- Home

- »

- Plastics, Polymers & Resins

- »

-

UAE Paper Packaging Market Size, Industry Report, 2033GVR Report cover

![UAE Paper Packaging Market Size, Share & Trends Report]()

UAE Paper Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Grade (Virgin Paper, Recycled Paper), By Product Type (Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Liquid Packaging Cartons), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-736-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

UAE Paper Packaging Market Summary

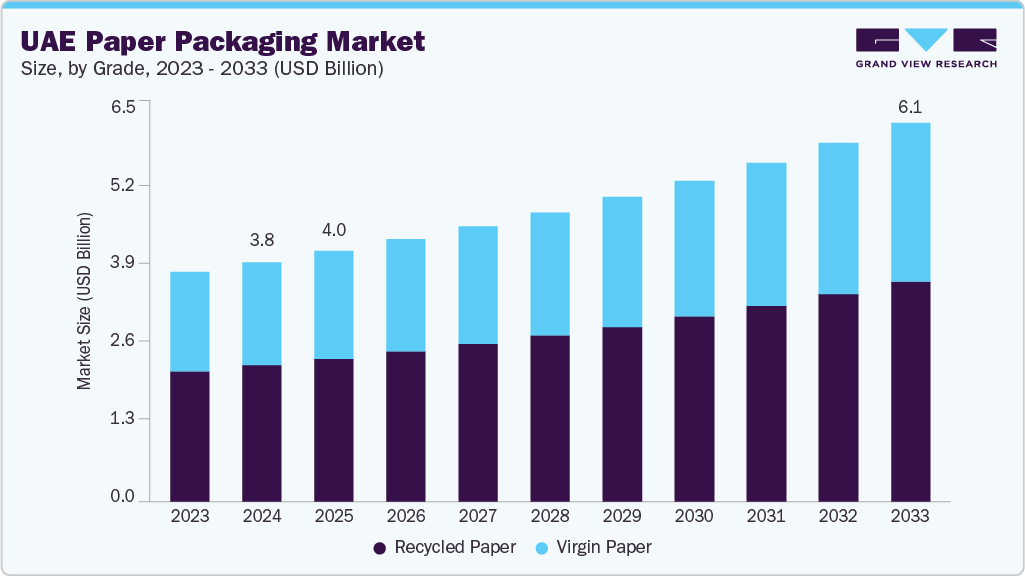

The UAE paper packaging market size was estimated at USD 3.84 billion in 2024 and is projected to reach USD 6.09 billion by 2033, growing at a CAGR of 5.3% from 2025 to 2033. The market growth is driven by the government’s strong push for sustainability and plastic bans, encouraging businesses to adopt eco-friendly alternatives.

Key Market Trends & Insights

- By grade, the recycled paper segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By product type, the folding cartons segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

- By application, the e-commerce & retail segment is expected to grow at a considerable CAGR of 6.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3.84 Billion

- 2033 Projected Market Size: USD 6.09 Billion

- CAGR (2025-2033): 5.3%

Additionally, rising e-commerce and food delivery services are fueling demand for paper-based packaging solutions. The UAE has introduced bans and restrictions on single-use plastics, most notably the 2024 nationwide ban on plastic bags, which has accelerated demand for paper-based alternatives. Businesses across retail, foodservice, and e-commerce are rapidly shifting to paper bags, cartons, and wraps to align with regulations and consumer preferences. For instance, major retailers like Carrefour and Lulu Hypermarket have replaced plastic bags with paper-based options, creating steady growth for the paper packaging sector.

The UAE’s dynamic food and beverage industry, driven by a strong hospitality sector, high expatriate population, and growing demand for convenience foods, is fueling the adoption of paper packaging. Restaurants, cafés, and fast-food chains increasingly prefer paper-based cups, trays, and wraps due to their eco-friendly appeal and compliance with sustainability goals. For example, global QSR brands like McDonald’s and KFC in the UAE are using paper straws and containers to cater to eco-conscious customers. The booming food delivery market, supported by platforms such as Talabat and Deliveroo, is further amplifying demand for durable and recyclable paper-based packaging.

The UAE’s thriving e-commerce sector is another key driver, with online retail sales experiencing double-digit growth in recent years. E-commerce players are heavily investing in eco-friendly packaging to meet consumer expectations and improve brand image. Paperboard boxes, corrugated cartons, and protective fillers are becoming the preferred packaging solutions due to their recyclability and strength. For instance, Amazon UAE and Noon have incorporated more paper-based packaging for delivery to reduce their environmental footprint and enhance customer satisfaction. This shift reflects both global best practices and regional demand for greener logistics solutions.

The UAE government’s “Green Agenda 2030” and commitment to a circular economy are strongly influencing the paper packaging market. Businesses are under pressure to adopt sustainable packaging strategies, leading to partnerships and investments in innovative paper-based solutions. Large corporations and SMEs alike are setting ambitious sustainability targets, which include replacing plastic with paper packaging in their supply chains.

For example, the UAE’s malls and department stores are phasing out plastic bags and switching to biodegradable or recyclable paper alternatives. With the implementation of single-use plastic bans in Abu Dhabi (2022) and Dubai (2024), supermarkets such as Lulu, Carrefour, and Spinneys now offer reusable kraft paper bags at checkout. This regulatory environment has driven higher demand for paper-based shopping bags, takeaway boxes, and product wraps, particularly in the food, apparel, and consumer electronics categories.

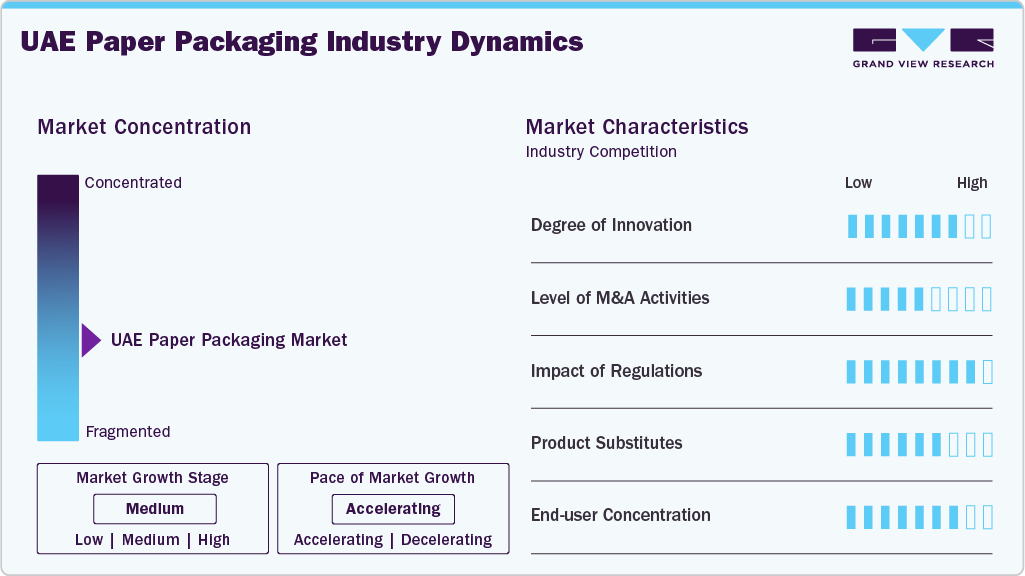

Market Concentration & Characteristics

The UAE paper packaging industry is characterized by strong government influence, with policies like the nationwide ban on single-use plastics shaping demand. This makes the market highly regulation-driven, where compliance with sustainability rules directly affects packaging choices. As a result, paper packaging manufacturers and converters are experiencing strong growth opportunities, supported by both domestic demand and imports.

The UAE paper packaging market is increasingly innovation-driven, with companies investing in biodegradable coatings, lightweight corrugated boards, and premium-quality printed cartons. Sustainability is not just a compliance requirement but also a key selling point for brands appealing to eco-conscious consumers. For instance, packaging with “100% recyclable” or “FSC-certified paper” labels enhances brand perception and consumer trust, giving companies with such innovations a competitive edge.

Grade Insights

The recycled paper segment recorded the largest market revenue share of over 56.0% in 2024 and is expected to grow at the fastest CAGR of 5.6% during the forecast period. With increasing pressure to reduce carbon footprints, recycled paper is widely used in corrugated boxes, cartons, paper bags, and secondary packaging formats across retail, e-commerce, and food service sectors. Many local converters are investing in recycling and reprocessing technologies to meet demand for eco-friendly packaging solutions. The main drivers include the UAE’s national sustainability agenda, such as the UAE Net Zero 2050 initiative, and government restrictions on single-use plastics, which are accelerating the shift toward recyclable alternatives.

Virgin paper packaging continues to be significant in premium applications where strength, durability, and hygiene standards are critical. It is commonly used for high-end food packaging, pharmaceuticals, cosmetics, and luxury goods. Since the UAE imports most of its virgin pulp and paper, the segment is largely supplied by international producers, with regional converters transforming it into packaging materials. The demand is driven by the country’s growing luxury retail and cosmetics market, rising pharmaceutical packaging needs, and consumer preference for high-quality, durable packaging that aligns with brand image.

Product Type Insights

The corrugated boxes segment recorded the largest revenue share of over 42.0% in 2024. Corrugated boxes are primarily used for shipping, storage, and e-commerce packaging due to their durability, lightweight structure, and cost-effectiveness. Industries such as food & beverages, electronics, FMCG, and pharmaceuticals heavily rely on corrugated boxes for both domestic and export logistics. The growth of e-commerce in the UAE, supported by platforms such as Noon, Amazon.ae, and Carrefour online, is significantly fueling the demand for corrugated boxes.

The folding cartons segment is expected to grow at the fastest CAGR of 6.0% during the forecast period. Folding cartons are primarily used for retail-ready and consumer product packaging, including cosmetics, personal care items, pharmaceuticals, and processed foods. These cartons are valued for their printability, lightweight nature, and ability to enhance brand visibility at the point of sale. The UAE’s rapidly growing retail sector, driven by malls, supermarkets, and luxury outlets, is boosting the adoption of folding cartons.

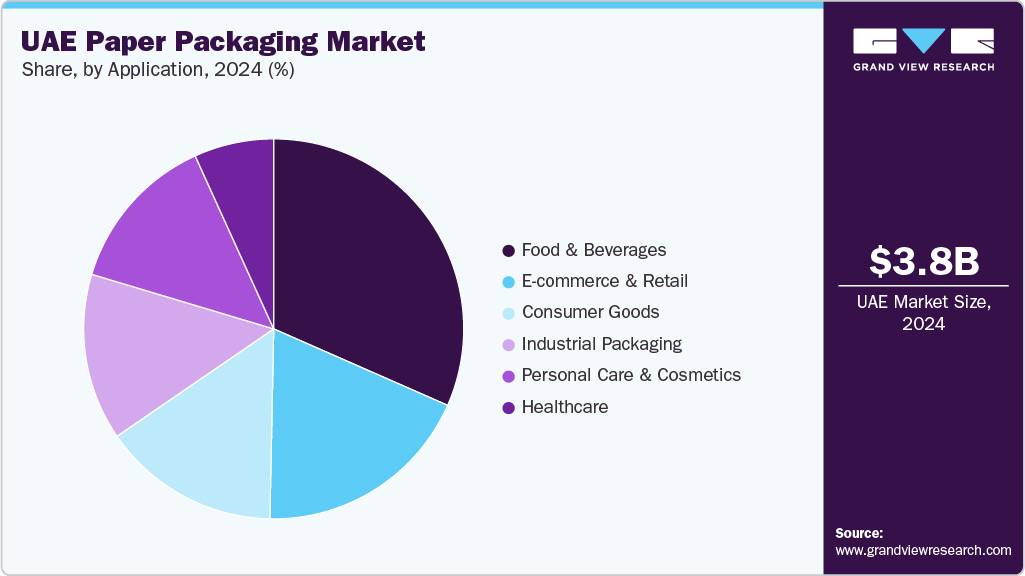

Application Insights

The food & beverages segment led the UAE paper packaging industry with the largest revenue share of over 31.0% in 2024. The growth of this segment is primarily driven by the rising demand for takeaway and delivery food services, fueled by a strong foodservice sector and the expansion of QSRs (Quick Service Restaurants). Additionally, increasing consumer awareness about eco-friendly packaging solutions and government initiatives promoting sustainability in food packaging have pushed manufacturers to adopt recyclable and biodegradable paper packaging solutions.

The e-commerce & retail segment is expected to grow at the fastest CAGR of 6.0% during the forecast period. E-commerce and retail packaging includes boxes, corrugated cartons, mailers, and gift packaging designed for safe transportation and brand presentation. The surge in online shopping, accelerated by smartphone penetration and digital payment adoption, is a key growth driver. Retailers are investing in customized, branded packaging to enhance customer experience and reinforce brand loyalty. Additionally, the UAE government’s focus on logistics infrastructure improvements further supports the expansion of e-commerce packaging demand.

Key UAE Paper Packaging Company Insights

The competitive environment of the UAE paper packaging industry is moderately fragmented, with a mix of large multinational players, regional leaders, and small-to-medium local manufacturers vying for market share. Key players focus on differentiation through sustainable and innovative packaging solutions, such as recyclable, biodegradable, and custom-printed options.

The market is characterized by intense price competition, strategic partnerships with FMCG and e-commerce companies, and investments in advanced production technologies to improve efficiency and product quality. Additionally, the growing adoption of digital printing and smart packaging solutions is creating opportunities for niche players to gain a competitive edge, while regulatory compliance and sustainability mandates are increasingly shaping the competitive landscape.

-

In December 2024, ZamZam Packaging Mat. Ind. LLC opened a new state-of-the-art plant in Umm Al Quwain, UAE. The new facility is equipped with the latest machinery, including fully automated corrugation, printing, folding, and stitching equipment.

-

In November 2024, Tetra Pak, in partnership with Union Paper Mills (UPM), launched the UAE’s first-of-its-kind recycling line for carton packages, backed by a joint investment of AED 2.5 million (approx. USD 0.68 million). This innovative recycling facility can process up to 10,000 tonnes of post-consumer carton packaging annually, diverting waste from landfills and enabling the recovery of high-quality virgin paper fibers for paperboard production and recycled polymers and aluminum. The initiative aligns with Tetra Pak’s sustainability goals and the UAE’s Green Agenda 2030.

-

In August 2024, Hotpack Packaging Industries LLC opened its largest retail outlet in the UAE for disposable food packaging products, covering over 5,600 square feet in Al Barsha on Umm Suqiem Street. This outlet, the biggest among Hotpack's 32 sales centers, caters to both retail and wholesale customers, offering a wide range of food packaging solutions focused on quality, innovation, and hygiene.

Key UAE Paper Packaging Companies:

- International Paper

- Mondi

- Hotpack Packaging Industries LLC

- Silver Corner Packaging

- Spectrum Converting Industry

- Bony Packaging

- ZamZam Packaging Mat. Ind. LLC

- Arabian Packaging

- Universal Carton Industries LLC

- RAK PACKAGING COMPANY LTD

- Four Corner Carton and Packaging

- Takamul Industrial Company

UAE Paper Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.02 billion

Revenue forecast in 2033

USD 6.09 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, product type, application

Key companies profiled

International Paper; Mondi; Hotpack Packaging Industries LLC; Silver Corner Packaging; Spectrum Converting Industry; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Arabian Packaging; Universal Carton Industries LLC; RAK PACKAGING COMPANY LTD; Four Corner Carton and Packaging; Takamul Industrial Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UAE Paper Packaging Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UAE paper packaging market report based on grade, product type, and application:

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

Virgin Paper

-

Recycled Paper

-

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Corrugated Boxes

-

Folding Cartons

-

Paper Bags & Sacks

-

Liquid Packaging Cartons

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Healthcare

-

Consumer Goods

-

E-commerce & Retail

-

Industrial Packaging

-

Frequently Asked Questions About This Report

b. The UAE paper packaging market was estimated at around USD 3.84 billion in the year 2024 and is expected to reach around USD 4.02 billion in 2025.

b. The UAE paper packaging market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach around USD 6.09 billion by 2033.

b. The food & beverages segment dominates the UAE paper packaging market due to rising demand from QSRs, cafes, and food delivery services, which require sustainable and disposable packaging solutions.

b. The key players in the UAE paper packaging market include International Paper; Mondi; Hotpack Packaging Industries LLC; Silver Corner Packaging; Spectrum Converting Industry; Bony Packaging; ZamZam Packaging Mat. Ind. LLC; Arabian Packaging; Universal Carton Industries LLC; RAK PACKAGING COMPANY LTD; Four Corner Carton and Packaging; and Takamul Industrial Company.

b. The market is driven by the rising demand for sustainable and eco-friendly packaging solutions and the rapid growth of e-commerce, food & beverage, and consumer goods sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.