- Home

- »

- Electronic Devices

- »

-

Through-hole Passive Components Market Size Report, 2030GVR Report cover

![Through-hole Passive Components Market Size, Share & Trends Report]()

Through-hole Passive Components Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Resistors, Capacitors, Inductors, Diodes), By Leads Model (Axial Leads, Radial Leads), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-015-7

- Number of Report Pages: 230

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Through-hole Passive Components Market Summary

The global through-hole passive components market size was estimated at USD 35.63 billion in 2022 and is projected to reach USD 62.99 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030. The growth of the market can be attributed to the growing penetration of connected devices and the continuously growing demand across the medical and automobile industries.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for a revenue share of 49.24% in 2022 and is also expected to emerge as the fastest-growing region, with a CAGR of 8.3% over the forecast period.

- Based on component, the capacitor segment led the market and accounted for a revenue share of more than 43.11% in 2022.

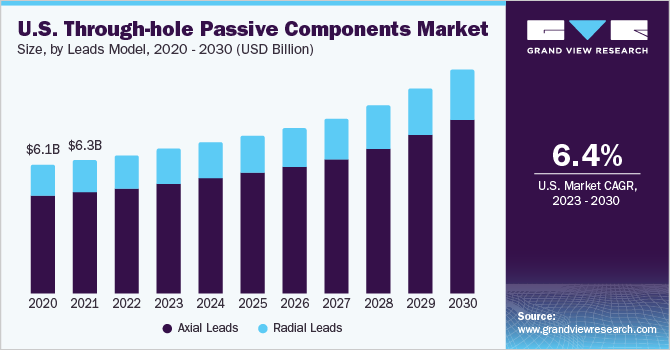

- In terms of lead type, the axial lead segment led the market and accounted for a revenue share of more than 75.72% in 2022.

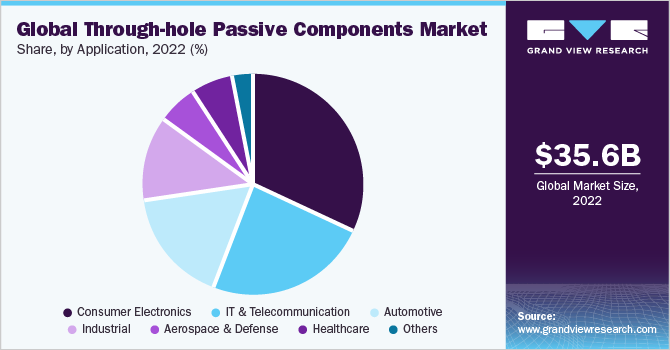

- Based on application, the consumer electronics segment led the market and accounted for a revenue share of more than 32.43% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 35.63 Billion

- 2030 Projected Market Size: USD 62.99 Billion

- CAGR (2023-2030): 7.6%

- Asia Pacific: Largest market in 2022

Programmable Logic Controllers (PLCs) are industrial computers utilized to control electrical and mechanical processes, commonly incorporating through-hole passive components. These modules are drilled into printed circuit boards rather than being surface-mounted, making them highly durable and better equipped to withstand diverse pressures and forces.

The rise of Industry 4.0, also known as the fourth industrial revolution, further amplifies the demand for the market. For instance, Germany’s Ministry for Economic Affairs and Climate Action launched programs such as Autonomics for Industry 4.0 and Smart Service World programs to boost its Industry 4.0 agenda, offering over EUR 100 million in initial funds. Such supporting initiatives are expected to drive market growth as every automated or non-automated machinery has components in the form of inductors, capacitors, resistors, diodes, etc.

The growing adoption of connected devices, such as security systems, smart meters, gaming consoles, home appliances, and smartphones across industries, is driving the demand for innovative through-hole passive components. Manufacturers are also focusing on providing breakthrough solutions, which could drive the increased use of this technology in connected devices. An increasing number of IoT end-node applications demand connected devices operating on batteries that can last for months and years without the need for battery replacement or maintenance, creating lucrative opportunities for the growth of the market.

Government initiatives aimed at supporting industrial automation are also creating promising growth opportunities for the market. For instance, under its Industry 4.0 program, South Korea plans to operate 30,000 smart factories by the end of 2022 and 20 smart industrial zones by 2030; such initiatives are expected to increase the adoption of through-hole components. In addition, the growing applications of Human-Machine Interfaces (HMIs), which allow humans to communicate with machines, are also expected to drive growth for this market.

COVID-19 Impact on the Through-Hole Passive Components Market

The COVID-19 pandemic substantially impacted the global through-hole passive components manufacturing industry. Initially, the rapidly rising number of COVID-19 cases across countries such as China, Germany, the U.S., Japan, and South Korea compelled governments to levy stringent regulations on movement, including lockdowns in highly affected cities, sealing international borders for trade, and requiring companies to allow their employees to work from their homes. The temporary shutdown of production facilities and international borders across several countries globally led to a decline in overall sales during 2020.

The pandemic led to a decrease in demand for various products and services, including automobiles, consumer electronics, and industrial equipment. This decline in demand directly affected the demand for these modules since they are widely used in these sectors. As a result, manufacturers experienced a decrease in orders and revenue during the pandemic. Additionally, the manufacturing of these components heavily relies on international trade and cooperation, which was disrupted due to the pandemic. Supply chain disruptions, scarcity of raw materials, and logistical challenges further hampered production and availability at a global level.

Component Insights

The capacitor segment led the market and accounted for a revenue share of more than 43.11% in 2022. By component segment, the market is bifurcated into resistors, capacitors, inductors, diodes, transducers, sensors, and others. The growing popularity of the capacitor segment is attributed to the rising demand for electronics and electrical products in sectors such as medical and healthcare, industrial, telecommunication, and automotive. Most of these business sectors involve using power circuit boards directly or indirectly in multiple devices, such as major medical devices, industrial robots, home appliances, and network devices, to carry out operations such as receiving and transferring data signals. These circuit boards have through-hole passive components integrated into them to carry out tasks such as configuration of circuits, power stability, and power conversion, which are crucial for an electronic gadget to function properly. Therefore, with the growing production of several types of home appliances, industrial digital devices, and other consumer electronic goods, the demand for capacitors is projected to grow rapidly over the forecast period.

The sensors segment is expected to be the fastest-growing segment, registering a CAGR of 12.4% over the forecast period. Sensors react to changes in the environment and help to indicate the changes through outputs on displays. Through-hole sensors enable automation and control in various industries. By monitoring and measuring critical parameters, they provide feedback that drives automated actions and control systems. This leads to increased accuracy, consistency, and reliability in processes, allowing businesses to achieve higher levels of efficiency and productivity. They offer a very wide range of applications, including fault detection, temperature measurement, smart lighting, animal tracking, traffic monitoring, autonomous braking, and high-end security features in the automobile industry (such as Advanced Driver Assistance Systems (ADAS) and autonomous driving). These factors are contributing to the segment growth.

Lead Type Insights

The axial lead segment led the market and accounted for a revenue share of more than 75.72% in 2022 and is also expected to witness the highest growth rate of 8.0% over the forecast period. By lead model segment, the market is bifurcated into axial lead and radial lead. Axial lead components provide mechanical stability to the circuit board assembly. The leads are typically longer and have a cylindrical shape, providing a strong anchoring point when soldered onto the circuit board. This enhances the overall durability and resistance to mechanical stress, ensuring that the components remain securely in place even under harsh operating conditions.The axial lead configuration offers improved thermal management capabilities. The extended leads and cylindrical shape allow for better heat dissipation. This is particularly advantageous in applications where a significant amount of heat is generated during the operation. The axial lead configuration facilitates efficient heat transfer from the component to the circuit board, reducing the risk of overheating and enhancing the overall reliability of the system.

Application Insights

The consumer electronics segment led the market and accounted for a revenue share of more than 32.43% in 2022. By application segment, the market is bifurcated into automotive, industrial, consumer electronics, aerospace and defense, healthcare, IT and telecommunication, and others. The consumer electronics industry is characterized by a high demand for electronic devices such as smartphones, televisions, computers, gaming consoles, and home appliances. These devices require a diverse range of through-hole components for their functionality, including resistors, capacitors, diodes, and transistors. The sheer volume of consumer electronics production contributes to the significant market demand for these modules. Consumer electronics often require repairs or part replacements throughout their lifespan. Through-hole components are advantageous in this context as they can be easily desoldered and replaced, allowing for efficient repair and serviceability. This ease of repair contributes to lower maintenance costs and enhances the overall customer experience, as consumers can have their devices fixed or upgraded without extensive downtime or expense.

The industrial segment is expected to emerge as the fastest-growing segment, with a CAGR of 10.6% over the forecast period. Through-hole components are renowned for their robust construction and durability, making them highly suitable for industrial applications. Industries such as manufacturing, automation, energy, and transportation often operate in harsh environments with extreme temperatures, vibrations, and electrical noise. Through-hole components, with their secure soldered connections and mechanical stability, can withstand these challenging conditions, ensuring reliable and long-lasting performance in industrial settings. The demand for security cameras, sensor-based devices, and robotic systems is increasing rapidly across industrial applications such as process automation and remote monitoring. Additionally, the adoption of robots in manufacturing has increased, which further increases the adoption of through-hole passive components. For instance, as per the data issued by the International Federation of Robotics, 517,385 industrial robots were sold in 2021, which accounted for a growth rate of 31% on a year-on-year basis.

Regional Insights

Asia Pacific dominated the market and accounted for a revenue share of 49.24% in 2022 and is also expected to emerge as the fastest-growing region, with a CAGR of 8.3% over the forecast period. The growth of the regional market can be attributed to the lucrative opportunities it offers for the implementation of these modules in several industries, such as automotive, consumer electronics, and industrial applications. Rapid implementation of robotic processes in Japan, South Korea, India, and China across various industries and industry verticals, especially in the automotive and consumer electronics industries, is driving the demand across the region. The initiatives being pursued by various governments in Asia Pacific, such as India’s Scheme for Manufacturing Electronic Components and Semiconductors, which envisages the government giving incentives to manufacturers, are expected to play a vital role in driving the growth of the regional market over the forecast period.

North America has a robust industrial sector comprising manufacturing, automation, aerospace, defense, and energy industries. These industries heavily rely on through-hole components for their applications, such as machinery control, power electronics, robotics, and infrastructure development. The continuous growth and innovation in these sectors fuel the demand for these modules in the North America region. The automotive industry is a significant driver of the North America through-hole components market. The region is home to numerous automobile manufacturers and suppliers, and through-hole components are extensively used in automotive electronics and systems. The increasing adoption of advanced driver assistance systems (ADAS), electric vehicles (EVs), and connectivity features in vehicles drives the demand for through-hole components in the automotive sector.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness increased competition due to the presence of several players. Key industry participants in the through-hole passive components market include Vishay Intertechnology, Inc.; YAGEO Group; Murata Manufacturing Co., Ltd.; KYOCERA AVX Components Corporation; Panasonic Holdings Corporation; Bourns, Inc.; TDK Corporation; TE Connectivity; Microchip Technology Inc. Most key players belong to the U.S. and Japan. A considerable amount of revenue share is held by four major players Vishay, TDK Corporation, Murata Manufacturing Co., Ltd, and Panasonic Holding Corporation. The remaining market share is distributed among several medium as well as small players. New product launches and mergers & acquisitions are the key strategies adopted by these players to gain a significant foothold in the market. Several key players are launching new components with better performance to expand their market share, broaden their product portfolio, and for regional expansion.

For instance, in August 2022, Vishay Intertechnology, Inc. announced the introduction of IHSR-6767GZ-5A, an automotive-grade inductor featuring shielded and composite construction. This new product release demonstrates the company's commitment to delivering advanced solutions to the automotive industry. The inductor is designed to offer exceptional resistance to thermal shock, moisture, and mechanical shock, ensuring reliable performance in challenging operating conditions. Additionally, it boasts the capability to handle high transient current spikes without saturation, further enhancing its efficiency and reliability in automotive applications. Some prominent players in the global through-hole passive components market include:

-

Vishay Intertechnology, Inc.

-

YAGEO Group

-

Murata Manufacturing Co., Ltd.

-

KYOCERA AVX Components Corporation

-

Panasonic Holdings Corporation

-

Bourns, Inc.

-

TDK Corporation

-

TE Connectivity

-

Microchip Technology Inc.

Through-hole Passive Components Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.60 billion

Revenue forecast in 2030

USD 62.99 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, leads model, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, UK, Germany, France, China, India, Japan, South Korea, Vietnam, Singapore, Brazil, Mexico.

Key companies profiled

Vishay Intertechnology, Inc., YAGEO Group, Murata Manufacturing Co., Ltd., KYOCERA AVX Components Corporation, Panasonic Holdings Corporation, Bourns, Inc., TDK Corporation, TE Connectivity, Microchip Technology Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Through-hole Passive Components Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global through-hole passive components market report based on component, leads model, application, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Resistors

-

Capacitors

-

Inductors

-

Diodes

-

Transducers

-

Sensors

-

Others

-

-

Leads Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Axial Leads

-

Resistors

-

Capacitors

-

Inductors

-

Diodes

-

Transducers

-

Sensors

-

Others

-

-

Radial Leads

-

Resistors

-

Capacitors

-

Inductors

-

Diodes

-

Transducers

-

Sensors

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer Electronics

-

Mobile Phones

-

Personal Computers

-

Home Appliances

-

Audio and Video Systems

-

Storage Devices

-

Others

-

-

IT & Telecommunication

-

Telecom Equipment

-

Networking Devices

-

-

Automotive

-

Driver Assistance Systems

-

Infotainment Systems

-

Others

-

-

Industrial

-

Industrial Automation and Motion Control

-

Mechatronics and Robotics

-

Power Electronics

-

Photovoltaic Systems

-

Others

-

-

Aerospace & Defense

-

Aircraft Systems

-

Military Radars

-

Others

-

-

Healthcare

-

Medical Imaging Equipment

-

Consumer Medical Devices

-

Others

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global through-hole passive components market size was estimated at USD 35.63 billion in 2022 and is expected to reach USD 37.60 billion in 2023.

b. The global through-hole passive components market is expected to grow at a compound annual growth rate of 7.6% from 2022 to 2030 to reach USD 62.99 billion by 2030.

b. Asia-Pacific dominated the through-hole passive component market with a share of 49.24% in 2022. The growth of the regional market can be attributed to the lucrative opportunities it offers for supplying through-hole passive components in several industries such as automotive, consumer electronics, and industrial applications.

b. Some key players operating in the through-hole passive components market include Vishay Intertechnology, Inc., YAGEO Group, Murata Manufacturing Co., Ltd., KYOCERA AVX Components Corporation, Panasonic Holdings Corporation, Bourns, Inc., TDK Corporation, TE Connectivity, Microchip Technology Inc., and others

b. Key factors that are driving the through-hole passive components market growth include growing penetration of connected devices and continuously growing demand for through-hole passive components in the medical and automobile industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.