- Home

- »

- Advanced Interior Materials

- »

-

U.S. Defense HVAC Systems Market, Industry Report, 2033GVR Report cover

![U.S. Defense HVAC Systems Market Size, Share & Trends Report]()

U.S. Defense HVAC Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Equipment (Air Handling Units, Chillers), By Type (Portable Climate Control Systems, Vehicle HVAC), By End-use, By Application (Military Bases, Vehicles), And Segment Forecasts

- Report ID: GVR-4-68040-670-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Defense HVAC Systems Market Summary

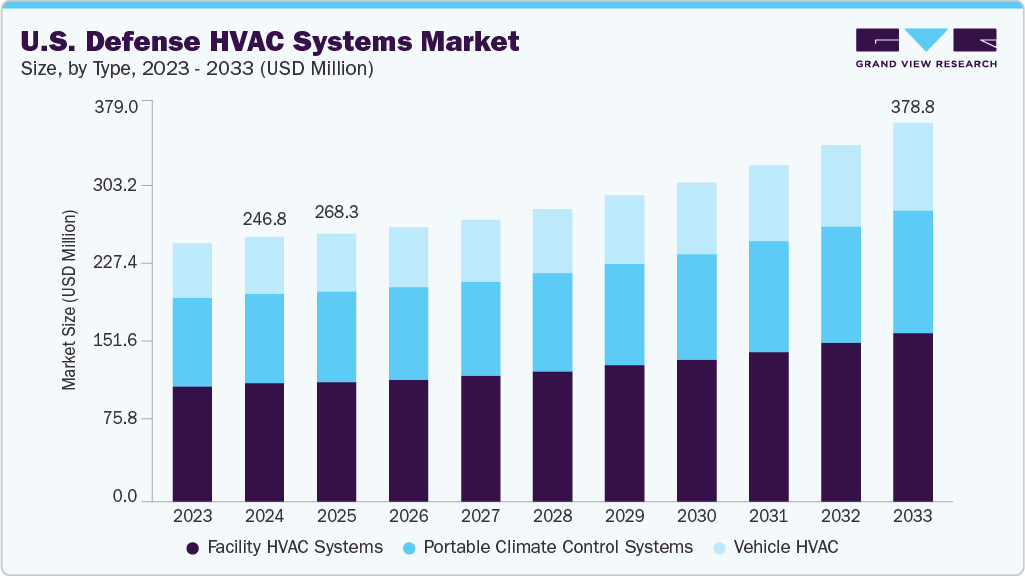

The U.S. defense HVAC systems market size was estimated at USD 264.8 million in 2024 and is projected to reach USD 378.8 million by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The rising demand for mobile and deployable climate control units across U.S. military operations is a key driver for the defense HVAC systems market.

Key Market Trends & Insights

- By type, the vehicle HVAC segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue.

- By end use, the military organizations segment is expected to grow at a considerable CAGR of 4.6% from 2025 to 2033 in terms of revenue.

- By equipment, the chillers segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

- By application, the command centers segment is expected to grow at a considerable CAGR of 5.2% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 264.8 Million

- 2033 Projected Market Size: USD 378.8 Million

- CAGR (2025-2033): 4.4%

These systems ensure optimal thermal comfort and air quality for troops in harsh environments, improving operational efficiency and personnel safety. Another key factor is the government’s focus on modernizing defense infrastructure with energy-efficient and sustainable systems. The U.S. military operates a vast number of bases and installations requiring frequent HVAC upgrades to meet energy compliance standards. Adoption of eco-friendly refrigerants, smart controls, and low-emission systems aligns with federal sustainability mandates. The Infrastructure Investment and Jobs Act and defense budgets also allocate significant funding toward HVAC modernization projects.

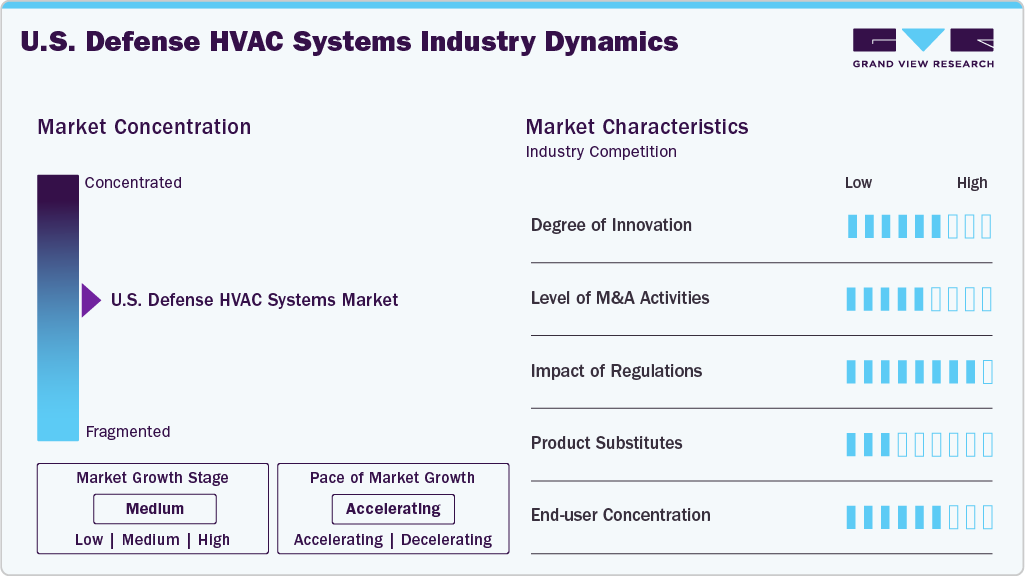

Market Concentration & Characteristics

The U.S. defense HVAC systems market is moderately concentrated, with a few major players dominating due to high entry barriers and specialized technical requirements. Companies with strong government ties and defense certifications maintain a competitive edge. Long-term defense contracts and stringent compliance standards limit new entrants. As a result, market share remains largely in the hands of established firms.

The U.S. defense HVAC systems industry shows a steady pace of innovation, driven by the need for compact, energy-efficient, and durable systems. Companies are investing in smart technologies, IoT integration, and environmentally friendly refrigerants. Focus is also on improving performance in extreme climates. Innovation is often guided by evolving military requirements and sustainability goals.

The level of mergers and acquisitions in the U.S. defense HVAC market is moderate, with strategic deals aimed at expanding technological capabilities and government contract access. Established players often acquire smaller firms with niche innovations or defense certifications. These consolidations help broaden product portfolios and enhance service capabilities. M&A activity is influenced by evolving defense priorities and budget allocations.

Regulations play a significant role in shaping the U.S. defense HVAC market, especially concerning energy efficiency and environmental compliance. Federal standards mandate the use of low-GWP refrigerants and reduced emissions in military-grade systems. Contractors must meet strict DoD and EPA guidelines during design and deployment. Regulatory frameworks also encourage sustainable practices across defense facilities.

Drivers, Opportunities & Restraints

The U.S. defense HVAC systems market’s growth is driven by increasing demand for climate control systems in extreme operational environments. Rising defense budgets and modernization efforts further fuel equipment upgrades across bases and field units. Portable and energy-efficient systems are gaining traction due to operational flexibility. Additionally, the focus on soldier safety and mission readiness boosts adoption.

Growing emphasis on sustainable and energy-efficient technologies presents significant opportunities for HVAC manufacturers. Integration of smart controls, remote diagnostics, and IoT-enabled systems is gaining interest within the defense sector. Government initiatives promoting green infrastructure can drive new projects. Expansion in unmanned and mobile military platforms also opens new HVAC application areas.

High initial investment and long procurement cycles act as major restraints for market growth. Strict defense compliance requirements can delay product deployment and limit new entrants. Budget constraints or shifts in military spending priorities may impact HVAC upgrades. Additionally, technical complexities in integrating systems into legacy infrastructure pose challenges.

Type Insights

The facility HVAC systems segment dominated the U.S. defense HVAC systems market, with a share of 44.5% in 2024, due to widespread use across military bases, command centers, and training facilities. These systems are essential for maintaining indoor air quality, temperature control, and equipment protection. The U.S. military's ongoing infrastructure upgrades drive consistent demand. Additionally, compliance with federal energy efficiency mandates boosts the adoption of advanced facility HVAC solutions.

Vehicle HVAC systems segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2033 in terms of revenue, driven by the increasing deployment of armored vehicles, mobile command units, and tactical transport fleets. These systems ensure occupant comfort and equipment stability in diverse climates. Rising investments in modernizing ground vehicles and unmanned platforms support growth. Demand for compact, rugged, and energy-efficient HVAC units is accelerating in this category.

Equipment Insights

The heat pumps segment accounted for a share of 35.7% in 2024. Heat pumps dominate the U.S. defense HVAC market due to their dual heating and cooling capabilities, offering operational efficiency across diverse climates. They are widely used in military buildings and portable shelters to reduce energy consumption. The U.S. Department of Defense favors heat pumps for their sustainability benefits. Growing focus on electrification and carbon reduction further boosts their demand.

The chillers segment is expected to grow at a fastest CAGR of 5.1% from 2025 to 2033 in terms of revenue, driven by increased demand in large-scale military installations and data centers. These systems provide precise temperature control, essential for high-performance equipment and mission-critical spaces. Technological advancements in modular and energy-efficient chillers enhance their appeal. Rising infrastructure development and cyber-defense expansion are fueling adoption in defense facilities.

Application Insights

The military bases segment accounted for a share of 54.8% in 2024 due to their size, complexity, and continuous operation. These facilities require robust HVAC systems to support barracks, administrative buildings, medical centers, and training areas. Regular upgrades and maintenance ensure compliance with energy standards. Government funding for base modernization further drives steady HVAC demand.

The command centers segment is expected to grow at a fastest CAGR of 5.2% from 2025 to 2033 in terms of revenue, as they house critical communication, surveillance, and decision-making infrastructure. These centers demand precise climate control to maintain sensitive electronic equipment and ensure uninterrupted operations. The rise in cybersecurity threats and digital warfare has increased investment in secure, high-tech facilities. As a result, advanced HVAC systems are essential for operational reliability and equipment protection.

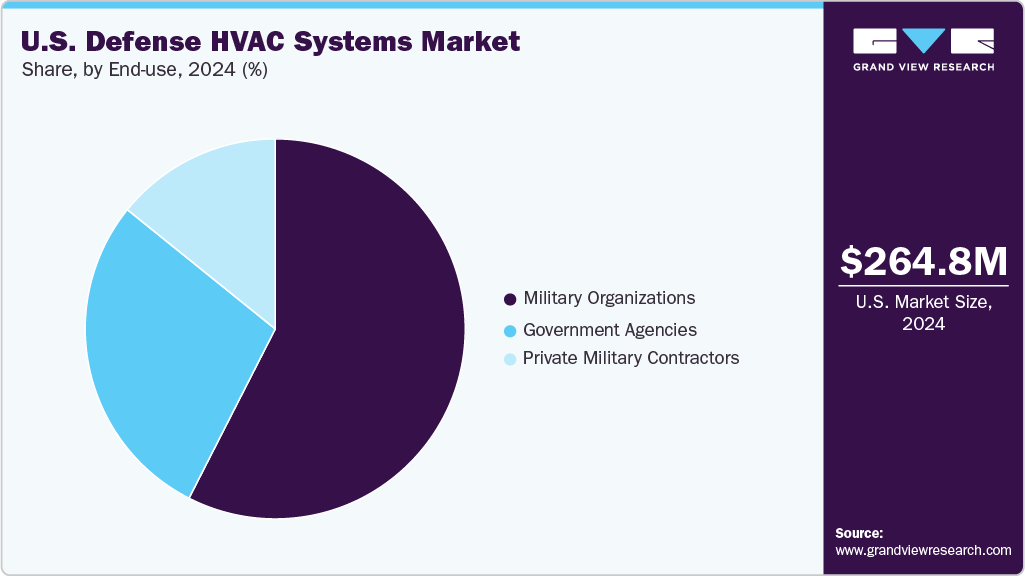

End-use Insights

The military organizations segment dominated the U.S. defense HVAC systems industry and accounted for a share of 57.5% in 2024, owing to their extensive infrastructure and operational needs. From bases to field deployments, HVAC systems are critical for maintaining functionality and comfort. Ongoing modernization of facilities and equipment sustains high demand. Long-term federal defense funding ensures continued investments in HVAC upgrades.

The government agencies segment is expected to grow at a significant CAGR of 4.3% from 2025 to 2033 in terms of revenue, due to increased involvement in homeland security, disaster response, and border control operations. These agencies require reliable climate control solutions for mobile units, emergency shelters, and administrative buildings. Emphasis on energy efficiency and sustainability supports equipment upgrades. Federal initiatives aimed at improving agency infrastructure further drive market expansion.

Key U.S. Defense HVAC Systems Company Insights

Some of the key players operating in the market include Eberspächer; DAIKIN INDUSTRIES Ltd.; and Advanced Cooling Technologies, Inc.

-

Daikin Industries Ltd. is recognized for its specialized HVAC systems engineered for high-performance and mission-critical environments, including defense infrastructure. The company offers customized climate control solutions suited for extreme temperatures and rugged conditions found in military applications. Its product range includes energy-efficient heat pumps, VRF systems, and air purification technologies tailored to sensitive installations. Daikin’s R&D focuses on integrating low-GWP refrigerants and smart control technologies into HVAC equipment for secure and reliable operation. Their systems are also compatible with modular structures and mobile facilities used in defense deployments.

-

Advanced Cooling Technologies, Inc. (ACT) is a specialized provider of thermal management solutions, serving sectors such as defense, aerospace, energy, and electronics. The company develops both passive and active cooling technologies, including heat pipes, vapor chambers, and custom liquid loops. In the defense field, ACT supplies rugged thermal systems for applications like UAVs, radar systems, and portable military shelters, designed to perform in extreme environments. They offer end-to-end services from design and prototyping to full-scale manufacturing and field support. Headquartered in Lancaster, Pennsylvania, ACT operates under ISO 9001/AS9100 certification and maintains ITAR registration to meet stringent defense industry standards.

Key U.S. Defense HVAC Systems Companies:

- DAIKIN INDUSTRIES Ltd.

- Eberspächer

- Advanced Cooling Technologies, Inc.

- ECU Corporation

- Trane

- Munters

- TAT Technologies

- Honeywell International Inc.

- BAE Systems

- Collins Aerospace

Recent Developments

-

In July 2025, ECU Corporation introduced a specialized line of HVAC systems built for highly demanding environments like defense installations and nuclear sites. These systems meet strict military and industrial standards, offering resistance to shock, radiation, and electromagnetic interference. Designed for reliability in critical conditions, they are suited for use in radar stations and containment facilities. The company focuses on custom solutions that prioritize durability, safety, and operational precision.

-

January 2025, The U.S. Department of Defense has invested USD 90 million to secure a reserve of hydrofluorocarbons (HFCs) essential for military cooling and fire suppression systems. This investment supports operational readiness amid U.S. restrictions on HFC production and usage. The Defense Logistics Agency will manage storage and facility upgrades to safeguard the supply. This initiative ensures continuous climate control capabilities across military operations worldwide.

U.S. Defense HVAC Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 268.3 million

Revenue forecast in 2033

USD 378.8 million

Growth rate

CAGR of 4.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, equipment, application, region.

Country scope

U.S.

Key companies profiled

DAIKIN INDUSTRIES Ltd.; Eberspächer; Advanced Cooling Technologies, Inc.; ECU Corporation; Trane; Munters; TAT Technologies; Honeywell International Inc.; BAE Systems; Collins Aerospace

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Defense HVAC Systems Market Report Segmentation

This report forecasts revenue growth at the U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. defense HVAC systems market report based on type, end-use, equipment, and application:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Portable Climate Control Systems

-

Vehicle HVAC

-

Facility HVAC Systems

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Military Organizations

-

Government Agencies

-

Private Military Contractors

-

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Handling Units

-

Chillers

-

Dehumidification Systems

-

Air Filtration Systems

-

Air Conditioning Systems

-

Heat Pump

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Military Bases

-

Vehicles

-

Field Operations

-

Command Centers

-

Frequently Asked Questions About This Report

b. The U.S. defense HVAC systems market size was estimated at USD 264.8 million in 2024 and is expected to be USD 268.3 million in 2025.

b. The U.S. defense HVAC systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2033 to reach USD 378.8 million by 2033.

b. The military organizations segment dominated the market and accounted for a share of 57.5% in 2024 owing to their extensive infrastructure and operational needs. From bases to field deployments, HVAC systems are critical for maintaining functionality and comfort. Ongoing modernization of facilities and equipment sustains high demand.

b. Some of the key players operating in the U.S. defense HVAC systems market include. DAIKIN INDUSTRIES Ltd.; Eberspächer; Advanced Cooling Technologies, Inc.; ECU Corporation; Trane; Munters; TAT Technologies; Honeywell International Inc.; BAE Systems; Collins Aerospace.

b. Key factors driving the U.S. defense HVAC systems market include increasing military modernization efforts and the need for reliable climate control in extreme environments. Rising defense spending supports upgrades in facilities and mobile units with advanced, energy-efficient systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.