- Home

- »

- Consumer F&B

- »

-

U.S. Coffee Creamer Market Size, Industry Report, 2030GVR Report cover

![U.S. Coffee Creamer Market Size, Share & Trends Report]()

U.S. Coffee Creamer Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dairy-based, Non-dairy), By Type, By Form (Liquid, Powder), By Nature, By Flavor (Regular/Unflavored, Flavored), By Packaging Type, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-547-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Coffee Creamer Market Size & Trends

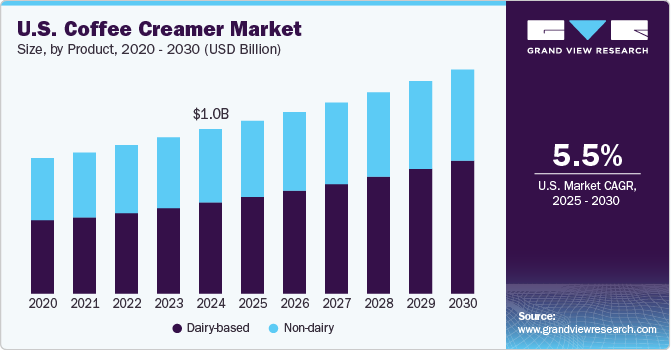

The U.S. coffee creamer market size was estimated at USD 1.02 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2030. The growth is attributable to a rising preference for at-home coffee preparation, shifting consumer taste profiles, and increasing demand for healthier and plant-based alternatives. Coffee creamer, originally a niche product, is now a staple in many American households, expanding beyond traditional dairy-based options to include a wide array of flavored, low-fat, sugar-free, and non-dairy alternatives. The market's growth is bolstered by innovation, premiumization, and the shift towards plant-based diets.

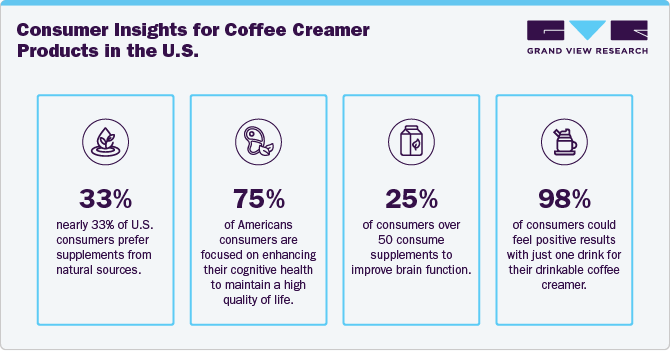

One of the primary drivers of growth in the U.S. coffee creamer market is the surge in coffee consumption at home, spurred by the COVID-19 pandemic when consumers began seeking ways to replicate café-style experiences. In 2022, 79% of U.S. adults drank coffee at home, creating a massive opportunity for creamer manufacturers to diversify product offerings. The shift towards personalized nutrition also fuels demand for options such as sugar-free, gluten-free, lactose-free, and keto-friendly creamers. Health-conscious consumers are actively looking for products that align with their dietary needs, pushing brands such as Nestlé’s Coffee-Mate Natural Bliss to introduce almond milk, coconut milk, and oat milk varieties, which have seen double-digit growth over the past few years.

The U.S. consumers for sugar-free and low-calorie creamers are diverse but share a focus on health and wellness. A significant portion of this demographic includes individuals following low-carb, ketogenic, or diabetic diets. According to the National Coffee Association's 2023 survey, 29% of U.S. coffee drinkers prefer creamers that are low in sugar, with a significant overlap among those monitoring their calorie intake. People with dietary conditions such as Type 2 diabetes are often looking for creamers that do not spike blood sugar levels, making sugar-free options particularly appealing.

The rise of fitness culture, particularly through social media influencers, has also contributed to the demand for low-calorie and sugar-free options. Fitness enthusiasts are often looking for ways to enhance their daily coffee without compromising their dietary goals. This has led to an uptick in demand for products that provide functional benefits, such as energy-boosting MCT oil or collagen protein, without the sugar content. Brands are responding by offering more personalized solutions, with variations catering to different health goals, whether it’s weight management, muscle recovery, or blood sugar control.

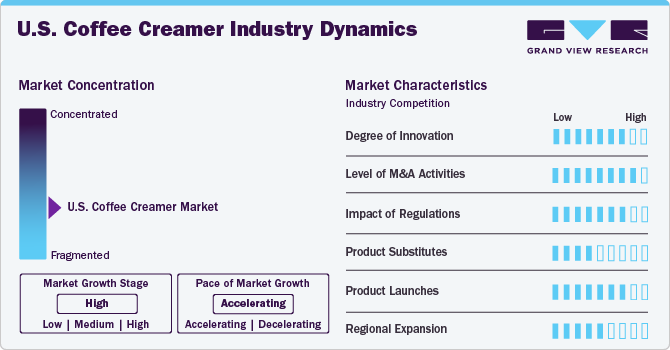

Market Concentration & Characteristics

Product innovation in the U.S. coffee creamer market is characterized by a notable degree of advancement, driven by the exploration of novel compounds, sophisticated delivery mechanisms, and synergistic formulations. Companies are actively engaged in researching and developing innovative nootropic stacks that aim to provide targeted cognitive benefits, often leveraging cutting-edge research in neuroscience and nutritional science.

Merger and acquisition activity in the U.S. coffee creamer space is moderately robust, as larger supplement and wellness companies strategically acquire promising coffee creamer brands to expand their offerings and capture a share of the growing cognitive enhancement market. This reflects a trend of consolidation as the market matures and established players seek to diversify into specialized niches.

The regulatory landscape exerts a considerable impact on the U.S. coffee creamer market, with agencies like the FDA scrutinizing product safety, labeling accuracy, and marketing claims, particularly given the detailed nature of cognitive enhancement and the need to ensure consumer protection. While the coffee creamer market does face competition, the prevalence of direct product substitutes is relatively limited.

Traditional stimulants such as caffeine or energy drinks offer some overlapping benefits but do not fully replicate the targeted cognitive effects sought by coffee creamer users. Finally, the U.S. coffee creamer market exhibits a moderate degree of end-user concentration, with a significant portion of consumers consisting of specific demographics such as professionals seeking performance enhancement, students aiming to improve focus, and health-conscious individuals exploring cognitive wellness solutions, indicating a market that is specialized yet with expanding appeal.

Product Insights

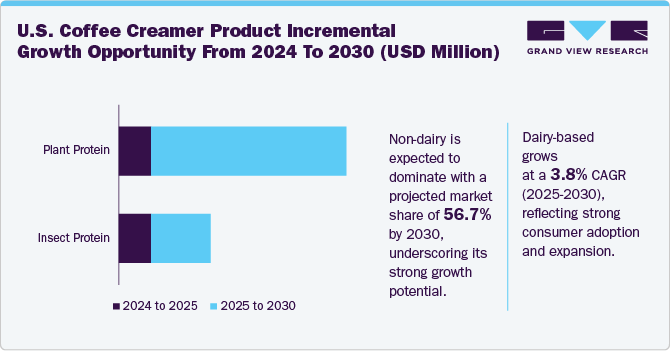

Non-dairy accounted for a market share of 56.7% of the U.S. revenue in 2024. One major driver is the growing consumer preference for plant-based diets and health-conscious living, which has led to increased demand for dairy-free alternatives. In addition, the rising awareness of lactose intolerance and the desire for low-fat and cholesterol-free products have contributed to this trend. For instance, Califia Farms, a prominent player in the market, offers a range of non-dairy creamers made from almond, oat, and coconut milk, catering to consumers seeking dairy-free options. The availability of diverse flavors and convenient formats, such as powdered and liquid creamers, has further enhanced the appeal of non-dairy creamers in the U.S. market.

The dairy-based segment in the U.S. is projected to grow at a CAGR of 3.8% from 2025 to 2030. The growth is driven by the enduring preference for traditional dairy products among consumers who value their taste and texture. In addition, innovations in dairy-based creamers, such as the introduction of new flavors and premium ingredients, continue to attract consumers seeking high-quality products. For instance, Darigold Inc. launched its "Belle" creamer line, featuring simple ingredients like real cream, which appeals to consumers seeking authentic dairy flavors.

Type Insights

High-fat accounted for a share of 62.8% of the U.S. revenue in 2024. Consumer preferences for rich and indulgent coffee experiences drive the growth. The growing popularity of specialty coffee drinks, such as lattes and cappuccinos, which often require high-fat creamers to achieve the desired texture and flavor, has further fueled the segment. In addition, the trend towards premium and gourmet coffee products has led to increased demand for high-fat creamers, which are perceived as offering better taste and quality. For instance, Land O'Lakes offers a range of high-fat creamers that cater to consumers seeking rich and creamy coffee experiences, contributing to the dominance of this segment in the U.S. market.

The fat-free (<0.5 grams) segment in the U.S. is projected to grow at a CAGR of 6.3% from 2025 to 2030, driven by increasing consumer health consciousness and dietary preferences. As consumers become more aware of the health impacts of saturated fats and calories, they are seeking low-fat alternatives that maintain flavor without compromising on nutritional values. For instance, Nestle's Coffee-Mate offers a range of fat-free creamers that cater to this demand by providing a creamy texture without the added fat, appealing to consumers managing their weight or cardiovascular health. In addition, advancements in food technology have enabled the development of fat-free creamers that are both flavorful and satisfying, further enhancing their appeal in the market. This trend aligns with broader shifts towards healthier and more sustainable food options.

Form Insights

Liquid accounted for a share of 57.4% of the U.S. revenue in 2024, driven by the convenience and ease of use offered by liquid creamers, which provide a hassle-free method to enhance the taste and texture of coffee. In addition, the growing trend of replicating cafe-quality coffee at home has increased demand for liquid creamers, as they allow consumers to easily create specialty coffee drinks like lattes and cappuccinos. This combination of convenience, versatility, and the desire for premium coffee experiences has contributed to the dominance of liquid creamers in the U.S. market.

The powder segment in the U.S. is projected to grow at a CAGR of 5.9% from 2025 to 2030. The convenience and affordability of powdered creamers are often priced lower than liquid alternatives and offer a longer shelf life. In addition, the ease of storage and transportation of powdered creamers makes them appealing to both consumers and retailers. For instance, Nestle's Coffee-Mate powdered creamers are widely available and offer a variety of flavors, catering to diverse consumer preferences. The growing demand for at-home coffee brewing also supports this trend, as consumers seek convenient and cost-effective ways to enhance their coffee experience. Furthermore, innovations in flavor offerings and packaging are expected to further boost the appeal of powdered creamers.

Nature Insights

Conventional accounted for a share of 87.9% of the U.S. revenue in 2024, driven by the widespread availability and consumer familiarity with traditional creamer brands, which often offer a consistent taste and texture that many consumers prefer. In addition, conventional creamers are typically priced lower than organic or natural alternatives, making them more accessible to a broader audience. For instance, Nestle's Coffee Mate is a well-established conventional creamer brand that offers a range of flavors and is widely available in most retail outlets, contributing to its market dominance.

The organic segment in the U.S. is projected to grow at a CAGR of 6.5% from 2025 to 2030. This surge is due to increasing consumer awareness of health and sustainability. Consumers are seeking products with clean labels and free from additives, aligning with broader wellness trends. The growing demand for organic products is also supported by rising disposable incomes and a shift towards environmentally friendly choices. As consumers become more health-conscious and environmentally aware, they are willing to pay a premium for organic coffee creamers, contributing to the segment's growth. This trend is further enhanced by the availability of organic creamers through major retailers such as Whole Foods and Sprouts Farmers Market.

Flavor Insights

Flavored accounted for a share of 64.4% of the U.S. revenue in 2024, driven by consumer preferences for diverse and enhanced coffee experiences. Flavored coffee creamers have become increasingly popular among consumers, leading to their significant demand in recent years. This can be attributed to several factors, such as the growing demand for customization and personalization in the food and beverage industry. Flavored creamers offer a variety of options, ranging from classic flavors like vanilla and caramel to more unique and seasonal options like cinnamon rolls and peppermint.

The regular/unflavored segment in the U.S. is projected to grow at a CAGR of 5.9% from 2025 to 2030, driven by the enduring preference for traditional coffee flavors among consumers who value simplicity and authenticity. In addition, the increasing trend of at-home coffee brewing has led to a rise in demand for basic creamers that allow consumers to customize their coffee without overpowering flavors. The convenience and versatility of unflavored creamers, combined with their affordability, contribute to their steady growth in the market.

Packaging Type Insights

PET bottles accounted for 43.2% of U.S. revenue in 2024. PET bottles are lightweight and shatterproof, making them a more convenient and safer option for consumers to use and transport. They also offer better protection against oxygen and light, which helps preserve the freshness and flavor of the creamer for longer periods. In addition, PET bottles are recyclable, making them a more sustainable packaging option that aligns with the growing demand for eco-friendly products among consumers. The popularity of PET bottles in the market is set to continue as manufacturers continue to invest in product innovation and packaging design to meet changing consumer preferences.

The tetrapacks segment in the U.S. is projected to grow at a CAGR of 6.2% from 2025 to 2030. The increasing demand for convenient and portable packaging solutions that align with the rising trend of on-the-go consumption has boosted the demand. Tetrapacks offer aseptic packaging, which extends shelf life without refrigeration, making them ideal for ready-to-drink coffee and creamer combinations. For instance, many tetrapacks has been innovating in packaging solutions, providing eco-friendly and compact formats that appeal to environmentally conscious consumers. In addition, advancements in Tetrapack technology have improved the sustainability and recyclability of these packages, further enhancing their appeal in the market. This combination of convenience, sustainability, and innovative packaging solutions supports the growth of the Tetrapacks segment.

Distribution Channel Insights

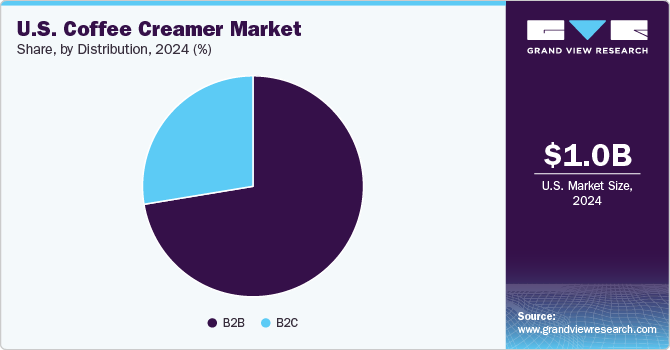

The B2B segment accounted for a share of 54.4% of the U.S. revenue in 2024, driven by significant demand from commercial establishments such as restaurants, cafes, and hotels. The larger share of this segment is attributed to the extensive product usage in restaurants and cafes. Product sales are rising across the globe due to the growing number of cafes and coffee outlets. Moreover, roasted coffee is highly served by various businesses in the hospitality industry including hotels, restaurants, and others, which is expected to propel industry growth.

The B2C segment is projected to grow at a CAGR of 5.9% from 2025 to 2030, driven by the increasing adoption of e-commerce platforms, which provide consumers with a convenient and accessible way to purchase coffee creamers directly. This trend is supported by the growing demand for online grocery shopping, allowing consumers to easily explore and purchase a wide variety of creamer products. For instance, online retailers such as Amazon offer a broad selection of coffee creamers, often with customer reviews and fast delivery options, enhancing the appeal of online shopping for this category.

Key U.S. Coffee Creamer Company Insights

The U.S. coffee creamer market is highly competitive and dynamic, with numerous players driving innovation and shaping trends. These companies focus on developing a wide range of creamers, from traditional dairy to plant-based options, catering to diverse consumer preferences. They have gained recognition for innovative formulations and marketing strategies, appealing to consumers seeking convenient and flavorful coffee experiences. Market leaders expand their product lines to include various formats, enhancing consumer convenience and contributing to market growth.

Key U.S. Coffee Creamer Companies:

- Nestlé S.A.

- Danone

- Chobani LLC

- Land O'Lakes, Inc.

- Heartland Food Products Group

- Leaner Creamer LLC

- Califia Farms, LLC

- nutPods

- Laird Superfood

Recent Developments

-

In January 2025,Organic Valley launched its first organic oat-based creamers nationwide, offering four flavors: vanilla, caramel, oatmeal cookie, and cinnamon spice. As a farmer-owned cooperative, they're sourcing oats directly from their U.S. organic family farms, expanding their product line to meet growing demand for organic plant-based alternatives.

-

In March 2024, Califia Farms launched a line of organic almond milk creamers, focusing on non-GMO, plant-based options with no added sugars. These creamers come in popular flavors like Unsweetened and Vanilla. The product caters to consumers seeking plant-based alternatives that are also certified organic, tapping into the growing trend for sustainable and clean-label ingredients. Califia’s creamers are positioned as a premium choice for coffee lovers looking for healthier and environmentally friendly options.

U.S. Coffee Creamer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.08 billion

Revenue forecast in 2030

USD 1.41 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, form, nature, flavor, packaging type, and distribution channel

Key companies profiled

Nestlé S.A.; Danone; Chobani LLC; Land O'Lakes, Inc.; Heartland Food Products Group; Leaner Creamer LLC; Califia Farms, LLC; nutPods; Laird Superfood

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Coffee Creamer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. coffee creamer market report based on product, type, form, nature, flavor, packaging type, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy-based

-

Non-dairy

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

High-fat

-

Low-fat (<3 grams)

-

Fat-free (<0.5 grams)

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Powder

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Regular/Unflavored

-

Flavored

-

-

Packaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Jars

-

Tetrapacks

-

PET Bottles

-

Others (pouches)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. coffee creamer market was estimated at USD 1.02 billion in 2024 and is expected to reach USD 1.08 billion in 2025.

b. The U.S. coffee creamer market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 1.41 billion by 2030.

b. High-fat accounted for a share of 62.8% of the U.S. revenue in 2024. Consumer preferences for rich and indulgent coffee experiences drive the growth. The growing popularity of specialty coffee drinks, such as lattes and cappuccinos, which often require high-fat creamers to achieve the desired texture and flavor, has further fueled the segment.

b. Some of the key market players in the U.S. coffee creamer market are Nestlé S.A., Danone, Chobani LLC , Land O'Lakes, Inc., Heartland Food Products Group, Leaner Creamer LLC, Califia Farms, LLC, nutPods and Laird Superfood

b. The U.S. coffee creamer market growth is attributable to a rising preference for at-home coffee preparation, shifting consumer taste profiles, and increasing demand for healthier and plant-based alternatives. Coffee creamer, originally a niche product, is now a staple in many American households, expanding beyond traditional dairy-based options to include a wide array of flavored, low-fat, sugar-free, and non-dairy alternatives. The market's growth is bolstered by innovation, premiumization, and the shift towards plant-based diets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.