- Home

- »

- Biotechnology

- »

-

U.S. Antibody Specificity Testing Market, Industry Report 2033GVR Report cover

![U.S. Antibody Specificity Testing Market Size, Share & Trends Report]()

U.S. Antibody Specificity Testing Market (2025 - 2033) Size, Share & Trends Analysis Report, By Product & Services (Products, Antibody Validation & Specificity Testing Services), By Technology, By Application (Research & Development), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-738-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

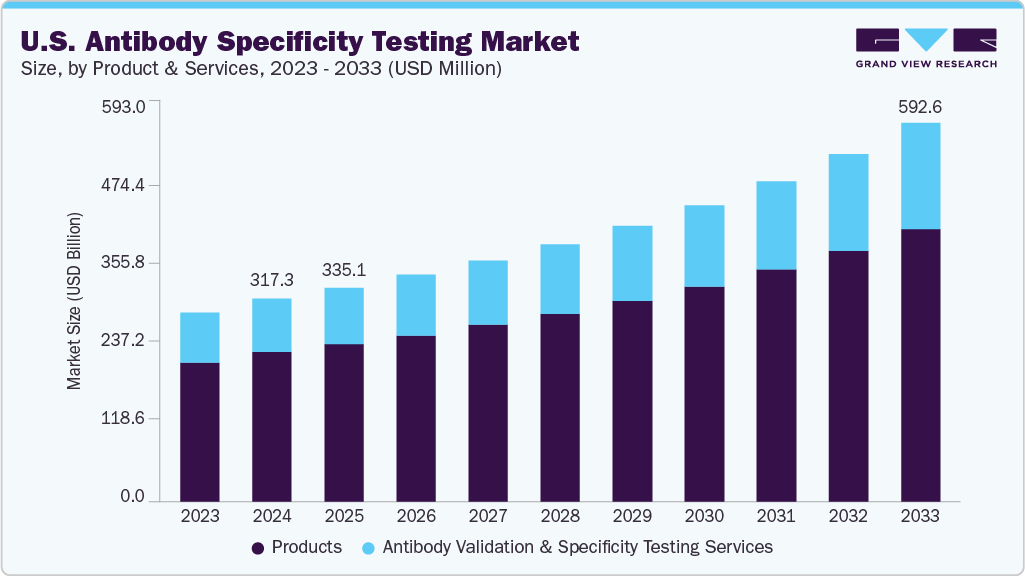

The U.S. antibody specificity testing market size was estimated at USD 317.3 million in 2024 and is projected to reach USD 592.6 million by 2033, growing at a CAGR of 7.39% from 2025 to 2033. The market growth is driven by the rising use of antibody-based therapeutics and diagnostics, coupled with the growing focus on research reproducibility. Advancements in validation methods such as high-throughput screening and flow cytometry, along with strong U.S. research infrastructure and funding support, are expected to accelerate adoption further.

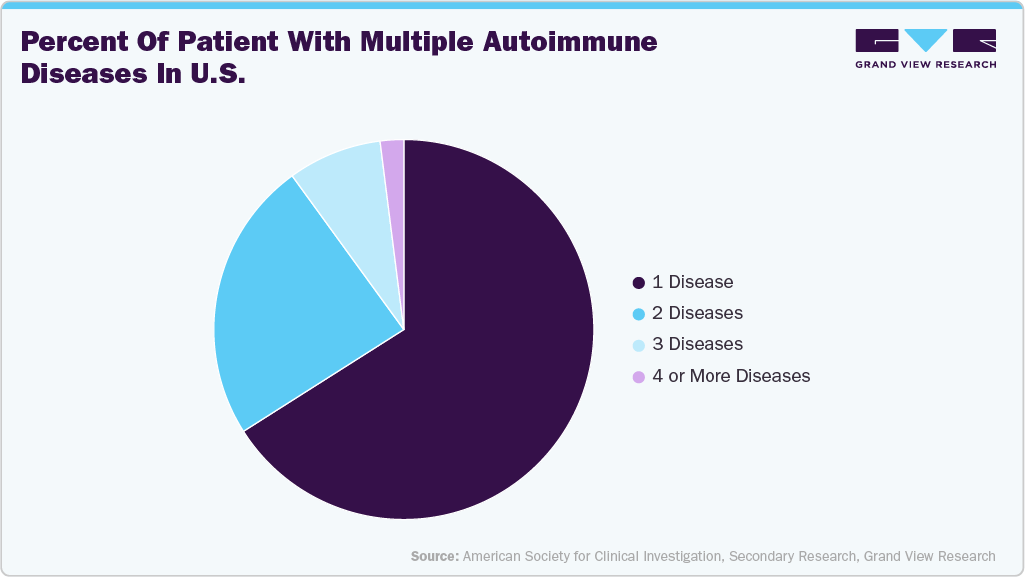

Growing disease burden

One of the major factors driving demand in the U.S. antibody specificity testing market is the growing disease burden, particularly the rising prevalence of cancer, autoimmune disorders, and infectious diseases. These conditions have significantly increased the reliance on antibody-based diagnostics and therapeutics, as antibodies play a crucial role in identifying disease biomarkers, monitoring disease progression, and developing targeted treatment approaches. With the U.S. witnessing a steady increase in chronic disease incidence, healthcare providers and researchers are placing greater emphasis on validating the accuracy and specificity of antibodies to ensure reliable diagnostic and therapeutic outcomes.

Moreover, the shift toward personalized and precision medicine has amplified the need for highly specific antibodies, as treatment strategies increasingly depend on biomarker-driven approaches. Antibody specificity testing enables the selection and validation of antibodies that can accurately target disease pathways without cross-reactivity, thereby improving patient outcomes and reducing risks of ineffective treatment. This growing demand for high-quality, validated antibodies supported by advances in testing technologies and strong U.S. R&D investment will remain a core driver of market expansion throughout the forecast period.

Advances in technologies

Technological advancements have emerged as a key driver of the U.S. antibody specificity testing market, as innovations such as high-throughput screening, automation, and next-generation sequencing (NGS)-based platforms are transforming how antibodies are validated. Traditional validation methods were often labor-intensive and time-consuming, leading to bottlenecks in research and clinical workflows. With the adoption of automated systems and high-throughput platforms, researchers can now test large libraries of antibodies with improved speed, reproducibility, and precision. These developments are especially critical for biopharmaceutical companies, where drug discovery and development timelines demand efficient and accurate antibody testing solutions.

Moreover, integrating advanced computational tools, artificial intelligence, and data analytics with antibody testing workflows further enhances efficiency and reliability. NGS and multi-omics approaches allow scientists to assess antibody performance at a deeper molecular level, identifying cross-reactivity and binding affinity with higher accuracy. Such innovations reduce costs associated with failed experiments and accelerate the development of diagnostic assays and antibody-based therapeutics. As the U.S. continues to invest heavily in biotech and life sciences R&D, the rapid adoption of these advanced technologies is expected to play a pivotal role in sustaining market growth over the coming years.

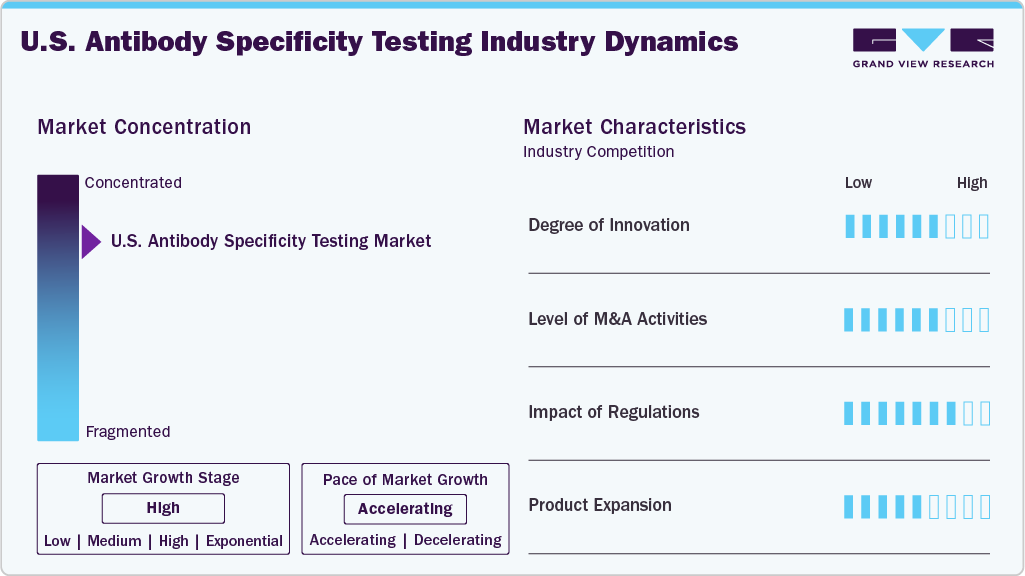

Market Concentration & Characteristics

The degree of innovation in the U.S. antibody specificity testing industry is high, driven by the adoption of advanced technologies such as high-throughput screening, flow cytometry, next-generation sequencing, and AI-enabled analytics that enhance accuracy, speed, and reproducibility. Traditional methods such as ELISA and Western blotting are supplemented with automated, data-driven platforms that reduce experimental errors and accelerate antibody validation. Strong collaborations among academic institutions, biopharma companies, technology providers, and significant investment in automation and precision medicine research further reinforce innovation, positioning technological advancement as a key differentiator in market growth.

The level of M&A activities in the U.S. antibody specificity testing industry is moderate to high, as major life sciences companies, diagnostic players, and contract research organizations are increasingly pursuing acquisitions to expand their antibody validation capabilities, strengthen technology portfolios, and access advanced platforms. Consolidation trends are evident as larger firms acquire niche technology providers specializing in high-throughput assays, automation, and AI-based validation tools, aiming to enhance competitiveness and accelerate innovation. For instance, in December 2023, in the U.S., Danaher completed its USD 24-per-share acquisition of Abcam, making it a wholly owned subsidiary to expand antibody and life sciences capabilities. These strategic deals also reflect the growing emphasis on integrating antibody testing solutions with broader drug discovery, biologics manufacturing, and precision medicine pipelines.

Regulations strongly impact the U.S. antibody specificity testing industry, as FDA and NIH guidelines mandate high standards of reproducibility and reliability for antibodies used in diagnostics, therapeutics, and clinical trials. While compliance increases costs and timelines, it drives demand for advanced validation tools and ensures higher-quality, standardized products, ultimately boosting market credibility and adoption.

Product expansion in the U.S. antibody specificity testing industry is driven by the launch of advanced kits, reagents, and automated platforms designed to improve accuracy, throughput, and reproducibility. Companies are increasingly broadening their portfolios with high-throughput assays, AI-integrated validation tools, and next-generation sequencing-based solutions to address rising demand in drug discovery, diagnostics, and precision medicine. This continuous stream of new and improved offerings enhances competitiveness, supports wider adoption across research and clinical settings, and positions product innovation as a key growth enabler in the market.

Product & Services Insights

The products segment accounted for the largest market share in 2024, driven by the extensive use of antibody validation kits, reagents, and assay platforms across research and clinical applications. High demand for consumables and instruments in academic laboratories, pharmaceutical R&D, and diagnostic centers has reinforced this segment’s dominance. Moreover, continuous innovations in high-throughput kits, automated testing systems, and next-generation platforms are further boosting adoption, as researchers and biopharma companies increasingly seek reliable, reproducible, and efficient solutions for antibody specificity testing.

The antibody validation & specificity testing services segment is expected to record the fastest CAGR over the forecast period, supported by the increasing outsourcing of testing activities by research institutions and biopharmaceutical companies. The growing complexity of antibody-based therapeutics and diagnostics has amplified the demand for specialized service providers that offer high-throughput, cost-effective, and regulatory-compliant validation solutions. Moreover, expanding contract research organizations (CROs) and partnerships between academic centers and industry players further accelerate this segment's growth.

Technology Insights

The immunoassay-based technologies segment dominated the market with the largest share of 52.63% in 2024, owing to their widespread adoption in antibody validation due to high sensitivity, specificity, and ease of use. Techniques such as ELISA, Western blotting, and immunohistochemistry remain the gold standard for assessing antibody performance in research and clinical applications. Their cost-effectiveness, compatibility with a wide range of samples, and established regulatory acceptance reinforce their market leadership. Moreover, ongoing advancements in multiplex immunoassays and automated platforms enhance throughput and reproducibility, sustaining strong demand for this segment.

The genetic validation-based technologies segment is expected to grow at the fastest CAGR of 8.90% during the forecast period, driven by the rising use of CRISPR, RNA interference, and knockout models to ensure highly accurate, reproducible antibody validation and reduce cross-reactivity in research and drug development. Their increasing adoption in precision medicine, biomarker discovery, and biopharmaceutical R&D further strengthens demand, positioning this segment as a critical enabler of next-generation antibody validation approaches.

Application Insights

The research & development segment dominated the market in 2024 and is expected to grow with the fastest CAGR throughout the forecast period, owing to the rising use of antibodies in drug discovery, biomarker identification, and translational research. Increased funding from government bodies and private organizations, and growing collaborations between academic institutions and biopharmaceutical companies, are further driving demand for reliable antibody validation tools. Moreover, the surge in personalized medicine initiatives and the need for reproducibility in preclinical studies are accelerating the adoption of advanced antibody specificity testing technologies in R&D settings.

The clinical diagnostics segment is expected to grow significantly during the forecast period, driven by the rising prevalence of chronic and infectious diseases and the increasing reliance on antibody-based diagnostic assays. The growing demand for accurate, rapid, cost-effective diagnostic solutions to support early disease detection and patient monitoring is fueling adoption. Moreover, advancements in immunoassay platforms, genetic validation tools, and automated systems enhance diagnostic accuracy and efficiency, while regulatory emphasis on reliable testing further strengthens the segment’s growth prospects.

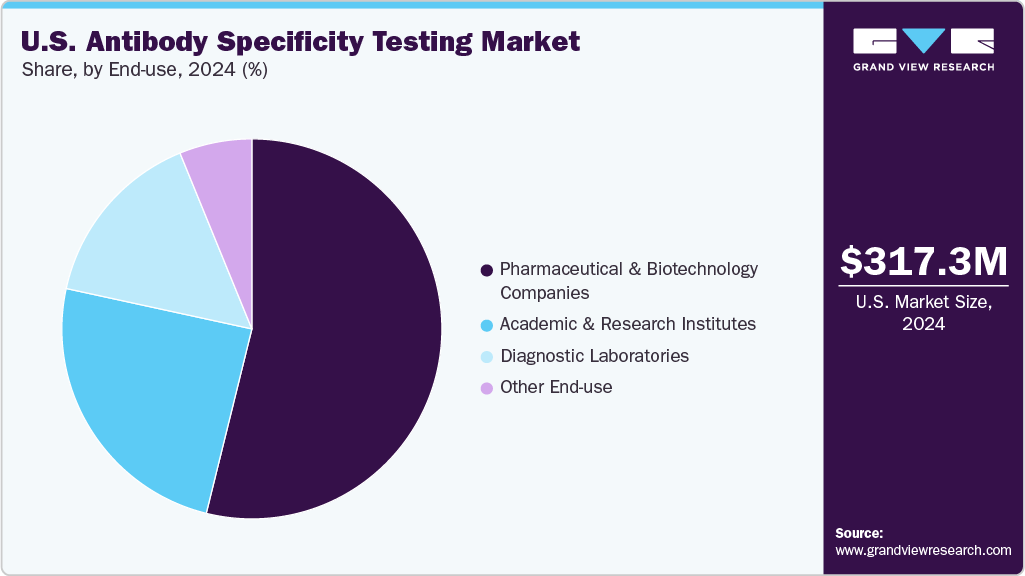

End-use Insights

The pharmaceutical & biotechnology companies segment captured the largest market share of 53.85% in 2024, driven by the extensive use of antibody specificity testing in drug discovery, biologics development, and quality assurance. These companies rely heavily on validated antibodies to ensure reproducibility, reduce development risks, and meet regulatory requirements in therapeutic pipelines. The increasing investment in biologics and biosimilars, coupled with the growing adoption of high-throughput and automated validation platforms, further reinforces the dominance of this segment.

The diagnostic laboratories segment is projected to grow fastest during the forecast period. This is driven by the increasing demand for accurate and timely disease detection, rising test volumes, and the growing use of antibody-based assays in routine diagnostics. Adopting advanced immunoassay and genetic validation platforms enhances reliability and efficiency in laboratory workflows. Moreover, the expansion of laboratory networks, greater outsourcing of diagnostic testing, and the push for personalized healthcare are expected to further accelerate growth in this segment.

Key U.S. Antibody Specificity Testing Company Insights

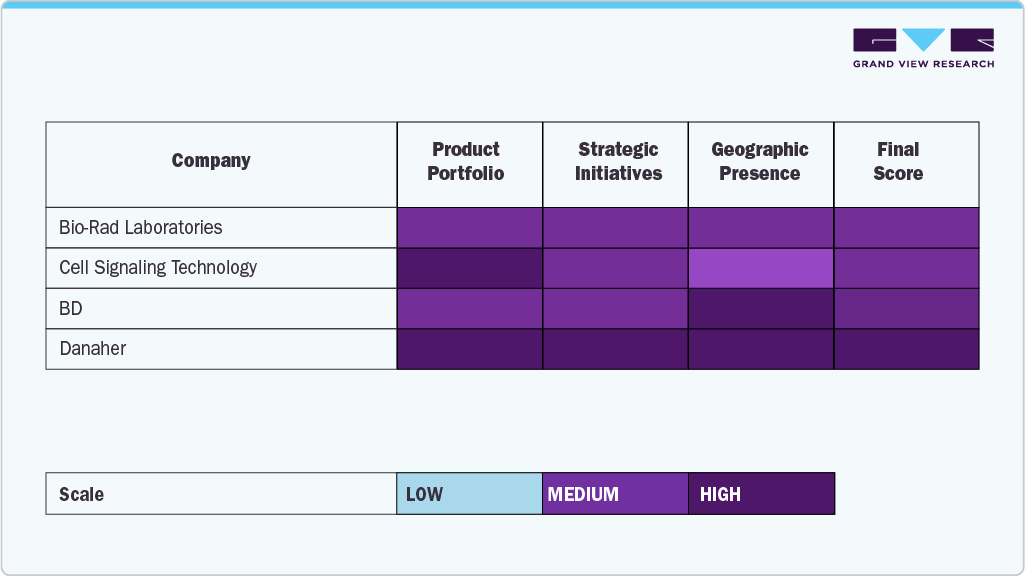

The U.S. antibody specificity testing industry is characterized by several established players who dominate through extensive product portfolios, advanced validation platforms, and continuous investments in research and development. Leading companies such as Danaher, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., and Merck KGaA maintain significant market share by leveraging cutting-edge technologies, diverse assay solutions, and global distribution networks catering to research and clinical applications.

Specialized firms, including Cell Signaling Technology, Inc., BD, Novus Biologicals, OriGene Technologies, Inc., Creative Diagnostics, and GenScript, are strengthening their market presence through innovative product launches, customized validation services, and collaborations with research institutions and biopharmaceutical companies. These companies focus on delivering high-quality, reproducible antibodies and validation tools to meet the rising demand in drug discovery, translational research, and diagnostic development.

As the demand for reproducibility, regulatory compliance, and next-generation validation solutions grows, the U.S. antibody specificity testing market will be shaped by commitments to innovation, standardization, and affordability, aligning closely with broader healthcare, precision medicine, and life sciences research objectives. The sector is also witnessing a convergence of established expertise and emerging innovators, with strategic collaborations, mergers and acquisitions, and advancements in high-throughput and AI-enabled validation methods intensifying competition. Companies that successfully integrate scientific innovation with customer-centric solutions are expected to drive sustained growth and reinforce leadership in this evolving market.

Key U.S. Antibody Specificity Testing Companies:

- Danaher

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Cell Signaling Technology, Inc.

- BD

- Novus Biologicals

- OriGene Technologies, Inc.

- Creative Diagnostics

- GenScript

Recent Developments

-

In June 2025, Bio-Rad Laboratories broadened its recombinant monoclonal anti-idiotypic antibody range, adding antibodies for Perjeta, Tremfya, Ilaris, Benlysta, and Hemlibra, along with a new Human IgM-FcSpyCatcher reagent.

-

In February 2023, in the U.S., Bio-Techne and Cell Signaling Technology partnered to validate CST antibodies on the Simple Western platform, enhancing reproducibility and accelerating protein analysis for research applications.

-

In November 2022, Leica Microsystems partnered with Cell Signaling Technology to validate CST antibodies on the Cell DIVE multiplexed imaging platform, enhancing antibody specificity and enabling reproducible spatial biology research.

U.S. Antibody Specificity Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 335.1 million

Revenue forecast in 2033

USD 592.6 million

Growth rate

CAGR of 7.39% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, application, end-use

Key companies profiled

Danaher; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Cell Signaling Technology, Inc.; BD; Novus Biologicals; OriGene Technologies, Inc.; Creative Diagnostics; GenScript

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Antibody Specificity Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. antibody specificity testing market on the basis of product & services, technology, application, and end-use:

-

Product & Services Outlook (Revenue, USD Million, 2021 - 2033)

-

Products

-

Antibodies

-

Control & Standards

-

Kits & Reagents

-

Gene Validation Tools

-

-

Antibody Validation & Specificity Testing Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Immunoassay-based Technologies

-

Western Blotting

-

Immunochemistry

-

Flow Cytometry

-

Others

-

-

Genetic Validation-based Technologies

-

Microarray-based Antibody Technologies

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Research & Development

-

Drug Discovery & Development

-

Proteomics & Biomarker Discovery

-

-

Clinical Diagnostics

-

Infectious Diseases

-

Oncology

-

Immunology & Autoimmune Disorders

-

Neurodegenerative Disorders

-

Metabolic Disorders

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

Diagnostic Laboratories

-

Other End Use

-

Frequently Asked Questions About This Report

b. The U.S. antibody specificity testing market size was estimated at USD 317.3 million in 2024 and is expected to reach USD 335.1 million in 2025.

b. The U.S. antibody specificity testing market is expected to grow at a compound annual growth rate of 7.39% from 2025 to 2033 to reach USD 592.6 million by 2033.

b. Key factors driving the U.S. antibody specificity testing market growth include rising demand for reliable antibodies in research and diagnostics, stringent regulatory requirements for validation, and technological advancements such as automation and AI-driven assay platforms.

b. The immunoassay-based technologies segment dominated the U.S. antibody specificity testing market with a share of 28.54% in 2024. This is attributable to their high sensitivity, reliability, and widespread use in research and clinical diagnostics.

b. Some key players operating in the U.S. antibody specificity testing market include Danaher; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Cell Signaling Technology, Inc.; BD; Novus Biologicals; OriGene Technologies, Inc.; Creative Diagnostics; GenScript.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.