- Home

- »

- Food Safety & Processing

- »

-

UK Food Preservatives Market Size, Industry Report, 2030GVR Report cover

![UK Food Preservatives Market Size, Share & Trends Report]()

UK Food Preservatives Market Size, Share & Trends Analysis Report By Label (Clean Label, Conventional), By Type (Natural, Synthetic), By Function (Anti-microbial, Anti-oxidant), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-211-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

UK Food Preservatives Market Size & Trends

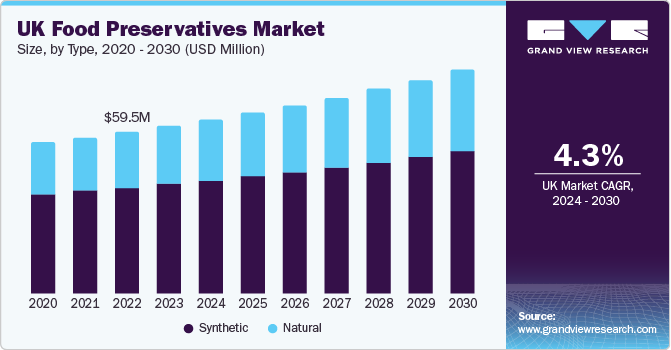

The UK food preservatives market size was estimated at USD 61.7 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. Due to growing preferences for natural food preservatives in foods such as dairy products, snack foods, and processed meat products, the natural food preservatives are witnessing augmented market demand.

The UK market accounted for a revenue share of 2.1% of the global food preservatives market in 2023. In comparison to other European nations, the UK's food and beverage industry is growing because of its low corporate tax and cheaper labor expenses. Over the course of the forecast period, the market for natural food preservatives is anticipated to be driven by the growing demand for nutritious food products. In the UK in 2018, synthetic food preservatives accounted for the greatest portion of the demand for food preservatives. However, throughout the course of the projection period, natural preservatives are anticipated to gain a sizable market share due to the growing demand for natural, nutritious food products.

The increasing need for natural preservatives to preserve meat and poultry products is predicted to drive up demand for rosemary extract, natamycin, and vinegar. In the past, grapes were used to supply vinegar needs; but, due to a decline in grape production, balsamic vinegar is now used to fill the need.

The UK imports processed meat from neighboring nations; as a result, the need for antimicrobial compounds is rising in the nation to stop microbial activity on the imported meat. Nonetheless, the demand for seafood and poultry is rising as a result of growing health concerns about consuming pig meat. The rise in demand for dairy products is probably going to balance out the decline in meat consumption. Consequently, during the course of the forecast period, it is expected that the need for antimicrobial agents in the preservation of dairy products will rise.

The demand for clean label solutions is expanding, as is the appeal of packaged and processed foods, and the intricate supply chain of the food business is propelling the market. The expansion of organized retail, particularly in emerging nations, is probably going to propel the market for food preservatives. The costlier natural preservatives (which are in greater demand) and customer knowledge of the negative impacts of synthetic preservatives are the main market constraints. Corbion NV, for instance, doubled its output of lactic acid and goods derived from lactic acid in March 2021 by concurrently working on development assignments in Europe and other regions.

Market Concentration & Characteristics

With a modest growth rate, the market is somewhat fragmented. The development of natural and clean-label preservatives, along with other continuous innovations in preservation technologies, is propelling the market's expansion.

In the UK industry, partnerships and acquisitions are being propelled by the rising demand for natural preservatives. In 2021, Kerry purchased Niacet, a company that specializes in food preservation products. Incorporating natural and clean-label ingredients into food items is receiving more attention.

Laws governing food safety and acceptable additives drive the market for preservatives that adhere to strict guidelines. Market participants must abide by these rules in order to guarantee consumer confidence and product acceptance.

The industry is being impacted by the increasing availability of natural preservatives. Synthetic preservatives may become less common as consumers' preferences for natural and organic alternatives grow. In response to these shifting consumer tastes, industry players are experimenting with novel preservation techniques or providing creative, natural preservatives in an effort to obtain a competitive advantage.

Type Insights

The synthetic food preservatives market accounted for a revenue share of 65.4% in 2023. Because it is affordable and simple to make, the synthetic variety is utilized extensively. They can be created according on the needs of the application.

Resulting from the wide use in meat, poultry, and dairy products, the sorbates category accounted for a share of 43.3% in 2023. Propionates, benzoates, and sorbates are frequently combined to increase efficacy. Due to its higher allowable limit and range of uses, such as baking items, snacks, and other confections, propionates are becoming more widely accepted. The propionates segment is projected to grow at a CAGR of 4.6% from 2024 to 2030.

The natural food preservatives market in the UK is projected to grow at a CAGR of 5.0% from 2024 to 2030. Owing to the fact that key regulatory bodies accept natural preservatives and consumers are becoming more health conscious, the market for natural food preservatives is expected to rise at a faster rate than the demand for their synthetic counterparts. A lot of producers are implementing innovative formulation techniques to produce organic goods in order to comply with the clean label requirements.

Label Insights

The conventional food preservatives market accounted for a revenue share of 58.7% in 2023. Either by alone or in combination with other preservation methods, conventional food preservatives are utilized. The majority of conventional preservatives are either antimicrobial preservatives, which stop bacteria or fungus from growing, or antioxidants, which act as oxygen absorbers.

A number of outbreaks, notably those involving salmonella infections and E. coli, have led to an increase in product recalls, both in the United States and abroad. In a similar vein, customers are now more careful when buying food goods and, consequently, product labeling after the recent coronavirus (SARS-CoV-2) contamination of ice cream in China in January 2021.The clean label food preservatives market in the UK is expected to grow at a CAGR of 5.4% from 2024 to 2030. Consumer attention is changing toward ingredients that are more dependable and easily understood. In an effort to meet the demands of a consumer base that is becoming more and more label-conscious, the food sector is quickly implementing clean-label preservatives.

Manufacturers have responded to end-user demand by introducing a clean label range that works with food formulas. To maintain the consistent freshness that consumers want, Corbion, for example, has created an enzyme technology that safeguards bread items during handling, delivery, and processing. In recent years, there has been a significant demand for clean-label food items due to the emergence of novel clean-label preservatives.

Function Insights

The anti-microbial food preservatives category held a revenue share of nearly 65% in 2023. Natural antimicrobial agents are becoming increasingly popular owing to the rising concerns among consumers regarding chemical preservatives. Antimicrobial properties against pathogens and microbes can be found in herbal plants, medicinal plants, and edible oils. These natural sources of antimicrobial properties are expected to increase the shelf life of packaged foods.

The antioxidant food preservatives market in the UK is projected to grow at a CAGR of 3.9% from 2024 to 2030. Oxidation is a common problem that causes rancidity in food when the oxygen reacts with the fat and pigment content. Oxidized food loses its color and texture, making it unappealing for consumers. Compliance with food packaging guidelines and adding preservatives during the processing of food help prevent oxidation and extend the shelf life. Green tea extracts, acerola, rosemary extract, and ascorbic acid possess antioxidant properties and are used in preventing food oxidation.

Application Insights

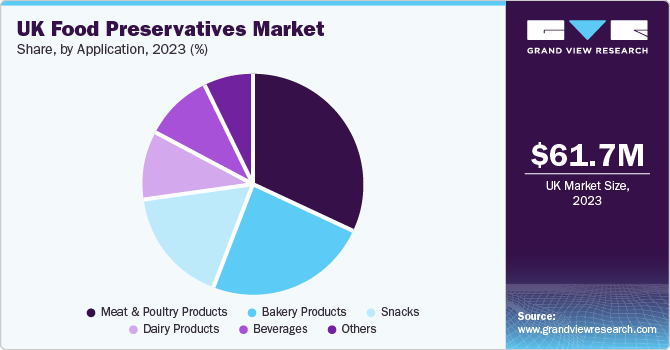

The food preservative demand in the meat & poultry segment held a revenue share of 32.4% in 2023. Factors such as increasing demand for processed food and availability of technology that can extend the shelf life of processed meat are attributing to the expansion of the food processing industry, thereby driving the demand for food preservatives. Moreover, use of food preservatives that can retain the natural flavor and aroma of the meat is the current trend in the meat & poultry industry.

Owing to microbial spoiling, bakery items have a limited shelf life, which can lead to both financial loss and a decline in the food product's quality. The natural alternatives of essential oils such as thyme, cinnamon, and lemongrass have become popular in bakery applications.

Due to the rise of the beverage industry, food preservative demand in drinks is anticipated to expand at the quickest rate over the projection period. Antioxidants, antibacterial agents, and anti-browning agents are the three categories of preservatives used in beverages. For example, because it is a reducing agent, ascorbic acid also has anti-browning and antioxidant properties.Key UK Food Preservatives Company Insights

The UK industry is characterized by the presence of a large number of synthetic preservative manufacturers. However, because organic preservatives are becoming more and more popular, new players have entered the market. Due to growing consumer health consciousness and willingness to pay more for high-quality goods, there is a progressive growth in demand for natural food products. The rivalry has been even more intense because of the enormous number of natural food manufacturers who have entered the market.

Key UK Food Preservatives Companies:

- Cargill, Inc.

- Kemin Industries, Inc.

- Archer Daniels Midland Company

- Tate & Lyle

- Koninklijke DSM N.V.

- BASF SE

- Celanese Corporation

- Corbion N.V.

- Galactic S.A.

- Kerry Group plc

Recent Developments

-

July 2022: Kemin Industries Inc. unveiled a new food preservative, RUBINITE GC Dry, as a alternative for sodium nitrite. According to the company, RUBINITE is a natural substitute, which can be utilized as a curing agent in foods, providing utmost microbiological safety and preserving product steadiness. Moreover, Kemin Industries aims to use it in processed meat products such as hot dogs and sausages.

-

March 2022: DSM introduced DelvoGuardcultures, directing producers towards pursuing for clean-label solutions while also offering them with a solution to increase the shelf life of their dairy products such as fresh cheese, yogurt, and sour cream.

UK Food Preservatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.9 million

Revenue forecast in 2030

USD 82.5 million

Growth Rate (Revenue)

CAGR of 4.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Label, type, function, application

Country scope

UK

Key companies profiled

Cargill, Inc.; Kemin Industries, Inc.; ADM; Tate & Lyle; Koninklijke DSM N.V.; BASF SE; Celanese Corporation; Corbion N.V.; Galactic S.A.; Kerry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Food Preservatives Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the UK food preservatives market report on the basis of label, type, function, and application:

-

Label Outlook (Revenue, USD Million, 2018 - 2030)

-

Clean Label

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Edible Oil

-

Rosemary Extracts

-

Natamycin

-

Vinegar

-

Chitosan

-

Others

-

-

Synthetic

-

Propionates

-

Sorbates

-

Benzoates

-

Others

-

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-microbial

-

Anti-oxidant

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat & Poultry Products

-

Bakery Products

-

Dairy Products

-

Beverages

-

Snacks

-

Others

-

Frequently Asked Questions About This Report

b. The UK food preservatives market size was estimated at USD 61.7 million in 2023 and is expected to reach USD 63.9 million in 2024.

b. The UK food preservatives market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 82.5 million by 2030.

b. The meat & poultry products segment dominated the UK food preservatives market with a share of 32.4% in 2023. This is attributable to the increasing demand for processed meat products and the growing use of food preservatives that can retain the natural flavor and aroma of meat products.

b. Some key players operating in the UK food preservatives market include Cargill, Inc., Kemin Industries, Inc., ADM, Tate & Lyle, Koninklijke DSM N.V., BASF SE, Celanese Corporation, Corbion N.V., Galactic S.A., and Kerry.

b. Key factors that are driving the market growth include increasing demand for processed foods and the rising use of natural food preservatives in dairy products, meat products, and snacks.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."