- Home

- »

- Biotechnology

- »

-

U.S. Cell Therapy Raw Materials Market Size Report, 2033GVR Report cover

![U.S. Cell Therapy Raw Materials Market Size, Share & Trends Report]()

U.S. Cell Therapy Raw Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Media, Sera, Antibodies, Reagents & Buffers), By End-use (Biopharmaceutical & Pharmaceutical Companies, CROs & CMOs), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-698-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

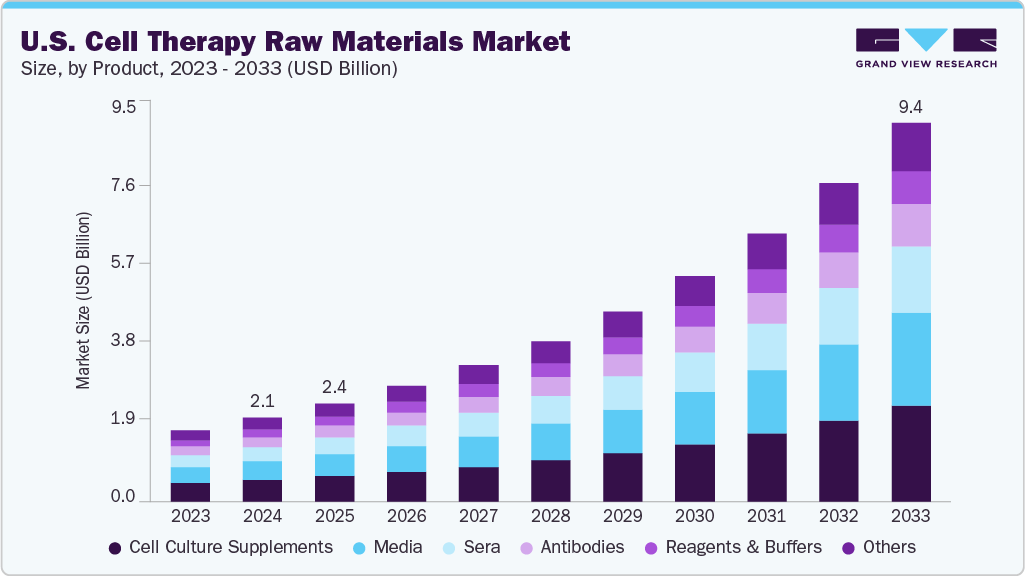

The U.S. cell therapy raw materials market size was estimated at USD 2.06 billion in 2024 and is projected to reach USD 9.37 billion by 2033, growing at a CAGR of 18.42% from 2025 to 2033. Growth is driven by the rising number of cell therapy approvals, increasing demand for GMP-grade and high-quality inputs, and advancements in regenerative medicine. In addition, expanding biomanufacturing capabilities, increased funding, and the growing role of CDMOs in therapeutic development are further propelling the market forward, as the industry prioritizes reliable, scalable, and regulatory-compliant raw materials to support clinical and commercial cell therapy programs.

Expanding Therapy Pipelines Drive Demand for Components

The U.S. cell and gene therapy raw materials industry is experiencing strong growth, driven by the increasing number of personalized therapies and the complexity of their manufacturing processes. As cell therapies transition from research to commercialization, demand for high-grade raw materials-such as culture media, plasmid DNA, growth factors, and viral vectors-has surged. Developers seek products that offer consistency, scalability, and regulatory compliance to support both clinical and commercial-scale production. Moreover, rising investments, facility expansions, and technology upgrades by raw material suppliers have further accelerated market momentum, strengthening the infrastructure supporting advanced therapy development.

Cell Therapy Pipeline in the U.S.

Therapy/Developer

Indication

Status

Anito‑cel (Arcellx/Gilead)

Multiple myeloma (CD19)

Phase II (iMMagine‑1)

Bioheng CTD402

UCAR‑T for T‑cell ALL/lymphoma

Phase Ib/II

OTL‑203 (Orchard Therapeutics)

MPS‑IH (Hurler syndrome)

Phase III (enrollment complete)

NGN‑401/NGN‑201 (Neurogene)

Rett syndrome, Angelman syndrome

Phase I

Source: Citeline, Industry Journals, Primary Interviews, Grand View Research

This demand is reflected in the expanding pipeline of cell and gene therapy candidates progressing through clinical trials. As seen in the accompanying table, therapies like Anito‑cel (Arcellx/Gilead) and OTL‑203 (Orchard Therapeutics) are advancing through Phase II and III stages, targeting complex conditions such as multiple myeloma and Hurler syndrome. These trials, along with others in early and mid-development phases, illustrate the diversity of indications and technologies being pursued.

The development of such therapies relies heavily on specialized raw materials for reproducible and compliant manufacturing. As a result, strategic partnerships between therapy developers and raw material providers are becoming increasingly common, highlighting the foundational role of raw materials in supporting innovation and driving long-term growth across the U.S. cell therapy landscape.

Manufacturing Infrastructure Gains Momentum

The U.S. cell therapy ecosystem is undergoing a significant transformation, driven in part by increased capital investments in domestic manufacturing infrastructure. Leading industry players such as Thermo Fisher Scientific, Danaher Corporation, and RoosterBio have strategically expanded their operations within the country, enabling greater control over quality, scalability, and regulatory compliance. These investments are not only enhancing the availability of high-grade raw materials-such as media, reagents, viral vectors, and plasmid DNA-but also improving turnaround times and streamlining supply chain resilience. With the push toward advanced therapy medicinal products (ATMPs), ensuring robust, GMP-compliant manufacturing capabilities has become a strategic priority for stakeholders across the value chain.

This shift toward localized, high-capacity production facilities helps mitigate risks associated with supply disruptions, while also supporting the needs of a growing number of clinical-stage and commercial-stage cell therapies. For example, Thermo Fisher’s expansion of its Maryland cell therapy site, Danaher’s strengthening of its Cytiva operations, and RoosterBio’s bioprocess innovation efforts all reflect the broader industry trend. These moves not only align with the rising demand for consistent, scalable manufacturing inputs but also cater to the evolving expectations of biopharma companies, CMOs, and CROs. As the U.S. strengthens its position as a global hub for cell therapy development, infrastructure investments are expected to play a critical role in shaping the upstream raw material landscape.

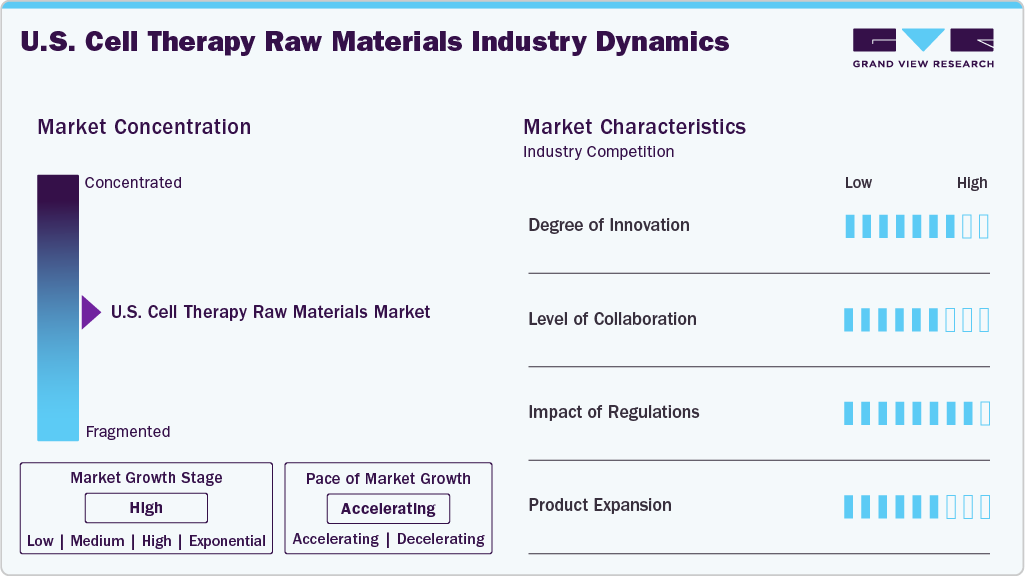

Market Concentration & Characteristics

Innovation in the U.S. cell therapy raw material industry is driven by the complex and highly specialized nature of raw materials required for cell expansion, gene modification, and preservation. Manufacturers are developing novel, high-purity reagents and media to meet stringent regulatory and therapeutic standards.

In the U.S. cell therapy raw materials industry, leading biopharmaceutical companies collaborate with suppliers to co-develop specialized reagents, culture media, and growth factors tailored to specific therapeutic applications. Likewise, academic institutions and research organizations partner with raw material manufacturers to drive innovation in cell culture media, biomaterials, and cell expansion technologies.

Regulatory frameworks in the U.S., led by the FDA, significantly influence the cell therapy raw materials market by enforcing stringent quality, safety, and traceability standards. Compliance with GMP guidelines and rigorous documentation requirements drives demand for high-grade, validated raw materials, impacting supplier selection, product development timelines, and overall manufacturing scalability in the cell therapy space.

A product expansion scenario in the U.S. cell therapy raw materials industry involves launching advanced, GMP-grade cytokines, growth factors, or xeno-free culture media tailored for emerging cell therapies like CAR-T and iPSC-based treatments. Companies may also expand into ancillary materials such as cell preservation agents or closed-system consumables to support end-to-end manufacturing workflows.

Product Insights

The U.S. cell therapy raw material industry is segmented into media, sera, cell culture supplements, antibodies, reagents & buffers, and others. The cell culture supplements segment led the market with the largest market share of 25.35% in 2024. Due to the rising demand for optimized cell growth conditions, increased use of customized supplements for specific cell types, and growing adoption of defined, serum-free formulations to ensure consistency, scalability, and regulatory compliance in clinical-grade cell therapy production.

The media segment is expected to grow at the fastest CAGR during the forecast period. This is attributed to the growing demand for serum-free, xeno-free, and chemically defined media to ensure consistency and regulatory compliance is a key driver. The rise of advanced therapies like CAR-T and iPSCs has also increased the need for specialized media formulations. In addition, strategic collaborations between biopharma firms and media suppliers, along with increased investments in cell therapy manufacturing infrastructure across the U.S., are further propelling the growth of this segment.

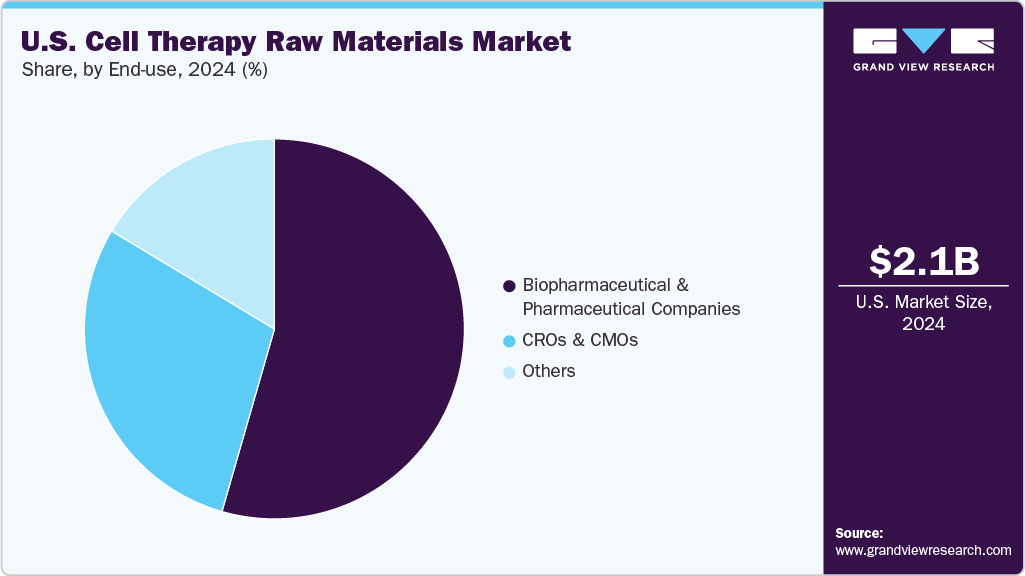

End Use Insights

Based on the end use, the market is segmented into biopharmaceutical & pharmaceutical companies, CMOs & CROs, and others. The biopharmaceutical & pharmaceutical companies segment led the market with the largest revenue share of 54.46% in 2024. This is driven by increasing in-house cell therapy development, rising clinical trial volumes, and growing demand for high-quality raw materials. For instance, in January 2025, Bionova Scientific announced the launch of a GMP-grade plasmid DNA facility in Texas to support gene-modified therapies like CAR-T and iPSCs, strengthening domestic raw material supply.

The CMOs & CROs segment is anticipated to register at the fastest CAGR over the forecast period, driven by increased outsourcing of cell therapy development and manufacturing by small and mid-sized biopharma firms. Rising demand for specialized expertise, cost-efficiency, and scalability in GMP-compliant production is fueling growth. Additionally, expanding clinical pipelines and capacity investments by leading CDMOs to support viral vectors, plasmid DNA, and cell expansion processes are further propelling the segment’s momentum.

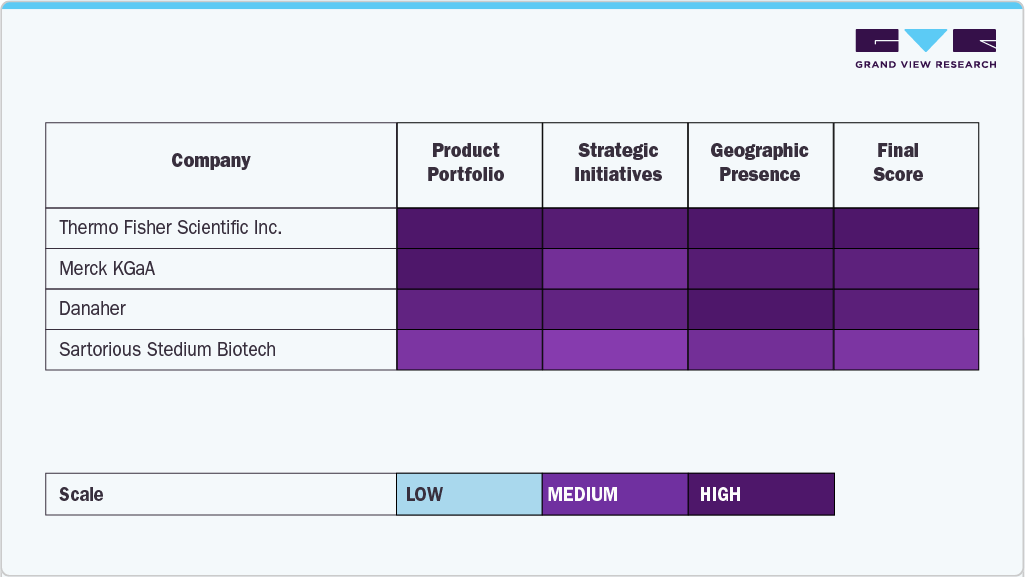

Key U.S. Cell Therapy Raw Materials Company Insights

The U.S. cell therapy raw materials industry is characterized by the presence of several established players offering a wide range of GMP-grade materials, reagents, and customized solutions. Thermo Fisher Scientific Inc. leads the market owing to its comprehensive product portfolio, including cell culture media, growth factors, reagents, and analytical services tailored for advanced therapies. The company’s continued investment in bioproduction capacity and partnerships with cell therapy developers solidifies its dominant position. Merck KGaA (MilliporeSigma in the U.S.) also holds a significant share, driven by its innovations in chemically defined media, scalable raw material solutions, and its BioReliance testing services that support regulatory compliance.

Danaher, through its subsidiaries such as Cytiva, plays a critical role in the supply of high-purity reagents, single-use systems, and automated platforms that support cell expansion and manufacturing processes. Sartorius Stedim Biotech has also emerged as a key player with its robust offerings in filtration systems, bioreactors, and media optimization technologies. The company’s focus on integrating digital bioprocessing tools further strengthens its market footprint. Another notable contributor is Actylis, which provides high-quality ingredients and excipients tailored for cell and gene therapy workflows.

Specialized companies such as ACROBiosystems and STEMCELL Technologies cater to niche segments within the raw materials landscape. ACROBiosystems focuses on recombinant proteins, assay kits, and GMP-grade reagents critical for cell characterization and QC processes. STEMCELL Technologies, on the other hand, offers specialized cell culture media and tools used extensively in research and early clinical development of stem cell-based therapies. Grifols, S.A., known for its plasma-derived products, is also expanding into the cell therapy domain with raw material inputs and manufacturing capabilities suited for advanced biologics.

Charles River Laboratories and RoosterBio, Inc. are also strengthening their presence. Charles River provides a wide range of testing, safety, and cell banking services that are increasingly integrated with raw material supply chains. RoosterBio, Inc. has carved out a niche in supplying high-volume human mesenchymal stem/stromal cells (hMSCs) and optimized media systems, enabling rapid development and scale-up of regenerative medicine products. PromoCell GmbH, with its expertise in primary human cells and cell culture systems, serves both academic and industrial end-users seeking high-quality, customizable raw material solutions. These companies are actively engaged in collaborations, acquisitions, and technology integration to address evolving needs in consistency, scalability, and regulatory compliance-key pillars driving competitiveness in the U.S. cell therapy raw materials industry.

Key U.S. Cell Therapy Raw Materials Companies:

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher

- Sartorius Stedim Biotech

- Actylis.

- ACROBiosystems

- STEMCELL Technologies.

- Grifols, S.A.

- Charles River Laboratories

- RoosterBio, Inc.

- PromoCell GmbH

Recent Developments

-

In July 2025, ViroCell Biologics partnered with AvenCell Therapeutics to manufacture and supply a GMP-grade retroviral vector for AvenCell’s allogeneic CAR-T candidate, AVC-203. The collaboration highlights the growing reliance on specialized CDMOs for high-quality viral vector production to support scalable cell therapy development and clinical advancement.

-

In June 2025, ProBio opened a flagship GMP-grade plasmid and viral vector manufacturing facility in New Jersey. The facility focuses on producing critical raw materials such as plasmid DNA and viral vectors used in gene-modified therapies like CAR-T. This expansion enhances domestic manufacturing capacity and supports scalability within the CMOs & CROs segment.

U.S. Cell Therapy Raw Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.42 billion

Revenue forecast in 2033

USD 9.37 billion

Growth rate

CAGR of 18.42% from 2025 to 2033

Base year for estimation

2023

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Danaher; Sartorius Stedim Biotech Actylis.; ACROBiosystems; STEMCELL Technologies; Grifols, S.A.; Charles River Laboratories; RoosterBio, Inc.; PromoCell GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cell Therapy Raw Materials Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. cell therapy raw materials market report based on the product, and end use:

-

Product Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Media

-

Sera

-

Cell Culture Supplements

-

Antibodies

-

Reagents & Buffers

-

Others

-

-

End Use Scope Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. cell therapy raw materials market size was estimated at USD 2.06 billion in 2024 and is expected to reach USD 2.42 billion in 2025.

b. The U.S. cell therapy raw materials market is expected to grow at a compound annual growth rate of 18.42% from 2025 to 2033 to reach USD 9.37 billion by 2033.

b. Cell culture supplements segment dominated the U.S. cell therapy raw materials market with a share of 25.35% in 2024. This dominance is driven by their critical role in ensuring optimal cell growth, viability, and productivity. Increased adoption in research and clinical manufacturing further fueled segment growth.

b. Some key players operating in the U.S. cell therapy raw materials market include Thermo Fisher Scientific Inc., Merck KGaA, Danaher, Sartorius Stedim Biotech Actylis., ACROBiosystems, STEMCELL Technologies, Grifols, S.A., Charles River Laboratories, RoosterBio, Inc., PromoCell GmbH.

b. Key factors that are driving the U.S. cell therapy raw materials market growth include rising demand for advanced cell therapies and increased R&D investments in regenerative medicine. Technological advancements in manufacturing and favorable regulatory support further accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.