- Home

- »

- Clinical Diagnostics

- »

-

U.S. ATP Assays Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. ATP Assays Market Size, Share & Trends Report]()

U.S. ATP Assays Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Luminometric ATP Assays, Enzymatic ATP Assays), By Application (Drug Discovery & Development, Clinical Diagnostics), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-682-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. ATP Assays Market Size & Trends

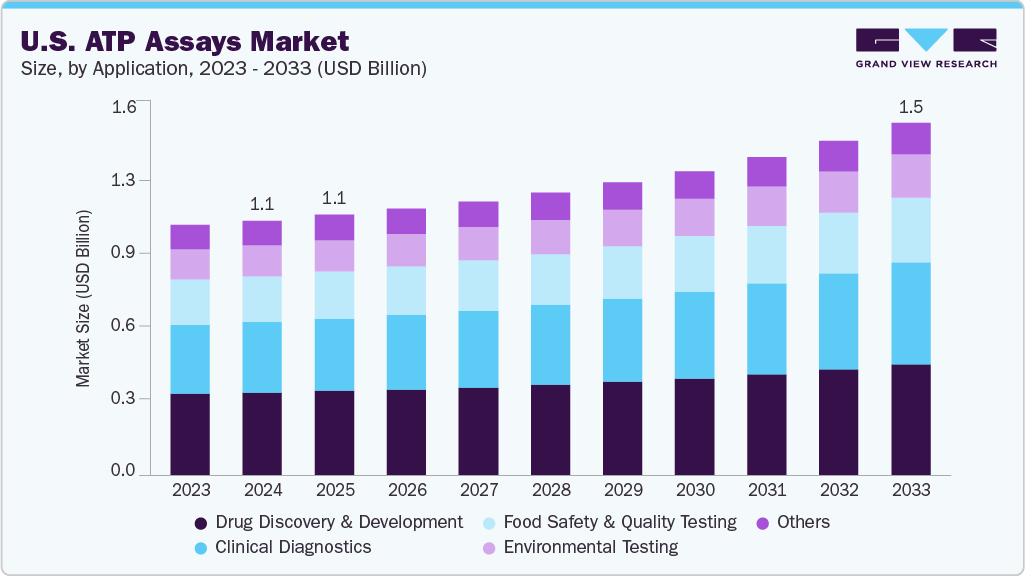

The U.S. ATP assays market size was estimated at USD 1.10 billion in 2024 and is projected to register a CAGR of around 3.87% through 2033. The market is primarily driven by increasing demand for rapid, reliable testing methods across drug discovery, clinical diagnostics, environmental monitoring, and food safety applications. In drug development and clinical research, ATP assays play a key role in cell viability and cytotoxicity studies, while their use in environmental testing and food quality control supports contamination detection and hygiene verification. The growing need for high‑throughput, real‑time analysis across these sectors continues to support adoption of automated, luminescence‑based ATP platforms.

In addition, the rising number of samples being tested has led to the adoption of more advanced ATP assay systems that support faster and more efficient processing. Improvements in preparing, measuring, and managing samples have helped laboratories work more effectively and reduce delays. These changes benefit areas such as drug testing and contamination detection, where time and accuracy matter. In December 2024, Hygiena acquired Nexcor Food Safety Technologies Inc., strengthening its range of ATP and environmental monitoring products and supporting the growing demand for quick, reliable testing solutions.

Moreover, the U.S. ATP Assays market is witnessing a notable shift toward integrated and automated detection systems, particularly in pharmaceutical manufacturing and food quality control. These platforms are designed to streamline contamination monitoring and regulatory compliance by combining rapid testing capabilities with digital record-keeping and cloud-based analytics. The growing need for standardized, traceable, and high-throughput workflows drives adoption across various sectors. This shift aligns with broader trends emphasizing real-time data, operational efficiency, and adherence to evolving regulatory requirements, reinforcing the continued expansion of the U.S. ATP Assays market.

Furthermore, growing awareness of biosafety and quality assurance standards across healthcare, food production, and environmental sectors supports sustained investment in ATP assay technologies. Laboratories and production facilities are placing increased emphasis on minimizing contamination risks and meeting regulatory guidelines set by agencies such as the FDA and USDA. This has led to greater integration of ATP assays within quality control frameworks, particularly within environmental monitoring and routine screening workflows. With organizations prioritizing compliance and efficiency, the U.S. ATP Assays market is expected to benefit from stable, cross-sector demand for fast, accurate, and scalable testing solutions.

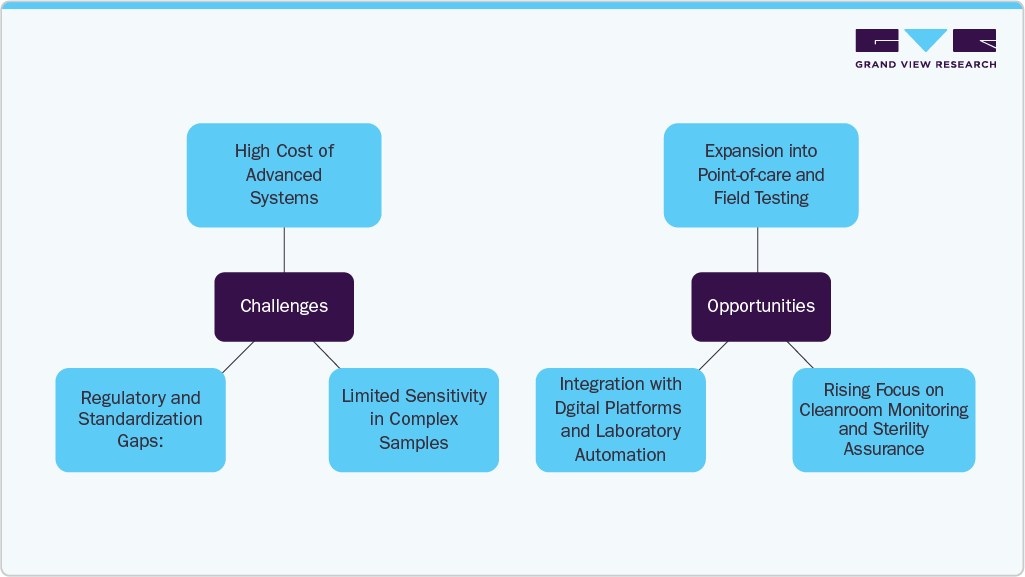

Challenges and Opportunities

-

Challenges:

-

High Cost of Advanced Systems: Adoption of next-generation ATP assay platforms with integrated automation and cloud connectivity can be cost-prohibitive for small- to mid-sized labs, limiting widespread uptake across non-institutional settings.

-

Limited Sensitivity in Complex Samples: ATP assays may show reduced accuracy when analyzing samples with high background interference or mixed microbial populations, affecting their reliability in certain diagnostic and environmental testing applications.

-

Regulatory and Standardization Gaps: While widely used, ATP assays are not uniformly regulated across all application areas, creating inconsistencies in validation protocols and complicating compliance for laboratories operating under multiple standards (e.g., FDA, USDA, EPA).

-

-

Opportunities:

-

Expansion into Point-of-Care and Field Testing: Miniaturized and portable ATP assay kits are creating new opportunities in point-of-care diagnostics and on-site environmental testing, especially for water quality, food hygiene, and emergency health surveillance.

-

Rising Focus on Cleanroom Monitoring and Sterility Assurance: Growth in biopharmaceutical manufacturing and cell therapy production is increasing the need for rapid, real-time contamination detection-positioning ATP assays as key tools in GMP-compliant cleanroom environments.

-

Integration with Digital Platforms and Laboratory Automation: Opportunities exist in linking ATP assays with lab information management systems (LIMS), AI-driven analytics, and robotic sample handling-helping labs improve throughput, traceability, and regulatory reporting.

-

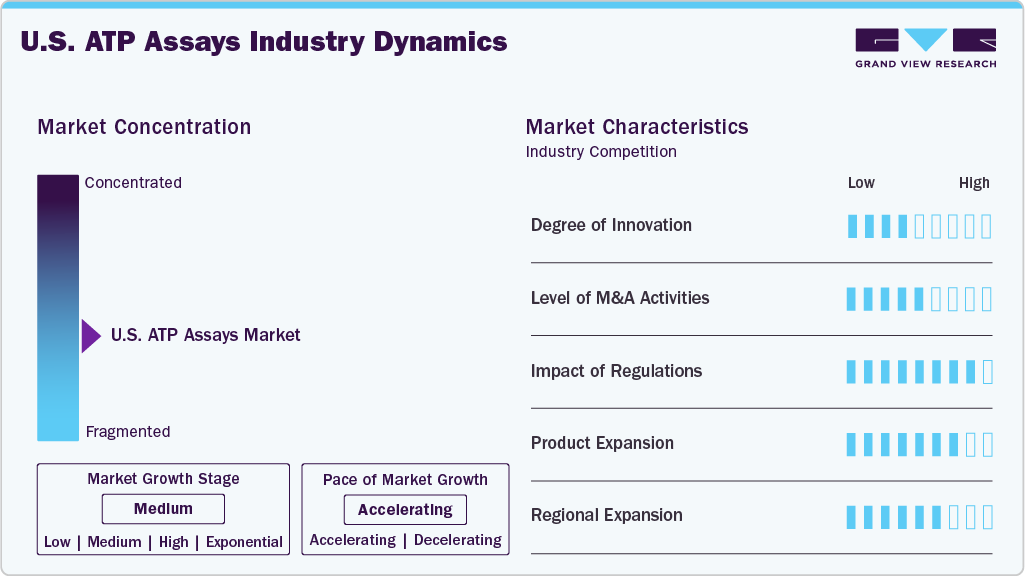

Market Concentration & Characteristics

The U.S. ATP Assays market demonstrates a moderate to high degree of innovation, especially in luminescence-based detection platforms and integrated assay systems. Recent developments focus on improving assay sensitivity, reducing turnaround time, and supporting real-time microbial detection. Innovations in reagent chemistry, miniaturized luminometers, and cloud-enabled systems are expanding applications in high-throughput drug screening, clinical diagnostics, and contamination control. The integration of ATP assays into automated laboratory workflows and quality monitoring systems continues to align with broader goals in precision testing and operational efficiency.

Mergers and acquisitions in the U.S. ATP Assays market are primarily centered around expanding product portfolios in microbial detection and environmental monitoring. Key players are acquiring smaller assay technology firms and food safety service providers to strengthen their presence across healthcare, pharmaceutical, and food industries. Recent transactions are aimed at enhancing assay capabilities, improving distribution channels, and offering bundled testing solutions. While the M&A activity remains selective, it reflects a strategic intent to consolidate expertise in rapid bioluminescence-based testing and expand market reach across multiple End User sectors.

Regulatory oversight plays a critical role in shaping the U.S. ATP Assays market, particularly in applications related to pharmaceutical manufacturing, food safety, and environmental testing. Compliance with standards set by the FDA, USDA, and EPA is essential for product validation and deployment. In pharmaceutical settings, ATP assays are often used within frameworks such as cGMP and 21 CFR Part 11 to ensure contamination control and data traceability. In addition, food safety applications must meet FSMA-driven hygiene monitoring requirements. While regulations help promote product quality and safety, they also necessitate ongoing investment in assay validation and documentation.

The U.S. ATP Assays market is experiencing steady product expansion driven by growing demand across diverse application areas. Manufacturers are introducing ATP-based testing kits with enhanced sensitivity, faster detection times, and broader compatibility with automated systems. New product lines are being tailored for specific use cases, such as water quality testing, cleanroom monitoring, and pharmaceutical QC. In addition, the development of portable ATP luminometers and ready-to-use reagent formats is enabling greater flexibility for both laboratory and field-based applications. This expansion is helping to address varied industry needs while strengthening product positioning across End User segments.

Regional expansion in the U.S. ATP assays market is centered on improving accessibility and operational reach across industrial, clinical, and environmental testing facilities nationwide. While major urban hubs continue to drive demand through advanced pharmaceutical and biotech operations, manufacturers and service providers are increasingly targeting smaller cities and rural areas through distributor partnerships, mobile testing solutions, and compact assay platforms. These efforts aim to support decentralized contamination monitoring, food safety testing, and public health screening in underserved regions. Collaborations with local laboratories, food producers, and public health agencies are helping extend the reach of ATP-based testing, ensuring broader compliance and real-time detection capabilities across diverse geographic settings.

Type Insights

Based on type, luminometric ATP assays accounted for the largest share of the U.S. ATP assays market in 2024. This dominance is due to their high sensitivity, fast results, and ability to work across many applications-from drug testing to food safety and environmental monitoring. These assays help detect very small amounts of ATP, making them helpful in checking cell health, identifying contamination, and ensuring product safety in regulated industries. As U.S. laboratories and production facilities focus more on quality control and regulatory compliance, luminometric ATP assays are widely used to support accurate and reliable testing. Products such as the Luminescent ATP Detection Assay Kit are commonly used to measure cell activity, assess drug effects, and support research in areas such as microbiology, cancer, and toxicology-using a simple process of breaking the cells, adding reagents, and measuring light output with a luminometer.

Enzymatic ATP assays are expected to grow at the fastest CAGR in the U.S. ATP assays market during the forecast period. These assays use the enzyme luciferase to trigger a bioluminescent reaction between ATP and luciferin, producing light that can be accurately measured. Because this reaction is particular to ATP, enzymatic assays allow for precise detection even at very low concentrations. This makes them highly valuable in clinical diagnostics, pharmaceutical research, and environmental testing in the U.S. In healthcare, they detect microbial contamination, check hospital cleanliness, and identify infections. In pharmaceutical labs, enzymatic ATP assays test cell health and measure how drugs affect biological systems. Their reliability and sensitivity support high standards in research and quality control.

Application Insights

The drug discovery & development segment held the largest share of the U.S. ATP assays market in 2024. This dominance is driven by ATP assays' vital role in screening and optimizing potential drug candidates, especially for evaluating cell viability, metabolic activity, and cytotoxicity. Measuring cellular ATP levels enables researchers to quickly assess drug effects and prioritize promising leads, fueling demand for high-throughput, reliable tools in pharmaceutical settings. Buoyed by sustained investment in drug R&D and the need for faster screening platforms, this segment's growth remains strong.

A notable instance is the April 2024 launch of Reaction Biology's HotSpot ATP‑Max KinomeScreen in the U.S., unveiled at the AACR (American Association for Cancer Research) Annual Meeting in San Diego. This advanced ATP-centered kinase profiling assay operates at physiologically relevant ATP concentrations (1 mM) across a broad kinase portfolio. It uses a gold‑standard radiometric filter binding format, enabling more precise and relevant data during kinase inhibitor screening. The innovation underscores how key players are enhancing ATP assay sophistication to better align with the rigorous demands of U.S.-based drug discovery pipelines.

Clinical diagnostics is expected to grow at the fastest CAGR in the U.S. ATP Assays market during the forecast period. In hospitals and clinics, ATP assays are widely used to check for harmful microorganisms and ensure proper hygiene. These tests help reduce the risk of healthcare-associated infections (HAIs) by allowing quick and reliable detection of bacteria, viruses, and other pathogens. ATP assays are often used on surfaces, medical tools, and other critical areas to monitor cleanliness and sterility. Their value increases when combined with other diagnostic tools such as PCR and next-generation sequencing (NGS), offering more detailed and accurate results. With more U.S. healthcare facilities aiming to improve infection control and diagnostic speed, ATP assays are becoming an essential part of clinical testing strategies.

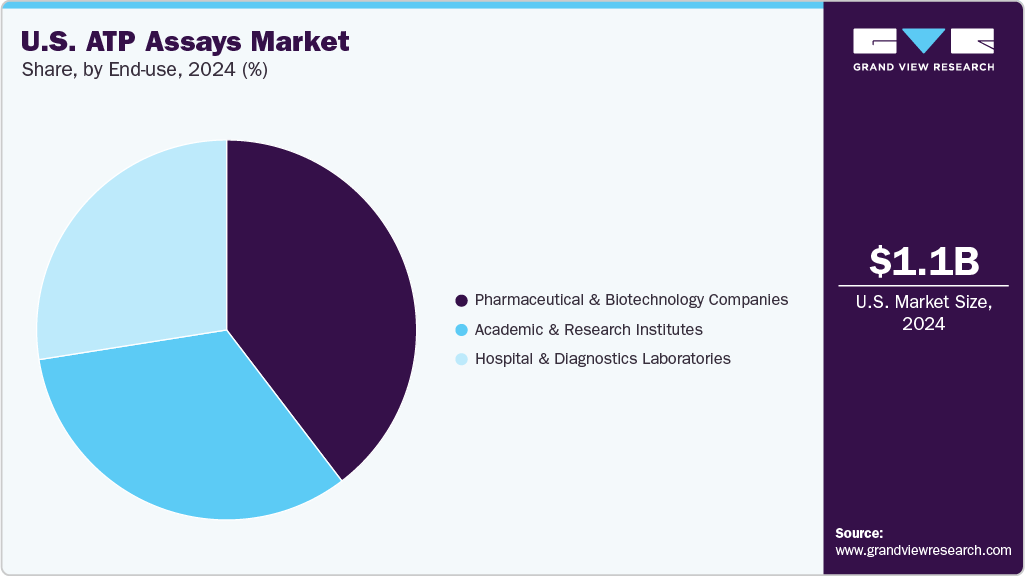

End Use Insights

Pharmaceutical and biotechnology companies held the largest share of 39.63% of the U.S. ATP Assays market in 2024 and are also expected to grow at the fastest CAGR during the forecast period. These companies depend on ATP assays throughout the drug discovery and development process to test how drug candidates affect cells. Researchers can understand how a drug impacts cell health, metabolism, and survival by measuring ATP levels. This helps them identify effective treatments and remove toxic ones early in development. ATP assays are especially useful in cancer research and antibiotic development, where they are used to check how well a drug stops the growth of cancer cells or harmful microbes. With the growing focus on high-throughput testing, precision medicine, and strict regulatory standards, ATP assays are a critical tool for pharmaceutical and biotech labs across the U.S.

In diagnostic laboratories, ATP assays play a valuable role in supporting research and development across multiple fields. Pharmaceutical labs in the U.S. frequently use these assays to screen for cytotoxic effects and assess how well potential drugs work. The high sensitivity of enzymatic ATP assays allows researchers to perform large-scale screenings quickly and accurately, helping to identify promising drug candidates more efficiently.

Key U.S. ATP Assays Company Insights

Some Key players operating in the ATP assays market aim to drive innovation, expand market reach, and strengthen their competitive position. The players are seeking regulatory approvals, such as FDA and CE-IVD, for their products to ensure compliance and expand their market access.

Key U.S. ATP Assays Companies:

- Thermo Fisher Scientific

- Promega Corporation

- PerkinElmer Inc.

- Becton, Dickinson and Company (BD)

- Lonza Group Ltd.

- Danaher Corporation

- Abcam plc

- Quest Diagnostics Incorporated

- Biomerieux SA

- 3M Company

Recent Developments

-

In March 2025, Biotium launched the Steady‑ATP HTS Viability Assay Kit, a luminescent, luciferase-based solution designed for high-throughput screening in U.S. research labs. The one-step, mix-and-measure format offers high sensitivity-capable of detecting ATP in as few as 16 cells per well-and features a stable light signal lasting over five hours. This launch supports growing demand for cost-effective and reliable cell viability testing in pharmaceutical and biotechnology settings, reflecting the market's shift toward efficient ATP-based assay tools for large-scale drug discovery applications.

-

In December 2024, Hygiena acquired Nexcor Food Safety Technologies Inc., aiming to strengthen its ATP and environmental monitoring solutions. The acquisition combines Hygiena’s bioluminescence-based hygiene monitoring systems with Nexcor’s KLEANZ and CAMS‑PM sanitation management software, enhancing end-to-end contamination control capabilities.

-

In April 2024, Reaction Biology (Malvern, PA) launched its HotSpot™ ATP‑Max KinomeScreen platform, a kinase‑testing service that measures inhibitor potency at a physiological 1 mM ATP, giving drug‑discovery teams higher‑sensitivity data for compound ranking. The company highlighted the new offering at the American Association for Cancer Research (AACR) Annual Meeting 2024 in San Diego,

U.S. ATP Assays Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.13 billion

Revenue forecast in 2033

USD 1.53 billion

Growth rate

CAGR of 3.87% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific; Promega Corporation; PerkinElmer Inc.; Becton, Dickinson and Company (BD); Lonza Group Ltd.; Danaher Corporation; Abcam plc; Quest Diagnostics Incorporated; Biomerieux SA; 3M Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. ATP Assays Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S. ATP assays market on the test type,application, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Luminometric ATP Assays

-

Enzymatic ATP Assays

-

Bioluminescence Resonance Energy Transfer (BRET) ATP Assays

-

Cell-based ATP Assays

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021- 2033)

-

Drug Discovery and Development

-

Clinical Diagnostics

-

Environmental Testing

-

Food Safety and Quality Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotechnology Companies

-

Academic and Research Institutes

-

Hospital and Diagnostics Laboratories

-

Frequently Asked Questions About This Report

b. The global U.S. ATP assays market size was estimated at USD 1.10 billion in 2024 and is expected to reach USD 1.13 billion in 2025

b. The global U.S. ATP assays market is expected to grow at a compound annual growth rate of 3.87% from 2025 to 2033 to reach USD 1.53 billion by 2033.

b. Based on type, luminometric ATP assays accounted for the largest share of the U.S. ATP assays market in 2024. This dominance is due to their high sensitivity, fast results, and ability to work across many applications—from drug testing to food safety and environmental monitoring.

b. Some key players operating in the U.S. ATP assays market include Thermo Fisher Scientific; Promega Corporation; PerkinElmer Inc.; Becton, Dickinson and Company (BD); Lonza Group Ltd.; Danaher Corporation; Abcam plc; Quest Diagnostics Incorporated; Biomerieux SA; 3M Company.

b. Key factors that are driving the market growth include increasing demand for rapid, reliable testing methods across drug discovery, clinical diagnostics, environmental monitoring, and food safety applications. In drug development and clinical research, ATP assays play a key role in cell viability and cytotoxicity studies, while their use in environmental testing and food quality control supports contamination detection and hygiene verification.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.