- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Hydrogenated Vegetable Oil Market Size Report, 2030GVR Report cover

![U.S. Hydrogenated Vegetable Oil Market Size, Share & Trends Report]()

U.S. Hydrogenated Vegetable Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (Unfractionated, Fractionated), By End Use (Food & Beverage, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-614-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

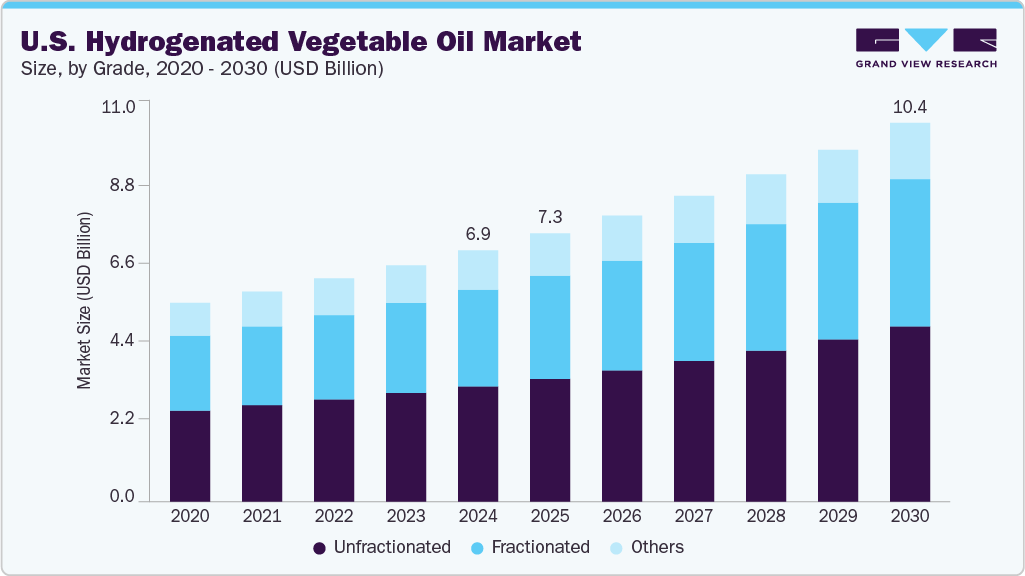

The U.S. hydrogenated vegetable oil market size was estimated at USD 6,904.5 million in 2024 and is expected to grow at a CAGR of 7.2% from 2025 to 2030. The growth is growing rapidly, driven by demand for processed foods, cosmetics, and renewable energy. Known for their stability and shelf life, these oils suit diverse industrial uses. Regulatory support for healthier alternatives and technological improvements is further propelling growth. As consumers prioritize health and sustainability, the market is set to expand and adapt accordingly.

The U.S. hydrogenated vegetable oil industry is experiencing significant growth, driven by the nation's commitment to renewable energy and sustainable alternatives to fossil fuels. Federal and state policies, such as the Renewable Fuel Standard and California's Low Carbon Fuel Standard, have been instrumental in promoting the use of biofuels, including hydrogenated vegetable oils, in transportation. These initiatives aim to reduce greenhouse gas emissions and enhance energy security.

Manufacturers in the U.S. offer three primary commercial grades of hydrogenated vegetable oil. Unfractionated hydrogenated vegetable oil retains the complete triglyceride profile, providing natural oxidative stability, making it suitable for food and cosmetic applications. Fractionated hydrogenated vegetable oil is produced through controlled crystallization to isolate specific fatty acid fractions, resulting in sharper melting profiles ideal for confectionery coatings and premium fat systems. The third category includes customized blends and co-processed grades designed for niche functionalities.

Hydrogenated vegetable oils are utilized across various industries due to their stability and extended shelf life. In the food industry, they enhance texture and shelf life in products like margarine and baked goods. In cosmetics, they serve as emollients in products such as bath items, eye makeup, and skin care formulations. In the pharmaceutical sector, they are employed as coating agents for hygroscopic drugs, protecting them from moisture and enhancing stability.

Technological advancements in the extraction and purification of hydrogenated vegetable oils are improving their quality and cost-effectiveness. Innovations in processing techniques are enhancing the taste profile and stability of these oils, making them more attractive to manufacturers and consumers. Furthermore, the development of hydrogenated oils with reduced trans-fat content aligns with health-conscious consumer trends and regulatory requirements. The U.S. Food and Drug Administration (FDA) has taken steps to eliminate partially hydrogenated oils, the primary dietary source of artificial trans fats, from processed foods. Emerging technologies are enabling the production of hydrogenated oils with significantly lower trans-fat levels.

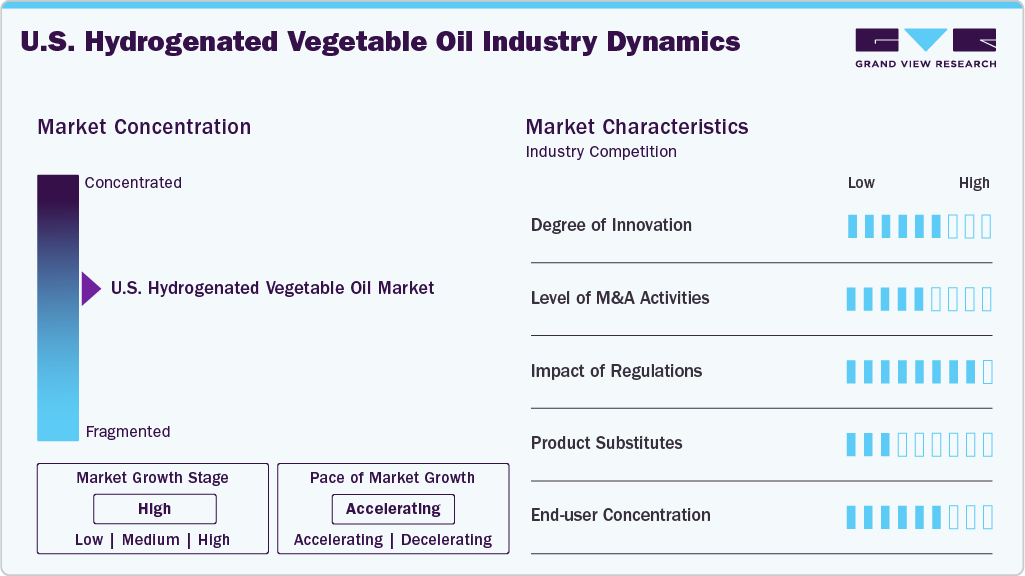

Market Concentration & Characteristics

The U.S. hydrogenated vegetable oil market is characterized by a moderate to high concentration, with major players like Bunge, AAK AB, and Wilmar International Ltd holding significant market shares. These companies benefit from vertically integrated operations, ensuring control over the supply chain from raw material sourcing to distribution. Their robust research and development capabilities enable the production of low-trans-fat and specialty hydrogenated vegetable oil products that meet evolving consumer preferences and regulatory standards.

The U.S. hydrogenated vegetable oil industry is significantly influenced by feedstock price volatility, particularly for soybean and sunflower oils. Factors such as climate conditions, supply disruptions, and global trade dynamics contribute to fluctuations in these raw material costs, impacting manufacturers' cost structures. Regulatory actions have also shaped the market landscape. The U.S. Food and Drug Administration (FDA) banned partially hydrogenated oils (PHOs), the primary source of artificial trans fats, determining they are no longer "generally recognized as safe" for use in food. This decision prompted manufacturers to reformulate products, focusing on health-conscious and sustainable alternatives.

While the U.S. market for hydrogenated vegetable oil is mature and innovation-driven, global trends influence local operations. Emerging economies like India, China, and Brazil are increasing their consumption of hydrogenated vegetable oils across various applications, affecting global trade flows and price competition. Nonetheless, the U.S. market shows growth potential through its regulatory frameworks, infrastructure, and technical expertise, positioning it as both a key producer and standard-setter in the global hydrogenated vegetable oil industry.

Grade Insights

The unfractionated segment led the market, accounting for the largest revenue share of 46.0% in 2024. This growth is driven by its extensive use in food and personal care, where the natural triglyceride structure offers superior oxidative stability and shelf life. The ability to use these oils without additional processing makes them ideal for bulk fat systems and emollients. Increasing demand for stable, cost-effective trans-fat-free oils in processed foods and cosmetic bases is a major contributor to this segment’s dominance.

The fractionated segment of the U.S. hydrogenated vegetable oil industry is expected to grow at the fastest CAGR of 7.5% from 2025 to 2030. The segment is gaining momentum, offering more targeted functionality through controlled crystallization to extract specific fat fractions. These include high-melting-point fats suited for confectionery, cosmetic sticks, and pharmaceutical creams. Demand for application-specific melting points, texture enhancement, and oxidative stability in formulations is fueling growth.

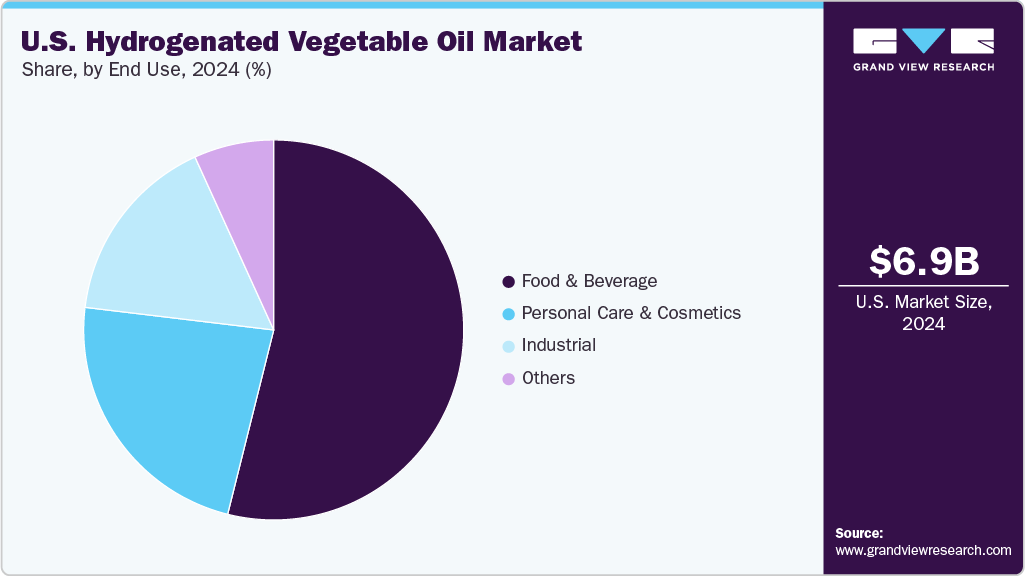

End Use Insights

The food & beverage segment dominated the U.S. hydrogenated vegetable oil market with a revenue share of 53.9% in 2024. Hydrogenated vegetable oils are widely used in bakery shortenings, frying fats, and confectionery coatings due to their shelf stability and consistency. Reformulation trends away from trans fats have further increased reliance on fully hydrogenated vegetable oils. Regulatory reforms in trans-fat elimination, paired with rising demand for shelf-stable, neutral-flavor oils, are driving the segment’s expansion.

The personal care and cosmetics segment accounted for a revenue share of 23.0% in 2024 and is poised for strong growth over the forecast period. These oils are used as emollients and structuring agents in products like skin creams, lip balms, and solid cosmetics due to their smooth texture, mildness, and biodegradability. Rising consumer preference for sustainable, plant-derived, and non-petroleum ingredients is driving their expanded use across U.S. beauty and personal care brands.

The "others" segment includes pharmaceutical and nutraceutical applications, where hydrogenated vegetable oils are valued for their chemical stability, inertness, and GRAS status. They are commonly used in oral drug formulations and dietary supplement encapsulation. As the U.S. pharmaceutical and wellness industries increasingly shift toward plant-based excipients, this niche is experiencing steady, functional growth.

Key U.S. Hydrogenated Vegetable Oil Company Insights

Some of the key players operating in the market include ADM (Archer Daniels Midland), Bunge, ABITEC, and others.

-

ADM is a U.S. food processing and agricultural commodities company headquartered in Chicago, operating in over 190 countries. It specializes in sourcing, transportation, processing, and distribution of oilseeds, corn, wheat, and other agricultural products. ADM’s portfolio includes plant-based proteins, specialty oils, sweeteners, and nutrition solutions for food, feed, fuel, and industrial uses. The company emphasizes traceability, vertical integration, and sustainability in raw material sourcing and production. ADM’s hydrogenated vegetable oil segment serves key applications in bakery, confectionery, and personal care, offering stable fat systems designed to improve product structure, shelf life, and heat resistance in finished formulations.

-

Bunge is a global agribusiness and food company with a corporate headquarters in St. Louis, Missouri. With over 200 years of operational history, Bunge operates approximately 300 facilities in more than 40 countries. The company is involved in the processing of oilseeds and is a major supplier of specialty plant-based oils and fats. Bunge connects farmers to consumers by sourcing, processing, and distributing food, feed, and fuel, while also collaborating with customers to develop tailored solutions aligned with changing dietary and sustainability trends. Bunge produces hydrogenated vegetable oils for a wide range of uses, including food processing and personal care, with a focus on developing customized fat solutions that enhance texture, performance, and stability while supporting clean-label and sustainable product demands.

Key U.S. Hydrogenated Vegetable Oil Companies:

- ADM (Archer Daniels Midland)

- Bunge

- ABITEC

- AAK AB

- BASF

- Croda International Plc

- Louis Dreyfus Company

- CLARIANT

- Amandus Kahl GmbH & Co. KG

- Wilmar International Ltd

Recent Development

-

In April 2025, Bunge partnered with Repsol to develop renewable fuels using hydrogenated vegetable oils. The collaboration focuses on processing camelina and safflower into low-carbon intensity oils, serving as feedstock for hydrotreated vegetable oil production, thereby advancing sustainable energy solutions.

U.S. Hydrogenated Vegetable Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,349.3 million

Revenue forecast in 2030

USD 10,391.9 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Grade and end use

Country scope

U.S.

Key companies profiled

ADM (Archer Daniels Midland); Bunge; ABITEC; AAK AB; BASF; Croda International Plc; Louis Dreyfus Company; CLARIANT; Amandus Kahl GmbH & Co. KG; Wilmar International Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hydrogenated Vegetable Oil Market Report Segmentation

This report forecasts volume & revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hydrogenated vegetable oil market report based on grade and end use:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Unfractionated

-

Fractionated

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Personal Care and Cosmetics

-

Industrial

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hydrogenated vegetable oil market size was estimated at USD 6,904.5 million in 2024 and is expected to reach USD 7,349.3 million in 2025.

b. The U.S. hydrogenated vegetable oil market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 10,391.9 million in 2030.

b. The unfractionated segment led the market, accounting for the largest revenue share of 46.0% in 2024. This growth is driven by its extensive use in food and personal care, where the natural triglyceride structure offers superior oxidative stability and shelf life.

b. Some key players operating in the hydrogenated vegetable oil market include ADM, Bunge, ABITEC, AAK AB, BASF, Croda International Plc, Louis Dreyfus Company, CLARIANT, Amandus Kahl GmbH & Co. KG, Wilmar International Ltd.

b. The U.S. hydrogenated vegetable oil market is expanding due to supportive policies, technological innovations, and a growing demand for sustainable and health-conscious products across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.