- Home

- »

- Plastics, Polymers & Resins

- »

-

Tube Packaging Market Size & Share, Industry Report, 2033GVR Report cover

![Tube Packaging Market Size, Share & Trends Report]()

Tube Packaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Material (Aluminum, Plastic), By Product (Laminated, Aluminum), By Application (Personal Care & Oral Care, Consumer Goods, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-292-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tube Packaging Market Summary

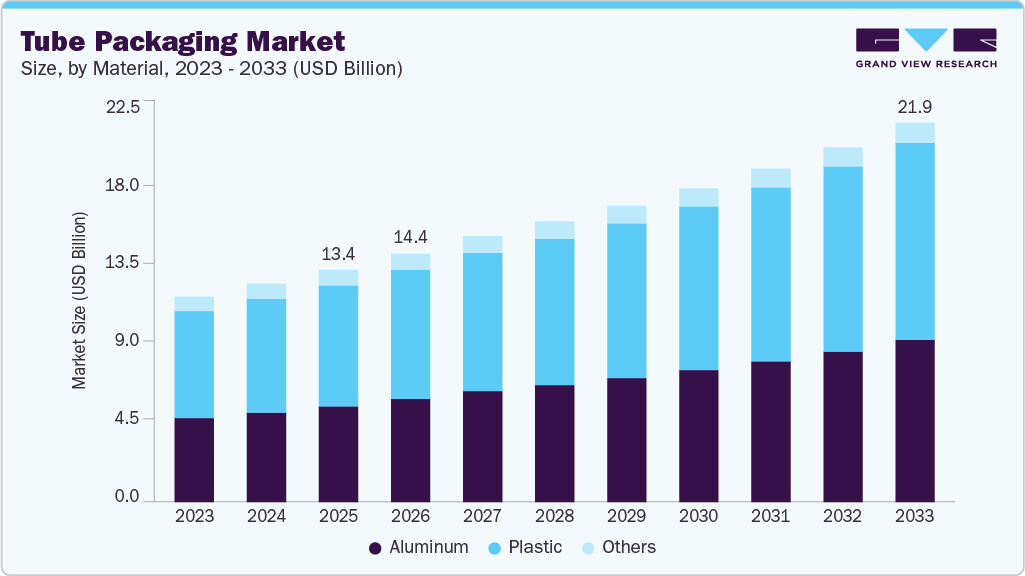

The global tube packaging market size was estimated at USD 13.43 billion in 2025 and is projected to reach USD 21.93 billion by 2033, growing at a CAGR of 6.2% from 2026 to 2033. The increasing demand for this type of packaging from application industries, including cosmetics & personal care, healthcare, and food industries, is expected to be the primary driver for the market.

Key Market Trends & Insights

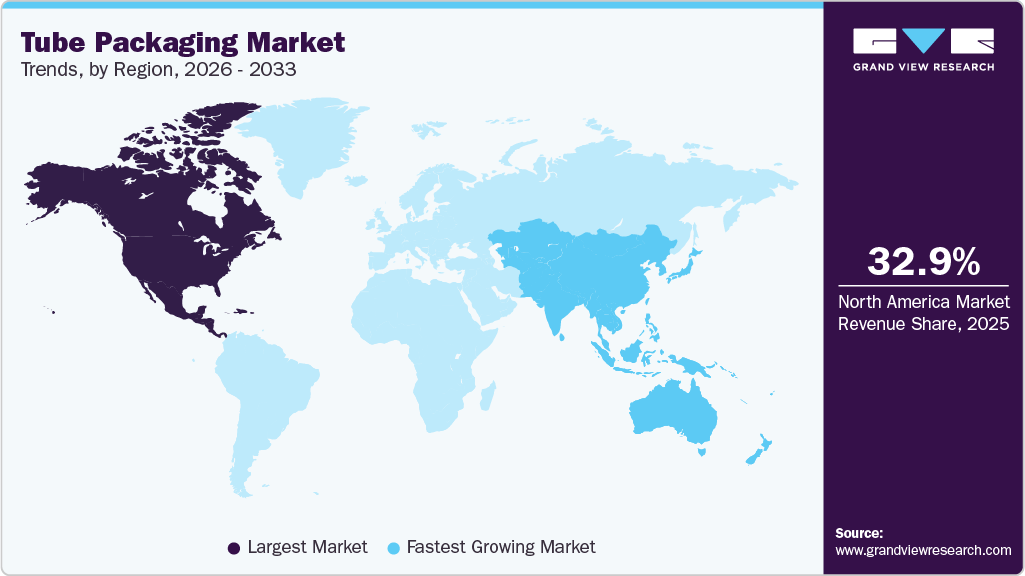

- North America dominated the tube packaging market with the largest revenue share of 32.97% in 2025.

- The U.S. tube packaging industry is expected to grow at the fastest CAGR of 6.5% from 2026 to 2033.

- By material, the aluminum segment is expected to grow at the fastest CAGR of 6.7% from 2026 to 2033, in terms of revenue.

- By product, the laminated tube segment is expected to grow at the fastest CAGR of 6.9% from 2026 to 2033, in terms of revenue.

- By application, the personal care & oral care segment is expected to grow at the fastest CAGR of 7.0% from 2026 to 2033, in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 13.43 Billion

- 2033 Projected Market Size: USD 21.93 Billion

- CAGR (2026-2033): 6.2%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

Increasing consumer awareness of personal health and wellness is expected to be a stimulating factor for the growth of the personal care market, creating demand for various packaging types. Growing awareness about personal appearance among individuals is driving the growth of personal care products, which primarily utilize tube packaging solutions.

Products are primarily distributed to the end users, such as pharmaceutical and cosmetics manufacturers, through distributors. However, many global end users have established direct contracts with the manufacturers to reduce the cost and ensure uninterrupted supply. Many manufacturers of the tube packaging have allowed the user to order directly from their websites. These portals allow direct contact between supplier and customer, as well as improve the profitability of both parties by reducing the distributor costs.

Drivers, Opportunities & Restraints

Convenience trends and shifting consumer lifestyles are driving the adoption of tubes across various industries, including food, adhesives, and industrial silicones. Tubes are lightweight, portable, and often more hygienic than jars or open pots, making them preferred for on-the-go and travel formats. E-commerce growth has also favored flexible and semi-rigid tubes because they pack efficiently and reduce breakage during transit. Additionally, advances in tube substrates have allowed tube formats to better address sustainability requirements, removing a previous barrier to adoption and unlocking new customer segments focused on circularity.

A major opportunity lies in sustainable and recyclable tube solutions. Brand owners are under pressure from regulators and consumers to improve the recyclability of their packaging and increase the recycled content. This offers an opportunity to converters, material suppliers, and tube manufacturers that can commercialize true mono-material tubes, easily separable multi-material constructions, or aluminum/metalized tubes with established recycling streams. Companies that can deliver performance-equivalent, low-carbon tube solutions at scale can capture share from legacy multi-layer laminates and rigid jars, especially in regions where EPR and recyclability rules are tightening.

Fluctuating raw material prices, including those for plastics, aluminum, and other laminates, are expected to create challenges for market growth. Plastic material majorly includes polyethylene, polyethylene terephthalate, and polypropylene. The prices of these polymers are sensitive to the fluctuations in the price of crude oil, which is highly volatile. Rising environmental concerns and stringent government regulations against the use of plastic and its disposal are expected to hinder market growth over the forecast period.

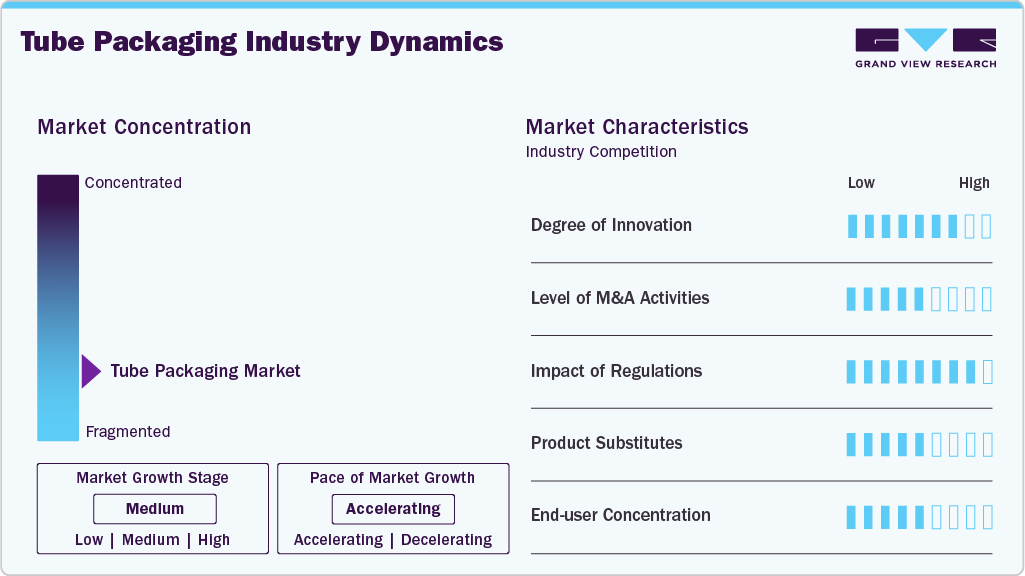

Market Characteristics

The tube packaging market is currently in a medium growth stage, with an accelerating pace. The degree of innovation in tube packaging is moderate to high, with emerging innovations including mono-material recyclable tubes, airless/plunger-based systems, hybrid aluminum-polymer constructions, and smart dispensing closures. Material science and digital printing for short runs are also emerging, enabling faster customization and premium looks without long lead times.

M&A activity is moderate and typically strategic, with larger converters, tube manufacturers, and chemical suppliers acquiring specialized players to expand their geographic reach, add sustainable material capabilities, or gain access to premium printing/finishing technology. Private equity interest in flexible packaging and contract manufacturing has also driven bolt-on acquisitions, while incumbents pursue vertical integration to control costs and secure their supply chains.

Regulatory impact is accelerating as circularity mandates, EPR schemes, recyclability labeling, and stricter food-contact safety requirements force manufacturers to rebuild substrate and supply chains. Regions with aggressive recyclability targets are pushing the rapid adoption of mono-material PE tubes or aluminum tubes with established recycling streams. At the same time, food and pharma regulations add testing and documentation burdens for barrier and multi-layer constructions.

Key substitutes in the tube packaging industry include stand-up pouches, bottles, sachets, jars, and rigid tubes; each substitute competes on the basis of cost, barrier performance, dispensing convenience, and perceived premium. Stand-up pouches and sachets are being replaced in single-use or trial-size applications due to lower material usage and improved transport efficiency. At the same time, bottles compete strongly where refillability or a higher barrier is needed.

Material Insights

The plastic segment dominated the tube packaging market in terms of revenue, accounting for a 52.14% share in 2025. This can be attributed to their cost efficiency, design flexibility, and compatibility with mass-production applications in personal care, oral care, food, and household products. They offer superior printability, shape customizability, and lightweight handling-attributes that support strong brand differentiation and high consumer convenience. Growth is reinforced by advancements such as PCR-content tubes, multilayer EVOH structures, and single-material recyclable PE tubes, which help brands meet sustainability targets while maintaining aesthetics and performance. While environmental scrutiny around plastics persists, the shift to monomaterial and bio-based plastics is helping this segment remain robust and innovative.

The aluminum segment is expected to register the fastest CAGR of 6.7% during the forecast period. Driven by their superior barrier properties, excellent oxygen and UV protection, and high product stability, they are ideal for cosmetics, pharmaceuticals, ointments, and high-value formulations. Their collapsible structure ensures controlled dispensing and prevents product backflow, a critical feature for sensitive formulations. Although aluminum tubes face cost pressures and growing sustainability debates surrounding energy-intensive smelting, they are increasingly benefiting from the push toward infinitely recyclable materials and premium brand positioning.

Product Insights

In terms of revenue, laminated tubes dominated the tube packaging industry, with a global share exceeding 46.8% in 2025. The segment is also expected to grow at the fastest rate of 6.9% over the forecast period. These products are composed of multiple layers of polymers and other materials. These layers act as an excellent barrier to the moisture, light, and air, leading to the increased shelf life of the products stored in them.

Laminated tubes are generally available in two types of aluminum barrier laminate (ABL) and plastic barrier laminate (PBL) tubes. ABL tubers use aluminum foil as a barrier, and PBL tubes have multiple layers of plastic foil as a barrier. The higher popularity of laminates is because they combine the properties of both plastic and metal, and thereby protect the products from spoilage.

In terms of revenue, plastic tubes emerged as the second-largest market segment and is expected to witness a CAGR of 5.9% over the forecast period. The plastic tube is mainly produced using extrusion using monomers, including LDPE, LLDPE, MDPE, and HDPE. Some tubes are also co-extruded with multiple layers of these monomers. Continuous developments in material science, including the advancement of biodegradable plastics, are expected to drive the plastic tube market, despite stringent government regulations hindering market growth.

The extruded laminated tubes segment is expected to witness a CAGR of 5.9% over the forecast period. Extruded laminated tubes combine the structural rigidity of extruded plastics with the enhanced barrier performance of laminated layers, providing a balanced solution for brands that require durability, aesthetics, and product protection. They typically feature a plastic outer layer with inner EVOH or aluminum laminate layers, providing excellent resistance to oxygen, moisture, and chemicals, making them ideal for use in oral care, cosmetics, pharmaceuticals, and food pastes.

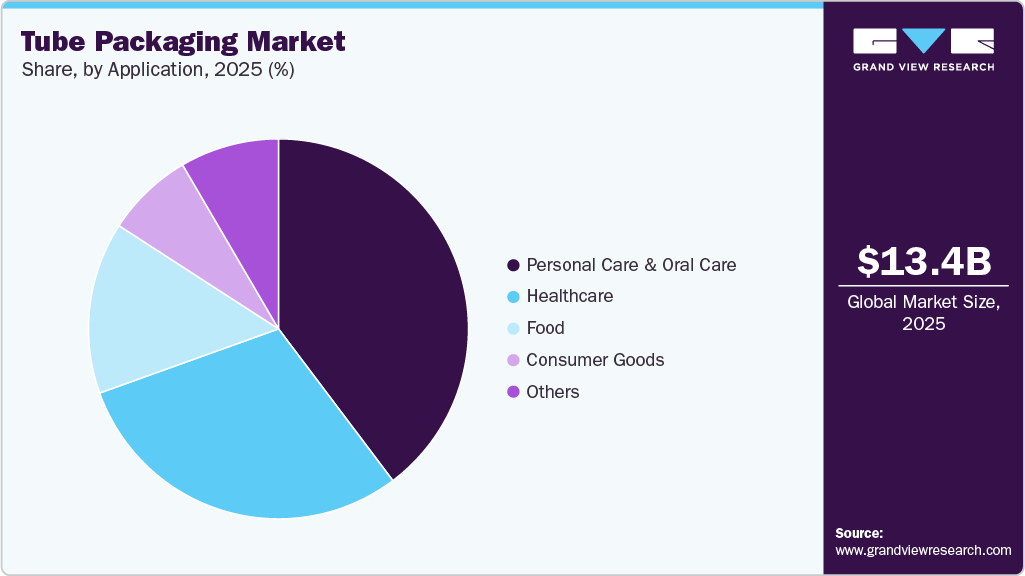

Application Insights

In terms of revenue, the personal care & oral care segment led the tube packaging market, accounting for a 39.72% share in 2025. Growing awareness regarding health and wellness, coupled with higher demand for chemical-free and organic products, is expected to drive the demand for personal care and oral care products over the forecast period.

The aging population in the European and North American countries is expected to increase the cosmetic products with anti-aging properties. Ratio of old-age benefits to GDP in the Europe has been increasing since 2011, according to Eurostat data, and is expected to increase as several countries like Italy, Spain, and others in the region are witnessing an increase in the percentage of old-age population.

In terms of revenue, the healthcare application segment is projected to grow at a CAGR of 6.4% during the forecast period. The rise in healthcare spending and the presence of prominent pharmaceutical manufacturing companies like Pfizer, Inc.; Johnson & Johnson; Abbott Laboratories; and AbbVie Inc. in European and North American countries is expected to drive the demand for tube packaging.

In terms of revenue, the food application segment accounted for more than 7.0% of the global share in 2025. Tubes are primarily used for packaging semi-liquid and liquid food products, including sauces, ketchup, dressings, creams, salsa, and beverage flavors. Increasing demand for seasoning and dressings for exotic foods, owing to higher consumer demand, is expected to drive the market growth over the forecast period.

Regional Insights

North America led the global tube packaging market, with a revenue share of 32.97% in 2025. Robust pharmaceutical, premium cosmetics, and personal care markets support the demand. The region is a pioneer in the development of recyclable tubes, with major brand owners committed to using 100% recyclable or PCR-integrated tubes by 2030. High consumer preference for premium, hygienic, and travel-friendly packaging continues to drive innovation across laminated and plastic tube formats.

U.S. Tube Packaging Market Trends

The U.S. leads North America’s tube packaging consumption, driven by high per-capita spending on cosmetics, dermatology products, pharmaceuticals, and specialty food segments. Sustainability regulations, brand commitments to PCR use, and increased demand for premium extruded and laminated tubes accelerate market evolution. The presence of large CPG companies and contract manufacturers supports continuous innovation in barrier technologies and printing quality.

Europe Tube Packaging Market Trends

The Europe tube packaging industry is mature but innovation-driven. The regional market is shaped by stringent packaging waste, recyclability, and EPR regulations. Consumers prioritize sustainable and premium packaging formats, pushing companies to adopt mono-material PE tubes, bio-based plastics, and aluminum recycling loops. High adoption of cosmetic and pharmaceutical tubes, combined with strong sustainability commitments from regional FMCG giants, makes Europe a key center for packaging R&D.

The Germany tube packaging market is expected to grow over the forecast period. Germany stands out as a technologically advanced and regulatory-driven market, emphasizing high-barrier, recyclable, and high-quality tube packaging solutions. The country’s strong pharmaceutical and premium cosmetics sectors generate continuous demand for laminated and aluminum tubes. Sustainability compliance, precision engineering, and strict quality standards make German manufacturers influential in shaping global tube packaging innovations.

Asia Pacific Tube Packaging Market Trends

The Asia Pacific tube packaging industry is anticipated to witness the fastest CAGR of 7.0% over the forecast period, driven by the rapid expansion of personal care, cosmetics, pharmaceuticals, and food sectors, alongside a rising middle-class population with increasing disposable incomes. Strong manufacturing ecosystems and cost-competitive production make the region a global hub for laminated and plastic tube exports. Sustainability adoption is accelerating, with brands shifting toward recyclable mono-material tubes and PCR-based plastics, particularly in markets such as China, India, South Korea, and Southeast Asia.

China tube packaging market is projected to grow over the forecast period. China remains the largest producer and consumer of tube packaging in Asia Pacific, supported by massive oral care, cosmetics, and pharmaceutical industries, as well as one of the world’s strongest plastic-processing clusters. The country’s push toward packaging sustainability-particularly recyclable PE tubes and reduced-aluminum laminates-is reshaping supply chains. Domestic players are exporting aggressively while international brands continue to invest in local production due to cost efficiency and proximity to end use markets.

Latin America Tube Packaging Market Trends

Latin America shows a growing demand for tube packaging fueled by expanding personal care, oral care, and affordable FMCG products. Economic fluctuations keep cost-effective laminated and plastic tubes dominant, while sustainability initiatives are gradually emerging, led by multinational FMCG brands. Local production is strengthening, especially in Brazil and Mexico, to reduce import dependency and improve market competitiveness.

Brazil's tube packaging market is the largest in Latin America, driven by the growth of its strong cosmetics and personal care industry, one of the largest globally. The country’s dynamic beauty sector, preference for flexible and small-format packaging, and growth of pharmaceutical and dermatology products support elevated tube consumption. Sustainability initiatives are on the rise, particularly through the increased use of recyclable PE tubes and bio-based plastics derived from sugarcane ethanol.

Middle East & Africa Tube Packaging Market Trends

The Middle East & Africa tube packaging industry is expanding moderately, supported by growing demand for personal care, pharmaceuticals, and economic diversification initiatives. The region relies heavily on imported tube packaging; however, local manufacturing is gradually growing, particularly in the UAE, South Africa, and Saudi Arabia. Rising hygiene awareness and population growth continue to create opportunities for cost-effective plastic and laminated tubes.

Saudi Arabia Tube Packaging Market benefits from strong investments in pharmaceuticals, beauty products, and healthcare as part of Vision 2030 diversification plans. Local plastics and petrochemical capabilities offer cost advantages for tube manufacturing, while an increasing consumer preference for premium personal care products drives demand for high-quality laminated and extruded tubes. Sustainability adoption is emerging but still in its early stages compared to Western markets.

Key Tube Packaging Company Insights

The competitive rivalry among the global tube packaging manufacturers is expected to increase over the forecast period. Multiple players can offer standard as well as customized plastic, aluminum, and laminated tube packaging solutions as per the customer's requirements. Increasing demand for innovative products like biodegradable and recyclable tubes is expected to intensify the competition over the forecast period.

Global manufacturers are intensifying their focus on sustainable production due to growing regulations regarding the processing and recycling of raw materials, particularly plastics. This change in demand has resulted in collaborations and partnerships among the manufacturers and plastic recycling companies to comply with stringent regulations.

Key Tube Packaging Companies:

The following are the leading companies in the tube packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Essel Propack Limited

- VisiPak

- Sonoco Products Company

- ALBEA

- Clariant

- Montebello Packaging

- Huhtamaki OYJ

- Unette Corporation

- Romaco Group

- Hoffman Neopac AG

Recent Developments

-

In December 2025, FlexiTubes, the packaging tubes business of UFlex, showcased its advanced and sustainable tube packaging solutions for beauty and personal care brands at Cosmoprof India 2025, held at the Jio World Convention Centre in Mumbai. Through its FlexiTubes division, UFlex highlighted innovations that combine premium aesthetics, product protection, and eco-friendly materials, positioning itself as a preferred partner for brands seeking customizable, efficient, and sustainable packaging solutions. The solutions reflect the growing demand in the beauty industry for packaging that balances functionality, sustainability, and visual appeal

-

In September 2025, Neopac unveiled the world’s first fully recyclable paper tube designed for complete recovery in the paper stream at the International Fiber and Paper Congress (IFPC). Developed in collaboration with AISA and Blue Ocean Closures, the new PaperX FiberTop tube features a fiber‑based body, shoulder, and closure. This initiative represents a significant step toward decarbonizing packaging, offering brands a scalable and sustainable alternative to traditional plastic tubes while meeting the growing demands of consumers and regulators for eco-friendly solutions.

Tube Packaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14.36 billion

Revenue forecast in 2033

USD 21.93 billion

Growth rate

CAGR of 6.2% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Essel Propack Limited; VisiPak; Sonoco Products Company; ALBEA; Clariant; Montebello Packaging; Huhtamaki OYJ; Unette Corporation; Romaco Group; Hoffman Neopac AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tube Packaging Market Report Segmentation

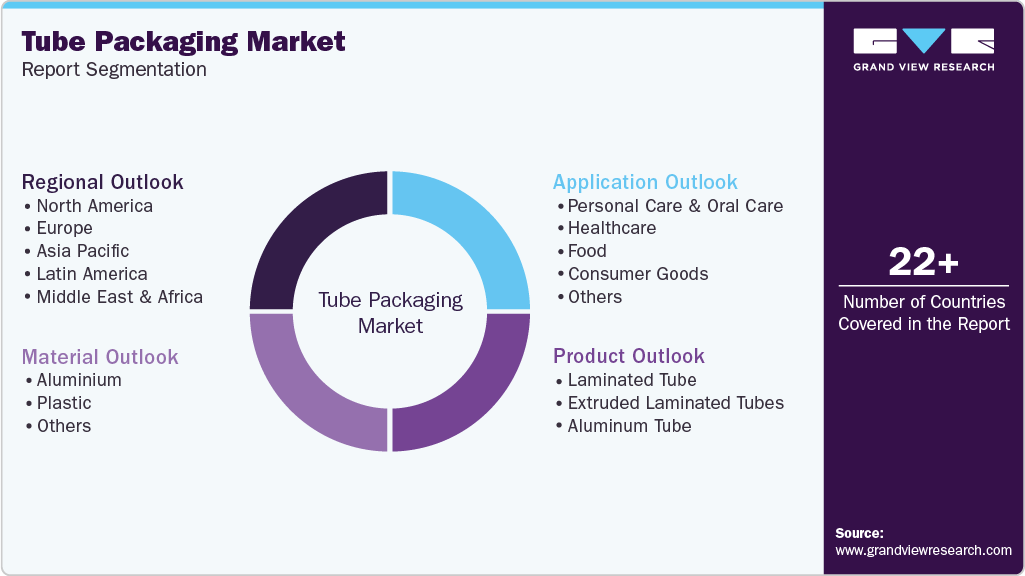

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the tube packaging market report based on material, product, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Aluminium

-

Plastic

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Laminated Tube

-

Extruded Laminated Tubes

-

Aluminum Tube

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Personal Care & Oral Care

-

Healthcare

-

Food

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global tube packaging market was estimated at around USD 13.43 billion in the year 2025 and is expected to reach around USD 14.36 billion in 2026.

b. The global tube packaging market is expected to grow at a compound annual growth rate of 6.2% from 2026 to 2033 to reach around USD 21.93 billion by 2033.

b. Plastic dominated the tube packaging market across the material segmentation in terms of revenue, accounting for a market share of 52.14% in 2025. It is driven due to their cost efficiency, design flexibility, and compatibility with mass-production applications in personal care, oral care, food, and household products.

b. Some of the key players operating in the tube packaging market include Essel Propack Limited, VisiPak, Sonoco Products Company, ALBEA, Clariant, Montebello Packaging, Huhtamaki OYJ, Unette Corporation, Romaco Group, Hoffman Neopac AG.

b. The key factors that are driving the tube packaging market include growing product demand for personal care & hygiene products packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.