- Home

- »

- Plastics, Polymers & Resins

- »

-

Temperature Controlled Packaging Solutions Market ReportGVR Report cover

![Temperature Controlled Packaging Solutions Market Size, Share & Trends Report]()

Temperature Controlled Packaging Solutions Market (2023 - 2030) Size, Share & Trends Analysis Report By Type, By Product (Insulated Container, Insulated Shipper, Refrigerants), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-858-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Temperature Controlled Packaging Solutions Market Summary

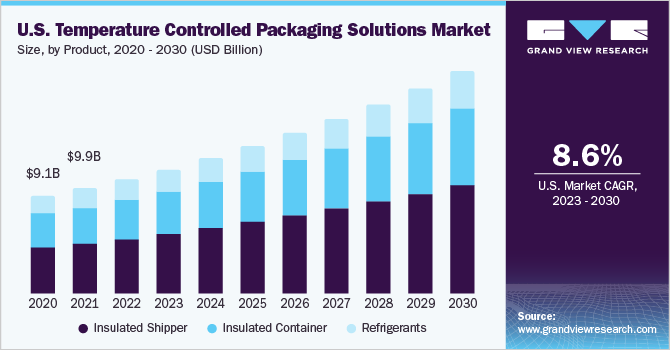

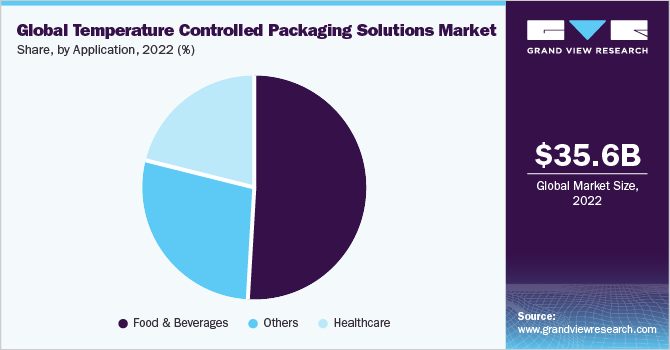

The global temperature controlled packaging solutions market size was estimated at USD 35.65 billion in 2022 and is projected to reach USD 66.95 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. This packaging method is specifically designed to keep the products safe and at a constant temperature till their final distribution.

Key Market Trends & Insights

- North America accounted for the highest revenue share of over 40.0% in 2022.

- Asia Pacific is expected to grow at a fast CAGR of 9.0% during the forecast period.

- Based on type, the passive systems segment recorded a higher revenue share of over 64.0% in 2022.

- Based on product, the insulated shippers segment recorded a higher revenue share of over 47.0% in 2022.

- Based on application, the food & beverage segment recorded a higher revenue share of over 50.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 35.65 Billion

- 2030 Projected Market Size: USD 66.95 Billion

- CAGR (2023-2030): 8.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The growth of the temperature-controlled packaging solutions industry is attributed to increased demand for frozen food and biopharmaceuticals such as vaccines, enzymes, and others requiring a constant temperature throughout their production to distribution cycle. The growth of the U.S. temperature-controlled packaging solutions market is driven by stringent regulations implemented on the food & beverage products distributed domestically and internationally. For instance, the U.S. Food and Drug Administration (FDA) mandates temperature-controlled packaging solutions for export-oriented or perishable food product packaging. This is done to prevent foodborne illnesses and maintain product integrity of its major food product exports such as soybean oil, fruits, nuts, and other items. Compliance with this regulation is necessary to export these products to its major trade partners such as Mexico, Canada, and Europe.

In addition, the growing pharmaceutical industry in the country drives demand for temperature-controlled packaging solutions. This is attributed to the increased focus on biopharmaceuticals such as vaccines, gene therapies, and personalized medicines, which often require constant temperature control to preserve their delicate molecular structure and potency. With the increased production and distribution of biopharmaceuticals, the need for reliable temperature-controlled packaging solutions continues to rise in the country.

Furthermore, the country witnessed a surge in demand for these packaging solutions during the covid-19 pandemic. COVID-19 vaccines require ultra-low temperatures for storage and transportation. This has created a need for specialized cold chain logistics of temperature-controlled packaging to ensure the vaccine’s integrity and efficacy. For instance, Pfizer’s BioNTech vaccine needs to be stored at temperatures as low as -70 degrees Celsius to maintain its efficacy and stability during warehousing and shipment.

Type Insights

Based on type, the temperature-controlled packaging solutions market is further categorized into passive systems and active systems. Among these, passive systems recorded a higher revenue share of over 64.0% in 2022, attributed to their cost-effectiveness and environment-sustainable properties compared to active systems. Passive systems provide thermal insulation and temperature stabilization to temperature-controlled packaging solutions without the use of external power or mechanical components. This is expected to further propel the growth of the segment.

The active systems segment is expected to grow at the fastest CAGR of 8.6% during the forecast period. This is due to its ability to provide accurate temperature within the packaging by relying on external power sources or mechanical components. Biopharmaceuticals such as vaccines require accurate temperatures during their storage and transportation which drives the demand for these active systems-based temperature-controlled packaging solutions industry.

Product Insights

Based on product, the temperature-controlled packaging solutions market is further segmented into insulated containers, insulated shippers, and refrigerants. Among these, the insulated shippers segment recorded a higher revenue share of over 47.0% in 2022 owing to their unique properties such as being portable and lightweight, making them suitable for product shipments of smaller quantities. They are mainly used for individual packaging or parcels, such as pharmaceutical vials, small food items, and clinical samples which drives the demand for this product.

The insulated container segment is expected to grow at a CAGR of 8.1% during the forecast period owing to the increased application in the food & beverage and healthcare industries to export frozen foods and temperature-sensitive drugs. These containers with additional features such as tight seals, double-walled construction, and advanced insulation materials are suitable to export bulk products. It provides a temperature-controlled environment, minimizes temperature excursions, and ensures that these products remain within the required temperature range. These factors are anticipated to further fuel the growth of this segment.

The refrigerants segment’s growth is driven by the increased demand for gel packs and dry ice refrigerants which are used in temperature-controlled packaging solutions. Gel packs freeze at a specific temperature, absorbing heat from the surroundings and maintaining a cold environment within the packaging, and are used for short-duration transports for products such as temperature-sensitive drugs and vaccines requiring refrigeration rather than deep freezing. However, dry ice is mainly used for products such as frozen foods or biological samples that require deep freezing or extremely low temperatures during transportation.

Application Insights

Based on application, the temperature-controlled packaging solutions market is further categorized into food & beverages, healthcare, and others. Among these, the food & beverage segment recorded a higher revenue share of over 50.0% in 2022 owing to the increased utilization of these packaging solutions for perishable food products and frozen foods. Perishable food products, such as fresh fruits and vegetables, dairy products, meats, seafood, and bakery goods require refrigeration or controlled atmosphere packaging to maintain their nutritional value, texture, and flavor. Frozen foods, such as frozen meals, ice cream, and frozen desserts, require packaging solutions that can maintain low temperatures to prevent thawing and preserve product quality which further drives the segment’s growth.

The healthcare segment is anticipated to grow at a fast CAGR of 9.2% during the forecast period. This growth is attributed to the healthcare products such as biologics and specialty drugs, having strict temperature requirements and are sensitive to temperature excursions. Temperature-controlled packaging solutions, such as insulated shippers and containers, help ensure that these healthcare products remain within the specified temperature range during shipment and storage.

Moreover, the growth is driven by strict regulatory compliance and government initiatives for temperature-controlled packaging in healthcare industries. For instance, in 2020 the World Health Organization (WHO) initiated monitoring vaccine wastage by emphasizing the use of temperature-control packaging solutions to keep its efficiency intact. Moreover, Goods Distribution Practices (GDP) regulate the transportation and storage of healthcare products in countries such as the U.S. and UK by emphasizing the need for maintaining appropriate temperature conditions during storage and distribution which further drives the market demand for this segment.

The clinical trials segment’s growth is driven by the utilization of temperature-controlled packaging solutions during drug research and study during clinical trials. These packaging solutions are of utmost importance during stability studies, where the drug's shelf life and stability under different temperature conditions are tested. These packaging solutions with accurate temperature control and monitoring capabilities help maintain the desired temperature during storage, ensuring that the drug remains stable throughout the study which further fuels the market growth for this segment.

The others segment includes industries such as electronics & semiconductors and chemicals. The segment’s growth is driven by the critical need for these packaging solutions in several temperature-sensitive products in these industries. For instance, electronic items sensitive to heat necessitate packaging that maintains low temperatures during transportation and storage. Similarly, chemicals such as enzymes require stable temperatures to preserve their stability and performance. This requirement for temperature control in these industries fuels the growth of the market for temperature-controlled packaging solutions in the others segment.

Regional Insights

North America accounted for the highest revenue share of over 40.0% in 2022. This is attributed to its robust healthcare sector, which in turn drives the demand for temperature-controlled packaging solutions which are used to ship and store temperature-sensitive drugs, vaccines, biologics, and medical devices. Moreover, with the increasing trend of online grocery shopping and food delivery, there is a need to ensure that perishable products, such as groceries, meal kits, and prepared foods, are delivered to consumers at the right temperatures. Temperature-controlled packaging solutions, including insulated shippers and containers, are crucial in maintaining the integrity and safety of these products during transportation which further drives the market growth in the region.

Asia Pacific is expected to grow at a fast CAGR of 9.0% during the forecast period. This growth is attributed to the increasing cross-border trade of temperature-sensitive agriculture products such as vegetable oils, rice, fish, and seafood. For instance, countries like Indonesia and Malaysia are the largest exporters of palm oil. Similarly, countries such as Thailand and Vietnam are the major exporters of rice to several European countries. The increasing international trade requires efficient temperature-controlled packaging solutions to maintain product quality and is anticipated to drive regional market growth.

The growth of the China temperature-controlled packaging solutions market is driven by the thriving electronics industry. The country is one of the largest exporters of electronic devices such as smartphones and laptops. These products require temperature-controlled packaging to protect them from freezing temperatures or extreme heat that could affect their performance or lifespan during long hours of transportation and storage.

The growth of the Europe market for temperature-controlled packaging solutions is driven by the increased demand for frozen foods, e-commerce, and home delivery services in the region. Temperature-controlled packaging is essential in preserving the quality and safety of perishable goods during the last-mile delivery in the form of insulated shippers and containers to maintain the desired temperature and ensure product freshness drives the market growth in the region.

The growth of the Central and South America region is driven by its thriving agricultural industry. The region is one of the largest producers and exporters of agricultural products such as fresh vegetables, fruits, and meat products. These perishable food products are temperature-sensitive and require temperature-controlled packaging solutions for their global export and domestic distribution to keep them fresh until consumption. For instance, the avocados grown in Central & South America require controlled atmosphere technology wherein the atmosphere within the shipping container such as temperature and humidity is kept constant throughout the shipping journey. This is expected to further boost the regional market growth.

The growth of the Middle East & Africa region is driven by the rising demand for organic food products and the increasing popularity of frozen meals that necessitate temperature-controlled packaging solutions. Additionally, there is a shift in consumer preferences towards convenience foods like frozen and ready-to-eat meals due to busy lifestyles and time constraints. To maintain the quality and freshness of organic products and frozen meals, temperature-controlled packaging solutions are necessary, as these items are sensitive to temperature fluctuations and require specific storage conditions which drives the demand in this region.

Key Companies & Market Share Insights

Key companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, on January 31, 2023, Cold Chain Technologies announced an expansion in its product portfolio by launching CCT Therashield, a reusable temperature-sensitive thermal packaging for the healthcare industry. Some prominent players in the global temperature controlled packaging solutions market include:

-

Sonoco Products Company

-

Cryopak Industries Inc.

-

DGP Intelsius

-

Cold Chain Technologies

-

Envirotainer

-

CSafe

-

AmerisourceBergen Corporation

-

Deutsche Post DHL Group

-

Inbox Solutions

-

APEX Packaging Corporation

-

TPC Packaging Solutions

-

PCI Pharma Services

-

Safe Box

-

Aeris

-

DGR PACKAGING & SUPPLY PTE LTD

-

Valor Industries

Temperature Controlled Packaging Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 38.67 billion

Revenue forecast in 2030

USD 66.95 billion

Growth Rate

CAGR of 8.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; Italy; China; Japan; India; Brazil; Saudi Arabia; UAE

Key companies profiled

Sonoco Products Company; Cryopak Industries Inc.; DGP Intelsius; Cold Chain Technologies, Inc.; Envirotainer AB; Softbox Systems Ltd.; AmerisourceBergen Corporation; DHL International GmbH; Inmark Temperature-Controlled Packaging; APEX Packaging Corporation; TPC Packaging Solutions; PCI Pharma Services; Safe Box; Aeris; DGR PACKAGING & SUPPLY PTE LTD; Valor Industries.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Temperature Controlled Packaging Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global temperature controlled packaging solutions market report based on type, product, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Passive Systems

-

Active Systems

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Insulated Container

-

Insulated Shipper

-

Refrigerants

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Grocery

-

Chocolates

-

Non-Alcoholic Beverages

-

Alcoholic Beverages

-

Dairy Products

-

Fish, Meat, and Seafood

-

-

Healthcare

-

Pharmaceuticals

-

Blood

-

Clinical Trials

-

Drug Testing

-

Pathology

-

Organ Transplantation

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates

-

-

Frequently Asked Questions About This Report

b. The global temperature-controlled packaging solutions market was valued at USD 35.65 billion in the year 2022 and is expected to reach USD 38.66 billion in 2023.

b. The global temperature-controlled packaging solutions market is expected to grow at a compound annual growth rate of 8.2% from 2023 to 2030 to reach USD 66.94 billion by 2030.

b. The passive systems segment accounted for the largest market share of over 64.0% in 2022 owing to their cost-effectiveness and environment-sustainable properties compared to the active systems.

b. The key market player in the temperature-controlled packaging solutions market includes. Cryopak Industries Inc.; DGP Intelsius; Cold Chain Technologies, Inc.; Envirotainer AB; Softbox Systems Ltd.; AmerisourceBergen Corporation; DHL International GmbH; Sonoco Products Company; Inmark Temperature Controlled Packaging; APEX Packaging Corporation, PCI Pharma Services; Safe Box; Aeris; DGR PACKAGING & SUPPLY PTE LTD; and Valor Industries

b. The temperature-controlled packaging solutions market growth is attributed to increased demand for frozen food and biopharmaceuticals such as vaccines, enzymes, and others requiring a constant temperature throughout their production to distribution cycle.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.