- Home

- »

- Organic Chemicals

- »

-

U.S. Acids Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Acids Market Size, Share & Trend Report]()

U.S. Acids Market (2025 - 2030) Size, Share & Trend Analysis Report By Type (Organic (Food and Beverages, Pharmaceuticals), Inorganic (Agriculture, Paint & Coatings), And Segment Forecasts

- Report ID: GVR-4-68039-567-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Acids Market Size & Trends

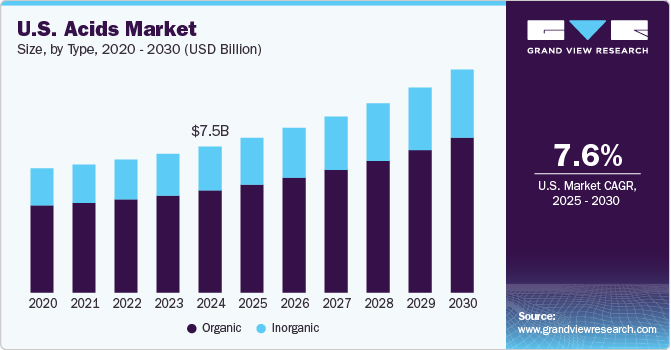

The U.S. acids market size was estimated at USD 7.45 billion in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. The growth of the U.S. acids market is primarily driven by an increase in demand across various industries, including food and beverages, pharmaceuticals, agriculture, and manufacturing. The food and beverage sector is one of the largest consumers of acids such as citric acid, acetic acid, and lactic acid, which are commonly used as preservatives, flavor enhancers, and pH regulators.

The growing consumer preference for processed foods and beverages, coupled with the rise in demand for convenience foods, is significantly contributing to the market's expansion. In addition, with the rising health consciousness among consumers, organic acids such as lactic acid are gaining traction as they are perceived as more natural and healthier alternatives to synthetic ones.

Hydrochloric acid, citric acid, and sulfuric acid are essential in producing pharmaceutical formulations, such as antibiotics, vaccines, and pain relief medications. As the aging population in the U.S. grows, along with the prevalence of chronic diseases, the need for pharmaceutical manufacturing and the use of acids in drug formulations is increasing. Furthermore, they are often used to produce vitamins, supplements, and other healthcare products, which are experiencing strong demand due to the growing focus on health and wellness.

The agricultural sector also plays a vital role in driving the demand for acids in the U.S. Agricultural acids, such as nitric acid and phosphoric acid, are essential for producing fertilizers that support crop growth and food production. As the need for increased agricultural productivity grows due to population growth and climate change concerns, the demand for fertilizers and soil amendments containing acids is expected to rise. This is particularly important as the U.S. maintains its status as one of the world’s largest agricultural producers. Acids are also utilized in food processing and preservation of animal feed, further driving the growth of the acids market.

Drivers, Opportunities & Restraints

The growing consumption of processed and convenience foods has led to a higher requirement for food-grade acids such as citric and acetic acids for preservation and flavoring. In addition, the rising demand for acids in chemical manufacturing, particularly in the production of fertilizers, detergents, and plastics, proliferates the market. The expansion of the pharmaceutical industry, where acids are integral in drug formulation and production, further boosts industry growth. Increasing industrialization, urbanization, and advancements in manufacturing technologies continue to propel the demand for acids in multiple sectors.

As consumers and industries increasingly focus on eco-friendly solutions, manufacturers are exploring the potential of organic acids derived from renewable resources. In addition, there is rising interest in acid-based solutions for energy storage, particularly in battery technologies like vanadium redox flow batteries, which offer new avenues for acid applications. The growing trend of green chemistry also provides opportunities for the development of less toxic and more biodegradable acids. Moreover, the increasing adoption of acids in emerging sectors such as personal care and environmental management opens up further growth prospects for industry players.

Fluctuations in the cost of key raw materials can affect production costs, thereby limiting profit margins. Environmental regulations and concerns over the safety and toxicity of certain acids, such as hydrochloric acid and sulfuric acid, pose significant challenges to manufacturers, leading to higher compliance costs and the need for more stringent safety measures.

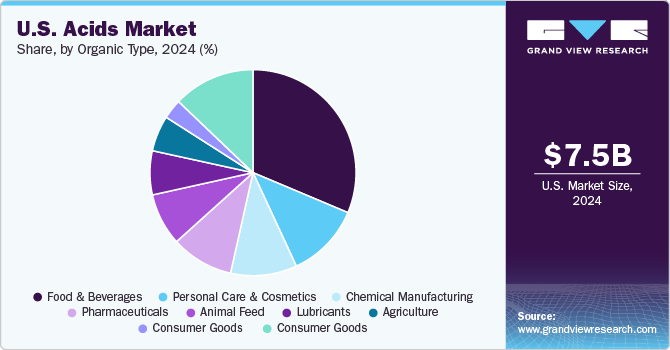

Type Insights

The organic segment accounted for the largest revenue share of 69.9%, in 2024. The growth of the organic type is driven by a combination of consumer demand for healthier, more sustainable options and increased awareness of the long-term environmental and health benefits of organic products. The shift toward organic goods is becoming more prominent in various industries, including food and beverages, pharmaceuticals, and consumer goods. Consumer preferences for products free from synthetic pesticides, fertilizers, and other chemicals drive this shift.

The inorganic type is anticipated to register the fastest CAGR of 7.8% over the forecast period. Inorganic compounds, which include salts, oxides, and minerals, play an essential role in enhancing the quality and performance of products in these sectors. For example, in agriculture, inorganic fertilizers and soil amendments are crucial for boosting crop yield and improving soil fertility. The increasing need for food production due to population growth and the expansion of agricultural activities has propelled the demand for these inorganic solutions, making them a significant growth driver for this segment.

Key U.S. Acids Company Insights

Some key players operating in the industry include Akzo Nobel NV and PVS Chemicals, Inc.

-

Akzo Nobel N.V. is a global paints and coatings company specializing in specialty chemicals, including various acid products. The company offers a range of acids used in industrial applications, such as sulfuric acid, hydrochloric acid, and phosphoric acid, which are essential for processes in sectors like agriculture, automotive, electronics, and water treatment.

-

PVS Chemicals, Inc. is a global provider of a wide range of acids that cater to various industries, including electronics, steel, agriculture, and water treatment. The company specializes in basic and specialty acids, ensuring that they meet the diverse needs of their customers while adhering to stringent safety and sustainability standards. Their offerings include hydrochloric acid, sulfuric acid, nitric acid, and phosphoric acid, which are essential for numerous industrial processes such as metal finishing, pH adjustment in water treatment, and chemical synthesis in agricultural applications.

Key U.S. Acids Companies:

- Akzo Nobel NV

- Basic Chemical Solutions LLC

- PVS Chemicals, Inc.

- Navin Fluorine International Limited

- Cargill Inc.

- The Dow Chemical Company

- BASF SE

- Tate & Lyle Plc

- AjinomotoCo., Inc.

- Adisseo

U.S. Acids Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 7.89 billion

The revenue forecast for 2030

USD 11.36 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD billion, Volume in million tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Akzo Nobel NV; Basic Chemical Solutions LLC; PVS Chemicals, Inc.; Navin Fluorine International Limited; Cargill Inc.; The Dow Chemical Company; BASF SE; Tate & Lyle Plc; AjinomotoCo., Inc.; Adisseo

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Acids Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. acids market report based on the type:

-

Type Outlook (Volume, Million Tons; Revenue, USD Billion, 2018 - 2030)

-

Organic

-

Personal Care & Cosmetics

-

Food & Beverages

-

Pharmaceuticals

-

Animal Feed

-

Chemical Manufacturing

-

Agriculture

-

Consumer Goods

-

Lubricants

-

Others

-

-

Inorganic

-

Agriculture

-

Paints & coatings

-

Textiles

-

Petroleum

-

Metalworking

-

Wastewater treatment

-

Chemical Manufacturing

-

Pulp & paper

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. acids market size was estimated at USD 7.45 billion in 2024 and is expected to reach USD 7.89 billion in 2025.

b. The U.S. acids market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 11.36 billion by 2030.

b. Organic type accounted for the largest revenue share 69.9% in 2024 of U.S. acids market owing to its increasing consumer demand for natural and sustainable products across various industries.

b. Some of the key players operating in the U.S. acids market include Akzo Nobel NV, Basic Chemical Solutions LLC, PVS Chemicals, Inc., Navin Fluorine International Limited, among others.

b. The key factors that are driving the U.S. acids market include increasing demand from industries such as food and beverages, pharmaceuticals, and agriculture and rising applications in chemical manufacturing and environmental regulations

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.