- Home

- »

- Animal Health

- »

-

U.S. Animal Genetics Market Size, Industry Report, 2033GVR Report cover

![U.S. Animal Genetics Market Size, Share & Trends Report]()

U.S. Animal Genetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Animal (Cattle, Pigs, Sheep & Goats), By Type (Assistive Reproduction Technologies, Live Animals, Genomic/Genetic Testing), By Distribution Channel (Private, Public), And Segment Forecasts

- Report ID: GVR-4-68040-729-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Animal Genetics Market Summary

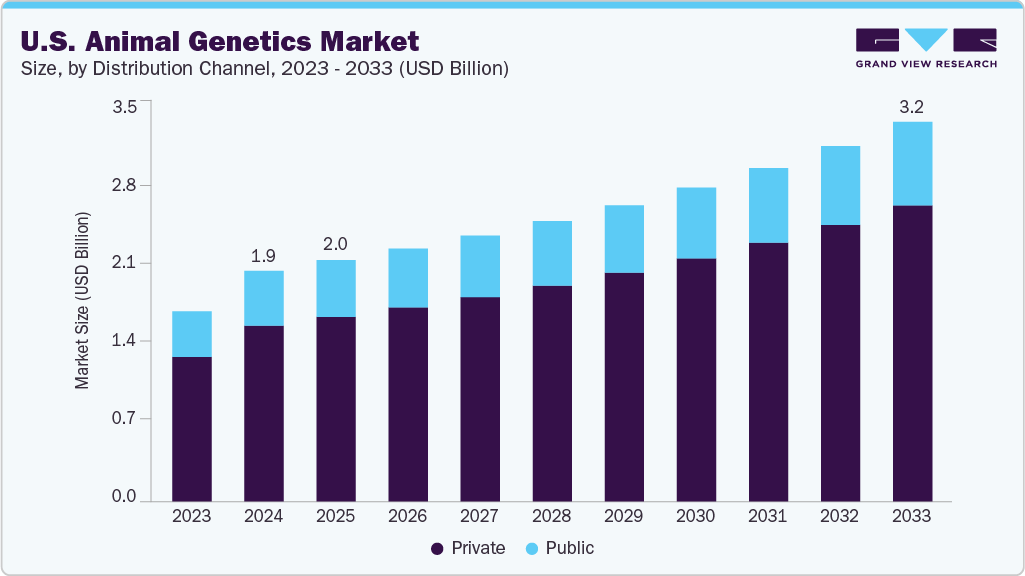

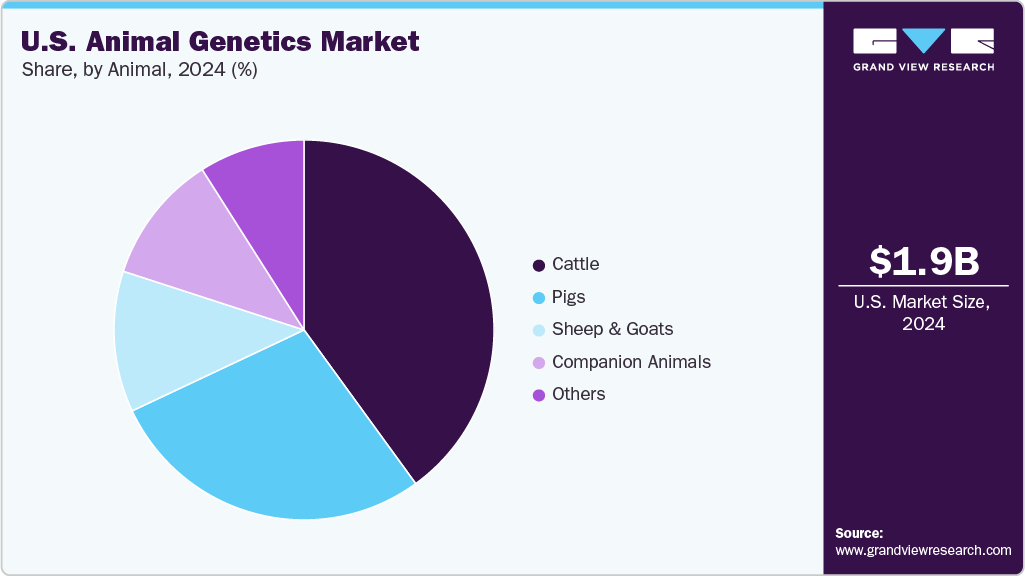

The U.S. animal genetics market size was estimated at USD 1.94 billion in 2024 and is projected to reach USD 3.19 billion by 2033, growing at a CAGR of 5.83% from 2025 to 2033. Some of the factors driving the market growth are advancements in veterinary genetic research, emerging large-scale veterinary genetics projects, growing application in animal breeding, and increasing veterinary genetics training and education.

Key Market Trends & Insights

- By animal, the cattle segment held the largest market share of over 40.31% in 2024.

- By type, the assistive reproduction technologies segment held the largest market share of 49.69% in 2024.

- By on distribution channel, the private segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.94 Billion

- 2033 Projected Market Size: USD 3.19 Billion

- CAGR (2025-2033): 5.83%

Advancements in animal genetics are significantly propelling growth in the U.S. market by enhancing disease resilience, breeding precision, and collaborative research infrastructure. A December 2024 USDA-funded collaboration network led by Utah State University, backed by more than USD 3.25 million, is fostering cross-institutional and interdisciplinary research in genome sequencing, digital DNA representations, and precision breeding across livestock such as cattle, sheep, pigs, poultry, and fish-ultimately supporting improvements in productivity, disease resistance, climate resilience, and food security.Complementing this, UC Davis’s March 2025 established Intentional Genomic Alteration Innovation Center (under an FDA-supported initiative) aims to advance genome editing across livestock like pigs, sheep, and cattle, with goals including improved animal health, productivity, and enabling well-informed, science-based regulatory frameworks for gene‐edited food animals. Meanwhile, on the practical side of gene editing, researchers are actively deploying DNA‐editing techniques to introduce beneficial traits such as naturally hornless (polled) animals and enhanced disease resistance-efforts that not only align with consumer preferences and welfare standards but also strengthen livestock biosecurity.

Cumulatively, these developments-from robust funding and collaborative infrastructure to targeted gene editing technologies-are underpinning larger-scale deployment of genomic tools in agriculture. Together, they drive market expansion by accelerating the translation of innovative research into commercially viable solutions, catalyzing demand for genetic testing, breeding services, and gene-editing applications.

The expanding use of genetic tools in animal breeding is propelling the growth of the U.S. animal genetics industry by enabling far more precise, efficient, and sustainable livestock development. According to the Genetic Literacy Project, exploiting the tiny genetic differences-even those under 1%-between individual animals makes it possible to breed animals optimized for economic performance, environmental resilience, and social sustainability; this precision elevates breeding programs from art to high-impact science.

Concurrently, the establishment of Texas A&M’s new Center for Comparative Genomics-backed by millions in institutional funding-positions the university as a hub for interdisciplinary research in animal genetics, fostering innovations in trait improvement, disease resistance, and translational applications across agriculture and biomedicine. Together, these developments-leveraging genomic insights and institutional capacity-are driving market expansion by accelerating the translation of research into commercial breeding services, genetic testing, and advanced genomic solutions that are transforming livestock production across the U.S.

The table below represents some of the leading areas of genetics in animal breeding and its impact on the industry:

Genetic Innovation Areas

Impact on Industry

Genomic Selection via Genotyping

Farmers can now directly assess an animal’s genetic value (for traits like productivity or sustainability) by DNA sequencing, enabling more precise and efficient breeding.

Comparative Genomics Center

Texas A&M’s new Center for Comparative Genomics advances research in animal health, production, biodiversity conservation, and workforce training in genetics.

Marker-Assisted & High-Throughput Selection

Tools like marker-assisted selection (MAS) and robotic genotyping accelerate precision in choosing desirable traits in livestock.

Heterosis (Hybrid Vigor)

Strategic breed crosses (e.g., cattle and poultry hybrids) combine genetic strengths to improve productivity, growth, and uniformity.

Genetically Engineered Traits

Engineered animals such as environmentally friendly pigs or cows producing allergy-free milk showcase the potential for trait innovation.

Disease-Resistant, Gene-Edited Pigs

Gene editing has produced pigs resistant to PRRS, a major swine disease, demonstrating genetics’ role in disease prevention.

Cat Genomics for Health and Conservation

Projects like the 99 Lives Cat Genome Project identify disease-linked mutations, helping eliminate hereditary conditions and improve feline breeding.

Genomic Selection in Honey Bees

Genomic markers improve prediction accuracy for traits such as honey yield and colony behavior in bee breeding.

Buffalo Genome Insights

Genome sequencing in buffalo supports improved breeding programs for growth, milk/meat yield, and climate adaptation.

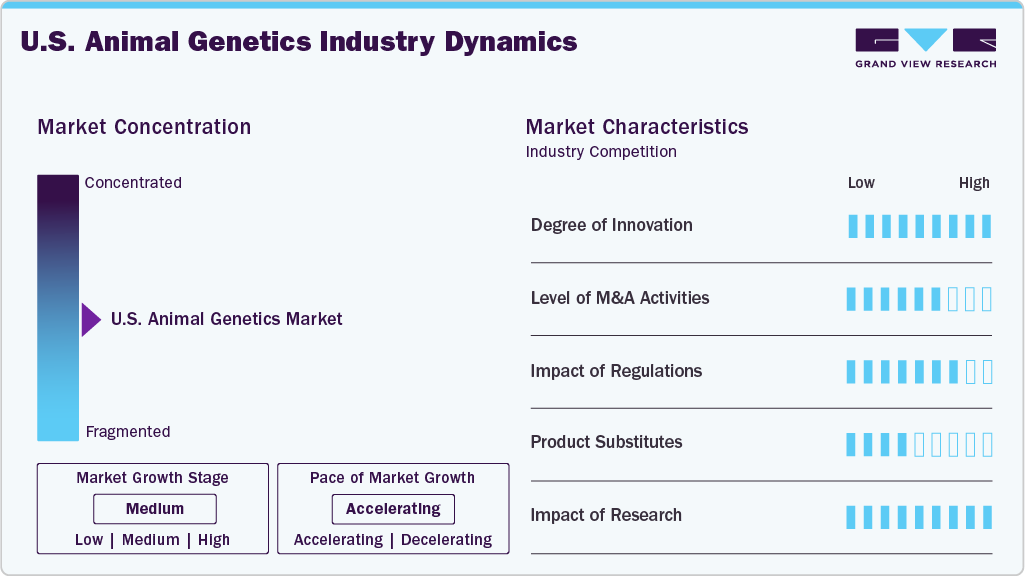

Market Concentration & Characteristics

The U.S. animal genetics market is moderately concentrated, with a mix of global leaders and specialized firms shaping the competitive landscape. Companies like Neogen, Zoetis, and Genus plc bring strong technological expertise, global distribution, and extensive R&D pipelines, positioning them as dominant players. Alongside these giants, firms such as STgenetics, Semex, and URUS Group focus on cattle and dairy genetics, contributing to sectoral depth and specialization. Hendrix Genetics and Swine Genetics International strengthen the swine and poultry segments with advanced breeding programs.

Smaller niche players like Animal Genetics Inc. and Select Sires Inc. provide genetic testing and tailored services, adding diversity and innovation. This blend of large multinationals and specialized companies creates a competitive but collaborative environment, with concentration driven more by technological leadership and species expertise than by market share alone.

The U.S. animal genetics industry is experiencing rapid innovation, propelled by advanced genomics, next-generation sequencing, and CRISPR-based technologies. Pioneering programs like the Dog Genome Project are unlocking insights into breed-specific diseases and traits, informing both animal and human health. In the agricultural sector, researchers are developing disease-resistant livestock, such as pigs with heightened immunity, and deploying precision breeding and genomic tools to enhance production efficiency. These innovations are creating smarter, healthier, and more sustainable animal breeding systems across the pet and farm industries.

M&A activity in the animal genetics sector is showing steady growth, with both industry leaders and private equity firms driving consolidation. Kemin Industries’ acquisition of Hennessy Research Associates strengthens its R&D capacity, while Hendrix Genetics’ purchase of Danish Genetics, backed by Paine Schwartz Partners, expands its global breeding portfolio. These deals highlight investor confidence in genetics as a high-value growth area. Overall, the market is experiencing moderate to high levels of strategic acquisitions focused on innovation, diversification, and global expansion.

USDA regulations and funding initiatives are shaping the U.S. animal genetics market by ensuring research aligns with national priorities like food security, animal welfare, and sustainability. Regulatory frameworks provide clarity and reduce risks for companies, encouraging investment in advanced breeding technologies. They also promote collaboration between academia, industry, and government, accelerating translation from research to application. Overall, regulations act as both safeguards and growth enablers for genetic innovation in animal agriculture.

In the U.S. animal genetics market, product substitutes mainly come from traditional and alternative breeding methods. Conventional selective breeding remains a lower-cost substitute for advanced genetic tools, especially among smaller producers. In addition, vaccines, nutritional supplements, and herd health programs can serve as substitutes by improving animal productivity and disease resistance without genetic modification. Emerging technologies like synthetic biology, lab-grown meat, and microbiome engineering are also indirect substitutes, as they can reduce reliance on genetic improvement in livestock. However, while these alternatives provide options, they generally lack the precision, long-term efficiency, and scalability offered by modern animal genetics solutions, making them complementary but not fully competitive substitutes.

Research is having a transformative impact on the U.S. animal genetics industry by driving innovation, improving efficiency, and creating new commercial opportunities. Advancements in genomics, gene editing, and digital DNA tools are enabling more precise breeding strategies that enhance productivity, disease resistance, and climate adaptability in livestock. Research initiatives funded by agencies like the USDA and led by universities are building collaborative networks that connect academia, industry, and government, accelerating the translation of discoveries into practical breeding solutions. These efforts are also shaping regulatory frameworks and ensuring ethical, science-based applications of genetic technologies. Overall, research is expanding the scope of genetic tools available, lowering costs of genetic testing, and fostering confidence in their adoption, thereby fueling sustained growth and competitiveness in the market.

Animal Insights

Cattle represented the largest segment with a revenue share of 40.31% in 2024, driven by the strong integration of genetic tools to enhance productivity, disease resistance, and sustainability. Research collaborations funded by the USDA are advancing genomic sequencing and precision breeding, directly benefiting the beef and dairy sectors. Gene-editing innovations, such as DNA-based improvements in disease resilience and animal welfare traits, are being increasingly adopted to optimize herds. The cattle industry is also prioritizing genetics to meet rising consumer demand for efficiency and sustainability in beef production. Ongoing innovation in genomic testing, coupled with industry-wide investments in breeding programs, has positioned cattle at the forefront of the U.S. animal genetics market.

Companion animals is projected to be the fastest-growing segment over the forecast period, supported by rising genomic research in dogs and cats. The mapping of the dog genome has opened new avenues for identifying disease-linked genes, improving breeding practices, and developing targeted healthcare solutions. At the same time, large-scale feline genetic studies, such as those inviting cat owners to share behavioral and health traits, are expanding the genetic knowledge base for cats. Growing pet ownership and the humanization of pets are further fueling demand for advanced genetic testing, precision breeding, and personalized veterinary care. Together, these advancements are positioning companion animals as the most dynamic and rapidly expanding segment within the U.S. animal genetics market.

Type Insights

Assistive Reproduction Technologies (ART) accounted for the largest segment with a share of 49.69% in 2024, reflecting their widespread use in livestock and companion animal breeding. Techniques such as artificial insemination, embryo transfer, and in vitro fertilization are central to accelerating genetic improvement and ensuring consistent herd quality. ART enables the rapid spread of desirable traits like disease resistance, productivity, and animal welfare enhancements across populations. The technology is also vital for preserving valuable genetics, managing biosecurity, and meeting global food demand efficiently. With continuous innovation and integration of genomic tools, ART has become the backbone of modern breeding strategies, securing its leading market share.

Genomic and genetic testing is the fastest-growing segment in the U.S. animal genetics industry, driven by rising demand for precision breeding and early disease detection. These tools allow producers to identify superior traits, improve herd productivity, and reduce economic losses from genetic disorders. Advances in sequencing technologies and bioinformatics are making testing faster and more affordable, broadening adoption across both livestock and companion animals. Pet owners are increasingly using genetic tests for health screening and breed insights, further fuelling growth. With strong research investments and expanding applications, this segment is rapidly transforming animal breeding and healthcare in the U.S.

Distribution Channel Insights

The private segment represents both the largest and fastest-growing share of the animal genetics market due to its strong investment capacity, rapid innovation, and global expansion strategies. Private companies dominate in delivering advanced solutions such as artificial insemination, embryo transfer, genomic testing, and gene-editing applications. They are quick to adopt innovative technologies, supported by significant R&D budgets and partnerships with universities and research institutes. Private equity firms are also actively investing in genetic companies, driving consolidation, and accelerating the commercialization of innovations.

Unlike public institutions, private players operate with higher agility, enabling faster translation of research into market-ready products. Their extensive distribution networks and customer-focused services further strengthen their market dominance. Growing demand for sustainable livestock production, improved productivity, and companion animal care is being met primarily through private sector initiatives. As regulatory clarity increases, private companies are scaling solutions more effectively than public counterparts. Overall, the segment benefits from its dual ability to lead in market share today while also spearheading future growth in animal genetics.

Key U.S. Animal Genetics Company Insights

The U.S. animal genetics market is shaped by a mix of global leaders and strong local players, with companies like Zoetis, Genus plc, Neogen, STgenetics, URUS Group, and Semex holding significant influence. These firms dominate through advanced breeding technologies, genomic testing, and reproductive services, while niche players such as Animal Genetics Inc. and Trans Ova Genetics add specialized expertise. Private companies are driving a lot of the innovation and consolidation, supported by steady M&A activity and investor confidence. Overall, the market is moderately concentrated, with leadership determined by technological capabilities, research collaborations, and the ability to scale genetic solutions across livestock and companion animals.

Key U.S. Animal Genetics Companies:

- Neogen Corporation

- Genetics Australia

- Hendrix Genetics BV

- URUS Group LP

- CRV

- Semex

- Swine Genetics International

- STgenetics

- Animal Genetics Inc.

- Select Sires Inc.

- Zoetis Services LLC

- Genus plc

Recent Developments

-

In August 2025, Kemin Industries has acquired Hennessy Research Associates, a Kansas-based firm specializing in veterinary contract research, vaccine development, and biological manufacturing. This acquisition enhances Kemin’s capacity in animal health by incorporating elite R&D expertise into its animal vaccine and biologics offerings.

-

In April 2025, Darwin’s Ark has partnered with Hill’s Pet Nutrition, UMass Chan Medical School, and the Broad Institute to launch “Darwin’s Cats,” a community-driven genomics initiative aimed at decoding feline DNA. This collaboration combines pet-owner contributions, innovative sequencing, and large-scale behavioral and health data to advance feline health and genetic understanding.

-

In February 2025, Texas A&M has established the Center for Comparative Genomics, uniting AgriLife Research with the Colleges of Agriculture & Life Sciences and Veterinary Medicine & Biomedical Sciences to elevate interdisciplinary research and training in animal genomics. Supported by the Chancellor’s Research Initiative and AgriLife funds, the center will foster innovations spanning animal health, agriculture, conservation, and biomedical applications.

U.S. Animal Genetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.03 billion

Revenue forecast in 2033

USD 3.19 billion

Growth Rate

CAGR of 5.83% from 2025 to 2033

Historical Period

2021 - 2023

Actual data

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, type, distribution channel

Country scope

U.S.

Key companies profiled

Neogen Corporation; Genetics Australia; Hendrix Genetics BV; URUS Group LP; CRV; Semex; Swine Genetics International; STgenetics; Animal Genetics Inc.; Select Sires Inc.; Zoetis Services LLC; Genus plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Animal Genetics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. animal genetics market report based on animal, type, and distribution channel:

-

Animal Outlook (Revenue, USD Million, 2021 - 2033)

-

Cattle

-

Pigs

-

Sheep & Goats

-

Companion Animals

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Assistive Reproduction Technologies

-

Live Animals

-

Genomic/Genetic Testing

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

Frequently Asked Questions About This Report

b. The U.S. animal genetics market size was estimated at USD 1.94 billion in 2024 and is expected to reach USD 2.03 billion in 2025.

b. The U.S. animal genetics market is expected to grow at a compound annual growth rate of 5.83% from 2025 to 2033 to reach USD 3.19 billion by 2033.

b. By animal, cattle represented the largest segment with a revenue share of 40.31% in 2024, driven by the strong integration of genetic tools to enhance productivity, disease resistance, and sustainability. Research collaborations funded by the USDA are advancing genomic sequencing and precision breeding, directly benefiting the beef and dairy sectors. Gene-editing innovations, such as DNA-based improvements in disease resilience and animal welfare traits, are being increasingly adopted to optimize herds.

b. Some key players operating in the U.S. animal genetics market include Neogen Corporation, Genetics Australia, Hendrix Genetics BV, URUS Group LP, CRV, Semex, Swine Genetics International, STgenetics, Animal Genetics Inc., Select Sires Inc., Zoetis Services LLC, and Genus plc

b. Key factors that are driving the market growth include advancements in veterinary genetic research, emerging large scale veterinary genetics projects, growing application in animal breeding, and increasing veterinary genetics training and education.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.