- Home

- »

- Medical Devices

- »

-

U.S. Aesthetic Injectable Market Size, Industry Report, 2030GVR Report cover

![U.S. Aesthetic Injectable Market Size, Share & Trends Report]()

U.S. Aesthetic Injectable Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hyaluronic Acid (HA), Botulinum Toxin), By Application (Facial Line Correction, Lip Augmentation), By End-use (Medical Spas, Dermatology Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-618-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Aesthetic Injectable Market Trends

The U.S. aesthetic injectable market size was estimated at USD 4.1 billion in 2024 and is projected to grow at a CAGR of 11.2% from 2025 to 2030. The U.S. aesthetic injectable industry continues to evolve as consumer expectations shift toward convenience, personalization, and preventative care. The growing popularity of injectables among a broader range of users, along with advances in product design, is changing the way cosmetic treatments are perceived and delivered. In May 2023, Allergan Aesthetics launched Skinvive by Juvederm in the U.S., an intradermal HA-based microdroplet injection designed to improve cheek skin quality by enhancing hydration and smoothness.

A strong preference for non-surgical cosmetic solutions drives the U.S. aesthetic injectable industry. Consumers are increasingly choosing injectables due to their convenience, short recovery time, and ability to deliver natural-looking results. These procedures offer a discreet option for facial rejuvenation without the risks or downtime associated with surgery. The appeal of quick treatments with visible enhancements fits nicely into the lifestyle of professionals and younger individuals seeking subtle improvements. According to the American Society of Plastic Surgeons (ASPS) 2023 data, 1.47 million cosmetic minimally invasive procedures were performed on males, including 526,062 neuromodulator injections and over 232,000 filler treatments. For females, the number reached 19.7 million, with 8.2 million neuromodulator injections and over 5.5 million filler procedures.

Injectable treatments are growing in popularity among men and younger consumers, who view them not just as corrective tools but as a form of proactive self-care. Men are turning to injectables to refine facial features, while individuals in their 20s and 30s often use them to prevent early signs of aging. This shifting demographic has broadened the customer base and encourages providers to tailor services and messaging to a more diverse audience, including those looking for maintenance rather than transformation. In October 2024, Allergan Aesthetics presented new data at the ASDS Annual Meeting in Orlando, Florida, highlighting safety and patient satisfaction with facial injectables. The presentations included diverse patient demographics across the U.S., emphasizing treatment efficacy and social media’s impact on patient expectations.

Ongoing innovation is shaping the competitive edge of the injectable market. New products are designed to last longer, integrate more seamlessly with skin, and provide more natural movement and appearance. These advancements make treatments more appealing to first-time users and returning clients. With the development of differentiated formulations and targeted applications, brands can address specific aesthetic concerns with greater precision and reliability. In January 2025, Galderma announced positive interim results from a U.S.-based trial evaluating Sculptra combined with Restylane for treating facial volume loss caused by medication-driven weight loss. The study showed significant aesthetic improvements and high patient satisfaction. A six-month extension is ongoing to assess long-term effects.

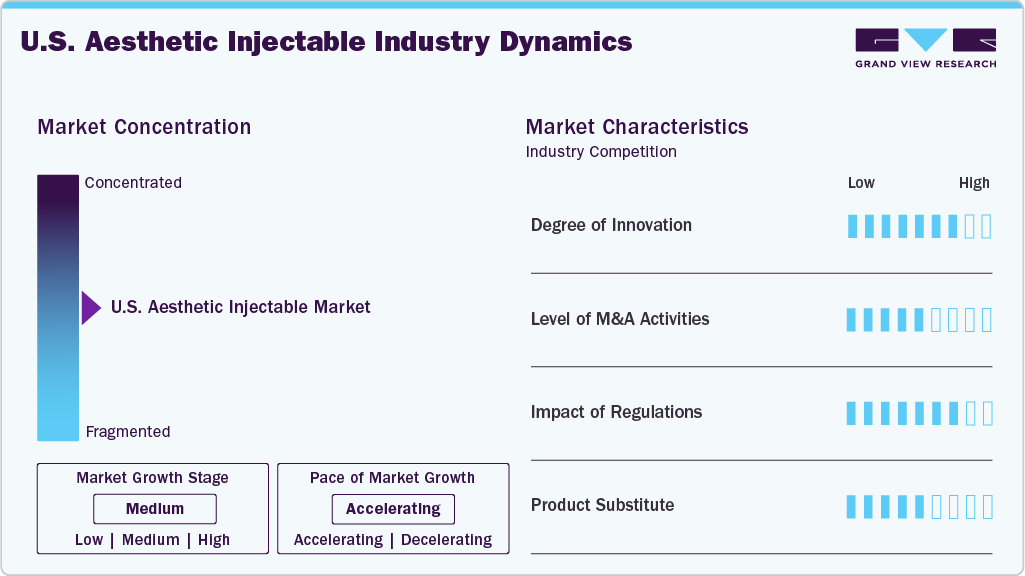

Market Concentration & Characteristics

The degree of innovation in the U.S. aesthetic injectable industry is high, driven by continuous R&D investments, advancements in formulation science, and increasing consumer demand for long-lasting and natural-looking outcomes. Companies focus on developing differentiated botulinum toxins and next-generation dermal fillers that offer improved safety profiles, extended duration, and greater treatment precision. In June 2023, Galderma received FDA approval for Restylane Eyelight, marking the first U.S. hyaluronic acid filler using NASHA Technology for the undereye area. The innovative gel formulation minimizes water absorption, delivering natural-looking, long-lasting results of up to 18 months.

The level of mergers and acquisitions in the U.S. aesthetic injectable industry is moderate, with strategic activity primarily focused on portfolio expansion and geographic reach. Larger players are acquiring niche biotech firms to access proprietary formulations or novel delivery platforms, while private equity interest remains stable around med-aesthetic clinics and distribution networks. In February 2025, Crown Laboratories finalized its acquisition of Revance Aesthetics, Inc., expanding its footprint in the U.S. skincare and aesthetics market. The move integrates Revance’s aesthetic product portfolio with Crown’s dermatology expertise.

The impact of regulations on the aesthetic injectable industry is high due to the stringent oversight by the U.S. FDA concerning safety, efficacy, and marketing practices. All injectable products must undergo rigorous clinical evaluation before approval, and off-label promotion is heavily restricted. In addition, state-level regulations influence who can administer injectables, often requiring certified medical professionals, which adds operational complexity for clinic chains and independent providers.

The level of product substitution in the U.S. aesthetic injectable market remains moderate. While injectables like neurotoxins and dermal fillers continue to dominate, alternatives such as energy-based devices, biostimulatory treatments, thread lifts, and advanced topical formulations are gaining presence. These substitutes offer different mechanisms and benefits but typically complement rather than fully replace injectables, limiting their overall substitution potential.

Product Insights

Botulinum toxin (Botox) segment held the largest share of 45.9% in 2024. This dominance is attributed to its widespread use in aesthetic and therapeutic applications, strong brand recognition, and broad acceptance across diverse age groups. Demand is supported by the consistent performance of market-leading brands and the increasing availability of advanced formulations with longer-lasting effects. The segment benefits from frequent repeat procedures, contributing to sustained revenue generation for clinics and manufacturers. In October 2024, AbbVie’s Allergan Aesthetics received FDA clearance for BOTOX Cosmetic to temporarily reduce the visibility of moderate to severe vertical neck bands called platysma bands. This approval makes BOTOX the only neurotoxin approved for four cosmetic indications, covering facial wrinkles and neck muscle bands, offering a nonsurgical injectable option for improving jawline and neck appearance.

The hyaluronic acid (HA) segment is expected to grow at the highest CAGR over the forecast period, driven by its versatility, biocompatibility, and immediate visible results. HA fillers are favored for their reversibility, minimal risk, and ability to address various facial concerns, including volume loss, wrinkles, and contouring. The segment is also gaining traction among younger consumers seeking preventative treatments and those drawn to non-permanent enhancement options. In April 2025, SYMATESE entered the U.S. dermal fillers market with the launch of Evolysse Form and Smooth, hyaluronic acid (HA) injectables, through Evolus, Inc. Powered by COLD-X Technology, the products offer long-lasting, natural-looking results.

Application Insights

In 2024, the facial line correction segment accounted for the largest share of 33.1% in the market, underscoring its position as the leading application area. This dominance stems from the widespread use of botulinum toxins and dermal fillers to address forehead lines, frown lines, and crow’s feet-concerns that are among the first visible signs of aging. The demand for minimally invasive procedures that offer quick, natural-looking results without downtime continues to attract a broad consumer base. In April 2023, Galderma received FDA approval for Sculptra to treat fine lines and wrinkles in the cheek area. As the first FDA-approved PLLA collagen stimulator, Sculptra helps boost natural collagen production, with results lasting up to two years. Clinical trials showed sustained aesthetic improvement, with 94% of patients maintaining results at two years.

The segment is projected to grow at the fastest CAGR over the forecast period, fueled by rising demand from new and existing patient groups. Younger consumers are increasingly seeking early intervention to delay the onset of wrinkles, while older users are maintaining results through regular treatments. Introducing advanced neuromodulators and targeted filler formulations enhances precision and longevity, further boosting uptake. In October 2024, the FDA approved Xeomin for treating forehead lines and crow’s feet, expanding its use beyond frown lines. This makes Xeomin the first neuromodulator besides Botox fully approved for all major upper facial wrinkles. Despite this, all neuromodulators are often used off-label for these areas. The approval highlights Xeomin’s simplified formula, potentially lowering the risk of patient resistance.

End-use Insights

In 2024, the medical spas segment held the largest market share of 47.3%, reflecting their growing role as the primary access point for non-surgical cosmetic procedures. This dominance is driven by the convergence of clinical expertise and spa-like experiences, making injectables more accessible, less intimidating, and increasingly routine for consumers. Medical spas offer a wide range of injectable treatments in relaxed, retail-oriented settings, often bundled with complementary services such as skincare and wellness therapies. In October 2022, BeautyFix Medspa launched the first medically accurate AI aesthetics simulation for injectables in partnership with EntityMed. The tool allows users to visualize real-time results of dermal fillers and toxins by uploading a photo. It aims to reduce treatment anxiety and improve decision-making with clinical-grade precision.

The segment is also expected to grow at the fastest CAGR over the forecast period, supported by rising consumer preference for minimally invasive procedures delivered in a lifestyle-oriented environment. The proliferation of franchised medspa chains, flexible service models, and targeted marketing toward younger and first-time users is accelerating demand. Many medical spas are also integrating loyalty programs, subscription packages, and digital engagement tools to improve client retention and frequency of visits. In April 2025, Facial Mania Med Spa announced opening new clinics in Doral and Orlando, Florida, and Irving, Texas, expanding its network to 14 locations. The brand offers FDA-cleared injectables like Botox and Xeomin, facials, and body treatments. Backed by board-certified oversight and standardized protocols, the chain targets further growth in cities like Atlanta and Phoenix.

Key U.S. Aesthetic Injectable Company Insights

Some key market players include AbbVie, Inc. (Allergan), Revance Therapeutics, Inc., Ipsen Pharma, and Evolus, Inc. These companies focus on advanced formulation technologies, expanding product portfolios, and strategic partnerships with clinics and medical spas. Brands invest in personalized treatment solutions and digital tools to enhance patient engagement and streamline service delivery. While established players drive innovation in neuromodulators and dermal fillers, emerging companies target niche segments with specialized products and localized distribution to maintain a competitive edge.

Key U.S. Aesthetic Injectable Companies:

- Ipsen Pharma

- AbbVie, Inc.

- Merz GmbH and Co. KGaA

- Galderma

- Prollenium Medical Technologies, Inc.

- Tiger Aesthetics Medical, LLC

- Sinclair Pharma

- Medytox, Inc.

- Revance Therapeutics, Inc.

Recent Developments

-

In May 2025, Teoxane expanded its presence in the U.S. market by launching its dermocosmetics line directly to consumers online. Previously accessible only through aesthetic professionals, this move allows broader consumer access to Teoxane’s advanced skincare products featuring patented Resilient Hyaluronic Acid technology, marking a strategic shift beyond their established dermal filler offerings.

-

In October 2024, Tiger Aesthetics Medical, LLC expanded its regenerative aesthetics portfolio by acquiring BellaFill, a biostimulatory dermal filler, from Suneva Medical, Inc. This acquisition strengthened Tiger Aesthetics’ presence in the dermal fillers market by adding BellaFill’s well-established, long-lasting filler to its product lineup.

-

In March 2024, Allergan Aesthetics received U.S. FDA approval for JUVÉDERM VOLUMA XC to treat moderate to severe temple hollowing, marking the first HA filler approved for this use. Clinical results showed over 80% patient improvement, with effects lasting up to 13 months. Market rollout is expected by late 2024 following provider training.

U.S. Aesthetic Injectable Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.6 billion

Revenue forecast in 2030

USD 7.8 billion

Growth rate

CAGR of 11.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Key companies profiled

Ipsen Pharma; AbbVie, Inc.; Merz GmbH and Co. KGaA; Galderma; Prollenium Medical Technologies, Inc.; Tiger Aesthetics Medical, LLC.; Sinclair Pharma; Medytox, Inc.; Revance Therapeutics, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aesthetic Injectable Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aesthetic injectable market report based on product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hyaluronic Acid (HA)

-

Botulinum Toxin (Botox)

-

Aquatic Light Injections

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Facial Line Correction

-

Lip Augmentation

-

Face Lift

-

Acne Scar Treatment

-

Lipoatrophy Treatment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Spas

-

Dermatology Clinics

-

Hospitals

-

Frequently Asked Questions About This Report

b. The U.S. aesthetic injectable market size was estimated at USD 4.14 billion in 2024 and is expected to reach USD 4.56 billion in 2025.

b. The U.S. aesthetic injectable market is expected to grow at a compound annual growth rate of 11.2% from 2025 to 2030 to reach USD 7.76 billion by 2030.

b. Botulinum toxin (Botox) segment held the largest share of 45.9% in 2024. This dominance is attributed to its widespread use in both aesthetic and therapeutic applications, strong brand recognition, and broad acceptance across diverse age groups.

b. Some of the major participants in the U.S. aesthetic injectable market include: • Ipsen Pharma • AbbVie, Inc. • Merz GmbH and Co. KGaA • Galderma • Prollenium Medical Technologies, Inc. • Tiger Aesthetics Medical, LLC • Sinclair Pharma • Medytox, Inc. • Revance Therapeutics, Inc.

b. The growing popularity of injectables among a broader range of users, along with advances in product design, is changing the way cosmetic treatments are perceived and delivered.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.