- Home

- »

- Next Generation Technologies

- »

-

U.S. Cloud Gaming Market Size, Industry Report, 2030GVR Report cover

![U.S. Cloud Gaming Market Size, Share & Trends Report]()

U.S. Cloud Gaming Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (File Streaming, Video Streaming), By Gamer Type (Casual Gamers, Avid Gamers), By Device (Smartphones, Gaming Consoles), And Segment Forecasts

- Report ID: GVR-4-68040-228-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cloud Gaming Market Size & Trends

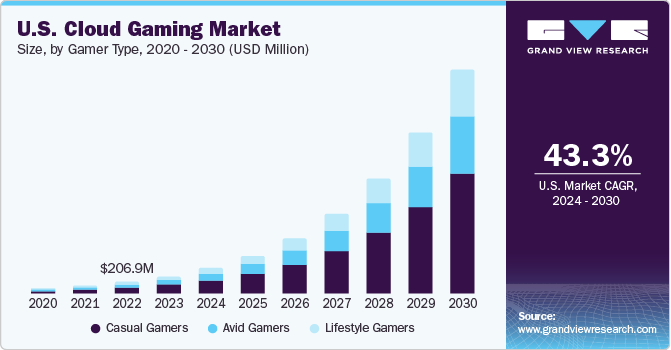

The U.S. cloud gaming market size was estimated at USD 303.8 million in 2023 and is expected to grow at a CAGR of 43.3% from 2024 to 2030. Cloud gaming is built so that users can control and engage in a range of games on web servers, which then broadcast the entire game to the device whereby the cloud is attached. Cloud gaming technology works as incorporation into the cloud technology. It runs on the gaming device's local disc space, requiring less storage on the user's device.

In 2023, the U.S. accounted for over 20.0% of the cloud gaming market. This is mainly due to the rise in cloud computing and data centers in the country. Cloud games reside entirely in data centers and delivery networks, eliminating the need for downloads and changing a user's device into a linked high-resolution terminal, with substantial benefits for both provider and player. Cloud gaming services combine global delivery networks, hyper-scale cloud capabilities, and streaming media services to construct the next era of immersive, interactive, and social entertainment platforms to support this transformation.

Due to the ease of operation and cost benefits, major companies of the video gaming industry have entered the cloud gaming market, while a few are researching and developing their services to enter the market. For instance, Electronic Arts, Inc. is soon to release its cloud game portfolio and has been testing the performance of its cloud gaming services.

The COVID-19 pandemic has also impacted the market growth. New gamers subscribed to cloud gaming services due to limited outdoor activities and social interactions imposed by the government. Major companies took advantage of the increasing interest in video games and launched cloud gaming services to provide an affordable solution and expand the overall gaming market.

Companies are focusing on the expansion of cloud data centers offering an enhanced gaming experience. For instance, AWS invested USD 35 billion in its cloud data centers in Virginia between 2011 and 2020. Cloud data centers enable companies to offer a seamless and low-latency gaming experience to their customers. Similarly, companies are also focusing on developing advanced cloud gaming products and services to attract a larger customer base. The advent of high speed internet is also favoring the growth of the market.

Market Concentration & Characteristics

The market witnesses continuous innovations in the field of technology. With an increasing number of gaming devices and gaming audience, the market is expected to gain a major thrust in upcoming years. Significant innovation in graphics has influenced gaming experiences.

The impact of regulations on the industry is also significant as securing user data in cloud computing is of utmost importance. As a result, regulatory bodies across the country are establishing stringent norms in order to address the security threats involved in video gaming. There are many laws regarding data privacy, copyright, licensing and the content of games.

In the U.S., videogames have been protected as both software and audiovisual works under the dual-layer theory. The U.S. recognizes the right through a combination of the Copyright Act’s exclusive rights of distribution, public performance, and public display.

Level of mergers and acquisitions is also moderate in the market. In November 2021, Intel acquired RemoteMyApp, a cloud gaming service, to enter the cloud gaming market. The acquisition gave Intel access to the RemoteMyApp team of skilled cloud service designers.

The market is characterized by a moderate to high level of end-use concentration. Cloud games saw a drastic rise in the adoption of cloud gaming as people spent most of the time at home during the social isolation period and were stimulated to consumer entertainment services through gaming and streaming. The gaming consoles by Microsoft and PlayStation have been dominating the gaming sector over the past few years.

Device Insights

Based on devices, the gaming consoles segment accounted for the largest market share in 2023. Due to the growing disposable income, people are choosing gaming consoles. Also, certain game titles are available exclusively on specific consoles. For instance, the popular Forza Horizon racing game is available solely on Microsoft Xbox consoles, which attracts users to purchase the Xbox. In addition, the 4K resolution output at 120-hertz capabilities of modern consoles is anticipated to attract lifestyle gamers for an immersive gaming experience.

The smart TV segment is anticipated to grow with a significant CAGR during the forecast period. A smart TV operates as an internet-connected, storage-aware computer geared for entertainment. Smart TVs are specifically tailored TV products that are able to automatically recognize a game console when it's connected. It features a dedicated HDR technology to enhance the gameplay. The gaming smart TVs also feature low input lag, enhancing the gaming experience for the player.

Gamer Type Insights

Based on gamer type, the market can be segmented into casual gamers, avid gamers, and lifestyle gamers and the casual gamers segment accounted for the largest market share in 2023. The segment’s growth can be attributed to the growing popularity of casual games under the freemium model. The trend of recreational and spontaneous gaming is expected to drive the segment. A casual gamer might play games with friends to pass the time and prefers a variety of games that require following a few simple rules and do not require a long-term time commitment or any special skills to play.

Lifestyle gamers segment comprises gamers playing games for more than 22 hours a week. The lifestyle gamers schedule their daily schedule around the game, attend gaming events, form gaming tournament teams, make vast amounts of in-app purchases, acquire gaming related media, and socialize extensively with other players of the game they follow. They prefer more challenging games, both in terms of mental ability and gaming ability.

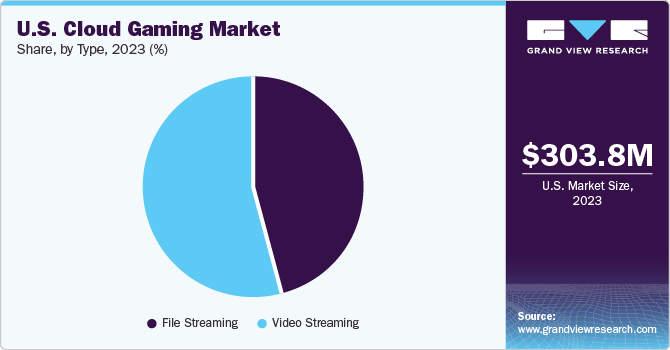

Type Insights

The video streaming segment accounted for the highest market share of around 54.0% in 2023. This can be attributed to the convenience offered by the segment which allows gamers to play any game regardless of hardware requirements. As gaming graphics are processed on the cloud rather than local devices, gamers require a stable and high-speed internet connection to run these games.

The file streaming segment is expected to grow with the highest CAGR over the forecast period. File streaming enables gamers to access the game after downloading a certain percentage of files (about 5%) to their device. It enables the developers to lower the cost of media production and reduce the need for sending patches to players’ devices. Despite having such advantages, players are required to have powerful equipment as the users are still forced to download files to their devices.

Key U.S. Cloud Gaming Company Insights

Some leading companies in market include Amazon.com, Inc., Apple Inc., Electronic Arts, Inc., Google LLC, and Intel Corporation.

-

Electronic Arts, Inc. has developed video games such as Apex Legends, EA SPORTS FIFA, The Sims, Battlefield, Need for Speed (NFS), and many more. The EA studios consist of 20 individual studios along with 6000 and above creators from around the globe. Some of the studios are PopCap, Red Crow, Playdemic, Tiburon and EA Create.

-

Amazon Luna, a cloud-based gaming platform, is designed and operated by Amazon.com Inc. The platform is accessed on devices like Windows PC, Chromebook, and Fire TVs, and it supports the use of controllers like PlayStation 4, Xbox One, mouse, and keyboard.

NVIDIA Corporation, Sony Interactive Entertainment, Ubitus Inc., and Tencent Holdings Ltd. are some other companies in the market.

-

Sony Corporation has entered the cloud gaming industry with its product PlayStation Now in 2014, and the platform allows streaming and downloading of games.

Key U.S. Cloud Gaming Companies:

- Amazon.com Inc.

- Apple Inc.

- Electronic Arts, Inc.

- Google Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

- SONY Interactive Entertainment

- Tencent Holdings Ltd.

- Ubitus Inc.

Recent Developments

-

In May 2023, Microsoft Corporation entered into a multi-year agreement with Nware, a cloud gaming platform, and added it to its game streaming offering. The partnership was consistent with Microsoft Corporation’s plan to outperform competitors and develop a significant cloud gaming service.

-

In October 2021, NVIDIA introduced its next-generation cloud gaming platform, GeForce NOW, which will enable GeForce RTXTM 3080-class gaming exclusively in a new, high-performance subscription tier. The system is expected to give the highest resolutions and frame rates in cloud gaming and the lowest latency.

U.S. Cloud Gaming Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.86 billion

Growth Rate

CAGR of 43.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, device, gamer type

Country scope

U.S.

Key companies profiled

Amazon.com Inc.; Apple Inc.; Electronic Arts, Inc.; GameFly Holdings, LLC; Google LLC; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation; SONY Interactive Entertainment; Tencent Holdings Ltd.; Ubitus Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cloud Gaming Market Report Segmentation

This report forecasts revenue growth at country level and analyzes the industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cloud gaming market report based on type, device and gamer type:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

File Streaming

-

Video Streaming

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smartphones

-

Tablets

-

Gaming Consoles

-

PCs & Laptops

-

Smart TVs

-

Head-Mounted Displays

-

-

Gamer Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Casual Gamers

-

Avid Gamers

-

Lifestyle Gamers

-

Frequently Asked Questions About This Report

b. The U.S. cloud gaming market size was estimated at USD 303.8 million in 2023 and is expected to reach USD 447.1 million in 2024.

b. The U.S. cloud gaming market is expected to grow at a compound annual growth rate of 43.3% from 2024 to 2030 to reach USD 3.86 billion by 2030.

b. The gaming consoles segment accounted for the largest market share of 50.6% in 2023, due to the growing disposable income, people are choosing gaming consoles. Also, certain game titles are available exclusively on specific consoles.

b. Some key players operating in the U.S. cloud gaming market include Amazon.com Inc., Apple Inc., Electronic Arts, Inc., Google Inc., Google LLC, IBM Corporation, Intel Corporation, Microsoft Corporation, NVIDIA Corporation, SONY Interactive Entertainment, Tencent Holdings Ltd., and Ubitus Inc.

b. The growing popularity and demand for gaming across multiple devices such as smartphones, and consoles, among others are anticipated to drive the expansion of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.