- Home

- »

- Advanced Interior Materials

- »

-

U.S. Anchoring Fasteners Market Size, Industry Report 2033GVR Report cover

![U.S. Anchoring Fasteners Market Size, Share & Trends Report]()

U.S. Anchoring Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mechanical Anchors, Chemical Anchors, Plastic Anchors), By Substrate, By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-619-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Anchoring Fasteners Market Summary

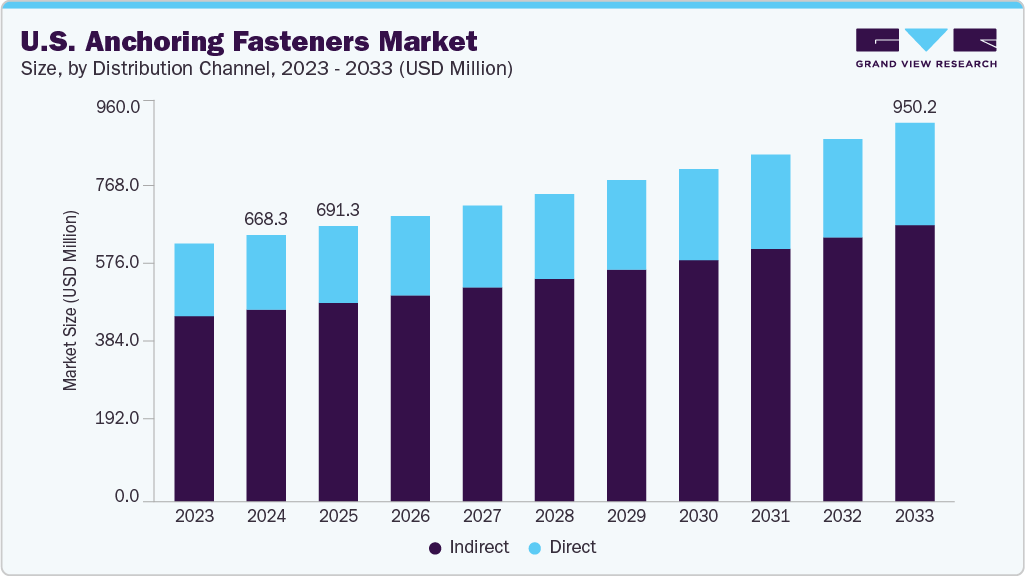

The U.S. anchoring fasteners market size was estimated at USD 668.3 million in 2024 and is projected to reach USD 950.2 million by 2033, growing at a CAGR of 3.8% from 2025 to 2033, driven by a combination of federal infrastructure initiatives, industrial resurgence, and tightening construction standards.

Key Market Trends & Insights

- By product, the chemical anchors segment is expected to grow at the fastest CAGR of 4.1% over the forecast period.

- By substrate, the autoclaved aerated concrete segment is expected to grow at the fastest CAGR of 4.8% over the forecast period.

- By end use, the energy and utilities (solar and green roofs) segment is expected to grow at the fastest CAGR of 4.7% over the forecast period.

- By distribution channel, the direct segment is expected to grow significantly at a CAGR of 4.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 668.3 Million

- 2033 Projected Market Size: USD 950.2 Million

- CAGR (2025-2033): 3.8%

With the implementation of large-scale projects under the Bipartisan Infrastructure Law, there is a renewed emphasis on the maintaining and modernizing highways, bridges, rail networks, and energy systems. These projects demand structurally certified fastening systems capable of withstanding heavy loads, seismic activity, and varying climatic conditions. Anchoring fasteners are critical in securing structural elements to concrete and masonry, making them indispensable in retrofitting older infrastructure and erecting new developments.

Additionally, the resurgence of domestic manufacturing in the United States, particularly in automotive, aerospace, and energy sectors, has created new demand avenues for industrial-grade anchoring fasteners. Expanding manufacturing facilities, warehouses, and assembly plants necessitate anchoring solutions that meet exacting strength and safety requirements. This demand is being matched by technological advancements within the fasteners industry, such as developing high-performance coatings for corrosion resistance, load-tested expansion anchors, and anchors compatible with seismic applications.

Moreover, end users in the U.S. increasingly seek direct supplier relationships to ensure consistent quality, compliance with ASTM and ACI standards, and access to engineering support. Tariff-related changes and evolving domestic sourcing policies have also encouraged investment in local production capabilities, further strengthening the supply ecosystem and enhancing product availability. This convergence of infrastructure expansion, industrial demand, and innovation continues to drive the long-term momentum of the U.S. anchoring fasteners industry.

Market Concentration & Characteristics

The U.S. anchoring fasteners industry is moderately concentrated, with a strong presence of established global and regional players such as Hilti, Simpson Strong-Tie, Powers Fasteners, and ITW Red Head. These companies dominate market share through robust distribution networks, advanced R&D capabilities, and a broad product portfolio tailored to meet U.S. building code standards. The degree of innovation in the U.S. market is high, driven by the need for compliance with seismic, fire-resistance, and structural integrity regulations. Manufacturers continuously develop new anchoring systems with enhanced load-bearing capacities, improved corrosion resistance, and faster installation mechanisms. Digital design tools and pre-engineered fastening solutions-compatible with BIM platforms and tailored for modular construction-have also become standard offerings, underscoring the market’s push toward technological integration and value-added services.

The market has witnessed a steady but selective mergers and acquisitions, largely aimed at portfolio expansion, entry into niche sectors, and compliance alignment. Regulatory oversight remains a defining feature, with agencies like the International Code Council (ICC), American Concrete Institute (ACI), and Occupational Safety and Health Administration (OSHA) setting strict guidelines that influence anchor design, testing, and certification. This regulatory framework creates high entry barriers and fosters product standardization across states. Service substitutes in the anchoring fasteners space are minimal, as these components are essential to structural safety and cannot be easily replaced. However, competition exists between mechanical and chemical anchors depending on application-specific requirements. End-user concentration is evident among large EPC firms, infrastructure developers, and industrial facility managers requiring large-volume certified anchoring systems. This reinforces the importance of quality assurance, technical assistance, and reliable supply chains within the U.S. market.

Substrate Insights

The concrete segment dominated the market and accounted for the largest revenue share of 41.12% in 2024, driven by its widespread applercial, industrial, and infrastructure construction. Co applicationncrete remains the most commonly used material for structural foundations, flooring, walls, and support systems in buildings and civil works, necessitating strong and durable anchors that ensure stability and safety.

The autoclaved aerated concrete segment is expected to grow at the fastest CAGR of 4.8% over the forecast period, driven by the increasing adoption of lightweight construction materials in residential and commercial projects. AAC offers numerous advantages, such as thermal insulation, fire resistance, and ease of handling, making it a preferred choice for modern energy-efficient buildings. However, AAC requires specialized anchoring systems to provide a secure hold without damaging the material due to its porous and brittle nature.

End-use Insights

The construction & real estate segment dominated the market and accounted for the largest revenue share of 43.41% in 2024, driven by a nationwide resurgence in residential, commercial, and institutional development. Population growth, urban sprawl, and changing lifestyle preferences have intensified the need for multi-family housing units, mixed-use developments, and high-rise commercial properties. Anchoring fasteners are fundamental in ensuring the structural integrity of these buildings, particularly in load-bearing components, façade systems, HVAC installations, and foundation connections.

The energy & utilities (solar and green roofs) segment is expected to grow at the fastest CAGR of 4.7% over the forecast period, driven by the rapid expansion of solar photovoltaic (PV) installations and the increasing adoption of green roofing systems. As the nation accelerates its shift toward renewable energy, ground-mounted solar farms and rooftop solar projects require robust anchoring systems capable of withstanding environmental loads such as wind, snow, and seismic activity. Anchors used in solar energy systems such as ground screws, earth anchors, and concrete fasteners are engineered to provide long-term structural stability, even in loose or rocky soils.

Distribution Channel Insights

The indirect segment dominated the market and accounted for the largest revenue share of 72.20% in 2024, driven by the extensive reach and logistical capabilities of distributors, wholesalers, and third-party retailers who bridge the gap between manufacturers and end users. These channels provide immediate availability of diverse anchoring products, enabling faster procurement for time-sensitive projects.

The direct segment is expected to grow significantly at a CAGR of 3.4% over the forecast period, driven by increasing demand from large-scale contractors, infrastructure developers, and industrial end users for tailored, high-performance fastening solutions. Direct sales allow manufacturers to establish direct engagement with customers, offering greater control over pricing, product customization, and delivery timelines.

Product Insights

The mechanical anchors segment led the market and accounted for the largest revenue share of 58.1% in 2024, driven by the rising demand for durable, quick-installation fastening solutions across new construction and retrofit applications. Mechanical anchors, including wedge, sleeve, drop-in, and undercut anchors, are preferred for their reliability, ease of use, and ability to provide immediate load-bearing capacity after installation. These attributes are especially valuable in the U.S., where infrastructure renovation is a national priority. Aging bridges, tunnels, and public buildings require structural reinforcement using anchoring solutions that can be securely installed with minimal downtime.

The chemical anchors segment is expected to grow at the fastest CAGR of 4.1% over the forecast period, driven by increasing demand for high-strength, load-bearing applications in concrete and masonry structures. Chemical anchors are favored in environments where traditional mechanical anchors may fall short due to cracking, edge distance limitations, or structural irregularities.

Key U.S. Anchoring Fasteners Company Insights

Some key players operating in the market include Hilti and Simpson Strong-Tie Company Inc.

-

Hilti is a globally recognized leader in construction technology, specializing in products, systems, and services that support the professional building industry. The company’s anchoring solutions are widely used in commercial, industrial, and infrastructure projects, offering a comprehensive range that includes mechanical anchors, chemical anchors, cast-in-place anchors, and screw anchors. These products are engineered for superior performance in concrete and masonry, particularly under demanding conditions such as seismic zones or corrosive environments.

-

Simpson Strong-Tie is one of North America's most recognized names in structural anchoring and connection systems. The company’s U.S. anchoring product portfolio includes expansion anchors, adhesive, and undercut anchoring accessories that comply with ACI 355 and ICC-ES standards. Their fasteners are widely used in seismic retrofits, concrete anchorage, and structural steel connections.

ITW Red Head and DeWALT Industrial Tool Co. are some of the emerging market participants in the anchoring fasteners market.

-

ITW Red Head, a brand under Illinois Tool Works, is a key player in the U.S. anchoring fasteners market. It is known for its wide range of anchoring solutions used in concrete and masonry installations. Their offerings include wedge anchors, epoxy systems, and screw-in anchors, all tailored for commercial construction, bridge supports, and heavy machinery anchoring.

-

DeWALT, a Stanley Black & Decker subsidiary, delivers fastening and anchoring systems as part of its broader power tool and construction product offerings. The brand provides a full range of screw anchors, mechanical expansion anchors, and epoxy systems for use in concrete, block, and brick substrates. Small and mid-size contractors favor DeWALT products for their ease of use, availability through major retail channels, and integration with power tool systems that simplify anchor installation.

Key U.S. Anchoring Fasteners Companies:

- Hilti Inc.

- Simpson Strong-Tie Company Inc.

- Powers Fasteners Inc.

- ITW Red Head

- DeWALT Industrial Tool Co.

- Fastenal Company

- EDSCO Fasteners LLC

- Allfasteners USA LLC

- BTM Manufacturing

U.S. Anchoring Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 668.3 million

Revenue forecast in 2033

USD 950.2 million

Growth rate

CAGR of 3.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, substrate, end-use, distribution channel

Country scope

U.S.

Key companies profiled

Hilti Inc.; Simpson Strong-Tie Company Inc.; Powers Fasteners Inc.; ITW Red Head; DeWALT Industrial Tool Co.; Fastenal Company; EDSCO Fasteners LLC; Allfasteners USA LLC; BTM Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Anchoring Fasteners Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. anchoring fasteners market report based on product, substrate, end-use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanical Anchors

-

Through Bolts & drop-in Anchors

-

Undercut Anchors

-

Concrete Screws

-

Cast-in Anchors

-

Others

-

Chemical Anchors

-

Epoxy Resin Anchors

-

Polyester Resin Anchors

-

Hybrid Chemical Anchors

-

Others

-

Plastic Anchors

-

-

Substrate Outlook (Revenue, USD Million, 2021 - 2033)

-

Concrete

-

Solid Masonry

-

Hollow or Perforated Masonry

-

Autoclaved Aerated Concrete

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar and Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

Frequently Asked Questions About This Report

b. The global robotaxi market size was estimated at USD 1.95 billion in 2024 and is expected to reach USD 2.79 billion in 2025.

b. The global robotaxi market is expected to grow at a compound annual growth rate of 73.5% from 2025 to 2030 to reach USD 43.76 billion by 2030

b. Asia Pacific dominated the robotaxi market with a share of 36.0% in 2024. This is attributable to the key factors, such as 5G integration, smart city initiatives, and AI-based fleet optimization.

b. Some key players operating in the Robotaxi market include Waymo LLC; Baidu, Inc.; Didi Chuxing Technology Co., Ltd.; Cruise LLC; EasyMile; Tesla Inc.; Aptiv; Uber Technologies Inc. ; Lyft, Inc ; Zoox, Inc.

b. The growth of the market can be attributed to the autonomous ride-hailing services that are scaling rapidly with advancing AI and regulatory approvals, reshaping urban mobility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.