- Home

- »

- Medical Devices

- »

-

Cell Expansion Market Size, Share & Growth Report, 2030GVR Report cover

![Cell Expansion Market Size, Share & Trends Report]()

Cell Expansion Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Culture Flasks & Accessories, Consumables), By Cell Type (Mammalian, Microbial), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-665-3

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Expansion Market Summary

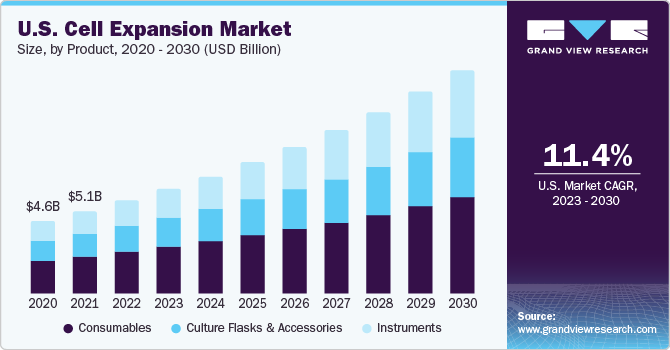

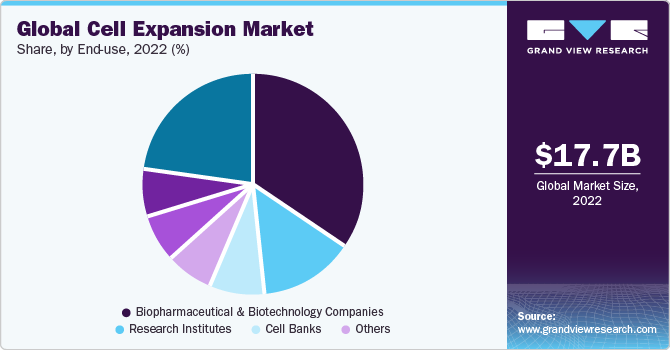

The global cell expansion market size was estimated at USD 17.75 billion in 2022 and is projected to reach USD 47.13 billion by 2030, growing at a CAGR of 12.85% from 2023 to 2030. The increase in the usage of automated solutions in cell expansion applications is one of the primary market drivers.

Key Market Trends & Insights

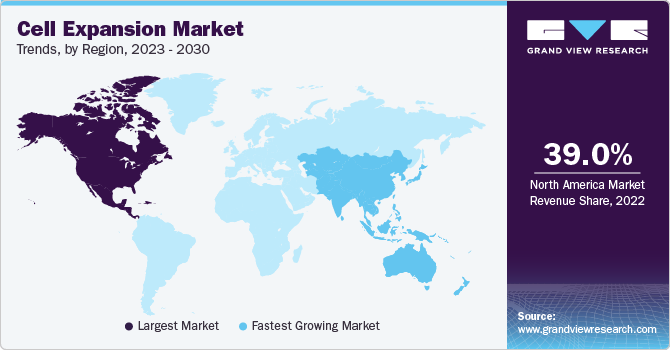

- The North America accounted for the largest revenue share of 39.0% in 2022.

- Based on product, the consumables led the product segment in 2022 and accounted for 45.7% of the overall market share.

- Based on cell type, the mammalian cells segment held the highest revenue share in 2022.

- Based on end-use, the biotechnology & biopharmaceutical companies segment held the largest share of 46.3% in 2022.

- Based on application, the biopharmaceutical segment captured the largest revenue share.

Market Size & Forecast

- 2022 Market Size: USD 17.75 Billion

- 2030 Projected Market Size: USD 47.13 Billion

- CAGR (2023-2030): 12.85%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Automated systems minimize the manpower and costs incurred during the production of Cell Therapy Products (CTP), gene therapies, and other biologics, leading to robust and reliable processes.

Key players engaged in CTP development are expanding their product lines to address the significant rise in global demand for these therapy products. For instance, in January 2021, Thermo Fisher Scientific introduced the Gibco CTS OpTmizer Pro Serum Free Media platform for developing and expanding human T lymphocytes for cell therapy developers using allogeneic workflows. This platform targets donor cell metabolism, making it suitable for allogeneic, off-the-shelf cell therapies.

The paradigm shift toward Single-Use Systems (SUS) offers substantial production advantages in CTP manufacturing. SUS eliminates concerns of cross-contamination and culture contamination caused due to inappropriate sterilization. SUS also allows the production of CTP with high cell densities and offers cost savings in the long run. Thus, a rise in the adoption of SUS surges the development of CTP, which boosts market growth.

Cellular therapies are constantly gaining popularity in the life sciences industry. A significant rise in funding from private & government organizations and initiatives undertaken by them to encourage the development of cellular therapies act as drivers for the market. The International Society for Stem Cell Research is involved in identifying stem cell-related funding opportunities across biomedical research applications.

Substitution of serum and other incompatible reagents is essential to control the quality of the product in CTP manufacturing. Several research studies have validated that applying serum-free media controls product quality. Researchers have also developed an optimization platform that integrates high-throughput tools with a differential evolution-based algorithm, which acts as an automated effective optimization strategy for serum-free culture formulations. In the third quarter of 2022, Lonza received commercial approval for its two cell and gene therapies, SKYSONA and ZYNTEGLO.

Product Insights

Consumables led the product segment in 2022 and accounted for 45.7% of the overall market share. The segment is furthermore estimated to retain its dominant position throughout the forecast years. The availability of a wide range of commercial media and reagent products that are dedicated to specific types of cells contributes to the large revenue share of this segment. In addition, these products are convenient, ready to use, and are also available as serum-free formulations.

For instance, in May 2023, Lonza introduced TheraPEAK T-VIVO Cell Culture Medium, a chemically defined medium optimized for the manufacturing of CAR T-cells. This non-animal-origin medium enhances consistency and process control and streamlines regulatory approval, accelerating cell therapy development.

The instruments segment is expected to register the fastest CAGR of 13.18% over the forecast period, owing to the automation trend in bioreactors and other expansion platforms to enhance the efficiency of culturing procedures. The advent of automated platforms standardizes the process and facilitates process tracking while reducing hands-on time; therefore, it enables more effective use of the time of skilled personnel.

In September 2022, Terumo Blood and Cell Technologies (Terumo BCT) launched the Quantum Flex Cell Expansion System, a bioreactor platform for cell and gene therapy (CGT) development and manufacturing. The platform aims to automate processes, reduce time-consuming steps, and streamline technology transfers. In this manner, the continuous commercialization and introduction of automated culturing equipment also is poised to drive revenue generation in the instruments segment.

Cell Type Insights

The mammalian cells segment held the highest revenue share in 2022 and is expected to remain dominant during the forecast period, as these culture systems are highly preferred in the production of complex protein therapeutics. This is because these systems are pharmacokinetically and functionally relevant to post-translational modifications in humans. Therefore, most of the biopharmaceuticals, including monoclonal antibodies, specific interferons, thrombolytics, and various therapeutic enzymes, are produced using these culture systems.

Differentiated human cells accounted for substantial revenue share as these cells perform a specific function in the body. Differentiated cells, such as fibroblasts, have gained immense importance in cutaneous wound healing and skin bioengineering, augmenting segment growth. Moreover, the evaluation of 3D Gingival Fibroblast (GF) toroids as a feasible and simple in vitro assay for biomaterial testing has expanded their usage rate.

Human stem cells have gained significant traction and are expected to witness the fastest CAGR during the forecast period. The exponential growth in research activities in this sector and the huge success of regenerative medicines are among the key factors attributed to the segment’s rapid growth rate. Furthermore, the implementation of automated, robotic, and closed production systems in the production of clinical-grade mesenchymal stem cells drives the segment’s expansion.

For instance, in June 2022, STEMCELL Technologies and PBS Biotech announced a supply partnership to make the PBS-MINI Bioreactor available for researchers to scale up human pluripotent stem cell (hPSC) cultures. This partnership enables reliable and scalable suspension culture, enabling scientists to obtain the required quantity and quality of cells needed for advanced research.

End-use Insights

The biotechnology & biopharmaceutical companies segment held the largest share of 46.3% in 2022 and is poised to expand further at a significant growth rate. The broadening horizon of cell-based therapeutics in the healthcare industry is one of the major factors contributing to the large share of biopharmaceutical companies. For instance, cellular-based therapies have gained immense popularity in regenerative medicine, with constant improvements in injectable cell delivery systems for various clinical applications.

In March 2023, TrakCel and Lonza achieved a significant milestone through the combination of the former’s ‘OCELLOS’ cell orchestration platform with Lonza's manufacturing platform MODA-ES. This integration ensures secure manufacturing steps, checks, and data flow within the cell and gene therapy supply chain, ensuring seamless patient journey connections.

The research institutes segment is poised to register the fastest CAGR of 14.37% through 2030, as researchers are engaged in several studies in the biomedical field. In March 2022, an infrastructure network was established at seven university hospitals in North Rhine-Westphalia, Germany, to implement novel cell therapies against COVID-19 and future viral pandemics. The University Hospital of Cologne is conducting research into COVID-19 cell therapy. The Ministry of Economic Affairs, Innovation, Digitalization and Energy of North Rhine-Westphalia funded the projects with 7.75 million euros.

Application Insights

The biopharmaceutical segment captured the largest revenue share owing to an increase in the approval rate of biopharmaceutical products in the past few years. The entry of new biopharmaceutical companies and the proliferation of bioprocessing technologies further drive the development of biopharmaceuticals, which, in turn, boosts the expansion procedures conducted during bio-production.

In addition, single-use technologies are gaining immense traction in manufacturing cellular therapies on a commercial level. The introduction of alternative planar cell expansion technologies, such as compact multi-layer bioreactors, has been witnessed in recent years. This has sufficed the requirement of closed systems that limit the potential risks associated with contamination and maintain control of large-scale upstream production and unit production.

On the other hand, the vaccine production segment is expected to witness the fastest growth rate during the forecast period in the cell expansion market, due to the rapid advancement of cell-based vaccine production in recent years. The production of these vaccines offers a cost-effective manufacturing solution while accelerating the development process.

Regional Insights

North America accounted for the largest revenue share of 39.0% in 2022. The region is anticipated to retain its leading position in the coming years due to a rise in funding initiatives by government agencies, which has accelerated the manufacturing of stem cells and the development of regenerative medicines and cellular therapy products. This, in turn, drives the demand for cell expansion platforms in this region.

Asia Pacific is expected to witness the fastest CAGR of over 15.0% during the forecast period, due to increasing initiatives by several local pharmaceutical and biotechnology companies to develop and commercialize their cellular therapies. In September 2022, Alkem Laboratories, in collaboration with Stempeutics, launched the first off-the-shelf cell therapy product, "StemOne," for treating knee osteoarthritis in India. The product has received regulatory approval from the Drugs Controller General of India, making it the first allogeneic cell therapy product approved for commercial use in the country.

Key Companies & Market Share Insights

Key market participants are undertaking several initiatives to expand their market presence and maintain a competitive edge. Moreover, they are involved in collaborations & partnership models, product development, agreements, and business expansion strategies in untapped regions.

For instance, in April 2022, STEMCELL Technologies Canada and Applied Cells Inc. joined forces to develop a modern way to separate cells, through the combination of the MARS platform of Applied Cells with STEMCELL's EasySep kits to make isolating cells from different samples easier and more automatic. These samples can be from whole blood, bone marrow, apheresis products, and tissue. The collaboration aims to improve the process of isolation of cells for research and medical purposes, making it more efficient and effective.

In another development, in May 2023, a research agreement was signed by panCELLa and BioCentriq to study stem cell-derived Natural Killer cell expansion technology. The agreement aims to evaluate panCELLa’s feeder cells, which are genetically engineered, to positively impact the expansion rate, total yield, and potency of manufactured NK cells.

Key Cell Expansion Companies:

- Thermo Fisher Scientific, Inc.

- Corning Incorporated

- Merck KGaA

- Miltenyi Biotec

- BD (Becton, Dickinson and Company)

- Terumo BCT, Inc.

- Sartorius AG

- Takara Bio Inc.

- TRINOVA BIOCHEM GmbH

- upcyte technologies GmbH

Cell Expansion Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 20.22 billion

Revenue forecast in 2030

USD 47.13 billion

Growth rate

CAGR of 12.85% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cell type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; GE Healthcare; Corning Incorporated; Merck KGaA; Miltenyi Biotec; BD (Becton, Dickinson and Company); Terumo BCT, Inc.; Sartorius AG; Takara Bio Inc.; TRINOVA BIOCHEM GmbH; upcyte technologies GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Expansion Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cell expansion market report based on product, cell type, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents, Media, & Serum

-

Other Consumables

-

-

Culture Flasks and Accessories

-

Tissue Culture Flasks

-

Bioreactor Accessories

-

Other Culture Flasks and Accessories

-

-

Instruments

-

Automated Cell Expansion Systems

-

Cell Counters

-

Centrifuges

-

Bioreactors

-

Other Instruments

-

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian

-

Human

-

Stem Cells (SCs)

-

Adult SCs

-

Embryonic SCs

-

Induced Pluripotent SCs

-

-

Differentiated Cells

-

-

Animal

-

-

Microbial

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceuticals

-

Tissue Culture & Engineering

-

Vaccine Production

-

Drug Development

-

Gene Therapy

-

Cancer Research

-

Stem Cell Research

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Biotechnology Companies

-

Research Institutes

-

Cell Banks

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell expansion market size was estimated at USD 17.75 billion in 2022 and is expected to reach USD 20.00 billion in 2023.

b. The global cell expansion market is expected to grow at a compound annual growth rate of 12.85% from 2023 to 2030 to reach USD 47.13 billion by 2030.

b. North America dominated the cell expansion market with a share of 39.0% in 2022. A rise in funding initiatives initiated by government agencies has accelerated the manufacture of stem cells and the development of regenerative medicine and cellular therapy products in this region.

b. Some key players operating in the cell expansion market include Thermo Fisher Scientific, Inc; GE Healthcare; Corning Incorporated; STEMCELL Technologies Inc.; Merck KGaA; Miltenyi Biotec; Becton, Dickinson and Company; TERUMO BCT, INC.; Sartorius AG; Takara Bio Inc.; TRINOVA BIOCHEM GmbH; and upcyte Technologies GmbH.

b. Key factors that are driving the market growth include growing trends of tissue engineering, regenerative medicine, and biopharmaceuticals, technological advancements in the field of cell culturing, increase in funding for cell-based research, and advantages of single-use technologies for commercial manufacturing of cell-based products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.