- Home

- »

- Next Generation Technologies

- »

-

U.S. Deep Learning Market Size, Industry Report, 2030GVR Report cover

![U.S. Deep Learning Market Size, Share & Trends Report]()

U.S. Deep Learning Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Hardware, Software), By Application (Image Recognition, Voice Recognition), By End-use (Automotive, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68040-283-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Deep Learning Market Size & Trends

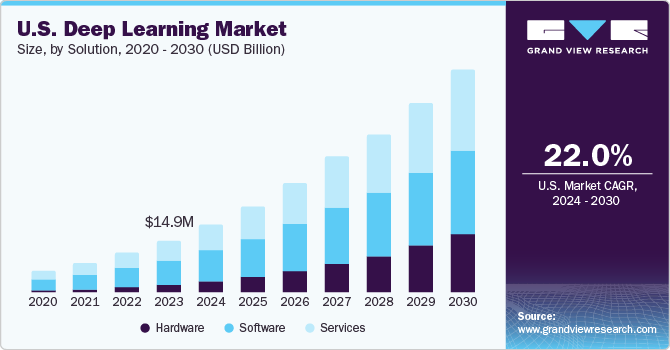

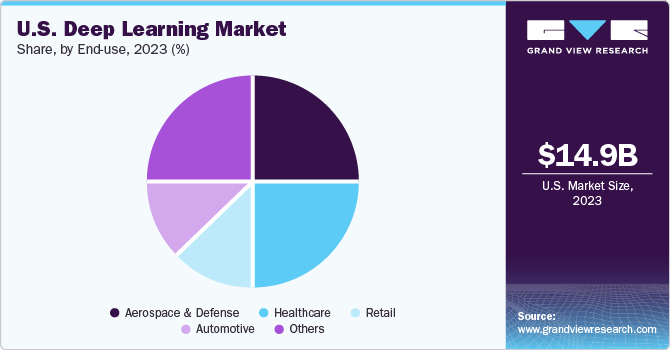

The U.S. deep learning market size was estimated at USD 14.97 billion in 2023 and is projected to grow at a CAGR of 22.0% from 2024 and 2030. The trend for deep learning is growing due to investments in cloud-based technology and technology advancements in data center capabilities. Organizations are banking on big data analytics, artificial intelligence (AI), and enhancements in computing power. Robust demand for data mining, voice recognition, video surveillance, and image recognition across end-use applications, including aerospace & defense, automotive, healthcare, and retail, will augur growth for deep learning solutions and service providers.

The U.S. has witnessed increased investments in neural network architecture, graphics processing units (GPU), industrial automation, cybersecurity applications, Internet of Things (IoT), and robots. Moreover, the penetration of machine vision technology will bolster the value proposition. Prominently, growing applications in chatbots, machine translation, and service bots have boded well for the business outlook.

The trend for chatbots has propelled the footprint of Natural Language Processing (NLP) and Automatic Speech Recognition (ASR). Industry-specific chatbots have gained ground to automate and simplify business and IT processes. For instance, voice chatbots played an invaluable role in offering information to people on health checks, COVID-19 pandemic status, and quarantine checks. Deep learning-powered chatbots will continue to redefine the intelligence of chatbots and facilitate natural conversations.

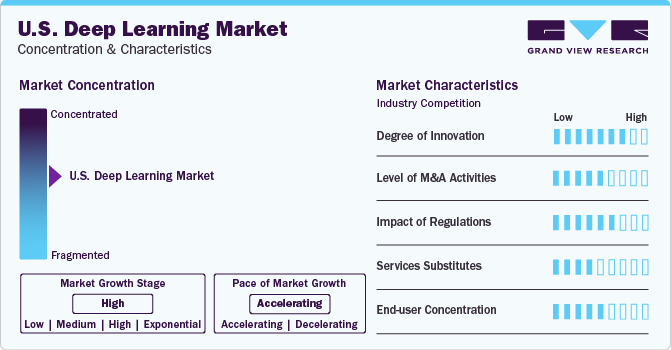

Market Concentration & Characteristics

Innovations have become replete in deep learning as stakeholders inject funds into the machine to boost productivity, augment revenue, and foster retention. Market companies will continue to seek the technology to automate predictive analytics and underpin fraud detection, virtual assistants, disease diagnoses, facial recognition, and language translation. Financial service providers have sought deep learning to automate trading, minimize risk, and detect fraud.

Mergers and acquisitions activities will likely be noticeable as deep learning brings a paradigm shift across industry verticals. Several AI and machine learning (ML) companies have gained ground from AI innovations, with startups and established companies being acquired or merged. For instance, in 2022, Pinterest announced that it would develop an innovative AI-based shopping platform, THE YES, to propel its position for “taste-driven shopping.”

Regulations on deep learning are expected to be noticeable in the U.S. ecosystem. The federal agencies have issued a series of frameworks, while AI-specific laws are present in several states. In February 2023, the Federal Trade Commission (FTC) issued guidance on its enforcement authority's applicability to address deceptive or unfair AI advertising claims. In April 2023, the FTC, along with the Consumer Financial Protection Bureau (CFPB), the Civil Rights Division of the U.S. Department of Justice, and the U.S. Equal Employment Opportunity Commission (EEOC), released a joint statement to uphold America’s commitment to equality, fairness and justice as AI become prevalent in daily lives.

The threat of substitutes may be moderate as deep learning continues to prominence. AI is increasingly embedded across businesses to bolster productivity and boost competitiveness and differentiation. Since AI technologies can cater to end-use industries, including pharmaceuticals, retail, finance, and manufacturing, substitutes for deep learning could be minimal.

End-use concentration could be pronounced as healthcare, automotive, retail, and aerospace & defense are likely to infuse funds into AI and ML. This state-of-the-art technology has gained ground for aircraft testing & optimization, aircraft design and development, back-office business functions, and in-flight assistance. AI has become sought-after for scheduling, tracking, and managing maintenance based on predictive analytics and historical data.

Solution Insights

The software segment contributed 47.72% toward the market in 2023, accounting for the largest revenue share. The growth is partly attributed to the footprint of powerful tools, high levels of programming, and libraries that can help train, design, and corroborate deep neural networks. In addition, stakeholders have furthered investments in edge intelligence, machine comprehension, and ONNX (open neutral network exchange) architecture to underpin deep learning across business verticals.

The hardware segment will grow at the fastest CAGR during the forecast period due to the expanding penetration of GPUs and Field Programmable Gate Array (FPGA) in deep learning. FPGA has gained ground to provide tremendous performance with low latency and high throughput. The growing footfall of video streaming in the U.S. has made the hardware highly sought-after. Some dynamics, including overcoming I/O bottlenecks, leveraging sensor fusion, adding AI capabilities to workloads, and lowering power consumption, have made the hardware a valuable proposition.

Application Insights

The image recognition segment dominated the market and held the highest revenue share in 2023 due to the heightened demand for deep learning in video websites and stock photography to make visual content discoverable for the user. The bespoke solution has received an impetus in facial recognition for security and surveillance, image assessment, and image detection in social media analytics. Moreover, the trend for content modernization against surging visual content has boded well for the regional outlook.

The voice recognition segment is expected to grow at the fastest CAGR during the forecast period due to the surging demand for voice-activated technologies across applications, including smart home systems, virtual assistants, and automotive interfaces. Deep neural networks for natural language understanding, speech recognition, and continuous enhancements through machine algorithms will solidify the position of leading companies in the landscape. Voice recognition tools will continue to seek the technology to comprehend and learn human speech.

End-use Insights

The automotive segment is poised to expand significantly against the demand for autonomous vehicles. Automakers have sought deep neural networks to underpin the mobility of the future. Autonomous vehicles can bolster the productivity of taxi and trucking services, minimize accidents, and reduce traffic congestion. Moreover, the rising footprint of light detection and ranging (LIDAR), global positioning system (GPS), inertia sensors, and radio detection and ranging (RADAR) is expected to fuel the market growth.

The healthcare segment is expected to grow significantly during the forecast period due to the penetration of data analytics, deep learning, and AI. For instance, deep learning has gained prominence for the early detection of diseases, predicting future hospitalization, and identifying clinical risks. Notably, the U.S. FDA emphasizes regulatory frameworks for implementing machine learning and AI in the healthcare sector.

Key U.S. Deep Learning Company Insights

Some of the leading players operating in the market include Google, Inc., NVIDIA Corporation, IBM Corporation, and Microsoft. They will likely focus on organic and inorganic strategies to underscore their approach in the regional landscape.

-

In July 2023, NVIDIA announced an infusion of USD 50 Million in AI-powered drug discovery. The investment in Recursion Pharmaceuticals will see the chip designer ramp up the training of AI models.

-

In January 2023, Microsoft announced an investment of USD 10 billion in OpenAI to bolster its position in generative AI intelligence.

-

In May 2022, Intel reportedly launched deep learning processors to enhance AI and give customers a plethora of choices, including edge and cloud.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In October 2023, Advanced Micro Devices announced the acquisition of Nod.AI to strengthen its position in data centers and chips. The acquisition will help the former provide its customers with machine learning models, libraries, and developer tools.

-

In November 2023, Clarifai asserted its goal to have AI accessible to more than 50 Million developers. Prominently, in October 2021, it raised USD 60 Million in series C funding to bring AI to developers globally.

Key U.S. Deep Learning Companies:

- Advanced Micro Devices, Inc.

- Clarifai, Inc.

- Entilic

- Google, Inc.

- HyperVerge

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- NVIDIA Corporation

Recent Developments

-

In November 2023, IBM launched a USD 500 Million venture fund to infuse funds into various AI companies. The company claims AI could unlock close to USD 16 trillion in productivity by 2030.

-

In February 2023, Google announced that it would pour USD 300 Million into Anthropic, which will help the latter conduct breakthrough AI research on the same infrastructure that boosts YouTube and Google Search.

U.S. Deep Learning Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.42 billion

Revenue forecast in 2030

USD 63.93 billion

Growth rate

CAGR of 22.0% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Solution, application, end-use

Key Companies Profiled

Advanced Micro Devices, Inc.; Clarifai Inc.; Entilic; Google, Inc.; HyperVerge; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation

Customization Scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Deep Learning Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the U.S. deep learning market report based on solution, application, and end-use.

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

CPU

-

GPU

-

FPGA

-

ASIC

-

-

Software

-

Services

-

Installation Services

-

Integration Services

-

Maintenance & Support Services

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Image Recognition

-

Voice Recognition

-

Video Surveillance & Diagnostics

-

Data Mining

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. deep learning market size was estimated at USD 14.97 billion in 2023 and is expected to reach USD 19.42 billion in 2024.

b. The U.S. deep learning market is expected to grow at a compound annual growth rate of 22.0% from 2024 to 2030 to reach USD 63.93 billion by 2030.

b. Image recognition segmnet dominated the U.S. deep learning market with a share of 36.10% in 2023. This is attributable to heightened demand for deep learning in video websites and stock photography to make visual content discoverable for the users.

b. Some key players operating in the U.S. deep learning market include Advanced Micro Devices, Inc.; Clarifai Inc.; Entilic; Google, Inc.; HyperVerge; IBM Corporation; Intel Corporation; Microsoft Corporation; NVIDIA Corporation

b. Key factors that are driving the market growth include investments in cloud-based technology and technology and growing applications in chatbots, machine translation, and service bots

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.