Use Insights

Transportation dominated the synthetic resin industry across the end use segmentation in terms of revenue, accounting for a market share of 24.24% in 2024. The shift towards electric vehicles (EVs) and lightweight construction is intensifying demand for high-performance synthetic resins. Thermoplastics such as polyamide and polycarbonate blends are favored for battery enclosures, structural components, and interior parts due to their excellent mechanical strength, heat resistance, and electrical insulation properties.

The food & beverage segment is projected to witness a substantial CAGR of 5.18% over the forecast period. Compliance with stringent food-contact regulations has spurred demand for high-purity, low-extractable synthetic resins such as medical-grade cyclic olefin copolymers (COC) and ultra-clean polyolefins. Recent updates to EU Regulation 10/2011 have forced manufacturers to adopt advanced resins that minimize heavy metal migration. This has led to a surge in demand for bioplastic alternatives like polylactic acid (PLA) and chemically recycled PET (rPET).

Regional Insights

Asia Pacific dominated the global synthetic resin market and accounted for the largest revenue share of 47.78% in 2024. Rapid industrialization and urbanization across Asia Pacific, notably in India and Southeast Asia, are fueling robust demand for synthetic resins in construction, automotive, and packaging applications. Governments are launching initiatives to curb plastic pollution, such as India’s Plastic Waste Management Rules, which incentivize investment in biodegradable and recyclable resin technologies. The region’s electronics manufacturing boom, particularly in Vietnam and Malaysia, is driving the uptake of engineering plastics for circuit boards and housing components. China’s Belt and Road infrastructure projects are propelling demand for resin-based building materials.

The China synthetic resin market is expected to grow during the forecast period. Ambitious national carbon reduction targets are reshaping China’s synthetic resin sector, forcing resin manufacturers to adopt energy-efficient processes and integrate post-consumer recycled content into production lines. Tightening restrictions on non-recyclable plastics under the National Sword policy have accelerated the adoption of biodegradable alternatives. At the same time, investments in advanced recycling technologies, such as chemical depolymerization, aim to establish circular supply chains. The country’s burgeoning electric vehicle and solar panel industries further drive demand for specialty resins with high thermal stability and mechanical strength.

North America Synthetic Resin Market Trends

Investment in chemical recycling and bio-based resin production is a primary growth driver for the North America synthetic resin industry, as major players seek to meet stringent Extended Producer Responsibility (EPR) policies and corporate ESG targets. The construction sector’s recovery, propelled by infrastructure spending under federal initiatives, has increased demand for high-performance resins in insulation and composite materials. Furthermore, automotive manufacturers in the U.S. and Canada are incorporating lightweight, recyclable thermoplastics to enhance fuel efficiency and comply with evolving emissions standards.

U.S. Synthetic Resin Market Trends

U.S. synthetic resin demand is being propelled by the Inflation Reduction Act’s incentives for domestic manufacturing and clean energy investments, prompting resin producers to expand capacity for renewable and recycled feedstocks. The packaging industry’s shift to post-consumer recycled (PCR) content, mandated by state-level legislation such as California’s Assembly Bill 793, has led to higher adoption of recycled PET and HDPE grades, bolstering resin volumes. In the automotive realm, surging electric vehicle (EV) production demands advanced thermoplastics for battery enclosures and lightweight structural components to achieve efficiency targets.

Europe Synthetic Resin Market Trends

Europe’s synthetic resin industry is underpinned by the EU’s Circular Economy Action Plan and stringent REACH regulations, compelling producers to develop fully traceable, bio-based, and recycled resin portfolios. Automotive OEMs across Germany, France, and the UK are accelerating the use of lightweight composites and recyclable thermoplastics in EV and hybrid platforms to meet strict CO₂ emissions targets.

Key Synthetic Resin Company Insights

The synthetic resin market is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Synthetic Resin Companies:

The following are the leading companies in the synthetic resin market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- SABIC

- Covestro AG

- Mitsubishi Chemical Group Corporation

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Arkema S.A.

- DSM-Firmenich

- Dow Inc.

- DuPont de Nemours, Inc.

- Westlake Chemical Corporation

- Hexion Inc.

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Ingevity

- AOC, LLC

- Reichhold LLC

Recent Developments

-

In February 2025, Abu Dhabi National Oil Company (ADNOC) and Austrian energy firm OMV announced plans to merge their plastics businesses and acquire Canadian plastic producer Nova Chemicals in a deal valued at over USD 30 billion. The merger aimed to consolidate their polyolefin operations by integrating Borealis, Borouge, and Nova Chemicals, enhancing resource allocation, technology access, and market competitiveness.

-

In March 2025, Westlake Corporation announced that its Westlake Epoxy division launched the EpoVIVE portfolio, a new line of epoxy phenolic resins and curing agents designed with sustainability in mind. The portfolio targets diverse industries such as adhesives, aerospace, automotive, construction, composites, electronics, marine, and protective coatings.

Synthetic Resin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 541.80 billion

Revenue forecast in 2033

USD 795.83 billion

Growth rate

CAGR of 4.92% from 2024 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, volume in million tons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Form, product type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Dow Inc.; DuPont de Nemours, Inc.; Westlake Chemical Corporation; Hexion Inc.; Huntsman Corporation; Ashland Global Holdings Inc.; Ingevity; AOC, LLC; Reichhold LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Synthetic Resin Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global synthetic resin market report based on form, product type, application, end use, and region:

-

Form Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Solid

-

Liquid

-

Emulsion

-

Dispersion

-

-

Product Type Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Thermosetting Resin

-

Epoxy Resins

-

Phenolic Resins

-

Polyurethane Resins

-

Polyester Resins

-

Other Thermosetting Resin

-

-

Thermoplastic Resin

-

Polyethylene

-

Polypropylene

-

Polyvinyl Chloride

-

Polycarbonate

-

Polyethylene Terephthalate

-

Nylon

-

Other Thermoplastic Resin

-

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Packaging

-

Printing Inks

-

Pipes & Hoses

-

Sheets & Films

-

Paints & Coatings

-

Adhesives & Sealants

-

Electronic Fabrications

-

Transportation Components

-

Other Applications

-

-

End Use Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

Transportation

-

Food & Beverage

-

Personal Care & Cosmetic

-

Building & Construction

-

Oil & Gas

-

Electrical & Electronics

-

Other End Uses

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global synthetic resin market size was estimated at USD 521.33 billion in 2024 and is expected to reach USD 541.80 billion in 2025.

b. The global synthetic resin market is expected to grow at a compound annual growth rate of 4.92% from 2025 to 2033 to reach USD 795.83 billion by 2033.

b. Solid form dominated the synthetic resins market across the form segmentation in terms of revenue, accounting for a market share of 71.28% in 2024. Manufacturers are responding to increasing regulatory and consumer pressures for sustainability by developing bio-based solid resins derived from lignocellulosic feedstocks.

b. Some key players operating in the synthetic resin market include BASF SE, SABIC, Covestro AG, Mitsubishi Chemical Group Corporation, LG Chem, Sumitomo Chemical Co., Ltd., Arkema S.A., DSM-Firmenich, Dow Inc., DuPont de Nemours, Inc., Westlake Chemical Corporation, Hexion Inc., Huntsman Corporation, Ashland Global Holdings Inc., Ingevity, AOC, LLC, and Reichhold LLC.

b. Growing demand for high-performance resins in the electronics industry is driving market growth, as manufacturers seek materials with superior thermal and electrical properties for consumer devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.