- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Amino Acids Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Amino Acids Market Size, Share & Trends Report]()

U.S. Amino Acids Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Essential, Non-essential), By Source (Plant, Animal), By Grade, By End-use (Food & Beverages, Pharmaceuticals), And Segment Forecasts

- Report ID: GVR-4-68040-234-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Amino Acids Market Size & Trends

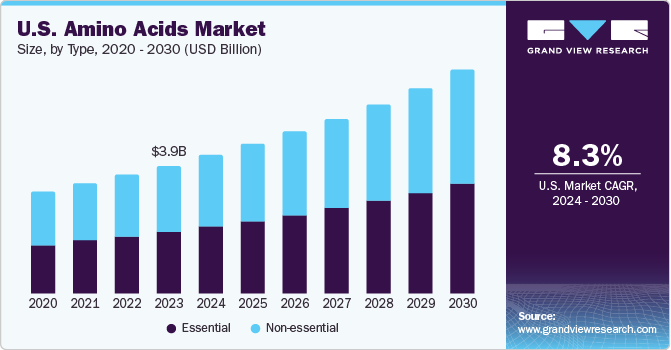

The U.S. amino acids market size was estimated at USD 3.93 billion in 2023 and is anticipated to grow at a CAGR of 8.3% from 2024 to 2030. This is attributable to increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyles and preventive care. In addition, a prominent trend in the amino acids market is the increasing demand for products that are environmentally sustainable and eco-friendly. Another noteworthy observation in this market is the advancements in technology to elevate both the efficiency and quality of products.

The need for alternate protein sources has increased due to the trend towards plant-based and flexitarian diets. To address this demographic's nutritional demands, plant-based protein products include amino acids. Moreover, the market for amino acids is growing due to a large part of the sports nutrition industry. Supplements with amino acids help athletes and fitness enthusiasts perform better, recover faster, and boost muscular development. This industry has grown significantly, which is indicative of wider trends in health and wellbeing. The market is expanding in part because amino acids are used extensively in the pharmaceutical sector in the discovery and production of drugs, particularly for conditions needing metabolic support or modification.

Amino acid uses go beyond dietary supplements; they are also employed as excipients in pharmaceutical formulations and parenteral nutritional solutions. Furthermore, improvements in biotechnology have made it possible to produce amino acids through fermentation more effectively, which lowers costs and improves environmental friendliness. Growth has been spurred by this technical innovation, which has increased the variety and availability of product in the market.

Market Concentration & Characteristics

The market tends to be fragmented due to the existence of several participants, ranging from big multinational firms to small and medium-sized businesses. Several specialized industries are supported by the wide range of applications for amino acids, ranging from food and drinks to medicines. Significant M&A activity highlights this fragmentation even further as businesses want to diversify their product offerings and market share.

The market is marked by a moderate level of innovation owing to the advances in biotechnological techniques and amino acid synthesis for particular uses in the pharmaceutical and agri-food sectors. However, the fundamental structure of the market is stable despite ongoing innovation, particularly in the areas of fermentation technology and enzyme synthesis, suggesting a modest rate of innovation.

Further the level of mergers and acquisitions (M&A) activity tends to be high in the market as businesses look to diversify their product lines, break into untapped areas, and acquire a competitive edge. The goal of utilizing new technology, achieving economies of scale, and broadening the market is what motivates this merger and acquisition.

The market is significantly impacted by the regulations as strict rules for amino acid synthesis, labeling, and distribution are enforced by the Food and Drug Administration (FDA) of the United States and other international regulatory bodies have been implemented. Adherence to these laws guarantees the safety and efficacy of the product; however, necessitates a substantial financial commitment from the corporation, thereby impacting the market dynamics.

Type Insights

The non-essential type dominated the market with a revenue share of 51.6% in 2023. This growth is attributed to the use of these amino acids in animal feed to provide the animal with a well-rounded nutritional profile. Diets for animals are designed by animal nutritionists to satisfy all of their nutritional demands, including protein. Moreover, non-essential amino acids are frequently included in dietary supplements to promote muscle development, repair, and recuperation. Non-essential amino acids (NEAAs) are those that the body can synthesize; as a result, food is not necessary to receive them. These are essential for the body because they function as neurotransmitters, metabolic regulators, and precursors for the creation of proteins.

Glutamic acid within the non-essential segment accounted for the largest market share in 2023. This rise can be attributed to its role in the creation of proteins, as it is an element found in some enzymes. It is a crucial neurotransmitter in the brain and is also involved in energy generation. There may be advantages to glutamic acid for maintaining cognitive function and brain health. It has neuroprotective properties in addition to regulating neurotransmitters in the brain.

The essential segment held a significant market share in 2023 owing to a growing number of people with chronic illnesses, an ageing population, and growing consumer awareness of the advantages of essential amino acids. Moreover, Plant-based essential amino acids have also been developed as a result of the expanding vegan and vegetarian movements throughout the world. Consequently, this is driving the market for essential amino acids.

The methionine within the essential segment experienced a significant revenue share in 2023 due to its significance for the synthesis of cartilage and collagen. Due to its possible advantages in maintaining joint and skin health, the usage of this acid in dietary supplements is growing rapidly around the world. New methionine supplement forms, such as powdered drink mixes and sustained-release capsules, are being introduced by manufacturers to the market.

Source Insights

Plant-based dominated the market with a revenue share of 42.7% in 2023. This growth is attributed to consumers' rising awareness of natural and organic products, which is predicted to propel plant-based production and consumption. Plants including soybeans, wheat, corn, potatoes, and peas are good providers of amino acids. Because soybeans are widely produced and consumed worldwide, they are being employed as a commercial source of amino acids. The demand for amino acids produced from plants is predicted to rise as a result of increased public awareness of animal slaughter.

Furthermore, the fermentation segment held a significant market share in 2023 as it is one of the widely utilized methods for manufacturing amino acids. Many companies are focusing on manufacturing plant-based product through the fermentation process. To create amino acids, fermentation requires microorganisms, most often bacteria or fungi. These organisms are cultivated under carefully regulated conditions, where their metabolic activities transform substrates which are often derived from renewable resources—into amino acids. Because of its sustainability and effectiveness in producing amino acids, this approach is frequently employed.

End-use Insights

The food & beverages segment dominated the market and accounted for the largest revenue share of 29.0% in 2023. In the food processing sector, amino acids are employed as preservatives, nutrition enhancers, and flavor enhancers. Commonly utilized as flavor and taste enhancers include glycine and alanine. A common flavor enhancer found in canned veggies, soups, processed meat, salad dressings, bread, carbohydrate-based snacks, and ice cream is monosodium glutamate (MSG), a derivative of glutamic acid. While tryptophan and histidine are employed as preservatives in milk powder, cysteine is utilized as a preservative in a variety of drinks, including fruit juices. A mixture of phenylalanine and aspartic acid is used to create aspartame, which is becoming more and more common as a sugar substitute in soft drink recipes.

The functional beverages segment within the food and beverage accounted for a significant market share in 2023. Amino acids are added to functional beverages to enhance users' concentration, mood, and cognitive function. Moreover, the inclusion of collagen, a structural protein made up of amino acids like proline, glycine, and hydroxyproline, in functional drinks guarantees the health of customers' skin and joints and improves their general structural integrity.

The dietary supplement segment accounted for a significant revenue share in 2023. This growth is attributed to the health advantages they offer customers that go beyond simple nourishment. They are used in supplements for sports nutrition to help athletes perform better and heal from injuries to their muscles. Dietary supplements are advantageous because they aid in the generation of enzymes, the control of neurotransmitters, and the healing of muscles, among other physiological processes. They are particularly helpful for athletes, individuals on a restricted diet, and anybody looking to increase their general health and well-being by making sure they are getting enough vital amino acids in their diet.

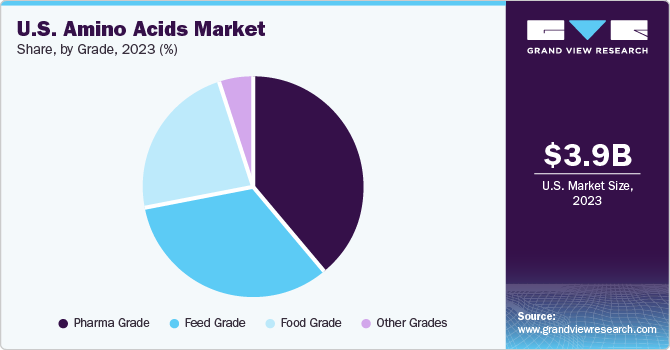

Grade Insights

The pharma grade segment held a significant market share in 2023. This growth is attributed to the crucial role played by these amino acids in various biological processes within the human body, including protein synthesizing, cell signaling, and neurotransmitter manufacturing. Pharmaceutical-grade products are among the most premium and high-cost grades of these acids. These are commonly used in various therapeutic applications. They can support muscle growth and recovery, enhance athletic performance, manage certain medical conditions, and promote the overall well-being of consumers.

Feed-grade amino acids can be tailored to fulfil the unique requirements of animals, as various animal species have varying demands when it comes to amino acids. Because of this adaptability, nutritionists can create feed compositions that maximize an animal's growth, reproduction, and general performance. Feed-grade proteins are produced via a demanding process that involves the fermentation or hydrolysis of plant or animal protein sources. Through the breakdown of complex proteins into their constituent amino acids, this process facilitates their simple digestion and absorption.

Key U.S. Amino Acids Company Insights

The U.S. amino acid industry is a dynamic environment with major firms like Blue Star Corp, and ADM. The growth of the amino acid market is driven primarily by the food, pharmaceutical, and nutritional supplement industries, led by the medical and healthcare sectors. An increasing customer demand for high-quality amino acid products is being met by the market's emphasis on efficient and sustainable manufacturing methods, such as biotech fermentation.

Key players in the market include Bill Barr & Company; BI Nutraceuticals; and ADM. Novus International; Blue Star Corp.; and Sigma-Aldrich are other participants operating in the U.S. amino acid market.

-

Bill Barr & Company provides specialized ingredients used worldwide in the production of pet and animal food. It sources and distributes premium components that enhance the quality of its clients' formulations. Amino acids, buffers, enzymes, minerals, premixes, and other specialized components are among the products offered by the firm

-

ADM generates cocoa, maize, wheat, oilseeds, and other agricultural products. Ag Services & Oilseeds, Carbohydrate Solutions, Nutrition, and Other sectors are how it runs. The company's Ag Services and Oilseeds division produces, markets, ships, and holds agricultural raw materials

Key U.S. Amino Acids Companies:

- Bill Barr & Company

- BI Nutraceuticals

- Cargill Inc.

- ADM

- Blue Star Corp.

- Novus International

- PACIFIC RAINBOW INTERNATIONAL, INC.

- Sigma-Aldrich

- Gemini Pharmaceuticals

- Carolina Biological Supply

Recent developments

-

In February 2024, Cargill Inc. and ENOUGH extended their present collaboration to further develop wholesome and sustainable substitutes for dairy and meat that customers need. Cargill has agreed to use and promote ENOUGH's fermented protein commercially and is contributing to the organization's most recent (Series C) expansion financing campaign. As more sustainably farmed protein is required to keep up with the world's population expansion, Cargill is fortifying its alliance with ENOUGH. Due to its various advantages such as its protein profile, scalability, sustainability, and meat-like texture mycoprotein is an emerging component with a potentially disruptive function.

-

In June 2023, Novus International, Inc., announces the launch of intelligent nutrition, a new field of better solutions for farmers worldwide. The firm supports the health and performance of animals through intelligent feeding. With a fresh blend of seasoned individuals, perceptive viewpoints, and more intelligent solutions, the organization can invest more in everything we produce.

-

In May 2023, ADM and Air Protein jointly announced a Strategic Development Agreement aimed at advancing the development of new and innovative proteins for nutritional purposes through research and development. Through the Strategic Development Agreement, Air Protein's unique landless agriculture platform and ADM's extensive knowledge of nutrition, formulation, and research would be combined to find ways to scale up affordable ingredients so that meat substitutes could meet their targets for cost, nutrition, flavour, and texture. Additionally, it grants ADM and Air Protein the exclusive right to work together to construct and run the first commercial-scale Air Protein factory in the world.

U.S. Amino Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.24 billion

Revenue forecast in 2030

USD 6.86 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, source, grade, end-use

Key companies profiled

Bill Barr & Company; BI Nutraceuticals; Cargill Inc.; ADM; Blue Star Corp.; Novus International; PACIFIC RAINBOW INTERNATIONAL, INC.; Sigma-Aldrich; Gemini Pharmaceuticals; Carolina Biological Supply

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Amino Acids Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. amino acids market report based on type, source, grade, and end-use:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Essential

-

Histidine

-

Isoleucine

-

Leucine

-

Lysine

-

Methionine

-

Phenylalanine

-

Threonine

-

Tryptophan

-

Valine

-

-

Non-essential

-

Alanine

-

Arginine

-

Asparagine

-

Aspartic Acid

-

Cysteine

-

Glutamic Acid

-

Glutamine

-

Glycine

-

Proline

-

Serine

-

Tyrosine

-

Ornithine

-

Citrulline

-

Creatine

-

Selenocysteine

-

Taurine

-

Others

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant-based

-

Animal-based

-

Chemical Synthesis

-

Fermentation

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Grade

-

Feed Grade

-

Pharma Grade

-

Other Grades

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Bakery

-

Dairy

-

Confectionery

-

Convenience Foods

-

Functional Beverages

-

Meat Processing

-

Infant Formulation

-

Others

-

-

Animal Feed

-

Pet Food

-

Pharmaceuticals

-

Vaccine Formulation

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Agriculture

-

Other End-uses

-

Frequently Asked Questions About This Report

b. The U.S. amino acids market size was estimated at USD 3.93 billion in 2023 and is expected to reach USD 4.24 billion in 2024.

b. The U.S. amino acids market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 6.86 billion by 2030.

b. Non-essential type dominated the U.S. amino acids market with a share of 51.6% in 2023. This is attributable to the use of these amino acids in animal feed to provide the animal with a well-rounded nutritional profile. Moreover, non-essential amino acids are frequently included in dietary supplements to promote muscle development, repair, and recuperation.

b. Some key players operating in the U.S. amino acids market include Bill Barr & Company; BI Nutraceuticals; Cargill Inc.; ADM; Blue Star Corp.; Novus International; PACIFIC RAINBOW INTERNATIONAL, INC.; Sigma-Aldrich; Gemini Pharmaceuticals; Carolina Biological Supply

b. Key factors that are driving the market growth include increased consumer spending capacity and growing awareness among individuals regarding healthy lifestyles and preventive care. In addition, a prominent trend in the amino acids market is the increasing demand for products that are environmentally sustainable and eco-friendly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.